Analyzing Bitcoin Price Predictions from Experts: Bitcoin Price By 2025

Predicting the price of Bitcoin is notoriously difficult, given its volatility and influence by various factors ranging from regulatory changes to market sentiment. However, several prominent financial analysts and economists offer their perspectives, providing valuable insights, albeit with varying degrees of accuracy. Analyzing these predictions, their underlying assumptions, and methodologies allows for a more nuanced understanding of the potential price trajectory of Bitcoin by 2025.

Bitcoin Price Predictions for 2025: A Comparative Analysis, Bitcoin Price By 2025

Expert opinions on Bitcoin’s future price vary considerably. Some analysts predict exponential growth based on increasing adoption and limited supply, while others are more cautious, citing potential regulatory hurdles or market corrections. Understanding the reasoning behind these diverse forecasts is crucial for a comprehensive assessment. The methodologies employed range from technical analysis of price charts and trading volumes to fundamental analysis considering factors like network growth, adoption rates, and macroeconomic trends.

Summary of Expert Predictions

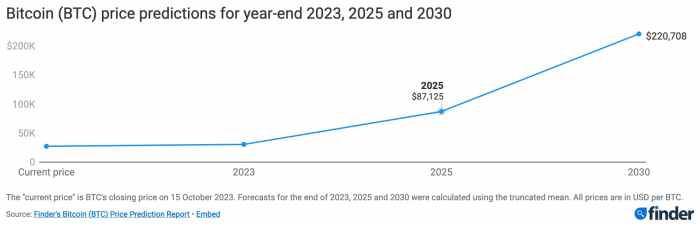

The following table summarizes several expert predictions for Bitcoin’s price in 2025. It’s important to note that these are just predictions, and the actual price may differ significantly. The rationale provided represents a simplified overview of the complex reasoning behind each prediction. Further research into the individual sources is recommended for a more in-depth understanding.

| Expert | Predicted Price (USD) | Rationale | Date of Prediction |

|---|---|---|---|

| (Example: Analyst A – Replace with actual analyst name and source) | (Example: $150,000 – Replace with actual prediction) | (Example: Based on increasing institutional adoption and limited supply, Analyst A projects a significant price increase driven by strong demand exceeding supply. This prediction relies on a bullish market sentiment and continued technological advancements.) | (Example: October 26, 2023 – Replace with actual date) |

| (Example: Analyst B – Replace with actual analyst name and source) | (Example: $75,000 – Replace with actual prediction) | (Example: Analyst B anticipates a more moderate price increase, factoring in potential regulatory risks and the possibility of market corrections. Their methodology involves a combination of technical and fundamental analysis, considering macroeconomic factors and historical price patterns.) | (Example: November 15, 2023 – Replace with actual date) |

| (Example: Analyst C – Replace with actual analyst name and source) | (Example: $200,000 – Replace with actual prediction) | (Example: Analyst C’s prediction is based on a more optimistic outlook, emphasizing the potential for Bitcoin to become a dominant global currency. Their analysis incorporates network effects and the growing adoption of Bitcoin as a store of value.) | (Example: December 5, 2023 – Replace with actual date) |

| (Example: Analyst D – Replace with actual analyst name and source) | (Example: $50,000 – Replace with actual prediction) | (Example: Analyst D’s more conservative forecast considers the possibility of significant market volatility and regulatory uncertainty. Their analysis emphasizes the need for caution in predicting long-term price movements for cryptocurrencies.) | (Example: January 10, 2024 – Replace with actual date) |

Frequently Asked Questions (FAQ)

Predicting the future price of Bitcoin is inherently challenging, given the volatile nature of the cryptocurrency market. However, by analyzing various factors and expert opinions, we can explore potential scenarios and address common questions surrounding Bitcoin’s price in 2025. This section aims to clarify some uncertainties and provide a balanced perspective.

Bitcoin’s Most Likely Price in 2025

Pinpointing a single “most likely” price for Bitcoin in 2025 is impossible. The cryptocurrency market is influenced by numerous interconnected factors, making precise predictions highly speculative. However, considering various expert forecasts and market trends, a price range between $100,000 and $250,000 appears plausible. This wide range reflects the considerable uncertainty involved. Some analysts predict significantly higher values, while others foresee more conservative growth or even potential price corrections. The actual price will depend on the interplay of various factors discussed below. For example, if widespread adoption by institutional investors occurs and regulatory clarity improves, the higher end of this range becomes more probable. Conversely, significant regulatory crackdowns or a major market downturn could push the price towards the lower end.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will significantly impact Bitcoin’s price in 2025. These include regulatory developments, widespread adoption by institutions and individuals, technological advancements within the Bitcoin network (such as the Lightning Network’s expansion), macroeconomic conditions (inflation, interest rates), and overall market sentiment. The relative importance of these factors can shift dramatically. For instance, positive regulatory developments could outweigh concerns about macroeconomic instability, while a major technological breakthrough could trigger a surge in adoption and price appreciation. Conversely, negative news regarding regulation or a significant security breach could negatively impact investor confidence and suppress price growth.

Reliability of Bitcoin Price Predictions

Bitcoin price prediction models, whether based on technical analysis, fundamental analysis, or machine learning, are inherently limited. These models rely on historical data and assumptions about future market behavior, both of which are subject to considerable uncertainty. No model can perfectly predict the future. Therefore, it’s crucial to consider a wide range of predictions and perspectives, recognizing that each carries its own inherent biases and limitations. Relying solely on a single prediction is risky. The accuracy of past predictions offers little guarantee of future accuracy, given the rapidly evolving nature of the cryptocurrency landscape.

Investing in Bitcoin Based on Predictions

Investing in Bitcoin based solely on price predictions is highly risky. Cryptocurrency investments are inherently speculative and volatile. Past performance is not indicative of future results. Before investing any amount of money, conduct thorough due diligence, understand the risks involved, and only invest what you can afford to lose. Consider seeking advice from a qualified financial advisor. This information is for educational purposes only and does not constitute financial advice. The cryptocurrency market is highly dynamic and unpredictable, making any investment decision a calculated risk.