Bitcoin Price Predictions for 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, as numerous interconnected factors influence its value. However, by analyzing historical trends, considering current market dynamics, and factoring in potential future developments, we can construct plausible price scenarios. These scenarios are not guarantees but rather informed estimations based on available data and reasonable assumptions.

Price Prediction Scenarios for Bitcoin in 2025

Several models exist for predicting Bitcoin’s price, each with its strengths and weaknesses. These models often incorporate factors such as adoption rates, regulatory landscapes, technological innovations, and macroeconomic conditions. We will examine a range of potential outcomes, highlighting the underlying assumptions of each scenario.

Methodology and Data Sources

Our analysis draws upon various data sources, including historical Bitcoin price data from reputable exchanges (like Coinbase and Binance), on-chain metrics (such as transaction volume and network hash rate), and macroeconomic indicators (such as inflation rates and interest rates). We employ both quantitative methods, such as time series analysis and econometric modeling, and qualitative assessments, incorporating expert opinions and market sentiment analysis. For instance, time series analysis helps identify patterns and trends in historical price data, while econometric models attempt to quantify the relationship between Bitcoin’s price and various influencing factors. Qualitative assessments, however, consider less quantifiable elements like regulatory changes or major technological breakthroughs. The limitations of these methods should be acknowledged; econometric models, for example, rely on assumptions about the relationships between variables which may not always hold true.

Comparison of Prediction Models

Different models yield different results. For example, a purely technical analysis model, relying solely on historical price charts and indicators, might suggest a price range based on identified support and resistance levels. Conversely, a fundamental analysis model, focusing on factors like adoption rates and market capitalization, could project a price based on valuations relative to other asset classes. The strengths of technical analysis lie in its simplicity and focus on price action, while its weakness is its limited consideration of fundamental factors. Fundamental analysis, while offering a broader perspective, is prone to subjective interpretations and difficulty in accurately predicting future adoption rates. A hybrid approach, combining both technical and fundamental analysis, often provides a more balanced and nuanced prediction.

Price Scenarios and Likelihoods

The following table presents three potential price scenarios for Bitcoin in 2025, along with their estimated likelihoods. These are illustrative examples and should not be taken as financial advice.

| Scenario | Bitcoin Price (USD) | Likelihood | Rationale |

|---|---|---|---|

| Bullish | $150,000 – $200,000 | 25% | Widespread institutional adoption, positive regulatory developments, and significant technological advancements. This scenario mirrors the rapid growth seen in previous bull markets, though the likelihood is tempered by potential regulatory headwinds. An example of a positive development could be the widespread acceptance of Bitcoin as a legitimate store of value by major financial institutions. |

| Neutral | $50,000 – $100,000 | 50% | Moderate adoption rates, a stable regulatory environment, and continued technological development. This scenario reflects a more conservative outlook, assuming a continuation of current market trends without major disruptions or breakthroughs. For example, this could involve steady growth driven by increasing retail investor participation and the continued development of Bitcoin’s underlying technology. |

| Bearish | $20,000 – $40,000 | 25% | Slow adoption rates, negative regulatory changes, or significant technological setbacks. This scenario considers potential risks, such as increased regulatory scrutiny leading to decreased investor confidence or a major security breach impacting the Bitcoin network. A real-world example would be a major regulatory crackdown that significantly restricts Bitcoin trading. |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic conditions, technological advancements, regulatory shifts, and market sentiment. While no one can definitively state the price in 2025, understanding these key drivers offers valuable insight into potential price trajectories.

Macroeconomic Factors

Macroeconomic factors exert significant influence on Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can make alternative investments more attractive, potentially drawing capital away from Bitcoin and suppressing its price. Global economic growth, or a recession, will also play a crucial role; periods of uncertainty often see investors flocking to safe-haven assets, which could include Bitcoin, while strong economic growth might shift attention to more traditional investments. The interplay between inflation, interest rates, and global economic health will significantly shape Bitcoin’s price environment in 2025. For instance, the 2022 inflation surge saw increased Bitcoin investment, while subsequent interest rate hikes by central banks impacted its value negatively.

