Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently speculative, but analyzing key influencing factors offers valuable insight into potential price movements. Several interconnected elements will likely shape the market, ranging from institutional adoption to regulatory landscapes and technological advancements.

Institutional Investment in Bitcoin

The growing involvement of institutional investors, including corporations, hedge funds, and asset management firms, significantly impacts Bitcoin’s price. Increased institutional adoption generally leads to higher demand, pushing prices upwards. Examples include MicroStrategy’s substantial Bitcoin holdings and Tesla’s previous investment, which, while fluctuating, demonstrated a large-scale commitment to the asset class. This institutional buying pressure can counterbalance periods of market uncertainty and individual selling, providing a degree of price stability and upward momentum. The continued maturation of institutional-grade custody solutions and regulatory clarity will further fuel this trend.

Regulatory Changes and Bitcoin Adoption

Regulatory frameworks surrounding Bitcoin vary widely across jurisdictions. Clear and consistent regulations, while potentially restrictive in some aspects, can increase investor confidence and institutional participation. Conversely, overly restrictive or unclear regulations can stifle adoption and negatively impact price. The example of El Salvador’s adoption of Bitcoin as legal tender, despite its challenges, illustrates the potential impact of government policy on both price and adoption. Conversely, instances of regulatory crackdowns in certain countries can create short-term price volatility and discourage investment. The evolution of regulatory landscapes globally will be a key driver of Bitcoin’s price trajectory in 2025.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem can influence price in several ways. Improvements in scaling solutions, such as the Lightning Network, can increase transaction speed and reduce fees, making Bitcoin more user-friendly and potentially driving demand. Developments in privacy-enhancing technologies, while potentially controversial, could also impact the asset’s appeal to a wider range of investors. Conversely, any major security breaches or significant technological setbacks could trigger negative price reactions. The ongoing development and adoption of layer-2 solutions will be crucial in determining Bitcoin’s scalability and overall usability.

Social Media Sentiment and News Coverage

Social media sentiment and news coverage significantly impact Bitcoin’s price volatility. Positive news, endorsements from influential figures, and generally positive social media chatter can create a “fear of missing out” (FOMO) effect, leading to price increases. Conversely, negative news, regulatory uncertainty, or widespread negative sentiment on social media can trigger sell-offs and price declines. The rapid spread of information and the amplification of narratives on social media platforms make Bitcoin particularly susceptible to short-term price fluctuations driven by sentiment. This highlights the importance of discerning credible information from hype and misinformation.

Bitcoin’s Scarcity and Increasing Demand

Bitcoin’s fixed supply of 21 million coins is a key factor underpinning its long-term price potential. This inherent scarcity contrasts sharply with traditional fiat currencies, which can be printed indefinitely. As demand continues to grow, particularly from institutional investors and emerging markets, the limited supply should exert upward pressure on the price. The interplay between increasing demand and fixed supply is a fundamental driver of Bitcoin’s value proposition and its potential for long-term price appreciation. This scarcity, coupled with increasing adoption, is expected to be a long-term positive influence on the price.

Risks and Challenges for a 2025 Bitcoin Bull Run

A Bitcoin bull run in 2025, while potentially lucrative, carries significant risks. Understanding these potential downsides is crucial for any investor considering participation. A variety of factors, both internal and external to the cryptocurrency market, could negatively impact Bitcoin’s price trajectory, even during a period of generally upward momentum.

Market Manipulation and Price Volatility

The cryptocurrency market is susceptible to manipulation, particularly during periods of high volatility associated with bull runs. Large holders, or “whales,” can influence price movements through coordinated buying or selling. Furthermore, the relatively thin trading volume in Bitcoin compared to traditional markets exacerbates price swings, leading to sharp increases and potentially devastating drops. The 2021 bull run, for example, saw dramatic price spikes followed by significant corrections, illustrating the inherent volatility of the market. These rapid changes can create significant risk for investors who are unprepared for such sudden shifts.

