Factors Influencing Bitcoin’s Future Price: Bitcoin Price Future 2025

Predicting Bitcoin’s price in 2025 is inherently complex, involving a multitude of interconnected factors. While no one can definitively state the exact price, analyzing these influential elements provides a clearer picture of potential price trajectories. This section explores key factors impacting Bitcoin’s future valuation.

Regulatory Changes and Bitcoin’s Value

Government regulations significantly influence cryptocurrency markets. Clear and consistent regulatory frameworks could boost investor confidence, potentially driving Bitcoin’s price upwards. Conversely, overly restrictive or unpredictable regulations could stifle adoption and depress prices. For example, a nation-wide ban on Bitcoin trading could immediately impact its value, while a well-defined regulatory landscape allowing for institutional investment could lead to a surge in demand. The ongoing regulatory landscape varies greatly across different jurisdictions, leading to diverse market impacts. The evolution of these regulations will be a key driver of Bitcoin’s price.

Technological Advancements and Bitcoin Adoption, Bitcoin Price Future 2025

Technological advancements play a crucial role in shaping Bitcoin’s future. The Lightning Network, for instance, aims to improve scalability and transaction speeds, addressing some of Bitcoin’s current limitations. Wider adoption of the Lightning Network could lead to increased usability and potentially higher demand, influencing price positively. Similarly, advancements in mining technology or the development of new, more efficient consensus mechanisms could affect the overall security and efficiency of the network, ultimately impacting its value.

Bitcoin’s Price Performance Compared to Other Assets

Bitcoin’s price performance is often compared to other cryptocurrencies and traditional assets like gold and the US dollar. Its correlation with other cryptocurrencies can vary significantly depending on market sentiment and technological developments within the broader cryptocurrency ecosystem. Its correlation with traditional assets, particularly during periods of economic uncertainty, can also significantly influence its price. For instance, during periods of high inflation, investors may see Bitcoin as a hedge against inflation, driving up demand.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors, such as inflation, interest rates, and economic growth, exert a significant influence on Bitcoin’s price. High inflation can drive investors towards Bitcoin as a store of value, increasing its demand. Conversely, rising interest rates can make other investment options more attractive, potentially diverting investment away from Bitcoin. Global economic recessions can also lead to increased volatility and uncertainty in the cryptocurrency market.

Geopolitical Events and Bitcoin’s Price

Geopolitical events, including wars, political instability, and sanctions, can create uncertainty in global financial markets, impacting Bitcoin’s price. During times of political turmoil, investors might seek refuge in Bitcoin’s decentralized nature, potentially driving up demand. However, geopolitical instability can also lead to increased market volatility, making price predictions challenging. For example, the outbreak of a major war could cause significant price swings as investors react to the uncertainty.

Institutional Investment and Bitcoin’s Price

The entry of institutional investors, such as large corporations and investment funds, into the Bitcoin market has the potential to significantly impact its price. Large-scale purchases by institutional investors can increase demand and push prices higher. However, institutional selling could have the opposite effect, leading to price drops. The level of institutional adoption will continue to be a major factor influencing Bitcoin’s price trajectory.

Bullish and Bearish Price Predictions for Bitcoin in 2025

| Scenario | Price Range (USD) | Rationale | Supporting Factors |

|---|---|---|---|

| Bullish | $100,000 – $200,000 | Widespread adoption, positive regulatory developments, and continued institutional investment. | Increased Lightning Network usage, positive macroeconomic conditions, and global economic recovery. |

| Bearish | $20,000 – $40,000 | Negative regulatory actions, increased market volatility, and a general downturn in the global economy. | Stringent regulatory frameworks, a global recession, and lack of widespread institutional adoption. |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, as numerous factors can influence its trajectory. However, by considering various economic and technological developments, we can construct plausible price scenarios for 2025. These scenarios are not exhaustive, and the actual price could fall outside these ranges. It’s crucial to remember that these are educated guesses, not financial advice.

Bullish Scenario: Bitcoin Surpasses $100,000

This scenario assumes widespread institutional adoption, significant regulatory clarity (or even favorable regulation), and continued technological advancements within the Bitcoin ecosystem. Increased adoption by institutional investors, such as large corporations and pension funds, could drive significant demand. Simultaneously, a positive regulatory landscape would attract more mainstream investors, leading to increased liquidity and price appreciation. Furthermore, scaling solutions like the Lightning Network could improve transaction speeds and reduce fees, making Bitcoin more user-friendly for everyday transactions.

