Bitcoin Price Prediction April 2025

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatility and potential. Its price has swung wildly since its inception, from near-worthlessness to record highs, reflecting the interplay of technological advancements, regulatory shifts, and market sentiment. Understanding these fluctuations is crucial for anyone considering investment, and accurate prediction, while challenging, is paramount. This article aims to explore potential Bitcoin price scenarios in April 2025, considering a range of influential factors, acknowledging the inherent uncertainty involved in such forecasting.

Bitcoin’s history is marked by dramatic price swings. Early adopters witnessed exponential growth, followed by periods of significant correction. The 2017 bull run, propelled by increasing mainstream awareness and speculative investment, saw Bitcoin reach nearly $20,000, only to plummet drastically in the following year. Subsequent years saw periods of consolidation and further growth, punctuated by events like the 2021 bull market reaching all-time highs exceeding $60,000, and subsequent corrections. These fluctuations underscore the complexity of predicting its future trajectory.

Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will likely shape Bitcoin’s price by April 2025. These include the overall state of the global economy, regulatory developments in key markets, technological advancements within the Bitcoin network itself, and the evolving sentiment among investors and institutions. For example, widespread adoption by institutional investors could significantly drive up demand, while increased regulatory scrutiny could potentially dampen enthusiasm. Technological upgrades enhancing transaction speed and scalability could also impact the price positively.

Potential Price Scenarios

Predicting the precise price of Bitcoin in April 2025 is inherently speculative. However, considering the historical volatility and the factors discussed above, several scenarios are plausible. A conservative scenario might see Bitcoin trading in the range of $50,000 to $100,000, reflecting moderate growth and continued adoption. A more bullish scenario, fueled by widespread institutional investment and technological advancements, could push the price significantly higher, potentially reaching $200,000 or more. Conversely, a bearish scenario, perhaps triggered by a global economic downturn or stringent regulations, could see the price fall below current levels. These are illustrative examples, and the actual price could deviate significantly. The interaction of these factors creates a complex dynamic that makes precise prediction extremely challenging.

Impact of Regulatory Landscape

The regulatory landscape surrounding cryptocurrencies will play a critical role in determining Bitcoin’s future price. Governments worldwide are grappling with how to regulate this nascent asset class. Favorable regulatory frameworks, fostering innovation and investor confidence, could contribute to substantial price increases. Conversely, overly restrictive regulations could stifle growth and negatively impact the price. The example of China’s crackdown on cryptocurrency mining in 2021 serves as a reminder of the potential impact of regulatory actions on Bitcoin’s value. Different jurisdictions adopting diverse approaches to regulation will likely create a complex and evolving environment.

Factors Influencing Bitcoin’s Price: Bitcoin Price Prediction April 2025

Bitcoin’s price, known for its volatility, is a complex interplay of various factors. Understanding these influences is crucial for navigating the cryptocurrency market. These factors range from global economic conditions to technological advancements and investor sentiment. Predicting the price with certainty remains impossible, but analyzing these key drivers provides valuable insight.

Macroeconomic Factors and Bitcoin Price

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates, making traditional investments more attractive, can lead to a decrease in Bitcoin’s price as investors shift their capital. Strong global economic growth might lead to increased risk appetite, potentially boosting Bitcoin’s value, while economic downturns often result in decreased investor confidence and lower Bitcoin prices. For example, the 2022 bear market coincided with rising inflation and interest rate hikes by central banks globally.

Regulatory Changes and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s adoption and, consequently, its price. Favorable regulatory frameworks, such as clear guidelines for cryptocurrency exchanges and tax treatment, can boost investor confidence and increase demand. Conversely, restrictive regulations, including outright bans or heavy taxation, can stifle adoption and negatively impact the price. The varying regulatory approaches across different countries illustrate this impact; countries with clear, supportive regulations tend to see higher Bitcoin adoption rates and, often, higher trading volumes.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem influence its long-term price trajectory. Scaling solutions, like the Lightning Network, which aims to improve transaction speed and reduce fees, can increase Bitcoin’s usability and attract more users. The development of new applications built on Bitcoin, such as decentralized finance (DeFi) platforms, can also expand its utility and drive demand. Conversely, technological setbacks or security vulnerabilities could negatively impact investor confidence and suppress price growth.

Market Sentiment, Media Coverage, and Investor Confidence

Market sentiment, heavily influenced by media coverage and news events, directly impacts Bitcoin’s price volatility. Positive news, such as large institutional investments or regulatory approvals, can trigger price surges driven by increased investor confidence and buying pressure. Negative news, such as security breaches or regulatory crackdowns, can lead to sharp price drops as investors sell off their holdings. The role of social media in amplifying both positive and negative sentiment is also significant, contributing to the inherent volatility of the market.

