Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging, as it depends on a complex interplay of economic, technological, regulatory, and psychological factors. While no one can definitively state the exact price, understanding these influential elements provides a framework for informed speculation.

Global Economic Conditions and Bitcoin’s Price

Macroeconomic factors significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, a recession might lead to risk-aversion, causing investors to sell off assets like Bitcoin, even though it has historically demonstrated a negative correlation with traditional markets during periods of economic downturn. The severity and duration of these economic events will dictate the extent of their influence. For example, the 2008 financial crisis saw Bitcoin emerge as a response to distrust in traditional financial systems, while the current inflationary environment has seen renewed interest in Bitcoin as a store of value.

Institutional Adoption and Large-Scale Investments

Increased institutional adoption is a major catalyst for Bitcoin’s price appreciation. Large-scale investments from corporations, pension funds, and other institutional players signal a growing acceptance of Bitcoin as a legitimate asset class. This influx of capital significantly increases demand, pushing prices upward. Grayscale Investments, for example, manages billions of dollars in Bitcoin, demonstrating the significant institutional interest in the cryptocurrency. The more established players embrace Bitcoin, the more likely it is to see sustained price increases.

Technological Advancements and Their Impact

Technological upgrades to the Bitcoin network directly influence its scalability, efficiency, and usability. The Lightning Network, a layer-2 scaling solution, aims to facilitate faster and cheaper transactions, potentially boosting adoption and price. Taproot, an upgrade enhancing transaction privacy and efficiency, also contributes positively. These improvements reduce transaction fees and increase transaction speeds, making Bitcoin more attractive for everyday use. The successful implementation and adoption of such upgrades directly impact market sentiment and subsequently the price.

Regulatory Frameworks and Governmental Policies

Governmental regulations and policies significantly shape Bitcoin’s price trajectory. Favorable regulations can boost investor confidence and increase market liquidity. Conversely, stringent or unclear regulations can create uncertainty and dampen investor enthusiasm, leading to price volatility or declines. The regulatory landscape varies significantly across countries, and changes in any major jurisdiction can have a ripple effect globally. For instance, the increased clarity on Bitcoin regulation in certain jurisdictions has positively influenced investor sentiment.

Market Sentiment, Fear, Uncertainty, and Greed (FUD), and Media Coverage

Market sentiment, driven by fear, uncertainty, and greed (FUD), profoundly influences Bitcoin’s price. Positive media coverage and optimistic forecasts tend to drive prices up, while negative news and regulatory uncertainty can trigger sell-offs. The amplification effect of social media and mainstream media further exacerbates these price swings. For example, Elon Musk’s tweets about Bitcoin have historically shown a correlation with significant price fluctuations, illustrating the impact of media attention and market sentiment.

| Factor | Potential Impact on Bitcoin Price in 2025 | Supporting Evidence |

|---|---|---|

| Global Economic Conditions (Inflation/Recession) | High inflation could drive demand as a hedge against currency devaluation; recession could lead to risk-aversion and sell-offs. | Historical correlation between Bitcoin price and inflation/recessionary periods. The 2008 financial crisis and recent inflationary pressures are relevant examples. |

| Institutional Adoption & Large-Scale Investments | Increased institutional investment will likely drive up demand and prices. | Significant investments from firms like Grayscale Investments demonstrate institutional interest. |

| Technological Advancements (Lightning Network, Taproot) | Improved scalability, efficiency, and usability will likely increase adoption and price. | Successful implementation and adoption of these upgrades would increase the utility of Bitcoin. |

| Regulatory Frameworks & Governmental Policies | Favorable regulations increase confidence and liquidity; unfavorable regulations create uncertainty and dampen enthusiasm. | Varying regulatory approaches across different countries demonstrate this impact; clear regulations tend to positively influence the market. |

| Market Sentiment (FUD) & Media Coverage | Positive sentiment and media coverage drive prices up; negative sentiment and FUD trigger sell-offs. | Elon Musk’s tweets on Bitcoin illustrate the impact of media attention and market sentiment on price volatility. |

