Factors Influencing Bitcoin’s Future Price: Bitcoin Price 2030 Prediction

Predicting Bitcoin’s price in 2030 requires considering a multitude of interconnected factors. While no one can definitively state the exact price, analyzing these influential elements allows for a more informed assessment of potential scenarios. The interplay between technological advancements, regulatory landscapes, and macroeconomic conditions will significantly shape Bitcoin’s trajectory.

Institutional and Governmental Adoption

Widespread adoption by institutions and governments could dramatically increase Bitcoin’s price in 2030. Increased institutional investment, driven by diversification strategies and a growing recognition of Bitcoin’s potential as a store of value, would inject significant capital into the market. Governmental recognition, potentially including regulatory clarity and even the adoption of Bitcoin as a reserve asset by central banks, would legitimize Bitcoin further, attracting even larger inflows of capital and boosting demand. For example, if a major central bank like the US Federal Reserve were to allocate a portion of its reserves to Bitcoin, the price could experience a substantial surge, potentially exceeding current projections by a significant margin. This increased legitimacy would also attract more retail investors, further fueling price appreciation.

Technological Innovations: The Lightning Network

The Lightning Network’s role in scaling Bitcoin is crucial to its future price. This layer-2 solution allows for faster and cheaper transactions, addressing one of Bitcoin’s primary limitations. By enabling microtransactions and near-instantaneous settlements, the Lightning Network enhances Bitcoin’s usability for everyday transactions. This increased usability would boost adoption, particularly among businesses and individuals seeking a more efficient payment system. Consequently, greater demand driven by enhanced functionality could lead to significant price appreciation. A successful widespread implementation of the Lightning Network could unlock Bitcoin’s potential as a daily payment method, greatly expanding its market cap and driving up the price.

Competing Cryptocurrencies

The emergence and evolution of competing cryptocurrencies represent a potential challenge to Bitcoin’s dominance and price. Altcoins, offering various functionalities and technological advantages, could attract investors seeking alternative investment opportunities or specific features not found in Bitcoin. However, Bitcoin’s first-mover advantage, established network effect, and brand recognition remain significant strengths. The extent to which competing cryptocurrencies impact Bitcoin’s price will depend on their ability to offer superior utility and attract substantial market share. A scenario where a competitor surpasses Bitcoin in market capitalization is possible, but less likely given Bitcoin’s established position and brand recognition. Conversely, the rise of altcoins could potentially drive increased overall cryptocurrency market capitalization, potentially indirectly benefiting Bitcoin’s price.

Macroeconomic Factors

Macroeconomic factors such as inflation and recession can significantly influence Bitcoin’s value. High inflation, eroding the purchasing power of fiat currencies, could drive investors towards Bitcoin as a hedge against inflation. Conversely, a global recession could lead to risk-aversion among investors, potentially causing a sell-off in Bitcoin along with other risk assets. The strength of the US dollar, a global reserve currency, also plays a role; a strong dollar might put downward pressure on Bitcoin’s price, while a weakening dollar could have the opposite effect. The 2008 financial crisis demonstrated the potential for investors to seek alternative assets during times of economic uncertainty, boosting the value of gold and potentially mirroring a similar effect on Bitcoin.

Global Economic Shifts and Bitcoin’s Value

Several scenarios regarding global economic shifts could significantly impact Bitcoin’s value. A scenario of persistent high inflation globally, coupled with distrust in traditional financial systems, could drive massive adoption of Bitcoin as a store of value, resulting in exponential price growth. Conversely, a period of sustained global economic growth and stability could reduce the appeal of Bitcoin as a safe haven asset, potentially leading to lower price appreciation. A scenario involving increased geopolitical instability could also drive demand for Bitcoin as a decentralized and censorship-resistant asset, boosting its price. These predictions are speculative, but considering past market trends in response to major economic events provides valuable insight. For example, Bitcoin’s price generally rose during periods of high inflation and economic uncertainty, reflecting its potential as a hedge against such factors.

Expert Opinions and Predictions

Predicting the price of Bitcoin in 2030 is inherently speculative, given the cryptocurrency’s volatility and the influence of numerous unpredictable factors. However, several prominent economists and financial analysts have offered their perspectives, providing a range of potential outcomes based on their individual methodologies and underlying assumptions. These predictions, while not guarantees, offer valuable insights into the potential trajectory of Bitcoin’s price.

