Bitcoin Price Prediction

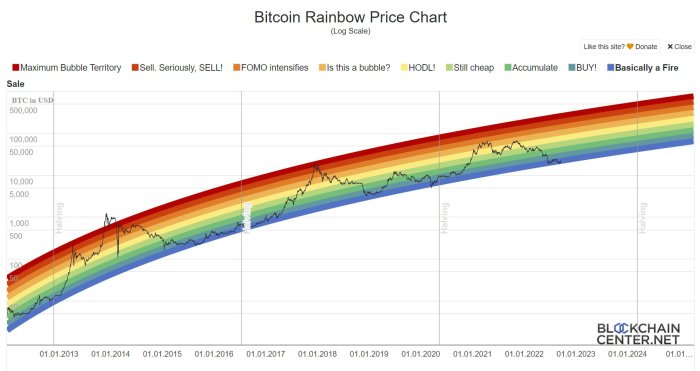

Bitcoin’s price has experienced dramatic fluctuations since its inception. From its humble beginnings with negligible value to reaching all-time highs exceeding $68,000 in late 2021, the cryptocurrency has demonstrated remarkable volatility. This volatility is a defining characteristic, making it a high-risk, high-reward asset for investors. Understanding the factors that influence this volatility is crucial for any attempt at price prediction.

Several interconnected factors contribute to Bitcoin’s price movements. Market sentiment, driven by news, social media trends, and investor confidence, plays a significant role. Positive news, such as institutional adoption or regulatory clarity, tends to boost prices, while negative news, such as security breaches or regulatory crackdowns, can lead to sharp declines. Regulations imposed by governments worldwide also significantly impact Bitcoin’s price. Stringent regulations can stifle adoption and reduce demand, whereas supportive regulatory frameworks can foster growth. Technological advancements, such as improvements in scalability and transaction speed, can also influence price by enhancing Bitcoin’s usability and appeal. Finally, macroeconomic conditions, including inflation rates, interest rates, and economic growth, indirectly affect Bitcoin’s price, often acting as a safe haven asset during periods of economic uncertainty.

Factors Influencing Bitcoin’s Price

The unpredictable nature of these interacting factors makes predicting Bitcoin’s price a particularly challenging endeavor. Market sentiment can shift rapidly and unexpectedly, influenced by a multitude of often unpredictable events. Regulatory landscapes are constantly evolving, with different jurisdictions adopting varying approaches. Technological advancements, while generally positive, can also introduce unforeseen challenges or vulnerabilities. The interplay between these factors, combined with the inherent speculative nature of the cryptocurrency market, creates a complex and dynamic environment where accurate long-term price prediction is extremely difficult, if not impossible. For example, the 2022 cryptocurrency market downturn, influenced by a combination of regulatory uncertainty, macroeconomic instability, and the collapse of several prominent cryptocurrency projects, demonstrates the unpredictable nature of the market and the difficulty in forecasting its trajectory. Even sophisticated models, incorporating various macroeconomic indicators and market sentiment data, have historically struggled to accurately predict Bitcoin’s price.

Factors Affecting Bitcoin’s Price by End of 2025

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of factors that interact in unpredictable ways. While no one can definitively state the price in 2025, understanding these key drivers provides a framework for informed speculation. The following sections detail some of the most significant factors likely to shape Bitcoin’s trajectory.

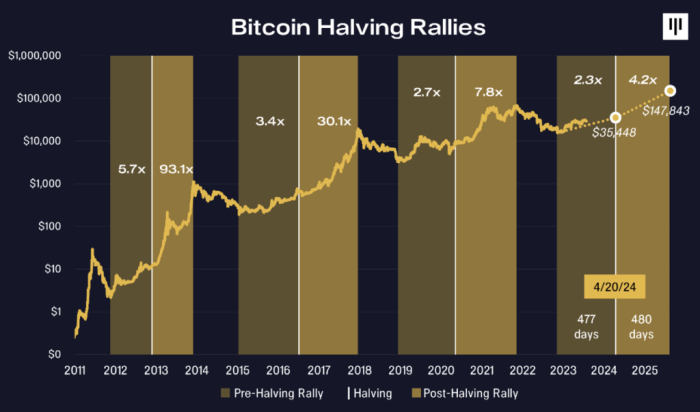

Bitcoin Halving Events

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation approximately every four years, is a significant event anticipated to impact price. Historically, halvings have been followed by periods of increased price appreciation, likely due to the decreased supply and increased scarcity. The next halving, expected around 2024, could trigger another bull market, potentially impacting the price by the end of 2025. However, it’s crucial to note that other market forces can significantly influence the outcome, and past performance is not indicative of future results. For example, the 2020 halving was followed by a substantial price surge, but other factors, such as increased institutional interest, also contributed.