- Widespread Institutional Adoption: Major financial institutions actively integrate Bitcoin into their portfolios, significantly increasing demand.

- Favorable Regulatory Environment: Governments globally adopt clear and supportive regulations for cryptocurrencies, fostering trust and investor confidence.

- Technological Advancements: Scaling solutions enhance Bitcoin’s usability and efficiency, leading to broader adoption.

- Macroeconomic Factors: Global economic uncertainty drives investors towards Bitcoin as a safe-haven asset.

This scenario could see Bitcoin’s price exceeding $100,000 by 2025, mirroring the significant price increases observed during previous bull runs, albeit potentially at a slower pace. For example, the 2017 bull run saw Bitcoin reach almost $20,000, driven by similar factors like increased media attention and growing institutional interest.

Neutral Scenario: Bitcoin Consolidates Around $50,000

This scenario assumes a more moderate level of adoption and a period of market consolidation. While institutional investment continues, it occurs at a slower pace than in the bullish scenario. Regulatory uncertainty persists in some regions, hindering widespread adoption. Technological advancements continue, but their impact on price is less pronounced. The overall market sentiment remains relatively stable, neither overwhelmingly bullish nor bearish.

- Gradual Institutional Adoption: Institutional investors gradually increase their Bitcoin holdings, but at a slower rate than in the bullish scenario.

- Mixed Regulatory Landscape: Some regions adopt favorable regulations, while others remain hesitant or even hostile towards cryptocurrencies.

- Stable Technological Development: Technological improvements continue, but their impact on price appreciation is less significant.

- Moderate Market Sentiment: Overall market sentiment is neither strongly bullish nor bearish, leading to price consolidation.

In this scenario, Bitcoin’s price might fluctuate around $50,000 in 2025, experiencing periods of both upward and downward movement, but generally remaining within a relatively narrow range. This would represent a period of slower, more organic growth, similar to the periods of consolidation seen between major bull runs in Bitcoin’s history.

Bearish Scenario: Bitcoin Falls Below $25,000

This scenario considers several negative factors that could significantly impact Bitcoin’s price. A major regulatory crackdown globally could severely limit its use and accessibility. A prolonged cryptocurrency market downturn, potentially triggered by a broader economic crisis or a major security breach affecting the Bitcoin network, could also lead to a significant price drop. Furthermore, the emergence of a superior competing cryptocurrency could divert investor interest and capital away from Bitcoin.

- Stringent Global Regulation: Governments worldwide implement strict regulations that significantly restrict Bitcoin’s use and accessibility.

- Major Market Downturn: A prolonged bear market in the cryptocurrency space, possibly driven by macroeconomic factors, leads to significant price declines.

- Technological Disruption: A new cryptocurrency emerges with superior technology or features, diverting investment away from Bitcoin.

- Security Concerns: A significant security breach affecting the Bitcoin network erodes investor confidence.

In this bearish scenario, Bitcoin’s price could fall below $25,000 by 2025, reflecting a significant loss of investor confidence and a potential shift in market sentiment. This would be comparable to the significant price drops seen during previous bear markets, such as the one experienced in 2018-2019.

Bitcoin Adoption and Market Sentiment

The future price of Bitcoin is inextricably linked to its adoption rate and the prevailing market sentiment. While predicting the future is inherently uncertain, analyzing current trends in adoption and sentiment provides valuable insights into potential price movements. A confluence of factors, including institutional investment, regulatory developments, and public perception, shapes the overall market narrative and influences investor behavior.

Increased adoption by both individuals and institutions is a key driver of Bitcoin’s price. The growing acceptance of Bitcoin as a store of value and a potential medium of exchange is fueling demand, pushing prices higher. Conversely, a decline in adoption could lead to a price correction. Market sentiment, often volatile and influenced by various news events, plays a crucial role in determining short-term price fluctuations.

Institutional Adoption of Bitcoin

Institutional investors, including hedge funds, asset management firms, and corporations, are increasingly allocating a portion of their portfolios to Bitcoin. This institutional adoption provides a degree of stability and legitimacy to the cryptocurrency market, attracting further investment. For example, MicroStrategy’s significant Bitcoin purchases have been a major catalyst for price increases in the past. The growing involvement of established financial institutions signals a shift in the perception of Bitcoin from a speculative asset to a viable investment option within diversified portfolios. This institutional interest lends credibility and helps to reduce the volatility associated with primarily retail-driven markets.

