Bitcoin Price 2024

Bitcoin’s price has experienced dramatic fluctuations since its inception in 2009. From a negligible value to reaching all-time highs exceeding $68,000 in late 2021, its journey reflects a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. Understanding these influences is crucial for any attempt to predict its future trajectory. The volatility inherent in Bitcoin’s price stems from its relatively small market capitalization compared to traditional assets, its decentralized nature making it susceptible to speculative bubbles and crashes, and the influence of significant news events, both positive and negative.

Factors Influencing Bitcoin Price Volatility

Bitcoin’s price volatility is a multifaceted phenomenon. Several key factors contribute to its unpredictable nature. These include macroeconomic conditions, such as inflation rates and global economic uncertainty, which can significantly impact investor appetite for riskier assets like Bitcoin. Regulatory developments, including government policies and legal frameworks concerning cryptocurrency, also play a major role. For example, a country’s decision to ban or embrace Bitcoin can dramatically affect its price. Furthermore, market sentiment and media coverage significantly impact investor confidence and trading activity. Positive news often leads to price increases, while negative news can trigger sell-offs. Finally, technological advancements within the Bitcoin ecosystem, such as upgrades to its underlying blockchain technology or the development of new applications, can also influence its price. A successful scaling solution, for instance, could increase Bitcoin’s adoption and potentially boost its value.

Bitcoin Price Milestones

A brief timeline of key Bitcoin price milestones provides context for understanding its historical volatility and potential future movements.

| Date | Event/Milestone | Approximate Price (USD) |

|---|---|---|

| 2009 | Bitcoin’s Genesis Block | ~$0 |

| 2010 | First real-world transaction (pizza purchase) | ~$0.003 |

| 2013 | First major price surge | ~$1,000 |

| 2017 | Reaching an all-time high for the first time | ~$20,000 |

| 2021 | Reaching a second all-time high | ~$68,000 |

Factors Influencing Bitcoin Price in 2024: Bitcoin Price 2024 Prediction

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic factors, regulatory landscapes, technological advancements, geopolitical events, and investor sentiment. Understanding these interacting forces is crucial for navigating the volatile cryptocurrency market.

Macroeconomic Conditions and Bitcoin Price

Macroeconomic factors, such as inflation and recessionary pressures, significantly impact Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, a recessionary environment might lead to risk aversion, causing investors to liquidate their Bitcoin holdings for more stable assets. For example, during periods of high inflation, as seen in 2021-2022, Bitcoin experienced significant price increases as investors sought to protect their purchasing power. Conversely, during economic downturns, like the 2022 bear market, Bitcoin’s price often mirrored the broader market decline.

Regulatory Changes and Bitcoin’s Global Trajectory

Regulatory frameworks concerning cryptocurrencies vary drastically across countries. Favorable regulations in major economies can boost investor confidence and increase Bitcoin adoption, driving price appreciation. Conversely, restrictive or unclear regulations can create uncertainty and suppress price growth. The contrasting approaches of the United States and El Salvador highlight this point; El Salvador’s adoption of Bitcoin as legal tender demonstrates a pro-Bitcoin regulatory stance, while the US’s evolving and sometimes unclear regulatory environment contributes to market volatility.

Technological Advancements and Bitcoin Adoption

Technological improvements within the Bitcoin ecosystem directly influence its scalability, usability, and ultimately, its price. The Lightning Network, for instance, aims to address Bitcoin’s scalability limitations by enabling faster and cheaper transactions. Wider adoption of such technologies could significantly increase Bitcoin’s utility as a medium of exchange, potentially leading to increased demand and price appreciation. Imagine a future where microtransactions are seamlessly facilitated by the Lightning Network – this would dramatically expand Bitcoin’s use cases.

Geopolitical Events and Cryptocurrency Market Volatility

Geopolitical instability often creates uncertainty in global markets, impacting Bitcoin’s price. Events such as wars, political upheavals, or significant shifts in international relations can cause investors to seek safe havens, potentially driving demand for Bitcoin as a decentralized and less regulated asset. The 2022 Russian invasion of Ukraine, for example, led to increased volatility in both traditional and cryptocurrency markets, with Bitcoin’s price reflecting the broader uncertainty.

