Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s a significant event that historically has influenced Bitcoin’s price and market dynamics. Understanding this mechanism is crucial for anyone interested in the long-term prospects of Bitcoin.

Bitcoin Halving: A Core Mechanism

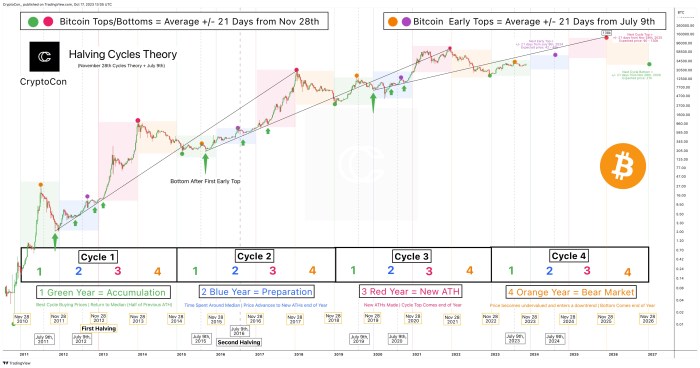

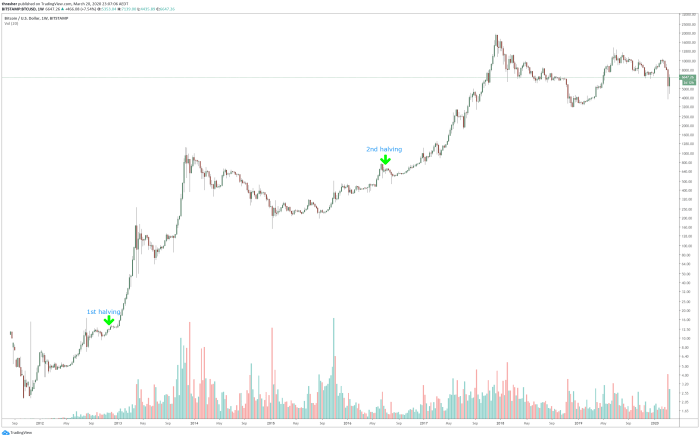

The Bitcoin halving mechanism is a fundamental part of Bitcoin’s design, intended to control inflation and maintain the scarcity of Bitcoin. Every 210,000 blocks mined, the reward given to miners for successfully adding a new block to the blockchain is cut in half. This halving directly impacts the rate of Bitcoin issuance, reducing the supply entering the market. The first halving occurred in November 2012, the second in July 2016, and the third in May 2020. Each halving has been followed by periods of significant price appreciation, although other market factors have also played a role.

Bitcoin Halving 2025: Date and Supply Implications

The next Bitcoin halving is expected to occur in the spring of 2025, around block height 840,000. The precise date will depend on the rate of block mining, which can fluctuate slightly. This halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block. This reduction in the rate of new Bitcoin creation further strengthens Bitcoin’s deflationary nature, meaning the supply of Bitcoin will increase at a slower rate. This scarcity is a key argument for Bitcoin’s long-term value proposition, as it mirrors the characteristics of precious metals like gold. The reduced supply, combined with potentially increasing demand, could theoretically exert upward pressure on the price. However, it’s important to note that past performance is not indicative of future results, and other macroeconomic factors heavily influence Bitcoin’s price.

Halving’s Impact on Mining Profitability

The halving directly affects the profitability of Bitcoin mining. With a reduced block reward, miners’ revenue per block decreases. This can lead to some miners becoming unprofitable and potentially exiting the market, unless the price of Bitcoin increases sufficiently to offset the reduced reward. The cost of electricity, mining hardware, and maintenance are all significant factors influencing mining profitability. Historically, halvings have been followed by periods of increased mining difficulty as miners compete for the reduced reward, leading to a consolidation of the mining landscape. This can lead to greater centralization of the mining power within the network. For example, after the 2020 halving, we saw a significant increase in the dominance of large mining pools. This is a complex dynamic with implications for the overall decentralization of the Bitcoin network.

