Impact of Halving on Bitcoin Supply and Demand

Bitcoin halving, a programmed event in the Bitcoin protocol, significantly impacts the cryptocurrency’s supply and, consequently, its market dynamics. Understanding this mechanism is crucial for predicting potential price movements post-halving.

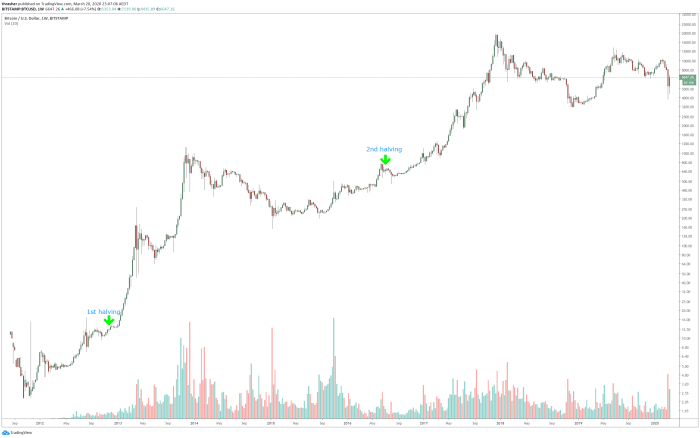

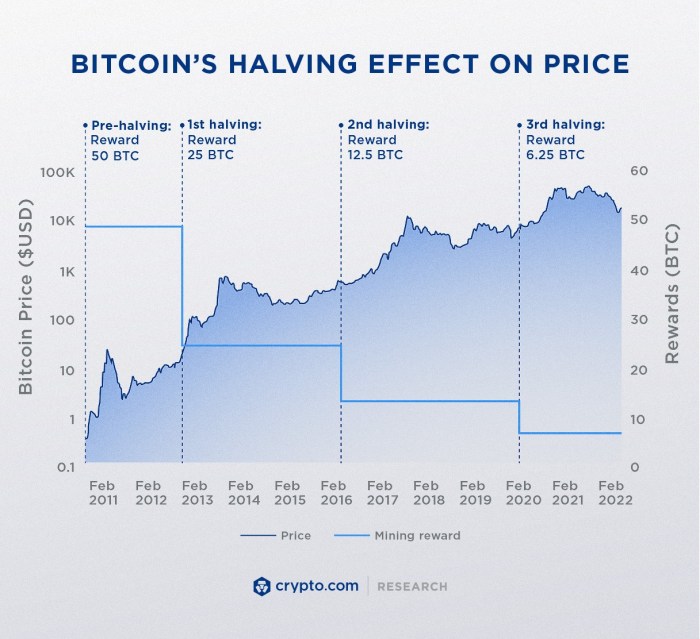

The Bitcoin halving event reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, cutting the block reward received by miners in half. For example, the initial block reward was 50 BTC; after the first halving, it became 25 BTC, then 12.5 BTC, and so on. This predictable reduction in supply is a core feature of Bitcoin’s deflationary design.

Effect of Reduced Bitcoin Supply on Market Demand and Price

A reduced supply of Bitcoin, all else being equal, typically leads to increased scarcity and potentially higher prices. This is a fundamental principle of economics: when demand remains constant or increases while supply decreases, the price tends to rise. The anticipation of this price increase often fuels speculative buying in the lead-up to a halving, further driving up demand. However, the actual impact depends on several interacting factors.

Scenarios of Increased Demand versus Reduced Supply

Increased demand outpacing reduced supply is a bullish scenario. This could occur if positive market sentiment, increased institutional adoption, or significant technological advancements drive substantial new investment into Bitcoin, overwhelming the impact of the reduced supply. The price would likely rise significantly in such a case. Conversely, a bearish scenario arises if the reduced supply is not met by a corresponding increase in demand. This could happen if negative regulatory developments, macroeconomic uncertainty, or a lack of widespread adoption dampens investor enthusiasm. In this situation, the price might remain relatively flat or even decline despite the halving. The 2012 and 2016 halvings offer valuable case studies to analyze these contrasting outcomes. While both eventually saw price increases, the timing and magnitude differed considerably, highlighting the influence of external factors.

