Bullish vs. Bearish Predictions for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, but analyzing current trends and market factors allows for the formulation of both bullish and bearish scenarios. These predictions are based on a combination of technical analysis, adoption rates, regulatory developments, and macroeconomic conditions. It’s crucial to remember that these are just possibilities, and the actual price could fall anywhere between these extremes or even beyond them.

Arguments Supporting a Bullish Bitcoin Price Prediction for 2025

Several factors could contribute to a significantly higher Bitcoin price by 2025. Increased institutional adoption, coupled with growing mainstream awareness and the potential for Bitcoin to become a more widely accepted store of value, could drive demand. Furthermore, ongoing technological developments, such as the Lightning Network improving transaction speeds and reducing fees, could enhance Bitcoin’s usability. Finally, a continued scarcity of Bitcoin, with a fixed supply of 21 million coins, could fuel further price appreciation as demand increases. Consider the historical price increases following previous halving events; these could serve as a precedent for future growth. For example, the halving in 2016 preceded a significant bull run.

Arguments Supporting a Bearish Bitcoin Price Prediction for 2025

Conversely, several factors could lead to a lower Bitcoin price in 2025. Increased regulatory scrutiny from governments worldwide could dampen investor enthusiasm and limit the growth of the cryptocurrency market. Furthermore, the emergence of competing cryptocurrencies or blockchain technologies could divert investment away from Bitcoin. Macroeconomic factors, such as a global recession or increased inflation, could also negatively impact Bitcoin’s price, as investors may seek safer havens for their assets. Finally, the inherent volatility of Bitcoin, characterized by significant price swings, presents a considerable risk to investors. For example, the 2018 bear market saw a drastic price drop, highlighting the potential for future downturns.

Comparison of Bullish and Bearish Predictions

| Scenario | Price Range (USD) | Supporting Factors | Risks |

|---|---|---|---|

| Bullish | $100,000 – $250,000+ | Increased institutional adoption, mainstream awareness, technological improvements, scarcity | Regulatory uncertainty, competing cryptocurrencies, macroeconomic instability |

| Bearish | $10,000 – $50,000 | Increased regulation, competing technologies, macroeconomic downturn, inherent volatility | Underestimation of adoption, technological breakthroughs, unexpected market shifts |

Long-Term Bitcoin Price Forecasts and Their Underlying Assumptions

Predicting the long-term price of Bitcoin is inherently speculative, given its relatively young age and volatile nature. However, several reputable sources offer forecasts, each based on different underlying assumptions and methodologies. Understanding these assumptions is crucial to evaluating the credibility and potential risks associated with these projections. These forecasts often rely on complex models incorporating factors like adoption rates, technological advancements, regulatory changes, and macroeconomic conditions.

Bitcoin Price Forecasts from Reputable Sources

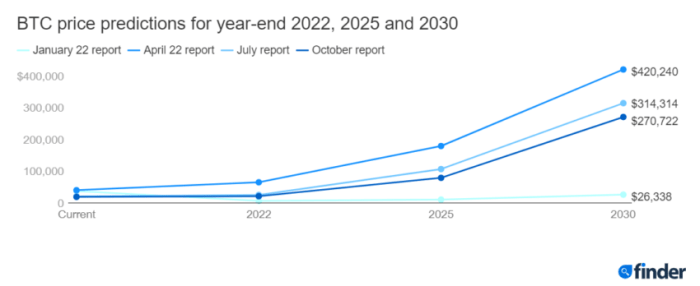

Several financial institutions and analytical firms publish long-term Bitcoin price predictions. These predictions vary significantly, reflecting the inherent uncertainty in the cryptocurrency market. For example, some analysts at major investment banks have offered price targets ranging from several thousand dollars to hundreds of thousands of dollars per Bitcoin by 2025 and beyond. These forecasts often lack publically available detailed methodologies, making independent verification difficult. It’s crucial to remember that these are not guarantees, but rather potential outcomes based on specific models and assumptions.

