Frequently Asked Questions (FAQs)

The Bitcoin halving is a significant event in the cryptocurrency world, impacting its supply and potentially its price. Understanding this event and its implications is crucial for anyone interested in Bitcoin, whether as an investor or simply a curious observer. The following FAQs aim to clarify some common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. Every four years, approximately, the reward given to Bitcoin miners for verifying transactions on the blockchain is cut in half. This process is designed to control inflation and maintain the scarcity of Bitcoin. For example, initially, miners received 50 BTC per block; after the first halving, this dropped to 25 BTC, then to 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This controlled release mimics the scarcity of precious metals like gold.

Timing of the Next Bitcoin Halving, Bitcoin Price Halving 2025

While the exact date depends on the block generation time, the next Bitcoin halving is expected to occur sometime in early 2025. The precise date is difficult to predict with certainty because the block time can fluctuate slightly. However, based on historical data and current block generation rates, a timeframe within the first few months of 2025 is highly probable.

Bitcoin Halving’s Impact on Price

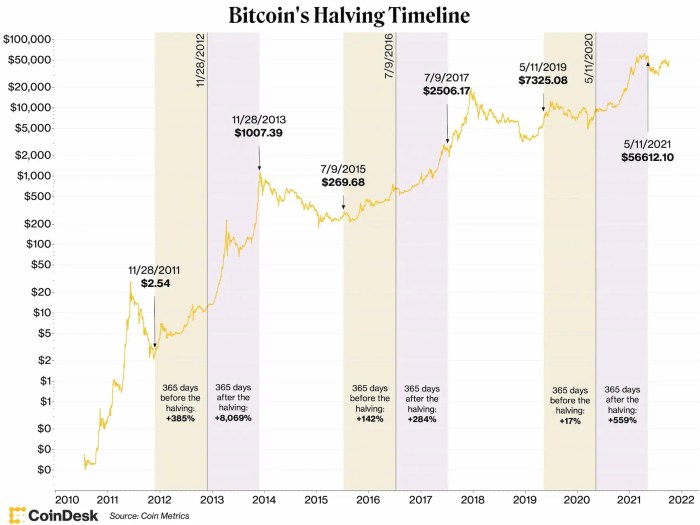

Historically, Bitcoin’s price has tended to increase in the period leading up to and following a halving event. This is largely attributed to the decreased supply of newly minted Bitcoins, potentially increasing demand. The 2012 and 2016 halvings were followed by significant price rallies, though the market conditions and external factors always play a substantial role. It’s important to note that past performance is not indicative of future results. The 2025 halving’s impact on price will depend on various factors including overall market sentiment, regulatory developments, and macroeconomic conditions.

Risks and Rewards of Investing After a Halving

Investing in Bitcoin after a halving carries both risks and potential rewards. The reduced supply could drive price appreciation, but the market is volatile and subject to significant price swings. External factors, such as regulatory changes or economic downturns, can negatively impact Bitcoin’s price regardless of the halving. Therefore, investing only what you can afford to lose is paramount. Thorough research and understanding of the inherent risks are crucial before making any investment decisions. Remember, the potential for high returns is often accompanied by a high level of risk. The 2012 and 2016 halvings saw substantial price increases following the event, but this doesn’t guarantee a similar outcome in 2025.

Alternative Investment Strategies

Diversification is key to mitigating risk in any investment portfolio. Investing solely in Bitcoin, even after a halving, is not advisable. Consider diversifying your portfolio across various asset classes, such as stocks, bonds, real estate, or other cryptocurrencies. This approach can help reduce the overall risk and improve the resilience of your portfolio against market fluctuations. For example, allocating a portion of your investment to stablecoins or established stocks can help balance the volatility associated with Bitcoin. Always seek professional financial advice tailored to your individual circumstances and risk tolerance before making any investment decisions.

Illustrative Data Representation (Table)

Analyzing historical Bitcoin halving events provides valuable insights into potential price movements following the 2025 halving. While past performance is not indicative of future results, examining these trends can offer a framework for informed speculation. The table below summarizes key metrics from previous halvings.

Bitcoin Price Halving 2025 – The data presented represents a simplified overview and should be considered alongside broader market factors and individual investment strategies. It’s crucial to remember that numerous economic and geopolitical events can significantly influence Bitcoin’s price, making precise predictions extremely challenging.

Bitcoin Halving Price Performance Comparison

| Halving Date | Price Before Halving (USD) | Price After Halving (USD) | Percentage Change (%) |

|---|---|---|---|

| November 2012 | $12 | ~$100 | ~733% |

| July 2016 | ~$650 | ~$20,000 | ~3000% |

| May 2020 | ~$8,700 | ~$64,000 | ~640% |

Visual Representation of Price Trends (Image Description)