Institutional Adoption and Investment

Growing institutional adoption of Bitcoin as a store of value and a potential investment asset has significantly influenced its price. Large corporations, investment firms, and even sovereign wealth funds are increasingly allocating portions of their portfolios to Bitcoin. This increased demand from institutional investors can drive up the price, as it represents a significant influx of capital into the market. For instance, MicroStrategy’s significant Bitcoin holdings have been cited as a factor in price increases at certain times. Continued institutional adoption will likely remain a major price driver.

Regulatory Changes Across Jurisdictions

The regulatory landscape surrounding Bitcoin varies significantly across different countries and regions. Favorable regulations, such as those promoting clarity and facilitating institutional investment, can lead to increased price stability and potential growth. Conversely, restrictive regulations or outright bans can negatively impact Bitcoin’s price and adoption. The contrasting approaches of El Salvador (which adopted Bitcoin as legal tender) and China (which imposed a ban) illustrate the potential for significant price fluctuations driven by regulatory actions. Future regulatory developments will be a crucial determinant of Bitcoin’s price.

Impact of Emerging Technologies

The emergence of decentralized finance (DeFi) and non-fungible tokens (NFTs) has created new use cases for cryptocurrencies, including Bitcoin. While Bitcoin itself is not directly involved in DeFi applications, its price can be influenced by the overall growth and success of the DeFi ecosystem. Similarly, the increasing popularity of NFTs, often transacted using cryptocurrencies, can indirectly impact Bitcoin’s price through increased demand for cryptocurrencies in general. The growth of these sectors may foster a broader interest in cryptocurrencies and indirectly benefit Bitcoin’s price.

Macroeconomic Factors

Macroeconomic factors, such as inflation, recessionary periods, and interest rate changes, exert a significant influence on Bitcoin’s price. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may see increased demand and price appreciation. Conversely, during economic downturns or periods of rising interest rates, investors may move towards more conservative assets, potentially leading to a decrease in Bitcoin’s price. The correlation between Bitcoin’s price and macroeconomic indicators is not always straightforward and can be influenced by other factors, but understanding these relationships is crucial for assessing potential price movements. For example, the 2022 bear market coincided with rising interest rates and increased inflation.

Analyzing Various Price Prediction Models

Predicting Bitcoin’s price is a complex undertaking, fraught with uncertainty. No model guarantees accuracy, yet understanding the different approaches allows for a more nuanced perspective on potential future price movements. This section explores three primary methods: technical analysis, fundamental analysis, and quantitative models, highlighting their strengths, weaknesses, and interpretations.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. It assumes that past market behavior is indicative of future behavior. This approach utilizes various charting techniques and indicators. For example, moving averages smooth out price fluctuations, identifying trends. The Relative Strength Index (RSI) measures momentum, indicating overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) identifies changes in momentum by comparing two moving averages.

Interpreting Bitcoin Price Charts and Indicators

A Bitcoin price chart typically displays the price over time. A simple moving average (e.g., 50-day or 200-day) can highlight the overall trend. A rising 50-day moving average above a 200-day moving average suggests a bullish trend, while the opposite suggests a bearish trend. The RSI, typically ranging from 0 to 100, signals overbought conditions above 70 and oversold conditions below 30. The MACD, which plots the difference between two exponential moving averages, generates buy signals when crossing above its signal line and sell signals when crossing below. Analyzing these indicators together provides a more comprehensive picture than relying on any single indicator. For instance, a bullish trend confirmed by a rising MACD and RSI above 50 would strengthen the bullish outlook. Conversely, a falling MACD and RSI below 30 would point towards a bearish outlook.

