Bitcoin Adoption and Market Sentiment in 2025

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and extrapolating likely developments, we can formulate a reasonable picture of Bitcoin adoption and market sentiment in 2025. Several factors, including institutional investment, regulatory clarity, and public perception, will play crucial roles in shaping Bitcoin’s trajectory.

The projected growth of Bitcoin adoption hinges on a confluence of factors. Increased institutional and individual investor participation will be key drivers. Public perception, shaped by media coverage and real-world applications, will significantly influence market sentiment.

Projected Growth of Bitcoin Adoption

Institutional adoption is expected to accelerate. Large financial institutions are increasingly recognizing Bitcoin’s potential as a store of value and diversifier within their portfolios. MicroStrategy’s significant Bitcoin holdings serve as a prime example of this trend. Simultaneously, individual investor adoption will likely continue to grow, driven by factors such as increasing financial literacy regarding cryptocurrencies and the potential for high returns. However, the rate of adoption will depend on factors like regulatory frameworks and the overall macroeconomic environment. A more stable regulatory landscape could significantly boost investor confidence and accelerate adoption rates. Conversely, negative economic conditions might lead to decreased investment in riskier assets, including Bitcoin.

Impact of Widespread Institutional Adoption on Bitcoin’s Price

Widespread institutional adoption could significantly impact Bitcoin’s price. Large-scale purchases by institutional investors would increase demand, potentially driving the price upwards. This is due to the sheer volume of capital these institutions can deploy. However, the price impact isn’t solely dependent on volume. The timing and strategic allocation of institutional investments also matter significantly. A sudden influx of institutional buying could trigger a rapid price surge, while a more gradual approach might lead to a more stable, albeit still upward, price trend. The overall market sentiment and macroeconomic conditions will also play a crucial role in moderating the price impact.

Influence of Public Perception and Media Coverage on Market Sentiment

Public perception and media coverage profoundly influence market sentiment towards Bitcoin. Positive media coverage, highlighting successful Bitcoin applications or its potential as a hedge against inflation, can boost investor confidence and drive price increases. Conversely, negative news, such as regulatory crackdowns or security breaches, can trigger sell-offs and negatively impact the price. The narrative surrounding Bitcoin—whether it’s presented as a revolutionary technology or a speculative bubble—will significantly shape public perception and subsequently influence market sentiment. A shift towards more balanced and informative reporting could lead to a more mature and less volatile market.

Potential for Bitcoin to Become a Mainstream Form of Payment

The potential for Bitcoin to become a mainstream form of payment depends on several factors, including scalability, transaction fees, and regulatory frameworks. While Bitcoin’s current transaction speeds and fees may not be ideal for everyday transactions, ongoing technological developments, such as the Lightning Network, aim to address these limitations. Widespread merchant adoption is also crucial. Increased acceptance by major retailers and businesses would significantly increase Bitcoin’s usability as a payment method. However, regulatory uncertainty and potential government restrictions could hinder the adoption of Bitcoin as a mainstream payment option. The degree of regulatory clarity and the establishment of clear guidelines will play a crucial role in determining Bitcoin’s future as a widespread payment system.

Technological Developments and Their Impact: Bitcoin Price In 2025 Year

Technological advancements will significantly shape Bitcoin’s trajectory in 2025 and beyond. Factors such as network scalability, energy consumption, and protocol upgrades will all play crucial roles in determining Bitcoin’s price and overall utility. Understanding these developments is key to forecasting the cryptocurrency’s future.

The Lightning Network’s Influence on Scalability and Transaction Fees

The Lightning Network is a layer-2 scaling solution designed to address Bitcoin’s limitations in handling a high volume of transactions. By enabling off-chain transactions, it aims to significantly reduce transaction fees and increase transaction speed. Widespread adoption of the Lightning Network could lead to a more user-friendly experience, potentially boosting Bitcoin’s appeal to a broader range of users and businesses. This increased usability could, in turn, drive demand and positively impact the price. For example, if businesses widely adopt Lightning for microtransactions, the demand for Bitcoin could surge.

Bitcoin Mining and Energy Consumption

Bitcoin mining, the process of verifying and adding transactions to the blockchain, requires significant computational power and consequently, substantial energy consumption. This has drawn criticism and concerns about environmental impact. However, the transition towards renewable energy sources for mining operations and advancements in mining efficiency could mitigate these concerns. The overall energy consumption of Bitcoin mining, along with regulatory pressures regarding environmental sustainability, will influence public perception and potentially impact Bitcoin’s price. A shift towards greener mining practices could positively affect investor sentiment and attract environmentally conscious investors.