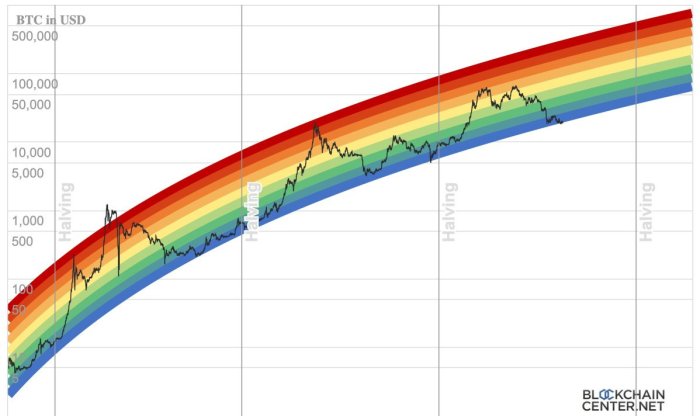

Potential Bitcoin Price Scenarios in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and investor sentiment. However, by considering various plausible scenarios, we can gain a better understanding of the potential range of outcomes. The following Artikels three distinct scenarios: a bullish, a bearish, and a neutral outlook.

Bullish Scenario: Bitcoin Price Above $100,000

This scenario assumes widespread institutional adoption, continued technological advancements improving Bitcoin’s scalability and efficiency, and a generally positive macroeconomic environment. Global economic uncertainty could drive increased demand for Bitcoin as a safe-haven asset, mirroring the behavior seen during periods of high inflation or geopolitical instability. Further fueling the bullish momentum would be the successful development and integration of layer-2 scaling solutions, significantly increasing transaction throughput and reducing fees. Imagine a world where Bitcoin is not only a store of value but also a widely accepted medium of exchange for everyday transactions. This widespread adoption, coupled with limited supply, would drive prices significantly higher. The narrative would be one of sustained growth, marked by periods of consolidation interspersed with powerful upward price movements. Investor confidence would be high, attracting both individual and institutional investors, leading to a potential price exceeding $100,000 by 2025.

Bearish Scenario: Bitcoin Price Below $20,000

A bearish scenario hinges on several negative factors. Stringent regulatory crackdowns globally, particularly from major economies, could significantly dampen investor enthusiasm and reduce market liquidity. A prolonged period of macroeconomic instability, perhaps triggered by a global recession or a major financial crisis, could see investors flee riskier assets like Bitcoin in favor of more stable investments like government bonds or precious metals. Furthermore, the emergence of a superior cryptocurrency or a significant technological flaw in Bitcoin’s underlying infrastructure could erode investor confidence. In this scenario, the market would be characterized by fear and uncertainty. News headlines would be dominated by negative stories surrounding Bitcoin, and investor behavior would shift from speculative buying to panic selling. The price could plummet well below $20,000, reflecting a deep loss of confidence in the cryptocurrency market. This scenario mirrors the market crash of 2022, where a combination of macroeconomic factors and regulatory uncertainty led to significant price declines.

Neutral Scenario: Bitcoin Price Between $30,000 and $60,000

This scenario assumes a more balanced outlook, with neither significant bullish nor bearish catalysts dominating the market. Regulatory clarity, while not necessarily favorable, would avoid major disruptions. The macroeconomic environment would be relatively stable, neither significantly boosting nor hindering investor appetite for risk assets. Technological advancements would continue at a moderate pace, without any major breakthroughs or setbacks. Investor sentiment would remain mixed, with periods of both optimism and pessimism. The price would fluctuate within a relatively predictable range, potentially between $30,000 and $60,000. This scenario represents a continuation of the existing market dynamics, with gradual price appreciation interspersed with periods of consolidation and minor corrections. This range reflects a balance between the potential for growth and the inherent volatility of the cryptocurrency market, mirroring the price behavior observed in the years leading up to 2025.

Risks and Opportunities Associated with Bitcoin in 2025

Predicting the future of Bitcoin is inherently uncertain, yet understanding the potential risks and opportunities is crucial for any investor. By carefully weighing these factors, individuals can make informed decisions about their Bitcoin holdings in 2025 and beyond. This section will Artikel both the potential downsides and upsides associated with Bitcoin investment, offering insights into navigating this dynamic market.

Potential Risks Associated with Bitcoin Investment

Investing in Bitcoin, like any other asset class, carries inherent risks. Market volatility, security concerns, and regulatory uncertainty are prominent examples. Understanding these risks and implementing mitigation strategies is essential for responsible investment.

