Bitcoin Price Predictions for 2050

Predicting the price of Bitcoin in 2050 is inherently speculative, relying on numerous interconnected factors with varying degrees of uncertainty. Reddit, as a platform for diverse opinions, offers a fascinating glimpse into the range of these predictions and the reasoning behind them. Analyzing Reddit discussions reveals a complex tapestry of bullish, bearish, and neutral sentiments, each supported by a unique set of arguments.

Reddit Sentiment Analysis on Bitcoin’s 2050 Price

Reddit discussions regarding Bitcoin’s future price in 2050 are highly varied. While a definitive consensus is absent, a broad categorization reveals a predominance of bullish sentiment, tempered by a significant contingent holding bearish or neutral views. The bullish sentiment often stems from beliefs in Bitcoin’s potential as a store of value, its growing adoption as a payment method, and the ongoing development of its underlying technology. Bearish sentiment frequently cites regulatory risks, potential technological disruptions, and the inherent volatility of cryptocurrencies as reasons for a less optimistic outlook. Neutral perspectives often emphasize the difficulty of accurate long-term prediction, highlighting the numerous unforeseen events that could drastically alter the trajectory of Bitcoin’s price.

Categorization of Reddit User Sentiments and Reasoning

Reddit users base their price predictions on a variety of factors. Bullish predictions frequently cite technological advancements like the Lightning Network, which promises faster and cheaper transactions, and the increasing institutional adoption of Bitcoin. They also point to macroeconomic factors such as inflation and the potential for Bitcoin to act as a hedge against it. Bearish sentiment often focuses on the regulatory landscape, with concerns about potential government crackdowns and increased regulation impacting Bitcoin’s price negatively. Economic downturns and the emergence of competing cryptocurrencies are also frequently cited as bearish factors. Neutral predictions often highlight the unpredictable nature of the market and the influence of unforeseen events.

Comparison of Price Predictions Across Reddit Threads and Subreddits

The range of price predictions found across various Reddit threads and subreddits is vast. Some users predict prices exceeding one million dollars per Bitcoin, fueled by the belief in its scarcity and growing adoption. Others offer considerably more conservative predictions, often in the tens of thousands of dollars, citing the inherent risks and volatility of the cryptocurrency market. The specific subreddit also plays a role; subreddits dedicated to Bitcoin often exhibit more bullish sentiment compared to more general cryptocurrency or investing subreddits. For example, r/Bitcoin tends to show higher price predictions than r/CryptoCurrency.

Influential Factors Driving the Range of Price Predictions

Several key factors contribute to the wide range of Bitcoin price predictions on Reddit. These include differing views on Bitcoin’s long-term adoption rate, the impact of future technological advancements, and the regulatory environment. The perceived scarcity of Bitcoin and its potential as a hedge against inflation also significantly influence the optimistic projections. Conversely, concerns about market manipulation, security vulnerabilities, and the potential for disruptive technological advancements (e.g., quantum computing) contribute to more pessimistic outlooks. The level of risk tolerance among individual users also plays a crucial role, with more risk-averse users tending toward more conservative predictions.

Summary of Bitcoin Price Predictions from Reddit

| Prediction Range (USD) | Reasoning | Frequency | Subreddit Source |

|---|---|---|---|

| $100,000 – $500,000 | Widespread adoption, technological advancements, inflation hedge | High | r/Bitcoin, r/CryptoCurrency |

| $500,000 – $1,000,000+ | Extreme scarcity, institutional adoption, long-term store of value | Moderate | r/Bitcoin, r/BitcoinBeginners |

| <$100,000 | Regulatory uncertainty, technological disruption, market crashes | Moderate | r/CryptoCurrency, r/Investing |

| Unpredictable/No Prediction | Inherent market volatility, unforeseen events | High | Various |

Factors Influencing Bitcoin’s Price in 2050

Predicting Bitcoin’s price in 2050 is inherently speculative, but analyzing the key factors influencing its trajectory offers valuable insights. Several interconnected elements will shape Bitcoin’s value over the next three decades, ranging from technological advancements to macroeconomic shifts and regulatory landscapes.