Potential Upgrades or Forks to the Bitcoin Protocol

Upgrades and forks to the Bitcoin protocol, while potentially enhancing its functionality or addressing specific limitations, can also introduce uncertainty and volatility into the market. A successful upgrade that improves scalability or security could lead to a positive price reaction. Conversely, a contentious hard fork could split the community and create a new cryptocurrency, potentially diluting the value of the original Bitcoin. The implementation of Taproot, a significant upgrade improving transaction privacy and efficiency, serves as an example of how protocol changes can influence market perception. The successful integration of Taproot was generally met with positive market sentiment.

Comparison of Potential Technological Advancements

The following table compares various potential technological advancements for Bitcoin, highlighting their advantages and disadvantages:

| Technological Advancement | Advantages | Disadvantages | Potential Impact on Bitcoin Price |

|---|---|---|---|

| Lightning Network | Increased scalability, lower transaction fees, faster transactions | Complexity of implementation, potential security risks if not properly secured | Potentially positive, increased usability and adoption could drive demand |

| Improved Mining Efficiency | Reduced energy consumption, lower mining costs | Potential for centralization if a few large miners dominate | Potentially positive, reduced environmental concerns could improve investor sentiment |

| Protocol Upgrades (e.g., Taproot) | Enhanced security, improved functionality, increased efficiency | Potential for unforeseen bugs or vulnerabilities, community disagreements during implementation | Potentially positive or negative depending on the success and acceptance of the upgrade |

| Layer-2 Solutions (beyond Lightning) | Further scalability improvements, potential for specialized functionalities | Increased complexity, potential for interoperability issues | Potentially positive, increased scalability could lead to wider adoption and higher demand |

Risk Factors and Potential Challenges

Investing in Bitcoin, while potentially lucrative, carries inherent risks. Understanding these risks is crucial for making informed investment decisions and mitigating potential losses. The volatile nature of the cryptocurrency market, coupled with security vulnerabilities and regulatory uncertainty, presents significant challenges for Bitcoin investors.

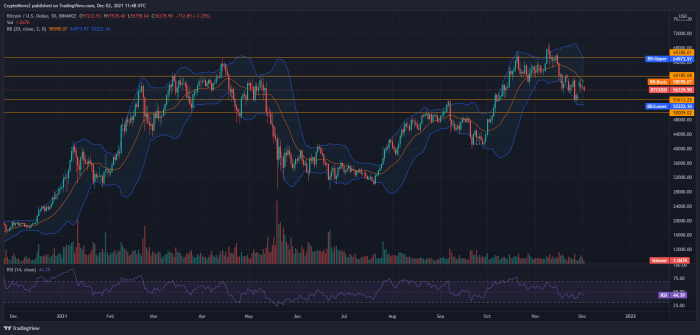

Bitcoin’s price is notoriously volatile, subject to sharp and unpredictable swings. These fluctuations can be driven by a variety of factors, including market sentiment, regulatory announcements, technological developments, and macroeconomic conditions. A sudden drop in price can result in substantial losses for investors, particularly those who have leveraged their investments.

Volatility and Price Swings

The inherent volatility of Bitcoin stems from its decentralized nature and relatively small market capitalization compared to traditional asset classes. News events, both positive and negative, can significantly impact investor confidence and trigger dramatic price movements. For example, Elon Musk’s tweets have historically shown the power of a single influential figure to sway market sentiment and cause significant price fluctuations. Similarly, regulatory crackdowns in specific countries have led to temporary price drops, illustrating the sensitivity of Bitcoin’s price to external factors. Investors should be prepared for significant price swings and manage their risk accordingly, perhaps by diversifying their portfolio and avoiding over-leveraging.

Security Risks and Hacking Incidents

Bitcoin’s decentralized nature, while a strength in terms of censorship resistance, also presents security challenges. Exchanges and individual wallets are vulnerable to hacking and theft. A major security breach, such as the Mt. Gox exchange hack in 2014, which resulted in the loss of hundreds of thousands of Bitcoins, can severely impact investor confidence and trigger a significant price drop. The lessons learned from such incidents highlight the importance of robust security measures, including strong passwords, two-factor authentication, and the use of reputable exchanges and wallets. Furthermore, the potential for quantum computing to break current cryptographic algorithms poses a long-term security risk that needs to be considered.

Government Regulation and Bans

Government regulation and potential bans on cryptocurrencies represent another significant risk factor. Governments worldwide are grappling with how to regulate cryptocurrencies, with approaches ranging from outright bans to more permissive regulatory frameworks. Changes in regulatory landscape can significantly impact the price of Bitcoin. China’s ban on cryptocurrency trading in 2021, for instance, led to a noticeable decline in Bitcoin’s price. Uncertainty surrounding future regulations creates volatility and makes it difficult to predict the long-term trajectory of Bitcoin’s price. Investors need to monitor regulatory developments closely and understand the potential impact on their investments.

