Bitcoin Price Prediction Early 2025

Bitcoin, the world’s first and most well-known cryptocurrency, has captivated investors and technologists alike with its volatile price swings and disruptive potential. Predicting its future value is a notoriously challenging task, given its sensitivity to a complex interplay of factors. The cryptocurrency market is inherently speculative, driven by rapidly shifting market sentiment, evolving regulatory landscapes, and continuous technological advancements. This article aims to explore potential Bitcoin price scenarios for early 2025, drawing upon various analytical perspectives and considering the influence of key market drivers.

The price of Bitcoin is influenced by a multitude of interconnected factors. Market sentiment, often fueled by news cycles and social media trends, plays a crucial role, driving periods of both exuberant optimism and deep pessimism. Regulatory developments, from outright bans to supportive frameworks, significantly impact investor confidence and market liquidity. Furthermore, technological advancements within the Bitcoin ecosystem, such as the implementation of the Lightning Network for faster transactions or the emergence of new layer-2 scaling solutions, can influence its adoption and, consequently, its price. Macroeconomic conditions, such as inflation rates and global economic uncertainty, also contribute to the overall volatility and price fluctuations of Bitcoin.

Factors Influencing Bitcoin’s Price in 2025

Several key factors are expected to shape Bitcoin’s price trajectory by early 2025. These factors, while interconnected, offer distinct avenues for analysis and prediction. Considering these elements allows for a more nuanced understanding of potential price movements.

Market Sentiment and Adoption

Market sentiment towards Bitcoin will significantly influence its price. Widespread adoption by institutional investors and mainstream consumers would likely drive prices upward. Conversely, negative news, regulatory crackdowns, or a significant market correction could lead to price declines. For example, the 2021 bull run was largely driven by positive media coverage and increased institutional investment, while the subsequent bear market reflected a shift in sentiment and increased regulatory scrutiny in certain jurisdictions. The level of mainstream adoption by 2025 will be a crucial determinant of its price.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies will play a vital role. Clearer and more consistent regulations across major jurisdictions could boost investor confidence and lead to higher prices. Conversely, inconsistent or overly restrictive regulations could stifle growth and depress prices. The example of the differing regulatory approaches taken by the US and China highlights the significant impact that governmental policies can have on Bitcoin’s value. A more unified and supportive global regulatory framework would likely be positive for Bitcoin’s price.

Technological Advancements

Technological developments within the Bitcoin ecosystem could also influence its price. Improvements in scalability, transaction speed, and security could enhance Bitcoin’s usability and appeal, potentially driving adoption and price appreciation. Conversely, a failure to address scalability issues or the emergence of superior competing technologies could negatively impact its price. The ongoing development of the Lightning Network, aiming to improve transaction speeds and reduce fees, serves as an example of a technological advancement that could positively influence Bitcoin’s price in the future.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Price Prediction Early 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of factors. While no one can definitively state the exact price, analyzing these key influences provides a framework for informed speculation. These factors range from broad macroeconomic trends to specific technological advancements and regulatory decisions.

Macroeconomic Conditions and Bitcoin’s Price

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, a recession might lead to risk-aversion, causing investors to sell Bitcoin along with other risk assets. The strength of the US dollar, a common benchmark for global markets, also plays a crucial role. A strong dollar typically puts downward pressure on Bitcoin’s price denominated in USD, while a weaker dollar often has the opposite effect. The Federal Reserve’s monetary policy decisions directly influence inflation and interest rates, creating ripples throughout the financial system, impacting investor sentiment towards Bitcoin. For example, the aggressive interest rate hikes in 2022 contributed to a significant Bitcoin price drop as investors moved towards higher-yielding assets.