Technological Developments

Technological advancements within the Bitcoin ecosystem will be key in determining its future price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, potentially making Bitcoin more user-friendly and attractive for everyday transactions. Improvements in mining efficiency, through advancements in hardware and energy sources, could lower the cost of mining, potentially influencing the overall supply dynamics and price. For example, the widespread adoption of more efficient ASIC miners has historically impacted Bitcoin’s mining difficulty and profitability, indirectly influencing its price. The success and adoption of these technological innovations are therefore directly tied to Bitcoin’s future price potential.

Regulatory Landscape Changes, Bitcoin Price In 2025 Year

The regulatory environment surrounding Bitcoin will significantly shape its price. Increased clarity and adoption of crypto regulations in major economies could boost investor confidence, potentially driving price appreciation. Conversely, overly restrictive or unclear regulations could stifle adoption and negatively impact the price. Government policies, such as outright bans or taxes on cryptocurrency transactions, will also influence the market. The contrasting regulatory approaches seen in countries like El Salvador (Bitcoin as legal tender) and China (Bitcoin ban) demonstrate the potential impact of government policy on Bitcoin’s price. The overall regulatory landscape in 2025 will be a crucial factor.

Institutional Adoption and Mainstream Media Coverage

The level of institutional adoption and mainstream media coverage will play a pivotal role in Bitcoin’s price trajectory. Increased investment from large financial institutions, such as hedge funds and asset managers, signals a growing level of acceptance and legitimacy, typically leading to price increases. Positive media coverage, presenting Bitcoin in a favorable light, can increase public awareness and drive demand, whereas negative coverage can foster uncertainty and price volatility. The growing number of publicly traded companies holding Bitcoin on their balance sheets, coupled with increased media attention (both positive and negative), has already demonstrated this dynamic impact on Bitcoin’s price.

Bitcoin’s Technological Advancements and Their Price Implications

Bitcoin’s price is not solely determined by market speculation; technological advancements play a crucial role in shaping its long-term value and adoption. Improvements in scalability, security, and efficiency directly impact transaction costs, user experience, and overall network stability, all of which influence investor confidence and, consequently, price.

The Lightning Network and Layer-2 Solutions

The Lightning Network is a layer-2 scaling solution designed to alleviate Bitcoin’s on-chain transaction limitations. By enabling off-chain micropayments, it significantly reduces transaction fees and speeds up processing times. This increased efficiency could lead to broader adoption, particularly for everyday transactions, potentially driving up demand and, subsequently, the price of Bitcoin. Similar layer-2 solutions, such as the Liquid Network, aim to achieve similar results, further enhancing Bitcoin’s scalability and usability. The success of these solutions is directly linked to the ease of use and widespread adoption by merchants and users. A scenario where widespread adoption occurs would likely result in increased demand for Bitcoin, thus increasing its price.

Protocol Upgrades and Their Impact

Potential upgrades to Bitcoin’s core protocol, such as improvements to privacy features (e.g., Taproot), enhanced security measures, or the introduction of new functionalities, could significantly influence its long-term value. These upgrades can enhance the overall robustness and attractiveness of the Bitcoin network, making it more appealing to both individual investors and institutional players. For example, the Taproot upgrade improved transaction efficiency and privacy, potentially increasing the network’s capacity to handle a larger number of transactions. This improved efficiency and security could lead to a rise in Bitcoin’s price as it becomes more viable for a wider range of applications.

Mining Efficiency and its Relation to Price and Energy Consumption

Increased mining efficiency, achieved through advancements in hardware and mining techniques, directly affects Bitcoin’s price stability and energy consumption. More efficient mining reduces the cost of securing the network, potentially contributing to price stability by mitigating the impact of large-scale sell-offs by miners. However, it’s crucial to note that increased efficiency can also lead to a higher hash rate, potentially making it more difficult for smaller miners to compete. This could lead to centralization concerns, which in turn might negatively impact price. Furthermore, the relationship between Bitcoin’s price and its energy consumption is complex. While more efficient mining reduces energy consumption per transaction, a higher Bitcoin price can incentivize more mining activity, potentially offsetting some of the gains in efficiency.