Past Events and Lessons Learned

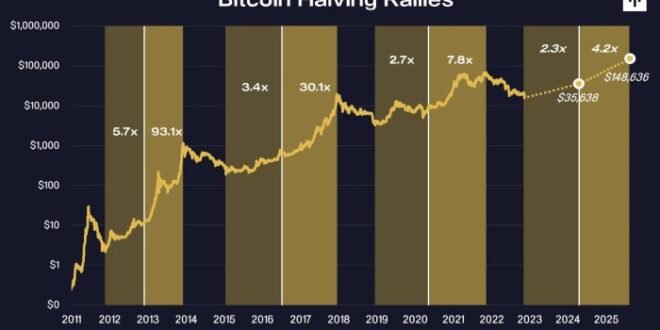

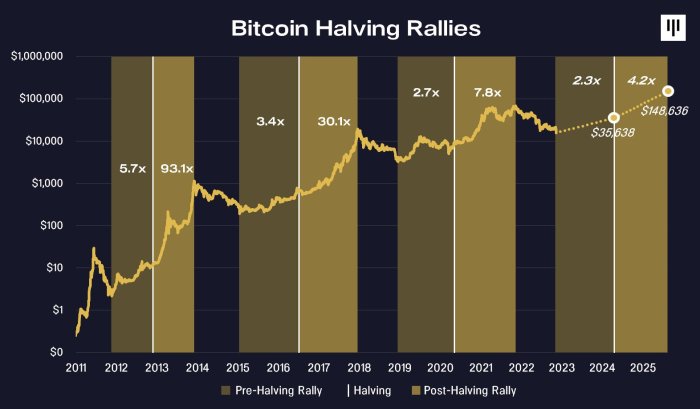

Several past events have significantly impacted Bitcoin’s price, offering valuable lessons for investors. The 2017-2018 bubble, followed by a sharp correction, highlighted the speculative nature of the market and the risks associated with rapid price increases. The 2020-2021 bull run, driven by increased institutional adoption and macroeconomic factors, demonstrated the potential for significant price appreciation, but also the vulnerability to market corrections. Analyzing these events reveals the importance of understanding market cycles, managing risk effectively, and avoiding emotional decision-making. The impact of these events underscores the need for a long-term perspective and a thorough understanding of the underlying technology and market dynamics.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset class, requires careful consideration of your risk tolerance and financial goals. The cryptocurrency market is highly volatile, meaning prices can fluctuate dramatically in short periods. Understanding your risk appetite and aligning your investment strategy accordingly is paramount to successful participation in this market. This section Artikels several strategies and factors to consider before investing in Bitcoin.

Risk Tolerance Assessment

Before allocating any capital to Bitcoin, it’s crucial to assess your personal risk tolerance. This involves understanding how comfortable you are with the potential for significant losses. High-risk tolerance implies a willingness to accept substantial price swings in exchange for the potential for higher returns. Conversely, a low-risk tolerance suggests a preference for preserving capital, even if it means foregoing potentially higher returns. Consider your overall financial situation, including existing investments and emergency funds, before making any decisions. A thorough self-assessment, or consultation with a financial advisor, can help determine your appropriate risk profile for Bitcoin investment. For example, an investor with a high-risk tolerance and a longer time horizon might be comfortable with a larger Bitcoin allocation, while someone with a low-risk tolerance might prefer a smaller, more conservative position.

Bitcoin Investment Strategies

Several strategies can be employed when investing in Bitcoin, each carrying its own set of risks and rewards.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy mitigates the risk of investing a lump sum at a market peak. For example, investing $100 per week into Bitcoin, regardless of its price, reduces the impact of short-term price fluctuations.

- Buy and Hold (Long-Term Investing): This strategy involves purchasing Bitcoin and holding it for an extended period, typically years, regardless of short-term price movements. This strategy relies on the belief that Bitcoin’s long-term value will appreciate. This approach requires a high risk tolerance, as short-term losses are inevitable. However, historically, long-term holders have seen significant returns.

Diversification in Cryptocurrency Portfolios

Diversification is crucial for mitigating risk within a cryptocurrency portfolio. Investing solely in Bitcoin exposes you to the specific risks associated with that cryptocurrency. Diversification involves spreading your investment across multiple cryptocurrencies, potentially including altcoins, to reduce the impact of any single asset’s underperformance. For example, an investor might allocate a portion of their portfolio to Bitcoin, another portion to Ethereum, and perhaps a smaller allocation to other promising cryptocurrencies, effectively reducing the overall portfolio risk.

