Bitcoin Prediction May 2025

Bitcoin, first introduced in 2009 as a decentralized digital currency, has experienced a turbulent yet fascinating journey. From its humble beginnings as a niche technology to its current status as a globally recognized asset class, its trajectory has been marked by periods of explosive growth and significant corrections. While it holds a considerable market capitalization, its price remains highly volatile, influenced by a complex interplay of factors. Predicting its future value, therefore, presents both a significant challenge and an enticing opportunity for market analysts and investors alike.

Bitcoin’s price volatility stems from several key factors. Supply and demand dynamics play a crucial role, with limited supply and fluctuating demand creating price swings. Regulatory uncertainty across different jurisdictions significantly impacts investor confidence and trading activity. Market sentiment, driven by news events, technological advancements, and macroeconomic conditions, exerts considerable influence. For example, positive regulatory developments in a major economy often correlate with price increases, while negative news, such as a major exchange hack, can trigger sharp declines. Furthermore, the influence of large institutional investors and whales, who can manipulate the market through large-scale buying or selling, is undeniable.

Factors Influencing Bitcoin’s Price Volatility

The inherent volatility of Bitcoin is a double-edged sword. Its price fluctuations, while posing risks to investors, also create opportunities for significant profits. Understanding the drivers behind this volatility is paramount for informed decision-making. A comprehensive analysis needs to consider macroeconomic trends, regulatory changes, technological advancements, and the psychology of the market. For example, the 2020-2021 bull run was partially fueled by institutional adoption and increased mainstream media attention, while the subsequent correction was partly attributed to regulatory crackdowns in certain countries and concerns about environmental sustainability. Successfully predicting Bitcoin’s price requires a deep understanding of these interwoven factors and their potential impact.

Challenges and Opportunities in Bitcoin Price Prediction

Predicting the price of Bitcoin in May 2025, or any future date, is inherently difficult. The cryptocurrency market is characterized by its nascent nature, its susceptibility to unpredictable events, and the lack of historical data compared to traditional asset classes. Accurate prediction requires sophisticated models capable of incorporating various factors, from technical analysis and on-chain metrics to fundamental analysis and macroeconomic indicators. The complexity of the interplay between these factors, combined with the inherent unpredictability of human behavior in the market, makes accurate long-term prediction a significant challenge. However, this challenge also presents an opportunity for those who can successfully develop robust predictive models. Successful predictions can lead to significant financial gains for investors and provide valuable insights for policymakers and regulators. The potential rewards are substantial, but so are the risks associated with inaccurate forecasts.

Influential Factors Affecting Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging, as numerous interconnected factors influence its value. These factors range from macroeconomic trends to technological advancements and regulatory decisions, all of which interact in complex ways. Understanding these influences is crucial for any assessment of Bitcoin’s potential trajectory.

Global Economic Conditions and Bitcoin’s Value, Bitcoin Prediction May 2025

Global economic conditions significantly impact Bitcoin’s price. Periods of economic uncertainty, such as inflation, recession, or geopolitical instability, often drive investors towards alternative assets, including Bitcoin, perceived as a hedge against traditional financial systems. For example, the 2020 COVID-19 pandemic and subsequent inflationary pressures saw a surge in Bitcoin’s price as investors sought to preserve their wealth. Conversely, periods of strong economic growth and stability might see investors shift their focus back to traditional assets, potentially leading to a decline in Bitcoin’s value. The strength of the US dollar, a dominant global currency, also plays a crucial role; a strong dollar can negatively correlate with Bitcoin’s price in USD terms.

Technological Advancements and Bitcoin’s Future

Technological advancements, particularly within the Bitcoin ecosystem, will play a defining role in its future. The Lightning Network, for instance, aims to address Bitcoin’s scalability limitations by enabling faster and cheaper transactions off the main blockchain. Widespread adoption of the Lightning Network could significantly increase Bitcoin’s usability and appeal, potentially boosting its price. Other technological developments, such as improved mining hardware and enhanced wallet security, also contribute to Bitcoin’s long-term viability and market attractiveness. Improvements in transaction speed and reduced fees are key factors in attracting a wider range of users.

