Bitcoin Price Predictions for 2025 (Euro)

Predicting the price of Bitcoin in Euros by the end of 2025 is inherently challenging, given the cryptocurrency’s volatile nature and susceptibility to various macroeconomic and geopolitical factors. Numerous models attempt to forecast future prices, each with its strengths and weaknesses. This analysis will explore several approaches and present potential price scenarios.

Bitcoin Price Prediction Models, Bitcoin Price Euro 2025

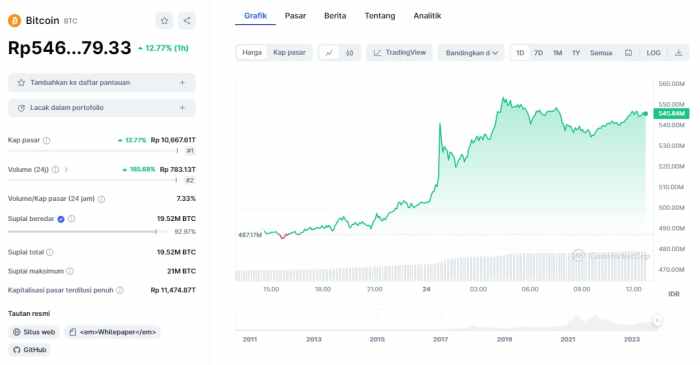

Several methodologies exist for predicting Bitcoin’s price. Technical analysis relies on historical price and volume data to identify patterns and trends, aiming to predict future price movements. Fundamental analysis, on the other hand, considers factors like adoption rates, regulatory changes, and macroeconomic conditions to assess Bitcoin’s intrinsic value. While technical analysis can provide short-term insights, fundamental analysis offers a longer-term perspective. Predictive models often combine elements of both approaches. For example, a model might use technical indicators to identify potential short-term price fluctuations, while incorporating fundamental factors to estimate long-term price trends. The accuracy of any model, however, remains limited due to the inherent volatility of Bitcoin and the difficulty of predicting future events. Previous predictions have shown significant variations, highlighting the complexity of this task. For instance, predictions made in 2020 for the Bitcoin price in 2022 varied widely, demonstrating the inherent uncertainty involved.

Projected Bitcoin Price Ranges in Euros for 2025

Technical analysis models, based on charting patterns and indicators like moving averages and relative strength index (RSI), might suggest price ranges for Bitcoin in 2025. These ranges often vary widely depending on the specific indicators used and the interpretation of the patterns. Some models might predict a conservative range, perhaps between €30,000 and €50,000, while more bullish predictions could reach significantly higher figures, potentially exceeding €100,000. Fundamental analysis, focusing on factors like increasing institutional adoption, growing global interest in digital assets, and potential regulatory clarity, could support higher price predictions. However, unforeseen events like a major market crash or significant regulatory setbacks could drastically alter these projections. The lack of a universally accepted valuation model for Bitcoin further complicates accurate prediction.

Potential Bitcoin Price Scenarios in Euros for 2025

The following table illustrates potential Bitcoin price scenarios in Euros by the end of 2025, based on varying levels of market adoption and regulatory environments. These scenarios are hypothetical and should not be considered financial advice.

| Scenario | Market Adoption | Regulatory Environment | Bitcoin Price (EUR) |

|---|---|---|---|

| Bearish | Slow growth, limited institutional adoption | Increased regulation, negative sentiment | €20,000 – €30,000 |

| Neutral | Moderate growth, some institutional adoption | Mixed regulatory signals, stable sentiment | €40,000 – €60,000 |

| Bullish | Rapid growth, widespread institutional adoption | Favorable regulatory environment, positive sentiment | €70,000 – €100,000+ |

| Extreme Bullish | Mass adoption, global acceptance as a store of value | Supportive regulatory framework, widespread positive sentiment | €100,000+ |

Factors Influencing Bitcoin’s Euro Price in 2025: Bitcoin Price Euro 2025

Predicting Bitcoin’s price is inherently complex, but analyzing key macroeconomic factors, regulatory landscapes, and technological advancements offers valuable insight into potential price movements in Euros by 2025. Several interconnected elements will significantly shape Bitcoin’s trajectory.

