Bitcoin Price Prediction 2025

Predicting the price of Bitcoin in 2025 is inherently challenging due to the cryptocurrency’s volatile nature. Its history is marked by periods of dramatic price surges followed by significant corrections, making any prediction inherently speculative. However, by analyzing historical trends and considering influential factors, we can attempt to understand the potential price trajectory.

Bitcoin’s price is influenced by a complex interplay of factors. Widespread adoption by businesses and individuals directly impacts demand and, consequently, price. Regulatory frameworks, both supportive and restrictive, significantly affect investor confidence and market accessibility. Furthermore, market sentiment, driven by news events, technological advancements, and overall economic conditions, plays a crucial role in price fluctuations. A positive outlook fuels bullish trends, while negative news or uncertainty can trigger sell-offs.

Bitcoin’s Technological Underpinnings

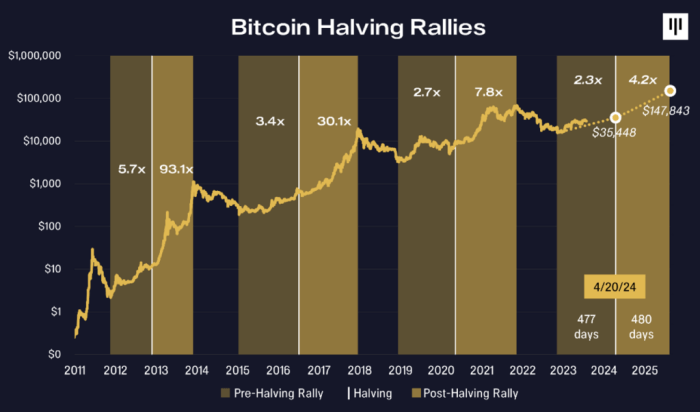

Bitcoin operates on a decentralized, peer-to-peer network using blockchain technology. This blockchain is a public, distributed ledger recording all Bitcoin transactions chronologically and cryptographically secured. This ensures transparency and immutability, preventing double-spending and enhancing security. The underlying technology, while innovative, also presents limitations, such as scalability issues and energy consumption concerns, which can indirectly influence price dynamics. The limited supply of 21 million Bitcoins, a fixed parameter embedded in its code, is often cited as a factor contributing to its potential long-term value appreciation. This scarcity is contrasted with the inflationary nature of fiat currencies, potentially making Bitcoin a more attractive store of value over the long term. For example, the halving events, which reduce the rate of Bitcoin creation, have historically been correlated with subsequent price increases, though the relationship is not always linear.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of interconnected factors. While no single element dictates its value, several key influences will likely shape its trajectory. These factors span macroeconomic trends, institutional involvement, technological advancements, competitive dynamics within the cryptocurrency market, and the evolving regulatory landscape.

Global Economic Conditions and Bitcoin’s Value

Global economic conditions will significantly impact Bitcoin’s price in 2025. Periods of high inflation or economic uncertainty often see investors seeking alternative assets, potentially driving demand for Bitcoin as a hedge against inflation and traditional market volatility. Conversely, strong economic growth and stable markets might lead to reduced demand for Bitcoin as investors shift focus towards more traditional investment vehicles. For example, the 2020-2021 bull run coincided with unprecedented monetary easing and fiscal stimulus globally, boosting Bitcoin’s price. Conversely, periods of economic contraction, such as potential recessions, could negatively affect Bitcoin’s price as investors liquidate assets to cover losses in other markets.

Institutional Investment in Bitcoin

The involvement of institutional investors, such as large corporations, hedge funds, and pension funds, plays a pivotal role in Bitcoin’s price. Increased institutional adoption translates to larger trading volumes and increased market liquidity, often leading to price stability and potential upward momentum. The growing acceptance of Bitcoin as a legitimate asset class by major financial institutions will likely influence its price positively in 2025. For instance, MicroStrategy’s significant Bitcoin holdings have demonstrated the increasing confidence of large corporations in the cryptocurrency’s long-term potential. Conversely, a significant reduction in institutional investment could trigger price corrections.

