Bitcoin Price Prediction in 2030

Predicting the price of Bitcoin in 2030 is akin to gazing into a crystal ball. Its history is a rollercoaster of dramatic highs and lows, making any definitive prediction inherently speculative. While numerous analysts offer projections, the inherent volatility of the cryptocurrency market renders precise forecasting nearly impossible. This article aims to explore the various factors that could significantly influence Bitcoin’s price by 2030, offering informed speculation rather than concrete assertions.

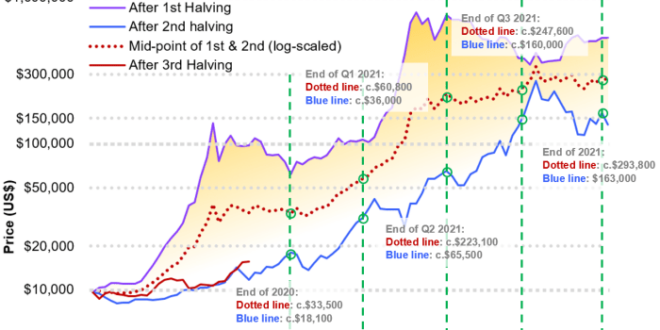

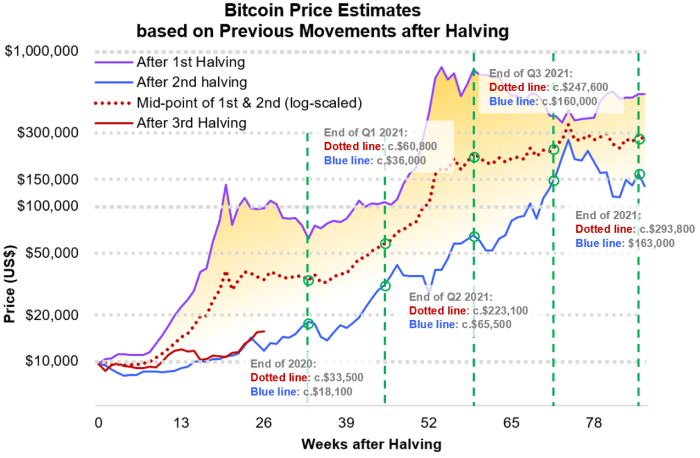

Bitcoin’s journey has been marked by periods of explosive growth punctuated by sharp corrections. Its initial years saw a gradual rise from a negligible value to a few dollars. The subsequent years witnessed periods of parabolic growth, reaching record highs in 2017 and again in late 2021, followed by substantial pullbacks. Major events such as the 2017 ICO boom, the 2020 COVID-19 pandemic-induced market rally, and the increasing institutional adoption have all profoundly impacted its price. Understanding these historical fluctuations is crucial for contextualizing potential future scenarios.

Factors Influencing Bitcoin’s Price in 2030

Several key factors will likely shape Bitcoin’s price trajectory over the next decade. These include macroeconomic conditions, regulatory developments, technological advancements, and the overall adoption rate by both individuals and institutions. A confluence of positive factors could propel Bitcoin to unprecedented heights, while a combination of negative influences could lead to a significant price decline. Analyzing these contributing elements provides a framework for understanding the range of possible outcomes.

Macroeconomic Factors and Bitcoin’s Price

Global economic conditions will undeniably play a pivotal role. Periods of economic uncertainty, inflation, or geopolitical instability often drive investors towards alternative assets like Bitcoin, potentially increasing its demand and price. Conversely, periods of economic stability and growth might lead investors to allocate capital to more traditional assets, potentially suppressing Bitcoin’s price. For example, the 2020 pandemic-induced economic downturn saw a flight to safety, boosting Bitcoin’s price, while periods of strong economic growth have sometimes seen Bitcoin’s price consolidate or even decline as investors shifted their focus.