Key Assumptions Underlying Long-Term Forecasts, Bitcoin Price In 2025 Year

The accuracy of any long-term Bitcoin price forecast hinges on several critical assumptions. These include:

- Adoption Rate: Forecasts often assume a specific rate of Bitcoin adoption by individuals, businesses, and institutions. Higher adoption rates generally translate to higher price predictions, as increased demand pushes the price upward. However, predicting adoption rates is challenging, influenced by factors like regulatory clarity, technological advancements, and overall market sentiment.

- Technological Advancements: Improvements in Bitcoin’s underlying technology, such as scalability solutions (Layer-2 scaling) or upgrades to the consensus mechanism, can significantly impact its price. Forecasts often assume specific technological breakthroughs and their effect on Bitcoin’s usability and efficiency. The successful implementation of these improvements is crucial for the validity of the projections.

- Regulatory Landscape: Government regulations play a crucial role in determining Bitcoin’s price trajectory. Forecasts often incorporate assumptions about future regulatory frameworks, ranging from outright bans to complete acceptance and integration into the mainstream financial system. Uncertainty surrounding regulatory developments represents a significant risk to long-term price predictions.

- Macroeconomic Conditions: Global economic factors, such as inflation, interest rates, and economic growth, can influence Bitcoin’s price. Forecasts often incorporate assumptions about future macroeconomic trends, often assuming a correlation between Bitcoin’s price and traditional asset classes during periods of economic uncertainty or inflation.

Risks and Uncertainties Associated with Long-Term Projections

It is important to acknowledge the significant risks and uncertainties inherent in any long-term Bitcoin price forecast. The cryptocurrency market is known for its extreme volatility and susceptibility to unexpected events. Some of the key risks include:

- Market Manipulation: The relatively small market capitalization of Bitcoin compared to traditional asset classes makes it vulnerable to manipulation by large investors or coordinated efforts. This risk is particularly relevant for short-term price movements but can also impact long-term trajectories.

- Security Breaches: Major security breaches targeting Bitcoin exchanges or wallets could significantly impact investor confidence and lead to sharp price drops. While the Bitcoin network itself is secure, vulnerabilities in the ecosystem remain a potential risk.

- Technological Disruptions: The emergence of competing cryptocurrencies or disruptive technologies could potentially reduce Bitcoin’s dominance and negatively impact its price. The constant evolution of the blockchain space introduces significant uncertainty.

- Unforeseen Events: Geopolitical events, natural disasters, or unforeseen regulatory changes can significantly impact Bitcoin’s price. The inherent unpredictability of these factors makes long-term forecasting exceptionally challenging.

Investing in Bitcoin: Bitcoin Price In 2025 Year

Investing in Bitcoin, like any other investment, presents a unique blend of potential rewards and significant risks. Understanding both sides is crucial before committing any capital. The cryptocurrency market is known for its volatility, and Bitcoin, as the most prominent cryptocurrency, is no exception. This volatility, coupled with regulatory uncertainty and security concerns, necessitates a thorough assessment before investment.

Bitcoin Investment Risks

Bitcoin’s price is notoriously volatile. Sharp price swings, both upward and downward, are common. For instance, in 2021, Bitcoin experienced a significant price surge, reaching an all-time high, only to subsequently undergo a considerable correction. This volatility can lead to substantial losses for investors who are not prepared for such fluctuations. Beyond price volatility, security risks are a major concern. The decentralized nature of Bitcoin means that individuals are solely responsible for securing their private keys. Loss or theft of these keys can result in the permanent loss of funds. Furthermore, regulatory uncertainty adds another layer of risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s price and accessibility.

Bitcoin Investment Rewards

Despite the inherent risks, Bitcoin offers the potential for substantial returns. Its history demonstrates periods of remarkable price appreciation, attracting investors seeking high-growth opportunities. The potential for high returns stems from Bitcoin’s limited supply and increasing adoption as a store of value and a medium of exchange. Furthermore, Bitcoin can act as a diversifier in an investment portfolio. Its price tends to move independently of traditional asset classes like stocks and bonds, offering the potential to reduce overall portfolio risk. For example, during periods of market downturn in traditional markets, Bitcoin’s price may not correlate, providing a hedge against losses.

Factors to Consider Before Investing in Bitcoin

Before investing in Bitcoin, it’s essential to consider several key factors.