Supply and Demand Dynamics

Bitcoin’s price, like any asset, is fundamentally determined by supply and demand. The fixed supply of 21 million Bitcoins creates scarcity, potentially driving up its value over time. However, demand fluctuates based on the factors discussed above. Increased demand, coupled with limited supply, leads to price increases, while decreased demand puts downward pressure on the price.

| Factor | Impact on Price (Increased Demand) | Impact on Price (Decreased Demand) |

|---|---|---|

| Supply | Price Increase (Scarcity) | Price remains relatively stable (or may decrease slightly if other factors also decline) |

| Demand | Price Increase (High Buying Pressure) | Price Decrease (Selling Pressure) |

Analyzing Historical Price Trends

Bitcoin’s price history is a volatile yet fascinating narrative of technological innovation, market speculation, and regulatory uncertainty. Understanding its past movements is crucial for informed speculation about its future trajectory. Analyzing these trends reveals recurring patterns, offering insights into potential drivers of future price fluctuations.

Bitcoin’s journey began in 2009 with a negligible price. Early adoption was slow, with the price remaining relatively low for several years. The first significant price surge occurred in 2013, driven by increased media attention and growing interest from investors. This period saw Bitcoin’s price climb dramatically, only to experience a sharp correction later that year. Subsequent years saw a mix of bull and bear markets, with significant price increases often followed by substantial declines. The 2017 bull run, reaching an all-time high exceeding $20,000, stands out as a period of intense speculation and mainstream media coverage. This was followed by a significant bear market that lasted until late 2019. The 2020-2021 bull market saw Bitcoin’s price exceed $60,000, driven by factors including institutional adoption, increased acceptance by payment processors, and the perception of Bitcoin as a hedge against inflation. Since then, the price has seen further fluctuations, highlighting the inherent volatility of the cryptocurrency market.

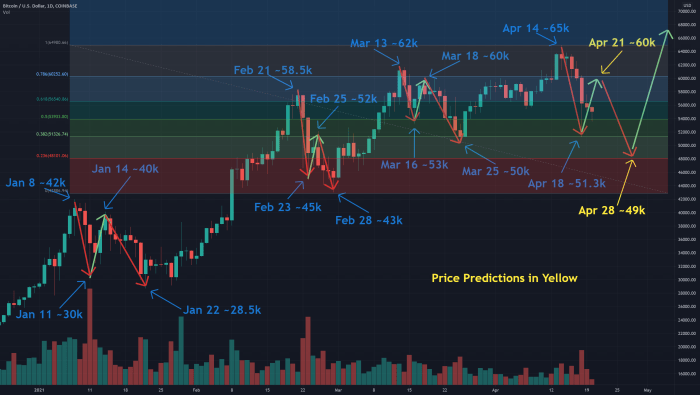

Bitcoin’s Price History: A Visual Representation

Imagine a graph charting Bitcoin’s price over time. The X-axis represents time, from its inception in 2009 to the present. The Y-axis represents the price in US dollars. The line initially crawls along the X-axis near zero for several years, representing the early stages of adoption. Around 2013, the line begins a steep ascent, representing the first major bull run. This ascent is followed by a sharp drop, illustrating the subsequent correction. The line continues to fluctuate, with several more peaks and valleys, representing subsequent bull and bear markets. The highest peak, significantly above $60,000, would represent the high point of the 2020-2021 bull market. From there, the line continues to oscillate, showing the ongoing volatility of Bitcoin’s price. This visual representation clearly illustrates the cyclical nature of Bitcoin’s price movements, with periods of rapid growth followed by significant corrections.

Comparison with Other Asset Classes

Bitcoin’s price performance differs significantly from traditional asset classes like gold and stocks. While gold is often considered a safe haven asset, its price movements are generally less volatile than Bitcoin’s. Similarly, the stock market, while exhibiting its own volatility, tends to show a more gradual, long-term growth trend compared to Bitcoin’s sharp, cyclical fluctuations. Unlike gold, which has a long history and established market, Bitcoin’s relatively short lifespan makes direct historical comparisons challenging. However, comparing its volatility and growth patterns against established asset classes provides valuable context for understanding its unique risk profile and potential returns. For example, while the stock market might experience a 10-20% correction, Bitcoin’s corrections can often be far more significant, reaching 50% or even more. This highlights the higher risk associated with Bitcoin investment.

