Long-Term Implications of the 2025 Halving: Bitcoin Price After Halving 2025

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially profound long-term implications for Bitcoin’s market capitalization, the broader cryptocurrency market, and its status as a store of value. While predicting the future is inherently uncertain, analyzing historical trends and economic principles allows us to explore potential scenarios.

The reduced supply of newly minted Bitcoin following the halving is expected to exert upward pressure on price, assuming demand remains relatively constant or increases. This is based on the fundamental principle of supply and demand; a decrease in supply, coupled with consistent or growing demand, typically leads to price appreciation. However, external factors like macroeconomic conditions and regulatory changes can significantly influence the outcome.

Bitcoin’s Market Capitalization

The halving’s effect on Bitcoin’s market capitalization is complex. While a price increase is anticipated, the actual magnitude depends on various factors. A substantial price increase following the halving could significantly boost Bitcoin’s market cap, potentially pushing it into a higher valuation range compared to other asset classes. Conversely, a muted price response or a negative macroeconomic environment could limit the impact on market capitalization. Historical precedent shows that previous halvings have been followed by periods of significant price appreciation, but the timeframe and extent of these increases varied. For example, the 2012 halving was followed by a gradual price increase, while the 2016 halving preceded a much more dramatic price surge. The 2025 halving’s impact will depend on the confluence of factors affecting both supply and demand.

Impact on the Overall Cryptocurrency Market

Bitcoin’s price movements often influence the broader cryptocurrency market. A significant price increase in Bitcoin post-halving could trigger a positive ripple effect, boosting the prices of other cryptocurrencies. This is because many altcoins often move in correlation with Bitcoin, particularly during periods of strong market sentiment. However, it’s crucial to note that this correlation isn’t always perfect and other factors specific to individual altcoins play a significant role. A bearish market or negative news surrounding a specific altcoin could offset the positive influence of Bitcoin’s price appreciation. Conversely, a disappointing price performance from Bitcoin could negatively impact the entire crypto market.

Bitcoin’s Position as a Store of Value

The 2025 halving could reinforce Bitcoin’s position as a store of value. The predictable reduction in supply, coupled with its decentralized and deflationary nature, makes it an attractive asset for investors seeking to hedge against inflation or protect their wealth. However, its volatility and susceptibility to market manipulation remain significant concerns. For Bitcoin to truly solidify its position as a store of value, it needs to demonstrate consistent price stability and greater resilience against external shocks. This would require increased adoption by institutional investors and a reduction in volatility, factors that are not guaranteed. The success of Bitcoin as a store of value will depend on its ability to overcome these challenges.

Bitcoin’s Long-Term Prospects Compared to Other Investment Assets

Comparing Bitcoin’s long-term prospects to other investment assets, such as gold, real estate, or equities, requires a nuanced approach. Bitcoin’s potential for high returns is undeniable, but it also carries significantly higher risk. Gold, traditionally viewed as a safe haven asset, offers relative stability but lower potential returns. Real estate provides diversification and potential rental income, but is less liquid than Bitcoin. Equities offer diversification and growth potential but are subject to market fluctuations. The choice between these assets depends on an investor’s risk tolerance, investment horizon, and financial goals. Bitcoin’s long-term success will depend on its ability to consistently deliver returns that are competitive with, or exceed, other asset classes while managing its inherent volatility.

Timeline of Key Events and Anticipated Effects, Bitcoin Price After Halving 2025

The following timeline Artikels key events leading up to and following the 2025 halving, and their anticipated effects on Bitcoin’s price. It is crucial to understand that these are predictions based on current trends and historical data; actual outcomes may differ significantly.

- Pre-Halving (2023-2024): Increasing anticipation builds, potentially leading to price speculation and volatility. This period might see a gradual price increase as investors position themselves for the halving event.

- Halving Event (2025): The block reward is halved. Immediately following the halving, the price may experience short-term volatility, either upward or downward, depending on market sentiment and other external factors.

- Post-Halving (2025-2027): A gradual price increase is anticipated, driven by the reduced supply of newly minted Bitcoin. However, the pace and extent of this increase will depend on market demand and external factors like macroeconomic conditions and regulatory developments. This period might witness periods of consolidation and correction.