- Risk Tolerance: Assess your comfort level with potentially significant price fluctuations. Bitcoin is not a suitable investment for those with low risk tolerance.

- Investment Goals: Define your investment goals and timeframe. Bitcoin is a long-term investment for many, requiring patience and understanding of market volatility.

- Financial Situation: Only invest money you can afford to lose. Never invest borrowed money or funds essential for daily living expenses.

- Security Measures: Understand and implement robust security measures to protect your Bitcoin holdings. This includes using secure wallets and strong passwords.

- Regulatory Landscape: Stay informed about the evolving regulatory environment surrounding Bitcoin in your jurisdiction.

- Diversification Strategy: Consider Bitcoin as part of a diversified investment portfolio, not as a sole investment.

- Market Research: Conduct thorough research and understand the technology, market dynamics, and potential risks associated with Bitcoin before investing.

Bitcoin’s Role in the Future of Finance

Bitcoin’s emergence has sparked a significant debate about its potential to revolutionize the global financial landscape. Its decentralized nature and cryptographic security challenge the established order of centralized banking and financial institutions, presenting both opportunities and risks for the future of finance. This section explores Bitcoin’s potential impact, considering its role as both a store of value and a medium of exchange.

Bitcoin’s potential to disrupt traditional financial systems stems from its inherent characteristics. Unlike fiat currencies controlled by governments and central banks, Bitcoin operates on a peer-to-peer network, eliminating intermediaries and reducing transaction fees. This decentralized structure offers the potential for greater financial inclusion, particularly in regions with limited access to traditional banking services. The transparency of the Bitcoin blockchain also enhances accountability and reduces the risk of fraud, although challenges related to regulatory oversight and illicit activities remain.

Bitcoin as a Store of Value

Bitcoin’s limited supply of 21 million coins and its decentralized nature have led many to view it as a potential store of value, similar to gold. Its price volatility, however, remains a significant concern. While some investors see Bitcoin as a hedge against inflation and currency devaluation, others remain skeptical, citing its price fluctuations as evidence of its unreliability as a stable store of value. The historical performance of Bitcoin, marked by periods of dramatic price increases and decreases, reflects this ongoing debate. For example, the significant price surge in 2017 followed by a sharp correction in 2018 illustrates the inherent risk associated with investing in Bitcoin as a store of value. The long-term viability of Bitcoin as a store of value will depend on factors such as its adoption rate, regulatory clarity, and its ability to maintain its security and stability.

Bitcoin as a Medium of Exchange

The use of Bitcoin as a medium of exchange is still relatively limited compared to traditional currencies. While some merchants accept Bitcoin as payment, widespread adoption faces challenges related to price volatility, transaction speeds, and regulatory uncertainty. The scalability of the Bitcoin network also presents limitations to its ability to handle a large volume of transactions efficiently. However, the development of the Lightning Network and other second-layer solutions aims to address these scalability issues and potentially accelerate Bitcoin’s adoption as a medium of exchange. Examples of businesses already accepting Bitcoin, albeit a small percentage, showcase its potential, though the overall adoption remains a significant hurdle to overcome for mainstream usage. The future of Bitcoin as a medium of exchange hinges on technological advancements, regulatory frameworks, and consumer acceptance.

Bitcoin’s Impact on Global Finance

Bitcoin’s impact on global finance is likely to be multifaceted and far-reaching. Its decentralized nature could challenge the dominance of traditional financial institutions, potentially leading to greater competition and innovation in the financial sector. The increased transparency offered by the blockchain technology could also enhance trust and efficiency in cross-border payments and other financial transactions. However, the potential for Bitcoin to be used in illicit activities, such as money laundering and terrorist financing, remains a significant concern for regulators worldwide. Governments and central banks are grappling with how to regulate Bitcoin and other cryptocurrencies while balancing the need to foster innovation with the need to mitigate risks. The ongoing evolution of Bitcoin and its regulatory landscape will significantly shape its impact on global finance in the coming years. The development of central bank digital currencies (CBDCs) also presents a potential alternative and a competitive force influencing Bitcoin’s future role in the global financial system.