Global Economic Factors and Bitcoin’s Euro Price

Inflation and Interest Rates

High inflation rates often drive investors towards alternative assets perceived as hedges against inflation, such as Bitcoin. Conversely, aggressive interest rate hikes by central banks to combat inflation can reduce the attractiveness of riskier assets like Bitcoin, potentially leading to price declines. For example, the aggressive interest rate increases implemented by the European Central Bank (ECB) in 2022 to combat inflation had a noticeable impact on Bitcoin’s price, demonstrating the sensitivity of the cryptocurrency market to monetary policy changes. The level of inflation and the ECB’s response in 2025 will be crucial determinants of Bitcoin’s value.

Recessionary Risks

The possibility of a recession in the Eurozone or globally can significantly impact Bitcoin’s price. During economic downturns, investors tend to be more risk-averse, potentially leading to a sell-off in cryptocurrencies. However, Bitcoin’s decentralized nature and its potential as a store of value could also attract investors seeking safe haven assets, counteracting the negative pressure. The severity and duration of any potential recession will play a pivotal role in shaping Bitcoin’s price performance. The 2008 financial crisis, for instance, saw a significant drop in many asset classes, though Bitcoin did not exist at the time, offering a historical parallel to consider.

Regulatory Developments and Bitcoin’s Euro Price

Impact of MiCA Regulation

The Markets in Crypto-Assets (MiCA) regulation, set to come into effect within the EU in 2024, will likely influence Bitcoin’s price in the Eurozone in 2025. The regulation aims to provide a clearer regulatory framework for cryptocurrencies, potentially increasing investor confidence and boosting adoption. However, the specific details of MiCA’s implementation and enforcement could impact the market positively or negatively. A well-defined regulatory framework could attract institutional investment, driving up prices, while overly restrictive measures could hinder growth and depress prices. The overall effect will depend on the balance between increased clarity and potential limitations imposed by the regulation.

Technological Advancements and Bitcoin’s Euro Price

Layer-2 Scaling Solutions and Transaction Speeds

Technological advancements, particularly in Layer-2 scaling solutions, can significantly impact Bitcoin’s adoption rate and, consequently, its price. Layer-2 solutions, such as the Lightning Network, aim to improve Bitcoin’s scalability and transaction speed, addressing some of its limitations as a payment system. Wider adoption of Layer-2 technologies could make Bitcoin more practical for everyday transactions, increasing demand and potentially driving up its price. The success of these scaling solutions will be crucial in determining whether Bitcoin can truly become a mainstream payment method and thus increase its value. Increased transaction speeds and reduced fees would directly improve the user experience, potentially leading to broader adoption and a positive impact on price.

Bitcoin Price Euro 2025 – Predicting the Bitcoin price in Euros for 2025 requires considering various factors. A key element in this forecasting is understanding broader Bitcoin price predictions, which you can explore further in this insightful analysis: Bitcoin Price 2025 Prediction. Ultimately, the Euro valuation will depend on the overall Bitcoin price and the fluctuating Euro-to-dollar exchange rate during that period.

Predicting the Bitcoin price in Euros for 2025 is challenging, relying heavily on various market factors and technological advancements. To gain a broader understanding of potential future Bitcoin valuations, it’s helpful to consult resources like this article on What Will Bitcoin Cost In 2025 , which offers insightful analysis. Ultimately, the Bitcoin price in Euros in 2025 will depend on a complex interplay of global economic conditions and the cryptocurrency’s overall adoption rate.

Predicting the Bitcoin price in Euros for 2025 is challenging, given the inherent volatility of the cryptocurrency market. To gain a broader perspective on long-term price trajectories, it’s helpful to consider longer-term forecasts; for instance, you might find the analysis in this article useful: What Will Bitcoin Price Be In 2030. Understanding potential price movements a decade out can offer context for shorter-term predictions like the Bitcoin price in Euros for 2025, allowing for a more informed assessment.

Predicting the Bitcoin price in Euros for 2025 is challenging, given the inherent volatility of the cryptocurrency market. To understand potential long-term trajectories, it’s helpful to consider broader predictions; for instance, check out this insightful article on What Will Bitcoin Price Be In 2030 to gain perspective. Extrapolating from such long-term forecasts can offer a framework for considering more near-term price estimations in Euros for 2025, though considerable uncertainty remains.

Predicting the Bitcoin price in Euros for 2025 is challenging, given the inherent volatility of the cryptocurrency market. To gain a broader perspective on potential future values, it’s helpful to consult broader market analyses, such as this comprehensive report on Crypto 2025 Price Prediction. Understanding the wider crypto landscape will help refine any predictions for the Bitcoin Euro price in 2025, offering a more nuanced outlook.