Bitcoin’s Social and Cultural Impact in India

Bitcoin’s emergence in India presents a complex interplay of technological advancement, socio-economic factors, and cultural nuances. Understanding its impact requires examining its adoption across demographics, the underlying cultural influences shaping its perception, and its potential ramifications on Indian society.

Bitcoin Awareness and Adoption Across Demographics in India

While Bitcoin awareness is growing in India, adoption rates vary significantly across demographics. Younger, tech-savvy urban populations, particularly those familiar with online trading and investment, show higher adoption rates. This contrasts with older generations and rural communities where awareness and understanding of cryptocurrency remain limited, often hindered by digital literacy barriers and a preference for traditional financial instruments. The level of financial literacy also plays a significant role, with those possessing a higher level of financial understanding being more likely to invest in Bitcoin. Furthermore, regional variations exist, with metropolitan areas exhibiting higher adoption rates than smaller towns and villages.

Social and Cultural Factors Influencing Bitcoin Perception and Use in India

Several social and cultural factors shape the Indian perception of Bitcoin. Trust in established financial institutions remains strong, and the perceived volatility and regulatory uncertainty surrounding Bitcoin create hesitation for many. The strong emphasis on community and family within Indian culture also influences investment decisions, with many individuals consulting family and friends before making financial commitments. Conversely, the entrepreneurial spirit and a desire for financial independence, especially among younger generations, fuels interest in alternative investment avenues like Bitcoin, viewed as a potential path to wealth creation outside traditional systems. Religious and cultural beliefs also play a role, with some interpretations of religious texts influencing views on financial instruments and risk-taking.

Examples of Bitcoin Use in Different Sectors of the Indian Economy

Bitcoin’s use in India is expanding beyond individual investment. Some businesses, particularly in the technology and e-commerce sectors, are exploring its potential for faster and cheaper cross-border transactions. Remittances, a significant aspect of the Indian economy, could benefit from Bitcoin’s reduced transaction fees and faster processing times. However, widespread adoption in this sector is hampered by regulatory uncertainties and the lack of robust infrastructure. The use of Bitcoin for peer-to-peer lending and borrowing is also emerging, though it remains a niche area due to regulatory challenges and associated risks.

Potential Societal Implications of Widespread Bitcoin Adoption in India

A widespread shift towards cryptocurrencies in India could have profound societal implications. Increased financial inclusion, particularly for unbanked populations, is a potential benefit. Bitcoin could offer a faster and more accessible alternative to traditional banking systems, empowering individuals with limited access to formal financial services. However, the potential for increased financial crime, including money laundering and scams, is a significant concern. The lack of consumer protection mechanisms in the cryptocurrency space also poses a risk to vulnerable individuals. Furthermore, the potential for social inequalities to widen due to uneven access to technology and financial literacy needs careful consideration.

Ethical Considerations Surrounding Bitcoin Adoption in India

The ethical considerations surrounding Bitcoin adoption in India are multifaceted. The environmental impact of Bitcoin mining, due to its energy-intensive nature, is a significant concern, particularly in a country grappling with energy challenges. Promoting sustainable mining practices and exploring energy-efficient alternatives are crucial for responsible Bitcoin adoption. Concerns about the potential for misuse, including illicit activities like money laundering and terrorist financing, necessitate robust regulatory frameworks and anti-money laundering measures. Balancing innovation with responsible regulation is crucial to mitigating these risks and ensuring ethical Bitcoin adoption in India.

Frequently Asked Questions about Bitcoin in India: Bitcoin Price 2025 In India

Bitcoin’s increasing popularity in India necessitates understanding its legal standing, investment processes, and tax implications. This section addresses common queries regarding Bitcoin’s role within the Indian financial landscape.

Bitcoin’s Legal Status in India

Currently, there’s no specific law in India that explicitly bans Bitcoin. However, the Reserve Bank of India (RBI) has issued circulars discouraging banks and financial institutions from dealing in cryptocurrencies. This has created a grey area, leading to uncertainty for many. While the RBI’s stance hasn’t outright prohibited Bitcoin, it significantly restricts its accessibility through traditional banking channels. The government is actively exploring regulatory frameworks for cryptocurrencies, suggesting a potential shift in the legal landscape in the coming years. The situation remains dynamic, requiring continuous monitoring of official announcements and policy changes.

Acquiring Bitcoin in India

Purchasing Bitcoin in India involves using cryptocurrency exchanges. These platforms allow users to buy and sell cryptocurrencies using Indian Rupees (INR). Several reputable exchanges operate in India, each with its own registration and verification processes. The process generally involves creating an account, completing KYC (Know Your Customer) verification by providing identity documents, linking a bank account or other payment method, and then placing an order to buy Bitcoin. It’s crucial to choose a well-established and secure exchange to mitigate risks associated with scams or security breaches.