Exploring Potential Price Scenarios for April 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively state the price of Bitcoin in April 2025, exploring potential scenarios based on various assumptions can offer valuable insights into the possible range of outcomes. We will examine three distinct scenarios: a bullish, a bearish, and a neutral outlook.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes continued widespread adoption of Bitcoin as a store of value and a medium of exchange, coupled with significant institutional investment. Increased regulatory clarity and the development of robust Bitcoin infrastructure globally will fuel this growth. Factors contributing to this bullish outlook include the increasing acceptance of Bitcoin by major corporations and financial institutions, the maturation of the Bitcoin ecosystem with improved scalability and security, and a general positive macroeconomic environment. We could see a substantial increase in the number of Bitcoin holders and a decrease in the supply available for trading, creating upward pressure on the price. This scenario envisions a positive feedback loop, where rising prices attract more investors, leading to further price appreciation. A real-life example mirroring this scenario could be the increased institutional adoption seen in late 2020 and early 2021, although it is crucial to acknowledge the volatility inherent in the market.

Bearish Scenario: Regulatory Crackdown and Market Correction

Conversely, a bearish scenario anticipates a significant price correction driven by factors such as increased regulatory scrutiny, a global economic downturn, or a major security breach impacting investor confidence. Stringent government regulations aimed at limiting Bitcoin’s use or increasing taxation could dampen investor enthusiasm and lead to a significant price drop. A global economic recession could also negatively impact risk appetite, leading investors to divest from volatile assets like Bitcoin. Furthermore, a large-scale security breach or hacking incident could severely erode trust in the Bitcoin network, triggering a sell-off. This scenario would likely see a substantial decrease in Bitcoin’s price, potentially returning it to levels seen in previous market corrections. The 2018 bear market serves as a historical example of a sharp correction driven by a combination of regulatory uncertainty and overall market downturn.

Neutral Scenario: Consolidation and Gradual Growth

The neutral scenario assumes a period of consolidation and gradual growth for Bitcoin. This scenario avoids extreme price fluctuations and suggests a more stable and predictable market trajectory. Factors contributing to this scenario include a balanced regulatory landscape, stable macroeconomic conditions, and a steady increase in Bitcoin adoption without major breakthroughs or setbacks. The price would likely fluctuate within a defined range, exhibiting moderate growth over time. This scenario is less dramatic than the bullish or bearish scenarios, representing a more moderate and sustainable path for Bitcoin’s price. This could be characterized by periods of sideways trading interspersed with gradual upward movements, reflecting a maturing market with less volatility than seen in previous years.

Price Scenario Summary

| Scenario | Predicted Price Range (USD) | Supporting Rationale |

|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread adoption, significant institutional investment, positive macroeconomic environment, improved infrastructure. |

| Bearish | $20,000 – $40,000 | Increased regulatory scrutiny, global economic downturn, major security breach, decreased investor confidence. |

| Neutral | $50,000 – $80,000 | Balanced regulatory landscape, stable macroeconomic conditions, steady adoption, moderate growth. |

Likelihood of Each Scenario

The likelihood of each scenario is difficult to quantify precisely, given the inherent uncertainties in the cryptocurrency market. However, based on current market conditions and historical trends, the neutral scenario appears to be the most probable outcome. The bullish scenario, while possible, hinges on several optimistic assumptions that might not fully materialize. The bearish scenario also remains a possibility, given the potential for unforeseen events. It’s crucial to remember that these are just potential scenarios, and the actual price of Bitcoin in April 2025 could fall outside of these ranges.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with uncertainty. The volatile nature of the market, coupled with the influence of numerous unpredictable factors, makes accurate long-term forecasting exceptionally challenging. While historical trends can offer some insight, they are not a reliable predictor of future performance, particularly in a market as young and dynamic as Bitcoin’s.

The inherent limitations in accurately predicting Bitcoin’s future price stem from the complexity of the factors influencing its value. These range from macroeconomic conditions and regulatory changes to technological advancements and market sentiment. No single model can adequately capture the interplay of these variables, leading to a high degree of uncertainty in any price projection. Moreover, the relatively short history of Bitcoin itself limits the amount of reliable historical data available for sophisticated analytical models.