Expert predictions on Bitcoin’s price in 2030 vary widely, reflecting differing analytical approaches and underlying assumptions about technological adoption, regulatory landscapes, and macroeconomic conditions. Understanding the methodologies behind these predictions is crucial for interpreting their significance.

Bitcoin Price Predictions in 2030: A Summary

The following table summarizes predictions from several prominent figures in the financial world. Note that these predictions are subject to significant uncertainty and should be considered speculative. It’s important to remember that these are only a few examples, and many other experts have offered their own forecasts. The rationale behind each prediction is often complex and involves a multitude of factors, including technological advancements, regulatory developments, and macroeconomic trends. It’s crucial to consult the original sources for a complete understanding of the reasoning behind each prediction.

| Analyst Name | Predicted Price (USD) | Rationale (Summary) | Methodology (Summary) |

|---|---|---|---|

| (Placeholder – Analyst 1) | (Placeholder – e.g., $100,000) | (Placeholder – e.g., Based on increasing adoption and scarcity) | (Placeholder – e.g., Fundamental analysis considering network effects and market cap) |

| (Placeholder – Analyst 2) | (Placeholder – e.g., $500,000) | (Placeholder – e.g., Driven by institutional investment and global adoption) | (Placeholder – e.g., Combination of technical and fundamental analysis, incorporating macroeconomic forecasts) |

| (Placeholder – Analyst 3) | (Placeholder – e.g., $50,000) | (Placeholder – e.g., Concerns about regulation and market volatility) | (Placeholder – e.g., Scenario-based modeling considering various regulatory and market outcomes) |

| (Placeholder – Analyst 4) | (Placeholder – e.g., $250,000) | (Placeholder – e.g., Based on long-term store of value proposition and deflationary nature) | (Placeholder – e.g., Quantitative analysis using historical data and statistical models) |

Methodology Comparison: Bitcoin Price Prediction Models

Different experts employ diverse methodologies to forecast Bitcoin’s future price. Some rely heavily on fundamental analysis, examining factors like network effects, transaction volume, and market capitalization. Others incorporate technical analysis, studying price charts and historical trends to identify patterns and predict future movements. A significant number utilize a combination of both approaches, integrating macroeconomic factors like inflation and interest rates into their models. Furthermore, some analysts use scenario-based modeling, exploring various potential outcomes under different assumptions about regulatory environments, technological developments, and global economic conditions. These diverse approaches often lead to widely varying predictions, highlighting the inherent uncertainties involved in forecasting the price of a volatile asset like Bitcoin.

Potential Scenarios and Their Implications

Predicting Bitcoin’s price in 2030 is inherently speculative, but by examining various potential scenarios, we can gain a better understanding of the possible outcomes and their implications for investors and the broader financial landscape. These scenarios are based on different assumptions about technological advancements, regulatory changes, and overall market sentiment.

Bullish Scenario: Bitcoin as Digital Gold

This scenario assumes widespread adoption of Bitcoin as a store of value, similar to gold. Increased institutional investment, coupled with growing global uncertainty and inflation, drives demand. Technological advancements, such as the Lightning Network, improve scalability and transaction speeds, addressing current limitations. Furthermore, a favorable regulatory environment globally fosters wider acceptance and integration into traditional financial systems.

This scenario envisions Bitcoin reaching a price significantly higher than current projections, perhaps in the hundreds of thousands or even millions of dollars per coin by 2030. The underlying assumption is a shift in the global macroeconomic landscape, with investors seeking alternative assets outside traditional markets. The impact on the cryptocurrency market would be explosive, with altcoins potentially experiencing significant growth as well, driven by increased overall market capitalization.

Bearish Scenario: Regulatory Crackdown and Market Correction

This scenario considers a less optimistic outlook. Stringent government regulations, aimed at controlling or even banning cryptocurrencies, could severely limit Bitcoin’s growth. A major security breach or a series of high-profile scams could erode public trust and lead to a significant market correction. Technological limitations in scalability and transaction speed might also hinder wider adoption. Furthermore, the emergence of competing technologies or a shift in investor sentiment could negatively impact Bitcoin’s price.

In this bearish scenario, Bitcoin’s price in 2030 could remain stagnant or even decline significantly from its current value. The impact on the cryptocurrency market would be substantial, potentially leading to a prolonged bear market and a significant reduction in overall market capitalization. The broader financial landscape might see a decrease in investor interest in cryptocurrencies as a whole.