Regulatory Landscape and Bitcoin’s Future

The regulatory environment surrounding cryptocurrencies will significantly influence Bitcoin’s price. Clear, consistent, and supportive regulations could foster widespread adoption and institutional investment, potentially driving up the price. Conversely, overly restrictive or ambiguous regulations could stifle growth and suppress the price. The varying regulatory approaches across different countries illustrate this point. For instance, countries with progressive cryptocurrency regulations have seen increased Bitcoin adoption, while those with strict bans have seen limited participation.

Technological Advancements and Bitcoin’s Scalability

Technological improvements to the Bitcoin network, such as the Lightning Network, aim to enhance scalability and transaction speed. These upgrades could address current limitations and increase Bitcoin’s usability, potentially increasing demand and price. Conversely, a failure to address scalability issues could hinder broader adoption and negatively impact the price. The ongoing development of layer-2 solutions and other technological improvements will be key determinants of Bitcoin’s long-term viability and price appreciation.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, constantly shifting and reacting to global events and technological advancements. Understanding these influences is crucial for navigating the volatile cryptocurrency market. While predicting the future price remains challenging, analyzing these factors provides valuable insight into potential price movements.

Technological Advancements

Technological advancements significantly impact Bitcoin’s adoption and price. Layer-2 scaling solutions, such as the Lightning Network, aim to address Bitcoin’s scalability limitations by processing transactions off-chain, thereby increasing transaction speeds and reducing fees. Improved transaction speeds make Bitcoin more user-friendly and attractive for everyday transactions, potentially driving wider adoption and increased demand, ultimately impacting its price positively. For example, the successful implementation and widespread adoption of a highly efficient layer-2 solution could lead to a surge in Bitcoin’s usage for micro-transactions, boosting its value.

Regulatory Frameworks and Government Policies

Government regulations and policies worldwide play a crucial role in shaping Bitcoin’s market value. Favorable regulatory frameworks, such as clear guidelines for cryptocurrency exchanges and tax treatments, can boost investor confidence and increase institutional investment. Conversely, restrictive regulations or outright bans can severely limit Bitcoin’s accessibility and negatively impact its price. The contrasting approaches of countries like El Salvador (adopting Bitcoin as legal tender) and China (banning Bitcoin trading) highlight the significant influence of governmental actions on Bitcoin’s price trajectory.

Macroeconomic Factors

Macroeconomic factors, such as inflation, interest rates, and economic recessions, significantly influence Bitcoin’s price fluctuations. During periods of high inflation, investors may see Bitcoin as a hedge against inflation, driving up demand and price. Conversely, rising interest rates can make other investment options more attractive, potentially diverting capital away from Bitcoin and depressing its price. Economic recessions can lead to increased risk aversion, causing investors to sell off assets, including Bitcoin, to secure their capital. The 2022 cryptocurrency market downturn, partially attributed to rising interest rates and fears of a global recession, serves as a clear example of this relationship.

Institutional Investor and Corporate Adoption

The increasing adoption of Bitcoin by institutional investors and mainstream corporations is a major driver of its price. Large-scale investments from institutions like MicroStrategy and Tesla have demonstrated a growing acceptance of Bitcoin as an asset class, boosting its credibility and attracting further investment. This increased institutional involvement adds stability and liquidity to the market, potentially reducing volatility and driving long-term price appreciation.

Public Sentiment, Media Coverage, and Social Media Trends

Public sentiment, fueled by media coverage and social media trends, significantly impacts Bitcoin’s price. Positive news coverage and enthusiastic social media discussions can create a “fear of missing out” (FOMO) effect, leading to increased demand and price surges. Conversely, negative news or social media narratives can trigger panic selling and price drops. The impact of Elon Musk’s tweets on Bitcoin’s price serves as a stark illustration of the influence of social media on market sentiment and price fluctuations.