Regulatory Changes and Government Policies

Government regulations and policies exert a powerful influence on Bitcoin adoption and price. Favorable regulations, such as clear legal frameworks for cryptocurrency trading and investment, could attract institutional investors and boost market confidence, leading to price appreciation. Conversely, restrictive or unclear regulations can stifle growth and negatively impact Bitcoin’s value. Examples include China’s crackdown on cryptocurrency mining in 2021, which resulted in a temporary price dip, or the varying regulatory approaches taken by different countries, creating market fragmentation and uncertainty. The level of regulatory clarity and consistency across major jurisdictions will be pivotal.

Institutional Investment versus Individual Investor Sentiment

The interplay between institutional and individual investor sentiment shapes Bitcoin’s price dynamics. Large-scale institutional investments, such as those from hedge funds and corporations, can inject significant capital into the market, driving price increases. However, institutional investment often involves a longer-term perspective, potentially less susceptible to short-term market volatility. Individual investor sentiment, characterized by its often-rapid shifts in enthusiasm and fear, can cause dramatic price swings. A surge in retail investor interest can create speculative bubbles, while periods of fear and uncertainty can trigger sharp sell-offs. The balance between these two forces significantly influences Bitcoin’s price volatility.

Emerging Cryptocurrencies and Blockchain Technologies

The emergence of new cryptocurrencies and blockchain technologies presents both opportunities and challenges for Bitcoin. While competing cryptocurrencies might siphon off some market share, they also contribute to broader blockchain adoption and technological innovation. The success of alternative blockchain platforms might indirectly benefit Bitcoin by increasing overall awareness and acceptance of decentralized technologies. However, the emergence of more efficient or feature-rich cryptocurrencies could pose a long-term threat to Bitcoin’s dominance, depending on their adoption rate and ability to address Bitcoin’s limitations. The competition could spur innovation within the Bitcoin ecosystem itself, leading to improvements and enhancements.

Potential Bitcoin Price Scenarios for May 2025: Bitcoin Prediction May 2025

Predicting Bitcoin’s price is inherently speculative, but by analyzing influential factors like regulatory developments, macroeconomic conditions, and technological advancements, we can formulate plausible scenarios for May 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and reflect the inherent volatility of the cryptocurrency market. It’s crucial to remember that these are just educated guesses, and the actual price could fall outside these ranges.

Bitcoin Price Scenarios: Bullish, Bearish, and Neutral

The following scenarios consider the interplay of factors previously discussed, including regulatory clarity (or lack thereof), the overall economic climate, and the adoption of Bitcoin by institutional investors and mainstream users. Each scenario presents a different outlook on how these factors might combine to influence Bitcoin’s price by May 2025.

| Scenario | Price Range (USD) | Rationale | Triggering Events |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread institutional adoption, positive regulatory developments globally, sustained macroeconomic growth, and significant technological advancements (like Lightning Network scalability improvements) drive demand, pushing Bitcoin’s price to new all-time highs. This scenario assumes a generally positive global economic outlook and a continued narrative around Bitcoin as a hedge against inflation. Increased demand from emerging markets also contributes significantly to price appreciation. | Positive regulatory announcements from major economies (e.g., US, EU), successful integration of Bitcoin into mainstream financial systems, a significant increase in Bitcoin’s use for cross-border payments, a major global event showcasing Bitcoin’s resilience as a store of value. |

| Bearish | $20,000 – $40,000 | Negative regulatory crackdowns, a global economic recession, decreased investor confidence, and a significant security breach or major technological flaw in the Bitcoin network all contribute to a substantial price decline. This scenario assumes a pessimistic global economic forecast, coupled with increased regulatory uncertainty and a loss of faith in Bitcoin’s long-term viability as a safe-haven asset. A potential alternative cryptocurrency surpassing Bitcoin in market dominance could also contribute to this bearish outlook. | Stringent regulatory restrictions on Bitcoin trading and use in multiple countries, a major global financial crisis, a significant security exploit leading to a loss of investor confidence, the emergence of a superior cryptocurrency technology. |

