Bitcoin Prediction October 2025

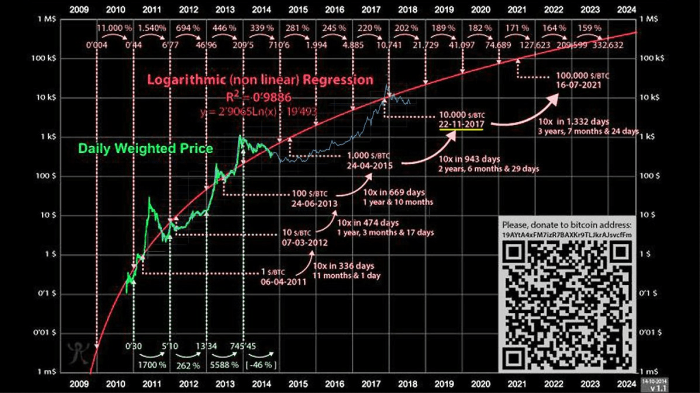

Bitcoin, first introduced in 2009 as a decentralized digital currency, has experienced a tumultuous yet fascinating journey. From its humble beginnings as a niche technology to its current status as a globally recognized asset, Bitcoin has captivated investors, technologists, and economists alike. While its price has fluctuated wildly, demonstrating periods of explosive growth and significant corrections, Bitcoin remains a significant player in the global financial landscape. Its market capitalization, while subject to considerable volatility, consistently places it among the top assets in the world.

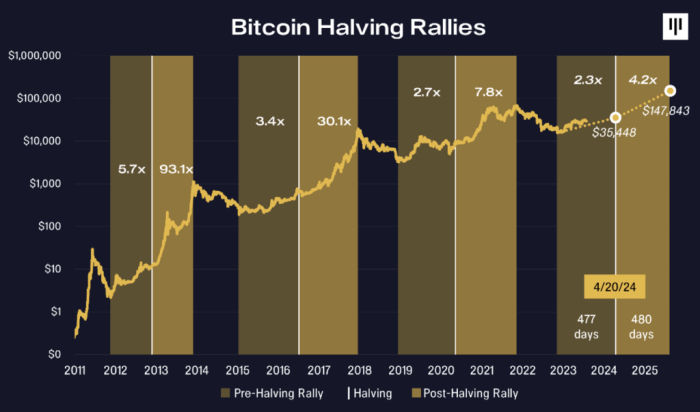

Bitcoin’s price volatility is a complex phenomenon influenced by a multitude of intertwined factors. Supply and demand dynamics, driven by investor sentiment and market speculation, play a crucial role. Regulatory announcements and actions from governments worldwide significantly impact investor confidence and trading activity. Technological advancements within the Bitcoin network itself, such as halving events that reduce the rate of new Bitcoin creation, also exert considerable influence. Furthermore, macroeconomic factors like inflation, interest rates, and geopolitical events can indirectly affect the perceived value and desirability of Bitcoin as a store of value and hedge against traditional financial systems.

Factors Influencing Bitcoin’s Price Volatility

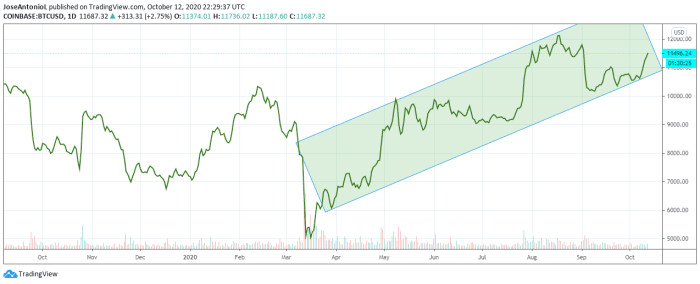

Several key factors contribute to Bitcoin’s price volatility. These include market sentiment, driven by news events and social media trends; regulatory uncertainty, as governments grapple with the implications of decentralized cryptocurrencies; and technological developments, such as scaling solutions and improvements to network security. The limited supply of Bitcoin (only 21 million coins will ever exist) is another significant factor, creating a scarcity that can drive up demand during periods of bullish sentiment. Finally, macroeconomic conditions, such as inflation or global economic instability, can also influence investor interest in Bitcoin as a potential safe haven asset. For example, the 2020-2021 bull run coincided with increased concerns about fiat currency inflation and government responses to the COVID-19 pandemic.

