Bitcoin Price Prediction

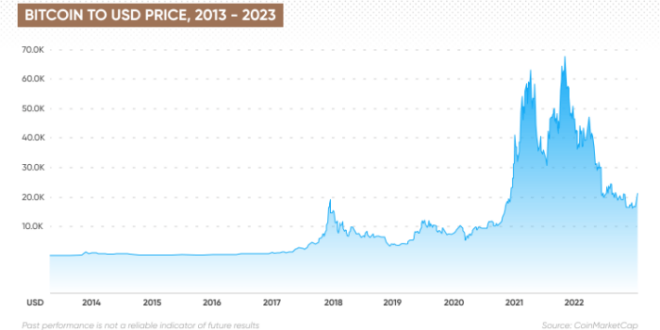

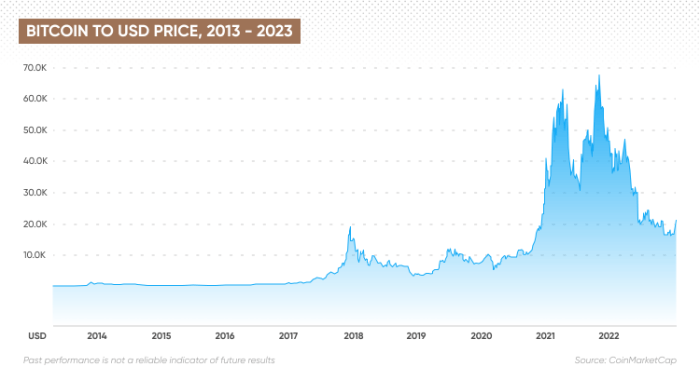

Predicting the price of Bitcoin in January 2025 is inherently speculative, as numerous interconnected factors influence its volatile nature. However, by analyzing historical trends, macroeconomic indicators, and potential regulatory developments, we can construct plausible scenarios and associated probability ranges. This analysis will consider various prediction models and their limitations, offering a comprehensive, albeit uncertain, outlook.

Factors Influencing Bitcoin’s Price by January 2025

Several macroeconomic and technological factors will significantly impact Bitcoin’s price trajectory. Global inflation rates, interest rate policies implemented by central banks, and the overall health of the global economy will all play a crucial role. For example, a period of high inflation might drive investors towards Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, aggressive interest rate hikes could divert investment away from riskier assets like Bitcoin, leading to a price decline. Technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s scalability improvements, could also influence adoption and, consequently, price. Furthermore, the emergence of competing cryptocurrencies and their adoption rates will present both opportunities and challenges for Bitcoin’s market dominance.

Comparative Analysis of Bitcoin Price Prediction Models

Various models attempt to predict Bitcoin’s price, each with its strengths and weaknesses. Technical analysis, for instance, relies on historical price and volume data to identify patterns and predict future movements. While it can be effective in identifying short-term trends, it often struggles to account for unforeseen events and macroeconomic shifts. Fundamental analysis, on the other hand, focuses on evaluating the underlying value proposition of Bitcoin, considering factors like adoption rates, network effects, and regulatory developments. This approach provides a longer-term perspective but is less precise in predicting short-term price fluctuations. Machine learning models, trained on extensive datasets, can potentially offer more sophisticated predictions, but their accuracy depends heavily on the quality and completeness of the data used for training, and they are prone to overfitting or underfitting. The limitations of each model highlight the inherent uncertainty in Bitcoin price prediction.

Bitcoin Price Prediction Ranges and Probabilities, Bitcoin Price By January 2025

The following table illustrates different price prediction scenarios for Bitcoin in January 2025, along with their associated probabilities and contributing factors. These ranges are illustrative and should not be interpreted as financial advice. Real-world outcomes could significantly deviate from these predictions.

| Scenario | Price Range (USD) | Probability (%) | Contributing Factors |

|---|---|---|---|

| Bullish Scenario | $100,000 – $150,000 | 20% | Widespread adoption, positive regulatory developments, sustained macroeconomic growth. Similar to the 2021 bull run, but with increased institutional adoption. |

| Neutral Scenario | $50,000 – $100,000 | 60% | Moderate adoption growth, mixed regulatory landscape, fluctuating macroeconomic conditions. This scenario reflects a continuation of the current market volatility with periods of both growth and decline. |

| Bearish Scenario | $25,000 – $50,000 | 20% | Slow adoption, negative regulatory developments, significant macroeconomic downturn. This could be triggered by a major global economic crisis or widespread regulatory crackdowns. |

Impact of Regulatory Changes on Bitcoin’s Price

Regulatory changes worldwide will significantly influence Bitcoin’s price trajectory. Favorable regulations, such as clear guidelines for Bitcoin’s use and taxation, could boost investor confidence and drive price increases. Conversely, restrictive regulations, including outright bans or excessive taxation, could suppress demand and lead to price declines. The regulatory landscape is constantly evolving, and its impact on Bitcoin’s price will depend on the specific policies adopted by different jurisdictions. The example of China’s 2021 ban on cryptocurrency trading illustrates the significant negative impact that regulatory uncertainty can have.

