Bitcoin Price Prediction 2025

Bitcoin, the pioneering cryptocurrency, emerged in 2009 with the publication of a whitepaper by the pseudonymous Satoshi Nakamoto. Since then, it has experienced periods of explosive growth and dramatic crashes, establishing itself as a significant asset class, albeit one with considerable volatility. Currently, Bitcoin holds a dominant position in the cryptocurrency market, though its share is subject to fluctuations as alternative cryptocurrencies gain traction. Understanding its price trajectory requires considering a complex interplay of factors.

Bitcoin’s price volatility is influenced by a multitude of intertwined factors. Supply and demand dynamics play a crucial role, with limited supply (21 million Bitcoin) creating scarcity and potentially driving up prices. Regulatory actions by governments worldwide significantly impact investor sentiment and market accessibility. Technological advancements within the Bitcoin network itself, such as scaling solutions, also affect its efficiency and adoption. Macroeconomic conditions, such as inflation and global economic uncertainty, often correlate with Bitcoin’s price movements, as investors seek alternative assets during periods of economic instability. Finally, media coverage, public perception, and the actions of large institutional investors all contribute to the price’s fluctuations.

Factors Influencing Bitcoin’s Price Volatility

The inherent volatility of Bitcoin stems from its relatively young age and the speculative nature of the cryptocurrency market. Unlike traditional assets with established valuation models, Bitcoin’s price is largely driven by market sentiment and speculative trading. For instance, positive news regarding regulatory clarity or widespread institutional adoption can trigger substantial price increases, while negative news, such as security breaches or regulatory crackdowns, can lead to sharp declines. The decentralized nature of Bitcoin, while a strength in terms of censorship resistance, also makes it susceptible to market manipulation by large players or coordinated attacks. The lack of intrinsic value, compared to gold or other commodities, further contributes to its volatile nature. Historically, Bitcoin’s price has shown strong correlation with the overall market sentiment towards risk assets. During periods of economic uncertainty, investors often seek safe havens, leading to decreased demand and lower Bitcoin prices. Conversely, periods of economic growth and investor confidence can fuel speculation and drive prices higher.

Examples of Previous Bitcoin Price Predictions and Their Accuracy

Numerous predictions regarding Bitcoin’s price have been made throughout its history, with varying degrees of accuracy. For example, in 2017, some analysts predicted Bitcoin would reach $100,000 by the end of 2018, a prediction that proved wildly inaccurate. The actual price peaked around $20,000 before undergoing a significant correction. Conversely, predictions made during periods of lower market capitalization have often been more accurate, as the potential for growth was significantly higher. It’s crucial to note that the accuracy of Bitcoin price predictions is significantly limited by the inherent volatility of the market and the multitude of factors influencing its price. The complexity of the factors involved makes accurate long-term forecasting exceptionally challenging. Past predictions should therefore be viewed with a healthy dose of skepticism, and any investment decision should be based on a thorough understanding of the risks involved. The absence of a clear and consistent historical precedent for such a novel asset class makes reliable forecasting exceptionally difficult.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of factors. While no one can definitively state the price, analyzing these influences offers a clearer picture of potential trajectories. These factors range from regulatory landscapes and technological advancements to macroeconomic conditions and institutional involvement.

Regulatory Changes and Bitcoin’s Price

The regulatory environment surrounding Bitcoin significantly impacts its price. Clear, consistent, and globally harmonized regulations could boost investor confidence, leading to increased adoption and potentially higher prices. Conversely, overly restrictive or inconsistent regulations across different jurisdictions could stifle growth and suppress price appreciation. For example, a sudden ban on Bitcoin trading in a major economy could trigger a significant price drop, while the establishment of clear regulatory frameworks in several key markets might encourage institutional investment and increase price stability. The uncertainty surrounding future regulations remains a significant factor influencing price volatility.