Technological Advancements

Technological improvements will significantly impact Bitcoin’s scalability, transaction speed, and overall usability. Layer-2 scaling solutions, such as the Lightning Network, aim to address Bitcoin’s current limitations in transaction throughput. Widespread adoption of these solutions could dramatically increase Bitcoin’s utility for everyday transactions, potentially driving up demand and price. Simultaneously, advancements in privacy-enhancing technologies could attract users concerned about transaction transparency, further boosting adoption. For example, advancements in privacy coins built on top of or alongside Bitcoin could offer a level of anonymity currently lacking, thereby attracting a wider user base. The success of these technological advancements hinges on developer activity, community support, and user adoption.

Global Economic Conditions

Global economic conditions will play a crucial role in Bitcoin’s price. Periods of high inflation could drive investors towards Bitcoin as a hedge against currency devaluation, mirroring the behavior observed in recent years. Conversely, a prolonged global recession might lead to decreased risk appetite, potentially causing a sell-off in Bitcoin and other risky assets. Geopolitical instability, such as wars or major political upheavals, can also influence Bitcoin’s price due to its decentralized nature and perceived safe-haven qualities. The 2022 war in Ukraine, for example, saw some investors turning to Bitcoin as a store of value amidst market volatility.

Government Regulations

Government regulations will significantly impact Bitcoin’s adoption and price. Favorable regulatory frameworks that clarify legal status and promote innovation could lead to increased institutional investment and mainstream adoption. Conversely, overly restrictive or unclear regulations could stifle growth and hinder price appreciation. The regulatory landscape varies considerably across different jurisdictions, creating uncertainty and potentially influencing investor behavior. The evolving regulatory environment in countries like El Salvador, which adopted Bitcoin as legal tender, provides a case study of both the potential benefits and challenges of government involvement.

Institutional Adoption and Large-Scale Investment

The level of institutional adoption and large-scale investment will be a critical determinant of Bitcoin’s price. Increased participation from major financial institutions, corporations, and sovereign wealth funds could inject substantial liquidity into the market, driving up demand and potentially pushing prices higher. Conversely, a lack of institutional confidence or significant sell-offs by large holders could exert downward pressure on the price. The increasing involvement of institutional investors in recent years suggests a growing acceptance of Bitcoin as an asset class, but this trend’s long-term trajectory remains uncertain.

Visual Representation of Influencing Factors

Imagine a four-quadrant chart. Each quadrant represents one of the four major factors discussed above: Technological Advancements, Global Economic Conditions, Government Regulations, and Institutional Adoption. The size of each quadrant reflects the relative influence of that factor on Bitcoin’s price in 2050. Arrows connecting the quadrants illustrate the interdependencies between these factors. For example, a large “Technological Advancements” quadrant could have a strong positive arrow pointing to a large “Institutional Adoption” quadrant, indicating that advancements can spur institutional interest. Similarly, a large “Global Economic Conditions” (e.g., high inflation) quadrant might have a positive arrow pointing to Bitcoin’s price, while a negative “Government Regulations” quadrant (e.g., highly restrictive laws) would have a negative arrow pointing to the price. The overall size and positioning of the price indicator (represented as a separate element in the center) would reflect the combined effect of all these factors, offering a visual summary of the predicted price trajectory.

Reddit User Demographics and Bitcoin Price Opinions: Bitcoin Price 2050 Reddit

Analyzing Reddit discussions surrounding Bitcoin’s future price reveals a diverse user base with varying predictions shaped by their individual backgrounds and experiences. Understanding these demographic influences and potential biases is crucial for interpreting the information found on such platforms. The self-selecting nature of Reddit’s community necessitates a critical approach to the data gathered.

Reddit User Demographics

Determining the precise demographics of Reddit users discussing Bitcoin is challenging due to the platform’s anonymous nature. However, anecdotal evidence and observations from various Bitcoin-focused subreddits suggest a predominantly male audience, with a significant portion falling within the 25-45 age range. Many participants appear to possess some level of investment experience, ranging from novice to seasoned traders, with a considerable number actively involved in cryptocurrency trading or holding. Geographic location is similarly difficult to pinpoint precisely, but a strong representation from North America, Europe, and East Asia is evident. The lack of verifiable data on user demographics presents a limitation in analyzing the correlation between demographics and price predictions.

