Bitcoin Price Prediction for 2025

Bitcoin, since its inception in 2009, has experienced a volatile yet fascinating journey. From its humble beginnings with a negligible price to reaching all-time highs exceeding $68,000 in late 2021, its price has been driven by a confluence of factors, including technological advancements, regulatory changes, and market sentiment. Significant events like the 2017 bull run and the subsequent market corrections have shaped its trajectory, leaving investors constantly speculating about its future value.

Bitcoin’s price volatility is a defining characteristic. Several interconnected elements contribute to this instability. These include the relatively small market capitalization compared to traditional assets, the influence of large institutional investors and whales who can significantly impact the price with their trades, the speculative nature of the cryptocurrency market, and the impact of news events, regulatory announcements, and technological developments. For example, positive news regarding Bitcoin adoption by major corporations can trigger price surges, while negative regulatory pronouncements can lead to sharp declines. Furthermore, macroeconomic factors, such as inflation and interest rate changes, also play a crucial role in influencing investor sentiment and consequently, Bitcoin’s price.

Challenges in Predicting Bitcoin’s Long-Term Price

Accurately forecasting the price of Bitcoin, particularly over the long term, presents significant challenges. The cryptocurrency market is inherently unpredictable, characterized by rapid price swings driven by factors that are often difficult to quantify or forecast with precision. Unlike traditional markets with established historical data and well-understood economic models, Bitcoin’s relatively short history and the novelty of the technology make reliable long-term predictions exceptionally difficult. Furthermore, external factors like geopolitical events, regulatory changes, and the emergence of competing cryptocurrencies can dramatically alter the market landscape, rendering any prediction based on past performance potentially inaccurate. For instance, the unforeseen impact of a major regulatory crackdown in a key market could significantly deflate the price, while a widespread adoption by a large developing nation could trigger exponential growth. These unpredictable events highlight the inherent limitations of any long-term Bitcoin price prediction.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of technological, regulatory, economic, and competitive factors. While no single element dictates its trajectory, understanding these influences provides a clearer picture of potential price movements.

Technological Advancements

Technological progress significantly impacts Bitcoin’s value. Improvements in scaling solutions, such as the Lightning Network, could enhance transaction speeds and reduce fees, increasing Bitcoin’s usability and potentially driving demand. Conversely, the emergence of more energy-efficient mining techniques could lower the cost of production, potentially influencing price stability. Furthermore, breakthroughs in quantum computing pose a theoretical long-term threat, although the timeline for such a threat remains uncertain. The development and adoption of layer-2 solutions will be key factors influencing scalability and transaction costs, directly impacting Bitcoin’s attractiveness as a transactional medium.

Regulatory Frameworks and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s price. Favorable regulatory frameworks, such as clear guidelines on taxation and anti-money laundering (AML) compliance, could increase institutional investment and mainstream adoption. Conversely, stringent regulations or outright bans could severely restrict Bitcoin’s growth and negatively impact its price. The regulatory landscape varies widely across jurisdictions, creating uncertainty and potentially influencing price volatility. For example, a positive regulatory shift in a major economy like the United States could trigger a significant price increase, whereas a crackdown in a key Asian market might cause a downturn.

Macroeconomic Conditions

Macroeconomic factors like inflation and recession significantly influence Bitcoin’s price. During periods of high inflation, Bitcoin, often viewed as a hedge against inflation, may see increased demand and a price surge. Conversely, during economic recessions, investors may liquidate Bitcoin holdings to cover losses in other asset classes, potentially leading to price drops. The correlation between Bitcoin’s price and traditional market indices, while not always consistent, is often observed during major economic events. For example, the 2022 market downturn saw Bitcoin prices decline alongside other risk assets.

