Bitcoin Price Prediction 2025 in INR

Bitcoin, first introduced in 2009, has experienced a turbulent yet fascinating journey. Its decentralized nature and potential for disrupting traditional financial systems have garnered significant global attention, including within the Indian market. While adoption in India faces hurdles, the country’s large and increasingly tech-savvy population presents a substantial potential user base. Understanding Bitcoin’s price fluctuations in relation to the Indian Rupee requires considering various intertwined factors.

Bitcoin’s price is notoriously volatile, influenced by a complex interplay of market forces. Market sentiment, driven by news events, technological developments, and overall investor confidence, plays a crucial role. Regulatory changes, both globally and within India, significantly impact accessibility and investor behavior. Technological advancements, such as the development of the Lightning Network aiming to improve transaction speeds and reduce fees, also influence the cryptocurrency’s value. Furthermore, macroeconomic factors such as inflation and global economic uncertainty can impact Bitcoin’s perceived value as a hedge against traditional assets.

Factors Influencing Bitcoin’s Price in INR

Several key factors contribute to Bitcoin’s price fluctuations when measured against the Indian Rupee. These include global Bitcoin market trends (as the INR is tied to the USD), the regulatory stance of the Indian government, the adoption rate of Bitcoin within India, and overall investor sentiment within the Indian market. For example, a positive global news cycle regarding Bitcoin adoption might lead to increased demand and a rise in its price in INR, while stricter regulatory measures in India could suppress demand and cause a price drop. Similarly, a period of economic uncertainty in India could drive investors towards Bitcoin as a potential safe haven asset, thereby increasing its price.

Challenges and Opportunities of Bitcoin Investment in India

Investing in Bitcoin in India presents both significant challenges and opportunities. Challenges include regulatory uncertainty, volatility, and the potential for scams and fraudulent activities. The Indian government’s stance on cryptocurrency has been evolving, leading to periods of uncertainty for investors. The inherent volatility of Bitcoin poses a considerable risk for those lacking a high-risk tolerance. Furthermore, the lack of robust consumer protection mechanisms in the crypto space exposes investors to scams and fraud. Conversely, opportunities exist in the potential for high returns, the increasing accessibility of cryptocurrency exchanges, and the growing awareness and adoption of Bitcoin among the Indian population. The potential for Bitcoin to act as a hedge against inflation in a developing economy like India also presents a significant long-term opportunity. For example, if the Indian Rupee experiences significant inflation, the relative value of Bitcoin might increase, offering investors a potential safeguard.

Factors Affecting Bitcoin’s Price in INR

Predicting Bitcoin’s price in Indian Rupees (INR) requires understanding the interplay of various factors, both domestic and global. These factors influence both the price of Bitcoin itself and the exchange rate between the INR and other major currencies, creating a complex dynamic. This section delves into the key macroeconomic conditions, regulatory landscapes, and global events that significantly impact Bitcoin’s INR valuation.

Macroeconomic Factors Affecting INR and Bitcoin’s Price

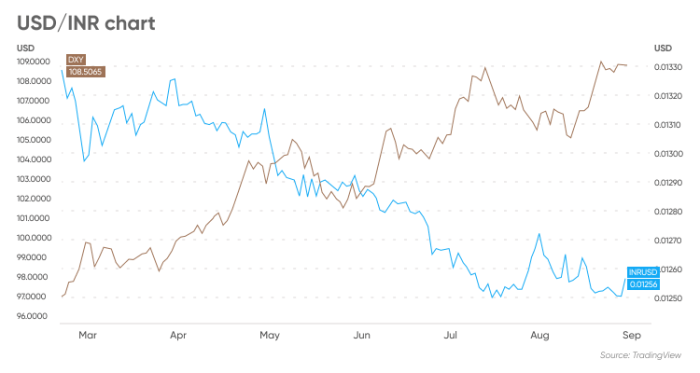

India’s macroeconomic environment significantly influences the INR’s value against other currencies, including the USD, in which Bitcoin is primarily priced. Factors like inflation, interest rates set by the Reserve Bank of India (RBI), economic growth, and the country’s balance of payments directly affect the INR’s strength. A stronger INR generally leads to a lower Bitcoin price in INR terms, while a weaker INR can result in a higher price. For instance, periods of high inflation in India could weaken the INR, potentially pushing up the Bitcoin price expressed in INR, even if the USD price of Bitcoin remains stable. Conversely, strong economic growth and increased foreign investment could strengthen the INR, potentially leading to a lower Bitcoin price in INR.