Technological Advancements and Bitcoin’s Scalability

Technological advancements, particularly Layer-2 scaling solutions like the Lightning Network, are crucial in influencing Bitcoin’s price. These solutions aim to improve Bitcoin’s transaction speed and reduce fees, making it more user-friendly and accessible for everyday transactions. Wider adoption of Layer-2 solutions could significantly boost Bitcoin’s utility and appeal, potentially driving up its price. Successful implementation and widespread adoption of such technologies could address some of Bitcoin’s current limitations and increase its overall attractiveness to a wider range of users and investors.

Bitcoin’s Price Trajectory Compared to Other Cryptocurrencies

Bitcoin’s price trajectory will be influenced by its performance relative to other cryptocurrencies. The overall cryptocurrency market sentiment and the performance of competing cryptocurrencies with innovative features or superior scalability could impact Bitcoin’s dominance and, consequently, its price. For instance, the rise of Ethereum and its DeFi ecosystem has attracted significant investment, potentially diverting some capital from Bitcoin. However, Bitcoin’s established market position and reputation as “digital gold” might continue to attract investors seeking a more secure and less volatile store of value compared to other, potentially riskier, altcoins.

Regulatory Changes and Their Impact on Bitcoin

Regulatory changes at the national and international levels will significantly impact Bitcoin’s market. Clearer and more favorable regulations could attract institutional investment and boost investor confidence, driving up the price. Conversely, stricter regulations or outright bans could negatively affect Bitcoin’s price and trading volume. The regulatory landscape remains highly dynamic and varies across jurisdictions, making it a significant unpredictable factor in Bitcoin’s price prediction. Examples of regulatory impacts can be seen in countries that have either embraced cryptocurrencies through clear regulatory frameworks or have imposed restrictions, significantly impacting their local markets.

Potential Price Scenarios for Bitcoin in 2025: Bitcoin Price In Year 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the volatile nature of the cryptocurrency market. However, by considering various macroeconomic factors, technological advancements, and regulatory developments, we can Artikel three plausible scenarios: a bullish, a bearish, and a neutral outlook. These scenarios are not exhaustive, and the actual price could fall outside these ranges.

Bullish Scenario: Bitcoin Surpasses $100,000

This scenario assumes widespread institutional adoption, continued technological innovation, and a generally positive global economic climate. Increased institutional investment could drive demand significantly, pushing the price upwards. Furthermore, successful scaling solutions and the development of Layer-2 technologies could enhance Bitcoin’s usability and transaction speed, attracting a larger user base. A positive regulatory environment, particularly in major economies, would also contribute to this bullish outlook. This scenario is analogous to the rapid price appreciation seen in 2020-2021, albeit potentially at a more sustained pace. For example, if mainstream financial institutions continue to integrate Bitcoin into their portfolios and offer Bitcoin-related financial products, demand could surge.

Bearish Scenario: Bitcoin Falls Below $20,000

This pessimistic scenario hinges on several negative factors. A significant global economic downturn, coupled with increased regulatory scrutiny and potential bans in key markets, could severely impact Bitcoin’s price. Negative news related to security breaches or significant hacks could also erode investor confidence. Furthermore, the emergence of a superior competitor cryptocurrency with significantly better technology or features could divert investment away from Bitcoin. This scenario mirrors the market correction seen in 2022, where various macroeconomic factors and regulatory uncertainties led to a considerable price decline. For instance, a global recession could severely limit investment in risk assets, including Bitcoin.

Neutral Scenario: Bitcoin Trades Between $30,000 and $60,000

This scenario represents a more moderate outlook, assuming a relatively stable global economy and a mixed regulatory landscape. While institutional adoption continues, it proceeds at a slower pace than in the bullish scenario. Technological advancements occur, but they don’t drastically alter Bitcoin’s market position. Regulatory uncertainty persists, but no major negative events occur. This scenario is comparable to periods of sideways price movement seen in Bitcoin’s history, where neither bullish nor bearish sentiment dominates the market. This could be influenced by factors like the general maturation of the cryptocurrency market and increased awareness among investors about risk management.

