Bitcoin Price Prediction 2025 in INR

Bitcoin’s price, highly volatile and influenced by global macroeconomic factors, has seen significant swings impacting its value in Indian Rupees. Currently, the market shows a complex interplay of investor sentiment, regulatory developments in India and globally, and technological advancements within the cryptocurrency space. This dynamic environment makes predicting Bitcoin’s future price in INR a challenging but fascinating endeavor.

Bitcoin’s price volatility stems from several key factors. These include the overall market sentiment towards cryptocurrencies (often influenced by news cycles and regulatory announcements), the adoption rate of Bitcoin by businesses and individuals, the level of institutional investment, and the supply and demand dynamics inherent to its limited supply. Furthermore, macroeconomic conditions, such as inflation rates and geopolitical events, also significantly impact Bitcoin’s price. Government policies and regulations regarding cryptocurrencies in various countries, including India, play a crucial role in shaping investor confidence and market activity.

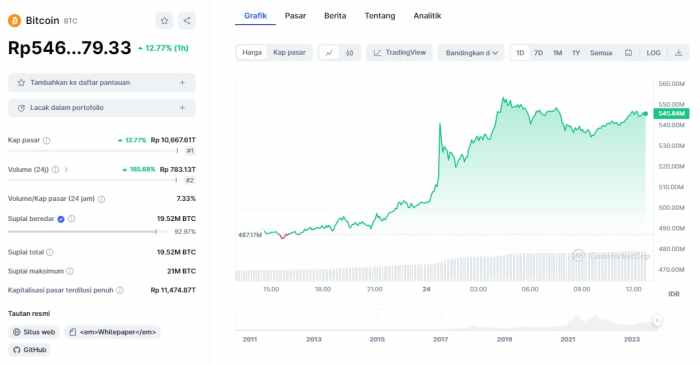

Bitcoin’s Price Fluctuations in INR: A Brief History

Bitcoin’s journey in the Indian Rupee market has been characterized by significant price swings. Initially, its price was relatively low and largely unknown to the general public. However, as awareness and adoption grew, the price experienced periods of rapid appreciation, followed by substantial corrections. For example, we can observe significant price increases in 2017 and 2021, followed by significant drops. These fluctuations reflect the inherent volatility of the cryptocurrency market and its sensitivity to global news and events. While pinpointing exact INR figures for every historical point would be extensive, it is important to note that the correlation between the USD price of Bitcoin and its INR equivalent is strong, but not perfect, due to fluctuations in the USD/INR exchange rate. This historical volatility underscores the uncertainty inherent in predicting future price movements.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Price Prediction 2025 In Inr Forbes

Predicting Bitcoin’s price in INR for 2025 requires considering a complex interplay of macroeconomic factors, regulatory landscapes, technological advancements, and market dynamics. While precise prediction is impossible, analyzing these influential factors provides a framework for understanding potential price movements.

Global Economic Conditions and Bitcoin’s Value in INR

The global economy significantly impacts Bitcoin’s price. Periods of economic uncertainty, inflation, or geopolitical instability often drive investors towards Bitcoin as a hedge against risk or a store of value. For example, during periods of high inflation, like those seen in various countries in recent years, Bitcoin’s price has often increased as investors seek to protect their purchasing power. Conversely, periods of strong economic growth might see investors shift their focus to traditional assets, potentially leading to a decrease in Bitcoin’s value. The strength of the Indian Rupee against the US dollar also plays a crucial role, as Bitcoin is primarily priced in USD. A weakening Rupee could lead to a perceived increase in Bitcoin’s INR price, even if its USD price remains stable.

Regulatory Changes and Bitcoin’s Price

Regulatory clarity and acceptance are critical for Bitcoin’s growth. India’s stance on cryptocurrency regulation remains a key factor. A supportive regulatory framework could boost investor confidence and lead to increased adoption, driving up the price. Conversely, stricter regulations or outright bans could significantly dampen price growth. Globally, similar trends are observed. Clear, consistent regulations across major economies could lead to greater institutional investment and broader mainstream adoption, positively influencing Bitcoin’s price. Conversely, fragmented or conflicting regulations could create uncertainty and limit price appreciation. The example of El Salvador’s adoption of Bitcoin as legal tender, while initially boosting the price, also highlighted the challenges of widespread cryptocurrency adoption by a nation.

