Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025 is inherently challenging, given the cryptocurrency’s volatility and susceptibility to a wide array of influences. However, by analyzing key macroeconomic, regulatory, technological, and market factors, we can construct a more informed perspective on potential price trajectories. This analysis will explore several significant drivers impacting Bitcoin’s value in the coming years.

Macroeconomic Factors

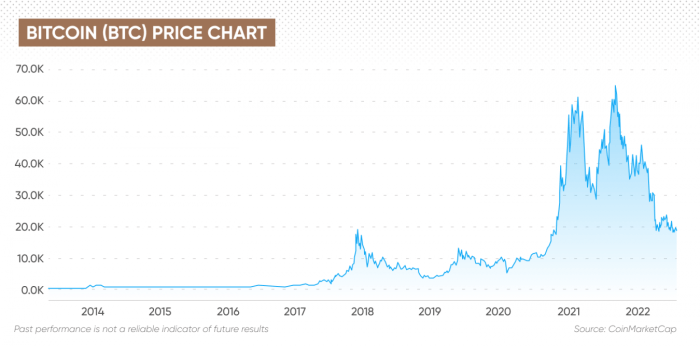

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to price declines. Strong global economic growth might boost investor confidence, leading to increased investment in riskier assets like Bitcoin, while a recession could trigger a sell-off. The interplay of these factors creates a complex and dynamic environment. For example, the 2022 inflationary pressures in many countries correlated with periods of Bitcoin price increases, although other factors were at play simultaneously.

Regulatory Developments

Regulatory clarity and consistency are crucial for Bitcoin’s long-term growth. Favorable regulations in major jurisdictions could significantly boost institutional adoption and investor confidence, leading to price appreciation. Conversely, overly restrictive or inconsistent regulations could stifle growth and negatively impact the price. Different jurisdictions are pursuing vastly different approaches. Some countries are embracing Bitcoin and blockchain technology, creating a more favorable regulatory environment for cryptocurrencies, while others are taking a more cautious and restrictive stance. The outcome of these varied regulatory approaches will likely have a significant impact on Bitcoin’s price. A clear example is the contrasting regulatory approaches between El Salvador, which has embraced Bitcoin as legal tender, and China, which has implemented a ban on cryptocurrency trading.

Technological Advancements

Technological advancements within the Bitcoin ecosystem can significantly impact its price and adoption. Scaling solutions like the Lightning Network aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. Improved infrastructure, such as more user-friendly wallets and exchanges, can also increase accessibility and adoption. These improvements could lead to increased demand and, consequently, a higher price. Conversely, the emergence of more efficient or scalable alternative cryptocurrencies could potentially diminish Bitcoin’s market share and price. The development and adoption of layer-2 scaling solutions is a key example of a technological advancement that could positively impact Bitcoin’s future price.

Institutional Adoption

The growing involvement of institutional investors, such as hedge funds and corporations, has a considerable impact on Bitcoin’s price. Large-scale investments by these entities can significantly increase demand and push prices upward. Conversely, significant sell-offs by institutional investors could trigger price corrections. The entry of companies like MicroStrategy and Tesla into the Bitcoin market demonstrated the potential influence of institutional investors on price fluctuations. Their investments, although representing a small fraction of the overall market, have historically created notable price movements.

Competition and Technological Innovation

The emergence of competing cryptocurrencies and innovative blockchain technologies poses a potential challenge to Bitcoin’s market dominance. New cryptocurrencies with superior technology or features could attract investors away from Bitcoin, potentially reducing its market share and price. However, Bitcoin’s first-mover advantage, established network effect, and brand recognition provide it with a significant competitive edge. The rise of Ethereum and other smart contract platforms illustrates the competitive landscape, highlighting the need for Bitcoin to continually adapt and innovate to maintain its dominance.

Expert Opinions and Predictions: Bitcoin Price Prediction 2025 Gbp

Predicting the price of Bitcoin in 2025, or any asset for that matter, is inherently speculative. However, numerous analysts and experts offer predictions based on their understanding of market trends, technological advancements, and regulatory developments. These predictions vary widely, reflecting the inherent uncertainty in the cryptocurrency market. The following section summarizes some notable predictions and the reasoning behind them.