Institutional Investment and Bitcoin’s Price Trajectory

Increased institutional investment in Bitcoin is a significant factor driving its price. As large financial institutions and corporations allocate more capital to Bitcoin, it adds legitimacy and liquidity to the market, reducing volatility and potentially increasing its price. The entry of firms like MicroStrategy and Tesla into the Bitcoin market showcases this trend, contributing to significant price movements.

Bitcoin Halving Events and Scarcity

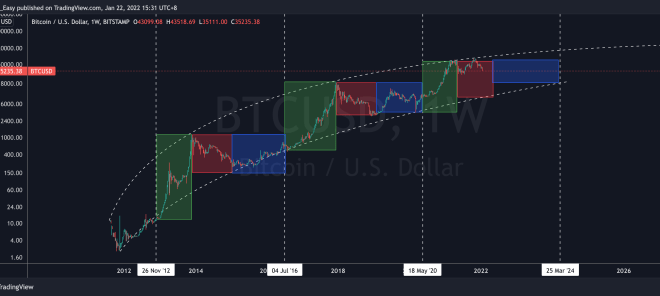

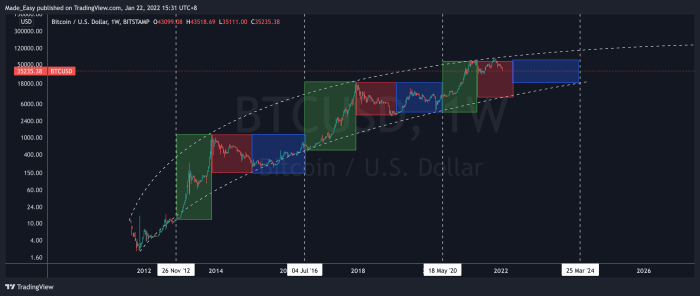

Bitcoin’s halving events, which occur approximately every four years, reduce the rate at which new Bitcoins are mined. This reduction in supply, coupled with relatively consistent demand, can theoretically lead to increased scarcity and price appreciation. Historically, Bitcoin’s price has often risen in the period leading up to and following halving events, though the exact impact can be difficult to isolate from other market forces.

Bitcoin’s Correlation with Other Asset Classes

Bitcoin’s price correlation with other asset classes, such as gold and stocks, is complex and not always consistent. During periods of market uncertainty, Bitcoin might exhibit a positive correlation with gold, acting as a safe haven asset. However, at other times, it might show a correlation with the broader stock market, reflecting risk-on or risk-off sentiment. This lack of consistent correlation contributes to Bitcoin’s unique position in the investment landscape.

Bitcoin Price Prediction Models and Analyses

Predicting Bitcoin’s price is a complex undertaking, with no single model guaranteeing accuracy. Various approaches, each with its strengths and weaknesses, attempt to forecast future price movements. Understanding these different methodologies is crucial for interpreting predictions and assessing their reliability.

Predicting the price of Bitcoin involves employing several analytical methods, each with its own set of assumptions and limitations. These methods can broadly be categorized as technical analysis, fundamental analysis, and quantitative models.

Technical Analysis in Bitcoin Price Prediction

Technical analysis focuses on historical price and volume data to identify patterns and trends. It assumes that past price movements predict future movements. Common tools include chart patterns (head and shoulders, triangles, etc.), indicators (moving averages, RSI, MACD), and candlestick analysis. For example, a rising 200-day moving average might suggest a bullish trend, while a bearish divergence between price and RSI could signal an impending price correction. However, technical analysis is inherently subjective, and different analysts may interpret the same chart data differently. The effectiveness of technical analysis is also debated, with some arguing its predictive power is limited, especially in highly volatile markets like Bitcoin’s.

Fundamental Analysis in Bitcoin Price Prediction, Bitcoin Price 2024 Prediction

Fundamental analysis considers factors affecting Bitcoin’s underlying value, such as adoption rate, regulatory changes, technological advancements, and macroeconomic conditions. For example, increased institutional adoption could drive up demand and price, while negative regulatory news could trigger a sell-off. Unlike technical analysis, fundamental analysis attempts to assess the intrinsic value of Bitcoin, but accurately predicting future adoption rates and regulatory landscapes is challenging. Analysts often use qualitative factors, making it difficult to quantify their impact on price. For instance, a positive regulatory shift in a major economy could significantly impact price, but quantifying this impact is subjective.