- Long-Term (2027 onwards): Bitcoin’s price is expected to continue its long-term trend, influenced by factors like adoption, technological advancements, and regulatory changes. The impact of the halving will gradually diminish over time as other factors become more influential.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin halvings, their historical impact, and the potential implications of the 2025 halving. Understanding these factors is crucial for anyone considering investing in Bitcoin. We’ll explore the mechanics of halving, analyze past price movements, assess potential risks and rewards, and guide you to reliable information sources.

Bitcoin Halving

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism cuts the block reward in half, thus decreasing the inflation rate of Bitcoin. For example, the initial block reward was 50 BTC. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2024 will reduce it to 6.25 BTC. This controlled reduction in supply is designed to maintain Bitcoin’s scarcity and potentially influence its value over time.

Past Halvings and Bitcoin’s Price

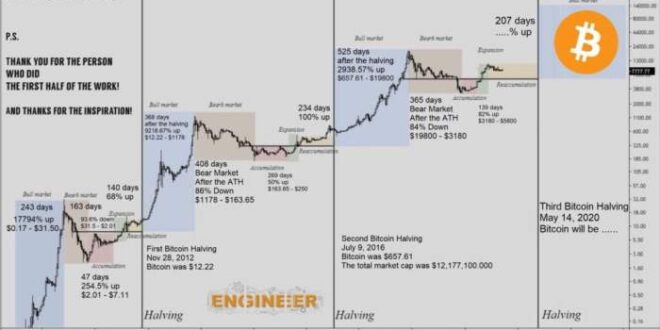

Analyzing past halvings provides valuable insights into potential future price movements, although it’s crucial to remember that past performance is not indicative of future results. The first halving in 2012 saw a relatively modest price increase in the following months. The second halving in 2016 was followed by a significant price surge that began several months later, culminating in the bull market of late 2017. The third halving in 2020 was followed by a period of consolidation before a significant price increase in 2021. Each halving event saw a different market response, influenced by a variety of factors beyond the halving itself, including regulatory changes, technological advancements, and overall market sentiment.

Risks Associated with Investing in Bitcoin After the 2025 Halving

Investing in Bitcoin, particularly after a halving, involves significant risks. Volatility is inherent to the cryptocurrency market; Bitcoin’s price can experience sharp and unpredictable swings. Regulatory uncertainty in various jurisdictions poses a potential threat, impacting market accessibility and liquidity. Furthermore, technological advancements and the emergence of competing cryptocurrencies could affect Bitcoin’s dominance and market share. Finally, the security of Bitcoin exchanges and individual wallets remains a concern.

Potential Benefits of Investing in Bitcoin After the 2025 Halving

Despite the inherent risks, investing in Bitcoin after the 2025 halving presents potential benefits. The reduced inflation rate, stemming from the halving, could create a scarcity effect, potentially driving up demand and price. Bitcoin’s decentralized nature and its growing adoption as a store of value and a medium of exchange contribute to its long-term appeal. Furthermore, the potential for significant returns, although risky, attracts investors seeking high-growth opportunities. However, these benefits are not guaranteed and are subject to market forces and external factors.

Reliable Information About Bitcoin Price Predictions

Predicting Bitcoin’s price is inherently speculative. No one can definitively predict future price movements. However, several sources offer reliable information and analysis to help informed decision-making.

- Reputable financial news outlets (e.g., Bloomberg, Reuters, The Wall Street Journal): These provide market analysis and reporting.

- Established cryptocurrency news websites (e.g., CoinDesk, Cointelegraph): These focus specifically on the cryptocurrency market.

- Independent financial analysts and researchers: Look for individuals with a proven track record and transparent methodologies.

- On-chain data analysis platforms: These provide insights into Bitcoin’s network activity and transaction patterns.

It is important to critically evaluate information from any source and avoid relying on unsubstantiated claims or overly optimistic predictions.

Bitcoin Price After Halving 2025 – Predicting the Bitcoin price after the 2025 halving is challenging, with various analysts offering differing opinions. However, effective marketing strategies will be crucial for businesses operating in this space, and setting up a robust Google Ads Account can help reach potential investors interested in the volatile yet potentially lucrative Bitcoin market post-halving. Understanding these marketing dynamics will be just as important as understanding the technical aspects of the Bitcoin halving itself.