Bitcoin Price Predictions for 2030

Predicting the price of Bitcoin in 2030 is inherently speculative, given the volatile nature of the cryptocurrency market. However, analyzing Reddit discussions provides a valuable insight into the collective sentiment and expectations surrounding Bitcoin’s future value. This analysis will examine various viewpoints expressed on Reddit, categorizing them based on user profiles and comparing them to predictions from established financial institutions.

Reddit Sentiment Analysis on Bitcoin’s 2030 Price

Reddit forums dedicated to Bitcoin are a rich source of price predictions, ranging from extremely bullish to profoundly bearish. The diversity of opinion reflects the varied levels of understanding and investment strategies within the community. For instance, long-term holders (HODLers) often express bullish sentiment, projecting substantial price increases based on Bitcoin’s scarcity and potential for widespread adoption. Conversely, those with shorter-term investment horizons or a more cautious outlook tend to express more neutral or bearish sentiments, citing factors like regulatory uncertainty and potential market corrections. Many users base their predictions on technical analysis, fundamental analysis, or a combination of both.

Categorization of Reddit User Sentiment

A significant factor influencing Reddit user sentiment is investment experience. Experienced investors often exhibit more nuanced perspectives, acknowledging both the potential for substantial gains and the risks involved. Conversely, newer investors may show a greater tendency toward either extreme bullishness or extreme bearishness, reflecting a lack of exposure to market cycles. Cryptocurrency knowledge also plays a role; users with a deeper understanding of blockchain technology and Bitcoin’s underlying mechanics tend to articulate more informed predictions. Furthermore, historical price analysis influences sentiment. Those who recall past Bitcoin price crashes may be more inclined toward caution, while those who witnessed periods of significant growth may hold more optimistic views.

Comparison with Professional Predictions

While Reddit provides a snapshot of public opinion, professional financial analysts and market research firms offer a different perspective. These institutions often employ sophisticated modeling techniques and consider macroeconomic factors that individual Reddit users may overlook. Their predictions typically fall within a narrower range than those found on Reddit, often reflecting a more conservative outlook. For example, while some Reddit users predict Bitcoin reaching $1 million or more by 2030, professional analyses might project a range between $100,000 and $500,000, acknowledging the inherent uncertainties and risks. These differences highlight the gap between speculative enthusiasm and professional, risk-adjusted assessments.

Summary of Reddit Price Predictions

The following table summarizes the diverse opinions found on Reddit regarding Bitcoin’s price in 2030. Note that these are broad generalizations, and individual predictions vary significantly.

| Sentiment | Predicted Price Range (USD) | Supporting Arguments | User Demographics |

|---|---|---|---|

| Bullish | $100,000 – $1,000,000+ | Widespread adoption, scarcity, institutional investment, technological advancements | Long-term HODLers, experienced investors, technologically savvy users |

| Neutral | $50,000 – $200,000 | Balanced view considering both upside potential and market risks, focus on long-term trends | Experienced investors with a diversified portfolio, users with a balanced understanding of the market |

| Bearish | Below $50,000 | Regulatory uncertainty, potential market crashes, competition from alternative cryptocurrencies | Newer investors, users with a negative past experience with Bitcoin, those focusing on short-term gains |

Factors Influencing Redditors’ Bitcoin Price Forecasts

Reddit discussions surrounding Bitcoin’s price in 2030 are fueled by a complex interplay of factors, reflecting a diverse range of perspectives and levels of understanding within the cryptocurrency community. These predictions are not based on rigorous financial modeling but rather a blend of technical analysis, speculation, and belief in Bitcoin’s underlying technology and potential. The weight assigned to each factor varies considerably depending on the individual Redditor’s background, investment strategy, and overall outlook on the future of finance.

Technological Advancements and Adoption Rates are significant factors shaping Redditors’ price forecasts. Discussions frequently center on the scalability of the Bitcoin network, the development of the Lightning Network, and the broader adoption of Bitcoin as a payment method and store of value. Positive developments in these areas often lead to more bullish predictions. Conversely, concerns about technological limitations or security vulnerabilities can dampen enthusiasm.