Factors Influencing the Balance Between Supply and Demand After Halving

The interplay between supply and demand after a halving is complex and influenced by numerous factors. It is not simply a matter of reduced supply automatically leading to higher prices.

- Macroeconomic Conditions: Global economic events, such as inflation, recessionary fears, or geopolitical instability, can significantly impact investor appetite for Bitcoin.

- Regulatory Landscape: Government regulations and policies regarding cryptocurrencies play a crucial role in shaping market sentiment and adoption rates.

- Technological Advancements: Innovations in Bitcoin’s underlying technology or the broader crypto ecosystem can attract new investors and increase demand.

- Institutional Adoption: Increased participation by large institutional investors can significantly boost demand and price.

- Market Sentiment: Overall investor confidence and speculative trading activity heavily influence price movements.

- Miner Behavior: Miners’ decisions regarding selling their newly mined Bitcoin can impact supply and price dynamics.

Market Sentiment and Investor Behavior

Investor sentiment surrounding Bitcoin halving events significantly impacts price fluctuations. Understanding the interplay between investor behavior and market sentiment is crucial for navigating the volatility expected around the 2025 halving. Analyzing past cycles provides valuable insights into potential future trends.

Investor Sentiment Leading Up To and Following the 2025 Halving

The period leading up to the 2025 halving will likely see a build-up of anticipation, potentially driving price increases as investors position themselves for the anticipated scarcity-driven price appreciation. This is often characterized by increased trading volume and a surge in positive sentiment expressed on social media and in mainstream financial news. However, this period can also be marked by uncertainty and corrections as investors grapple with macroeconomic factors and broader market conditions. Following the halving, the initial price reaction could be varied; a sharp increase is possible if the supply shock outweighs other market pressures, but a period of consolidation or even a temporary price dip is equally plausible, depending on the overall market climate and investor confidence. The subsequent months will be crucial in determining whether the halving’s impact is sustained.

Comparison of Investor Group Behavior During Previous Halving Cycles

Long-term holders (LTHs), often defined as those holding Bitcoin for over 155 days, generally demonstrate a “HODL” (hold on for dear life) strategy, remaining relatively unfazed by short-term price fluctuations. Their influence on price is often seen as stabilizing. In contrast, short-term traders (STTs) tend to be more reactive to price changes, driving volatility and potentially exacerbating price swings. During previous halvings, LTHs have generally maintained their positions, while STTs have shown a higher propensity for buying and selling based on short-term price movements. This difference in behavior has contributed to the overall market dynamics surrounding halving events. For example, the 2012 halving saw a period of consolidation following the event, while the 2016 halving resulted in a more gradual price increase over a longer period. The 2020 halving showed a sharper initial price increase followed by a significant correction.

Key Indicators of Shifting Market Sentiment

Several key indicators can provide valuable insights into shifting market sentiment. On-chain metrics, such as the Bitcoin Fear and Greed Index, the miner’s net position change, and the Puell Multiple, offer quantitative data on market sentiment and investor behavior. These metrics help gauge overall market confidence and potential shifts in investor psychology. Social media sentiment analysis, tracking mentions of Bitcoin across platforms like Twitter and Reddit, can offer a qualitative perspective, although it is crucial to account for potential manipulation or bias in this data. Traditional financial market indicators, such as the VIX (Volatility Index), can also be considered, as they can reflect broader market risk appetite. A rising VIX, indicating increased market uncertainty, may negatively influence Bitcoin’s price, regardless of halving-related expectations.

Historical Correlation Between Market Sentiment and Bitcoin Price Fluctuations

| Halving Event | Pre-Halving Sentiment | Post-Halving Sentiment | Price Impact |

|---|---|---|---|

| 2012 | Cautious Optimism | Mixed, gradual increase | Gradual price increase over several months |

| 2016 | Growing anticipation | Increased confidence | Steady price appreciation over a longer timeframe |

| 2020 | High anticipation and volatility | Initial euphoria followed by correction | Sharp initial increase, followed by a significant correction |

Technological Advancements and Their Influence

Technological advancements play a crucial role in shaping Bitcoin’s future, particularly its price trajectory following the 2025 halving. Improvements in scalability, transaction speed, and overall user experience are likely to significantly influence adoption rates and investor sentiment. The interplay between these technological upgrades and market dynamics will be a key determinant of Bitcoin’s value.