Government Regulations and Policies on Cryptocurrency Adoption in India

The Indian government’s stance on cryptocurrencies significantly shapes the market. While the government hasn’t outright banned cryptocurrencies, its regulatory approach remains evolving. Announcements regarding taxation, licensing, and potential future regulations create uncertainty and volatility. For example, the introduction of a 30% tax on cryptocurrency gains in India in 2022 impacted investor sentiment and potentially influenced the price. Future regulations clarifying the legal status of cryptocurrencies and their usage could either boost or dampen investor enthusiasm, directly affecting Bitcoin’s price in INR. A clear and favorable regulatory framework could attract more investment and potentially increase the price, whereas restrictive measures could have the opposite effect.

Global Events and Market Trends Influencing Bitcoin’s Price in INR

Global events and broader market trends play a substantial role. Major geopolitical events, such as wars or global economic crises, can lead to increased volatility in both the cryptocurrency market and the foreign exchange market, influencing the INR/USD exchange rate and, consequently, Bitcoin’s INR price. For instance, the global financial uncertainty following the collapse of several prominent financial institutions in 2023 impacted both the USD value of Bitcoin and the INR’s value against the USD, leading to fluctuations in the INR price of Bitcoin. Similarly, shifts in global investor sentiment towards risk assets (including cryptocurrencies) will directly affect Bitcoin’s price globally and, consequently, its price in INR. Positive global news and increased institutional investment in Bitcoin can lead to price increases, while negative news or regulatory crackdowns in other major markets can trigger price drops.

Bitcoin Price Prediction 2025 in INR

Predicting the future price of Bitcoin is inherently speculative, as numerous factors can influence its value. However, by analyzing current trends and considering various possibilities, we can Artikel potential scenarios for Bitcoin’s price in Indian Rupees by 2025. These scenarios are not financial advice and should be considered for informational purposes only.

Bitcoin Price Prediction 2025 in INR: Potential Scenarios

We present three distinct scenarios: a bullish scenario reflecting significant price appreciation, a bearish scenario anticipating a price decline, and a neutral scenario projecting moderate growth. These scenarios are based on a combination of technical analysis, adoption rates, regulatory changes, and macroeconomic factors.

Bullish Scenario

This scenario assumes widespread institutional adoption, positive regulatory developments, and continued technological advancements in the Bitcoin ecosystem. Increased demand alongside limited supply could propel Bitcoin’s price significantly higher.

| Projected Price Range (INR) | Key Influencing Factors | Potential Risks |

|---|---|---|

| ₹500,00,000 – ₹1,00,00,000 | Widespread institutional adoption, positive regulatory environment, technological advancements (e.g., Lightning Network improvements), increasing scarcity due to halving events, significant global macroeconomic instability driving investors towards Bitcoin as a safe haven asset. | Regulatory crackdowns, unforeseen technological vulnerabilities, market manipulation, a significant global economic recovery reducing the demand for safe-haven assets. |

Bearish Scenario

This scenario assumes negative regulatory changes, a significant cryptocurrency market crash, or a loss of investor confidence. Increased selling pressure and a lack of new investment could lead to a substantial price decline. This scenario considers factors like increased competition from alternative cryptocurrencies, negative media coverage, and a global economic downturn.

| Projected Price Range (INR) | Key Influencing Factors | Potential Risks |

|---|---|---|

| ₹5,00,000 – ₹15,00,000 | Negative regulatory developments, increased competition from altcoins, major security breaches impacting investor confidence, a prolonged global economic recession, significant sell-offs by large holders. | Further regulatory uncertainty, a prolonged bear market, a lack of innovation in the Bitcoin ecosystem, the emergence of a superior cryptocurrency. |

