Bitcoin Price Prediction After 2025 Halving

The 2025 Bitcoin halving is a highly anticipated event within the cryptocurrency community, poised to significantly impact the digital asset’s price. This event, occurring approximately every four years, reduces the rate at which new Bitcoins are created, effectively decreasing the supply entering the market. Historically, halvings have been followed by substantial price increases, leading many to speculate on the potential for another bullish run after the 2025 event. This article will explore various perspectives and analyses regarding Bitcoin’s price trajectory following the 2025 halving, focusing on the factors likely to influence its value.

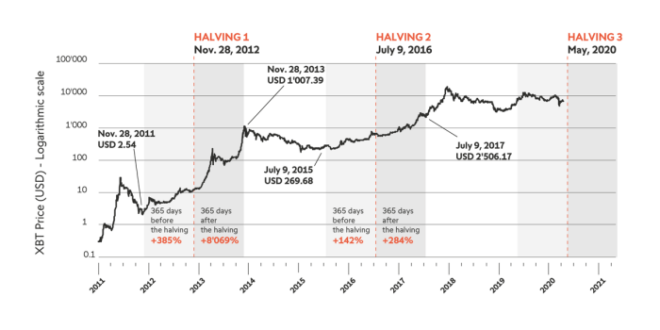

The Bitcoin halving is a programmed mechanism embedded within the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This halving reduces the inflation rate of Bitcoin, creating a scarcity effect that can potentially drive up demand and, consequently, price. We’ve witnessed this phenomenon in previous halvings. For example, the halving in 2012 was followed by a significant price increase, and the 2016 halving also preceded a period of substantial price appreciation, although the timing and magnitude of the price surge varied in each instance. Understanding this historical precedent is crucial for assessing the potential impact of the 2025 halving.

Bitcoin Halving Mechanics and Historical Price Impact, Bitcoin Price Prediction After 2025 Halving

The halving mechanism is designed to control the inflation of Bitcoin. By reducing the rate of new Bitcoin creation, the halving aims to maintain the scarcity of the cryptocurrency. Historically, halvings have been followed by periods of price appreciation, although the timing and magnitude of the increase have varied. The 2012 halving, for instance, saw a gradual price increase over several months following the event, while the 2016 halving was followed by a more dramatic surge, albeit after a period of consolidation. This difference highlights the complexity of predicting the precise impact of a halving, as other market factors significantly influence the price. Analyzing these historical patterns, while acknowledging the influence of external variables, provides a valuable framework for considering potential future price movements. For example, the macroeconomic environment, regulatory changes, and overall market sentiment all play a significant role.