Challenges and Opportunities Facing Bitcoin

Bitcoin faces significant long-term challenges, including scalability issues that limit the number of transactions the network can process per second; energy consumption concerns related to the proof-of-work consensus mechanism; and regulatory uncertainty that varies considerably across different jurisdictions. However, opportunities abound. The growing adoption of Bitcoin as a payment method and store of value presents significant potential for future growth. Technological advancements, such as the Lightning Network, aim to address scalability concerns and improve transaction speeds. Increased institutional investment and the development of sophisticated financial products based on Bitcoin also suggest a broadening of its use cases beyond speculative trading. For instance, the growing acceptance of Bitcoin by institutional investors, such as MicroStrategy, signals a shift towards considering Bitcoin as a long-term asset.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently speculative, yet understanding the key factors influencing its value provides a framework for informed consideration. Several intertwined elements – regulatory landscapes, technological advancements, competitive cryptocurrency dynamics, macroeconomic conditions, and institutional investment – will significantly shape Bitcoin’s trajectory.

Regulatory Changes and Bitcoin’s Value

Regulatory clarity and acceptance will be crucial. A globally harmonized regulatory framework could boost institutional confidence and potentially increase Bitcoin’s price. Conversely, overly restrictive or inconsistent regulations across different jurisdictions could dampen investor enthusiasm and suppress price growth. For example, a scenario where the United States adopts a comprehensive and favorable regulatory structure for cryptocurrencies, while Europe maintains a more cautious approach, could create market volatility as capital flows adjust to these differing environments. The impact will depend on the specifics of the regulations; a clear and predictable regulatory environment is generally considered more favorable than a chaotic one.

Technological Advancements and Bitcoin’s Future

Technological developments within the Bitcoin ecosystem and the broader blockchain space will play a pivotal role. Improvements in scalability, transaction speed, and energy efficiency could significantly enhance Bitcoin’s usability and appeal. The development and adoption of the Lightning Network, for example, is a key factor; wider adoption of second-layer solutions will address current limitations and make Bitcoin more attractive for everyday transactions. Conversely, the emergence of competing blockchain technologies with superior capabilities could potentially divert investment away from Bitcoin.

Bitcoin’s Performance Compared to Other Cryptocurrencies

Bitcoin’s performance relative to other cryptocurrencies will be a major determinant of its price. The rise of altcoins with innovative features or superior functionalities could lead to a shift in market share and potentially diminish Bitcoin’s dominance. Conversely, Bitcoin’s established network effect, brand recognition, and first-mover advantage could help it maintain its position as the leading cryptocurrency, even amidst competition. The market capitalization of Bitcoin compared to the aggregate market capitalization of all other cryptocurrencies will be a crucial indicator of its relative strength.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions will undeniably influence Bitcoin’s price. Periods of economic uncertainty or inflation may drive investors towards Bitcoin as a hedge against traditional assets. Conversely, periods of economic stability or rising interest rates could lead to a decline in Bitcoin’s value as investors seek higher returns in more traditional investment vehicles. For example, a global recession could trigger a flight to safety, potentially benefiting Bitcoin; conversely, a period of strong economic growth might lead investors to favor more traditional, higher-yield assets.

Institutional Investment and Bitcoin’s Price

Increased institutional investment in Bitcoin will likely have a positive impact on its price. As large financial institutions, corporations, and pension funds allocate a portion of their portfolios to Bitcoin, it will increase liquidity and potentially reduce price volatility. However, significant institutional selling could also lead to a sharp decline in price. The level of institutional adoption will be a significant driver of price fluctuations; a gradual increase in institutional holdings suggests sustained growth, while rapid inflows or outflows could create volatility.