Impact of Unforeseen Events on Price Predictions

Unforeseen events, by their very nature, are impossible to incorporate into predictive models. Geopolitical instability, for instance, can significantly impact Bitcoin’s price. A major international conflict or a sudden shift in global economic policy could trigger substantial price volatility, either upward or downward, depending on how investors perceive the situation. Similarly, technological disruptions, such as a major security breach affecting the Bitcoin network or the emergence of a superior competing cryptocurrency, could drastically alter the market landscape and invalidate any existing price projections. The collapse of FTX in 2022 serves as a stark reminder of how unforeseen events can dramatically impact the cryptocurrency market. The sudden loss of investor confidence led to a significant decline in Bitcoin’s price, highlighting the vulnerability of the market to unforeseen circumstances.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. The most prominent is volatility. Bitcoin’s price can fluctuate dramatically in short periods, leading to significant gains or losses for investors. While this volatility can create opportunities for profit, it also exposes investors to the risk of substantial losses. The potential for complete loss of investment is a very real possibility, particularly for those who invest more than they can afford to lose. Furthermore, the regulatory landscape surrounding Bitcoin remains uncertain in many jurisdictions, adding another layer of risk for investors. Changes in regulations could impact the usability and value of Bitcoin, potentially leading to significant price drops.

Responsible Investment Strategies and Risk Management

Responsible Bitcoin investment necessitates a thorough understanding of the associated risks and the adoption of appropriate risk management strategies. Diversification is crucial. Instead of placing all investment capital in Bitcoin, a diversified portfolio that includes other asset classes can help mitigate risk. Only investing what one can afford to lose is paramount. This means avoiding leveraging or borrowing money to invest in Bitcoin. Thorough research and due diligence are also essential before making any investment decisions. Staying informed about market trends, regulatory changes, and technological developments can help investors make more informed choices. Finally, employing a long-term investment strategy can help to reduce the impact of short-term price volatility. Instead of attempting to time the market, a long-term approach allows investors to ride out periods of volatility and potentially benefit from long-term price appreciation. For example, investors who purchased Bitcoin in 2010 and held onto it for several years have seen substantial returns, despite experiencing periods of significant price decline along the way.

Bitcoin’s Long-Term Outlook

Bitcoin’s long-term prospects are a subject of considerable debate, with predictions ranging from its complete demise to its ascension as a dominant global currency. Its potential rests on a complex interplay of technological advancements, regulatory landscapes, and evolving market sentiment. Understanding these factors is crucial to assessing its future role in the financial ecosystem.

Bitcoin’s potential long-term value proposition stems from its decentralized nature, scarcity (a fixed supply of 21 million coins), and its growing acceptance as a store of value and a medium of exchange. Its resistance to censorship and inflation makes it an attractive alternative to traditional financial systems, particularly in regions with unstable currencies or limited access to banking services.

Factors Contributing to Bitcoin’s Long-Term Growth or Decline

Several factors could significantly influence Bitcoin’s long-term trajectory. Positive factors include increasing institutional adoption, technological improvements enhancing scalability and transaction speed (like the Lightning Network), and growing global awareness and understanding of its underlying technology. Conversely, negative factors include increased regulatory scrutiny, the emergence of competing cryptocurrencies with superior technology or features, and the potential for significant security breaches or hacks that erode user confidence. The overall balance of these forces will ultimately shape Bitcoin’s future.

Comparison of Bitcoin’s Long-Term Potential Against Other Established Assets

Comparing Bitcoin’s long-term potential against established assets like gold or the US dollar requires careful consideration. Gold, a traditional safe haven asset, benefits from its tangible nature and long history of value retention. However, gold’s supply is not fixed, and its value is susceptible to market forces. The US dollar, while the world’s reserve currency, faces challenges from inflation and geopolitical instability. Bitcoin, on the other hand, offers a fixed supply and is theoretically immune to government manipulation, though its volatility remains a significant concern. The long-term value proposition of each asset is ultimately dependent on the individual investor’s risk tolerance and investment goals. For example, an investor seeking a hedge against inflation might favor Bitcoin over the US dollar, while an investor prioritizing stability might prefer gold.

Impact of Technological Advancements on Bitcoin’s Future

Technological advancements will likely play a pivotal role in shaping Bitcoin’s future. Improvements in scalability, transaction speed, and energy efficiency are crucial for wider adoption. The development of second-layer solutions, such as the Lightning Network, aims to address Bitcoin’s current limitations in transaction throughput. Furthermore, advancements in cryptography and security protocols will be essential for maintaining the integrity and security of the Bitcoin network. Conversely, the emergence of more energy-efficient consensus mechanisms or competing blockchain technologies could potentially challenge Bitcoin’s dominance. For instance, the development of more efficient consensus mechanisms could significantly reduce Bitcoin’s energy consumption, addressing a major criticism. The success of such advancements could influence Bitcoin’s adoption and value in the long term.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price, investment risks, and long-term prospects. Understanding these aspects is crucial for making informed decisions about Bitcoin investment. We’ll explore the key drivers of Bitcoin’s price volatility, the inherent limitations of price predictions, the risks and rewards of investing, and finally, offer a balanced perspective on Bitcoin’s future.