Neutral Scenario

This scenario assumes a relatively stable market environment with moderate growth. This projection accounts for a balance between positive and negative factors, resulting in a gradual increase in Bitcoin’s price. It assumes a continuation of current adoption trends and a moderate level of regulatory oversight.

| Projected Price Range (INR) | Key Influencing Factors | Potential Risks |

|---|---|---|

| ₹20,00,000 – ₹40,00,000 | Continued mainstream adoption, stable regulatory environment, gradual technological improvements, moderate economic growth, increasing institutional investment at a slower pace than in the bullish scenario. | Unexpected geopolitical events, a sudden shift in market sentiment, increased competition from other assets, slower-than-expected adoption rates. |

Using a Bitcoin Price Prediction Calculator (Illustrative Example)

Many online tools offer Bitcoin price predictions, often based on various algorithms and market analyses. These calculators provide a convenient way to explore potential future values based on different assumptions and scenarios. While not guarantees, they offer valuable insights into potential price movements. Understanding how these calculators work and their limitations is crucial for interpreting their outputs responsibly.

A hypothetical Bitcoin price prediction calculator would typically require several inputs to generate its estimations. These inputs would influence the final predicted price, highlighting the inherent uncertainty involved in such predictions. The calculator’s functionality relies on integrating historical data, current market trends, and potentially even incorporating user-defined parameters like adoption rates or regulatory changes.

Calculator Functionality and Usage

Let’s consider a simplified example of a Bitcoin price prediction calculator. This calculator uses a proprietary algorithm combining historical price data, trading volume, and network activity to project future prices. The user would input a starting Bitcoin price (in INR), a timeframe (e.g., until 2025), and an estimated annual growth rate (expressed as a percentage). The calculator then applies its algorithm to these inputs, generating a predicted price for Bitcoin in INR at the specified future date.

Illustrative Example of Calculator Use

Imagine our hypothetical calculator has the following interface:

Bitcoin Price Prediction 2025 In Inr Calculator – Bitcoin Price Prediction Calculator

Current Bitcoin Price (INR):

Accurately predicting the Bitcoin price in INR for 2025 requires considering various factors, including global economic conditions and technological advancements. To gain a better understanding of potential Bitcoin price trajectories, it’s helpful to consult resources like this article: What Price Will Bitcoin Reach In 2025. Ultimately, using this information alongside other market analyses can help refine your Bitcoin Price Prediction 2025 Inr Calculator estimations.

Target Year:

Predicting the Bitcoin price in INR for 2025 requires considering various factors. One influential model to examine is Plan B’s prediction, which you can find detailed here: Bitcoin Price 2025 Plan B. Understanding Plan B’s methodology helps refine your own Bitcoin Price Prediction 2025 Inr Calculator estimations, leading to a more informed outlook on potential future values.

Estimated Annual Growth Rate (%):

Accurately predicting the Bitcoin price in INR for 2025 requires considering various factors, including market sentiment and technological advancements. For a broader perspective on potential future values, you might find the analysis provided by reputable sources helpful, such as the insights offered in this article on Btc 2025 Price Prediction Forbes. Ultimately, though, a Bitcoin Price Prediction 2025 In Inr Calculator will need to incorporate this type of market data for a more comprehensive forecast.

Accurately predicting the Bitcoin price in INR for 2025 requires considering various factors, including global economic trends and technological advancements. To gain a broader perspective on potential future values, it’s helpful to consult resources like What Price Bitcoin 2025 , which offers insights into global Bitcoin price projections. Understanding these broader predictions can then inform your use of a Bitcoin Price Prediction 2025 Inr Calculator for a more nuanced assessment.

Predicted Bitcoin Price (INR in 2025):

Accurately predicting the Bitcoin price in INR for 2025 requires considering various factors. A helpful tool in this process is a Bitcoin Price Prediction 2025 In INR Calculator, which often uses algorithms and historical data. To visualize potential price movements, you can also consult a Bitcoin price chart, such as this one: Bitcoin Price Chart 2025.

Ultimately, using both a calculator and a chart provides a more comprehensive understanding when attempting a Bitcoin Price Prediction 2025 In INR Calculator.