Technological Advancements and Bitcoin Adoption, Bitcoin Price Outlook 2025

Technological advancements, such as the Lightning Network, are crucial for improving Bitcoin’s scalability and transaction speed. Widespread adoption of the Lightning Network could drastically reduce transaction fees and processing times, making Bitcoin more practical for everyday transactions. This increased usability could attract a larger user base and drive price increases. Conversely, failure to overcome scalability challenges could limit Bitcoin’s growth potential and negatively impact its price. Successful implementation of Layer-2 solutions, like the Lightning Network, represents a significant catalyst for increased adoption and potentially higher valuations.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors like inflation and recession significantly influence Bitcoin’s price. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, might see increased demand and price appreciation. Investors may seek refuge in Bitcoin’s decentralized nature and limited supply as a protection against fiat currency devaluation. Conversely, during a recession, investors might sell off assets, including Bitcoin, to cover losses in other investments, leading to a potential price decline. The correlation between Bitcoin’s price and macroeconomic indicators is not always straightforward, and the impact can vary depending on the specific circumstances and investor sentiment. The 2022 bear market, for example, coincided with rising inflation and interest rates, demonstrating this complex relationship.

Institutional Investment and Bitcoin Adoption

The growing involvement of institutional investors, such as hedge funds and corporations, is a major driver of Bitcoin’s price. Large-scale investments by institutional players inject significant capital into the market, increasing demand and potentially driving up prices. However, a sudden withdrawal of institutional investment could lead to price corrections. The increased participation of established financial institutions lends credibility to Bitcoin as an asset class, potentially attracting further investment and driving long-term price appreciation. Grayscale Bitcoin Trust’s significant holdings, for instance, serve as a notable example of institutional involvement.

Widespread Cryptocurrency Adoption and Bitcoin’s Value

A scenario of widespread cryptocurrency adoption could significantly impact Bitcoin’s value. If Bitcoin maintains its position as the leading cryptocurrency, increased overall cryptocurrency adoption could translate to increased demand for Bitcoin and potentially higher prices. However, if other cryptocurrencies gain significant market share, Bitcoin’s dominance could be challenged, potentially impacting its price. The rise of competing cryptocurrencies with different functionalities or superior technology could lead to a diversification of the market, potentially reducing Bitcoin’s market capitalization and price. The future depends on Bitcoin’s ability to adapt and maintain its competitive edge within the evolving cryptocurrency landscape.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, and market sentiment. However, by considering various factors, we can construct plausible price scenarios for 2025, ranging from optimistic to pessimistic outlooks. These scenarios are not exhaustive and should be considered as potential possibilities rather than definitive predictions.

Bitcoin Price Scenarios in 2025

The following table Artikels three distinct price scenarios for Bitcoin in 2025: a bullish scenario, a bearish scenario, and a neutral scenario. Each scenario is based on a set of assumptions regarding the factors influencing Bitcoin’s price, such as regulatory clarity, widespread adoption, technological advancements, and macroeconomic conditions.

| Scenario | Price Range (USD) | Underlying Factors |

|---|---|---|

| Bullish | $150,000 – $250,000 | This scenario assumes widespread institutional adoption, positive regulatory developments globally, significant technological improvements (like layer-2 scaling solutions), and continued growth in the overall cryptocurrency market. Increased demand from institutional investors and a growing number of retail investors fueled by positive market sentiment would drive prices significantly higher. This could be similar to the 2021 bull run, but potentially even more pronounced due to increased maturity and institutional involvement in the market. For example, if several large financial institutions fully integrate Bitcoin into their portfolios, it could easily trigger a massive price surge. |

| Bearish | $10,000 – $30,000 | This scenario assumes a less favorable regulatory environment, significant macroeconomic headwinds (like a prolonged recession or increased inflation), major security breaches affecting Bitcoin’s network, or a loss of investor confidence. Increased regulatory scrutiny, particularly in major economies, could severely restrict the growth of the cryptocurrency market, leading to a significant price drop. A major security flaw or a large-scale hacking incident could also erode trust in Bitcoin, triggering a sell-off. A prolonged period of economic uncertainty could also cause investors to move away from riskier assets like Bitcoin. This could resemble the market downturn seen in 2018, where the price fell sharply after a period of rapid growth. |

| Neutral | $50,000 – $100,000 | This scenario assumes a relatively stable macroeconomic environment, moderate regulatory changes, and continued, albeit slower, adoption of Bitcoin. The price would consolidate around its current valuation, with gradual increases driven by steady adoption and technological improvements. This scenario reflects a more balanced outlook, where neither significant bullish nor bearish factors dominate. The price might fluctuate within this range depending on various market events, but overall, the trend would be relatively flat. This scenario could be compared to the period of consolidation Bitcoin experienced in 2019-2020 before the next bull run. |

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin, like any other asset class, presents a unique blend of potential rewards and inherent risks. The highly volatile nature of the cryptocurrency market demands a thorough understanding of both sides before committing capital. While the potential for significant returns is undeniable, so too are the dangers of substantial losses. The following sections detail these aspects, providing context for informed decision-making.