Regulatory Crackdowns and Increased Scrutiny

Governments worldwide are increasingly scrutinizing cryptocurrencies, and a stricter regulatory environment could significantly impact Bitcoin’s price. Increased regulatory oversight, including stricter KYC/AML requirements, taxation policies, or outright bans, could dampen investor enthusiasm and reduce trading activity. China’s previous ban on cryptocurrency trading, for instance, had a noticeable impact on Bitcoin’s price. The uncertainty surrounding future regulatory actions poses a substantial risk to the longevity and growth of the Bitcoin market.

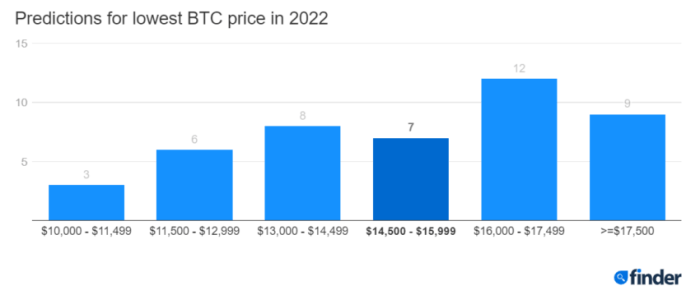

Bitcoin Price Correction or Crash

History suggests that significant bull runs are often followed by substantial corrections, or even crashes. The inherent speculative nature of Bitcoin and the potential for market bubbles contribute to this cyclical pattern. The exuberance surrounding a bull run can lead to overvaluation, making the asset vulnerable to a sharp price decline once investor sentiment shifts. The bursting of the dot-com bubble in the early 2000s serves as a relevant analogy, demonstrating how rapid growth can be followed by a significant market correction.

Competition from Altcoins

The emergence and growth of competing cryptocurrencies (“altcoins”) pose a threat to Bitcoin’s dominance and price. Innovation in the blockchain space, coupled with the development of new technologies and functionalities, could attract investors away from Bitcoin and towards alternative projects. The increasing popularity of Ethereum, for example, and the growth of the decentralized finance (DeFi) ecosystem highlights the potential for Bitcoin’s market share to erode over time, thus impacting its price.

Categorization of Risks by Likelihood and Severity

The following table categorizes potential risks based on their likelihood and severity. This is a subjective assessment and should not be considered definitive financial advice.

| Risk | Likelihood | Severity |

|---|---|---|

| Market Manipulation | High | High |

| Regulatory Crackdowns | Medium | High |

| Price Correction/Crash | High | Medium to High |

| Competition from Altcoins | Medium | Medium |

Investing Strategies for a Potential Bitcoin Bull Run: Bitcoin Price 2025 Bull Run

Predicting the future of Bitcoin is inherently speculative, but understanding various investment strategies can help navigate a potential 2025 bull run. This section Artikels several approaches, their associated risks and rewards, and provides a framework for managing risk in a volatile market. Remember, all investment decisions carry inherent risk, and past performance is not indicative of future results.

Bitcoin Investment Strategies

Several approaches exist for capitalizing on a potential Bitcoin bull run. Each strategy carries different levels of risk and requires a distinct understanding of market dynamics.

- HODLing: This strategy involves buying Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. It’s a passive approach suitable for long-term investors with a high risk tolerance. The potential reward is substantial if the price appreciates significantly, but the risk of prolonged periods of stagnation or price decline is also considerable.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of the price. DCA mitigates the risk of buying high by averaging the purchase price over time. It’s a less volatile strategy than lump-sum investing but may result in lower overall returns if the price appreciates rapidly.

- Day Trading: This high-risk, high-reward strategy involves buying and selling Bitcoin within the same day to profit from short-term price movements. It requires significant market knowledge, technical analysis skills, and emotional discipline. The potential for quick profits is high, but losses can be equally substantial.

- Swing Trading: A less intense form of day trading, swing trading involves holding Bitcoin for a few days or weeks to capitalize on price swings. It requires less constant monitoring than day trading but still carries significant risk.