Comparison of Price Predictions Across Demographics

While precise demographic segmentation is impossible without direct user data, general trends emerge from observing discussions. Younger users (under 30) often exhibit more bullish predictions, sometimes projecting exceptionally high prices based on speculative technological advancements and adoption rates. Older users (over 45) tend to offer more conservative predictions, often anchoring their estimations to more established economic models and historical market trends. Users with significant investment experience tend to present a more nuanced range of predictions, acknowledging both the potential for substantial growth and the inherent risks associated with cryptocurrency investments. For example, experienced traders might cite historical price volatility as a reason for caution, while newer investors might focus on the potential for mass adoption.

Correlations Between Demographics and Price Predictions

A clear correlation exists between perceived risk tolerance and price predictions. Younger users, often with less financial experience and a higher risk tolerance, tend to predict significantly higher Bitcoin prices in 2050 compared to older, more experienced users. This aligns with established behavioral finance principles suggesting that younger investors, due to their longer time horizon, are more willing to accept higher levels of risk in pursuit of potentially higher returns. Conversely, older users, often with more established financial portfolios and lower risk tolerance, frequently offer more conservative predictions, reflecting their desire for capital preservation. The observed correlation is not absolute, however, as individual circumstances and investment strategies will always play a significant role.

Potential Biases in Reddit Discussions

The self-selection bias inherent in Reddit’s user base is a major factor affecting the reliability of price predictions. Users actively participating in Bitcoin discussions are inherently more interested in the cryptocurrency than the average person. This leads to an overrepresentation of bullish opinions, as individuals holding negative views might be less inclined to engage in online forums dedicated to Bitcoin. Furthermore, confirmation bias is likely at play, with users tending to seek out and interpret information that confirms their pre-existing beliefs about Bitcoin’s future price. This can lead to echo chambers where extreme viewpoints are amplified and less nuanced perspectives are marginalized.

Key Differences in Price Predictions Based on Demographic Segments

- Younger Users (Under 30): Tend towards significantly higher price predictions, often based on optimistic technological advancements and widespread adoption scenarios. Examples might include predictions exceeding $1 million per Bitcoin.

- Older Users (Over 45): Generally offer more conservative price predictions, grounded in established economic principles and historical market analysis. Predictions may range from a few hundred thousand dollars to a million, but rarely exceed it.

- Experienced Investors: Present a broader range of predictions, acknowledging both the potential for substantial growth and the risks associated with Bitcoin’s volatility. Their predictions might span a wider spectrum, reflecting a more nuanced understanding of market dynamics.

Comparing Reddit Predictions with Other Forecasts

Reddit’s vibrant Bitcoin discussion forums offer a unique perspective on price predictions, contrasting sharply with the more formal analyses produced by professional analysts and financial institutions. Comparing these diverse viewpoints reveals valuable insights into the range of expectations and the methodologies employed in forecasting this volatile asset. Understanding these differences is crucial for navigating the complex landscape of Bitcoin price speculation.

Predicting Bitcoin’s price is inherently challenging due to its decentralized nature and susceptibility to various factors, from regulatory changes to technological advancements. Consequently, the methodologies used by different forecasters vary significantly, leading to a wide spectrum of predictions. While some rely on sophisticated econometric models, others employ simpler methods, such as trend analysis or sentiment indicators. This divergence in approach contributes significantly to the disparity in projected prices.

Methodological Differences in Bitcoin Price Forecasting

Professional analysts often utilize quantitative models, incorporating macroeconomic indicators, technical analysis, and network data (like transaction volume and hash rate) to generate forecasts. These models aim to identify correlations between Bitcoin’s price and other variables, allowing for projections based on statistical relationships. Financial institutions, on the other hand, may also consider broader market trends, regulatory environments, and the adoption rate of cryptocurrencies in their predictions. In contrast, Reddit users often base their predictions on a mix of technical analysis, speculation based on news events, and community sentiment. While some Reddit users may engage in rigorous analysis, many rely on intuition and informal assessments. The strengths of professional models lie in their rigorous data-driven approach, while their weakness lies in the potential for over-reliance on historical correlations that may not hold in the future. Conversely, Reddit’s informal predictions can reflect a wider range of perspectives and potentially capture emergent trends missed by more formal models, but lack the rigorous statistical backing.