In this example, we input a current Bitcoin price of ₹2,000,000, a target year of 2025, and an estimated annual growth rate of 25%. After clicking “Calculate,” the calculator would perform the calculation (a simplified compound interest calculation in this case) and display the predicted price. For instance, if the calculation is based on a simple compound interest model, the predicted price in 2025 would be approximately ₹7,873,242.17. This is a highly simplified model and actual predictions would be significantly more complex. Remember that this is an illustrative example, and real-world calculators employ far more sophisticated algorithms. The result displayed would depend entirely on the input values and the underlying algorithm used by the calculator. It is crucial to remember that these are only predictions, and the actual price could vary significantly.

Risks and Considerations for Bitcoin Investment: Bitcoin Price Prediction 2025 In Inr Calculator

Investing in Bitcoin, like any other asset class, carries significant risks. While the potential for high returns is alluring, understanding these risks is crucial before committing any capital. Failure to adequately assess and manage these risks could lead to substantial financial losses.

Price volatility is a defining characteristic of Bitcoin. Its price can fluctuate dramatically in short periods, influenced by market sentiment, regulatory changes, technological developments, and macroeconomic factors. For example, Bitcoin’s price experienced a significant drop in 2022, impacting many investors. This inherent volatility makes it a high-risk investment unsuitable for risk-averse individuals.

Price Volatility and Market Sentiment

Bitcoin’s price is highly susceptible to market sentiment. News events, social media trends, and even celebrity endorsements can trigger substantial price swings. A negative news story or a regulatory crackdown can cause a sharp decline, while positive news can lead to a rapid surge. This makes predicting Bitcoin’s price trajectory extremely challenging and highlights the importance of a long-term investment strategy, if one chooses to invest. It’s crucial to remember that past performance is not indicative of future results.

Security Risks and Breaches

Bitcoin’s decentralized nature doesn’t eliminate security risks. Individuals holding Bitcoin are responsible for securing their private keys, which are essential for accessing their funds. Losing these keys, whether through theft, hacking, or negligence, results in the irreversible loss of Bitcoin. Furthermore, exchanges where Bitcoin is traded have been targets of hacking attempts in the past, resulting in significant losses for users. Therefore, robust security measures, including strong passwords, two-factor authentication, and reputable exchange selection, are paramount.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is constantly evolving. Different governments worldwide have adopted varying approaches, ranging from outright bans to regulatory frameworks designed to control and monitor Bitcoin transactions. This regulatory uncertainty can create significant risks for investors, as changes in regulations can impact the price, accessibility, and legality of Bitcoin. Investors should stay informed about regulatory developments in their jurisdictions and globally.

Diversification and Risk Management, Bitcoin Price Prediction 2025 In Inr Calculator

Diversification is a cornerstone of sound investment strategy. It involves spreading investments across different asset classes to reduce overall portfolio risk. Including Bitcoin in a portfolio should be done cautiously, and only after careful consideration of its volatility and other risks. A diversified portfolio containing traditional assets like stocks and bonds can help mitigate the impact of Bitcoin’s price fluctuations. Risk management strategies, such as setting stop-loss orders to limit potential losses, are also essential for Bitcoin investors.

Responsible Investment Practices and Due Diligence

Before investing in Bitcoin, thorough due diligence is essential. This involves researching the technology behind Bitcoin, understanding its risks and potential rewards, and assessing its suitability for your personal financial situation and risk tolerance. Only invest what you can afford to lose, and avoid investing based on hype or speculation. Seek advice from qualified financial advisors before making any investment decisions, especially in high-risk assets like Bitcoin. Never invest more than you can afford to lose.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin investment in 2025, focusing on potential benefits, associated risks, using prediction calculators, and finding reliable information sources. Understanding these aspects is crucial for making informed investment decisions.