Comparison of Bitcoin Price Scenarios in 2025, Bitcoin Price In Year 2025

| Scenario | Price Range (USD) | Key Drivers | Probability (Subjective Estimate) |

|---|---|---|---|

| Bullish | >$100,000 | Widespread institutional adoption, technological advancements, positive global economy, favorable regulation | 25% |

| Bearish | <$20,000 | Global economic downturn, increased regulation, security breaches, superior competitor emergence | 25% |

| Neutral | $30,000 – $60,000 | Moderate institutional adoption, stable global economy, mixed regulatory landscape | 50% |

Investing in Bitcoin

Investing in Bitcoin presents a unique opportunity with substantial potential rewards, but also carries significant risks. Understanding both sides of this equation is crucial before committing any capital. This section will explore the inherent risks and potential returns associated with Bitcoin investment, comparing it to traditional asset classes and outlining different investment strategies.

Bitcoin Investment Risks

Bitcoin’s price volatility is its most prominent risk. Its value can fluctuate dramatically in short periods, leading to substantial gains or losses. For example, Bitcoin’s price has experienced periods of rapid growth followed by sharp corrections, sometimes exceeding 50% in a matter of weeks. This high volatility makes it unsuitable for risk-averse investors with shorter time horizons. Other risks include regulatory uncertainty, as governments worldwide grapple with how to regulate cryptocurrencies. Changes in regulations could significantly impact Bitcoin’s price and accessibility. Security risks, such as exchange hacks or loss of private keys, are also considerable. Losing access to your Bitcoin wallet means losing your investment entirely. Finally, the relatively nascent nature of the cryptocurrency market introduces inherent risks associated with market manipulation and technological vulnerabilities.

Bitcoin Investment Rewards

Despite the risks, Bitcoin offers the potential for significant returns. Its limited supply of 21 million coins creates scarcity, potentially driving up its value over time. The growing adoption of Bitcoin by businesses and institutions suggests increasing mainstream acceptance, which could further fuel price appreciation. Historically, Bitcoin has demonstrated periods of exponential growth, exceeding the returns of many traditional asset classes over the long term. Furthermore, Bitcoin offers a hedge against inflation, as its value is not tied to traditional fiat currencies. As a decentralized asset, it operates independently of central banks and government policies, making it an attractive investment for those seeking diversification beyond traditional markets.

Bitcoin Risk Profile Compared to Traditional Assets

Compared to traditional asset classes like stocks and bonds, Bitcoin exhibits a significantly higher risk profile. Stocks and bonds, while subject to market fluctuations, generally display less volatility than Bitcoin. Diversified stock portfolios, for instance, tend to offer more stable returns over the long term, although with potentially lower growth potential compared to Bitcoin. Gold, often considered a safe haven asset, also displays less volatility than Bitcoin, though it typically offers lower returns. However, Bitcoin’s potential for high returns outweighs its high risk for some investors seeking higher growth opportunities, while others prefer the relative stability of traditional assets.

Bitcoin Investment Strategies

Investors can adopt various strategies when investing in Bitcoin. Long-term holding, or “hodling,” involves buying and holding Bitcoin for an extended period, aiming to benefit from its potential long-term growth. This strategy mitigates the impact of short-term price fluctuations. Short-term trading, on the other hand, involves frequent buying and selling of Bitcoin based on short-term price movements. This strategy requires significant market knowledge and carries a much higher risk of losses. Dollar-cost averaging, a strategy involving regular investments of a fixed amount regardless of price, can help mitigate risk by reducing the impact of volatility. Finally, diversification within the cryptocurrency market by investing in other cryptocurrencies alongside Bitcoin can further diversify risk, although it also introduces the risks associated with those other assets.

Bitcoin’s Role in the Future of Finance

Bitcoin’s emergence has sparked a fundamental reassessment of traditional financial systems. Its decentralized nature and inherent resistance to censorship offer a compelling alternative to centralized institutions, potentially transforming how we manage, transact, and interact with money. This disruption is not merely theoretical; it’s already underway, influencing various aspects of the financial landscape and paving the way for a more inclusive and efficient future.

Bitcoin’s potential to disrupt traditional financial systems stems from its core characteristics. Unlike fiat currencies controlled by governments and central banks, Bitcoin operates on a transparent, publicly verifiable blockchain. This eliminates the need for intermediaries, reducing transaction costs and processing times. Furthermore, its decentralized nature makes it resistant to censorship and single points of failure, a significant advantage over systems vulnerable to government control or manipulation. The potential for increased financial inclusion, particularly in regions with underdeveloped banking infrastructure, is another key driver of its disruptive power. For example, individuals in countries with hyperinflation or limited access to traditional banking services can utilize Bitcoin as a store of value and a medium of exchange, gaining greater control over their finances.