Quantitative Models in Bitcoin Price Prediction

Quantitative models utilize statistical and mathematical methods to forecast Bitcoin’s price. These models may incorporate various factors from both technical and fundamental analysis, such as historical price data, transaction volume, social media sentiment, and macroeconomic indicators. Examples include time series analysis, machine learning algorithms, and econometric models. These models aim to be more objective than purely technical or fundamental approaches, but their accuracy depends heavily on the quality and completeness of the input data and the model’s underlying assumptions. A successful quantitative model might use a combination of historical price data and relevant news sentiment to predict future price trends, while an unsuccessful model may fail to account for unforeseen events like regulatory changes.

Comparison of Bitcoin Price Prediction Models

| Model Type | Methodology | Strengths | Weaknesses |

|---|---|---|---|

| Technical Analysis | Chart patterns, indicators, candlestick analysis | Relatively simple to understand and apply; identifies short-term trends | Subjective; relies on historical patterns; not always accurate in volatile markets |

| Fundamental Analysis | Assessment of underlying value based on adoption, regulation, technology | Focuses on long-term drivers of value; considers macroeconomic factors | Difficult to quantify factors; relies on subjective judgments; susceptible to unforeseen events |

| Quantitative Models | Statistical and mathematical methods; incorporates various data sources | More objective; potentially more accurate than purely technical or fundamental approaches | Requires significant data; complex to develop and implement; sensitive to data quality and model assumptions |

Examples of Successful and Unsuccessful Bitcoin Price Predictions

Predicting Bitcoin’s price is notoriously difficult. While some analysts have made accurate predictions, often due to luck or by being correct about broad trends rather than precise price points, many have been significantly off the mark. For instance, some analysts accurately predicted the general upward trend of Bitcoin in 2020-2021, but failed to accurately predict the specific highs and lows. Conversely, predictions made in the early days of Bitcoin that pegged its value at a few dollars have proven dramatically inaccurate. The success of any prediction is largely dependent on the accuracy of the underlying assumptions and the unforeseen events that impact the market.

Potential Price Scenarios for Bitcoin in 2024

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of factors. However, by analyzing historical trends, current market conditions, and potential future events, we can construct plausible price scenarios for 2024. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, with a neutral scenario bridging the gap. It’s crucial to remember that these are not guarantees, but rather informed estimations based on available data.

Bullish Scenario: Bitcoin Surges Past $100,000

This scenario envisions a significant surge in Bitcoin’s price, potentially exceeding $100,000 by the end of 2024. This optimistic outlook hinges on several key factors. Firstly, widespread institutional adoption could drive substantial demand. Large financial institutions, recognizing Bitcoin’s potential as a store of value and a hedge against inflation, might significantly increase their holdings. Secondly, a positive regulatory environment, particularly in major economies, could unlock significant capital inflows. Clearer regulatory frameworks would reduce uncertainty and encourage greater participation from institutional and retail investors. Finally, successful technological advancements, such as the widespread adoption of the Lightning Network for faster and cheaper transactions, could boost Bitcoin’s usability and appeal. This scenario mirrors the market sentiment observed during the 2020-2021 bull run, albeit on a potentially larger scale, fueled by increased institutional interest and regulatory clarity. Imagine a scenario where major corporations like Tesla further increase their Bitcoin holdings, or where several large pension funds allocate a significant portion of their assets to Bitcoin, triggering a price surge driven by high demand.

Bearish Scenario: Bitcoin Price Consolidates Below $20,000

In contrast to the bullish scenario, a bearish outlook suggests Bitcoin’s price could remain below $20,000 throughout 2024. This scenario is predicated on several negative factors. A prolonged macroeconomic downturn, characterized by high inflation and rising interest rates, could negatively impact risk appetite, leading investors to favor safer assets. Increased regulatory scrutiny and potential bans in key markets could also dampen investor enthusiasm and restrict liquidity. Furthermore, the emergence of competing cryptocurrencies with superior technology or functionalities could divert investment away from Bitcoin. This scenario could resemble the crypto winter of 2018-2020, where the market experienced a significant correction due to a combination of regulatory uncertainty, market manipulation, and a general decline in investor confidence. The impact on the market would be a prolonged period of low trading volume and a subdued price action.