Potential Bitcoin Price Scenarios for October 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively say what the price will be in October 2025, exploring potential scenarios based on various assumptions can offer valuable insight. The following Artikels three distinct scenarios: bullish, bearish, and neutral, each with its own set of underlying assumptions and projected price ranges.

Bitcoin Price Scenarios: Bullish, Bearish, and Neutral

The following table summarizes three potential price scenarios for Bitcoin in October 2025. These scenarios represent a range of possibilities, from extremely optimistic to pessimistic, with a neutral scenario representing a more moderate outcome. It’s crucial to remember that these are just possibilities, and the actual price could fall outside these ranges.

| Scenario | Price Range (USD) | Rationale |

|---|---|---|

| Bullish | $150,000 – $250,000 | This scenario assumes widespread institutional adoption, significant technological advancements (like Layer-2 scaling solutions achieving mass adoption), positive regulatory developments globally, and continued macroeconomic uncertainty driving investors towards Bitcoin as a safe haven asset. A similar surge could be seen if a major global event, like a significant geopolitical shift, pushes investors towards Bitcoin as a hedge. The historical precedent of Bitcoin’s previous bull runs, though not directly comparable, also supports this level of growth. |

| Bearish | $20,000 – $40,000 | This scenario assumes a significant regulatory crackdown globally, leading to decreased investor confidence. Furthermore, it incorporates a prolonged period of macroeconomic stability, reducing the demand for Bitcoin as a hedge against inflation. A major security breach or technological flaw in the Bitcoin network could also contribute to a significant price drop. This scenario also considers the possibility of a crypto winter extending beyond the expected timeframe. The 2018 bear market, where Bitcoin fell from around $20,000 to below $3,000, serves as a cautionary example, though the market dynamics are not perfectly analogous. |

| Neutral | $60,000 – $100,000 | This scenario assumes a more moderate level of adoption by both institutional and retail investors. Regulatory clarity emerges, but it’s not universally positive across all jurisdictions. Macroeconomic conditions remain relatively stable, with Bitcoin maintaining its position as a digital asset with moderate growth. This scenario reflects a more balanced outlook, accounting for both positive and negative factors without extreme fluctuations. The price range reflects a continuation of existing growth trends, albeit at a more moderate pace. |

Technological Developments and Their Impact

Technological advancements are poised to significantly influence Bitcoin’s trajectory in the coming years, impacting its scalability, transaction speeds, and overall energy consumption. These developments will play a crucial role in determining Bitcoin’s adoption rate and its long-term viability as a dominant digital currency. The interplay between these technological factors and broader economic trends will shape Bitcoin’s price and market position.

Layer-2 scaling solutions are crucial for Bitcoin’s future adoption. The inherent limitations of Bitcoin’s base layer, which restrict transaction throughput and increase fees during periods of high network activity, are being addressed by these solutions. They essentially build on top of the existing Bitcoin blockchain to handle transactions more efficiently, offloading some of the processing burden. This increased efficiency leads to lower transaction fees and faster confirmation times, making Bitcoin more accessible and user-friendly for everyday transactions.

Layer-2 Scaling Solutions and Bitcoin Adoption

The success of layer-2 solutions directly correlates with Bitcoin’s ability to compete with faster, cheaper payment systems. For example, the Lightning Network, a prominent layer-2 protocol, allows for near-instantaneous, low-fee transactions. Increased adoption of these solutions will significantly reduce the friction associated with using Bitcoin, thus broadening its appeal to a wider audience, including businesses and everyday consumers. This increased usage, in turn, would likely exert upward pressure on Bitcoin’s price. Imagine a future where microtransactions are seamlessly conducted via the Lightning Network – this would represent a significant leap forward in Bitcoin’s usability. The wider adoption of layer-2 solutions could lead to a more decentralized and resilient network, reducing reliance on centralized exchanges and improving overall network security.