Technological Advancements and Their Predicted Effects on Bitcoin’s Price

| Technological Advancement | Predicted Effect on Bitcoin’s Price | Rationale |

|---|---|---|

| Lightning Network Adoption | Positive (Increase) | Increased scalability and usability lead to higher demand. |

| Protocol Upgrades (e.g., Taproot) | Positive (Increase) | Enhanced security and efficiency increase network attractiveness. |

| Improved Mining Efficiency | Potentially Mixed | Reduced costs can stabilize price, but centralization risks exist. |

| Increased Institutional Adoption | Positive (Increase) | Greater institutional involvement brings more capital and legitimacy. |

Risks and Uncertainties Affecting Bitcoin’s Future Price: Bitcoin Price In 2025 Year

Predicting the future price of Bitcoin is inherently challenging due to the numerous factors that can influence its value. While technological advancements and increasing adoption contribute to potential price increases, several significant risks and uncertainties could negatively impact Bitcoin’s trajectory. Understanding these risks is crucial for any investor considering exposure to the cryptocurrency market.

Market Volatility

Bitcoin’s price is known for its extreme volatility. Sharp price swings, both upward and downward, are common. These fluctuations are driven by a combination of factors, including news events (regulatory announcements, technological breakthroughs, or macroeconomic shifts), investor sentiment, and trading activity. For example, the 2021 bull run saw Bitcoin reach record highs, followed by a significant correction in 2022. This volatility presents significant risk for investors, as substantial losses can occur quickly. The lack of inherent value backing Bitcoin, unlike fiat currencies or precious metals, further amplifies this risk. Sudden shifts in market sentiment can lead to drastic price drops, potentially impacting the long-term viability of Bitcoin as an investment.

Security Breaches and Hacks

The decentralized nature of Bitcoin doesn’t eliminate the risk of security breaches. Exchanges, wallets, and even individual users remain vulnerable to hacking and theft. High-profile hacks in the past have resulted in significant losses for investors, and the potential for future breaches poses a considerable threat to Bitcoin’s price. A major security breach could erode investor confidence, leading to a sell-off and a subsequent price decline. Furthermore, the complexity of Bitcoin’s underlying technology can make it difficult to recover stolen funds, adding to the risk. The potential for large-scale theft remains a considerable uncertainty that could affect the future price of Bitcoin.

Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies, including Bitcoin. Regulatory uncertainty creates significant risk. Different jurisdictions may adopt varying approaches, ranging from outright bans to comprehensive regulatory frameworks. Unclear regulatory landscapes can lead to investor hesitancy and limit the adoption of Bitcoin. Changes in regulations, even seemingly minor ones, can significantly impact Bitcoin’s price. For instance, stricter regulations could limit access to Bitcoin exchanges or increase compliance costs, potentially reducing trading volume and price. Conversely, favorable regulatory developments could boost investor confidence and drive price appreciation. This unpredictable regulatory environment contributes to the overall uncertainty surrounding Bitcoin’s future.

Competition from Other Cryptocurrencies

Bitcoin is not the only cryptocurrency in the market. Numerous altcoins offer different functionalities, technologies, and potential use cases. The emergence of successful competitors could erode Bitcoin’s market dominance, potentially impacting its price. Altcoins may offer faster transaction speeds, lower fees, or more advanced smart contract capabilities. This competition could lead to a shift in investor preference away from Bitcoin and towards alternative cryptocurrencies. The rise of Ethereum, for example, highlights the potential for other cryptocurrencies to gain significant market share, thereby affecting Bitcoin’s overall price.

Environmental Concerns

Bitcoin mining is an energy-intensive process. The environmental impact of Bitcoin mining has become a growing concern, leading to calls for more sustainable mining practices. Increased scrutiny of Bitcoin’s environmental footprint could lead to regulatory pressure, potentially impacting its price. Governments might introduce stricter regulations on energy consumption for mining, increasing operating costs for miners and potentially leading to a reduction in mining activity. Negative publicity surrounding Bitcoin’s environmental impact could also erode public support and investor confidence, impacting its long-term viability and price. The shift towards more sustainable mining practices, such as the increased use of renewable energy sources, is crucial to mitigate these risks.

Investment Strategies and Considerations

Investing in Bitcoin in 2025, like any asset class, requires a thoughtful approach tailored to individual risk tolerance and financial goals. Understanding different investment strategies, the importance of diversification, tax implications, and secure storage is crucial for maximizing potential returns while mitigating risks.