Main Factors Influencing Bitcoin’s Price, Bitcoin Price Prediction April 2025

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics are fundamental, with increased demand driving prices higher and vice versa. Regulatory actions by governments worldwide significantly impact investor sentiment and market liquidity. Technological advancements, such as upgrades to the Bitcoin network, can also affect price. Furthermore, macroeconomic conditions, such as inflation and interest rates, play a role, as do events impacting the broader cryptocurrency market and the overall global financial landscape. Finally, media coverage and public perception contribute significantly to price fluctuations. For example, positive news about Bitcoin adoption by major corporations can lead to price increases, while negative news about regulatory crackdowns can trigger price drops.

Accuracy of Bitcoin Price Predictions

Bitcoin price predictions are inherently uncertain and should be viewed with considerable skepticism. The cryptocurrency market is highly volatile and susceptible to unpredictable events, making accurate long-term forecasting extremely difficult. Many predictions rely on technical analysis, which involves studying past price patterns to anticipate future movements, but this method has limitations, as past performance is not necessarily indicative of future results. Fundamental analysis, which focuses on factors such as adoption rate and technological advancements, can also be unreliable due to the nascent nature of the cryptocurrency market and the rapid pace of technological change. Consequently, it’s crucial to remember that any price prediction is merely speculation and should not be the sole basis for investment decisions. Consider, for instance, the wide range of predictions made for Bitcoin’s price in 2023, many of which proved significantly inaccurate.

Risks and Potential Rewards of Bitcoin Investment

Investing in Bitcoin carries significant risks. The cryptocurrency market is notoriously volatile, with prices experiencing substantial swings in short periods. This volatility is driven by factors such as regulatory uncertainty, market manipulation, and security breaches. Furthermore, Bitcoin’s price is highly speculative, meaning its value is largely based on expectations and beliefs rather than tangible assets. However, potential rewards can be substantial if the investment is successful. Bitcoin’s limited supply and growing adoption could lead to significant price appreciation over the long term. It’s crucial to remember that responsible investing involves careful risk assessment, diversification of assets, and only investing what one can afford to lose.

Potential Long-Term Outlook for Bitcoin

Bitcoin’s long-term outlook is a subject of ongoing debate. Proponents point to its decentralized nature, limited supply, and potential as a store of value and a medium of exchange. They argue that increasing adoption by institutions and governments could drive significant price appreciation. However, critics highlight the risks associated with its volatility, regulatory uncertainty, and the emergence of competing cryptocurrencies. The long-term success of Bitcoin will depend on several factors, including technological advancements, regulatory developments, and broader adoption by individuals and businesses. A balanced perspective suggests that while Bitcoin has significant potential, substantial risks remain, and its future trajectory remains uncertain. The long-term outlook is contingent upon several intertwined variables, making a definitive prediction impossible at this stage.

Bitcoin Price Prediction April 2025 – Predicting the Bitcoin price in April 2025 is challenging, involving numerous factors. A key element influencing long-term price predictions is the Bitcoin halving events, which significantly impact supply. Understanding the implications of the next halving is crucial; for detailed analysis, check out this resource on Bitcoin Next Halving After 2025. This information will help refine your understanding of Bitcoin’s potential price trajectory leading up to and beyond April 2025.

Predicting the Bitcoin price in April 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a detailed understanding of this pivotal event, refer to this informative resource on The Bitcoin Halving 2025. This halving is expected to create substantial upward pressure on the price, influencing Bitcoin Price Prediction April 2025 considerably.

Predicting the Bitcoin price in April 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a detailed understanding of this pivotal event, refer to this informative resource on The Bitcoin Halving 2025. This halving is expected to create substantial upward pressure on the price, influencing Bitcoin Price Prediction April 2025 considerably.

Predicting the Bitcoin price in April 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a detailed understanding of this pivotal event, refer to this informative resource on The Bitcoin Halving 2025. This halving is expected to create substantial upward pressure on the price, influencing Bitcoin Price Prediction April 2025 considerably.

Predicting the Bitcoin price in April 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a detailed understanding of this pivotal event, refer to this informative resource on The Bitcoin Halving 2025. This halving is expected to create substantial upward pressure on the price, influencing Bitcoin Price Prediction April 2025 considerably.

Predicting the Bitcoin price in April 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a detailed understanding of this pivotal event, refer to this informative resource on The Bitcoin Halving 2025. This halving is expected to create substantial upward pressure on the price, influencing Bitcoin Price Prediction April 2025 considerably.