- Market Volatility: Bitcoin’s price is notoriously volatile, subject to significant swings in short periods. This volatility stems from various factors including market sentiment, regulatory announcements, and technological developments. For example, the price of Bitcoin experienced dramatic drops in 2022, highlighting the risk of significant capital loss. Mitigation: Diversification of investment portfolios, employing dollar-cost averaging strategies, and setting stop-loss orders can help manage this risk.

- Security Breaches: Bitcoin exchanges and individual wallets are potential targets for hackers. The loss of private keys can result in the irreversible loss of funds. The infamous Mt. Gox exchange hack in 2014, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of this risk. Mitigation: Using reputable exchanges with robust security measures, employing multi-factor authentication, and storing Bitcoin in hardware wallets are crucial steps in mitigating this risk.

- Regulatory Uncertainty: The regulatory landscape surrounding Bitcoin is constantly evolving. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty about future regulations. Changes in regulations could significantly impact Bitcoin’s price and accessibility. Mitigation: Staying informed about regulatory developments and considering jurisdictions with favorable regulatory frameworks is important. Consultations with financial advisors specializing in cryptocurrency are recommended.

Potential Opportunities Presented by Bitcoin, Bitcoin Price 2025 Forecast

Despite the risks, Bitcoin presents significant opportunities for investors with a long-term perspective. Its potential for growth, inflation hedging capabilities, and role in decentralized finance are noteworthy.

- Long-Term Growth Potential: Many believe Bitcoin’s scarcity and growing adoption will drive long-term price appreciation. The limited supply of 21 million Bitcoin, coupled with increasing institutional and individual adoption, could lead to substantial price increases over time. While predicting specific price targets is speculative, historical trends suggest significant potential for growth. Example: Bitcoin’s price has increased dramatically since its inception, demonstrating its potential for long-term growth, although past performance is not indicative of future results.

- Hedge Against Inflation: Some view Bitcoin as a potential hedge against inflation. Its decentralized nature and limited supply make it an attractive alternative to traditional fiat currencies, especially in times of high inflation. Example: During periods of high inflation in certain countries, Bitcoin has shown relative strength compared to fiat currencies, suggesting its potential as an inflation hedge, although this is not guaranteed.

- Decentralized Finance (DeFi): Bitcoin’s underlying technology, blockchain, is driving innovation in decentralized finance. This includes lending, borrowing, and other financial services without intermediaries, offering potential for higher returns and greater financial inclusion. Example: The growth of DeFi platforms built on various blockchains demonstrates the potential for Bitcoin and other cryptocurrencies to revolutionize traditional finance.

Comparing Bitcoin to Other Cryptocurrencies in 2025

Predicting the relative performance of cryptocurrencies in 2025 is inherently speculative, but by analyzing current trends and technological advancements, we can construct plausible scenarios comparing Bitcoin’s projected trajectory with that of other major players like Ethereum and Solana. While Bitcoin maintains its position as the dominant cryptocurrency by market capitalization, the potential for altcoins to outperform it in specific metrics cannot be ignored.

Bitcoin Price 2025 Forecast – Several factors contribute to the complex interplay between Bitcoin and altcoins. Technological innovation within the Ethereum ecosystem, for instance, through advancements like sharding and improved scalability, could significantly boost Ethereum’s transaction speed and efficiency, potentially attracting more users and increasing its value. Similarly, Solana’s focus on high transaction throughput could give it an edge in specific application areas. However, Bitcoin’s established network effect and first-mover advantage remain significant strengths, making it a relatively safe haven asset for many investors.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by various market factors and technological advancements. For a detailed analysis focusing specifically on the coin’s potential value, you might find the resource on Bitcoin Coin Price 2025 helpful. Ultimately, Bitcoin Price 2025 Forecast remains speculative, but informed predictions can offer valuable insights into potential investment strategies.

Projected Price Performance Comparison

Projecting precise price points for cryptocurrencies is inherently unreliable. However, we can explore potential scenarios based on various market conditions. For example, a bullish market scenario might see Bitcoin reaching a price of $150,000, while Ethereum might reach $10,000, and Solana $500. Conversely, a bearish market could see Bitcoin at $50,000, Ethereum at $2,000, and Solana at $50. These are illustrative examples and should not be taken as financial advice. The actual price movements will depend on a multitude of intertwined factors, including regulatory changes, macroeconomic conditions, and technological developments.