Institutional Adoption and Investment

The increasing involvement of institutional investors, such as hedge funds, corporations, and investment firms, significantly influences Bitcoin’s price. Large-scale purchases by these entities can drive up demand and prices, while significant sell-offs can trigger price declines. The growing acceptance of Bitcoin as a legitimate asset class by institutional players provides a degree of stability and credibility that was previously lacking. Grayscale Bitcoin Trust, for instance, is a prime example of an institutional vehicle that holds a substantial amount of Bitcoin, influencing market liquidity and price discovery. The future trajectory of institutional investment will largely depend on regulatory clarity and the overall performance of the global economy.

Technological Advancements and Bitcoin’s Utility

Technological advancements within the Bitcoin ecosystem directly impact its utility and, consequently, its price. The Lightning Network, for example, aims to improve scalability and transaction speed, addressing some of Bitcoin’s limitations. Wider adoption of the Lightning Network could lead to increased usage and a higher demand for Bitcoin, potentially driving price appreciation. Other technological developments, such as improved wallet security and user-friendly interfaces, also contribute to broader adoption and price appreciation. Conversely, a failure to address scalability concerns or a significant security breach could negatively impact the price.

Regulatory Developments and Government Policies

Government regulations and policies significantly influence Bitcoin’s price. Favorable regulations that provide clarity and legal certainty can boost investor confidence and increase adoption. Conversely, restrictive regulations or outright bans can severely limit Bitcoin’s growth and suppress its price. Different jurisdictions have adopted varying approaches to Bitcoin regulation, creating a complex and dynamic environment. For example, El Salvador’s adoption of Bitcoin as legal tender significantly impacted its price in the short term, while China’s ban had a conversely negative impact. Future regulatory developments will likely play a critical role in shaping Bitcoin’s price trajectory.

Competing Cryptocurrencies and Blockchain Technologies

The emergence of competing cryptocurrencies and blockchain technologies poses a challenge to Bitcoin’s dominance and price. While Bitcoin remains the most established and widely recognized cryptocurrency, altcoins with potentially superior features or functionalities could attract investors away from Bitcoin, potentially impacting its market share and price. The development of more efficient and scalable blockchain technologies could also affect Bitcoin’s dominance, particularly if these alternatives offer superior transaction speeds and lower fees. The competitive landscape within the cryptocurrency market is constantly evolving, with new projects and innovations continually emerging, creating uncertainty regarding Bitcoin’s long-term dominance.

Risk Assessment and Considerations

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these risks is crucial for making informed investment decisions and mitigating potential losses. While the potential for high returns is a significant draw, a balanced perspective on the risks involved is equally important. This section Artikels key risk factors and strategies for managing them.

Bitcoin’s price volatility is arguably its most prominent risk. Its value can fluctuate dramatically in short periods, leading to substantial gains or losses. For example, Bitcoin’s price experienced a significant drop in 2022, impacting many investors. This volatility stems from various factors, including market sentiment, regulatory changes, and technological developments. Understanding this inherent volatility and managing expectations accordingly is paramount.

Volatility and Price Fluctuations

The unpredictable nature of Bitcoin’s price is a major concern for investors. Sharp price swings, driven by news events, market sentiment, and even social media trends, can result in significant financial losses if not properly managed. A diversified portfolio, including less volatile assets, can help to cushion the impact of these fluctuations. Historical price data can illustrate the extent of this volatility, showing periods of rapid growth followed by equally dramatic declines. Effective risk management strategies include setting stop-loss orders to limit potential losses and only investing an amount one can afford to lose.

Security Risks and Breaches

Bitcoin’s decentralized nature, while a strength, also presents security challenges. Exchanges and individual wallets can be vulnerable to hacking and theft. High-profile exchange hacks in the past have resulted in significant losses for investors. Protecting private keys, using secure wallets, and diversifying holdings across multiple platforms are essential security measures. Regularly reviewing security protocols and staying updated on best practices is vital to mitigate these risks.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin remains uncertain in many jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to potential legal and operational risks. Changes in regulations can significantly impact Bitcoin’s price and accessibility. Investors should stay informed about regulatory developments and consider the potential impact on their investments. The lack of clear regulatory frameworks in some regions introduces uncertainty about the future legal status and taxation of Bitcoin holdings.