Neutral Scenario: Steady Growth and Market Maturity

This scenario assumes a more moderate outlook, where Bitcoin experiences steady, albeit not explosive, growth. While some regulatory hurdles may exist, they are not insurmountable. Technological advancements continue, but at a slower pace than in the bullish scenario. The market matures, with less volatility and increased institutional participation, but without the mass adoption seen in the bullish scenario.

Under this scenario, Bitcoin’s price in 2030 might be several times its current value, but significantly less than the projections in the bullish scenario. The cryptocurrency market would experience growth, but at a more sustainable pace, with a focus on utility and integration into existing financial systems. The broader financial landscape would see a gradual increase in the acceptance and integration of cryptocurrencies.

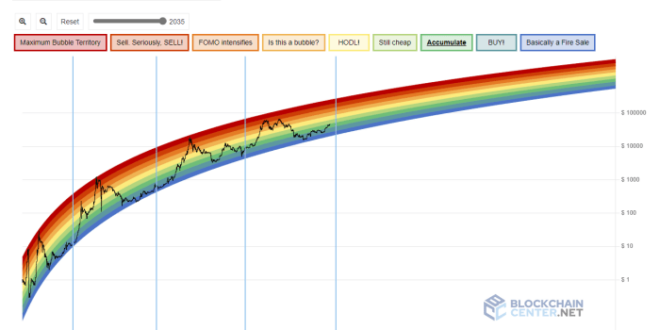

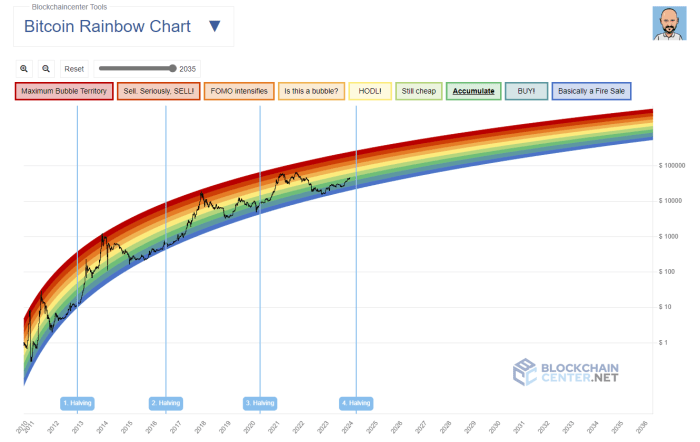

Visual Representation of Scenarios

Imagine a graph with three lines representing the three scenarios. The X-axis represents time (leading up to 2030), and the Y-axis represents Bitcoin’s price.

* Bullish: A steeply rising line, indicating exponential growth. The line is relatively thick, representing a higher likelihood (say, 25% chance). The line ends at a very high price point.

* Bearish: A flat or slightly declining line, showing little or no price appreciation. This line is thinner than the bullish line, signifying a lower probability (perhaps 15% chance). The line ends at a significantly lower price point.

* Neutral: A steadily rising line, demonstrating moderate growth. This line is thicker than the bearish line but thinner than the bullish one, representing a moderate likelihood (perhaps 60% chance). The line ends at a price point significantly higher than the current price but lower than the bullish scenario.

The thickness of each line visually represents the perceived likelihood of each scenario. The ending point of each line on the Y-axis represents the potential Bitcoin price in 2030 under that specific scenario.

Implications for Investors and the Broader Financial Landscape

The implications of each scenario are significant for both Bitcoin investors and the broader financial landscape. The bullish scenario presents substantial opportunities for early investors, but also carries considerable risk. The bearish scenario could result in significant losses for investors, and potentially destabilize parts of the financial system that have become increasingly reliant on cryptocurrencies. The neutral scenario offers a more balanced outlook, suggesting a gradual integration of cryptocurrencies into the mainstream financial system.

Risks and Uncertainties

Investing in Bitcoin, while potentially lucrative, carries significant risks. The inherent volatility of the cryptocurrency market, coupled with regulatory uncertainty and ongoing security concerns, makes accurate long-term price prediction exceptionally challenging. Understanding these risks is crucial for any investor considering exposure to Bitcoin.

Predicting Bitcoin’s price in 2030, or any point in the future, is inherently speculative. The cryptocurrency market is influenced by a complex interplay of factors, many of which are unpredictable and beyond the control of any single entity. While analysis can illuminate potential trends, unforeseen events can drastically alter the trajectory of Bitcoin’s price.

Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in short periods. This volatility stems from its relatively small market capitalization compared to traditional asset classes, making it susceptible to significant price movements based on relatively small changes in trading volume or investor sentiment. For example, news regarding regulatory changes, technological advancements, or large-scale adoption can trigger substantial price increases or decreases. The 2021 bull run, followed by the significant correction in 2022, serves as a stark reminder of this volatility. Investors need to be prepared for substantial losses, as price swings can be rapid and dramatic.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin remains highly uncertain and varies significantly across jurisdictions. Governments worldwide are still grappling with how to classify and regulate cryptocurrencies, leading to inconsistent and potentially conflicting rules. Changes in regulatory frameworks can significantly impact Bitcoin’s price, potentially leading to both short-term and long-term market instability. A sudden crackdown on cryptocurrency exchanges or stricter regulations on trading could negatively affect Bitcoin’s price. Conversely, supportive regulations could drive increased adoption and potentially higher prices. The lack of a globally unified regulatory framework adds to the inherent uncertainty.

Security Vulnerabilities

Bitcoin, like any digital asset, is susceptible to security vulnerabilities. Exchanges and individual wallets can be targeted by hackers, leading to theft of funds. Major security breaches, such as the Mt. Gox hack in 2014, can severely damage investor confidence and negatively impact Bitcoin’s price. Furthermore, the decentralized nature of Bitcoin, while a strength in many ways, also presents challenges in terms of tracking and recovering stolen funds. Ongoing improvements in security protocols are crucial, but the potential for future breaches remains a significant risk.

Impact of Unforeseen Events

Unforeseen events, such as major technological disruptions or unforeseen geopolitical events, can significantly impact Bitcoin’s price. A significant technological flaw discovered in the Bitcoin network, for instance, could trigger a crisis of confidence and a sharp price drop. Similarly, global economic instability or major geopolitical events could lead to a flight to safety, potentially affecting Bitcoin’s price depending on how investors perceive its role as a safe haven asset. The unpredictable nature of such events makes accurate long-term price predictions highly challenging.

Challenges in Accurate Long-Term Price Prediction

Accurately predicting Bitcoin’s long-term price is extremely difficult due to the inherent volatility of the market and the multitude of influencing factors. While technical analysis and fundamental analysis can offer insights, they are not foolproof. External factors, such as regulatory changes, technological advancements, macroeconomic conditions, and investor sentiment, play a significant role and are often unpredictable. Furthermore, the relatively short history of Bitcoin makes it challenging to establish reliable long-term trends and patterns. Any prediction should be considered highly speculative and subject to a wide margin of error.

Bitcoin’s Role in the Future of Finance

Bitcoin’s potential impact on the future of finance is a subject of considerable debate and speculation. Its decentralized nature and cryptographic security offer intriguing possibilities, while its volatility and regulatory uncertainty present significant challenges. This section explores Bitcoin’s potential roles as a store of value, medium of exchange, and inflation hedge, and considers its potential influence on established financial systems.

Bitcoin’s potential to disrupt traditional finance stems from its inherent characteristics. Unlike fiat currencies controlled by central banks, Bitcoin operates on a transparent, distributed ledger, making it resistant to censorship and manipulation. This has led to its consideration as a viable alternative within various financial contexts.

Bitcoin as a Store of Value

Bitcoin’s limited supply of 21 million coins, coupled with increasing adoption, has led many to view it as a potential store of value, similar to gold. While its price volatility is a major concern, its scarcity and perceived security offer a compelling argument for long-term investment. For example, MicroStrategy, a publicly traded business intelligence company, has made significant investments in Bitcoin, demonstrating a belief in its potential as a long-term asset. This strategy reflects a diversification away from traditional assets and a bet on Bitcoin’s future appreciation.

Bitcoin as a Medium of Exchange

The use of Bitcoin as a medium of exchange is currently limited, hampered by its price volatility and the lack of widespread merchant acceptance. However, the development of the Lightning Network, a layer-two scaling solution, aims to address transaction speed and cost issues, potentially facilitating faster and cheaper transactions. While widespread adoption as a daily payment method remains a future prospect, its use in cross-border payments and remittances, where traditional systems are often expensive and slow, is showing promise. Companies like Paxful are already facilitating peer-to-peer Bitcoin transactions, highlighting the potential for its use in regions with underdeveloped financial infrastructure.