Predicting the Bitcoin price in 2025 is challenging, with forecasts varying widely. For a diverse range of opinions and speculative discussions on this topic, you might find it helpful to check out online communities; for example, you can explore the ongoing conversation on Bitcoin Price 2025 Reddit. Ultimately, the future Bitcoin price remains uncertain, dependent on numerous factors impacting the cryptocurrency market.

Market Share and Technological Advancements

While Bitcoin is expected to retain a significant portion of the overall cryptocurrency market capitalization in 2025, the market share of altcoins is likely to increase. This increase will be driven by the adoption of newer technologies and the emergence of innovative decentralized applications (dApps) built on platforms like Ethereum and Solana. The technological advancements of these altcoins, particularly in areas like smart contracts and decentralized finance (DeFi), could attract a substantial user base, potentially eroding Bitcoin’s dominance in specific sectors. Bitcoin’s strength, however, lies in its established network effect and its position as a store of value, potentially mitigating this erosion.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key element to consider within this forecast is the potential for a significant bull run, as discussed in detail on this insightful article about the Bitcoin Price 2025 Bull Run. Understanding the dynamics of such a run is crucial for refining any Bitcoin Price 2025 Forecast and forming a well-informed perspective.

Comparison Table of Projected Cryptocurrency Performance in 2025

The following table provides a hypothetical comparison, illustrating potential differences in projected price movements, market share, and technological advancements. It’s crucial to remember that these are estimations and actual outcomes may vary considerably.

| Cryptocurrency | Projected Price Range (USD) | Projected Market Share (Illustrative) | Key Technological Advancements |

|---|---|---|---|

| Bitcoin (BTC) | $50,000 – $150,000 | 40-50% | Layer-2 scaling solutions, improved security |

| Ethereum (ETH) | $2,000 – $10,000 | 20-30% | Sharding, improved scalability, enhanced smart contract capabilities |

| Solana (SOL) | $50 – $500 | 5-10% | High transaction throughput, improved network performance |

Investment Strategies for Bitcoin in 2025: Bitcoin Price 2025 Forecast

Predicting Bitcoin’s price in 2025 remains highly speculative, yet understanding various investment strategies can help navigate potential market fluctuations. The optimal approach depends heavily on individual risk tolerance, investment timeline, and financial goals. Below, we explore several strategies, outlining their advantages, disadvantages, and potential outcomes under different market scenarios.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the Bitcoin price. This strategy mitigates the risk of investing a large sum at a market peak. By consistently purchasing Bitcoin, you average out your purchase price over time, reducing the impact of price volatility.

For example, imagine investing $100 per week in Bitcoin. If the price fluctuates wildly, some weeks you’ll buy more Bitcoin at lower prices and fewer at higher prices, leading to a lower average cost than if you had invested a lump sum at a high price point. Conversely, if the price steadily rises, you’ll acquire less Bitcoin over time, but your average cost will still be lower than if you had purchased everything at the highest price. The advantage is risk reduction; the disadvantage is that you might miss out on significant gains if the price consistently increases.

Long-Term Holding (HODLing)

This strategy involves buying Bitcoin and holding it for an extended period, typically years, regardless of short-term price fluctuations. The core belief is that Bitcoin’s value will appreciate significantly over the long term, driven by factors like increasing adoption, scarcity, and technological advancements. This strategy requires patience and a high risk tolerance, as short-term losses are inevitable.

Consider an investor who purchased Bitcoin in 2011. While the price experienced dramatic drops and rises, a long-term holding strategy would have yielded substantial returns by 2025, even accounting for periods of significant price decline. However, this strategy is not without risk; unexpected regulatory changes or unforeseen technological disruptions could negatively impact the long-term value of Bitcoin.

Short-Term Trading

Short-term trading involves buying and selling Bitcoin frequently to profit from short-term price movements. This strategy requires a deep understanding of technical analysis, market trends, and a higher risk tolerance. Profits can be significant, but losses can also be substantial if market predictions are inaccurate.