Comparison of Bitcoin Investment Strategies, Bitcoin Price In 2025 Year

The table below compares different Bitcoin investment strategies:

| Strategy | Risk | Reward Potential | Time Horizon |

|---|---|---|---|

| Dollar-Cost Averaging | Moderate | Moderate | Long-term |

| Buy and Hold | High | High | Long-term |

| Short-Term Trading | Very High | Very High (or Very Low) | Short-term |

Note: Short-term trading involves attempting to profit from short-term price fluctuations and carries extremely high risk. It is generally not recommended for inexperienced investors.

Frequently Asked Questions (FAQ)

Predicting the future price of Bitcoin is inherently speculative, but understanding the factors influencing its value allows for a more informed assessment of potential scenarios. This section addresses common questions surrounding Bitcoin’s price and investment viability in 2025.

Bitcoin’s Most Likely Price in 2025

Pinpointing a precise Bitcoin price for 2025 is impossible. Numerous variables, including regulatory changes, technological advancements, and overall market sentiment, exert significant influence. While some analysts offer price predictions, these should be viewed with caution. Historical price volatility demonstrates the unpredictability of the cryptocurrency market. For example, Bitcoin’s price experienced significant fluctuations in 2021 and 2022, showcasing its susceptibility to market forces. A more responsible approach involves considering a range of potential outcomes, based on various scenarios and market conditions, rather than relying on a single, precise figure.

Bitcoin as a Long-Term Investment

Bitcoin’s long-term investment potential presents both advantages and disadvantages. On the one hand, its decentralized nature, limited supply, and growing adoption by institutions suggest potential for long-term growth. The scarcity of Bitcoin, with a maximum supply of 21 million coins, could drive its value upwards over time as demand increases. Conversely, the high volatility, regulatory uncertainty, and potential for technological disruption pose significant risks. The cryptocurrency market is notoriously susceptible to sharp price swings, and regulatory changes could drastically impact Bitcoin’s value. Therefore, a long-term investment strategy should account for these inherent risks and potential downsides.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. Price volatility is a primary concern, with significant price swings occurring frequently. Regulatory uncertainty represents another major risk; governments worldwide are still developing frameworks for cryptocurrencies, and changes in regulation could negatively impact Bitcoin’s value or even lead to bans. Security risks, including the potential for hacking and theft from exchanges or personal wallets, also exist. Furthermore, the relatively nascent nature of the cryptocurrency market introduces additional uncertainties, such as the potential for unforeseen technological disruptions or the emergence of competing cryptocurrencies. Investors must thoroughly understand these risks before allocating capital to Bitcoin.

Factors Affecting Bitcoin’s Price in 2025

Several key factors will likely influence Bitcoin’s price in 2025. These include widespread adoption by institutions and mainstream users, regulatory developments and their impact on accessibility and trading, technological advancements such as the scaling solutions improving transaction speeds and reducing fees, and overall macroeconomic conditions, including inflation and global economic stability. The interplay of these factors will shape the market environment and ultimately determine Bitcoin’s price trajectory. For example, increased institutional adoption could drive price increases, while negative regulatory changes could lead to price declines. The level of public confidence and market sentiment will also play a significant role.

Bitcoin Price In 2025 Year – Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors including technological advancements and global economic shifts. For those interested in a specific regional perspective, particularly concerning the Indian Rupee, a useful resource is this prediction: Bitcoin Coin Price Prediction 2025 In Inr. Ultimately, the Bitcoin price in 2025 remains speculative, but such analyses provide valuable insight into potential market trajectories.

Speculating on the Bitcoin price in 2025 is a popular pastime, with many factors influencing potential outcomes. To gain a clearer understanding of the daily fluctuations that might shape the yearly average, it’s helpful to consult resources that provide detailed predictions, such as the comprehensive analysis found at Bitcoin Price Prediction Daily 2025. Ultimately, the Bitcoin price in 2025 remains uncertain, but daily predictions offer valuable insights into potential trajectories.

Predicting the Bitcoin price in 2025 is a complex task, influenced by numerous factors. To gain insights, many analysts utilize sophisticated AI models; for example, you can explore predictions from a resource like Bitcoin Price Prediction 2025 Ai which offers a comprehensive look at potential price movements. Ultimately, the Bitcoin price in 2025 remains speculative, but such resources provide valuable data for informed consideration.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. To gain a clearer insight into potential values towards the year’s end, it’s helpful to consult specific forecasts like the one offered at Btc Price Prediction December 2025. Understanding December’s predicted price can offer a valuable data point when considering the overall Bitcoin price throughout 2025.

Predicting the Bitcoin price in 2025 is a complex endeavor, with numerous factors influencing its potential trajectory. For a comprehensive perspective on potential future values, it’s helpful to consult reputable sources like this analysis from Forbes: Btc 2025 Price Prediction Forbes. Ultimately, the Bitcoin price in 2025 will depend on a multitude of economic and technological developments, making any prediction inherently uncertain.