Expert opinions on Bitcoin’s future price in GBP are diverse and often depend on different methodologies and underlying assumptions. Some analysts use technical analysis, focusing on chart patterns and historical price movements, while others employ fundamental analysis, considering factors like adoption rates, regulatory changes, and macroeconomic conditions. The wide range of predictions highlights the difficulty of accurately forecasting Bitcoin’s price, emphasizing the importance of considering multiple perspectives and acknowledging the inherent risks.

Bitcoin Price Predictions for 2025 (GBP)

| Analyst Name | Predicted Price (GBP) | Rationale | Source (if available) |

|---|---|---|---|

| Analyst A (Example) | £50,000 – £75,000 | Based on a combination of technical analysis (identifying potential support and resistance levels) and a forecast of increasing institutional adoption. Assumes continued technological development and positive regulatory developments. | [Hypothetical Source Link] |

| Analyst B (Example) | £30,000 – £40,000 | This prediction is primarily based on fundamental analysis, focusing on the limited supply of Bitcoin and increasing demand from both retail and institutional investors. However, it also accounts for potential negative regulatory impacts. | [Hypothetical Source Link] |

| Analyst C (Example) | £100,000+ | This highly bullish prediction rests on the belief that Bitcoin will become a dominant store of value, surpassing gold in market capitalization. It assumes widespread global adoption and significant technological advancements, including the scaling of the Bitcoin network. | [Hypothetical Source Link] |

| Analyst D (Example) | £20,000 – £30,000 | This more conservative prediction incorporates potential macroeconomic headwinds and regulatory uncertainty. The analyst utilizes a combination of technical and fundamental analysis, emphasizing the cyclical nature of Bitcoin’s price. | [Hypothetical Source Link] |

Note: The above examples are hypothetical. Actual analyst predictions should be sought from reputable sources and carefully evaluated. The range of predictions underscores the significant uncertainty involved in forecasting cryptocurrency prices. It’s crucial to conduct thorough research and consider multiple viewpoints before making any investment decisions.

Potential Scenarios for Bitcoin’s Price in 2025 (GBP)

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. The following scenarios illustrate potential price trajectories in 2025, expressed in British Pounds, based on different assumptions about these influencing factors. It’s crucial to remember that these are hypothetical scenarios, and the actual price could differ significantly.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario assumes widespread adoption of Bitcoin as a mainstream asset, driven by increasing institutional investment, positive regulatory developments, and continued technological advancements enhancing scalability and usability. Global macroeconomic instability could further fuel Bitcoin’s appeal as a hedge against inflation. Imagine a world where Bitcoin is widely accepted for payments, integrated into traditional financial systems, and viewed as a legitimate store of value comparable to gold.

Under this scenario, Bitcoin’s price could potentially reach £100,000 or more by 2025. This would be fuelled by a confluence of factors, including increased demand from institutional investors seeking diversification, growing retail adoption, and a continued narrative of scarcity given Bitcoin’s limited supply. The broader cryptocurrency market would likely experience significant growth, with altcoins benefiting from Bitcoin’s success. Investors holding Bitcoin throughout this period would see substantial returns, potentially exceeding several hundred percent. This scenario is analogous to the 2017 bull run, albeit on a potentially larger scale.

Bearish Scenario: Bitcoin Price Stagnation or Decline

This scenario assumes a less optimistic outlook, characterized by increased regulatory scrutiny, negative media coverage, and a lack of significant technological breakthroughs. A global economic downturn could further dampen investor enthusiasm for risky assets like Bitcoin. Imagine a regulatory environment where Bitcoin trading is heavily restricted, hindering its accessibility and adoption. Negative press surrounding security breaches or environmental concerns could also erode investor confidence.