The Lightning Network’s Role in Enhancing Transaction Speed and Efficiency

The Lightning Network operates by creating off-chain payment channels between users. These channels allow for numerous transactions to occur without directly interacting with the main Bitcoin blockchain. This drastically reduces congestion on the main chain and results in faster transaction confirmation times, often measured in seconds, compared to the minutes or even hours it can take for on-chain transactions. The low transaction fees associated with the Lightning Network also make it a more attractive option for smaller payments, such as those used in everyday commerce. Successful scaling solutions like the Lightning Network are essential for Bitcoin’s mainstream adoption and could contribute to increased price volatility as the network handles larger transaction volumes. A successful scaling solution would effectively reduce congestion, lowering transaction fees and improving user experience.

Developments in Mining Technology and Their Influence on Bitcoin’s Energy Consumption and Security

The Bitcoin mining process, which involves solving complex cryptographic puzzles to validate transactions, is energy-intensive. However, ongoing developments in mining technology, such as the use of more energy-efficient hardware (ASICs) and renewable energy sources, are aiming to mitigate this concern. More efficient mining hardware reduces the energy consumed per transaction, thus lowering the environmental impact of Bitcoin mining. The shift towards renewable energy sources for powering mining operations further contributes to reducing the carbon footprint of the Bitcoin network. Increased efficiency in mining also improves the security of the network by making it more difficult for malicious actors to conduct 51% attacks. Improvements in mining efficiency can translate to lower operational costs for miners, which could indirectly influence the overall cost of Bitcoin and potentially impact its price. A significant shift towards renewable energy sources for Bitcoin mining could positively influence public perception and investor confidence.

Regulatory Landscape and its Influence: Bitcoin Prediction October 2025

The regulatory environment surrounding Bitcoin and other cryptocurrencies is rapidly evolving, posing significant uncertainty but also the potential for greater mainstream adoption. Different jurisdictions are taking diverse approaches, creating a complex global landscape that significantly impacts Bitcoin’s price and overall market sentiment. Understanding these regulatory shifts is crucial for predicting Bitcoin’s future trajectory.

The impact of regulatory changes on Bitcoin’s price is multifaceted. Increased regulatory clarity, for instance, can boost investor confidence and lead to price increases. Conversely, overly restrictive regulations could stifle innovation and adoption, potentially causing price drops. The specific effect depends heavily on the nature and stringency of the regulations implemented.

Varying Regulatory Approaches Across Jurisdictions

Different countries are adopting markedly different approaches to regulating cryptocurrencies. Some, like El Salvador, have embraced Bitcoin as legal tender, while others, like China, have implemented outright bans. Many nations are opting for a more nuanced approach, focusing on consumer protection, anti-money laundering (AML) compliance, and tax regulations. For example, the European Union is working towards a comprehensive regulatory framework (MiCA) aiming to standardize crypto asset rules across member states. The United States, meanwhile, is grappling with a patchwork of state and federal regulations, leading to inconsistencies and uncertainty. This fragmented global regulatory landscape creates opportunities and challenges for Bitcoin’s future.

Potential Effects of Stricter Regulations on Bitcoin Adoption and Price

Stricter regulations could potentially hinder Bitcoin adoption by increasing compliance costs for businesses and individuals. This could discourage smaller players from entering the market, leading to decreased liquidity and potentially lower prices. However, increased regulation could also build trust among institutional investors, potentially offsetting the negative impacts on adoption. For example, if regulations successfully address concerns about money laundering and market manipulation, it could attract larger institutional investments, ultimately driving up the price. The net effect will depend on the balance between these opposing forces. A scenario where regulations are perceived as overly burdensome and stifle innovation could lead to a significant price decline. Conversely, a well-structured regulatory framework that addresses key concerns without being overly restrictive could foster greater trust and wider adoption, potentially leading to price appreciation. The ultimate outcome remains highly dependent on the specific details of the regulatory landscape in major global markets.

