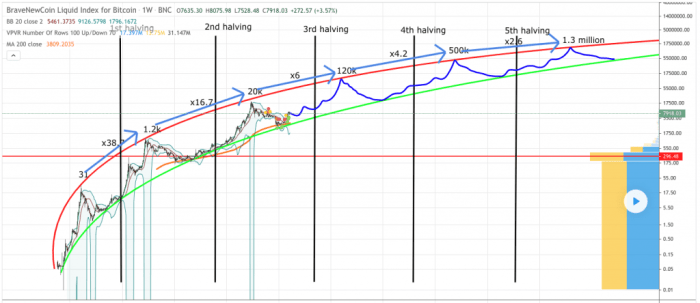

Bitcoin Price Prediction in 2030: Bitcoin Price In 2030

Bitcoin, first introduced in 2009, has experienced a turbulent journey marked by periods of explosive growth and significant price corrections. Its decentralized nature, underpinned by blockchain technology, has attracted both fervent supporters and skeptical critics. The cryptocurrency’s history is characterized by immense volatility, with price swings ranging from dramatic rallies to precipitous drops, making accurate prediction a significant challenge.

Bitcoin’s price is influenced by a complex interplay of factors. Technological advancements, such as the development of the Lightning Network aiming to improve transaction speed and scalability, can positively impact its adoption and, consequently, its price. Conversely, regulatory uncertainty and government crackdowns in various jurisdictions have historically led to price declines. Market sentiment, driven by news events, media coverage, and the overall economic climate, plays a crucial role in shaping investor behavior and price fluctuations. For example, Elon Musk’s tweets have demonstrably influenced Bitcoin’s price in the past.

Factors Influencing Bitcoin’s Price

The inherent volatility of Bitcoin makes long-term price forecasting exceptionally difficult. Numerous variables, many of which are unpredictable, contribute to price movements. Economic conditions, such as inflation rates and macroeconomic trends, exert considerable influence. Technological breakthroughs, or conversely, security breaches and vulnerabilities within the Bitcoin network, can trigger significant price shifts. Changes in investor sentiment, fueled by speculation and media narratives, further complicate any attempts at precise prediction. Predicting the future price of Bitcoin is not unlike predicting the future price of any asset class, with the additional layer of complexity brought by its relative youth and the evolving regulatory landscape. While various analytical models exist, they rely heavily on assumptions that may not hold true over a decade-long timeframe. Historical price data, while useful for understanding past trends, offers limited predictive power when facing such a multitude of dynamic external factors.

Factors Influencing Bitcoin’s Price in 2030

Predicting Bitcoin’s price in 2030 requires considering a multitude of interacting factors. While no one can definitively state its value, analyzing key influences provides a framework for understanding potential price movements. These factors range from technological advancements and macroeconomic conditions to the degree of institutional and governmental adoption.

Institutional and Governmental Adoption

Widespread acceptance by institutions and governments would significantly impact Bitcoin’s price. Increased institutional investment, driven by factors like diversification strategies and the perceived store-of-value potential, could lead to higher demand and consequently, a price increase. Similarly, government recognition, perhaps through regulatory clarity or even direct investment, could legitimize Bitcoin further, boosting confidence and driving price appreciation. For example, if a major central bank were to incorporate Bitcoin into its reserves, a substantial price surge could be anticipated, mirroring the effect of gold’s role in global financial systems. Conversely, unfavorable regulations or outright bans in key markets could negatively impact Bitcoin’s price.

Technological Innovations

Technological advancements, particularly those enhancing Bitcoin’s scalability and transaction speed, will play a crucial role. The Lightning Network, for instance, offers a solution to Bitcoin’s scalability limitations by enabling faster and cheaper off-chain transactions. Widespread adoption of the Lightning Network could alleviate congestion and reduce transaction fees, making Bitcoin more user-friendly for everyday transactions and potentially increasing its appeal and value. Other innovations, such as improved privacy solutions or advancements in mining technology, could also influence Bitcoin’s price positively. Consider a scenario where a significant breakthrough in consensus mechanisms results in significantly reduced energy consumption for Bitcoin mining; this would likely attract more environmentally conscious investors and potentially drive up the price.

Macroeconomic Factors

Macroeconomic conditions, such as inflation and interest rates, exert considerable influence on Bitcoin’s value. High inflation, eroding the purchasing power of fiat currencies, could drive investors towards Bitcoin as a hedge against inflation, increasing its demand and price. Conversely, rising interest rates could make other investment options more attractive, potentially diverting capital away from Bitcoin and depressing its price. The interplay between these factors is complex and dynamic, making accurate prediction challenging. For example, a period of high inflation coupled with low interest rates might lead to a substantial increase in Bitcoin’s price, while the opposite scenario could lead to a price decline.

Global Economic Events, Bitcoin Price In 2030

Global economic events, such as geopolitical instability, major financial crises, or significant shifts in global trade patterns, can significantly impact Bitcoin’s price. During periods of uncertainty, investors often seek safe haven assets, and Bitcoin, with its decentralized nature and limited supply, could benefit from increased demand. However, large-scale economic downturns could also negatively impact Bitcoin’s price as investors liquidate assets to cover losses in other markets. The 2008 financial crisis, for example, saw a surge in interest in alternative assets, including Bitcoin (although it was still in its early stages then), highlighting its potential role as a safe haven during times of economic turmoil.

Impact of a Major Technological Breakthrough

A major technological breakthrough could dramatically alter Bitcoin’s value. Imagine the development of a quantum-resistant cryptographic algorithm specifically designed for Bitcoin. This would significantly enhance its security against future threats posed by quantum computing, potentially boosting investor confidence and driving a significant price increase. This hypothetical scenario demonstrates how fundamental technological advancements can reshape the cryptocurrency landscape and influence Bitcoin’s price trajectory. The magnitude of the price change would depend on the nature and impact of the breakthrough, as well as the market’s reaction to it.