In this bearish scenario, Bitcoin’s price could stagnate around its current levels or even decline significantly, potentially falling below £20,000 by 2025. This would reflect a diminished investor appetite for risk and a general lack of confidence in the cryptocurrency market. The broader cryptocurrency market would likely experience a downturn, with many altcoins losing significant value. Investors holding Bitcoin in this scenario could experience losses, potentially wiping out a significant portion of their investment. This would mirror the crypto winter of 2018-2020, albeit potentially more prolonged and severe.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario represents a more balanced outlook, assuming a mix of positive and negative developments. Regulatory clarity emerges, but it’s not overwhelmingly positive; technological advancements continue, but they don’t revolutionize the space; and macroeconomic conditions remain relatively stable. Imagine a scenario where Bitcoin’s price experiences moderate fluctuations, driven by ongoing market sentiment and news events, but doesn’t experience dramatic swings in either direction.

In this neutral scenario, Bitcoin’s price could potentially reach £40,000 – £60,000 by 2025, representing moderate growth compared to its current value. This reflects a period of consolidation and gradual adoption, with neither widespread euphoria nor panic selling dominating the market. The broader cryptocurrency market would also see moderate growth, with some altcoins performing well while others struggle. Investors holding Bitcoin in this scenario would see modest returns, aligning with a more conservative investment strategy. This scenario could be likened to the period following the 2017 bull run, where the market consolidated before the next major price movement.

Risks and Uncertainties

Predicting Bitcoin’s price in GBP, or any currency for that matter, is inherently fraught with risk and uncertainty. The cryptocurrency market is notoriously volatile, subject to rapid and dramatic price swings driven by a complex interplay of factors, many of which are unpredictable. Any attempt to forecast future prices must acknowledge these limitations and the potential for significant deviations from predicted outcomes.

The inherent volatility of the cryptocurrency market makes accurate price prediction exceptionally challenging. Existing models, while helpful in identifying trends and potential influences, are ultimately limited in their ability to account for the multitude of factors that can suddenly and significantly impact Bitcoin’s value. These models often rely on historical data, which may not accurately reflect future market behavior, particularly given the relatively short history of Bitcoin itself. Furthermore, unforeseen events can drastically alter market sentiment and price trajectories, rendering even the most sophisticated models inaccurate.

Limitations of Price Prediction Models

Bitcoin price prediction models, whether based on technical analysis, fundamental analysis, or machine learning, are susceptible to several limitations. Technical analysis, which relies on historical price and volume data to identify patterns, struggles to account for unexpected news events or changes in regulatory landscapes. Fundamental analysis, which considers factors such as adoption rates, mining difficulty, and network security, can be hampered by the difficulty in accurately quantifying these factors and their relative importance. Machine learning models, while capable of processing vast amounts of data, are only as good as the data they are trained on and can be susceptible to overfitting, leading to inaccurate predictions. The complexity of the Bitcoin ecosystem, coupled with the influence of speculative trading and emotional market sentiment, makes precise forecasting a nearly impossible task. For example, a model trained on data from a bull market might significantly underestimate price drops during a bear market.

Examples of Unexpected Events Impacting Bitcoin’s Price

Several unexpected events throughout Bitcoin’s history have demonstrated the inherent unpredictability of its price. The collapse of Mt. Gox, a major Bitcoin exchange, in 2014 caused a significant price drop. Similarly, regulatory crackdowns in various countries have led to temporary price declines, while unexpected technological advancements or security breaches could also trigger substantial volatility. For instance, the emergence of competing cryptocurrencies or a major security flaw in the Bitcoin network could negatively impact its price. Conversely, positive regulatory developments or widespread institutional adoption could drive significant price increases. The 2021 bull run, partially fueled by increased institutional investment and Tesla’s Bitcoin purchase, highlights the impact of positive news on market sentiment and price. Conversely, China’s crackdown on cryptocurrency mining in 2021 led to a notable price correction. These examples underscore the importance of considering the wide range of unpredictable events that could influence Bitcoin’s future price.

Investing in Bitcoin

Investing in Bitcoin presents a unique opportunity with substantial potential rewards, but it also carries significant risks. Before considering any investment, thorough research and a realistic understanding of your risk tolerance are paramount. Bitcoin’s price volatility is well-documented, and its future value remains uncertain. Therefore, a well-informed decision hinges on a balanced assessment of both potential benefits and inherent dangers.