Tax Implications of Bitcoin in India, Bitcoin Price 2025 In India

The Indian government treats Bitcoin transactions as taxable events. Income from Bitcoin trading (profit from selling Bitcoin) is taxed as capital gains. Short-term capital gains (profits from Bitcoin held for less than a year) are taxed at the individual’s applicable income tax slab rate. Long-term capital gains (profits from Bitcoin held for more than a year) are taxed at a rate of 20%, with an indexation benefit to adjust for inflation. Furthermore, any income earned from Bitcoin mining or staking activities is also taxable. It’s essential to maintain accurate records of all Bitcoin transactions for tax reporting purposes. Consulting a tax professional is recommended for navigating the complexities of cryptocurrency taxation in India.

Safety of Bitcoin Investment in India

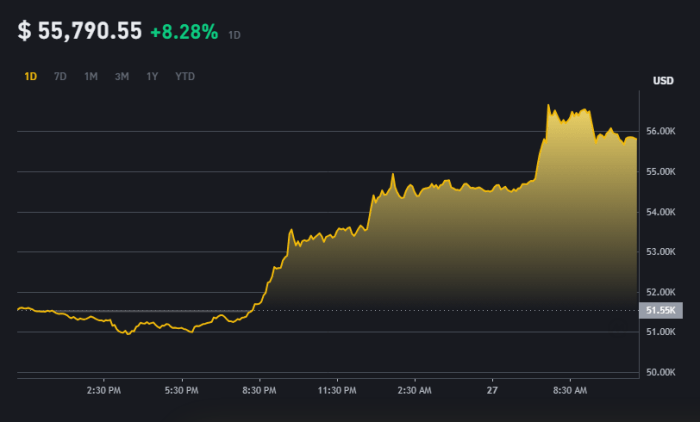

Investing in Bitcoin, like any other investment, carries risks. The price of Bitcoin is highly volatile, meaning its value can fluctuate dramatically in short periods. This volatility can lead to significant losses. Security is another major concern. Exchanges can be targets for hacking, and individuals can lose their Bitcoin through theft or scams. To mitigate risks, it’s crucial to use secure and reputable exchanges, employ strong passwords and two-factor authentication, and store Bitcoin in secure wallets. Diversifying investments and only investing what one can afford to lose are essential risk management strategies. The lack of regulatory clarity also adds to the overall risk profile.

Future Prospects of Bitcoin in India

The future of Bitcoin in India is uncertain but holds potential. Increased awareness and technological advancements could lead to wider adoption. The government’s stance on regulation will play a significant role. A clear regulatory framework could boost investor confidence and facilitate institutional investment, potentially driving growth. However, challenges remain, including volatility, security concerns, and the need for greater financial literacy among the population. The Indian market’s size and growing tech-savvy population suggest a potential for significant Bitcoin adoption, but this hinges on favorable regulatory developments and increased public trust. Observing the trajectory of other countries’ cryptocurrency regulations and adoption rates can offer some insights into potential future scenarios.

Bitcoin Price 2025 In India – Predicting the Bitcoin price in India for 2025 is challenging, influenced by global market trends and local regulations. For a broader perspective on potential price movements, it’s helpful to consult external analyses like those offered by Bitcoin Price Prediction 2025 Walletinvestor , which can provide valuable insights. Ultimately, the Indian Bitcoin market in 2025 will depend on a complex interplay of factors, making precise prediction difficult.

Predicting the Bitcoin price in India for 2025 is challenging, influenced by global market trends and local regulatory changes. A key factor to consider is the broader cryptocurrency market performance, specifically, the projected Bitcoin Price in December 2025, which you can explore further at Bitcoin Price Dec 2025. Understanding this global trend will offer valuable insight into potential price movements within the Indian market throughout 2025.

Predicting the Bitcoin price in India for 2025 is challenging, influenced by global market trends and local regulations. For diverse perspectives and speculative discussions on potential price movements, it’s worth checking out online communities; for example, you can find a lot of conversations on Bitcoin Price 2025 Reddit. Ultimately, the Indian Bitcoin market in 2025 will likely reflect a complex interplay of international factors and domestic economic conditions.

Predicting the Bitcoin price in India for 2025 is challenging, influenced by global market trends and regulatory changes. Understanding the potential trajectory requires considering related cryptocurrencies, such as gaining insight into the Bitcoin Cash Future Price 2025 , which could indirectly impact Bitcoin’s value. Ultimately, the Bitcoin price in India in 2025 will depend on a complex interplay of factors.

Predicting the Bitcoin price in India for 2025 requires considering various global and local factors. A key element in this prediction involves understanding broader market trends, which is why checking out resources like this comprehensive analysis on Bitcoin Coin Price Prediction 2025 is helpful. Ultimately, the Indian Bitcoin market will likely reflect these global predictions, though with its own unique regulatory and adoption nuances.