Bitcoin Investment Strategies Based on Risk Tolerance

The optimal Bitcoin investment strategy depends heavily on an investor’s risk profile. A conservative investor might prefer a dollar-cost averaging (DCA) approach, gradually accumulating Bitcoin over time regardless of price fluctuations, minimizing the impact of volatility. More aggressive investors might consider lump-sum investments, capitalizing on perceived market dips, accepting higher risk for potentially greater rewards. A balanced approach could involve a combination of both strategies, allocating a portion of funds to DCA and another to strategic lump-sum purchases. For example, an investor with a high-risk tolerance might allocate 70% of their Bitcoin investment budget to lump-sum purchases at perceived market lows, while the remaining 30% is used for DCA. Conversely, a conservative investor might allocate 90% to DCA and 10% to opportunistic lump-sum investments.

Diversification in a Bitcoin Portfolio

Diversification is a cornerstone of sound investment management. While Bitcoin offers potential for high returns, it’s also highly volatile. A diversified portfolio includes other asset classes, such as stocks, bonds, and real estate, to reduce overall portfolio risk. The specific allocation will vary based on individual risk tolerance and financial goals. For example, a balanced portfolio might allocate 5% to 10% to Bitcoin, with the remainder spread across various asset classes. This approach reduces the impact of potential Bitcoin price drops on the overall portfolio value.

Tax Implications of Bitcoin Investments

The tax implications of Bitcoin investments vary significantly depending on jurisdiction and individual circumstances. Profits from selling Bitcoin are generally considered capital gains, taxed at rates dependent on the holding period (short-term or long-term). Tax laws surrounding Bitcoin are constantly evolving, so consulting a qualified tax advisor is crucial to ensure compliance and optimize tax efficiency. For instance, in the US, short-term capital gains (holding period less than one year) are taxed at the investor’s ordinary income tax rate, while long-term capital gains (holding period over one year) have lower tax rates. Accurate record-keeping of all Bitcoin transactions is essential for accurate tax reporting.

Safe Storage and Management of Bitcoin Investments

Securing Bitcoin investments is paramount. Hardware wallets, physical devices designed to store private keys offline, offer the highest level of security against hacking and theft. Software wallets, while more convenient, carry a higher risk of loss due to malware or online vulnerabilities. Choosing a reputable exchange for buying and selling Bitcoin is also important, considering factors such as security measures, regulatory compliance, and user reviews. It’s crucial to diversify storage methods and not keep all Bitcoin in a single location or exchange. For example, an investor might use a combination of a hardware wallet for long-term holdings and a software wallet for short-term trading, further diversifying risk.

Frequently Asked Questions (FAQs) about Bitcoin’s Price in 2025

This section addresses common questions regarding Bitcoin’s potential price trajectory in 2025, considering the various factors discussed previously, including technological advancements, regulatory landscapes, and market sentiment. While precise prediction is impossible, we can analyze the likelihood of different scenarios.

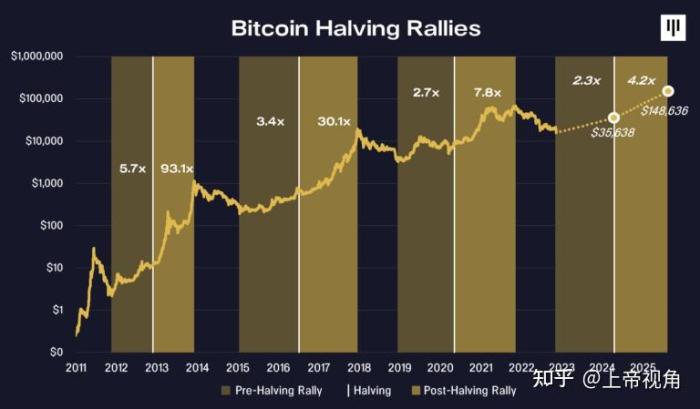

Bitcoin Reaching $100,000 by 2025

Reaching a price of $100,000 by 2025 is a significant target, requiring substantial growth from current levels. This scenario is plausible, but hinges on several factors aligning favorably. Continued adoption by institutional investors, widespread regulatory clarity promoting mainstream acceptance, and sustained technological innovation driving increased utility could all contribute to such a surge. However, significant hurdles remain, including potential regulatory crackdowns, market corrections, and the inherent volatility of cryptocurrencies. For instance, if Bitcoin’s market capitalization were to reach a level comparable to that of gold, a price exceeding $100,000 would be within the realm of possibility. However, this assumes a significant increase in market capitalization, which is not guaranteed. Conversely, negative news or a major market downturn could easily derail such a bullish prediction.