Bitcoin’s Price Performance Compared to Other Assets

Comparing Bitcoin’s price performance with other cryptocurrencies and traditional asset classes reveals its unique characteristics. While Bitcoin often exhibits higher volatility than traditional assets like gold or stocks, it has also demonstrated significant growth potential over the long term. Its performance relative to other cryptocurrencies is also variable, with periods of outperformance and underperformance depending on market dynamics and technological developments. For instance, while Bitcoin has historically outperformed many altcoins over the long term, specific altcoins have experienced periods of rapid growth, surpassing Bitcoin’s returns during certain timeframes.

Price Prediction Models

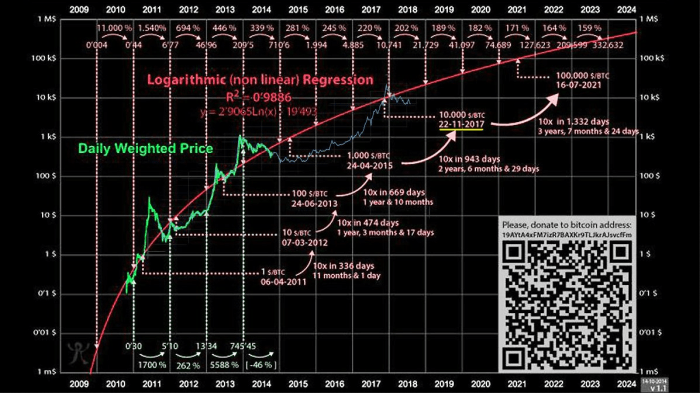

Different price prediction models utilize various assumptions and methodologies, leading to a range of price forecasts.

| Model | Assumptions | Predicted Price (2030) | Limitations |

|---|---|---|---|

| Stock-to-Flow Model | Based on Bitcoin’s scarcity and halving schedule. | Varies widely, with some predictions exceeding $1 million. | Assumes consistent adoption and ignores potential technological disruptions. |

| Adoption-Based Model | Projects price based on projected user adoption and market capitalization. | Highly dependent on adoption rate estimations, with significant uncertainty. | Difficult to accurately predict future adoption rates. |

| Technical Analysis | Utilizes chart patterns and indicators to predict price movements. | Highly variable depending on the specific indicators and interpretation. | Subjective and susceptible to manipulation. |

| Fundamental Analysis | Evaluates Bitcoin’s underlying value based on its utility and adoption. | Wide range of predictions, reflecting different assessments of Bitcoin’s future use cases. | Difficult to quantify the impact of future technological developments and regulatory changes. |

Potential Bitcoin Price Scenarios in 2030

Predicting the price of Bitcoin in 2030 is inherently speculative, given the cryptocurrency’s volatility and the numerous factors influencing its value. However, by considering various economic and technological trends, we can Artikel three plausible scenarios: a bullish, a bearish, and a neutral outlook. These scenarios are not exhaustive, but they represent a range of possibilities based on current understanding.

Bullish Bitcoin Price Scenario in 2030

This scenario envisions widespread global adoption of Bitcoin as a store of value and a medium of exchange, driven by factors like increased institutional investment, regulatory clarity in key markets, and technological advancements enhancing scalability and transaction speeds.

Bitcoin Price In 2030 – Key Characteristics:

- Widespread Institutional Adoption: Major financial institutions and corporations increasingly hold Bitcoin as part of their portfolios, driving demand.

- Global Regulatory Clarity: Clear and favorable regulatory frameworks emerge in major economies, reducing uncertainty and boosting investor confidence. This could mirror the evolution of the stock market’s regulatory landscape.

- Technological Advancements: Layer-2 scaling solutions and improved privacy features significantly enhance Bitcoin’s usability and efficiency, addressing current limitations.

- Deflationary Nature of Bitcoin: The limited supply of 21 million Bitcoins continues to exert upward pressure on price as demand increases.

Visual Representation:

The graph would show a steep upward trajectory, starting from the current price and exhibiting exponential growth throughout the decade. The line would show periods of volatility but ultimately maintain a strong upward trend, reflecting a consistently bullish market. Market conditions would be depicted as largely positive, with high trading volumes and increasing investor confidence.