Technological Advancements and Adoption

The speed and success of Bitcoin’s technological development significantly influence Redditors’ price predictions. For example, widespread adoption of the Lightning Network, which enables faster and cheaper transactions, is often cited as a catalyst for substantial price increases. Conversely, persistent scalability issues could limit Bitcoin’s growth potential and negatively impact price forecasts. The level of mainstream adoption, reflected in merchant acceptance and institutional investment, is another crucial factor. Increased institutional involvement, such as large-scale purchases by corporations or investment funds, is often viewed as a strong bullish signal. Redditors often point to past instances of institutional adoption, like MicroStrategy’s significant Bitcoin holdings, as evidence of future price appreciation.

Regulatory Landscape and Macroeconomic Conditions, Bitcoin Price 2030 Reddit

Regulatory changes globally play a considerable role in shaping Redditors’ expectations. Favorable regulations, such as the clear legal framework for Bitcoin in certain jurisdictions, tend to generate positive sentiment. Conversely, strict regulations or outright bans can trigger negative price predictions. Macroeconomic conditions, such as inflation, interest rates, and geopolitical instability, are also frequently discussed. High inflation, for instance, can drive demand for Bitcoin as a hedge against inflation, leading to bullish forecasts. Conversely, a strong dollar or a period of economic stability might dampen Bitcoin’s appeal, potentially leading to more bearish predictions. Redditors often compare the current macroeconomic environment to historical periods, referencing past market cycles to justify their predictions.

Different Perspectives Among Reddit Users

The relative importance assigned to these factors varies greatly depending on the type of Redditor. Long-term holders (HODLers) often prioritize technological advancements and the long-term adoption of Bitcoin, showing less concern about short-term price fluctuations or regulatory uncertainties. Their forecasts tend to be more optimistic, based on their belief in Bitcoin’s underlying value proposition. Day traders, on the other hand, are more sensitive to short-term price movements and macroeconomic factors. They are more likely to adjust their price predictions based on recent market trends and news events. Their forecasts may be more volatile and less focused on long-term fundamentals. This difference in perspective highlights the diverse motivations and investment strategies within the Bitcoin community.

Comparison with Mainstream Financial News Outlets

Mainstream financial news outlets typically focus more on macroeconomic factors and regulatory developments when analyzing Bitcoin’s price. They tend to apply more traditional financial models and incorporate data from established financial markets. While they acknowledge the role of technological advancements, they often place less emphasis on the purely technical aspects discussed extensively on Reddit. The difference in approach stems from the different audiences and methodologies employed. Reddit’s discussions are characterized by a more speculative and community-driven approach, whereas mainstream news outlets strive for a more objective and data-driven analysis.

Comparing Reddit Predictions with Other Sources

Reddit’s Bitcoin price predictions for 2030 offer a fascinating glimpse into the collective sentiment of a large, engaged community. However, it’s crucial to compare these predictions with those from more established sources to understand the broader range of possibilities and identify potential biases. This comparison will highlight the diverse methodologies and assumptions underpinning different forecasts, ultimately offering a more nuanced perspective on Bitcoin’s potential future value.

Comparing Reddit’s predictions with those from established financial news sources, crypto analysis platforms, and expert opinions reveals both convergence and divergence in projected Bitcoin prices. While some sources might share similar price ranges, the underlying rationale and methodologies often differ significantly. Understanding these differences is crucial for interpreting the validity and reliability of each prediction.

Comparative Analysis of Bitcoin Price Predictions

The following table compares Bitcoin price predictions from various sources, highlighting their methodologies and potential biases. Note that these are examples, and specific predictions vary considerably depending on the timing of the forecast. The predictions are illustrative and should not be considered financial advice.

| Source | Predicted Price (USD) | Methodology | Potential Biases |

|---|---|---|---|

| Reddit (Average User Prediction) | $100,000 – $500,000 (wide range depending on subreddit and time of prediction) | Often based on speculation, technical analysis (often misused), news events, and community sentiment. Lacks rigorous quantitative modeling. | Echo chambers, confirmation bias, hype cycles, lack of diversification in sources, potential for manipulation by influencers. |

| Bloomberg (Example Analyst) | $150,000 (Illustrative example) | Typically involves macroeconomic analysis, assessment of adoption rates, technological advancements, and regulatory developments. Often uses sophisticated quantitative models. | Potential for bias towards mainstream financial perspectives, might underestimate disruptive potential of cryptocurrencies, influence by corporate interests. |

| CoinMetrics (Example Report) | $200,000 (Illustrative example) | Employs on-chain analysis, network activity, and historical price data to develop forecasts. Often uses statistical models and machine learning techniques. | Data limitations, reliance on historical patterns (which may not always hold), potential for model overfitting. |

| Expert Opinion (e.g., prominent economist) | $50,000 – $250,000 (wide range depending on the expert) | Combines macroeconomic factors, technological assessments, and geopolitical considerations. Methodologies vary greatly depending on the expert’s background and perspective. | Individual biases, potential conflicts of interest (e.g., consulting work for crypto companies), limited predictive power due to the nascent nature of the cryptocurrency market. |