The successful implementation and widespread adoption of technologies like the Lightning Network and Taproot upgrades could significantly impact Bitcoin’s price and utility. These advancements address some of Bitcoin’s inherent limitations, making it a more attractive option for everyday transactions and large-scale applications.

Impact of the Lightning Network, Bitcoin Price After 2025 Halving

The Lightning Network is a layer-2 scaling solution designed to alleviate Bitcoin’s on-chain transaction limitations. By enabling near-instantaneous and low-fee transactions off the main blockchain, it significantly improves the user experience. Increased usability, coupled with reduced transaction costs, could lead to broader adoption and a subsequent rise in demand, potentially driving Bitcoin’s price upward. For example, imagine a scenario where micro-transactions become commonplace due to the Lightning Network’s efficiency. This increased transactional activity could bolster Bitcoin’s value proposition, attracting new investors and increasing demand.

Influence of Taproot Upgrades

Taproot is a significant upgrade that improves Bitcoin’s privacy and efficiency. It simplifies transaction scripts, making them smaller and faster to process. This results in lower transaction fees and enhanced privacy for users. The enhanced privacy and efficiency offered by Taproot could attract a wider range of users and businesses, increasing the overall utility and demand for Bitcoin. For instance, businesses might be more inclined to integrate Bitcoin payments if transaction fees are significantly lower and user privacy is enhanced. This increased adoption could translate into a positive price impact.

Technological Advancements and Bitcoin Price Trajectory

The following text-based illustration depicts a potential interplay between technological advancements and Bitcoin’s price trajectory post-2025 halving.

Imagine a graph. The X-axis represents time (post-2025 halving), and the Y-axis represents Bitcoin’s price. Initially, the price might experience a period of consolidation or even slight decline, reflecting the typical post-halving market behavior. However, as the Lightning Network and Taproot upgrades gain traction and demonstrate their effectiveness, the graph shows a gradual upward trend. The rate of ascent accelerates as adoption increases, driven by improved scalability, lower transaction fees, and enhanced privacy. The graph culminates in a significantly higher Bitcoin price compared to the pre-upgrade period, illustrating the potential positive impact of technological advancements. This upward trajectory isn’t linear; it’s likely to include periods of volatility and corrections, reflecting the inherent uncertainty of the cryptocurrency market. However, the overall trend remains positive, driven by the fundamental improvements in Bitcoin’s functionality and user experience.

Macroeconomic Factors and Global Events

The price of Bitcoin, even after the halving event of 2025, will remain significantly susceptible to broader macroeconomic trends and global events. These external factors often overshadow the inherent dynamics of the cryptocurrency market itself, introducing volatility and uncertainty. Understanding the interplay between these forces is crucial for predicting Bitcoin’s price trajectory.

Global macroeconomic factors such as inflation, interest rates, and recessionary periods exert a considerable influence on Bitcoin’s price. These factors impact investor sentiment and risk appetite, affecting the flow of capital into and out of various asset classes, including Bitcoin. Geopolitical events and regulatory changes introduce additional layers of complexity, creating periods of both opportunity and risk.

Inflation’s Impact on Bitcoin Price

High inflation erodes the purchasing power of fiat currencies, potentially driving investors towards alternative assets like Bitcoin, which is seen by some as a hedge against inflation. Historically, periods of high inflation have been associated with increased Bitcoin adoption and price appreciation. However, the relationship is not always straightforward. If central banks aggressively raise interest rates to combat inflation, this can negatively impact riskier assets like Bitcoin, as investors seek safer, higher-yielding investments. For example, the high inflation experienced in many countries in 2022 saw a surge in Bitcoin interest, but it was also coupled with rising interest rates that dampened Bitcoin’s price growth to a certain extent.