Current Market Sentiment Towards Bitcoin

Market sentiment towards Bitcoin fluctuates dramatically, often mirroring broader macroeconomic trends. Periods of economic uncertainty or market instability can lead to increased demand for Bitcoin as a safe-haven asset, driving prices upwards. Conversely, periods of economic growth or regulatory uncertainty can trigger sell-offs and price declines. Analyzing sentiment indicators, such as the Bitcoin Fear and Greed Index, can offer a glimpse into the prevailing market mood. A high Fear and Greed Index, indicating widespread optimism, is often associated with price increases, while a low index suggests pessimism and potential price corrections. These indicators, however, should be interpreted cautiously as they are not perfect predictors of future price movements.

Media Coverage and Public Perception

Media coverage significantly impacts public perception and, consequently, Bitcoin’s price. Positive news, such as the adoption of Bitcoin by major corporations or positive regulatory developments, generally boosts investor confidence and drives prices higher. Conversely, negative news, such as regulatory crackdowns or security breaches, can lead to sell-offs and price declines. The tone and framing of media reports significantly influence public opinion, highlighting the importance of critical evaluation of information sources. For example, a sensationalized news report about a security breach can trigger a disproportionate negative reaction in the market, irrespective of the actual impact.

Correlation Between Bitcoin’s Price and Social Media Sentiment

Social media sentiment, measured through analysis of posts and comments on platforms like Twitter and Reddit, often exhibits a correlation with Bitcoin’s price. Positive social media sentiment, characterized by bullish comments and increased engagement, often precedes price increases. Conversely, negative sentiment, marked by bearish comments and reduced activity, frequently precedes price declines. While not a perfect predictor, analyzing social media sentiment can provide valuable insights into market dynamics and potential price movements. It’s important to note that the correlation is not always direct or immediate, and other factors also influence Bitcoin’s price. Sophisticated sentiment analysis tools are employed by traders and investors to gauge market sentiment and inform their trading strategies.

Risks and Challenges Facing Bitcoin

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these potential pitfalls is crucial for informed decision-making. While Bitcoin’s potential for growth is significant, it’s equally important to acknowledge the challenges that could impact its price and overall viability.

Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, experiencing significant swings in short periods. This volatility stems from several factors, including regulatory uncertainty, market sentiment, and macroeconomic events. For instance, the price of Bitcoin plummeted during the 2022 crypto winter, highlighting the substantial risk of significant capital loss. Investors need to be prepared for such dramatic fluctuations and only invest what they can afford to lose. The lack of intrinsic value also contributes to this volatility; unlike stocks representing ownership in a company, Bitcoin’s value is solely determined by supply and demand.

Scalability and Transaction Speed

Bitcoin’s current transaction speed and scalability are limitations compared to traditional payment systems. The blockchain’s block size limits the number of transactions processed per second, leading to congestion and higher transaction fees during periods of high network activity. Solutions like the Lightning Network aim to address this, but widespread adoption remains a challenge. This slow transaction speed and high fees can hinder Bitcoin’s widespread adoption as a daily payment method. For example, during peak times, transaction fees can become prohibitively expensive, making Bitcoin impractical for small everyday purchases.

Environmental Concerns of Bitcoin Mining

Bitcoin mining, the process of verifying and adding transactions to the blockchain, requires significant computing power, consuming substantial amounts of electricity. This energy consumption raises environmental concerns, particularly regarding greenhouse gas emissions. The environmental impact varies depending on the energy sources used for mining, with reliance on fossil fuels being particularly problematic. While some mining operations utilize renewable energy sources, the overall energy footprint remains a significant challenge to Bitcoin’s long-term sustainability. For example, estimates suggest that Bitcoin mining consumes more electricity annually than entire countries like Argentina.