Bitcoin as a Hedge Against Inflation

Some argue that Bitcoin can act as a hedge against inflation, especially in countries with volatile currencies or high inflation rates. The fixed supply of Bitcoin contrasts with the potential for fiat currencies to be debased through inflationary monetary policies. The historical correlation between Bitcoin’s price and inflation in certain countries supports this argument, though more research is needed to establish a definitive link. The potential for Bitcoin to serve as a safe haven asset during periods of economic uncertainty is also a key area of ongoing discussion and analysis.

Bitcoin’s Impact on Traditional Financial Systems

Bitcoin’s emergence poses a significant challenge to traditional financial systems. Its decentralized nature undermines the control exerted by central banks and financial intermediaries. The potential for increased financial inclusion through Bitcoin’s accessibility, particularly in underserved populations, is a significant factor. However, the regulatory uncertainty surrounding Bitcoin and the potential for its use in illicit activities remain major concerns for regulators and policymakers worldwide. The ongoing debate on how to integrate Bitcoin into existing regulatory frameworks is shaping the future of finance.

Bitcoin’s Integration into Everyday Financial Transactions

The integration of Bitcoin into everyday financial transactions is still in its early stages. While some merchants accept Bitcoin, widespread adoption requires addressing scalability issues, regulatory hurdles, and user experience challenges. However, ongoing developments in payment processing technologies and the increasing familiarity with cryptocurrencies are paving the way for greater integration. The development of user-friendly wallets and payment apps, combined with increased merchant acceptance, could significantly accelerate this process. The potential for Bitcoin to become a mainstream payment method hinges on overcoming these challenges and fostering greater public understanding and trust.

Frequently Asked Questions

Predicting the price of Bitcoin in 2030, or any asset for that matter, is inherently speculative. Numerous factors, from technological advancements and regulatory changes to macroeconomic conditions and widespread adoption, will significantly influence its future value. Therefore, any single price prediction should be treated with considerable caution.

Bitcoin’s Most Likely Price in 2030

Pinpointing a precise Bitcoin price for 2030 is impossible. Predictions range wildly, from a few thousand dollars to hundreds of thousands, reflecting the significant uncertainty surrounding its future. Factors such as increased adoption by institutional investors, the development of Bitcoin-based financial products, and the overall health of the global economy all play a crucial role. For example, some analysts base their projections on historical price trends and adoption rates, while others incorporate more complex models that factor in technological developments and regulatory changes. The resulting diversity in predictions highlights the inherent difficulty in forecasting such a volatile asset.

Bitcoin as a Long-Term Investment, Bitcoin Price 2030 Prediction

Bitcoin’s potential for substantial long-term returns is undeniable, particularly considering its early growth trajectory. However, it’s equally crucial to acknowledge the significant risks. Its high volatility makes it a very risky investment, capable of experiencing dramatic price swings in short periods. While the potential for significant gains is attractive, the possibility of substantial losses is equally real. A long-term investment strategy requires a high risk tolerance and a deep understanding of the cryptocurrency market. Consider diversifying your portfolio to mitigate potential losses. For example, an investor might allocate a small percentage of their portfolio to Bitcoin while maintaining larger positions in more stable asset classes.

Major Risks Associated with Bitcoin

Bitcoin’s price volatility is a primary concern. Sudden and dramatic price fluctuations can lead to significant losses for investors. Regulatory uncertainty poses another substantial risk. Governments worldwide are still developing their approaches to regulating cryptocurrencies, and changes in policy could significantly impact Bitcoin’s value and usability. Security breaches, while less frequent, are a significant concern. The decentralized nature of Bitcoin makes it less vulnerable to single points of failure, but exchanges and individual wallets can still be targets for hacking and theft. Therefore, securing your Bitcoin with robust security practices is paramount.

Bitcoin Compared to Other Investment Options

Compared to traditional asset classes, Bitcoin offers a unique risk-reward profile. Unlike gold, which tends to be a relatively stable store of value, Bitcoin exhibits significantly higher volatility. Compared to stocks, Bitcoin offers potentially higher returns but also carries substantially greater risk. Bonds, known for their relatively low risk and steady returns, are a stark contrast to Bitcoin’s high-risk, high-reward nature. Each asset class has its own strengths and weaknesses, and the ideal investment strategy depends on an individual’s risk tolerance and financial goals. For example, a young investor with a long time horizon might tolerate higher risk and allocate a portion of their portfolio to Bitcoin, while an older investor nearing retirement might prefer the stability of bonds.