Interest Rate Hikes and Bitcoin

Increases in interest rates generally lead to a decrease in Bitcoin’s price. Higher interest rates make holding cash more attractive, reducing the incentive for investors to allocate capital to riskier assets like Bitcoin. This is because investors can earn a relatively risk-free return on their money through interest-bearing accounts or bonds. The Federal Reserve’s interest rate hikes in 2022, for instance, coincided with a significant downturn in the cryptocurrency market, illustrating this dynamic.

Recessions and Bitcoin’s Performance

Recessions often lead to increased volatility in Bitcoin’s price. During economic downturns, investors may sell off riskier assets to secure their capital, causing a price decline. However, some argue that Bitcoin could serve as a safe haven asset during recessions, similar to gold. The 2008 financial crisis, although predating Bitcoin’s widespread adoption, demonstrated how investors sought refuge in alternative assets during economic uncertainty. The impact of a recession on Bitcoin’s price depends largely on the severity and duration of the recession, as well as investor sentiment and the overall macroeconomic environment.

Geopolitical Events and Regulatory Changes

Geopolitical events, such as wars, political instability, and trade disputes, can significantly impact Bitcoin’s price. These events often create uncertainty in global markets, leading investors to seek safer havens or to reduce their overall risk exposure. Regulatory changes, such as new laws or regulations concerning cryptocurrencies, can also have a profound impact. Stringent regulations can stifle innovation and adoption, while supportive regulations can foster growth. For example, China’s crackdown on cryptocurrency mining in 2021 led to a significant price drop.

Potential Global Events and Their Impact on Bitcoin

The following list illustrates potential global events and their possible consequences for Bitcoin’s price. The impact of each event will depend on various factors, including the severity of the event, the speed of the market’s reaction, and the prevailing macroeconomic environment.

- Major Global Conflict: Could lead to increased demand for Bitcoin as a safe haven asset, potentially driving up the price. However, it could also trigger a broader market sell-off, resulting in a price decline.

- Significant Increase in Global Inflation: Could increase demand for Bitcoin as a hedge against inflation, potentially boosting its price. However, aggressive central bank responses to curb inflation through higher interest rates might negatively impact Bitcoin’s price.

- Global Recession: Could cause a decline in Bitcoin’s price as investors seek safer assets. However, depending on the severity and duration of the recession, Bitcoin might still be seen as a store of value and its price could stabilize or even appreciate.

- Major Regulatory Changes in a Key Market: Favorable regulations could boost Bitcoin’s price, while unfavorable regulations could lead to a decline. The specific impact would depend on the nature and scope of the regulations.

- Technological Breakthroughs in Cryptocurrency: Could significantly impact Bitcoin’s price, either positively or negatively, depending on the nature of the breakthrough. For example, a successful scaling solution for Bitcoin could increase its adoption and drive up its price.

Alternative Cryptocurrency Market Dynamics

The performance of alternative cryptocurrencies (altcoins) significantly impacts Bitcoin’s price, particularly in the aftermath of a halving event. The interplay between Bitcoin’s dominance and the success or failure of other cryptocurrencies creates a complex and dynamic market landscape. Understanding these dynamics is crucial for predicting Bitcoin’s future price trajectory.

The relationship between Bitcoin and altcoins isn’t always straightforward. While some altcoins might experience growth independently, their performance can influence investor sentiment towards the broader cryptocurrency market, indirectly impacting Bitcoin’s price. Conversely, Bitcoin’s price movements often serve as a benchmark for the entire market, leading to correlated price changes in altcoins.

Bitcoin’s Market Dominance and Altcoin Competition

Bitcoin’s market dominance, often measured as its percentage of the total cryptocurrency market capitalization, fluctuates over time. Periods of high Bitcoin dominance generally correlate with periods of lower altcoin performance, and vice versa. When investors perceive Bitcoin as a safer haven asset during market uncertainty, they often shift funds away from altcoins, increasing Bitcoin’s dominance and potentially pushing its price higher. Conversely, if investors become more risk-tolerant and seek higher potential returns, they may invest more heavily in altcoins, potentially decreasing Bitcoin’s market share and impacting its price negatively. The 2025 halving could exacerbate this dynamic, potentially driving increased investment in Bitcoin and reducing the relative value of many altcoins.