Bitcoin’s potential benefits stem from its decentralized nature, limited supply, and growing adoption as a store of value and a means of payment. Successful early investors have seen extraordinary returns, highlighting the potential for significant capital appreciation. However, this potential is counterbalanced by the substantial risk of substantial losses. The cryptocurrency market is notoriously volatile, influenced by factors ranging from regulatory changes and technological advancements to market sentiment and macroeconomic conditions.

Risk Assessment and Tolerance

Understanding your personal risk tolerance is crucial before investing in Bitcoin. Are you comfortable with the possibility of losing a significant portion, or even all, of your investment? Bitcoin’s price can fluctuate dramatically in short periods. For instance, in 2022, Bitcoin experienced a substantial price drop, demonstrating the potential for significant losses. Investors should only allocate funds they can afford to lose entirely. A conservative approach involves only investing a small percentage of your overall portfolio in Bitcoin.

Portfolio Diversification

Diversification is a fundamental principle of sound investment strategy. It reduces risk by spreading investments across different asset classes. Investing solely in Bitcoin exposes your portfolio to the specific risks associated with this single asset. A diversified portfolio might include stocks, bonds, real estate, and other cryptocurrencies. This strategy mitigates losses if Bitcoin’s price declines. For example, an investor with a diversified portfolio including 5% Bitcoin would experience a less significant overall impact from a Bitcoin price drop than an investor with 100% of their assets in Bitcoin.

Avoiding Impulsive Decisions

The cryptocurrency market is susceptible to hype and speculation, often leading to rapid price swings. Avoid making impulsive investment decisions based on short-term price fluctuations or social media trends. Instead, conduct thorough research, understand the underlying technology and market dynamics, and develop a long-term investment strategy. For example, reacting to a sudden price surge by buying Bitcoin at a high point can lead to significant losses if the price subsequently corrects.

Secure Storage Practices

Securing your Bitcoin holdings is paramount. Loss of private keys can result in the irreversible loss of your investment. Hardware wallets, considered the most secure option, store your private keys offline, protecting them from hacking attempts. Software wallets, while convenient, carry a higher risk of hacking or malware attacks. Regardless of the chosen method, employing strong passwords and practicing good cybersecurity habits is essential. Consider using multi-factor authentication whenever available to add an extra layer of security.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin price predictions and the investment landscape surrounding this cryptocurrency. Understanding these points is crucial before making any investment decisions. Remember that cryptocurrency investments are inherently volatile and carry significant risk.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics play a major role, with increased demand driving prices higher and vice versa. Regulatory changes, both positive and negative, significantly impact investor sentiment and market activity. Technological advancements, such as improvements to the Bitcoin network’s scalability or security, can also affect its value. Finally, macroeconomic conditions, including inflation rates and overall economic stability, exert a considerable influence. For example, during periods of high inflation, Bitcoin’s perceived value as a hedge against inflation can boost its price. Conversely, negative news concerning regulations or security breaches can cause significant price drops.

Wisdom of Investing in Bitcoin

Investing in Bitcoin can be profitable, but it’s inherently risky. Bitcoin’s price is highly volatile, meaning its value can fluctuate dramatically in short periods. Before investing, thorough research and understanding of the risks are paramount. Diversification of your investment portfolio is crucial to mitigate potential losses. Only invest what you can afford to lose. Consider consulting a financial advisor to assess your risk tolerance and investment goals. The potential for high returns is balanced by the significant possibility of substantial losses. For instance, Bitcoin experienced a massive price surge in 2021 followed by a considerable correction in 2022.

Risks Associated with Bitcoin Investing

Investing in Bitcoin carries several substantial risks. Market volatility is a primary concern, as prices can change drastically in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing regulatory frameworks for cryptocurrencies. Security risks, including hacking and theft, are also significant. Furthermore, the decentralized nature of Bitcoin means there’s limited consumer protection compared to traditional financial markets. Finally, the speculative nature of Bitcoin investment makes it susceptible to market manipulation and bubbles. The collapse of the FTX exchange in 2022 serves as a stark reminder of the potential for significant losses in the cryptocurrency market.