The Role of Speculation and Hype on Reddit

Reddit, with its vibrant and often highly engaged communities, plays a significant role in shaping the narrative around Bitcoin and other cryptocurrencies. The platform’s decentralized nature and accessibility foster a breeding ground for speculation and hype, influencing price movements in ways both predictable and unpredictable. The ease of information sharing, coupled with the anonymity afforded by many usernames, contributes to a dynamic environment where opinions, both informed and uninformed, can quickly spread and impact market sentiment.

Reddit discussions often amplify existing market trends, accelerating both upward and downward price movements. The platform’s inherent structure, allowing for rapid dissemination of news and opinions, acts as a powerful amplifier for bullish or bearish sentiment. This can lead to situations where a surge in positive sentiment on a specific subreddit, for example, r/Bitcoin, can contribute to a short-term price increase, while negative news or a shift in community opinion can trigger a sell-off. This influence is not always rational; emotional responses often outweigh fundamental analysis.

Examples of Reddit’s Influence on Bitcoin Price

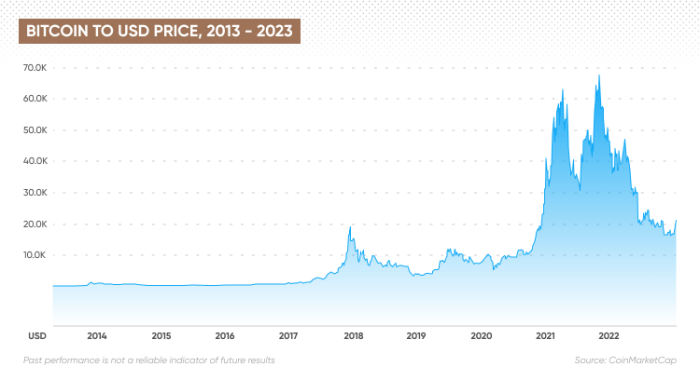

Several instances highlight Reddit’s impact on Bitcoin’s price. The 2017 Bitcoin price surge, for example, saw significant amplification from Reddit communities. Positive discussions and the spread of “get rich quick” narratives fueled a period of intense speculation, pushing the price to unprecedented highs. Conversely, periods of negative sentiment, often triggered by regulatory announcements or security breaches, have been observed to correlate with price dips, amplified by the rapid dissemination of such news across various Reddit forums. While it’s impossible to isolate Reddit’s influence entirely from other market factors, its role as a significant information hub and sentiment aggregator is undeniable. The case of Dogecoin, significantly boosted by Reddit-driven hype in 2021, serves as another potent example of how online community sentiment can impact cryptocurrency prices.

Psychological Factors Driving Speculative Behavior

The speculative behavior observed on Reddit is driven by a complex interplay of psychological factors. Herd mentality plays a crucial role, where individuals tend to follow the actions and opinions of the majority, even if those actions are not necessarily rational. This is exacerbated by the anonymity and group dynamics inherent in online communities. Fear of missing out (FOMO) is another powerful driver, pushing individuals to invest or trade based on the fear of losing out on potential profits. This can lead to impulsive decisions and a disregard for risk assessment, amplifying price volatility. Confirmation bias, the tendency to seek out information confirming pre-existing beliefs, also contributes to the formation of echo chambers within Reddit communities, reinforcing speculative narratives and further exacerbating price swings.