Predicting the Bitcoin price in 2030 is inherently speculative, relying heavily on various factors and future market trends. However, understanding shorter-term predictions can offer some insight; for example, you might find useful information on daily fluctuations by checking out this resource on Bitcoin Price Prediction Daily 2025: Bitcoin Price Prediction Daily 2025. Ultimately, though, extrapolating from 2025 predictions to 2030 requires considerable caution and further analysis.

Example: This scenario could see Bitcoin reaching prices in the hundreds of thousands of dollars per coin, perhaps exceeding $500,000 or even $1,000,000, depending on the speed of adoption and other factors. This would be comparable to the growth experienced by early investors in the internet or tech sector.

Speculating on the Bitcoin price in 2030 is a challenging endeavor, requiring careful consideration of various factors. A key element in such forecasting involves understanding shorter-term predictions, such as those for December 2025; for example, you can find one such analysis at Bitcoin Price Prediction Dec 2025. Ultimately, the Bitcoin price in 2030 will depend on the continued adoption of cryptocurrency and the overall state of the global economy.

Bearish Bitcoin Price Scenario in 2030

This scenario Artikels a less optimistic outlook, where Bitcoin fails to achieve widespread adoption and faces significant headwinds.

Key Characteristics:

- Increased Regulatory Scrutiny: Governments worldwide implement stringent regulations that stifle Bitcoin’s growth and limit its use.

- Technological Challenges: Scaling issues remain unresolved, hindering Bitcoin’s ability to handle a large number of transactions, leading to high fees and slow processing times.

- Competition from Alternative Cryptocurrencies: Newer cryptocurrencies with superior technology and features surpass Bitcoin in popularity and market capitalization.

- Economic Downturn: A global economic recession reduces investor appetite for riskier assets like Bitcoin, leading to a price decline.

Visual Representation:

The graph would depict a downward trend, potentially with periods of slight recovery, but overall showing a significant decline from the current price. Market conditions would be characterized by low trading volumes, investor uncertainty, and negative sentiment. The overall shape would resemble a gradual decline with sharp drops interspersed.

Example: In this scenario, Bitcoin’s price could fall significantly below its current value, potentially dropping to a few thousand dollars or even less, mirroring the bursting of speculative bubbles in previous market cycles.

Predicting the Bitcoin price in 2030 is inherently speculative, relying on numerous unpredictable factors. However, understanding shorter-term projections can offer clues. For instance, analyzing models like the one detailed in Bitcoin Price 2025 Plan B provides a framework for assessing potential future growth. Extrapolating from such analyses might help inform, though not definitively predict, Bitcoin’s value a decade hence.

Neutral Bitcoin Price Scenario in 2030

This scenario represents a more moderate outlook, where Bitcoin maintains its position as a significant asset but doesn’t experience the explosive growth of the bullish scenario or the sharp decline of the bearish scenario.

Key Characteristics:

- Gradual Institutional Adoption: Institutional investment increases gradually, but not at the exponential rate of the bullish scenario.

- Mixed Regulatory Landscape: Some jurisdictions embrace Bitcoin, while others remain cautious or restrictive.

- Technological Improvements: Some technological advancements occur, but they are not sufficient to overcome all limitations.

- Stable Market Conditions: The market experiences periods of both growth and decline, but overall maintains a relatively stable price range.

Visual Representation:

The graph would show a relatively flat trajectory, with some minor fluctuations above and below a mean price. The line would oscillate within a defined range, reflecting a market with moderate volatility and neither strong bullish nor bearish sentiment. The overall trend would be sideways, with no significant upward or downward movement.

Predicting the Bitcoin price in 2030 is challenging, requiring consideration of numerous factors like adoption rates and regulatory changes. To understand potential trajectories, it’s helpful to analyze shorter-term forecasts; for instance, a look at Bitcoin Price At 2025 provides valuable insight into intermediate-term trends that could influence the longer-term price in 2030. Ultimately, the 2030 price will depend on the continued evolution of the cryptocurrency market and its global acceptance.