Comparative Analysis of Bitcoin Price Predictions, Bitcoin Price 2050 Reddit

The reliability and credibility of different sources hinge on their data sources and prediction accuracy. Professional analysts generally use robust datasets from reputable sources, and while their historical accuracy is not perfect, it tends to be more reliable than less structured predictions. Reddit predictions, while offering diverse viewpoints, lack a standardized methodology and consistent data sources, leading to varying levels of reliability.

| Source | 2050 Price Prediction (USD) | Methodology | Strengths | Weaknesses |

|---|---|---|---|---|

| Reddit (Average User Prediction) | $500,000 – $1,000,000 (wide range) | Technical analysis, speculation, sentiment analysis | Captures diverse perspectives and potential emergent trends | Lack of standardized methodology, inconsistent data sources, wide range of predictions |

| Professional Analysts (Example: JP Morgan) | $150,000 (example) | Econometric models, macroeconomic indicators, technical analysis | Rigorous data-driven approach, potentially higher accuracy | Potential for over-reliance on historical correlations, limited scope of factors considered |

| Financial Institutions (Example: Goldman Sachs) | $400,000 (example) | Market trend analysis, regulatory considerations, adoption rate | Considers broad market trends and regulatory impacts | May underestimate the impact of technological disruptions |

| Other Forecasting Models (Example: Algorithmic Prediction Models) | Variable, depending on the model and inputs | Machine learning, statistical modeling, network data | Potential for high accuracy given sufficient data and appropriate model selection | Requires substantial computational resources, susceptible to biases in training data |

Note: The price predictions provided in the table are illustrative examples and do not represent actual predictions from these institutions. Actual predictions vary widely depending on the specific analyst, model, and timeframe.

Frequently Asked Questions (FAQ) about Bitcoin Price in 2050 from Reddit Discussions

Reddit discussions offer a diverse range of opinions on Bitcoin’s future price, reflecting the inherent volatility and speculative nature of the cryptocurrency market. Analyzing these discussions provides insights into public sentiment and expectations, although it’s crucial to remember that these are not professional financial forecasts.

Common Bitcoin Price Predictions for 2050 on Reddit

Reddit discussions reveal a wide spectrum of Bitcoin price predictions for 2050. While some users express extremely bullish sentiments, predicting prices in the millions of dollars per Bitcoin, others offer more conservative estimates, ranging from tens of thousands to hundreds of thousands of dollars. The lack of consensus highlights the significant uncertainty surrounding long-term price movements. For example, some Reddit threads feature users citing predictions based on adoption rates, comparing Bitcoin’s potential market cap to that of gold, while others focus on technological advancements and regulatory changes. A common thread is the impact of inflation and the potential for Bitcoin to serve as a hedge against it.

Factors Driving the Range of Bitcoin Price Predictions on Reddit

Several factors contribute to the wide range of Bitcoin price predictions found on Reddit. These include differing assumptions about Bitcoin adoption rates, the impact of technological advancements (such as the Lightning Network improving transaction speeds), regulatory developments (both positive and negative), macroeconomic conditions (inflation, economic recessions), and the overall level of investor sentiment. For instance, some users base their predictions on the belief that Bitcoin will become a dominant global currency, while others highlight the potential for competing cryptocurrencies to erode Bitcoin’s market share. Discussions often reference historical price movements and compare Bitcoin’s growth trajectory to that of other assets.

Reliability of Bitcoin Price Predictions from Reddit

Reddit-based Bitcoin price predictions should be treated with considerable caution. The platform is susceptible to biases, including confirmation bias (users selectively seeking out information confirming their existing beliefs), herd mentality (following the opinions of others without critical analysis), and the influence of misinformation or manipulation. Many Reddit users lack the financial expertise to make accurate long-term price forecasts. Furthermore, the anonymity afforded by the platform can lead to less accountability and the spread of unsubstantiated claims. Therefore, relying solely on Reddit for investment decisions is highly risky.