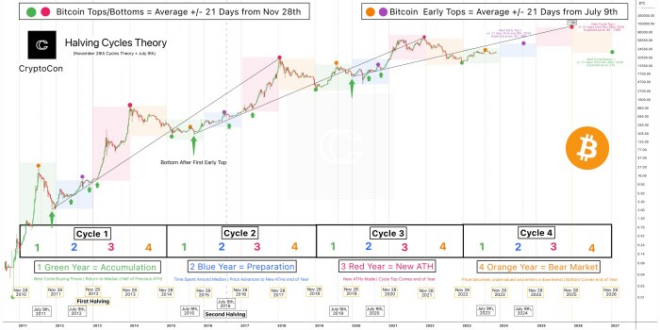

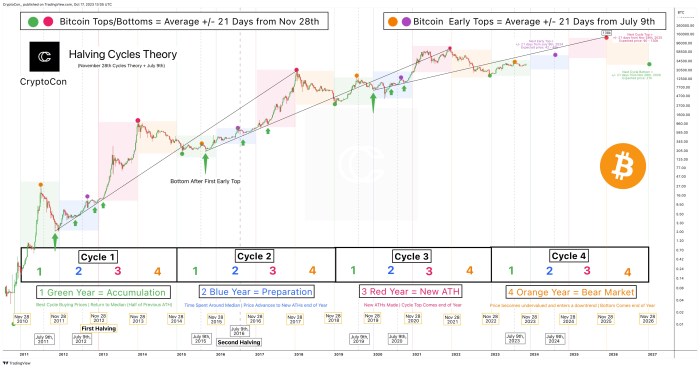

A comprehensive chart visualizing Bitcoin’s price behavior surrounding its previous halving events offers valuable insights into potential future price movements. Understanding these historical trends can aid in formulating informed expectations, although it’s crucial to remember that past performance is not indicative of future results. The chart’s design and interpretation are key to extracting meaningful information.

The chart would utilize a line graph, with the horizontal (x-axis) representing time, specifically the years leading up to and following each Bitcoin halving event (approximately every four years). The vertical (y-axis) would represent the Bitcoin price, typically expressed in US dollars. Each halving event would be clearly marked on the x-axis, perhaps with a vertical dashed line. Key price points, such as all-time highs and lows within the periods surrounding each halving, would be indicated with labeled data points. The line itself would trace the Bitcoin price over time, illustrating the price fluctuations and overall trends.

Price Action Around Previous Halvings

The chart would visually demonstrate the typical price patterns observed around previous halvings. Generally, a period of price increase often precedes the halving event, driven by anticipation of the reduced inflation rate. Post-halving, there’s often a period of consolidation or sideways trading, followed by a significant price surge in many cases. However, the magnitude and timing of these price movements vary significantly between halving cycles. The chart would clearly show this variability, potentially highlighting the different durations of price increases and subsequent corrections. For instance, the chart might display a relatively quicker price increase after the 2012 halving compared to a more gradual increase after the 2016 halving. Furthermore, the chart could highlight the periods of significant price volatility immediately following each halving event, illustrating the uncertainty that often accompanies these market shifts. The visual representation of these diverse price patterns emphasizes the complexity of predicting future price movements based solely on historical data.

Bitcoin Halving 2025: Bitcoin Price Halving 2025

The Bitcoin halving in 2025, reducing the block reward for miners by half, is a significant event with far-reaching consequences. While the reduced supply often leads to price appreciation, a deeper dive reveals several less-discussed factors that could significantly influence the market’s reaction and Bitcoin’s long-term trajectory.

Mining Difficulty Adjustments

Mining difficulty adjusts automatically to maintain a consistent block generation time of approximately 10 minutes. A halving reduces the profitability of mining, potentially leading to miners leaving the network if the price doesn’t rise sufficiently to compensate for the lower block reward. However, the difficulty adjustment mechanism will automatically reduce the computational difficulty required to mine a block, allowing less powerful or less efficient miners to remain profitable. This dynamic interplay between reduced block rewards and difficulty adjustments will determine the overall impact on the mining ecosystem. A rapid drop in hash rate could temporarily destabilize the network, while a slow, controlled adjustment could allow for a smoother transition. The 2016 and 2020 halvings saw similar adjustments, although the specific effects varied due to market conditions and technological advancements.

Unexpected Events and Market Sentiment

The cryptocurrency market is notoriously volatile and susceptible to unforeseen events. A major regulatory crackdown, a significant security breach affecting a major exchange, or a global macroeconomic shock could overshadow the halving’s impact. For example, the 2020 halving coincided with the beginning of the COVID-19 pandemic, creating significant uncertainty in global markets. Similarly, unforeseen technological advancements or the emergence of a compelling competitor could also influence investor sentiment and Bitcoin’s price trajectory. These events are unpredictable, making accurate price predictions extremely challenging.

Long-Term Implications for Bitcoin’s Trajectory

The 2025 halving is expected to contribute to Bitcoin’s deflationary nature, reducing the rate of new Bitcoin entering circulation. Historically, halvings have been followed by periods of price appreciation, although the extent of this appreciation varies. The long-term impact hinges on several factors, including adoption rates, regulatory clarity, technological developments, and overall macroeconomic conditions. If Bitcoin continues to gain mainstream acceptance and institutional investment, the halving could act as a catalyst for further price increases, reinforcing its position as a store of value and a hedge against inflation. Conversely, sustained negative sentiment or significant regulatory hurdles could dampen the halving’s positive effects.

Opportunities and Challenges for Investors and Miners

The halving presents both opportunities and challenges for Bitcoin investors and miners. For investors, the reduced supply could create a bullish environment, potentially leading to price appreciation. However, the timing of this appreciation is uncertain, and the market remains highly volatile. Miners face a period of reduced profitability, requiring them to optimize their operations, potentially leading to consolidation within the mining industry. More efficient and larger mining operations are likely to thrive, while smaller, less efficient miners might struggle to remain profitable. Successful navigation of this period requires careful risk management and strategic planning for both investors and miners.