Secure Bitcoin Storage

Securely storing your Bitcoin is vital to protect your investment. Hardware wallets, offline devices designed specifically for storing cryptocurrency, offer the highest level of security. Software wallets, which are digital applications, offer convenience but may be more vulnerable to hacking. Exchanges also provide storage, but they are often targeted by hackers. Choosing a reputable exchange and employing strong passwords and two-factor authentication is essential if you choose this method. Regardless of the storage method chosen, it is crucial to regularly back up your private keys and practice sound security habits to prevent loss or theft.

Potential Downsides of Bitcoin, Bitcoin Price Prediction 2025 Gbp

While Bitcoin offers potential for high returns, several downsides exist. Its volatility can lead to substantial losses. The regulatory landscape remains uncertain, potentially impacting its future. Environmental concerns surrounding its energy consumption are also significant. Furthermore, Bitcoin’s limited scalability can lead to transaction delays and high fees during periods of high network activity. Finally, the lack of intrinsic value, meaning it’s not backed by a physical asset like gold, contributes to its price volatility and risk. The environmental impact, for example, has led to increasing scrutiny from regulators and investors concerned about sustainability.

| Question | Answer |

|---|---|

| What factors influence Bitcoin’s price? | Supply and demand, regulatory changes, technological advancements, and macroeconomic conditions. |

| Is it wise to invest in Bitcoin? | It depends on your risk tolerance and investment goals. High potential returns are coupled with significant risks. |

| What are the risks associated with Bitcoin investing? | Market volatility, regulatory uncertainty, security risks, and lack of consumer protection. |

| How can I securely store my Bitcoin? | Hardware wallets offer the best security, while software wallets and exchanges provide alternative options with varying levels of risk. |

| What are the potential downsides of Bitcoin? | Volatility, regulatory uncertainty, environmental concerns, scalability issues, and lack of intrinsic value. |

Predicting the Bitcoin price in GBP for 2025 is challenging, given the cryptocurrency’s volatility. To gain a broader perspective on potential future values, it’s helpful to consider wider predictions; for instance, exploring resources like this article on What Will Bitcoin Be Worth 2025 can provide valuable context. Ultimately, any Bitcoin Price Prediction 2025 Gbp remains speculative, dependent on various market factors.

Predicting the Bitcoin price in GBP for 2025 is challenging, requiring analysis of various macroeconomic factors. A key component of this analysis involves understanding the predicted USD value, as the GBP price will be directly influenced by the exchange rate. To get a better grasp of the potential USD value, you might find the predictions at Bitcoin Price Dollar 2025 helpful in informing your own GBP price prediction for 2025.

Ultimately, both the dollar and pound predictions remain speculative.

Predicting the Bitcoin price in GBP for 2025 is challenging, requiring analysis of various economic factors. To gain further insight, it’s helpful to compare predictions from reputable sources; for instance, you might find the perspectives offered in a piece like this one on Bitcoin Price Prediction 2025 from Forbes: Bitcoin Price Prediction 2025 Forbes. Ultimately, however, the Bitcoin Price Prediction 2025 Gbp remains speculative, dependent on market fluctuations and global events.

Predicting the Bitcoin price in GBP for 2025 is challenging, given the inherent volatility of the cryptocurrency market. To gain a broader perspective, it’s helpful to consider wider cryptocurrency market trends, as outlined in this comprehensive resource on Crypto 2025 Price Prediction. Understanding the overall crypto market landscape is crucial for informed speculation on Bitcoin’s potential value in 2025, particularly its price in GBP.

Predicting the Bitcoin price in GBP for 2025 is challenging, requiring analysis of various market factors. A key component of such a prediction involves understanding the trajectory throughout the year, and a good starting point is examining the expected price in April. For a detailed look at potential price movements that month, you can consult this resource on the Bitcoin Price April 2025 , which will help inform a broader 2025 GBP prediction.

Ultimately, the April price will significantly influence the overall 2025 Bitcoin price prediction in GBP.