Factors Influencing Bitcoin’s Price: Bitcoin Price By January 2025

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic conditions, investor sentiment, and technological advancements. Understanding these factors is crucial for navigating the volatility inherent in the cryptocurrency market. The following sections delve into key influences likely to shape Bitcoin’s price trajectory over the next two years.

Macroeconomic Factors Impacting Bitcoin Price

Several macroeconomic factors can significantly impact Bitcoin’s price. These factors often influence investor risk appetite and the overall financial landscape, indirectly affecting the demand for Bitcoin as an asset.

- Inflation and Monetary Policy: High inflation rates often drive investors towards alternative assets, including Bitcoin, perceived as a hedge against inflation. Conversely, aggressive monetary tightening by central banks can negatively impact Bitcoin’s price by reducing liquidity in financial markets. For example, the Federal Reserve’s interest rate hikes in 2022 correlated with a significant Bitcoin price downturn. This is because higher interest rates make holding non-interest-bearing assets like Bitcoin less attractive compared to interest-bearing accounts.

- Global Economic Uncertainty: Periods of geopolitical instability, economic recession, or major financial crises can lead to increased demand for Bitcoin as a safe haven asset. Investors may seek refuge in Bitcoin’s decentralized and non-correlated nature during times of market turmoil. The 2020 COVID-19 pandemic initially saw a significant price drop, followed by a substantial recovery, demonstrating this effect.

- Regulation and Government Policies: Government regulations and policies concerning cryptocurrencies can significantly impact Bitcoin’s price. Favorable regulatory frameworks can boost investor confidence and increase adoption, while restrictive measures can dampen enthusiasm and lead to price declines. The ongoing regulatory debates surrounding Bitcoin in various countries exemplify this influence.

Institutional vs. Retail Investment Influence on Volatility

Institutional and retail investors exhibit different investment strategies and risk tolerances, impacting Bitcoin’s price volatility in distinct ways.

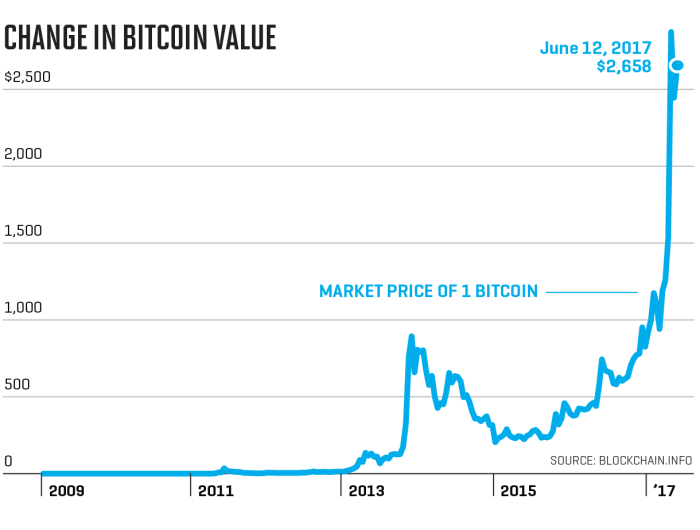

Institutional investors, such as large corporations and hedge funds, typically engage in more calculated, long-term investments. Their participation often leads to more stable and less volatile price movements. Conversely, retail investors, who are individuals, often exhibit more emotional and impulsive behavior, leading to greater price volatility driven by market sentiment and speculation. For example, the significant price increases in 2017 were partly driven by retail investor enthusiasm, resulting in a highly volatile market. The subsequent crash illustrates the risks associated with retail-driven market exuberance.

Technological Advancements and Bitcoin’s Price

Technological advancements, particularly in scaling solutions, can profoundly impact Bitcoin’s price and adoption.

Layer-2 scaling solutions, such as the Lightning Network, aim to enhance Bitcoin’s transaction speed and reduce fees. Widespread adoption of these solutions could address current limitations and make Bitcoin more practical for everyday transactions, potentially increasing demand and price. Increased transaction throughput and reduced fees could lead to a greater utility of Bitcoin, potentially attracting a wider range of users and investors. Successful implementation and adoption of these technologies could significantly impact the price positively.

Past Events and Price Fluctuations

Several past events have significantly impacted Bitcoin’s price, offering valuable insights into its volatility.

The 2017 bull market, fueled by increasing media attention and retail investor enthusiasm, saw Bitcoin’s price reach nearly $20,000. However, this rapid price increase was unsustainable and led to a significant correction in 2018. The contributing factors included speculative trading, regulatory uncertainty, and the emergence of various altcoins. The Mt. Gox hack in 2014, which resulted in the loss of a significant number of Bitcoins, also triggered a substantial price drop, highlighting the risks associated with security breaches within the cryptocurrency ecosystem.