| Neutral | $50,000 – $80,000 | A mixed bag of positive and negative developments leads to a relatively stable price range. This scenario assumes a moderate level of regulatory scrutiny, slow but steady institutional adoption, and fluctuating macroeconomic conditions. Technological advancements continue, but without a major breakthrough to dramatically alter the market dynamics. This scenario represents a continuation of the current market trend, with periods of both upward and downward price movements. | Mixed regulatory signals from various governments, moderate institutional investment, a period of economic uncertainty with no major recession or boom, incremental technological improvements to the Bitcoin network without significant breakthroughs. |

Risks and Uncertainties Associated with Bitcoin Predictions

Predicting Bitcoin’s price, even in the relatively near future of May 2025, is inherently fraught with challenges. The cryptocurrency market is notoriously volatile and influenced by a complex interplay of factors, many of which are difficult, if not impossible, to accurately forecast. Any prediction carries significant risk and should be approached with considerable caution.

The inherent limitations of Bitcoin price prediction stem from the decentralized and speculative nature of the cryptocurrency market. Unlike traditional assets, Bitcoin’s value isn’t tied to tangible assets or company performance, making fundamental analysis significantly less effective. Instead, price movements are heavily influenced by speculative trading, market sentiment, and external events.

Unpredictable Market Sentiment and Price Fluctuations

Market sentiment, the collective feeling of investors towards Bitcoin, plays a dominant role in shaping its price. Positive news, such as regulatory approvals or widespread adoption by major corporations, can trigger significant price increases. Conversely, negative news, such as security breaches or government crackdowns, can lead to sharp declines. This sentiment is notoriously difficult to predict and can shift rapidly, making accurate price forecasting extremely challenging. For example, the 2021 bull run saw Bitcoin’s price surge dramatically based on positive investor sentiment and adoption by institutional investors. However, the subsequent price correction in 2022 demonstrated the rapid reversal of this sentiment. The unpredictability of this shift highlights the inherent risk in attempting to predict future price movements.

Potential for Unforeseen Events and Their Impact on Bitcoin’s Value

The decentralized nature of Bitcoin, while a strength, also presents significant uncertainties. Unforeseen events, such as major security breaches affecting exchanges or the emergence of competing cryptocurrencies with superior technology, could significantly impact Bitcoin’s value. Similarly, regulatory crackdowns from governments worldwide remain a significant risk. Changes in regulatory landscapes, whether supportive or restrictive, can dramatically alter investor confidence and trading activity. The sudden ban on cryptocurrency trading in certain countries, for instance, can lead to immediate and substantial price drops. Furthermore, unforeseen technological developments, such as the widespread adoption of quantum computing, could pose a significant threat to Bitcoin’s security and consequently its value. The lack of historical precedent for such disruptive events makes predicting their impact on Bitcoin’s price virtually impossible.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset class, requires a careful assessment of risk tolerance and a well-defined investment strategy. The highly volatile nature of Bitcoin necessitates a nuanced approach, considering both potential rewards and significant downside risks. A diverse range of strategies caters to different investor profiles, from conservative to aggressive.

Investing in Bitcoin involves significant risk. The price can fluctuate dramatically in short periods, leading to substantial gains or losses. Therefore, understanding your risk tolerance and developing a suitable investment strategy is crucial. It’s vital to only invest what you can afford to lose.

Bitcoin Investment Strategies Based on Risk Tolerance

Different investment strategies align with varying risk appetites. Conservative investors might favor smaller, more gradual investments, while aggressive investors may opt for larger, potentially higher-risk allocations. A balanced approach combines elements of both, aiming for moderate risk and return.

- Conservative Strategy: This involves investing a small percentage of one’s portfolio in Bitcoin, regularly purchasing small amounts over an extended period (dollar-cost averaging). This strategy mitigates the risk of investing a large sum at a market peak.

- Moderate Strategy: This approach involves a larger allocation to Bitcoin than a conservative strategy but still diversifies across other asset classes. It may involve periodic lump-sum investments, but with careful consideration of market conditions.