Bitcoin’s Role in the Global Financial System

Bitcoin’s potential impact on the global financial system is a subject of intense debate. While its decentralized nature presents a compelling alternative to traditional finance, its volatility and regulatory uncertainty pose significant challenges to widespread adoption as a mainstream asset class. This section will explore Bitcoin’s potential to reshape the financial landscape, examining both its transformative possibilities and inherent risks.

Bitcoin’s potential to become a mainstream asset class hinges on several factors. Increased institutional investment, improved regulatory clarity, and enhanced user experience through more intuitive wallets and exchanges are all crucial. If Bitcoin demonstrates sustained price stability and becomes more widely accepted as a store of value and medium of exchange, its integration into mainstream finance will accelerate. The growing number of companies accepting Bitcoin as payment, albeit still limited, represents a step in this direction. For example, companies like MicroStrategy have made significant investments in Bitcoin, demonstrating a growing level of institutional confidence.

Bitcoin’s Disruptive Potential

Bitcoin’s decentralized and transparent nature directly challenges the centralized control characteristic of traditional financial systems. The elimination of intermediaries, such as banks and payment processors, promises lower transaction fees and faster settlement times. This potential for disintermediation could revolutionize cross-border payments, offering a more efficient and cost-effective alternative to traditional SWIFT transfers. However, this disruptive potential also raises concerns about financial stability and regulatory oversight. The absence of central control could make Bitcoin vulnerable to manipulation and increase the risk of illicit activities.

Risks and Benefits of Bitcoin Integration

The increasing integration of Bitcoin into the global financial system presents both significant benefits and considerable risks. On the one hand, Bitcoin’s decentralized nature offers increased financial inclusion, particularly for unbanked populations. It also provides a hedge against inflation and potentially offers greater security against government control and censorship. On the other hand, the volatility of Bitcoin’s price poses a substantial risk to investors and businesses. Its susceptibility to hacking and theft, along with the potential for regulatory crackdowns, presents further challenges. The lack of consumer protection mechanisms inherent in traditional financial systems also necessitates caution. The collapse of FTX, a major cryptocurrency exchange, serves as a stark reminder of the risks associated with the nascent cryptocurrency market. Balancing the potential benefits with these risks is a key challenge in navigating Bitcoin’s integration into the global financial system.

Addressing Common Concerns and Misconceptions

Understanding the potential of Bitcoin requires addressing common anxieties and misconceptions surrounding its future. Many questions arise regarding its volatility, security, and long-term viability. The following sections aim to clarify these points and offer a more nuanced perspective on Bitcoin’s prospects in October 2025 and beyond.

Bitcoin’s Volatility and Investment Risk

Bitcoin’s price history is characterized by significant volatility. This fluctuation stems from various factors, including regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. While this volatility presents inherent risks, it also presents opportunities for substantial returns. Historical data shows that despite periods of sharp decline, Bitcoin has demonstrated a remarkable capacity for recovery and long-term growth. For example, after the 2018 bear market, Bitcoin’s price eventually rebounded significantly. Investors should understand that a long-term perspective and a risk tolerance appropriate to their financial situation are crucial when considering Bitcoin as an investment. Diversification within a broader investment portfolio is also a widely recommended strategy to mitigate risk.

Bitcoin’s Security and Scalability

Concerns about Bitcoin’s security and scalability are frequently raised. Bitcoin’s decentralized nature, secured by a robust cryptographic system and a vast network of miners, makes it highly resistant to single points of failure or manipulation. However, the network’s transaction speed and fees have been subject to fluctuations, prompting ongoing development of solutions like the Lightning Network, which aims to improve scalability and reduce transaction costs. The Lightning Network, for example, operates as a layer-two solution, processing transactions off-chain before settling them on the main blockchain, thereby significantly increasing transaction throughput. While challenges remain, the ongoing development and innovation within the Bitcoin ecosystem demonstrate a commitment to addressing these concerns.