Historical Bitcoin Price Performance After Halvings

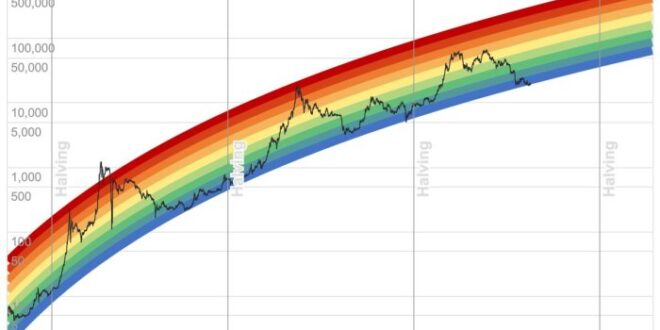

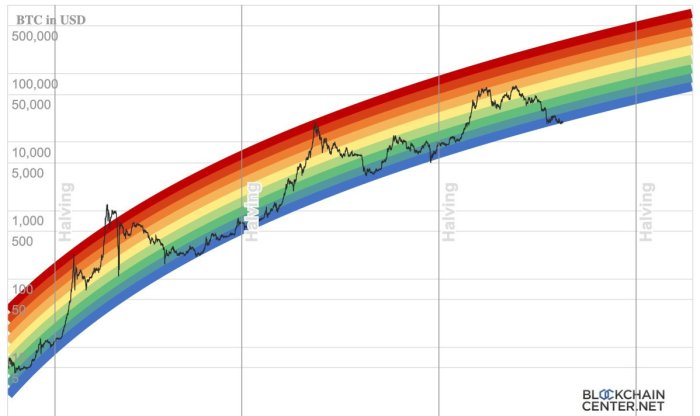

Bitcoin’s price has demonstrated a fascinating correlation with its halving events, although the extent and timing of price increases vary considerably. Analyzing past performance provides valuable insight, but it’s crucial to remember that past performance is not indicative of future results. Many factors beyond the halving itself influence Bitcoin’s price.

Analyzing the price movements after each halving reveals a complex interplay of factors. While a general upward trend is often observed, the magnitude and duration of these price increases differ significantly. Understanding these differences requires examining the broader macroeconomic climate, regulatory developments, and technological advancements concurrent with each halving.

Bitcoin Price Movements After Previous Halvings

The following table summarizes Bitcoin’s price performance around its previous halving events. Note that the “After” price represents a point in time after the halving, chosen to illustrate a significant price movement, and not necessarily a peak or trough. These figures are approximations and may vary slightly depending on the source and the exact time period considered. It is important to consult multiple reliable sources for the most accurate data.

| Halving Date | Price Before (USD) | Price During (USD) | Price After (USD) – Approximate & Timeframe |

|---|---|---|---|

| November 28, 2012 | ~13 | ~12 | ~100 (within ~1 year) |

| July 9, 2016 | ~650 | ~650 | ~20,000 (within ~3 years) |

| May 11, 2020 | ~8,700 | ~8,700 | ~64,000 (within ~1 year) |

Factors Influencing Price Changes After Halvings

Several interconnected factors influence Bitcoin’s price trajectory following a halving. These include:

* Market Sentiment: Halvings are highly anticipated events, often generating significant hype and speculation within the cryptocurrency market. Positive sentiment, fueled by the reduced supply, can drive price increases. Conversely, negative sentiment, driven by broader market downturns or regulatory uncertainty, can dampen the impact of the halving.

* Regulatory Changes: Government regulations and policies concerning cryptocurrencies significantly impact market sentiment and price. Favorable regulations can boost investor confidence and drive prices higher, while stricter regulations can have the opposite effect. The varying regulatory landscapes in different jurisdictions further complicate the picture.

* Technological Advancements: Improvements in Bitcoin’s underlying technology, such as scaling solutions or enhanced security features, can positively influence investor confidence and price appreciation. Conversely, significant technological setbacks or vulnerabilities could negatively impact the price.

* Macroeconomic Conditions: Broader macroeconomic factors, such as inflation, interest rates, and global economic growth, also play a crucial role. During periods of economic uncertainty or inflation, Bitcoin may be viewed as a safe haven asset, driving increased demand and price appreciation. Conversely, periods of economic stability might lead to decreased demand.