Security Risks Compared to Other Investments

While Bitcoin’s blockchain technology is considered highly secure, it is not immune to risks. The security of individual Bitcoin holdings depends heavily on the security measures taken by users. Loss of private keys, exchange hacks, and phishing scams are all potential threats. Compared to traditional investments like stocks held in brokerage accounts, Bitcoin’s security relies more on individual responsibility. While regulated exchanges offer some level of security, they are not entirely risk-free. For instance, the collapse of the FTX exchange highlighted the vulnerabilities of centralized exchanges and the potential for significant losses due to mismanagement or fraud.

Investing in Bitcoin

Investing in Bitcoin, like any other asset class, requires careful consideration of your financial goals, risk tolerance, and understanding of the market. It’s crucial to remember that Bitcoin is a highly volatile asset, meaning its price can fluctuate dramatically in short periods. This volatility presents both significant opportunities and substantial risks. Therefore, a well-defined investment strategy is paramount.

Investment Strategies for Bitcoin

Different investment strategies cater to varying risk appetites. Conservative investors might opt for dollar-cost averaging (DCA), gradually accumulating Bitcoin over time regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. More aggressive investors might consider leveraging, borrowing funds to amplify potential gains (though this significantly increases risk). A balanced approach could involve a combination of DCA and strategic buying during market dips, aiming to capture potential price increases while limiting exposure to extreme volatility. For example, an investor could allocate a fixed percentage of their monthly income to Bitcoin purchases, irrespective of the current price, demonstrating a DCA strategy. Alternatively, they could actively monitor market trends and purchase larger amounts when prices fall significantly below a determined support level.

Diversification in a Cryptocurrency Portfolio

Diversification is a cornerstone of responsible cryptocurrency investing. Holding only Bitcoin exposes your portfolio to the specific risks associated with its performance. Diversifying into other cryptocurrencies, such as Ethereum or stablecoins, can help reduce overall portfolio volatility. For instance, an investor might allocate 60% of their crypto portfolio to Bitcoin, 30% to Ethereum, and 10% to stablecoins, achieving a balanced risk profile. This approach aims to mitigate the impact of a potential Bitcoin price downturn by spreading investments across different assets with varying correlation to Bitcoin. This reduces the risk of substantial losses if one asset underperforms.

Responsible Bitcoin Investment Practices

Responsible Bitcoin investment involves several key practices. Firstly, only invest what you can afford to lose. Bitcoin’s price volatility means significant losses are possible. Secondly, conduct thorough research and understand the technology behind Bitcoin before investing. Thirdly, secure your Bitcoin using reputable hardware or software wallets, protecting your investment from theft or loss. Fourthly, be wary of scams and fraudulent investment schemes promising unrealistic returns. Finally, stay informed about market trends and regulatory developments impacting Bitcoin. Ignoring these responsible practices could lead to significant financial losses. For example, failing to secure your Bitcoin using a secure wallet could lead to the complete loss of your investment if your exchange is compromised or your personal device is stolen.

Resources for Further Research on Bitcoin Investment

Several resources can help you learn more about Bitcoin investment. These include reputable financial news websites (such as CoinDesk, Cointelegraph), educational platforms offering courses on cryptocurrency investing, and white papers published by Bitcoin developers and researchers. Additionally, consulting with a qualified financial advisor specializing in cryptocurrency investments can provide personalized guidance. These resources can provide valuable insights into market analysis, risk management, and investment strategies, allowing investors to make informed decisions. Utilizing these sources can help mitigate risks and maximize potential returns.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin’s price trajectory and investment strategies. We’ll explore potential price ranges, long-term investment viability, safe investment practices, and the key drivers influencing Bitcoin’s value.

Bitcoin’s Potential Price Range in 2025

Predicting Bitcoin’s price with certainty is impossible. Numerous analysts offer diverse projections, influenced by varying methodologies and underlying assumptions. Some optimistic forecasts suggest prices exceeding $100,000, fueled by widespread adoption and institutional investment. Conversely, more conservative estimates place the price in a range between $50,000 and $80,000, reflecting a more measured approach to growth. Ultimately, the actual price will depend on a complex interplay of factors, including regulatory developments, technological advancements, and overall market sentiment. It’s crucial to remember that past performance is not indicative of future results. For example, while Bitcoin reached an all-time high in late 2021, various factors contributed to subsequent price corrections, highlighting the volatility inherent in the cryptocurrency market.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. Proponents highlight its limited supply (21 million coins), its decentralized nature, and its potential to act as a hedge against inflation. The long-term price appreciation, if realized, could offer substantial returns. However, Bitcoin’s volatility presents a significant risk. Sharp price fluctuations can lead to substantial losses, especially for those with shorter investment horizons. Regulatory uncertainty, security breaches, and competition from other cryptocurrencies also pose challenges. Therefore, a well-informed decision requires careful consideration of both the potential rewards and the inherent risks. A diversified investment portfolio, incorporating less volatile assets, is often recommended for mitigating risk.