Sample Diversified Investment Portfolio

A diversified portfolio reduces overall risk by spreading investments across different asset classes. A sample portfolio might include:

| Asset Class | Allocation | Rationale |

|---|---|---|

| Bitcoin | 20% | Exposure to potential cryptocurrency growth. |

| Stocks (S&P 500 index fund) | 40% | Exposure to established, diversified equities. |

| Bonds (Government bonds) | 30% | Provides stability and income during market downturns. |

| Real Estate (REITs) | 10% | Diversification into real estate market. |

This allocation is illustrative and should be adjusted based on individual risk tolerance and financial goals. Note that the Bitcoin allocation reflects a relatively high-risk, high-reward approach.

Profit and Loss Calculation, Bitcoin Price 2025 Bull Run

Let’s illustrate potential profit and loss calculations with a simple example. Assume an investment of $10,000 in Bitcoin at a price of $30,000.

Profit Calculation: If the price rises to $60,000, you could sell 0.333 Bitcoin (10,000/30,000) for $20,000, resulting in a profit of $10,000.

Loss Calculation: If the price falls to $15,000, selling 0.333 Bitcoin would yield $5,000, resulting in a loss of $5,000.

These are simplified calculations and do not account for transaction fees or taxes. Real-world scenarios are far more complex and depend on the specific timing of entry and exit points.

Risk Management and Investment Protection

Managing risk is crucial during a volatile bull run. Strategies include:

- Diversification: Spreading investments across different asset classes minimizes the impact of losses in any single asset.

- Stop-Loss Orders: These automatically sell your Bitcoin if the price falls to a predetermined level, limiting potential losses.

- Regular Portfolio Reviews: Regularly assess your portfolio’s performance and adjust your strategy as needed.

- Avoid Emotional Decision-Making: Stick to your investment plan and avoid making impulsive decisions based on fear or greed.

- Secure Storage: Use secure wallets and exchanges to protect your Bitcoin from theft or loss.

Frequently Asked Questions (FAQ) about Bitcoin Price in 2025

This section addresses common queries regarding Bitcoin’s potential price trajectory in 2025, encompassing the likelihood of specific price targets, inherent risks, investment strategies, and broader implications. Understanding these aspects is crucial for informed decision-making in the volatile cryptocurrency market.

Bitcoin Reaching $100,000 by 2025

Predicting Bitcoin’s price with certainty is impossible. Reaching $100,000 by 2025 depends on several intertwined factors, including widespread adoption, regulatory clarity, technological advancements, and macroeconomic conditions. While some analysts predict this level based on historical price trends and adoption growth, others remain cautious. The 2017 bull run saw Bitcoin reach nearly $20,000, followed by a significant correction. Therefore, a similar trajectory isn’t guaranteed. Several factors could propel Bitcoin to this price point, such as institutional investment increasing significantly, mainstream adoption expanding rapidly, and the overall market capitalization growing substantially. Conversely, factors like increased regulatory scrutiny, major security breaches, or a global economic downturn could significantly hinder its price growth. Ultimately, the $100,000 target remains speculative and hinges on a confluence of favorable conditions.

Biggest Risks to a Bitcoin Bull Run in 2025

Several significant risks could impede a Bitcoin bull run in 2025. Increased regulatory pressure from governments worldwide could stifle growth by limiting accessibility or imposing stringent trading restrictions, as seen with various regulatory crackdowns in different countries. Security breaches or hacks targeting exchanges or individual wallets could erode investor confidence and lead to price drops. Furthermore, macroeconomic factors such as inflation, recessionary pressures, or geopolitical instability can negatively impact investor sentiment towards riskier assets like Bitcoin. Competition from emerging cryptocurrencies with superior technology or features also poses a threat, potentially diverting investment away from Bitcoin. Finally, market manipulation by large players, though difficult to definitively prove, remains a potential risk that could lead to dramatic price swings.

Investing in Bitcoin Before a Bull Run: Is it Too Late?

Whether it’s “too late” to invest depends entirely on individual risk tolerance and investment horizon. While the potential for significant gains remains, the risk of entering the market at a relatively high price point also increases. The later an investor enters a bull market, the less potential upside they may realize compared to those who invested earlier. However, a gradual investment strategy, such as dollar-cost averaging (investing a fixed amount at regular intervals), can mitigate the risk of investing at a peak. It’s crucial to remember that Bitcoin’s price is highly volatile, and past performance is not indicative of future results. Thorough research and understanding of the inherent risks are paramount before investing.