A Narrative Illustrating the Interplay Between Reddit Discussions, Price Volatility, and Market Manipulation

Imagine a scenario where a relatively unknown cryptocurrency, let’s call it “CryptoX,” is mentioned positively in a niche Reddit community. Initial posts are cautiously optimistic, based on the project’s underlying technology. However, as more users join the discussion, FOMO kicks in. Positive comments dominate, creating an echo chamber where any dissenting voices are quickly downvoted and dismissed. This fuels a rapid increase in CryptoX’s price, attracting more speculative investors driven by herd mentality. Some sophisticated actors might even capitalize on this by strategically posting positive comments or spreading false information, further amplifying the hype and potentially manipulating the market for their profit. As the price rises dramatically, the risk of a sudden correction increases. Eventually, as reality sets in and the speculative bubble bursts, the price plummets, leaving many investors with significant losses. This scenario illustrates how Reddit discussions, combined with psychological factors, can create volatile market conditions and increase the potential for market manipulation.

Risks and Opportunities in Bitcoin for 2030: Bitcoin Price 2030 Reddit

Predicting the future of Bitcoin is inherently speculative, but analyzing Reddit discussions alongside broader market trends offers valuable insights into potential risks and opportunities by 2030. While Reddit reflects a diverse range of opinions, certain recurring themes emerge regarding the challenges and potential rewards associated with Bitcoin investment.

Regulatory Uncertainty and its Impact

Regulatory landscapes surrounding cryptocurrencies are constantly evolving. Reddit discussions frequently highlight concerns about increased governmental regulation, potentially impacting Bitcoin’s price and accessibility. For example, stricter KYC/AML (Know Your Customer/Anti-Money Laundering) regulations could limit anonymity, a key feature valued by some Bitcoin users. Conversely, clearer regulatory frameworks could increase institutional confidence and lead to greater mainstream adoption. The potential for varying regulations across different jurisdictions also poses a significant risk, creating complexities for international transactions and investment strategies. Examples include differing tax treatments of Bitcoin gains in various countries, impacting the overall profitability for investors.

Technological Disruption and its Influence

The cryptocurrency space is characterized by rapid technological advancements. Redditors often debate the potential for newer, more efficient, or scalable cryptocurrencies to challenge Bitcoin’s dominance. The development of quantum computing also presents a long-term threat, potentially compromising Bitcoin’s cryptographic security. Conversely, technological advancements within Bitcoin itself, such as the Lightning Network improving transaction speeds and reducing fees, could enhance its usability and attractiveness. The ongoing development and adoption of layer-2 solutions are frequently discussed on Reddit as a means to address scalability issues and enhance Bitcoin’s overall functionality.

Market Volatility and Crash Scenarios

Bitcoin’s history is marked by periods of extreme volatility. Reddit discussions often reflect anxieties about potential market crashes, fueled by past price fluctuations and macroeconomic factors. The impact of global economic downturns or unexpected geopolitical events on Bitcoin’s value is a frequently discussed risk. However, some Redditors also view these crashes as opportunities to acquire Bitcoin at discounted prices, highlighting a contrarian investment strategy. The 2022 crypto winter, for instance, serves as a recent real-world example of a significant market downturn that influenced many Reddit discussions.

Opportunities: Widespread Adoption and Institutional Investment

Despite the risks, many Reddit users remain optimistic about Bitcoin’s long-term prospects. The potential for widespread adoption as a medium of exchange and store of value is frequently highlighted. Increased institutional investment, already observed in recent years, is viewed as a catalyst for greater price stability and legitimacy. The growing integration of Bitcoin into traditional financial systems, such as through Bitcoin ETFs, is also seen as a positive development. Examples include companies like MicroStrategy and Tesla’s past investments in Bitcoin, showcasing the growing institutional interest.

Opportunities: New Applications and Decentralized Finance (DeFi)

The development of new applications built on the Bitcoin blockchain, particularly within the DeFi space, is another area of optimism. Reddit discussions often explore the potential for Bitcoin to underpin innovative financial products and services, beyond simple peer-to-peer transactions. While still in its early stages, the potential for Bitcoin to play a central role in a decentralized financial system is a recurring theme of excitement. The potential for increased privacy through advancements like the Taproot upgrade is also frequently mentioned.

Risk Mitigation Strategies from Reddit Discussions

Reddit users often discuss various risk mitigation strategies, including diversification across different asset classes, dollar-cost averaging (DCA) to reduce the impact of price volatility, and holding Bitcoin long-term to weather short-term fluctuations. The importance of thorough research and understanding of the technology behind Bitcoin is also emphasized repeatedly. Many users highlight the need for secure storage solutions, such as hardware wallets, to protect against theft or hacking.