Comparison of Reddit Predictions with Professional Analyst Forecasts

While professional analysts also offer a range of Bitcoin price predictions, their forecasts generally tend to be more conservative and grounded in quantitative models and fundamental analysis than those found on Reddit. Professional predictions often incorporate factors such as market capitalization, transaction volume, and network effects. While there might be some overlap in the general direction of price movement (e.g., both groups might predict upward movement), the magnitude of the price changes frequently differs significantly. Professional analysts typically provide detailed justifications for their predictions, which are often absent in Reddit discussions.

Risks and Opportunities Associated with Investing in Bitcoin Based on Reddit Discussions

Investing in Bitcoin based solely on Reddit discussions carries significant risks. The cryptocurrency market is notoriously volatile, and prices can fluctuate dramatically in short periods. Regulatory uncertainty also poses a considerable risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. However, Reddit discussions also highlight the potential long-term growth opportunities associated with Bitcoin. Many users believe Bitcoin’s decentralized nature, limited supply, and potential as a store of value make it an attractive long-term investment. The perceived hedge against inflation is another key factor driving bullish sentiment. Ultimately, the decision to invest in Bitcoin should be based on thorough research, risk tolerance, and independent financial advice, rather than solely on Reddit discussions.

Bitcoin Price 2050 Reddit – Discussions on Bitcoin Price 2050 on Reddit often involve wildly speculative figures. However, to ground these predictions, it’s helpful to consider more near-term forecasts; for example, you might find a useful perspective by checking out this analysis on Bitcoin Price Prediction 2025 Usd Forbes. Understanding shorter-term trends can inform, though not definitively predict, the long-term trajectory of Bitcoin’s price as discussed on Reddit regarding 2050.

Speculation on Bitcoin’s price in 2050 is rampant on Reddit, with wildly varying predictions. However, to even begin forming such long-term forecasts, it’s crucial to understand shorter-term trends. A good starting point might be analyzing current predictions, such as those found in this article about the Bitcoin Price June 2025 , to better gauge potential future trajectories and inform our understanding of the Bitcoin Price 2050 Reddit discussions.

Discussions on Bitcoin Price 2050 Reddit often involve wildly speculative predictions. However, to even begin to approach such long-term forecasting, it’s helpful to consider more immediate projections. For example, understanding the potential price movement in the near future, as outlined in this analysis of the Bitcoin Price November 2025 , provides a crucial data point. Extrapolating from shorter-term trends can offer a more grounded perspective when considering the long-term Bitcoin Price 2050 Reddit debates.

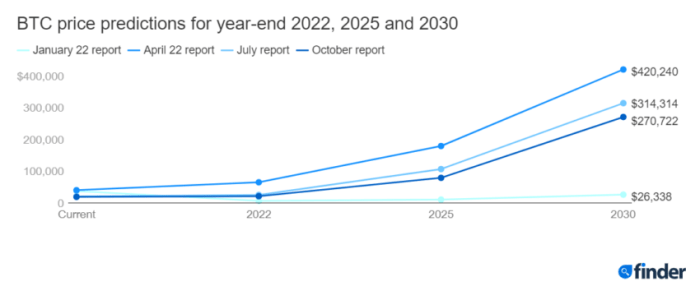

Discussions regarding Bitcoin’s price in 2050 are prevalent on Reddit, often fueled by speculation and varying levels of optimism. To understand potential trajectories, examining shorter-term predictions provides valuable context. For instance, a helpful resource for gauging intermediate-term trends is this Bitcoin Price Prediction 2025 Chart: Bitcoin Price Prediction 2025 Chart. Analyzing such charts can offer insights that inform, albeit indirectly, the longer-term conversations about Bitcoin’s price in 2050 found on Reddit.

Speculation on Bitcoin Price 2050 is rampant on Reddit, with various predictions ranging from wildly optimistic to cautiously pessimistic. Understanding the impact of future events is key, and a significant factor to consider is the effect of the next halving. To gain insight into this, check out this analysis on Bitcoin Halving Price 2025 , as its impact will undoubtedly ripple into the later years.

Ultimately, predicting the Bitcoin Price 2050 remains a challenging, yet fascinating exercise.