Key Risks Associated with Bitcoin Investment in 2025

Bitcoin’s price is notoriously volatile, subject to rapid and significant fluctuations driven by a complex interplay of factors including regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. The 2017-2018 bear market, for example, saw Bitcoin’s price plummet by over 80%, highlighting the potential for substantial losses. Further risks include the inherent security vulnerabilities associated with digital assets, the possibility of hacking or theft from exchanges or personal wallets, and the lack of regulatory clarity in many jurisdictions. These uncertainties can lead to significant price drops and erode investor confidence. Furthermore, the relatively young age of Bitcoin and the lack of a long-term track record make it difficult to predict its future performance with certainty. Consider, for instance, the unpredictable impact of emerging technologies like CBDCs (Central Bank Digital Currencies) on Bitcoin’s adoption and price.

Potential Opportunities for Investors in the Bitcoin Market

Despite the risks, Bitcoin presents compelling opportunities for investors. Its decentralized nature, limited supply (only 21 million Bitcoin will ever exist), and growing adoption as a store of value and a medium of exchange offer potential for long-term appreciation. The increasing institutional interest in Bitcoin, demonstrated by the growing holdings of major corporations and investment firms, further suggests a potential for sustained price growth. For example, MicroStrategy’s significant investment in Bitcoin has shown the growing acceptance of Bitcoin as a corporate treasury asset. Moreover, Bitcoin’s potential as a hedge against inflation, particularly in times of economic uncertainty, presents another significant opportunity. Historically, during periods of high inflation, Bitcoin’s price has often shown resilience or even growth, indicating its potential as a safe haven asset.

Risk/Reward Profile Compared to Other Asset Classes

Compared to traditional asset classes like stocks and bonds, Bitcoin exhibits a significantly higher risk/reward profile. While stocks and bonds offer relatively lower volatility and more established regulatory frameworks, their potential returns are generally lower than those offered by Bitcoin. The potential for exponential growth in Bitcoin is significantly higher, but so is the risk of substantial losses. Gold, often considered a safe-haven asset, presents a lower risk profile than Bitcoin, but also offers lower potential returns. Real estate investments, while relatively stable, typically offer lower liquidity and slower returns compared to Bitcoin. Therefore, the choice between Bitcoin and other asset classes depends on individual risk tolerance and investment goals. An investor with a higher risk tolerance and a longer time horizon might find Bitcoin’s potential returns attractive, while a more risk-averse investor might prefer the stability of traditional assets.

Bitcoin’s Role in the Future of Finance

Bitcoin’s decentralized nature and cryptographic security present a compelling alternative to traditional financial systems, potentially revolutionizing how we transact, store value, and access financial services. Its impact is already being felt, and its potential long-term implications are significant, shaping a future where finance is more accessible, transparent, and resilient.

Bitcoin’s inherent design challenges established financial institutions by offering a system free from intermediaries like banks and payment processors. This disintermediation reduces transaction fees and processing times, increasing efficiency and potentially lowering costs for consumers and businesses. The transparency provided by the public blockchain allows for increased accountability and auditability, fostering trust and reducing the risk of fraud.

Bitcoin’s Disruption of Traditional Financial Systems

The potential for Bitcoin to disrupt traditional finance stems from its core attributes: decentralization, security, and transparency. Unlike centralized systems controlled by single entities, Bitcoin operates on a distributed ledger, making it resistant to censorship and single points of failure. This resilience is particularly appealing in regions with unstable political or economic environments where traditional banking systems may be unreliable or inaccessible. The inherent security provided by cryptography protects transactions from unauthorized access and manipulation, offering a higher level of security than some traditional payment methods. The transparent nature of the blockchain allows anyone to view transaction history, increasing accountability and reducing opportunities for illicit activities. This increased transparency and security can potentially lead to a more efficient and trustworthy financial ecosystem. For example, the use of Bitcoin in international remittances can significantly reduce fees and processing times compared to traditional methods.