Diversification as a Risk Mitigation Strategy

Diversification is a fundamental principle of investment management, and it applies equally to Bitcoin investments. Allocating a portion of one’s investment portfolio to Bitcoin, rather than concentrating all funds in a single asset, helps to reduce overall risk. Diversifying across different asset classes (stocks, bonds, real estate) and even within the cryptocurrency market itself (investing in other cryptocurrencies) can help to minimize losses if Bitcoin’s price declines. The aim is to create a portfolio that is resilient to fluctuations in any single asset.

Balanced Perspective on Rewards and Risks

Bitcoin’s potential for high returns is undeniable, but it’s crucial to weigh these potential rewards against the significant risks involved. The technology behind Bitcoin is innovative, and its adoption continues to grow, suggesting potential for long-term growth. However, the inherent volatility, security concerns, and regulatory uncertainty demand a cautious approach. Investors should carefully assess their risk tolerance and only invest an amount they can afford to lose completely. A thorough understanding of the technology, market dynamics, and associated risks is essential before making any investment decisions.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is inherently speculative, yet analyzing expert opinions and prevailing market sentiment offers valuable insights, albeit with limitations. Understanding the diverse perspectives and the emotional drivers within the market helps contextualize potential price movements in early 2025. This section explores prominent viewpoints and the overall market mood, while acknowledging the inherent uncertainties involved.

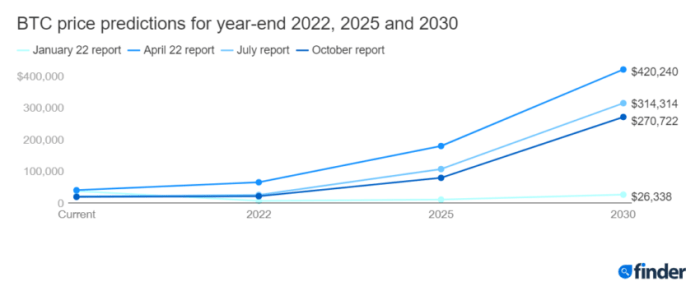

Expert opinions on Bitcoin’s price in early 2025 vary widely. Some analysts, basing their predictions on factors like adoption rate, regulatory changes, and technological advancements, anticipate a significant price increase, potentially exceeding $100,000. These bullish predictions often point to the growing institutional interest in Bitcoin as a hedge against inflation and the increasing scarcity of the asset due to its limited supply. Conversely, more cautious analysts foresee a more moderate price increase or even a period of consolidation, citing risks such as regulatory uncertainty, macroeconomic instability, and potential competition from alternative cryptocurrencies. For example, some experts have pointed to historical price cycles and predicted a potential bear market before another significant bull run. The range of predictions highlights the complexity of the market and the many factors at play.

Prominent Analyst Views on Bitcoin Price in Early 2025, Bitcoin Price Prediction Early 2025

A spectrum of opinions exists among prominent Bitcoin analysts. Some well-known figures in the crypto space have publicly stated price targets, though these should be viewed as educated guesses rather than definitive forecasts. For instance, some analysts who have historically been accurate in predicting past market trends may forecast a price range between $70,000 and $150,000 based on technical analysis and fundamental factors. Others, adopting a more conservative approach, might predict a much lower price range, perhaps around $50,000, emphasizing the potential for market corrections and external economic pressures. It is crucial to note that these are just examples, and numerous other perspectives exist.