Bitcoin’s Regulation and Legal Status, Bitcoin Prediction October 2025

The regulatory landscape surrounding Bitcoin varies considerably across jurisdictions. Some countries have embraced Bitcoin and other cryptocurrencies, while others maintain a more cautious or restrictive approach. This regulatory uncertainty can influence price movements and investor confidence. However, the increasing global recognition of Bitcoin’s potential and the ongoing efforts to establish clearer regulatory frameworks suggest that a more standardized and predictable regulatory environment may emerge over time. The evolving regulatory landscape is a dynamic factor that will continue to shape Bitcoin’s future. Examples include the increasing number of countries exploring central bank digital currencies (CBDCs) and the development of international regulatory standards for cryptocurrencies.

Bitcoin’s Long-Term Viability as a Store of Value

The long-term viability of Bitcoin as a store of value is a subject of ongoing debate. Proponents argue that its limited supply (21 million coins), decentralized nature, and growing adoption make it a compelling alternative to traditional assets, particularly during times of economic uncertainty. Critics, however, point to its volatility and the potential for technological disruption as reasons to question its long-term value. The assessment of Bitcoin’s long-term viability depends on various factors, including its continued adoption, technological improvements, and macroeconomic conditions. The fact that it has survived numerous market cycles and maintained its position as a leading cryptocurrency speaks to its resilience.

Bitcoin’s Environmental Impact

The energy consumption associated with Bitcoin mining has been a source of criticism. However, the industry is increasingly adopting more sustainable energy sources, such as renewable energy, and exploring energy-efficient mining techniques. Furthermore, the environmental impact of Bitcoin needs to be considered in the context of the broader financial system, which also has significant environmental footprints. Ongoing technological developments and initiatives aimed at reducing Bitcoin’s energy consumption are continuously being implemented. This ongoing effort highlights the industry’s responsiveness to environmental concerns.

Bitcoin Prediction October 2025 – Predicting Bitcoin’s price in October 2025 is challenging, requiring consideration of various factors. A key element influencing this prediction is the Bitcoin halving, a significant event impacting scarcity and potential price increases. To understand the timing of this crucial event, you should consult this resource on the halving: Quando Será O Halving Do Bitcoin 2025. Understanding the halving’s impact is critical for forming a more informed prediction of Bitcoin’s value in October 2025.

Predicting Bitcoin’s price in October 2025 is challenging, but a key factor to consider is the upcoming halving. The reduced supply of newly mined Bitcoin, as explained in detail on this informative page about the 2025 Halving Bitcoin , will likely impact the market. Therefore, understanding the halving’s potential consequences is crucial for any serious Bitcoin price prediction for October 2025.

Predicting Bitcoin’s price in October 2025 is challenging, as various factors influence its trajectory. A key event impacting future price predictions is the Bitcoin Halving, and to understand its potential effect, pinpointing the Bitcoin Halving Exact Date 2025 is crucial. This date significantly influences the supply dynamics of Bitcoin, ultimately impacting the October 2025 price prediction.

Predicting Bitcoin’s price in October 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event to consider is the Bitcoin Halving in 2025, and its potential impact on price is widely debated. For insightful analysis on the expected effects of the Bitcoin Halving 2025 Binance might offer, further research into this event is crucial for refining any October 2025 Bitcoin price prediction.

Predicting Bitcoin’s price in October 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event to consider is the Bitcoin Halving in 2025, and its potential impact on price is widely debated. For insightful analysis on the expected effects of the Bitcoin Halving 2025 Binance might offer, further research into this event is crucial for refining any October 2025 Bitcoin price prediction.

Predicting Bitcoin’s price in October 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event to consider is the Bitcoin Halving in 2025, and its potential impact on price is widely debated. For insightful analysis on the expected effects of the Bitcoin Halving 2025 Binance might offer, further research into this event is crucial for refining any October 2025 Bitcoin price prediction.