Competing Cryptocurrencies and Blockchain Technologies

The emergence of competing cryptocurrencies and alternative blockchain technologies presents both challenges and opportunities for Bitcoin. The rise of altcoins with superior technology or features could divert investment away from Bitcoin, impacting its dominance and price. However, Bitcoin’s first-mover advantage, brand recognition, and established network effect continue to provide a strong foundation. The success of competing blockchains in specific niches, like decentralized finance (DeFi), may not necessarily translate to a direct threat to Bitcoin’s overall value proposition, but it does highlight the evolving landscape of the cryptocurrency market.

Key Market Trends

Several key market trends could significantly affect Bitcoin’s price in 2025. Increasing institutional adoption, driven by factors such as regulatory clarity and the development of robust custodial solutions, could boost demand and price. Growing adoption in emerging markets could also fuel significant price appreciation. Conversely, increased market manipulation or security breaches could lead to price declines. The overall sentiment within the cryptocurrency community, driven by news events and technological developments, will also play a significant role in shaping price expectations.

Bullish and Bearish Scenarios for Bitcoin’s Price in 2025

| Scenario | Price Range (USD) | Factors Contributing | Real-World Example/Comparison |

|---|---|---|---|

| Bullish | $100,000 – $200,000 | Widespread institutional adoption, positive regulatory developments, sustained macroeconomic uncertainty | Similar to the 2021 bull run, fueled by increased institutional interest and retail investor enthusiasm. |

| Bearish | $20,000 – $40,000 | Stringent regulations, significant security breaches, prolonged economic recession | Comparable to the 2018 bear market, characterized by regulatory uncertainty and a broader market downturn. |

Adoption and Usage Scenarios

Predicting Bitcoin’s adoption and usage in 2025 requires considering various scenarios, ranging from limited growth to widespread integration into the global financial system. The interplay between individual and institutional adoption will significantly influence the price trajectory.

Several factors will shape Bitcoin’s future adoption. These include regulatory clarity, technological advancements improving scalability and transaction speeds, and the overall macroeconomic environment. Increased public understanding and trust in Bitcoin, coupled with successful integration into existing financial infrastructure, are crucial for broader acceptance.

Institutional Adoption and Price Impact

Widespread institutional adoption could dramatically increase Bitcoin’s price. Large financial institutions, such as investment firms and hedge funds, already hold significant Bitcoin reserves. Further institutional investment, driven by diversification strategies and the potential for high returns, could lead to substantial price appreciation. This increased demand, coupled with limited supply, would likely create upward pressure on the price. For example, if major pension funds begin allocating a small percentage of their assets to Bitcoin, the demand surge could be significant. Conversely, a major sell-off by a large institutional holder could temporarily depress the price, highlighting the inherent volatility associated with institutional involvement.

Increased Usage for Payments and Investments

The increased use of Bitcoin for payments and investments will have a direct correlation with its value. As more businesses accept Bitcoin as a form of payment, its utility increases, thereby driving demand. Similarly, increased investment in Bitcoin as a store of value, mirroring the behavior seen with gold, could significantly impact its price. Consider a scenario where major e-commerce platforms begin integrating Bitcoin payments seamlessly into their systems. This increased usage, coupled with growing investor confidence, would likely result in a higher Bitcoin price. Conversely, a decrease in transactional volume or a loss of investor confidence could exert downward pressure.

Potential Use Cases in 2025 and Their Price Impact

The following use cases could significantly influence Bitcoin’s price in 2025:

- Increased use in cross-border payments: Reduced transaction fees and faster transfer times compared to traditional methods could make Bitcoin a preferred choice for international transactions, increasing demand and potentially driving up the price. Imagine a scenario where remittances from migrant workers are primarily conducted using Bitcoin, significantly increasing its transactional volume.

- Integration into Decentralized Finance (DeFi): Bitcoin’s use as collateral in DeFi lending and borrowing protocols could increase its demand and value. The growth of DeFi applications built around Bitcoin could unlock new functionalities and attract further investment.

- Growth of Bitcoin-backed ETFs: The approval of Bitcoin Exchange-Traded Funds (ETFs) by major regulatory bodies would provide increased accessibility for institutional and retail investors, potentially leading to a surge in demand and price appreciation. The launch of a widely accessible Bitcoin ETF could significantly increase the number of investors holding Bitcoin, creating significant upward pressure on price.

