Illustrative Example: Bitcoin Price At 2025 Halving

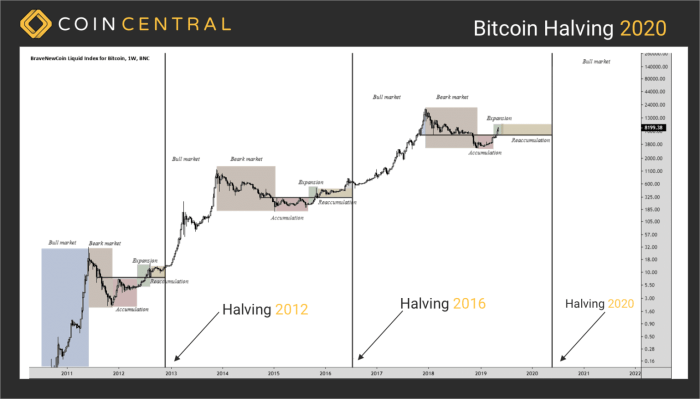

This section presents a hypothetical Bitcoin price chart illustrating potential price movements leading up to and following the 2025 halving. It’s crucial to remember that this is a speculative model, and actual price movements will depend on numerous unpredictable factors, including macroeconomic conditions, regulatory changes, and overall market sentiment. This example aims to demonstrate how the halving event might influence price action, not to provide a definitive prediction.

This hypothetical chart depicts a gradual price increase leading up to the halving event, followed by a period of volatility and eventual price appreciation. The chart considers several key price levels, support and resistance areas, and potential trend reversals. Specific price points and dates are included for illustrative purposes.

Bitcoin Price Chart Projection, Bitcoin Price At 2025 Halving

The hypothetical chart begins in early 2024 with Bitcoin trading at approximately $30,000. As the halving approaches (expected in March/April 2025), anticipation and accumulating buying pressure push the price steadily upwards. By February 2025, the price might reach $45,000, establishing a strong resistance level. A brief correction could then follow, bringing the price down to around $38,000, creating a support level. This support holds, and the price resumes its upward trend.

The halving event itself (let’s assume April 2025) could trigger a surge in price, potentially reaching $60,000 within a month or two. This rapid increase could be followed by a period of consolidation, with the price fluctuating between $55,000 and $70,000 for several months. This range represents a new resistance and support area. By the end of 2025, the price could settle around $65,000, reflecting the impact of the reduced supply and sustained market interest. A possible scenario would be a price correction to the $50,000 support level in early 2026, followed by a resumption of the upward trend based on sustained positive market sentiment. This hypothetical scenario showcases a post-halving price increase, albeit with expected volatility. This example is analogous to the price action observed after previous halvings, although the magnitude and timing will likely differ due to evolving market dynamics. This chart should not be interpreted as financial advice; it serves purely as an illustrative example.

Bitcoin Price At 2025 Halving – Predicting the Bitcoin price at the 2025 halving is challenging, with various factors influencing its trajectory. A related event to consider is the Bitcoin Cash halving, also occurring in 2025; you can find details on this at Bitcoin Cash Halving 2025. The interplay between these two events, and the broader cryptocurrency market, will likely significantly impact the Bitcoin price around that time.

Predicting the Bitcoin price at the 2025 halving is challenging, but understanding the timing is crucial. To accurately gauge the market’s potential reaction, we need to know precisely when the next halving will occur; you can find that information by checking the details on this page regarding the Bitcoin Halving Time 2025. This date significantly impacts the supply-demand dynamics and ultimately influences the price trajectory of Bitcoin leading up to and following the event.

Therefore, knowing the precise halving date is a critical element in any price prediction model.

Predicting the Bitcoin price at the 2025 halving is challenging, but understanding the event’s impact is key. The reduced Bitcoin supply, following the halving, is often cited as a bullish factor. To fully grasp this mechanism, it’s helpful to review the details of the upcoming event as outlined in this insightful article on Bitcoin Halving In 2025.

Ultimately, the 2025 halving’s effect on price will depend on various market forces beyond just the reduced supply.

Predicting the Bitcoin price at the 2025 halving is a complex task, influenced by numerous factors. Understanding the timing is crucial, however, as it directly impacts the supply and subsequent price. To clarify the exact date, you might find it helpful to check this resource: When Was Bitcoin Halving 2025. Knowing the precise date allows for more accurate modeling of the Bitcoin price leading up to and following the halving event, which historically has shown significant price movements.

Predicting the Bitcoin price at the 2025 halving is a complex task, influenced by numerous factors beyond the reduced block reward. Understanding the precise timing is crucial for any price prediction, and that’s why knowing the exact Halving Bitcoin 2025 Date is paramount. This date, in turn, significantly impacts analyses of potential price movements leading up to and following the halving event for Bitcoin.

Predicting the Bitcoin price at the 2025 halving is challenging, with various factors influencing its trajectory. A key element to consider is precisely *when* the halving will occur, which is detailed in this helpful resource: When Halving Bitcoin 2025. Understanding the timing is crucial for assessing the potential impact on price, as the reduced supply often leads to increased demand and price fluctuations in the months following the event.

Therefore, accurate predictions of the Bitcoin price at the 2025 halving necessitate a thorough understanding of the halving’s timing.