Illustrative Examples from Reddit Discussions

Reddit discussions regarding Bitcoin’s price in 2030 reveal a wide spectrum of opinions, ranging from extreme bullishness to cautious pessimism. Analyzing specific posts and comments illuminates the reasoning behind these diverse forecasts and the factors influencing user sentiment. These examples showcase the interplay of speculation, technical analysis, fundamental assessment, and overall market sentiment within the Bitcoin community.

Bitcoin Price 2030 Reddit – The following examples highlight the varied perspectives and reasoning behind Bitcoin price predictions on Reddit. It’s crucial to remember that these are individual opinions and not necessarily reflective of sound financial advice.

Examples of Bullish Sentiment

One user, posting on r/Bitcoin, argued for a price exceeding $1 million per Bitcoin by 2030. Their reasoning centered on Bitcoin’s increasing adoption as a store of value, coupled with a prediction of continued scarcity due to limited supply. They cited historical price trends and compared Bitcoin’s market capitalization potential to that of gold, suggesting significant future growth. The post generated considerable enthusiasm, with many users expressing agreement and sharing similar optimistic forecasts. The user’s evidence, however, lacked specific quantitative projections and relied heavily on qualitative arguments regarding long-term adoption and scarcity.

Another example showcased a user on r/CryptoCurrency who predicted a price between $500,000 and $1 million, basing their prediction on anticipated increased institutional investment and the potential for Bitcoin to become a global reserve currency. They presented charts illustrating past growth patterns and compared Bitcoin’s market capitalization to other established asset classes. This post sparked a lively debate, with some users questioning the feasibility of such a dramatic price increase, while others provided supporting arguments based on similar analyses. The user’s methodology, while relying on extrapolations of past trends, lacked explicit consideration of potential macroeconomic factors or regulatory risks.

Examples of Bearish or Cautious Sentiment

Conversely, a post on r/BitcoinMarkets expressed skepticism about reaching such high prices. This user highlighted the potential for increased regulation, the emergence of competing cryptocurrencies, and the inherent volatility of the cryptocurrency market as factors that could limit Bitcoin’s price appreciation. They pointed to past market crashes and periods of prolonged stagnation as evidence for their cautious outlook. This post triggered a more measured discussion, with users debating the likelihood of regulatory intervention and the competitive landscape within the cryptocurrency space. The user’s analysis emphasized the importance of considering potential downside risks, offering a counterpoint to the overwhelmingly bullish predictions found elsewhere.

In a different thread on r/cc, a user argued that Bitcoin’s price in 2030 would be significantly lower than many predicted, possibly remaining in the tens of thousands of dollars. Their reasoning centered on the limited practical use cases of Bitcoin beyond speculation and its energy consumption concerns. This post received a mixed response, with some users agreeing with the assessment of Bitcoin’s limitations, while others countered with arguments emphasizing Bitcoin’s potential as a hedge against inflation and its growing adoption as a payment method in certain regions. The user’s perspective underscored the potential limitations of Bitcoin’s technology and its broader impact on the environment.

Frequently Asked Questions (FAQs) about Bitcoin Price in 2030 (Reddit Perspective)

Reddit discussions regarding Bitcoin’s future price are diverse and often speculative, reflecting the inherent volatility and uncertainty surrounding cryptocurrency markets. While offering a glimpse into the collective sentiment of a large online community, it’s crucial to remember that these opinions aren’t financial advice and should be considered alongside other analyses.

Opinions on Bitcoin Reaching $1 Million by 2030

The range of opinions on Reddit regarding Bitcoin reaching $1 million by 2030 is vast. Some users express unwavering bullishness, citing Bitcoin’s potential for mass adoption and scarcity as key drivers. They often point to historical price increases and compare Bitcoin’s market capitalization to gold’s, suggesting significant room for growth. Conversely, many express skepticism, highlighting the inherent risks associated with cryptocurrencies, including regulatory uncertainty and potential market crashes. Examples from Reddit discussions showcase both extreme optimism, with users predicting prices far exceeding $1 million, and cautious pessimism, with users suggesting that such a price is highly improbable given potential hurdles. For example, some posts cite potential technological advancements that could render Bitcoin obsolete, while others focus on the potential impact of government regulation.