Example: In this scenario, Bitcoin’s price might hover around its current value or experience moderate growth, reaching perhaps a few tens of thousands of dollars, without exhibiting dramatic price swings.

Predicting the Bitcoin price in 2030 is inherently speculative, relying heavily on various factors. A crucial element in any such forecast is understanding the trajectory of Bitcoin’s value in the preceding years; for insights into the near-term future, you might find the analysis at Btc Price Expectation 2025 helpful. This intermediate prediction can inform broader models attempting to project Bitcoin’s price a further five years down the line to 2030.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin, like any other asset class, presents a unique blend of risks and opportunities. The decentralized nature and volatility of Bitcoin create both significant potential for profit and substantial potential for loss. Understanding these aspects is crucial for making informed investment decisions. This section will delve into the key risks and opportunities, along with strategies for mitigating risks and maximizing potential returns.

Price Volatility

Bitcoin’s price is notoriously volatile. Sharp price swings, both upward and downward, are common. For example, in 2021, Bitcoin experienced a significant surge, reaching near $65,000, only to later fall considerably. This volatility stems from factors such as market sentiment, regulatory announcements, technological advancements, and macroeconomic conditions. Such fluctuations can lead to significant gains but also substantial losses, depending on the timing of entry and exit from the market. Investors with a long-term horizon may be better equipped to weather these fluctuations, while short-term traders are more exposed to these risks.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin and cryptocurrencies remains uncertain globally. Different countries have adopted varying approaches, ranging from outright bans to regulatory frameworks that attempt to balance innovation with consumer protection. This uncertainty can create volatility in the market as regulations evolve and impact trading activities, exchange operations, and overall investor confidence. For instance, a sudden regulatory crackdown in a major market could trigger a significant price drop.

Security Risks

Bitcoin, while decentralized, is not immune to security risks. Individuals holding Bitcoin in exchanges or online wallets are vulnerable to hacking and theft. Furthermore, the anonymity associated with Bitcoin transactions can make it attractive for illicit activities, which could negatively impact its price and reputation. Robust security measures, such as using hardware wallets and employing strong passwords, are essential for mitigating these risks. The loss of private keys can result in the permanent loss of access to one’s Bitcoin holdings.

Potential for High Returns

Despite the risks, Bitcoin’s history shows the potential for exceptionally high returns. Early investors who held Bitcoin for several years have seen their investments grow exponentially. This potential for high returns is driven by Bitcoin’s scarcity, growing adoption, and its position as a potential hedge against inflation. The potential for high returns is a significant driver of investor interest, despite the associated risks.

Diversification Benefits

Bitcoin’s low correlation with traditional asset classes, such as stocks and bonds, offers diversification benefits to investors. Adding Bitcoin to a diversified portfolio can potentially reduce overall portfolio risk and enhance returns, as its price movements are not necessarily aligned with traditional asset classes. This can provide a buffer against market downturns in other sectors.

Strategies for Mitigating Risks and Maximizing Returns

Effective risk management is paramount in Bitcoin investment. This includes diversifying investments across different asset classes, only investing what one can afford to lose, and conducting thorough due diligence before investing. Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, can help mitigate the impact of price volatility. Furthermore, understanding the fundamentals of Bitcoin technology and the broader cryptocurrency market is essential for making informed investment decisions. Long-term investment horizons often prove more successful in navigating the volatility inherent in the Bitcoin market.