Safely Investing in Bitcoin

Securing your Bitcoin investment is paramount. Hardware wallets, such as Ledger or Trezor, provide the most secure storage option, keeping your private keys offline and protected from hacking. Software wallets, while more convenient, carry a higher risk of compromise. Furthermore, only utilize reputable and well-established exchanges for buying and selling Bitcoin. Diversify your holdings across multiple platforms to minimize the impact of potential exchange failures or security breaches. Regularly review your security settings and adopt strong password practices. Never share your private keys with anyone. Remember, due diligence and a cautious approach are crucial to minimizing investment risks.

Main Factors Driving Bitcoin’s Price

Several key factors influence Bitcoin’s price. These include widespread adoption by individuals and businesses, regulatory clarity and acceptance by governments, technological advancements improving scalability and efficiency, the overall macroeconomic environment (e.g., inflation, economic growth), and prevailing market sentiment. Institutional investment, competition from alternative cryptocurrencies, and significant news events (positive or negative) also play a crucial role. The interplay of these factors creates a dynamic and often unpredictable market.

Illustrative Example

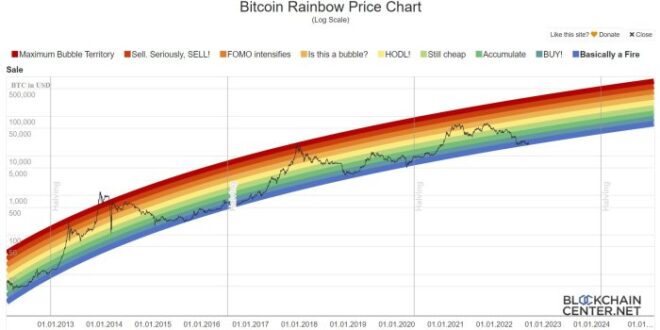

This section presents a hypothetical chart visualizing potential Bitcoin price movements throughout 2025. It’s crucial to remember that this is a speculative illustration and not a prediction. Real-world price movements are influenced by a complex interplay of factors, making precise forecasting impossible. This example aims to showcase possible scenarios based on past trends and market analyses.

This hypothetical chart depicts Bitcoin’s price fluctuating throughout 2025, influenced by various factors discussed previously, such as regulatory changes, adoption rates, and macroeconomic conditions. The chart’s trajectory is not linear; it reflects the inherent volatility of the cryptocurrency market.

Hypothetical Bitcoin Price Movement Chart for 2025

The chart begins in January 2025 at a price of $30,000, reflecting a moderate recovery from a potential downturn in late 2024. Throughout the first quarter, the price experiences a period of consolidation, trading sideways between $28,000 and $32,000. This sideways movement reflects uncertainty in the market as investors await key developments, such as potential regulatory announcements or major technological upgrades to the Bitcoin network. The price then experiences a gradual upward trend in the second quarter, driven by increased institutional investment and positive market sentiment. By June, the price reaches approximately $38,000. The summer months see a period of increased volatility, with the price fluctuating between $35,000 and $45,000, reflecting typical seasonal patterns and potential short-term market corrections. However, the overall trend remains upward. A significant catalyst, such as widespread adoption by a major corporation or positive regulatory news, could push the price above $50,000 by the end of the third quarter. The final quarter of the year sees the price stabilize around the $45,000 to $55,000 range, depending on macroeconomic conditions and market sentiment. A potential scenario involves a final push above $60,000 if positive market sentiment persists, but a correction to around $40,000 is also possible if negative news emerges. The year concludes with a closing price somewhere within this $40,000-$60,000 range. This wide range reflects the inherent uncertainty in predicting cryptocurrency prices. The overall shape of the chart would resemble a slightly upward-sloping wave, punctuated by periods of consolidation and volatility. Think of it as a smoother version of the historical price fluctuations, illustrating the inherent volatility while suggesting a general upward trend based on optimistic yet cautious assumptions.