Bitcoin’s Role in Decentralized Finance (DeFi)

Bitcoin, while not a DeFi protocol itself, serves as a foundational asset within the broader DeFi ecosystem. Its security and established market capitalization provide a degree of stability and trust, attracting users and developers to build decentralized applications (dApps) on top of it. For instance, Bitcoin-backed stablecoins are emerging, aiming to leverage Bitcoin’s inherent value while mitigating its price volatility. These stablecoins are then used within DeFi protocols for lending, borrowing, and other financial activities. The integration of Bitcoin into DeFi expands its utility beyond a simple store of value, making it a crucial component of a rapidly evolving financial landscape. This integration is still evolving, but the potential for Bitcoin to act as a collateralization layer or a bridge between traditional and decentralized finance is significant.

Bitcoin’s Use Cases Beyond Investment

While Bitcoin is frequently viewed as an investment asset, its use cases extend far beyond speculation. Its inherent properties make it suitable for various applications. As a peer-to-peer payment system, Bitcoin offers faster and cheaper cross-border transactions compared to traditional methods, bypassing intermediaries like banks and payment processors. This is particularly beneficial for remittances, where individuals send money across international borders. For example, migrant workers can send money to their families back home more efficiently and at lower costs using Bitcoin compared to traditional remittance services. The increased transparency and security offered by the blockchain also enhance trust and accountability. Moreover, Bitcoin’s immutability and cryptographic security can be leveraged in supply chain management to track goods and verify authenticity, improving transparency and preventing counterfeiting.

Bitcoin’s Integration with Existing Financial Infrastructure

The integration of Bitcoin with existing financial infrastructure is a gradual but increasingly important process. Several approaches are being explored. Custodial services are emerging, offering institutions and individuals a secure way to hold and manage Bitcoin. Payment processors are integrating Bitcoin payment options into their platforms, allowing businesses to accept Bitcoin alongside traditional currencies. Furthermore, some central banks are exploring the potential of central bank digital currencies (CBDCs), which, while distinct from Bitcoin, could interact with it through bridging technologies. The Lightning Network, a second-layer scaling solution for Bitcoin, is improving transaction speeds and reducing fees, making it more suitable for everyday payments. This integration is crucial for mainstream adoption, allowing Bitcoin to coexist and potentially complement existing financial systems rather than simply replace them. For instance, a hypothetical scenario could see a large financial institution offering Bitcoin as an investment option alongside traditional assets, allowing clients to diversify their portfolios.

Frequently Asked Questions (FAQs)

Predicting the future price of Bitcoin is inherently speculative, and various factors influence its value. This section addresses common questions regarding Bitcoin’s price in 2025, investment risks, storage, long-term potential, and its use in payments.

Bitcoin’s Most Likely Price in 2025

Predicting Bitcoin’s price in 2025 is challenging due to its volatile nature and the influence of numerous unpredictable factors, including regulatory changes, technological advancements, and overall market sentiment. While numerous analysts offer price predictions, ranging from significantly lower to considerably higher than current values, it’s crucial to remember these are estimations and not guarantees. Past performance is not indicative of future results. For example, some analysts have predicted a price as high as $100,000 based on adoption rates and scarcity, while others suggest a more conservative estimate based on macroeconomic conditions. Ultimately, the actual price will depend on a confluence of events and market forces.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its price volatility is well-documented, with substantial price swings occurring frequently. This volatility can lead to substantial losses in a short period. Furthermore, the regulatory landscape surrounding Bitcoin is constantly evolving, and changes in regulations could negatively impact its value or even lead to its prohibition in certain jurisdictions. Security risks also exist, including the potential for theft from exchanges or loss of private keys. The lack of intrinsic value compared to traditional assets like gold or real estate is another key consideration. Finally, Bitcoin’s price is highly susceptible to market manipulation and speculative bubbles.