- Aggressive Strategy: This strategy allocates a significant portion of the portfolio to Bitcoin, often involving larger, more frequent investments. This approach aims for higher returns but carries a significantly greater risk of substantial losses.

Diversification within a Cryptocurrency Portfolio

Diversification is paramount in mitigating risk within a cryptocurrency portfolio. Investing solely in Bitcoin exposes investors to the specific risks associated with its price volatility and regulatory uncertainties. A diversified portfolio includes various cryptocurrencies with different underlying technologies, use cases, and market capitalizations. This approach reduces the impact of a single cryptocurrency’s price decline on the overall portfolio value. For example, an investor could diversify across Bitcoin, Ethereum, and other altcoins, potentially hedging against losses in one area by gains in another.

Responsible Bitcoin Investment: Risk Management and Due Diligence

Responsible Bitcoin investment requires thorough research and a robust risk management plan. Before investing, it’s essential to understand the technology behind Bitcoin, its potential applications, and the factors influencing its price. This includes researching market trends, regulatory developments, and the competitive landscape. Risk management involves setting clear investment goals, defining acceptable risk levels, and adhering to a disciplined investment plan. It’s crucial to avoid impulsive decisions based on short-term price fluctuations and to stay informed about market developments. Using reputable exchanges and secure storage methods (like hardware wallets) is also essential for protecting investments. Consider consulting a qualified financial advisor before making any significant investment decisions.

Bitcoin’s Long-Term Outlook Beyond May 2025

Predicting the future of Bitcoin beyond May 2025 is inherently speculative, yet analyzing current trends and technological advancements allows for informed speculation about its potential role in the global financial landscape. Several factors, ranging from regulatory developments to technological innovations, will shape Bitcoin’s trajectory. While uncertainties remain, understanding the potential challenges and opportunities can offer valuable insights into its long-term prospects.

Bitcoin’s potential to disrupt traditional financial systems is significant. Its decentralized nature, transparency, and relative security offer an alternative to centralized banking and payment systems. The increasing adoption of Bitcoin by institutional investors and the ongoing development of Bitcoin-based financial instruments suggest a growing acceptance of its role in the broader financial ecosystem. However, scalability issues, regulatory hurdles, and the volatility inherent in its price remain substantial challenges that could impact its long-term growth and adoption.

Bitcoin’s Role in the Future of Finance and Technology

Bitcoin’s long-term impact hinges on its ability to address the limitations of existing financial systems. Its decentralized structure could enhance financial inclusion by providing access to financial services for underserved populations. The inherent transparency of the blockchain could increase trust and efficiency in cross-border payments and reduce transaction costs. Furthermore, the development of second-layer scaling solutions, such as the Lightning Network, aims to improve transaction speeds and reduce fees, addressing a major obstacle to wider adoption. However, the success of these solutions depends on their widespread adoption and continued development. The integration of Bitcoin into existing financial infrastructure, through custodial services and exchange-traded products (ETPs), also plays a crucial role in increasing its accessibility and mainstream acceptance. For example, the growing number of institutional investors allocating assets to Bitcoin reflects a shift in perception, viewing it as a potential hedge against inflation and a store of value.

Long-Term Challenges Facing Bitcoin

Several significant challenges could hinder Bitcoin’s long-term growth. Regulatory uncertainty remains a major concern. Governments worldwide are grappling with how to regulate cryptocurrencies, and inconsistent or overly restrictive regulations could stifle innovation and adoption. The energy consumption associated with Bitcoin mining is another significant challenge, particularly concerning its environmental impact. Efforts to transition to more sustainable mining practices, such as the use of renewable energy sources, are crucial for long-term viability. Furthermore, the scalability of the Bitcoin network, the ability to handle a large volume of transactions efficiently, remains a key challenge that needs to be addressed through technological improvements and wider adoption of layer-two solutions. Security concerns, including the risk of hacking and theft, are also persistent challenges that require ongoing development of robust security measures. Finally, the inherent volatility of Bitcoin’s price poses a significant risk for investors and could hinder its wider acceptance as a medium of exchange.