- Increased adoption in emerging markets: Bitcoin’s potential as a hedge against inflation and currency devaluation could drive adoption in emerging markets with volatile economies. If Bitcoin becomes a widely accepted alternative currency in countries experiencing hyperinflation, the demand could dramatically increase its price.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is notoriously difficult, with experts offering a wide range of opinions and market sentiment constantly fluctuating. Analyzing these diverse perspectives and the underlying factors driving them provides a more nuanced understanding of potential price trajectories in 2025. This section summarizes expert predictions, compares different forecasting models, and examines the prevailing market sentiment and its potential impact.

Summary of Expert Price Predictions, Bitcoin Price 2025 Target

Several financial analysts and experts have offered their predictions for Bitcoin’s price in 2025. These predictions vary significantly, reflecting the inherent uncertainty in the cryptocurrency market. For instance, some analysts, basing their projections on adoption rates and technological advancements, predict prices well above $100,000. Others, emphasizing regulatory risks and macroeconomic factors, offer more conservative estimates, sometimes below $50,000. These discrepancies highlight the difficulty in accurately forecasting Bitcoin’s future value, emphasizing the need to consider multiple perspectives and underlying assumptions. The range of predictions underscores the volatility and speculative nature of the Bitcoin market.

Comparative Analysis of Price Prediction Models

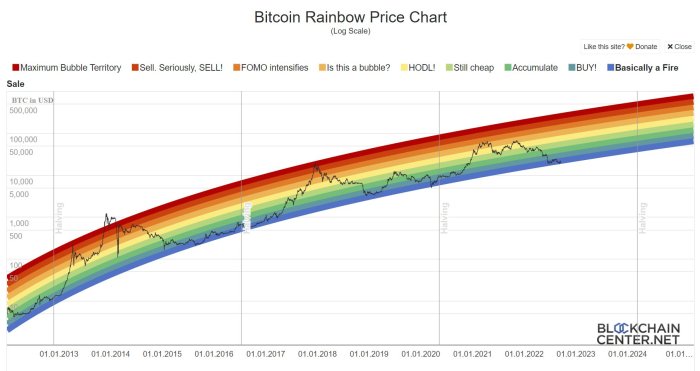

Different price prediction models utilize various methodologies, including technical analysis, fundamental analysis, and statistical modeling. Technical analysis, for example, relies on historical price charts and trading volume to identify trends and predict future price movements. Fundamental analysis focuses on factors like Bitcoin’s adoption rate, regulatory environment, and technological developments. Statistical models use quantitative data to generate forecasts. A comparison of these models reveals that while each offers valuable insights, none guarantees accuracy. The inherent limitations of each approach, such as the inability to account for unforeseen events, contributes to the divergence in price predictions. For example, a model heavily reliant on past price trends might not accurately capture the impact of a significant regulatory change.

Current Market Sentiment Towards Bitcoin

Currently, market sentiment towards Bitcoin is mixed. While some investors remain bullish, citing long-term growth potential and increasing institutional adoption, others express caution due to ongoing regulatory uncertainty and macroeconomic volatility. The overall sentiment is influenced by factors such as Bitcoin’s price performance, regulatory announcements, and broader market trends. Periods of high volatility often lead to increased uncertainty and a more cautious market sentiment. Conversely, periods of relative stability and price appreciation can boost investor confidence.

Impact of Social Media Sentiment on Bitcoin Price

Social media platforms significantly influence Bitcoin’s price. Positive sentiment, often fueled by influential figures or news events, can drive up demand and increase the price. Conversely, negative sentiment, potentially triggered by regulatory crackdowns or security breaches, can lead to price drops. The rapid spread of information and the potential for misinformation on social media amplify the impact of sentiment on market dynamics. For instance, a widely shared negative news story could trigger a sell-off, irrespective of its factual accuracy. Conversely, a positive tweet from a prominent figure could spark a buying frenzy, irrespective of underlying fundamentals.