Illustrative Scenarios for Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently speculative, relying on complex interactions between technological advancements, regulatory changes, macroeconomic factors, and market sentiment. However, by exploring various plausible scenarios, we can gain a better understanding of the potential range of outcomes. The following scenarios are illustrative and do not constitute financial advice.

Bitcoin Price Reaching Significantly Higher Value by 2025

This scenario envisions Bitcoin’s price surging to, for example, $200,000 or more by 2025. This bullish outcome hinges on several key factors converging positively. Widespread institutional adoption, fueled by increasing regulatory clarity and the development of robust institutional-grade custody solutions, would be crucial. Furthermore, a sustained period of global macroeconomic instability, potentially driven by inflation or geopolitical events, could drive investors towards Bitcoin as a safe-haven asset. Increased adoption in developing nations, where access to traditional financial systems is limited, could also contribute significantly to demand. Technological advancements, such as the successful implementation of the Lightning Network for faster and cheaper transactions, would further enhance Bitcoin’s utility and appeal. Finally, a lack of significant negative regulatory actions or major security breaches affecting the Bitcoin network would be essential to maintain investor confidence. This scenario mirrors the rapid price appreciation seen in previous bull markets, albeit on a potentially larger scale. For instance, the price increase from approximately $1,000 in 2017 to nearly $20,000 in late 2017, although driven by different factors, offers a glimpse into the potential for rapid growth.

Bitcoin Price Remaining Relatively Stable or Experiencing Moderate Growth by 2025

In this scenario, Bitcoin’s price experiences moderate growth, perhaps reaching a range between $50,000 and $100,000 by 2025. This relatively conservative forecast is based on the assumption of a more stable macroeconomic environment, with less volatility in traditional markets. Regulatory uncertainty persists, hindering significant institutional investment, while technological advancements, while present, fail to dramatically improve Bitcoin’s scalability or usability. Market sentiment remains relatively neutral, with neither significant bullish nor bearish pressures dominating. This scenario resembles the period following the 2017 bull market, where prices consolidated before another significant upswing. The price range reflects a more gradual, less dramatic price movement, reflecting a mature market adjusting to its new reality.

Bitcoin Price Declining Significantly by 2025

This bearish scenario posits a significant decline in Bitcoin’s price, perhaps falling below $20,000 by 2025. Several factors could contribute to such a downturn. A major regulatory crackdown, leading to significant restrictions on Bitcoin trading or usage, could severely impact investor confidence. A major security breach compromising the Bitcoin network, resulting in the loss of funds, would also cause a sharp decline. Furthermore, the emergence of a superior cryptocurrency or blockchain technology, offering significantly improved functionality and scalability, could divert investment away from Bitcoin. Finally, a prolonged period of global economic stability and recovery, reducing the need for safe-haven assets, could lead to decreased demand for Bitcoin. This scenario is analogous to the cryptocurrency market corrections seen in the past, where periods of significant growth are followed by sharp price drops due to factors such as regulatory uncertainty or technological limitations. The 2018 bear market, where Bitcoin’s price fell from approximately $20,000 to below $4,000, serves as a stark reminder of the potential for significant price declines.

Frequently Asked Questions (FAQ) about Bitcoin’s Price in 2025

Predicting the price of Bitcoin in 2025, or any future date for that matter, is inherently complex. Numerous interconnected factors influence its volatility, making definitive statements impossible. However, understanding the key drivers and potential scenarios can provide a more informed perspective. This section addresses common questions regarding Bitcoin’s price in 2025, focusing on the influential factors, the inherent limitations of price prediction, associated risks and rewards, and comparative analysis with other investment assets.