Imagine a trader who accurately predicts a short-term price surge in Bitcoin. By buying low and selling high within a short timeframe (e.g., hours or days), they could realize significant gains. However, if the market moves against their prediction, they could incur substantial losses. This strategy requires constant monitoring of the market and a considerable level of expertise. The high potential for reward is matched by a high potential for loss.

Frequently Asked Questions (FAQ) about Bitcoin Price in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, but by analyzing current market trends, technological advancements, and regulatory developments, we can explore potential scenarios and address common questions surrounding Bitcoin’s future value. This FAQ section aims to provide informed perspectives, acknowledging the inherent uncertainties involved.

Bitcoin Reaching $100,000 by 2025

Whether Bitcoin will reach $100,000 by 2025 is a matter of considerable debate. Several factors could contribute to such a price surge, including widespread institutional adoption, increased regulatory clarity, and sustained positive market sentiment. However, significant headwinds exist, such as regulatory uncertainty in various jurisdictions, potential macroeconomic downturns, and the emergence of competing cryptocurrencies. Reaching this price point would require a substantial increase in market capitalization, which depends on both increased demand and a limited supply of Bitcoin. While some analysts predict this scenario, others remain skeptical, highlighting the inherent volatility of the cryptocurrency market. The price trajectory will likely depend on a complex interplay of these and other factors. For example, a major technological breakthrough or a significant global event could drastically alter the prediction. Conversely, a prolonged bear market or a series of negative regulatory actions could significantly hinder Bitcoin’s price appreciation.

Investing in Bitcoin in 2023: Is it Too Late?

The question of whether it’s “too late” to invest in Bitcoin is subjective and depends heavily on individual risk tolerance and investment goals. While Bitcoin’s price has experienced significant volatility, it has also shown remarkable growth potential over the years. Entering the market later than its initial stages presents both risks and rewards. The risk of missing out on significant gains is present, yet the potential for future growth remains. Late entry introduces the possibility of purchasing at a higher price point, leading to potentially lower returns compared to early investors. However, the potential for future growth, albeit potentially at a slower pace, still exists. Careful consideration of personal financial circumstances and a long-term investment strategy are crucial for mitigating risks and maximizing potential returns. A diversified portfolio is recommended to reduce overall risk exposure.

Biggest Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Volatility is a primary concern, with price fluctuations often exceeding those of traditional asset classes. Regulatory uncertainty remains a major factor, as governments worldwide grapple with how to regulate cryptocurrencies. Changes in regulations can significantly impact Bitcoin’s price and accessibility. Security is another crucial aspect; the risk of hacking, theft, and loss of private keys necessitates careful consideration of storage solutions and security practices. Furthermore, the relatively nascent nature of the cryptocurrency market means that unforeseen events and technological disruptions could impact Bitcoin’s value. It’s crucial to thoroughly understand these risks before investing.

Protecting Against Bitcoin Price Volatility

Mitigating the risks associated with Bitcoin’s price volatility requires a strategic approach. Diversification is key; spreading investments across different asset classes, including traditional investments and other cryptocurrencies, can help reduce overall portfolio risk. Dollar-cost averaging (DCA) is another effective strategy, involving regular purchases of Bitcoin over time regardless of price fluctuations. This approach reduces the impact of buying high and averages the purchase price. Furthermore, implementing sound risk management techniques, such as setting stop-loss orders to limit potential losses, is crucial. Thorough research, a clear understanding of one’s risk tolerance, and a long-term investment horizon are vital components of a robust investment strategy. Only invest what you can afford to lose.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by various market factors and technological advancements. To gain further insight into potential price trajectories, exploring resources dedicated to this specific question is highly recommended. For example, you might find the article, What Will Bitcoin Price Be In 2025 , helpful in forming your own informed opinion on the Bitcoin Price 2025 Forecast.

Ultimately, any forecast remains speculative, highlighting the inherent volatility within the cryptocurrency market.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by various factors. Many analysts utilize sophisticated tools to forecast future values, and a helpful resource for exploring these predictions is the AI-driven analysis available at Bitcoin Price Prediction 2025 Ai. Understanding these AI-powered forecasts can contribute significantly to a more informed perspective on the Bitcoin Price 2025 Forecast overall.