Safe Storage of Bitcoin

Safeguarding Bitcoin requires a multi-pronged approach. Hardware wallets, physical devices designed specifically for storing cryptocurrency, are generally considered the most secure option. These devices keep your private keys offline, minimizing the risk of hacking. Software wallets, while more convenient, are susceptible to malware and online attacks. Choosing a reputable exchange for storing Bitcoin is another option, but it carries inherent risks related to exchange security breaches. Regardless of the chosen method, it is crucial to practice strong password hygiene, utilize two-factor authentication whenever possible, and regularly back up your private keys in a secure, offline location.

Bitcoin as a Long-Term Investment

Whether Bitcoin is a good long-term investment depends entirely on individual risk tolerance and investment goals. Its potential for significant returns is undeniable, but so is the potential for substantial losses. Long-term investors need to be prepared for periods of significant price volatility and understand the inherent risks associated with this asset class. Diversification is crucial; Bitcoin should not constitute a significant portion of one’s investment portfolio unless they have a high-risk tolerance. A thorough understanding of the technology, market forces, and regulatory landscape is also essential for informed decision-making.

Potential Benefits of Bitcoin for Payments

Bitcoin offers several potential benefits as a payment method. It enables fast, borderless transactions, bypassing traditional financial intermediaries and reducing transaction fees. This is particularly advantageous for international payments. Moreover, Bitcoin transactions are transparent and verifiable on the public blockchain, providing a degree of security and auditability. However, Bitcoin’s scalability remains a challenge, with transaction speeds sometimes being slower than traditional payment systems. Furthermore, its price volatility makes it unsuitable for everyday transactions where price stability is crucial. The lack of widespread merchant adoption also limits its practicality as a mainstream payment method.

Illustrative Examples (Visual Aids)

Visual aids can significantly enhance understanding of Bitcoin’s price dynamics and the factors influencing it. Two examples, a price volatility chart and an infographic detailing influential factors, are described below.

Bitcoin’s Historical Price Volatility Chart

This chart would display Bitcoin’s price over time, typically from its inception to the present. The horizontal (x-axis) would represent time, possibly in years or months, while the vertical (y-axis) would show the Bitcoin price in US dollars. Key features would include: a line graph illustrating the price fluctuation; significant price peaks and troughs clearly marked with dates and corresponding prices; shaded areas to highlight periods of significant volatility (e.g., bull and bear markets); and potentially, moving averages (like a 200-day moving average) to smooth out short-term fluctuations and show underlying trends. Data points could include specific dates and prices, such as the all-time high reached in November 2021 (approximately $69,000) and subsequent price drops. The overall trend would demonstrate Bitcoin’s highly volatile nature, characterized by periods of rapid growth and sharp corrections. For example, the chart would visually represent the significant price increase from around $1,000 in 2017 to nearly $20,000 by the end of that year, followed by a substantial drop in 2018, illustrating the inherent risk associated with Bitcoin investment.

Infographic Detailing Factors Influencing Bitcoin’s Price

This infographic would be divided into sections, each representing a key factor influencing Bitcoin’s price. Each section would use a combination of icons, short text descriptions, and potentially small charts or graphs to convey the information concisely.

For example:

* Regulation: This section might use an icon of a gavel or scales of justice, accompanied by a brief description of the impact of government regulations on Bitcoin adoption and price. A small bar graph could compare regulatory environments in different countries, showing a potential correlation between stricter regulations and lower Bitcoin adoption.

* Adoption and Demand: An icon representing a growing network or a rising graph would illustrate this section. The text would highlight the role of increasing institutional and individual adoption in driving price increases. A pie chart could show the distribution of Bitcoin ownership among different groups (e.g., institutions, individual investors, etc.).

* Market Sentiment: This section could use an icon representing a bull or bear, reflecting market optimism or pessimism. A line graph showing the Bitcoin price alongside a sentiment index (e.g., a social media sentiment score) could visually demonstrate the correlation between market sentiment and price movements.

* Technological Developments: An icon representing a computer chip or blockchain technology would represent this section. The text would explain the influence of technological upgrades, such as the Lightning Network, on Bitcoin’s scalability and transaction speed, potentially impacting its price.

* Macroeconomic Factors: An icon representing global finance or economic indicators could represent this section. The text would discuss how factors like inflation, interest rates, and global economic uncertainty can influence Bitcoin’s price as an alternative asset. A small chart could show the correlation between Bitcoin’s price and a macroeconomic indicator, such as the inflation rate.