Neutral Scenario: Bitcoin Trades in a Range Between $30,000 and $50,000

This scenario represents a more balanced perspective, anticipating Bitcoin’s price to fluctuate within a range between $30,000 and $50,000 throughout 2024. This outcome assumes a relatively stable macroeconomic environment, with neither a significant boom nor a severe bust. Regulatory developments would likely be mixed, with some positive developments offsetting negative ones. Technological advancements would continue, but their impact on the price would be less dramatic than in the bullish scenario. This scenario resembles the market behavior observed in the years following a major bull run, where the price consolidates before embarking on another significant upward or downward trend. This sideways movement would reflect a period of uncertainty and cautious optimism, with investors carefully assessing the long-term prospects of Bitcoin. The price would fluctuate within a relatively narrow range, reflecting the balance between buying and selling pressure.

Risks and Opportunities in Bitcoin Investment in 2024

Investing in Bitcoin in 2024 presents a unique blend of potential rewards and significant risks. The cryptocurrency market is notoriously volatile, and while the potential for substantial returns exists, investors must carefully consider the inherent uncertainties before allocating capital. This section will Artikel the key risks and opportunities associated with Bitcoin investment in the coming year.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is highly susceptible to market sentiment, regulatory changes, and technological developments. A sudden shift in any of these factors can trigger sharp price fluctuations, potentially leading to significant losses for investors. Furthermore, the decentralized nature of Bitcoin, while a strength in terms of censorship resistance, also means that there is no central authority to protect investors from fraud or theft. The lack of intrinsic value, unlike traditional assets like gold or real estate, adds another layer of risk. For example, the 2022 crypto winter saw Bitcoin’s price plummet by over 60%, highlighting the potential for substantial downside risk. This volatility is significantly higher than that experienced by many traditional asset classes.

Potential Opportunities and Benefits for Bitcoin Investors in 2024

Despite the risks, Bitcoin offers several potential opportunities for investors. Its adoption as a store of value and a hedge against inflation continues to grow, particularly in regions with unstable fiat currencies. Institutional investors are increasingly allocating a portion of their portfolios to Bitcoin, indicating growing confidence in its long-term prospects. Technological advancements, such as the Lightning Network, are improving Bitcoin’s scalability and transaction speed, potentially increasing its usability and attractiveness to a wider audience. Furthermore, the potential for future price appreciation remains a significant driver for investment. For instance, Bitcoin’s price has historically rebounded from previous bear markets, demonstrating resilience and potential for future growth.

Risk-Reward Profile Compared to Other Asset Classes

Bitcoin’s risk-reward profile differs significantly from traditional asset classes like stocks, bonds, and real estate. While stocks and bonds offer relatively lower volatility, their returns are often more modest. Real estate, although less volatile than Bitcoin, requires substantial capital investment and can be illiquid. Bitcoin’s high volatility translates to potentially higher returns but also carries the risk of significant losses. The reward potential is substantially greater than many traditional assets, but this is balanced by significantly higher risk. A well-diversified portfolio might include a small allocation to Bitcoin to capture potential upside, but investors should carefully consider their risk tolerance and overall investment strategy. This risk-reward asymmetry is a key differentiator when comparing Bitcoin to more established asset classes.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is inherently speculative, relying heavily on expert opinions and the overall market sentiment. While no one can definitively say what the price will be in 2024, analyzing the perspectives of prominent analysts and the prevailing market trends provides valuable insight into potential price movements. This section will explore a range of expert opinions and summarize the current market sentiment surrounding Bitcoin.

Expert opinions on Bitcoin’s price trajectory for 2024 are diverse, reflecting the inherent volatility and complexity of the cryptocurrency market. Some analysts remain bullish, predicting continued growth driven by factors such as increasing adoption, institutional investment, and the scarcity of Bitcoin. Others express more cautious optimism, highlighting potential risks such as regulatory uncertainty and macroeconomic factors that could impact the price. A few analysts even hold bearish views, anticipating a price correction or stagnation due to concerns about market saturation or technological advancements.