Fundamental Analysis

Fundamental analysis assesses the underlying value of Bitcoin based on factors such as adoption rates, regulatory developments, technological advancements, and macroeconomic conditions. This approach attempts to determine the intrinsic value of Bitcoin, comparing it to its current market price to identify potential mispricings. For example, increased institutional adoption could signal increased demand and potentially higher prices, while negative regulatory news might suppress prices. The scarcity of Bitcoin, with a fixed supply of 21 million coins, is a key fundamental factor often cited as a bullish driver. However, fundamental analysis is subjective and depends heavily on interpreting complex and evolving factors.

Quantitative Models

Quantitative models use statistical and mathematical techniques to forecast Bitcoin’s price. These models can incorporate various factors, including historical price data, market sentiment, and macroeconomic indicators. Examples include time series analysis, which predicts future prices based on past price patterns, and machine learning algorithms, which can identify complex relationships in large datasets. While these models offer a data-driven approach, their accuracy depends on the quality and relevance of the data used and the model’s ability to capture the inherent volatility of the cryptocurrency market. Overfitting, where a model performs well on historical data but poorly on new data, is a significant risk.

Comparison of Bitcoin Price Predictions

The following table summarizes predictions from several prominent analysts and forecasting models, acknowledging that these are just examples and predictions are constantly evolving. The rationale provided is a simplified summary.

| Analyst/Model | Predicted Price (USD) | Rationale | Date of Prediction |

|---|---|---|---|

| Analyst A (Example) | 150,000 | Increased institutional adoption and halving events | October 26, 2023 |

| Analyst B (Example) | 75,000 | Macroeconomic uncertainty and regulatory headwinds | November 15, 2023 |

| Model X (Example) | 100,000 | Based on time series analysis and machine learning | December 1, 2023 |

| Model Y (Example) | 50,000 | Based on a combination of fundamental and technical analysis | December 10, 2023 |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, given its volatility and dependence on numerous interacting factors. However, by considering historical trends, technological advancements, and macroeconomic conditions, we can construct plausible price scenarios for the end of 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral outlook. It’s crucial to remember that these are educated guesses, not guarantees.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario envisions a significant surge in Bitcoin’s price driven by widespread adoption among both individuals and institutions. Factors contributing to this bullish outlook include increasing regulatory clarity in key markets, further development of Bitcoin’s underlying technology (like the Lightning Network), and continued institutional investment. The narrative here is one of growing acceptance of Bitcoin as a legitimate store of value and a hedge against inflation. We might see mainstream financial institutions further integrating Bitcoin into their offerings, increasing liquidity and driving demand. This could lead to a price range between $150,000 and $250,000 by the end of 2025. This range is supported by the historical precedent of Bitcoin’s price growth during previous bull runs, albeit tempered by the acknowledgement that such growth is not linear and may be punctuated by significant corrections. For example, the 2017 bull run saw a price increase of over 1,000%, though this was followed by a substantial bear market.

Bearish Scenario: Regulatory Crackdown and Market Uncertainty

A bearish scenario assumes a less favorable environment for Bitcoin. This could stem from increased regulatory scrutiny and crackdowns in major markets, potentially leading to reduced trading volume and investor confidence. A global economic downturn or a major security breach affecting a significant Bitcoin exchange could also contribute to a negative price trajectory. Furthermore, the emergence of competing cryptocurrencies with superior technology or regulatory advantages could divert investment away from Bitcoin. In this scenario, the price could range between $20,000 and $40,000 by the end of 2025. This prediction is based on the historical observation that negative news and regulatory uncertainty have often led to significant price drops in the past. The 2018 bear market, for instance, saw Bitcoin’s price fall by over 80%.

Neutral Scenario: Gradual Growth and Consolidation, Bitcoin Price Prediction End Of 2025

This scenario assumes a more moderate trajectory for Bitcoin’s price, characterized by gradual growth punctuated by periods of consolidation and sideways trading. This is perhaps the most likely scenario, given the inherent volatility of the cryptocurrency market. Factors contributing to this neutral outlook include a balance between positive and negative news, continued technological development, but also a lack of major breakthroughs that would trigger a dramatic price increase or decrease. The price range in this scenario could fall between $50,000 and $100,000 by the end of 2025. This prediction takes into account the possibility of sustained adoption but also acknowledges the potential for market corrections and periods of uncertainty. This range is somewhat consistent with the general trend of Bitcoin’s price over the long term, showing a pattern of gradual appreciation interspersed with significant corrections.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with uncertainty. Numerous factors influence its value, many of which are unpredictable and beyond the control of any model or analyst. While predictive models can offer potential scenarios, they should be viewed with considerable caution, as they are ultimately just educated guesses based on past data and current trends. Over-reliance on any single prediction can lead to significant financial losses.