* Adoption and Institutional Investment: Increased adoption by businesses and institutions, as well as substantial institutional investments, can significantly impact Bitcoin’s price. This demonstrates a growing level of trust and legitimacy in the cryptocurrency.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with uncertainty. Numerous factors, both internal and external to the cryptocurrency market, can significantly influence its price, making accurate predictions exceptionally difficult, if not impossible. While historical data and technical analysis can offer some insights, they cannot account for the unpredictable nature of market sentiment and unforeseen events.

Predicting Bitcoin’s price involves navigating a complex web of interconnected variables. Attempts to forecast future prices often rely on extrapolating past trends, assuming consistent market behavior. However, the cryptocurrency market is known for its volatility and susceptibility to rapid shifts in sentiment, making such extrapolations unreliable. Moreover, the influence of regulatory changes, technological advancements, and macroeconomic conditions further complicates the process.

Limitations of Predictive Models

Bitcoin price prediction models, whether based on technical analysis, fundamental analysis, or machine learning algorithms, all share inherent limitations. Technical analysis, for example, relies on identifying patterns in historical price data, but these patterns are not guaranteed to repeat. Fundamental analysis assesses factors such as adoption rate and network security, but it’s difficult to accurately quantify the impact of these factors on future price movements. Machine learning models, while capable of processing vast datasets, are only as good as the data they are trained on and are vulnerable to unforeseen events. The inherent volatility of the Bitcoin market renders even the most sophisticated models prone to significant errors. For instance, a model trained on data from a bull market might drastically underestimate the price during a bear market.

Potential Black Swan Events

Black swan events – highly improbable events with significant consequences – pose a major challenge to Bitcoin price prediction. These events are, by definition, unpredictable and can drastically alter the market landscape. Examples include a major security breach compromising the Bitcoin network, a significant regulatory crackdown globally impacting cryptocurrency trading, or a widespread adoption of a competing cryptocurrency technology. The 2022 Terra Luna collapse serves as a stark reminder of how quickly unexpected events can severely impact the cryptocurrency market. The unforeseen collapse of this ecosystem had a significant ripple effect across the entire market, demonstrating the potential for unforeseen events to significantly alter Bitcoin’s price.

Risks Associated with Investing Based on Price Predictions

Investing in Bitcoin solely based on price predictions carries substantial risk. Over-reliance on predictions can lead to impulsive decisions, potentially resulting in significant financial losses. The inherent volatility of Bitcoin means that even seemingly accurate predictions can quickly become obsolete. Investors might miss opportunities or incur losses due to the unpredictable nature of the market. Furthermore, the proliferation of misleading or inaccurate predictions online adds to the risks. Many individuals and entities promote unrealistic price targets, potentially leading investors into making poorly informed decisions. A realistic approach involves acknowledging the limitations of prediction and diversifying investment portfolios to mitigate risks.

List of Potential Risks and Their Impact on Bitcoin Price

The following list highlights several potential risks and their potential impact on Bitcoin’s price:

- Regulatory Crackdowns: Increased government regulation or outright bans in major markets could significantly depress Bitcoin’s price by reducing demand and accessibility.

- Security Breaches: A major security breach affecting the Bitcoin network could erode trust and lead to a sharp price decline.

- Technological Disruptions: The emergence of a superior cryptocurrency technology or a significant technological advancement could render Bitcoin obsolete, negatively impacting its price.

- Market Manipulation: Coordinated efforts to manipulate the Bitcoin market (e.g., through large-scale selling or buying) could cause significant price swings.

- Macroeconomic Factors: Global economic downturns or significant changes in monetary policy can impact investor sentiment and lead to price volatility.

- Adoption Rate Slowdown: A slower-than-expected rate of Bitcoin adoption could negatively impact its long-term price trajectory.

- Environmental Concerns: Growing concerns about the environmental impact of Bitcoin mining could lead to decreased investor interest and lower prices.

The Impact of Bitcoin Halving on Mining: Bitcoin Price At Halving 2025

The Bitcoin halving, a pre-programmed event that reduces the block reward paid to miners by half, significantly impacts the economics of Bitcoin mining. This event creates a ripple effect throughout the ecosystem, influencing miner profitability, operational strategies, and ultimately, the security and stability of the Bitcoin network. Understanding these impacts is crucial for comprehending the long-term health and viability of Bitcoin.