Risks and Uncertainties

Predicting Bitcoin’s price in 2025, or any year for that matter, is inherently risky. Numerous factors beyond the control of investors and developers can significantly impact its value, potentially leading to substantial losses. Understanding these risks is crucial for anyone considering investing in Bitcoin.

Regulatory Uncertainty and Government Crackdowns pose a significant threat to Bitcoin’s price stability. Governments worldwide are grappling with how to regulate cryptocurrencies, and inconsistent or overly restrictive policies could severely limit Bitcoin’s adoption and usage. A sudden and widespread crackdown, such as a complete ban on trading or mining in major economies, could trigger a dramatic price drop. The experience of China’s 2021 ban serves as a stark reminder of this potential risk. The uncertainty surrounding future regulatory landscapes creates volatility and discourages institutional investment.

Regulatory Uncertainty and Government Crackdowns

The regulatory landscape surrounding Bitcoin is constantly evolving. Different countries have adopted vastly different approaches, ranging from outright bans to comprehensive regulatory frameworks. This inconsistency creates uncertainty for investors and businesses, making it difficult to plan long-term strategies. For example, while El Salvador has embraced Bitcoin as legal tender, other countries are actively exploring ways to restrict its use, leading to unpredictable market fluctuations. A coordinated global crackdown, though unlikely, could have a devastating impact on Bitcoin’s price. Furthermore, even seemingly minor changes in regulations in key markets can ripple through the global Bitcoin ecosystem, affecting price.

Security Breaches and Hacking Incidents

Bitcoin’s decentralized nature is a strength, but it doesn’t eliminate the risk of security breaches. Exchanges, wallets, and other platforms holding Bitcoin are vulnerable to hacking and theft. High-profile hacks, like the Mt. Gox collapse, have shown the potential for significant losses and resulting price drops. These incidents can erode investor confidence and negatively impact the overall perception of Bitcoin’s security, leading to sell-offs. While improvements in security protocols are constantly being made, the possibility of large-scale breaches remains a substantial risk. The sheer amount of money involved in the Bitcoin market makes it an attractive target for cybercriminals.

Technological Vulnerabilities

Despite its robust design, Bitcoin’s underlying technology is not immune to vulnerabilities. The discovery and exploitation of previously unknown flaws in the Bitcoin protocol could have severe consequences. A major security flaw could lead to the creation of double-spending attacks, allowing malicious actors to spend the same Bitcoin twice, undermining the system’s integrity and causing significant price volatility. While the Bitcoin community actively works to identify and address vulnerabilities, the possibility of unforeseen weaknesses remains a persistent risk. Furthermore, the development and adoption of competing cryptocurrencies with superior technology could also negatively impact Bitcoin’s market share and, consequently, its price.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price trajectory and investment potential in 2025. It’s crucial to remember that predicting cryptocurrency prices is inherently speculative, and the following information should be considered alongside your own research and risk tolerance.

Bitcoin Price Prediction for 2025

Predicting the precise Bitcoin price in 2025 is impossible. Numerous factors, including regulatory changes, technological advancements, and overall market sentiment, significantly influence its value. However, based on current trends and analysis, a price range between $100,000 and $250,000 is plausible. This range reflects a combination of optimistic scenarios (widespread adoption, positive regulatory developments) and more conservative projections (limited adoption, market corrections). For example, some analysts point to the historical halving cycles of Bitcoin, which typically precede price increases, to support higher price targets. Others, however, caution against overestimating the impact of these cycles, citing potential macroeconomic headwinds as countervailing forces.