Technological Advancements and Adoption Rates, Bitcoin Price Prediction 2025 In Inr Forbes

Technological improvements within the Bitcoin network, such as the Lightning Network enhancing transaction speeds and reducing fees, can positively impact adoption. Increased scalability and efficiency make Bitcoin more practical for everyday transactions, potentially driving demand and price. Conversely, technological limitations or security vulnerabilities could negatively affect investor confidence and suppress price growth. Widespread adoption across various sectors, including payments, finance, and supply chain management, is also crucial. Increased usage translates to higher demand, pushing the price upwards. The growing acceptance of Bitcoin by businesses and individuals globally will be a significant driver of price appreciation.

Bitcoin’s Performance Against Other Cryptocurrencies

Bitcoin’s price performance is intertwined with the broader cryptocurrency market. The performance of other major cryptocurrencies, like Ethereum, influences investor sentiment and capital allocation. If alternative cryptocurrencies gain significant traction and market share, it could potentially divert investment away from Bitcoin, impacting its price. Conversely, Bitcoin’s dominance as the leading cryptocurrency could continue to attract investors seeking exposure to the crypto market, maintaining its price leadership.

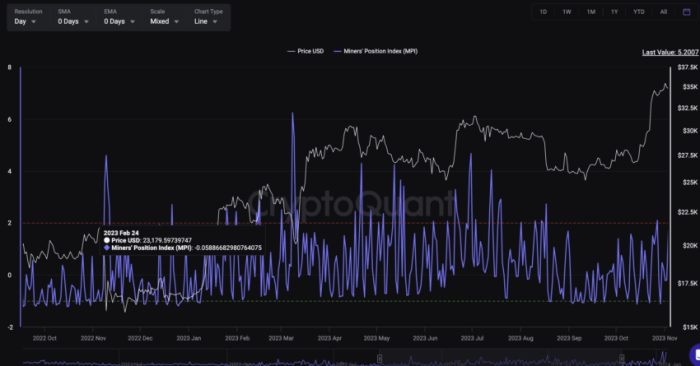

Institutional Investment and Mainstream Adoption

Growing institutional investment, such as from hedge funds, asset management firms, and corporations, significantly influences Bitcoin’s price. Large-scale investments inject liquidity into the market, driving price increases. Increased mainstream adoption, with greater usage by everyday consumers and businesses, further reinforces price growth through increased demand. Examples of large institutional investors entering the Bitcoin market have historically resulted in notable price surges. Conversely, a decrease in institutional investment or a decline in mainstream adoption could lead to price corrections.

Bitcoin Price Prediction 2025 In Inr Forbes – Analyzing Bitcoin’s potential value in INR by 2025 requires considering various predictions. Forbes’ projections, for instance, often factor in macroeconomic trends. To gain a broader perspective, it’s helpful to compare these with other forecasts, such as those provided by Bitcoin Price Prediction 2025 Walletinvestor , which offers a different analytical approach. Ultimately, understanding the diverse viewpoints helps refine one’s own assessment of the Bitcoin price prediction in INR for 2025.

While Forbes’ predictions for Bitcoin’s price in INR by 2025 offer valuable insight, visualizing potential trajectories is equally important. For a clearer understanding of these predicted price movements, you can consult a helpful resource such as this Bitcoin Price Prediction 2025 Chart , which provides a graphical representation. Returning to the Forbes predictions, remember that these are just estimations and the actual price remains subject to market volatility.

Predicting the Bitcoin price in INR for 2025, as reported by Forbes and other sources, involves considerable uncertainty. Many factors influence this, including regulatory changes and overall market sentiment. To gain further insight into potential future values, it’s helpful to consult resources like this article: What Will Bitcoin Be Worth 2025. Understanding these broader projections can help contextualize any specific Bitcoin Price Prediction 2025 In Inr Forbes analysis.

Predicting the Bitcoin price in INR for 2025, as discussed by Forbes, involves considering various factors. Understanding potential target prices is crucial for informed speculation, and a helpful resource for this is the detailed analysis provided at Bitcoin Price 2025 Target. This external perspective complements Forbes’ insights, offering a broader view of the potential price range for Bitcoin in 2025, allowing for a more comprehensive prediction.

Predicting the Bitcoin price in INR for 2025 is challenging, with Forbes and other outlets offering varied forecasts. To gain a broader perspective on potential future values, it’s helpful to consult resources like What Will Bitcoin Cost In 2025 , which offers insights into global price predictions. Understanding these different analyses is crucial for forming a well-rounded opinion on the Bitcoin Price Prediction 2025 In Inr Forbes.