Main Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will significantly shape Bitcoin’s price trajectory by 2025. These include macroeconomic conditions (global inflation, interest rates, recessionary pressures), regulatory developments (government policies regarding cryptocurrency adoption and taxation), technological advancements (scaling solutions, improved infrastructure, the emergence of new cryptocurrencies), and market sentiment (investor confidence, media coverage, and overall adoption rates). For example, a global recession might drive investors towards Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, stringent regulations could stifle growth and decrease its value. Technological advancements improving transaction speed and reducing fees would likely boost adoption and positively influence price. Finally, negative media coverage or a significant security breach could severely impact investor confidence and depress prices. The interplay of these factors will determine the final price.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is currently impossible. The cryptocurrency market is notoriously volatile and influenced by unpredictable events. While various analytical models and forecasting techniques exist, they all rely on assumptions that may or may not hold true. Past performance is not indicative of future results, and unexpected events – such as a major regulatory shift or a significant technological breakthrough – can dramatically alter the price trajectory. Instead of focusing on precise price predictions, it’s more prudent to consider a range of possible outcomes based on different scenarios and understand the inherent uncertainty involved. For example, while some analysts might predict a price of $100,000, others might forecast a significantly lower or higher figure, reflecting the inherent uncertainty in the market.

Risks and Rewards of Investing in Bitcoin

Investing in Bitcoin presents both substantial risks and potential rewards. On the risk side, Bitcoin’s price is highly volatile, meaning significant losses are possible. Regulatory uncertainty, security breaches, and technological disruptions can also negatively impact its value. Furthermore, the cryptocurrency market is relatively young and lacks the established regulatory framework of traditional financial markets. On the reward side, Bitcoin’s potential for significant price appreciation is a key attraction for investors. Its decentralized nature and limited supply are often cited as factors contributing to its long-term value proposition. However, it’s crucial to remember that high potential returns are usually accompanied by high risks. Diversification and careful risk management are essential when considering Bitcoin as part of an investment portfolio.

Bitcoin Compared to Other Investment Assets

Compared to traditional investment assets like stocks and bonds, Bitcoin exhibits significantly higher volatility. Its correlation with traditional markets is also less pronounced, offering potential diversification benefits for a well-balanced portfolio. However, Bitcoin lacks the historical data and established valuation metrics of more mature assets, making it harder to assess its intrinsic value. Compared to other cryptocurrencies, Bitcoin holds a dominant market share and benefits from greater liquidity and wider adoption. However, newer cryptocurrencies may offer potentially higher returns, albeit with correspondingly higher risks. Ultimately, the suitability of Bitcoin as an investment depends on individual risk tolerance, investment goals, and overall portfolio strategy. A thorough understanding of its characteristics compared to other assets is crucial for informed decision-making.

Bitcoin Price In 2025 Year – Predicting the Bitcoin price in 2025 is a complex task, influenced by numerous factors including adoption rates and regulatory changes. Understanding the potential trajectory requires considering related cryptocurrencies, and a useful resource for this is examining discussions on alternative coins like Bitcoin Cash; you might find insights by checking out the community speculation on Bitcoin Cash Price Prediction 2025 Reddit.

Ultimately, however, Bitcoin’s 2025 value will depend on its own market dynamics and overall cryptocurrency market health.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key aspect to consider is the potential price movement within that year, and for a glimpse into a specific month, you might find the predictions useful by checking out this resource on Bitcoin Price Prediction August 2025. Ultimately, the Bitcoin price in 2025 will depend on a complex interplay of market forces and technological developments.

Predicting the Bitcoin price in 2025 is inherently speculative, relying on numerous factors like adoption rates and regulatory changes. For diverse perspectives and community discussions on this very topic, you might find it helpful to check out the ongoing conversation on Bitcoin Price 2025 Reddit. Ultimately, the Bitcoin price in 2025 will depend on the interplay of technological advancements and market sentiment.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. Understanding potential catalysts requires considering related projects, such as analyzing the projected growth of altcoins. For instance, a helpful resource for assessing potential market shifts is the Bitcoin Hunter Price Prediction 2025 analysis, which can provide insight into broader market trends. Ultimately, the Bitcoin price in 2025 will depend on a complex interplay of technological advancements, regulatory changes, and overall market sentiment.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by numerous factors. To gain a better understanding of potential trajectories, exploring resources that focus on forecasting is crucial. For example, you can check out the detailed analysis provided by Btc Price Prediction Today 2025 which offers insights into current market trends and their potential impact on the Bitcoin price in 2025.

Ultimately, the actual Bitcoin price in 2025 will depend on the interplay of technological advancements, regulatory changes, and overall market sentiment.