Factors Affecting Bitcoin’s Price in 2030 According to Reddit Users

Several factors consistently emerge in Reddit discussions as significant influencers on Bitcoin’s price in 2030. Adoption rates by institutional investors and mainstream consumers are frequently mentioned, with widespread acceptance being viewed as a major bullish factor. Regulatory developments, both positive (clearer regulatory frameworks) and negative (restrictive regulations), are also highlighted as potentially impactful. Technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s scalability improvements, are discussed as potentially boosting Bitcoin’s utility and value. Macroeconomic conditions, including inflation and global economic uncertainty, are also considered, with many users suggesting that Bitcoin could serve as a hedge against inflation, driving price increases in times of economic instability. Finally, the overall sentiment and media coverage surrounding Bitcoin play a significant role, with positive news driving price increases and negative news potentially causing sell-offs.

Reliability of Reddit as a Source for Bitcoin Price Predictions

Reddit offers a valuable, albeit imperfect, window into the collective sentiment surrounding Bitcoin. Its advantages include access to a broad range of opinions, from seasoned investors to newcomers, allowing for a diverse perspective. The open and often unfiltered nature of the discussions can reveal underlying anxieties and hopes regarding Bitcoin’s future. However, the platform’s limitations are equally significant. The prevalence of speculation, hype, and unsubstantiated claims can lead to biased and unreliable predictions. The lack of professional verification and the potential for manipulation through coordinated campaigns (pump and dump schemes) significantly undermine the reliability of Reddit as a sole source for price forecasting. Moreover, the inherent anonymity of many users can make it difficult to assess the credibility of their opinions.

Comparison of Reddit Sentiment with Other Sources

Reddit’s sentiment on Bitcoin’s price in 2030 often exhibits greater volatility and extremes compared to more established sources like professional analyst reports and financial news outlets. While professional analysts tend to offer more measured predictions based on fundamental and technical analysis, Reddit discussions frequently reflect a wider spectrum of optimism and pessimism, influenced heavily by short-term market fluctuations and social media trends. Financial news sources usually provide a balanced view, incorporating various perspectives, while Reddit can be heavily skewed towards either bullish or bearish sentiment depending on prevailing market conditions and trending narratives. For instance, during periods of market growth, Reddit’s bullish sentiment may significantly outpace professional forecasts, while during downturns, the opposite may be true. The difference highlights the importance of critically evaluating information from all sources, recognizing the limitations of each.

Discussions regarding Bitcoin’s price in 2030 are prevalent on Reddit, often fueled by speculation and varying predictions. Predicting that far out is inherently difficult, however, understanding near-term projections can offer some insight. To gain a perspective on potential trajectory, it’s helpful to consider shorter-term forecasts, such as those found in articles like this one exploring What Price Bitcoin 2025 , which can inform broader long-term analyses for Bitcoin Price 2030 Reddit conversations.

Ultimately, any prediction remains speculative.

Speculation on Bitcoin’s price in 2030 is rampant on Reddit, with a wide range of predictions. To get a sense of potential trajectory, it’s helpful to consider shorter-term forecasts; understanding the potential price in January 2025, as discussed in this analysis: Bitcoin Price 2025 January , can inform our longer-term outlook for 2030. Ultimately, the Bitcoin price in 2030 remains highly dependent on various market factors and technological advancements.

Discussions on Bitcoin Price 2030 are rampant on Reddit, with wildly varying predictions. Getting a clearer picture requires analyzing shorter-term forecasts to build a foundation. For instance, checking out the Bitcoin Price Prediction 2025 Walletinvestor provides valuable insight into potential intermediate milestones. Ultimately, understanding these intermediate steps helps contextualize the longer-term Bitcoin Price 2030 Reddit debates.

Discussions on Bitcoin Price 2030 Reddit often involve speculation about various cryptocurrencies and their potential. It’s interesting to consider how other altcoins might perform in the interim, for example, by checking out the predictions for Bitcoin Cash, such as this analysis on Bitcoin Cash Price Prediction 2025 In Inr. Understanding the trajectory of altcoins like Bitcoin Cash could provide context for broader Bitcoin price predictions in 2030, which are, after all, highly speculative.

Speculation about Bitcoin’s price in 2030 is rampant on Reddit, with wildly varying predictions. To even begin to formulate an educated guess for 2030, however, it’s helpful to first consider more near-term projections; for instance, check out this insightful article on What Will Bitcoin Price Be In 2025 to gain some perspective. Understanding the trajectory in 2025 can help contextualize the longer-term Bitcoin Price 2030 Reddit discussions.