Potential Benefits of Investing in Bitcoin in 2025

Investing in Bitcoin in 2025 offers several potential benefits, though it’s crucial to remember that these are speculative and depend on various market factors. A primary benefit is the potential for high returns. Bitcoin’s history demonstrates periods of significant price appreciation. However, past performance is not indicative of future results. Another potential benefit is diversification. Bitcoin, as a decentralized digital asset, can offer diversification within a broader investment portfolio, potentially reducing overall risk. Furthermore, the growing adoption of Bitcoin by institutions and businesses could drive further price increases. Finally, the underlying technology, blockchain, has applications beyond cryptocurrency, offering potential long-term growth opportunities. It’s important to weigh these potential benefits against the inherent risks.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Volatility is a significant concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Regulatory uncertainty is another key risk; governments worldwide are still developing regulations for cryptocurrencies, which could impact Bitcoin’s value and trading. Security risks, such as hacking and theft from exchanges or personal wallets, are also present. Furthermore, Bitcoin’s value is largely speculative, influenced by market sentiment and technological developments, making it difficult to predict its future price accurately. Finally, the lack of inherent value, unlike traditional assets, contributes to its risk profile. Investors should carefully assess their risk tolerance before investing in Bitcoin.

Using a Bitcoin Price Prediction Calculator

Bitcoin price prediction calculators utilize various algorithms and data points (historical price data, market trends, etc.) to estimate future Bitcoin prices. These calculators are generally not foolproof, as they rely on assumptions and models that may not accurately reflect future market conditions. To use a calculator, you typically input relevant data, such as current price, historical volatility, and other market indicators. The calculator then applies its algorithm to generate a predicted price for a specific future date. For example, a user might input the current price of Bitcoin in INR and select 2025 as the target year. The calculator will then provide an estimated price in INR for that year, but it’s crucial to remember that this is just an estimation and should not be taken as financial advice. Always conduct your own thorough research and consider consulting a financial advisor.

Reliable Information on Bitcoin Price Predictions

Finding reliable information on Bitcoin price predictions requires a critical approach. Avoid sources that make overly optimistic or guaranteed predictions. Reputable financial news outlets, research firms specializing in cryptocurrency analysis, and blockchain data providers can offer more reliable, albeit still uncertain, forecasts. It’s crucial to cross-reference information from multiple sources and consider the methodologies used in generating predictions. Remember that even the most reputable sources cannot predict the future with certainty. Focus on understanding the underlying factors that influence Bitcoin’s price, rather than relying solely on specific price predictions. This will help you make more informed investment decisions.

Disclaimer and Additional Resources

It is crucial to understand that predicting the price of Bitcoin, or any cryptocurrency, is inherently speculative. The information provided in this document regarding potential Bitcoin prices in INR for 2025 is for illustrative purposes only and should not be considered financial advice. Market volatility, regulatory changes, technological advancements, and unforeseen events can significantly impact Bitcoin’s price, rendering any prediction unreliable. Investing in Bitcoin involves substantial risk, and you could lose some or all of your investment.

This section aims to provide you with additional resources and information to help you make informed decisions regarding Bitcoin investments. Remember that conducting thorough research and understanding the risks are paramount before committing any funds. This information is not intended to encourage or discourage investment but to empower you with knowledge.

Reputable Sources for Further Information

Several reputable sources offer valuable insights into the cryptocurrency market. These resources provide up-to-date news, analysis, and educational materials. It is recommended to consult multiple sources to gain a comprehensive understanding. Examples include established financial news outlets like Bloomberg and Reuters, which often feature sections dedicated to cryptocurrency analysis. Furthermore, dedicated cryptocurrency news websites and research firms provide specialized information and analysis. Always verify the credibility and objectivity of any source before relying on its information.

Financial Literacy Resources and Responsible Investing Practices

Investing in any asset class, including Bitcoin, requires a solid understanding of financial principles. Before investing, consider seeking guidance from a qualified financial advisor who can assess your risk tolerance and financial goals. Responsible investing involves diversifying your portfolio to mitigate risk, only investing what you can afford to lose, and avoiding impulsive decisions based on hype or speculation. Numerous online resources and educational institutions offer courses and materials on financial literacy, covering topics such as risk management, portfolio diversification, and investment strategies. Utilizing these resources can help you build a stronger foundation for making informed investment decisions.