Benefits and Drawbacks of Investing in Bitcoin in 2030

The following table summarizes the potential benefits and drawbacks of investing in Bitcoin in 2030. These are projections based on current trends and are subject to change.

| Benefit | Drawback |

|---|---|

| Potential for high returns exceeding traditional investments. | High price volatility and potential for significant losses. |

| Diversification benefits due to low correlation with traditional assets. | Regulatory uncertainty and potential for future regulatory restrictions. |

| Hedge against inflation, particularly in unstable macroeconomic environments. | Security risks associated with storage and exchange platforms. |

| Growing adoption and increasing institutional interest. | Potential for technological disruption or the emergence of competing cryptocurrencies. |

Bitcoin’s Long-Term Prospects: Bitcoin Price In 2030

Bitcoin’s long-term prospects are a subject of intense debate, with opinions ranging from complete dismissal to predictions of widespread adoption. Its future hinges on its ability to fulfill its intended roles within the global financial system, while also overcoming significant technological and regulatory hurdles. Analyzing its potential as a store of value, medium of exchange, and unit of account, alongside considering technological advancements and potential disruptions, provides a clearer picture of its trajectory.

Bitcoin’s potential as a store of value rests on its limited supply (21 million coins) and its decentralized nature, making it resistant to inflationary pressures and government manipulation. However, its volatility remains a significant challenge to its widespread acceptance as a reliable store of value, comparable to gold or other traditional assets. Some experts believe its scarcity and increasing institutional adoption will lead to long-term price appreciation, mirroring the historical performance of other scarce assets. Others argue that its inherent volatility and susceptibility to market manipulation will prevent it from achieving mainstream adoption as a stable store of value.

Bitcoin as a Store of Value, Bitcoin Price In 2030

The limited supply of Bitcoin, coupled with its decentralized nature, makes it a compelling candidate for a store of value. Its deflationary properties, unlike fiat currencies prone to inflation, could attract investors seeking to preserve purchasing power. However, its significant price volatility currently limits its effectiveness in this role. For example, the sharp price drops experienced in 2018 and 2022 highlight the risk associated with using Bitcoin as a long-term store of value. The ongoing debate centers on whether its price volatility will diminish over time, allowing it to become a more reliable store of value, similar to gold. Successful adoption by institutional investors and a reduction in market manipulation could contribute to increased stability and price predictability.

Bitcoin as a Medium of Exchange

Bitcoin’s adoption as a medium of exchange is hindered by its volatility and the relatively low number of merchants accepting it as payment. While some businesses, particularly those operating online, already accept Bitcoin, its widespread use as a daily transaction tool remains limited. The high transaction fees and slow processing speeds compared to traditional payment systems also pose challenges. However, advancements in layer-2 scaling solutions like the Lightning Network aim to address these limitations. If these technologies become widely adopted and Bitcoin’s price stabilizes, its use as a medium of exchange could significantly increase. A hypothetical example would be a future where international remittances are seamlessly conducted using Bitcoin, leveraging the Lightning Network to overcome transaction speed and cost barriers.

Bitcoin as a Unit of Account

The role of Bitcoin as a unit of account is even less developed than its use as a medium of exchange. Few contracts or transactions are currently denominated in Bitcoin. Its volatility makes it an unsuitable unit of account for most purposes, as the value of transactions could fluctuate significantly during the contract period. However, if Bitcoin’s price were to stabilize and its acceptance were to increase dramatically, it could potentially play a more significant role as a unit of account in specific niche markets, such as within the cryptocurrency ecosystem itself. For example, future decentralized autonomous organizations (DAOs) might use Bitcoin as their internal accounting unit, leveraging its transparency and immutability.

Technological Innovations and Bitcoin’s Viability

Technological innovations play a crucial role in shaping Bitcoin’s long-term viability. Advancements in areas like scaling solutions (e.g., the Lightning Network), privacy-enhancing technologies (e.g., CoinJoin), and improved security protocols are vital for addressing current limitations and ensuring its continued relevance. Conversely, the development of superior alternative cryptocurrencies or technological breakthroughs that render Bitcoin’s underlying technology obsolete could negatively impact its long-term prospects. The ongoing development and adoption of layer-2 solutions are particularly important for improving Bitcoin’s scalability and transaction speed, making it a more viable medium of exchange.