Examples of Bitcoin’s Use in Financial Applications

Bitcoin’s applications extend beyond simple peer-to-peer transactions. It is increasingly used in various financial contexts. Micro-lending platforms are leveraging Bitcoin to provide small loans to individuals in underserved communities, bypassing traditional banking systems. Companies are exploring the use of Bitcoin for payroll processing, offering employees faster and potentially cheaper payment options. Furthermore, Bitcoin-based decentralized finance (DeFi) platforms are creating innovative financial products, such as lending and borrowing services, that operate outside the traditional financial infrastructure. The use of stablecoins, cryptocurrencies pegged to fiat currencies, further expands Bitcoin’s role by providing a more stable store of value within the cryptocurrency ecosystem. These applications demonstrate the versatility and growing adoption of Bitcoin in various financial sectors.

Long-Term Implications of Widespread Bitcoin Adoption

The widespread adoption of Bitcoin could lead to significant shifts in the global financial landscape. Increased financial inclusion is a key potential benefit, as Bitcoin provides access to financial services for individuals in regions lacking traditional banking infrastructure. The enhanced transparency and security offered by Bitcoin could also lead to reduced fraud and improved efficiency in financial transactions. However, the potential for increased volatility and regulatory uncertainty remains a significant concern. The long-term implications are complex and depend on various factors, including regulatory developments, technological advancements, and public acceptance. A scenario where Bitcoin becomes a widely accepted medium of exchange could lead to a significant reduction in reliance on traditional financial intermediaries, potentially reshaping the financial industry’s structure and power dynamics. Conversely, a scenario of limited adoption might see Bitcoin primarily functioning as a store of value within a broader, evolving financial ecosystem.

Frequently Asked Questions (FAQ) about Bitcoin Price Outlook 2025

This section addresses common queries regarding Bitcoin’s price trajectory in 2025, considering various influencing factors and potential scenarios. Understanding these factors is crucial for informed decision-making regarding Bitcoin investment.

Main Factors Affecting Bitcoin’s Price in 2025

Several interconnected factors will significantly influence Bitcoin’s price in 2025. These include macroeconomic conditions (global inflation, recessionary pressures, interest rate policies), regulatory developments (governmental stances on cryptocurrency adoption and taxation), technological advancements (layer-2 scaling solutions, improved transaction speeds), adoption rates (increasing institutional and retail investment), and market sentiment (overall investor confidence and speculation). For example, a global recession could negatively impact Bitcoin’s price due to reduced risk appetite among investors, while widespread regulatory clarity could lead to increased institutional adoption and price appreciation. Conversely, a lack of technological advancements could hinder Bitcoin’s scalability and potentially limit price growth.

Wisdom of Investing in Bitcoin in 2023 Considering the 2025 Outlook

Investing in Bitcoin in 2023, with a 2025 outlook in mind, presents both potential benefits and risks. A potential benefit is the possibility of significant capital appreciation if the price rises substantially by 2025. However, risks include the volatile nature of the cryptocurrency market, potential regulatory crackdowns, and the possibility of price declines. The decision to invest should be based on a thorough risk assessment, considering individual financial circumstances and risk tolerance. It’s crucial to only invest what you can afford to lose and diversify your investment portfolio. For instance, an investor with a long-term horizon and high risk tolerance might find Bitcoin an attractive investment despite its volatility, while a risk-averse investor might prefer more stable assets.

Comparison of Bitcoin with Other Investment Options

Compared to traditional investments like stocks and bonds, Bitcoin offers potentially higher returns but with significantly higher risk. Stocks and bonds, while offering lower potential returns, typically exhibit less volatility. Gold, another common safe-haven asset, provides diversification benefits but generally offers lower returns compared to Bitcoin. The risk-reward profile of Bitcoin is vastly different from these traditional options, requiring a careful consideration of individual risk tolerance and investment goals. For example, a young investor with a long time horizon might allocate a small portion of their portfolio to Bitcoin to potentially benefit from its high growth potential, while an older investor nearing retirement might prefer lower-risk investments.

Potential Regulatory Hurdles Impacting Bitcoin’s Price

Government regulations concerning cryptocurrency can significantly impact Bitcoin’s price. Stringent regulations could limit adoption and suppress price growth, while supportive regulations could encourage wider adoption and price increases. Examples include differing tax policies across jurisdictions, restrictions on cryptocurrency trading, and varying levels of regulatory clarity. A clear and consistent regulatory framework across major economies could foster confidence and boost the price, while inconsistent or overly restrictive regulations could lead to price volatility and potential declines. The ongoing evolution of regulatory landscapes globally presents both opportunities and challenges for Bitcoin’s future.