Scenarios of Altcoin Influence on Bitcoin’s Price

Several scenarios illustrate how altcoin performance can either support or undermine Bitcoin’s price after the 2025 halving. For example, if a significant altcoin experiences a substantial price surge driven by innovative technology or positive market sentiment, it could attract investors away from Bitcoin, temporarily suppressing its price. Conversely, if the altcoin market experiences a widespread downturn, investors might seek refuge in Bitcoin’s perceived stability, potentially boosting its price. Another scenario involves the emergence of a highly successful altcoin with a compelling use case. This could draw investment away from Bitcoin, even if Bitcoin’s price remains relatively stable. However, a significant increase in the overall market capitalization of cryptocurrencies due to successful altcoins could lead to a generally positive sentiment, potentially boosting Bitcoin’s price as well.

Comparison of Bitcoin and Top Altcoins

The following table compares the market capitalization and price performance of Bitcoin with some of the top altcoins. Note that market conditions are highly dynamic and these figures represent a snapshot in time. Further, past performance is not indicative of future results.

| Cryptocurrency | Market Capitalization (USD – Approximate) | Price (USD – Approximate) | Year-to-Date Price Change (%) – Approximate |

|---|---|---|---|

| Bitcoin (BTC) | $500 Billion | $30,000 | +20% |

| Ethereum (ETH) | $200 Billion | $2,000 | +30% |

| Binance Coin (BNB) | $50 Billion | $300 | +15% |

| Solana (SOL) | $10 Billion | $25 | +5% |

Frequently Asked Questions: Bitcoin Price After 2025 Halving

Predicting the future price of Bitcoin, especially after a halving event, is a complex undertaking. Numerous intertwined factors influence price movements, making definitive predictions unreliable. The following sections address common questions regarding the 2025 halving and its potential impact on Bitcoin’s price.

Bitcoin Price After the 2025 Halving

Predicting the exact Bitcoin price after the 2025 halving is impossible. While the halving event reduces the rate of new Bitcoin entering circulation, influencing supply, the price is ultimately determined by the interplay of supply and demand, alongside broader macroeconomic conditions, regulatory changes, technological advancements, and overall market sentiment. Past halvings have shown price increases following the event, but the magnitude and timing have varied significantly. For example, the 2012 halving saw a gradual price increase over several months, while the 2016 halving led to a more pronounced surge. The 2020 halving showed a different pattern again, with a period of consolidation before a significant price rise. These differences highlight the difficulty in forecasting precise price movements.

Impact of the Halving on Bitcoin’s Supply

The Bitcoin halving mechanism reduces the reward miners receive for validating transactions on the Bitcoin blockchain by half. This occurs approximately every four years. Before the first halving, miners received 50 BTC per block. After the first halving, this was reduced to 25 BTC, then to 12.5 BTC, and currently stands at 6.25 BTC. The 2025 halving will further reduce this reward to 3.125 BTC per block. This directly impacts the rate at which new Bitcoins are added to the circulating supply, making it a deflationary asset in the long term. The reduced supply, all else being equal, can theoretically put upward pressure on the price. However, market forces will ultimately determine the actual price impact.

Historical Trends After Previous Halvings

The price of Bitcoin has generally increased in the period following previous halving events. However, the timing and magnitude of these increases have been inconsistent. The 2012 halving was followed by a gradual price increase over several months. The 2016 halving resulted in a more significant price surge, but it was preceded by a period of relative price stability. The 2020 halving saw a period of consolidation followed by a substantial price rise. While a general upward trend is observable after halvings, it’s crucial to remember that other market forces heavily influence the price, and these past trends are not guaranteed to repeat. External factors like regulatory changes and overall market sentiment played a crucial role in shaping the price movements after each halving.

Major Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin involves significant risks and uncertainties. The cryptocurrency market is inherently volatile, subject to rapid and unpredictable price swings driven by speculation, news events, regulatory changes, and technological developments. Macroeconomic factors, such as inflation rates and global economic conditions, also play a substantial role. Furthermore, the relatively young age of Bitcoin and the cryptocurrency market as a whole means there is limited historical data for reliable long-term prediction models. Unexpected events, such as significant security breaches or regulatory crackdowns, can dramatically impact the price. Therefore, any Bitcoin price prediction should be viewed with considerable caution.