Bitcoin’s Role in the Global Financial System: Expert Opinions

Expert opinions on Bitcoin’s future role in the global financial system are diverse. Some prominent economists and financial analysts believe Bitcoin could become a significant asset class, alongside gold and other traditional stores of value. Others are more skeptical, highlighting its volatility and regulatory uncertainties. For example, some predict that Bitcoin could be integrated into existing financial systems as a complementary asset, while others believe it could potentially disrupt the current financial architecture entirely. The extent of its future integration will depend on various factors, including regulatory developments, technological advancements, and its overall market acceptance. Predictions vary wildly, ranging from Bitcoin becoming a marginal asset to it becoming a dominant force in global finance.

Hypothetical Future Use Case: Supply Chain Management

Imagine a future where a major global retailer uses Bitcoin to track and verify the provenance of its products throughout the entire supply chain. Each stage of production, from raw materials sourcing to final delivery, is recorded on the Bitcoin blockchain, creating a transparent and immutable record. This would enhance traceability, reduce fraud, and improve accountability, providing consumers with greater confidence in the origin and authenticity of the products they purchase. This hypothetical scenario highlights Bitcoin’s potential beyond its role as a currency, showcasing its application as a secure and transparent data management tool within a specific industry.

Frequently Asked Questions (FAQ)

Predicting the future price of Bitcoin, or any asset for that matter, is inherently challenging. Numerous factors influence its value, making precise forecasts impossible. The following addresses some common questions surrounding Bitcoin’s future and investment strategies.

Bitcoin’s Most Likely Price in 2030

Accurately predicting Bitcoin’s price in 2030 is highly improbable. The cryptocurrency market is notoriously volatile, influenced by technological advancements, regulatory changes, macroeconomic conditions, and widespread adoption rates. While some analysts offer price projections, these should be viewed with extreme caution. These predictions often rely on various assumptions, which may or may not materialize. For example, a prediction based on increased adoption might fail to account for unforeseen regulatory hurdles. Instead of focusing on a specific price point, it’s more prudent to consider a range of potential outcomes and understand the factors that could drive them. Past performance is not indicative of future results, and Bitcoin’s price history demonstrates significant fluctuations.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. On one hand, its decentralized nature, limited supply, and growing adoption could drive significant price appreciation over time. On the other hand, its volatility, regulatory uncertainty, and the potential for technological disruption pose considerable risks. A well-diversified investment portfolio, incorporating both traditional assets and alternative investments, is crucial for mitigating risks. Before investing in Bitcoin, thorough research into its underlying technology, market dynamics, and associated risks is essential. Investors should only allocate capital they can afford to lose. Consider the example of gold, a traditional safe haven asset; its value has fluctuated significantly over the long term, mirroring the potential price swings Bitcoin could experience.

Protecting Against Bitcoin Price Volatility

Managing the inherent volatility of Bitcoin requires a strategic approach. Diversification is key. Don’t put all your eggs in one basket. Spread your investments across various asset classes, including stocks, bonds, and real estate, to reduce overall portfolio risk. Dollar-cost averaging (DCA) is another effective strategy. This involves investing a fixed amount of money at regular intervals, regardless of the price. This mitigates the risk of buying high and selling low. For instance, investing $100 per week consistently reduces the impact of short-term price fluctuations. Finally, understanding your risk tolerance and only investing what you can afford to lose is paramount.

Potential Regulatory Challenges Facing Bitcoin

The regulatory landscape surrounding Bitcoin is constantly evolving. Governments worldwide are grappling with how to regulate cryptocurrencies, balancing innovation with consumer protection and financial stability. Potential challenges include stricter KYC/AML (Know Your Customer/Anti-Money Laundering) regulations, increased taxation on cryptocurrency transactions, and outright bans in certain jurisdictions. These regulatory actions could significantly impact Bitcoin’s price, potentially leading to either increased adoption (with clearer regulatory frameworks) or reduced liquidity and price suppression (with restrictive regulations). The evolving regulatory environment is a critical factor to consider when assessing Bitcoin’s long-term prospects. Examples include the differing regulatory approaches taken by the US and China, which have resulted in vastly different market conditions for Bitcoin in each country.