Potential Future Use Cases for Bitcoin

Beyond its current use as a store of value and a medium of exchange, Bitcoin has the potential to be utilized in a variety of ways in the future. One significant area is cross-border payments, where Bitcoin’s decentralized nature and low transaction fees could offer a more efficient and cost-effective alternative to traditional methods. Another potential use case is microtransactions, where Bitcoin’s ability to handle small payments could facilitate new business models and applications. The integration of Bitcoin into decentralized finance (DeFi) applications is also expanding, creating new opportunities for lending, borrowing, and other financial services. Finally, the use of Bitcoin for secure and transparent record-keeping, leveraging the blockchain’s immutability, could have applications in various sectors, including supply chain management and digital identity verification. For example, a company could use Bitcoin’s blockchain to track the origin and movement of its products, enhancing transparency and traceability throughout the supply chain. This would provide consumers with greater confidence in the product’s authenticity and origin.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price, investment potential, and associated risks. Understanding these factors is crucial for making informed decisions about investing in this volatile cryptocurrency.

Major Factors Driving Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics are fundamental, with increased demand pushing prices upward and vice-versa. Regulatory actions by governments worldwide significantly impact investor sentiment and market liquidity. Technological advancements, such as the development of layer-2 scaling solutions, can affect transaction speed and efficiency, influencing adoption and price. Macroeconomic conditions, including inflation rates and overall market sentiment, also play a crucial role. For instance, periods of high inflation can drive investors towards Bitcoin as a hedge against inflation, increasing demand and price. Finally, media coverage and prominent figures’ opinions can sway public perception and, consequently, the price. The 2021 bull run, for example, was partially fueled by positive media attention and endorsements from prominent investors.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable due to the cryptocurrency’s volatility and the multitude of unpredictable factors influencing its price. Predictions often rely on technical analysis, which interprets historical price data and trading patterns, and fundamental analysis, which assesses factors like adoption rate and technological developments. However, these methods are not foolproof and past performance is not indicative of future results. Unexpected events, such as regulatory crackdowns, security breaches, or significant technological advancements, can drastically alter price trajectories, rendering even the most sophisticated predictions inaccurate. It’s important to approach all predictions with a healthy dose of skepticism and understand that they are speculative in nature. For example, predictions made in 2020 about Bitcoin’s price in 2021 varied wildly, highlighting the difficulty in accurately forecasting its future value.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. Proponents point to its decentralized nature, limited supply (21 million coins), and growing adoption as potential drivers of long-term price appreciation. The potential for high returns, significantly exceeding traditional asset classes, is a major draw. However, the considerable volatility and regulatory uncertainty pose significant risks. The possibility of complete loss of investment is a real concern, particularly given the nascent nature of the cryptocurrency market. The long-term success of Bitcoin hinges on factors such as widespread adoption, regulatory clarity, and the ongoing development of its underlying technology. Consider the example of early investors in Bitcoin who saw substantial gains over the long term, contrasting with those who entered the market later and experienced significant losses during periods of market correction.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Price volatility is a primary concern, with significant price swings occurring frequently. Regulatory uncertainty, varying across jurisdictions, poses another risk, with potential for government intervention impacting the market. Security risks, including hacking and theft from exchanges or personal wallets, are also significant. Furthermore, the lack of inherent value, unlike traditional assets, makes Bitcoin’s price entirely dependent on market sentiment and speculative demand. Mitigation strategies include diversifying investments, using secure storage methods (hardware wallets), and conducting thorough research before investing. Staying informed about regulatory changes and market trends is also vital for mitigating some of these risks. The Mt. Gox hack in 2014, resulting in the loss of a large number of Bitcoins, serves as a stark reminder of the security risks associated with holding Bitcoin.

Illustrative Examples

To better understand the potential volatility and impact of various factors on Bitcoin’s price, let’s examine some hypothetical scenarios and explore a possible future shaped by Bitcoin’s widespread adoption. These examples are not predictions but rather illustrative tools to highlight potential outcomes.