Biggest Risks to Bitcoin’s Price in 2025

Several key risks could negatively impact Bitcoin’s price in 2025. Increased regulatory scrutiny from governments worldwide, potentially leading to stricter regulations or outright bans, poses a significant threat. Furthermore, the emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin. Cybersecurity vulnerabilities and the risk of large-scale hacks remain a constant concern, impacting investor confidence. Finally, macroeconomic factors, such as global economic downturns or inflation, can significantly influence the overall cryptocurrency market, including Bitcoin’s price. The 2022 crypto winter, triggered partly by macroeconomic instability, serves as a stark reminder of this vulnerability.

Bitcoin as an Investment in the Current Market

Whether or not investing in Bitcoin is currently advisable depends on individual risk tolerance and investment goals. While the potential for significant returns exists, the high volatility inherent in Bitcoin necessitates a cautious approach. Current market conditions should be carefully assessed, considering factors like overall market sentiment and recent price trends. It is crucial to conduct thorough research and understand the risks involved before committing any capital. Diversification across different asset classes is recommended to mitigate risk. Remember that past performance is not indicative of future results.

Protecting Bitcoin Investments from Volatility

Several strategies can help mitigate the risks associated with Bitcoin’s price volatility. Dollar-cost averaging (DCA), a strategy involving regular investments of a fixed amount regardless of price fluctuations, can help reduce the impact of market swings. Diversification is crucial; spreading investments across multiple asset classes, including traditional investments like stocks and bonds, can reduce overall portfolio risk. Holding Bitcoin in a secure, cold storage wallet minimizes the risk of theft or loss due to exchange hacks or security breaches. Finally, maintaining a long-term investment horizon can help weather short-term price fluctuations. For example, investors who held Bitcoin through the 2018 and 2022 bear markets ultimately saw significant gains once the market recovered.

Bitcoin Price In 2025 Year – Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. Understanding the broader cryptocurrency market is key, and a significant part of that involves considering alternative cryptocurrencies like Bitcoin Cash. For insights into one such alternative’s potential, check out the projected values at Bitcoin Cash Future Price 2025. Ultimately, this analysis can inform a more comprehensive perspective on the overall cryptocurrency landscape and its potential impact on Bitcoin’s 2025 price.

Predicting the Bitcoin price in 2025 is a complex task, influenced by numerous factors. To gain insights, many turn to AI-driven predictions, and a useful resource for this is the Bitcoin Price Prediction 2025 Ai website. Analyzing these predictions alongside broader market trends can offer a more comprehensive understanding of what the Bitcoin price in 2025 might look like.

Ultimately, though, it remains speculative.

Predicting the Bitcoin price in 2025 is a complex task, influenced by numerous factors. To gain insights, many turn to AI-driven predictions, and a useful resource for this is the Bitcoin Price Prediction 2025 Ai website. Analyzing these predictions alongside broader market trends can offer a more comprehensive understanding of what the Bitcoin price in 2025 might look like.

Ultimately, though, it remains speculative.

Predicting the Bitcoin price in 2025 is a complex task, influenced by numerous factors. To gain insights, many turn to AI-driven predictions, and a useful resource for this is the Bitcoin Price Prediction 2025 Ai website. Analyzing these predictions alongside broader market trends can offer a more comprehensive understanding of what the Bitcoin price in 2025 might look like.

Ultimately, though, it remains speculative.

Predicting the Bitcoin price in 2025 is a complex task, influenced by numerous factors. To gain insights, many turn to AI-driven predictions, and a useful resource for this is the Bitcoin Price Prediction 2025 Ai website. Analyzing these predictions alongside broader market trends can offer a more comprehensive understanding of what the Bitcoin price in 2025 might look like.

Ultimately, though, it remains speculative.