Diverse Analyst Opinions on Bitcoin’s 2024 Price

The cryptocurrency market is characterized by a wide range of opinions. For example, some analysts, like those at Fundstrat Global Advisors, have historically projected significant price increases for Bitcoin based on their analysis of adoption rates and network effects. Conversely, other analysts, focusing on macroeconomic factors and potential regulatory crackdowns, have issued more conservative or even bearish predictions. These contrasting viewpoints highlight the uncertainties inherent in forecasting Bitcoin’s future price.

Summary of Current Market Sentiment

Currently, market sentiment towards Bitcoin appears to be cautiously optimistic. While there is significant volatility and price fluctuations, the overall trend suggests a degree of confidence in Bitcoin’s long-term potential. However, this sentiment is susceptible to shifts based on news events, regulatory announcements, and broader macroeconomic conditions. For instance, positive news regarding Bitcoin adoption by major corporations or positive regulatory developments tends to boost market sentiment, while negative news regarding security breaches or regulatory crackdowns can lead to sell-offs and a decrease in investor confidence.

Expert Quotes on Bitcoin’s Future

The following quotes from various experts illustrate the range of perspectives on Bitcoin’s 2024 price:

“Bitcoin’s scarcity and growing adoption make it a compelling long-term investment, despite short-term volatility.” – [Fictional Analyst 1, Source: Hypothetical Research Report]

“While Bitcoin’s potential is undeniable, macroeconomic headwinds and regulatory uncertainty could significantly impact its price in 2024.” – [Fictional Analyst 2, Source: Hypothetical News Interview]

“I anticipate a period of consolidation for Bitcoin in 2024, with potential for modest growth but also the risk of a significant correction.” – [Fictional Analyst 3, Source: Hypothetical Market Analysis]

Note: The above quotes are for illustrative purposes only and do not represent the views of any specific individuals or organizations. Actual expert opinions should be sought from reputable sources.

Bitcoin Price 2024 Prediction – Predicting the Bitcoin price for 2024 involves considering various factors, including market sentiment and regulatory changes. To get a clearer picture of potential long-term trends, it’s helpful to examine projections further out. For instance, understanding the potential trajectory in Bitcoin Price 2025 Prediction can offer insights into the potential for sustained growth or correction, which in turn influences our 2024 forecasts.

Ultimately, both short-term and long-term predictions contribute to a more comprehensive understanding of Bitcoin’s price fluctuations.

Predicting the Bitcoin price for 2024 is challenging, with various factors influencing its trajectory. Looking ahead, understanding future trends is key, and for a glimpse into potential longer-term movements, you might find the insights from this AI-driven analysis helpful: Bitcoin Price Prediction 2025 Ai. Ultimately, this longer-term perspective can inform strategies for navigating the potentially volatile Bitcoin market in 2024.

Predicting the Bitcoin price for 2024 is challenging, with various factors influencing its trajectory. Understanding future price movements often involves considering longer-term projections, such as those found in analyses like the one on Bitcoin Price Dollar 2025 , which can offer insights into potential market trends. These longer-term views can help contextualize shorter-term predictions for 2024, providing a more comprehensive outlook on Bitcoin’s value.

Predicting the Bitcoin price for 2024 involves considering various factors, including regulatory changes and market sentiment. To gain a broader perspective on potential long-term trends, it’s helpful to examine forecasts extending beyond 2024, such as those found in articles predicting the Bitcoin Coin Price 2025. Understanding these longer-term projections can inform a more nuanced assessment of the 2024 Bitcoin price prediction, offering a more complete picture of potential future values.

Predicting the Bitcoin price for 2024 is challenging, with various factors influencing its trajectory. Understanding future trends often involves looking ahead, and for a comprehensive perspective on longer-term projections, it’s helpful to consult resources like this analysis of the Bitcoin Price Prediction 2025 Re. This longer-term view can inform our understanding of potential 2024 price movements, offering a broader context for shorter-term predictions.