Impact of Technological Advancements on Bitcoin’s Future

Technological advancements are crucial for Bitcoin’s long-term success and price appreciation. Improvements in scalability (e.g., the Lightning Network), transaction speed, and security will enhance Bitcoin’s usability and attractiveness to a wider range of users and institutions. Conversely, a lack of technological innovation could hinder adoption and negatively impact its price. For example, the development and successful implementation of layer-2 scaling solutions could significantly increase transaction throughput and reduce fees, leading to increased adoption and potentially higher prices. Conversely, a failure to address scalability issues could limit Bitcoin’s growth and put downward pressure on its price.

Illustrative Examples

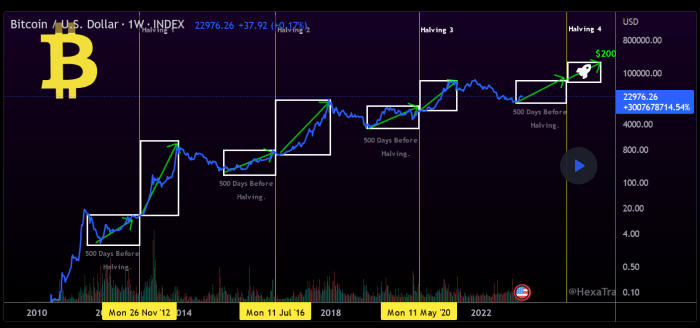

Visual representations can significantly enhance our understanding of Bitcoin’s price movements and the factors influencing them. The following examples illustrate how charts and visualizations can clarify complex information.

Hypothetical Bitcoin Price Chart for 2025

This hypothetical chart, displayed as a candlestick chart, shows Bitcoin’s price trajectory throughout 2025. The chart’s x-axis represents time (January to December 2025), and the y-axis represents the Bitcoin price in USD. The chart would begin the year around $30,000, experiencing a period of consolidation and sideways trading for the first quarter. A gradual upward trend would commence in the second quarter, reaching a peak of approximately $45,000 by mid-year, driven by positive regulatory developments and increasing institutional adoption. The third quarter might see a slight correction, dipping to around $38,000, before recovering and closing the year strongly at approximately $50,000. Each candlestick would represent a day’s trading activity, with the body showing the opening and closing prices, and the wicks indicating the high and low prices for that day. The overall trend would be positive, showing a clear upward movement throughout the year, punctuated by periods of consolidation and minor corrections. This visualization would clearly depict the volatility inherent in Bitcoin’s price while highlighting the overall bullish trend.

Visual Representation of Factors Influencing Bitcoin’s Price

A network graph would effectively visualize the various factors influencing Bitcoin’s price. The central node would represent Bitcoin’s price. Connecting nodes would represent different influential factors, such as regulatory announcements (e.g., positive news from the SEC), macroeconomic conditions (e.g., inflation, recession fears), technological advancements (e.g., Lightning Network adoption), adoption by institutional investors (e.g., increased holdings by major corporations), and market sentiment (e.g., social media hype or fear). The thickness of the lines connecting these nodes to the central node would represent the strength of influence. For example, a strong positive regulatory announcement would be depicted by a thick, positively colored line. Conversely, negative macroeconomic news would be represented by a thick, negatively colored line. This network graph would provide a clear and concise overview of the interplay between various factors affecting Bitcoin’s price.

Comparison of Bitcoin’s Price Performance to Other Assets

A line graph would effectively compare Bitcoin’s price performance against gold and the S&P 500 index over a specified period, for example, the year 2025. The x-axis would represent time (months), and the y-axis would represent the price (in USD) of each asset, normalized to a starting point of 100 for easier comparison. This would allow for a direct visual comparison of their relative performance throughout the year. For example, if Bitcoin experienced significant growth, its line would show a steeper upward trend compared to gold and the S&P 500. This visualization would highlight Bitcoin’s potential as an alternative asset class and allow investors to assess its risk-return profile relative to more traditional assets. The graph would include clearly labeled lines for Bitcoin, gold, and the S&P 500, along with a legend to distinguish each asset’s performance. This allows for easy understanding and interpretation of the relative price movements.