Protecting Bitcoin Investments During Market Volatility

Protecting Bitcoin investments during volatile periods requires a multi-faceted approach. Diversification across different asset classes (not just cryptocurrencies) can reduce overall portfolio risk. Holding only a portion of one’s investment portfolio in Bitcoin minimizes potential losses during downturns. Dollar-cost averaging, as mentioned earlier, is another effective strategy. Furthermore, utilizing secure hardware wallets to store Bitcoin offline enhances security against hacking and theft. Staying informed about market trends and news is crucial for making timely decisions. Finally, avoiding emotional decision-making – panic selling during downturns or chasing gains during rallies – is critical for long-term success.

Potential Long-Term Implications of a Bitcoin Bull Run

A significant Bitcoin bull run could have profound long-term economic and societal implications. Increased adoption could lead to greater financial inclusion, particularly in underserved regions with limited access to traditional banking systems. The broader acceptance of cryptocurrencies could challenge the existing financial infrastructure and potentially reshape the global monetary system. However, it could also exacerbate wealth inequality if the benefits of a bull run disproportionately accrue to early investors. Increased energy consumption associated with Bitcoin mining could raise environmental concerns, necessitating the development of more sustainable mining practices. The potential for regulatory changes and the need for robust regulatory frameworks to govern the cryptocurrency space would also be significant considerations.

Illustrative Data Presentation

Predicting Bitcoin’s price is inherently speculative, relying on various models and assumptions. The following table compares several prediction models, highlighting the range of potential outcomes for Bitcoin’s price in 2025. It’s crucial to remember that these are predictions, not guarantees, and the actual price could differ significantly.

Bitcoin Price Prediction Models Comparison

| Model Name | Predicted Price (USD) | Methodology | Source |

|---|---|---|---|

| PlanB’s Stock-to-Flow Model (Adjusted) | $100,000 – $150,000 | Based on Bitcoin’s scarcity and historical price trends, adjusted for market dynamics. | PlanB’s publications and various crypto analysis websites. |

| Quantitative Analysis (e.g., using technical indicators) | $75,000 – $120,000 | Utilizes technical indicators such as moving averages, RSI, and MACD to project future price movements. This often incorporates past price data and trading volume. | Various crypto trading platforms and analytical websites. Note that specific methodologies vary greatly. |

| Adoption-Based Model | $50,000 – $80,000 | Projects price based on projected adoption rates, considering factors such as institutional investment, regulatory clarity, and wider usage. | Research reports from financial institutions and market analysis firms focusing on cryptocurrency adoption. |

| Fundamental Analysis (e.g., considering network effects) | $60,000 – $100,000 | Focuses on Bitcoin’s underlying technology, network effects, and its position as a decentralized digital asset. Estimates value based on its utility and scarcity. | Academic research papers, white papers from crypto projects, and analysis by financial experts. |

Hypothetical Bitcoin Price Trajectory for 2025

This hypothetical illustration depicts a potential bull run scenario for Bitcoin’s price in 2025. The graph would be a line graph with two axes: the x-axis representing time (in months, from January to December 2025) and the y-axis representing Bitcoin’s price in USD.

The graph would show a gradual upward trend throughout the year, with some fluctuations along the way. The beginning of the year might show a relatively flat price, perhaps around $30,000, reflecting uncertainty and market consolidation. As the year progresses, the line would steadily rise, showing acceleration in the second and third quarters, culminating in a peak in the fourth quarter. This peak could be around $100,000, reflecting the culmination of a bull run. However, the line would also include minor dips and corrections along the way, representing typical market volatility. These dips would not be drastic, showing resilience within the overall bullish trend. Key data points would include the starting price, the highest price reached, and any significant dips or corrections. The overall trend would be a positive upward trajectory illustrating a strong bull run, but with the inherent risks and volatility associated with the cryptocurrency market clearly shown through the smaller fluctuations. The illustration would visually represent the potential for significant price appreciation within the context of realistic market behavior. For instance, a price drop of 10-15% from a peak could be shown, followed by a recovery, to demonstrate the typical market correction that would be expected within such a bull run.