Bitcoin Price Prediction 2025: Bitcoin Price Prediction 2025 Halving Usd

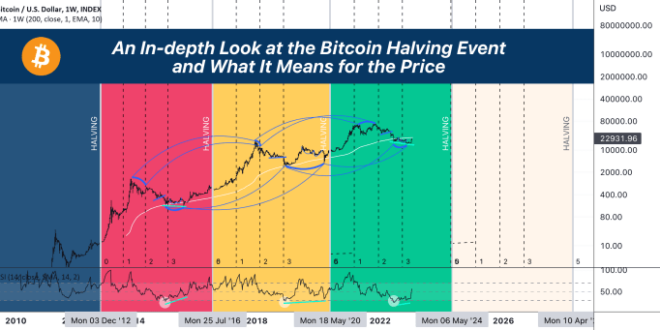

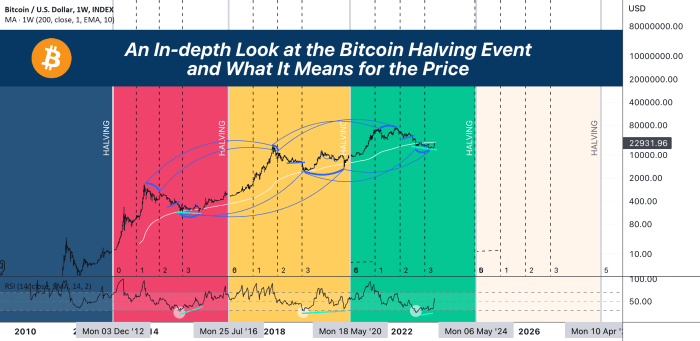

Bitcoin’s price has historically demonstrated a strong correlation with its halving events, periods where the rate of newly mined Bitcoin is cut in half. This reduction in supply often leads to increased scarcity and, consequently, upward pressure on price. However, predicting the exact price in 2025 requires considering various other market forces beyond the halving.

Historical Impact of Bitcoin Halvings, Bitcoin Price Prediction 2025 Halving Usd

The halving events of 2012, 2016, and 2020 each saw a significant price increase in the months and years following the event. While not immediate, the reduced inflation rate of newly minted Bitcoin typically created a bullish environment. However, it’s crucial to remember that other factors, such as regulatory changes, technological advancements, and macroeconomic conditions, also significantly influence Bitcoin’s price. The price increase following each halving varied considerably, indicating the complexity of predicting future price movements. For instance, the bull run following the 2012 halving was less pronounced compared to the one after the 2016 halving, highlighting the influence of external market dynamics.

Factors Influencing Bitcoin’s Price in 2025

Several factors beyond the 2024 halving will likely influence Bitcoin’s price in 2025. These include the overall state of the global economy, the regulatory landscape for cryptocurrencies, technological advancements within the Bitcoin ecosystem, and the level of institutional and retail adoption. A global recession, for example, could dampen demand, while increased regulatory clarity could attract more institutional investors. Technological developments, such as the Lightning Network’s widespread adoption, could also impact price by improving transaction speed and scalability. Conversely, negative regulatory changes or security breaches could significantly depress the price.

Comparison with Previous Halving Cycles

Comparing the projected price trajectory for 2025 with previous halving cycles reveals a complex picture. While the price typically increases after a halving, the magnitude and timing of this increase vary significantly. The 2012 halving saw a gradual price increase over several years, while the 2016 halving led to a more rapid and substantial price surge. The 2020 halving resulted in a significant price increase, followed by a correction, and then another significant surge, highlighting the volatility inherent in the cryptocurrency market. Therefore, simply extrapolating past performance is unreliable for predicting future price movements.

Hypothetical Price Range for Bitcoin in 2025

Considering the various scenarios Artikeld above, a hypothetical price range for Bitcoin in 2025 could be anywhere from $100,000 to $500,000 USD. A conservative scenario, factoring in potential economic downturns and regulatory uncertainty, might see Bitcoin trading closer to the lower end of this range. Conversely, a more optimistic scenario, characterized by widespread institutional adoption and positive regulatory developments, could push the price towards the higher end. This range acknowledges the significant uncertainties inherent in any long-term price prediction.

Bitcoin Price Performance After Previous Halvings

| Halving Date | Approximate Price Before Halving (USD) | Approximate Price 1 Year After Halving (USD) | Approximate Price Change (%) |

|---|---|---|---|

| November 2012 | ~12 | ~100 | ~733% |

| July 2016 | ~650 | ~2000 | ~208% |

| May 2020 | ~8700 | ~10000 | ~15% |

Bitcoin Price Prediction 2025 Halving Usd – Predicting the Bitcoin price in 2025, considering the halving event, is a complex task influenced by various factors. A key element in these predictions is the precise date of the halving, which you can find by checking this helpful resource on the Fecha Halving Bitcoin 2025. Understanding this date is crucial for accurately assessing the potential impact of the halving on the Bitcoin price prediction for 2025 and beyond.

Predicting the Bitcoin price in 2025, considering the halving’s impact on USD value, is a complex undertaking. A key factor influencing this prediction is understanding the Bitcoin Halving Cycle 2025, which you can read more about here: Bitcoin Halving Cycle 2025. Ultimately, the 2025 halving’s effect on Bitcoin’s price in USD remains a subject of ongoing discussion and analysis among market experts.

Predicting the Bitcoin price in 2025, considering the halving’s impact on USD value, is a complex undertaking. A key factor influencing this prediction is understanding the Bitcoin Halving Cycle 2025, which you can read more about here: Bitcoin Halving Cycle 2025. Ultimately, the 2025 halving’s effect on Bitcoin’s price in USD remains a subject of ongoing discussion and analysis among market experts.

Predicting the Bitcoin price in 2025, considering the halving’s impact on USD value, is a complex undertaking. A key factor influencing this prediction is understanding the Bitcoin Halving Cycle 2025, which you can read more about here: Bitcoin Halving Cycle 2025. Ultimately, the 2025 halving’s effect on Bitcoin’s price in USD remains a subject of ongoing discussion and analysis among market experts.

Predicting the Bitcoin price in 2025, considering the halving’s impact on USD value, is a complex undertaking. A key factor influencing this prediction is understanding the Bitcoin Halving Cycle 2025, which you can read more about here: Bitcoin Halving Cycle 2025. Ultimately, the 2025 halving’s effect on Bitcoin’s price in USD remains a subject of ongoing discussion and analysis among market experts.

Predicting the Bitcoin price in 2025, considering the halving’s impact on USD value, is a complex undertaking. A key factor influencing this prediction is understanding the Bitcoin Halving Cycle 2025, which you can read more about here: Bitcoin Halving Cycle 2025. Ultimately, the 2025 halving’s effect on Bitcoin’s price in USD remains a subject of ongoing discussion and analysis among market experts.