Bitcoin Prediction Monthly 2025

Bitcoin, first introduced in 2009 as a decentralized digital currency, has experienced a tumultuous yet fascinating journey. From its humble beginnings as a niche technology to its current status as a globally recognized asset, Bitcoin’s influence on the financial landscape is undeniable. Its market capitalization fluctuates dramatically, reflecting its volatile nature and attracting both significant investment and intense scrutiny. Currently, Bitcoin holds a substantial position in the cryptocurrency market, though its share is subject to ongoing shifts due to the emergence of competing cryptocurrencies and technological advancements.

Bitcoin’s price volatility is a complex phenomenon driven by a multitude of interacting factors. These include regulatory changes at national and international levels, macroeconomic conditions such as inflation and interest rate adjustments, market sentiment influenced by media coverage and social trends, technological developments within the Bitcoin network itself (like upgrades or scaling solutions), and the actions of large investors (often referred to as “whales”) who can significantly impact price movements through their buying and selling activities. Furthermore, the relatively limited supply of Bitcoin (21 million coins) compared to its growing adoption creates a dynamic tension that contributes to its volatility.

Factors Influencing Bitcoin Price Volatility, Bitcoin Prediction Monthly 2025

The price of Bitcoin is not governed by a central authority, making it susceptible to significant swings. For instance, news of a major regulatory crackdown in a significant market like China can trigger a sharp price drop, while positive announcements about Bitcoin adoption by institutional investors can lead to substantial price increases. Similarly, periods of global economic uncertainty often see investors flocking to Bitcoin as a potential hedge against inflation, causing price surges. Conversely, periods of economic stability can lead to profit-taking and price corrections. The interplay of these factors creates a complex and unpredictable market environment.

The Importance of Monthly Predictions in Long-Term Bitcoin Investment Strategies

While predicting the precise price of Bitcoin on a monthly basis is inherently challenging due to its volatility, monthly predictions offer a framework for understanding potential short-term trends within a long-term investment horizon. These predictions, while not guarantees, allow investors to develop more informed strategies. For example, a monthly prediction suggesting a price dip might inform a long-term investor to consider dollar-cost averaging – strategically buying more Bitcoin at lower prices – to reduce their average cost basis. Conversely, a prediction suggesting a price surge might prompt a re-evaluation of risk tolerance and profit-taking strategies. It’s crucial to remember that monthly predictions should be viewed as one piece of a larger puzzle, alongside fundamental analysis of the Bitcoin network and broader macroeconomic trends. Successful long-term Bitcoin investment relies on a robust understanding of these factors, not solely on short-term price predictions.

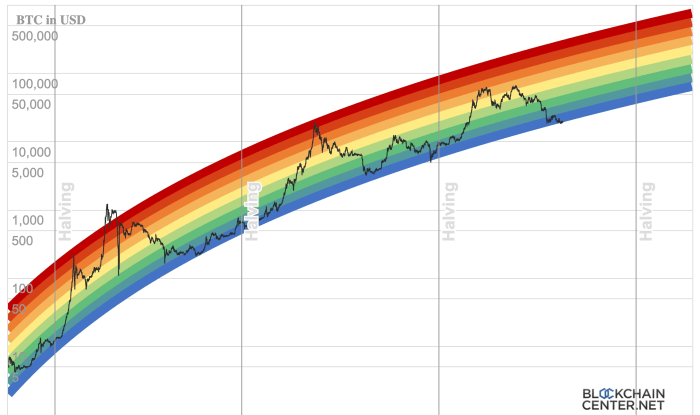

Accurately predicting Bitcoin’s monthly price in 2025 is challenging, relying on various factors. A key element influencing these predictions is the impact of the upcoming Bitcoin halving, which will significantly alter the rate of new Bitcoin entering circulation. For detailed information on this crucial event, refer to this comprehensive resource on Data Halving Bitcoin 2025. Understanding the halving’s effects is paramount when formulating any Bitcoin Prediction Monthly 2025 forecast.

Accurately predicting Bitcoin’s monthly performance in 2025 is challenging, requiring analysis of various factors. To gain a clearer perspective on the overall trajectory, it’s helpful to consider the broader picture; a comprehensive overview can be found by checking out the predictions for the end of 2025 at Bitcoin Prediction End Of 2025. Understanding the year-end forecast provides valuable context for formulating more precise monthly Bitcoin predictions for 2025.

Accurately predicting Bitcoin’s monthly performance in 2025 is challenging, relying heavily on various factors. A key element influencing these predictions is the impact of the upcoming halving events, such as the one detailed in this insightful article: Last Bitcoin Halving Before 2025. Understanding the historical effects of past halvings provides valuable context for formulating more informed Bitcoin Prediction Monthly 2025 forecasts.

Ultimately, the interplay of supply and demand, alongside macroeconomic conditions, will determine the actual trajectory.

Accurately predicting Bitcoin’s monthly price in 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting these predictions is the Bitcoin halving in 2025, whose significance is thoroughly explained here: Halving Bitcoin 2025 Meaning. Understanding the halving’s effect on Bitcoin’s supply and potential price increases is crucial for formulating more informed Bitcoin Prediction Monthly 2025 forecasts.

Accurately predicting Bitcoin’s monthly performance in 2025 is challenging, influenced by numerous factors including macroeconomic conditions and investor sentiment. A key event impacting these predictions is the Bitcoin halving, and to understand its timing, you should check out this resource: When Is The Halving Of Bitcoin 2025. The halving significantly alters the rate of new Bitcoin entering circulation, thus influencing its price and, consequently, our monthly predictions for 2025.

Accurately predicting Bitcoin’s monthly price in 2025 is challenging, but understanding key events is crucial. A significant factor influencing these predictions is the upcoming halving event; for a detailed explanation, check out this resource on 2025 Bitcoin Halving Nedir. This halving will undoubtedly impact Bitcoin’s scarcity and, consequently, its potential price fluctuations throughout 2025, making informed predictions even more complex.