Current Market Sentiment and its Impact on Bitcoin Price

Market sentiment, encompassing the overall mood and expectations of investors, plays a significant role in shaping Bitcoin’s price. Currently, the market sentiment can fluctuate dramatically, swinging between periods of optimism (bullish sentiment) and pessimism (bearish sentiment). Strong bullish sentiment, fueled by positive news, technological breakthroughs, or increasing institutional adoption, tends to drive prices upward. Conversely, bearish sentiment, often triggered by negative news, regulatory crackdowns, or macroeconomic uncertainty, can lead to price declines. Analyzing social media trends, news articles, and investor surveys provides some indication of the prevailing market sentiment, although this is not a foolproof method for predicting price movements. For example, a sudden surge in negative news coverage could trigger a sell-off, regardless of the underlying fundamentals.

Limitations of Relying on Expert Opinions and Market Sentiment

While expert opinions and market sentiment provide valuable context, relying solely on them for price prediction is inherently risky. Expert predictions, no matter how well-informed, are ultimately subjective and can be influenced by personal biases or unforeseen events. Market sentiment is equally volatile and can shift rapidly, making it difficult to accurately gauge its long-term impact. Furthermore, both factors often fail to account for the unpredictable nature of technological advancements, regulatory changes, and macroeconomic shifts that can significantly impact the cryptocurrency market. A robust prediction model should incorporate a wide range of factors beyond just expert opinions and current market sentiment.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price trajectory and investment viability in early 2025. It’s crucial to remember that predicting cryptocurrency prices with certainty is impossible, and any investment carries inherent risk.

Bitcoin’s Most Likely Price in Early 2025

Predicting a precise Bitcoin price for early 2025 is speculative. The price will depend on a complex interplay of factors, including regulatory developments, technological advancements, macroeconomic conditions (like inflation and interest rates), and overall market sentiment. A range of potential outcomes exists, from significantly higher prices driven by widespread adoption and institutional investment to lower prices resulting from negative regulatory changes or a broader market downturn. Analyzing historical price trends and considering the influence of these factors can offer a better understanding of potential price ranges, but a specific numerical prediction would be unreliable. For example, comparing Bitcoin’s price performance in previous bull and bear markets can provide some context, but past performance is not indicative of future results.

Bitcoin as an Investment for 2025

Bitcoin’s potential as an investment in 2025 presents both significant rewards and substantial risks. The potential for substantial returns is undeniable, given Bitcoin’s history of price appreciation. However, its extreme volatility poses a considerable threat to capital. Investors must carefully assess their risk tolerance and understand that they could lose a significant portion or even all of their investment. Thorough due diligence, including understanding the technology behind Bitcoin and the factors that influence its price, is essential before investing. Diversification across different asset classes is also crucial to manage risk. A conservative approach might involve allocating only a small percentage of one’s portfolio to Bitcoin.

Protecting Against Bitcoin Price Volatility

Mitigating the risks associated with Bitcoin’s price volatility requires a multi-pronged approach. Diversification is paramount; spreading investments across various asset classes (stocks, bonds, real estate, etc.) reduces the impact of Bitcoin’s price fluctuations on your overall portfolio. Avoiding emotional decision-making is equally important. Fear and greed can lead to impulsive trades that often result in losses. Instead, investors should adhere to a well-defined investment strategy based on their risk tolerance and long-term goals. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of price, can help mitigate the impact of volatility. Finally, only investing what one can afford to lose is crucial.

Biggest Threats to Bitcoin’s Price

Several factors pose significant threats to Bitcoin’s price. Regulatory uncertainty remains a major concern; stringent regulations could limit Bitcoin’s adoption and depress its price. Competition from other cryptocurrencies and emerging technologies could also erode Bitcoin’s dominance. Security breaches and hacking incidents, while relatively rare, could undermine investor confidence and lead to price drops. Macroeconomic factors, such as global recessions or changes in monetary policy, can significantly impact Bitcoin’s price, often correlating with broader market trends. Lastly, the overall sentiment and speculation within the cryptocurrency market can drive significant price swings, both positive and negative.

Disclaimer

The information presented in this document regarding Bitcoin’s potential price in early 2025 is purely speculative and should not be interpreted as financial advice. Predicting cryptocurrency prices is inherently uncertain, and past performance is not indicative of future results. Market conditions are highly volatile and influenced by numerous unpredictable factors.