The following examples explore the influence of regulatory changes and the societal impact of widespread Bitcoin adoption. They aim to provide a richer understanding of the complex dynamics at play in the Bitcoin ecosystem.

Impact of a Major Regulatory Change on Bitcoin’s Price

Imagine a scenario where the United States government unexpectedly announces a comprehensive regulatory framework for cryptocurrencies in May 2025. This framework, instead of being restrictive, provides clear guidelines for Bitcoin exchanges, clarifies tax implications, and establishes a robust anti-money laundering (AML) compliance system. The clarity provided significantly reduces uncertainty for institutional investors, who have previously hesitated due to regulatory ambiguity. Consequently, a wave of institutional investment floods the market. Large asset management firms, pension funds, and even central banks begin allocating a portion of their portfolios to Bitcoin, driven by the newfound regulatory certainty and the asset’s perceived store-of-value properties. This surge in demand significantly outpaces the available supply, causing a dramatic price increase. Let’s assume a scenario where the price jumps from, say, $50,000 to $100,000 within a month, fueled by this positive regulatory shift. This increase is further amplified by the positive media coverage and the growing perception of Bitcoin as a legitimate and regulated asset class. Conversely, a harshly restrictive regulatory environment could trigger a significant price drop, as investors flee the market due to uncertainty and fear of legal repercussions. This demonstrates how governmental actions can dramatically shape Bitcoin’s trajectory.

Bitcoin’s Role in Everyday Transactions and Societal Impact

Picture a world in May 2025 where Bitcoin is seamlessly integrated into daily life. Imagine walking into your local coffee shop and paying for your latte directly with Bitcoin using a simple mobile phone app. No more fumbling with cash or credit cards; transactions are instantaneous, secure, and transparent. This ease of use has driven widespread adoption, not just for small purchases, but also for larger transactions like paying rent or buying a car. Businesses of all sizes accept Bitcoin, benefiting from lower transaction fees and faster processing times compared to traditional payment systems. Furthermore, cross-border remittances become significantly cheaper and faster, benefiting migrant workers and international businesses alike. The reduced reliance on traditional banking institutions empowers individuals and communities, particularly in regions with limited access to financial services. However, this widespread adoption also brings challenges. Concerns around scalability and environmental impact remain, necessitating ongoing technological advancements and the exploration of more sustainable mining solutions. The increased use of Bitcoin also raises questions about privacy and data security, requiring robust security protocols and responsible user behavior. Despite these challenges, this hypothetical scenario showcases Bitcoin’s potential to revolutionize the financial landscape and foster a more inclusive and efficient global economy. The integration of Bitcoin into everyday life is not merely a technological advancement; it’s a profound societal shift, altering the way we conduct business, manage finances, and interact with the global economy.