The halving directly reduces miners’ revenue. With fewer newly minted Bitcoins awarded for each successfully mined block, profitability hinges on the Bitcoin price remaining sufficiently high to offset the reduced reward. Operational costs, including electricity, hardware maintenance, and cooling, remain largely unchanged. Therefore, a post-halving price drop could severely impact miners’ profitability, potentially leading to a cascade of consequences.

Miner Responses to Decreased Profitability

Miners are not passive actors; they adapt to changing market conditions. Faced with reduced profitability, several strategies may be employed. Firstly, miners will likely focus on increasing efficiency. This could involve upgrading to more energy-efficient hardware, optimizing mining operations, or relocating to regions with cheaper electricity. Secondly, consolidation within the mining industry is a probable outcome. Less profitable operations might be forced to shut down, leading to larger, more established mining firms absorbing their market share. This centralization, while potentially concerning from a decentralization perspective, could also lead to increased operational efficiency and economies of scale.

Impact of Halving on Hashrate and Network Security

The halving’s effect on the hashrate (the computational power securing the Bitcoin network) is complex. A decrease in miner profitability could lead to a decline in hashrate as less profitable miners exit the market. This would theoretically reduce the network’s security, making it potentially more vulnerable to attacks like 51% attacks. However, the increased efficiency mentioned above could partially offset this effect. Moreover, the price of Bitcoin itself plays a significant role; if the price increases post-halving, it could compensate for the reduced block reward, potentially maintaining or even increasing the hashrate.

Relationship Between Miner Profitability, Bitcoin Price, and Hashrate

Imagine a three-dimensional graph. The X-axis represents the Bitcoin price, the Y-axis represents the hashrate, and the Z-axis represents miner profitability. When the Bitcoin price is high, miner profitability is high, leading to a higher hashrate as more miners join the network. A halving immediately lowers the Z-axis (profitability) irrespective of the X-axis (price). If the X-axis (price) remains high or increases, the Z-axis might recover, and the Y-axis (hashrate) might remain stable or even increase due to efficiency gains. Conversely, if the X-axis (price) falls significantly, the Z-axis will plummet, potentially causing a drop in the Y-axis (hashrate) as miners shut down. This illustrates the interconnectedness of these three factors and the unpredictable nature of the post-halving period. The 2012 and 2016 halvings provide real-world examples of this dynamic interplay, showing both price increases and hashrate adjustments following each event. However, each halving is unique and influenced by various macroeconomic and technological factors.

Bitcoin’s Long-Term Price Outlook Beyond 2025

Predicting Bitcoin’s price beyond 2025 is inherently speculative, but analyzing potential long-term factors offers a framework for understanding possible trajectories. While past performance is not indicative of future results, considering historical trends alongside emerging technological and societal shifts can illuminate potential scenarios. The interplay of these factors will significantly shape Bitcoin’s future value and role in the global economy.

The long-term price of Bitcoin will be heavily influenced by a confluence of factors. Widespread adoption, technological advancements, and the regulatory landscape will all play crucial roles in determining its future value. These factors are interconnected and their effects can be synergistic or contradictory, leading to periods of significant price volatility or relative stability. Understanding these dynamics is key to forming a nuanced perspective on Bitcoin’s potential.

Widespread Adoption and Network Effects

The increasing adoption of Bitcoin as a store of value and, potentially, a medium of exchange will be a major driver of its long-term price. As more individuals and institutions embrace Bitcoin, the demand will likely increase, pushing the price upwards. This is further amplified by network effects: the more users Bitcoin has, the more valuable and secure the network becomes, attracting even more users. The growth of Bitcoin’s Lightning Network, for instance, could significantly improve transaction speed and reduce fees, making it more attractive for everyday use. This increased usability could lead to a wider adoption rate, boosting demand and, consequently, price.

Technological Innovations and Scalability

Technological advancements in Bitcoin’s underlying infrastructure are vital for its long-term success. Improvements in scalability, such as layer-two solutions like the Lightning Network, are crucial for handling a larger number of transactions. Further developments in privacy-enhancing technologies could also boost adoption by addressing concerns around anonymity and regulatory compliance. The development and integration of new technologies that enhance Bitcoin’s functionality and efficiency could significantly influence its price trajectory. For example, the integration of Taproot, a significant upgrade improving transaction privacy and efficiency, has already demonstrated positive effects.