This document aims to provide educational insights into potential factors influencing Bitcoin’s price, drawing on publicly available information and expert opinions. However, the complexity of the cryptocurrency market makes accurate predictions extremely difficult, if not impossible. Any decisions made based on the information contained herein are solely the responsibility of the individual. We strongly advise conducting thorough independent research and consulting with a qualified financial advisor before making any investment decisions related to Bitcoin or other cryptocurrencies.

Investment Risks Associated with Bitcoin

Investing in Bitcoin, or any cryptocurrency, carries significant risks. These risks include, but are not limited to, price volatility, regulatory uncertainty, security breaches, technological vulnerabilities, and market manipulation. The value of Bitcoin can fluctuate dramatically in short periods, leading to substantial gains or losses. Regulatory frameworks surrounding cryptocurrencies are still evolving, creating uncertainty about future legal and compliance requirements. Security breaches on exchanges or in personal wallets can result in the loss of funds. Technological advancements and vulnerabilities can also impact the value and functionality of Bitcoin. Finally, the market for Bitcoin is susceptible to manipulation by large investors or groups, potentially causing significant price swings. Consider the potential for total loss of investment before investing in Bitcoin.

Limitations of Price Predictions

Bitcoin price predictions, regardless of their source, should be viewed with extreme caution. Numerous factors beyond the scope of any prediction model can significantly influence Bitcoin’s price. These include macroeconomic conditions, technological developments, regulatory changes, adoption rates, and market sentiment. For example, unexpected global events, such as a major economic recession or geopolitical crisis, can dramatically impact the price of Bitcoin, rendering any prior prediction inaccurate. Similarly, significant technological breakthroughs or setbacks in the cryptocurrency space could cause unforeseen price movements. It’s crucial to understand that any prediction is a snapshot in time and is subject to constant change. Therefore, relying solely on predictions for investment decisions is highly inadvisable.

Bitcoin Price Prediction Early 2025 – Predicting the Bitcoin price in early 2025 is challenging, with various factors influencing its trajectory. For diverse perspectives and community discussions on this topic, you might find the insights shared on Bitcoin Price 2025 Reddit valuable. Ultimately, however, any Bitcoin price prediction for early 2025 remains speculative, requiring careful consideration of market trends and technological advancements.

Predicting the Bitcoin price in early 2025 involves considering numerous factors, including adoption rates and regulatory changes. To gain a clearer perspective on potential price movements within the Australian market, understanding the Australian dollar’s value against Bitcoin is crucial; for this, checking out the projections for Bitcoin Price 2025 Aud is highly recommended. Ultimately, Bitcoin Price Prediction Early 2025 remains a complex forecast dependent on various intertwined economic influences.

Predicting the Bitcoin price in early 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the potential for a significant bull run later that year, as discussed in this insightful analysis on Bitcoin Price 2025 Bull Run. Understanding the dynamics of this potential bull run will be crucial for refining early 2025 Bitcoin price predictions, offering a clearer picture of the market’s likely direction.

Predicting the Bitcoin price in early 2025 involves considering numerous factors, including technological advancements and regulatory changes. For a comprehensive outlook on the potential trajectory throughout the entire year, you might find the predictions from Walletinvestor helpful; check out their analysis at Bitcoin Price Prediction 2025 Walletinvestor. Understanding their full-year forecast can provide context for more refined predictions concerning the Bitcoin price in early 2025.

Predicting the Bitcoin price in early 2025 involves considering various factors, including market sentiment and technological advancements. To gain a more comprehensive perspective, understanding potential price movements later in the year is crucial; for instance, you might find the insights from this resource helpful: Bitcoin Price Prediction Dec 2025. Ultimately, both early and late 2025 predictions contribute to a more nuanced forecast for Bitcoin’s trajectory.