Biggest Risks to Bitcoin’s Price

Several significant risks could negatively impact Bitcoin’s price. Regulatory uncertainty remains a key concern, with governments worldwide grappling with how to regulate cryptocurrencies. Stringent regulations could stifle adoption and limit price appreciation. Technological risks, such as security breaches or scaling issues, could also erode investor confidence. Furthermore, market-based risks, including macroeconomic downturns and the volatility inherent in cryptocurrency markets, pose considerable challenges. For instance, a major security flaw in the Bitcoin network could lead to a significant price drop, as seen with other cryptocurrencies in the past. Similarly, a global recession could drastically reduce investor appetite for riskier assets like Bitcoin.

Adoption’s Effect on Bitcoin’s Price

Widespread adoption of Bitcoin as a payment method or store of value would likely drive up its price. Increased demand, coupled with a relatively fixed supply (21 million Bitcoin), would create upward pressure on price. However, mass adoption could also lead to increased scrutiny and regulation, potentially creating downward pressure. For example, if Bitcoin becomes widely used for everyday transactions, governments might introduce stricter regulations to mitigate risks associated with its use, potentially impacting its price. Conversely, if adoption remains limited, price growth may be slower or even stagnate.

Bitcoin as an Investment for 2025

Whether Bitcoin is a good investment for 2025 depends entirely on individual risk tolerance and investment goals. While the potential for significant returns exists, the inherent volatility and risks associated with Bitcoin investment cannot be overlooked. Diversification of investment portfolios is crucial, and investors should only allocate a portion of their capital to Bitcoin. Consider the potential for significant losses alongside the possibility of substantial gains. The decision to invest in Bitcoin should be made after thorough research and a careful assessment of one’s own financial situation and risk appetite. A comparison to investing in established assets like gold or stocks can provide a useful benchmark for understanding the level of risk involved.

Illustrative Examples: Bitcoin Price 2025 Target

To better understand the potential price trajectories of Bitcoin in 2025, let’s explore two contrasting hypothetical scenarios, one depicting a bullish market and the other a bearish one. These scenarios are not predictions, but rather illustrative examples highlighting the impact of various factors.

High Bitcoin Price Scenario in 2025

Imagine a world in 2025 where widespread institutional adoption has become a reality. Major financial institutions, previously hesitant, now actively manage Bitcoin holdings, viewing it as a valuable asset diversification tool. This is depicted by a vibrant, bustling cityscape, with holographic billboards displaying Bitcoin’s price soaring to unprecedented heights. The image shows sleek, modern offices representing financial giants, with screens showcasing positive Bitcoin price charts. Government regulations have become clearer and more supportive, fostering a climate of trust and encouraging investment. Simultaneously, technological advancements, such as the successful implementation of the Lightning Network, have significantly improved transaction speeds and reduced fees, making Bitcoin more user-friendly for everyday transactions. This is visually represented by a simplified, intuitive interface on a smartphone, displaying quick and seamless Bitcoin transactions. The global economy experiences a period of relative stability, with Bitcoin acting as a safe haven asset during times of uncertainty. This is portrayed by a stable, upward-trending graph, contrasting with a more volatile representation of traditional market indices. This combination of factors results in a significantly higher Bitcoin price, perhaps exceeding $200,000.

Low Bitcoin Price Scenario in 2025

Conversely, consider a scenario where regulatory uncertainty remains a significant hurdle. Governments worldwide implement restrictive policies, hindering Bitcoin’s adoption and creating a climate of fear and uncertainty. This is visually represented by a dark, ominous cityscape, with news reports displaying negative headlines about Bitcoin regulation. The image shows government buildings with closed doors, symbolizing bureaucratic obstacles and resistance to cryptocurrency. A major security breach affecting a prominent cryptocurrency exchange erodes public trust, leading to a significant sell-off. This is illustrated by a shattered screen displaying a crashing Bitcoin price chart, alongside news reports depicting the aftermath of the security breach. Furthermore, the emergence of a more efficient and technologically superior cryptocurrency overshadows Bitcoin, diverting investment and attention. This is represented by a futuristic, sleek logo of a competing cryptocurrency, contrasted with a less modern and less appealing Bitcoin logo. The combination of these negative factors could significantly depress Bitcoin’s price, potentially keeping it below $20,000, or even lower.