Regulatory Landscape and Institutional Acceptance

The regulatory environment surrounding Bitcoin will have a profound impact on its price. Clearer and more consistent regulations globally could lead to increased institutional investment and broader adoption. Conversely, overly restrictive or unpredictable regulations could stifle growth and negatively affect the price. The evolving relationship between governments and Bitcoin, including the acceptance of Bitcoin as a legal tender in some jurisdictions, will play a critical role in shaping its future. Examples such as El Salvador’s adoption of Bitcoin as legal tender illustrate the potential impact of governmental policy on price and adoption.

Bitcoin as a Mainstream Store of Value or Medium of Exchange

Bitcoin’s potential to become a mainstream store of value is a key factor in its long-term price outlook. Its limited supply (21 million coins) and decentralized nature make it an attractive alternative to traditional fiat currencies and other assets. However, its volatility remains a significant barrier to widespread adoption as a medium of exchange. The development of more stable and user-friendly payment systems built on Bitcoin could facilitate its transition into a more widely accepted form of payment. This would require overcoming challenges related to transaction speed, fees, and regulatory compliance.

Bitcoin’s Role in a Decentralized Financial System

Bitcoin’s potential role within a decentralized financial system (DeFi) is another significant factor influencing its long-term price. As DeFi grows, Bitcoin could become an increasingly important asset within this ecosystem, potentially driving demand and price appreciation. The integration of Bitcoin with other DeFi protocols and applications could create new use cases and further enhance its value proposition. However, the security and stability of DeFi platforms remain crucial concerns, and any negative events within the DeFi space could have knock-on effects on Bitcoin’s price.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the Bitcoin halving, its impact on price, and related investment considerations. Understanding these points is crucial for navigating the complexities of the cryptocurrency market.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving is designed to control inflation and maintain the scarcity of Bitcoin over time. The initial reward for mining a block was 50 BTC, and it has been halved three times already.

The Halving’s Effect on Bitcoin’s Price, Bitcoin Price At Halving 2025

Historically, Bitcoin’s price has tended to increase in the period following a halving event. This is largely attributed to the reduced supply of newly mined Bitcoin, potentially increasing demand and driving up the price. However, it’s crucial to remember that past performance is not indicative of future results. Other market factors, such as regulatory changes, technological advancements, and overall economic conditions, significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, although the timing and magnitude of these increases varied.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in approximately the first half of 2024. The exact date depends on the rate of block mining, which can fluctuate slightly. However, based on current block generation times, a prediction within a few weeks of the expected date is typically achievable.

Risks of Investing Based on Halving Predictions

Investing in Bitcoin based solely on halving predictions carries significant risk. While historical trends suggest a potential price increase, numerous other factors can negatively impact the price. These include market volatility, regulatory uncertainty, security breaches, and competition from other cryptocurrencies. The price may not rise as expected, or a rise might be delayed or short-lived. Investors should always conduct thorough research and understand the risks involved before investing in Bitcoin or any other cryptocurrency.

Alternative Cryptocurrencies

Several alternative cryptocurrencies (altcoins) exist, each with its own features and functionalities. Examples include Ethereum, which focuses on smart contracts and decentralized applications (dApps); Litecoin, designed for faster transaction speeds than Bitcoin; and Ripple (XRP), often used for cross-border payments. These altcoins differ from Bitcoin in their underlying technology, intended use cases, and market capitalization. Investing in altcoins also carries inherent risks, including volatility and potential for project failure. Thorough research is essential before investing in any altcoin.

Bitcoin Price At Halving 2025 – Predicting the Bitcoin price at the 2025 halving is a complex undertaking, influenced by numerous factors. Successfully reaching a targeted audience with your predictions requires effective marketing, and for that, you’ll need a robust online advertising strategy, perhaps utilizing a well-managed Google Ads Account. Therefore, understanding how to leverage online advertising could be as crucial as understanding the halving’s impact on Bitcoin’s price itself.