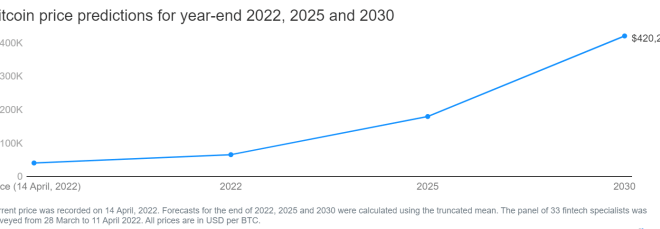

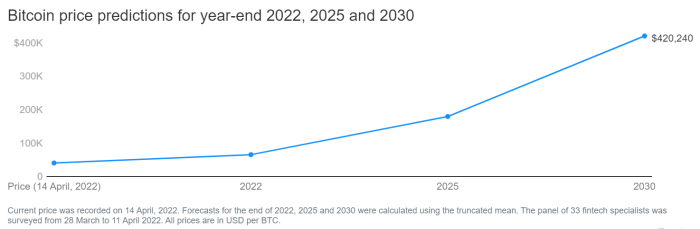

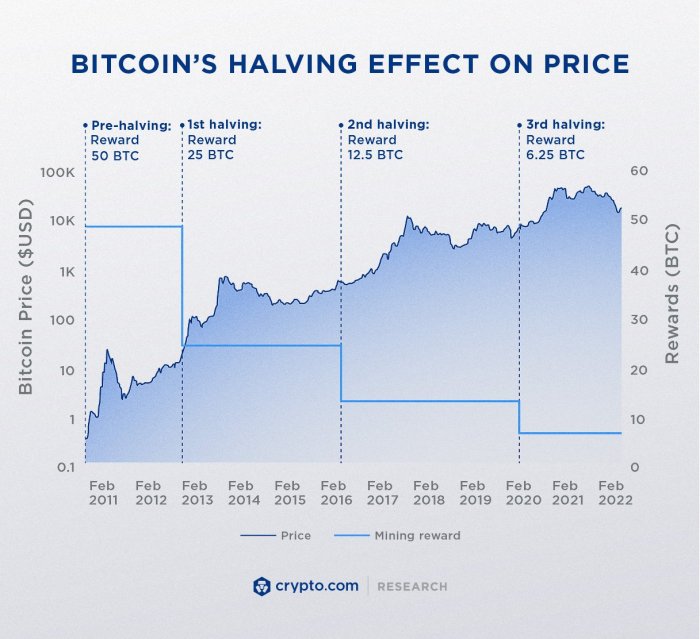

Bitcoin Prediction May 2025 – Accurately predicting Bitcoin’s price in May 2025 is challenging, but understanding key events significantly impacts forecasting. A major factor influencing Bitcoin’s future price is the halving, which reduces the rate of new Bitcoin creation. To understand the timeline for this crucial event, check out this resource on When Is The Bitcoin Halving 2025 and how it might affect Bitcoin’s price trajectory by May 2025.

Ultimately, the halving’s impact on scarcity and subsequent price predictions remains a central point of discussion for market analysts.

Accurately predicting Bitcoin’s price in May 2025 is challenging, but understanding historical trends offers valuable insight. A key factor to consider is the impact of the upcoming halving, and for detailed information on this, you should check out the comprehensive analysis available at Halving Bitcoin Data 2025. This data provides a crucial foundation for more informed predictions about Bitcoin’s potential trajectory in May 2025 and beyond.

Predicting Bitcoin’s price in May 2025 is challenging, requiring consideration of various factors. A key element influencing this prediction is the upcoming halving event, significantly impacting Bitcoin’s scarcity and potential price increase. For detailed insights into the price implications of this event, you can refer to this comprehensive analysis on the 2025 Bitcoin Halving Price Prediction.

Understanding the halving’s effects is crucial for formulating a well-informed Bitcoin Prediction May 2025.

Predicting Bitcoin’s price in May 2025 is challenging, but a key factor to consider is the impact of the next halving. Understanding the historical correlation between halving events and subsequent price increases is crucial for informed speculation. For detailed information on the timing and potential effects of this significant event, check out this resource on the Next Bitcoin Halving 2025.

This information will help refine any Bitcoin Prediction May 2025 analysis.

Predicting Bitcoin’s price in May 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event to consider when formulating any Bitcoin Prediction May 2025 is the upcoming halving, which significantly impacts the supply of new Bitcoins. To understand its influence, learning more about the halving process is crucial; for a detailed explanation, check out this informative resource: O Que É Halving Bitcoin 2025.

Ultimately, understanding the halving’s effect is vital for any accurate Bitcoin Prediction May 2025.

Predicting Bitcoin’s price in May 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the precise timing of this halving is crucial for accurate forecasting, and you can find details on the Bitcoin Halving Block Number 2025 to better inform your predictions. This information, combined with other market analyses, should provide a more comprehensive view of potential Bitcoin value in May 2025.

Predicting Bitcoin’s price in May 2025 is inherently speculative, relying on various factors like adoption rates and regulatory changes. However, effective marketing is crucial for any project aiming to capitalize on this potential, and a well-managed Google Ads Account can significantly enhance visibility and reach within the cryptocurrency market. Therefore, understanding the intricacies of digital advertising is as important as analyzing Bitcoin’s technical indicators when forecasting its future value in May 2025.