The inherent volatility of Bitcoin’s price makes accurate long-term predictions extremely challenging. Unlike traditional assets with established valuation methods, Bitcoin’s price is heavily influenced by market sentiment, technological advancements, regulatory changes, and macroeconomic conditions, all of which are difficult to forecast with precision. Furthermore, the relatively young age of Bitcoin and the cryptocurrency market as a whole means there’s limited historical data to draw upon for robust predictive modeling. This lack of a long and established track record amplifies the uncertainty surrounding any price forecast.

Impact of Unforeseen Events on Bitcoin’s Price

Unforeseen events can significantly and rapidly impact Bitcoin’s price, often in unpredictable ways. A major security breach affecting a major exchange, for example, could erode investor confidence and trigger a sharp price decline. Similarly, a sudden and unexpected regulatory crackdown in a major Bitcoin market could lead to substantial price volatility. The 2021 “China crypto ban” serves as a real-world example of how swift regulatory action can dramatically affect Bitcoin’s price. The announcement led to a significant and immediate drop in Bitcoin’s value, highlighting the vulnerability of the cryptocurrency to unexpected regulatory interventions. Conversely, positive developments, such as the adoption of Bitcoin by a major financial institution or a significant technological upgrade, could conversely drive substantial price increases.

Importance of Risk Management Strategies

Given the inherent risks and uncertainties associated with Bitcoin price predictions, implementing robust risk management strategies is crucial for any investor. This involves carefully assessing one’s risk tolerance, diversifying investments across different asset classes (not putting all eggs in one basket), and only investing an amount of capital that one can afford to lose. Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals regardless of price fluctuations, can help mitigate the risk associated with market volatility. Furthermore, staying informed about market trends, regulatory developments, and technological advancements is essential for making informed investment decisions. Ignoring these risks can lead to substantial financial losses. It is important to remember that past performance is not indicative of future results, and no prediction is guaranteed.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin price predictions and investment considerations, drawing upon the analysis presented earlier. Understanding the inherent uncertainties is crucial before making any investment decisions.

Bitcoin’s Most Likely Price at the End of 2025

Predicting a single “most likely” price for Bitcoin at the end of 2025 is inherently impossible. The price is subject to numerous intertwined factors, making precise forecasting unreliable. As Artikeld previously, various scenarios—ranging from significantly lower to considerably higher prices—are plausible depending on the interplay of macroeconomic conditions, regulatory developments, technological advancements, and overall market sentiment. Referring back to the presented price scenarios, it’s clear that a wide range of outcomes remains possible.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions, regardless of the methodology used, are inherently unreliable. The cryptocurrency market is exceptionally volatile and influenced by a multitude of unpredictable factors, including global economic events, technological disruptions, and shifts in investor sentiment. Historical price movements provide some context, but they do not guarantee future performance. Any prediction should be treated with a significant degree of skepticism, recognizing the substantial uncertainty involved. For example, predictions made in 2017 for the 2018 Bitcoin price proved wildly inaccurate, highlighting the difficulty of accurately forecasting this asset class.

Factors to Consider Before Investing in Bitcoin

Before investing in Bitcoin based on any prediction, investors should carefully assess their risk tolerance, diversify their portfolio, and conduct thorough independent research. Bitcoin is a highly volatile asset, and significant losses are possible. Therefore, only invest what you can afford to lose. Diversification across different asset classes reduces overall portfolio risk. Finally, relying solely on external predictions is unwise; investors should critically evaluate information from various sources and form their own informed opinion before making any investment decisions.

Impact of Bitcoin Halving Events on Price

The Bitcoin halving event is a programmed reduction in the rate at which new Bitcoins are created. This occurs approximately every four years, reducing the reward miners receive for verifying transactions on the blockchain. Historically, halving events have been followed by periods of increased Bitcoin price, although the timing and magnitude of these price increases vary. The reduced supply of new Bitcoins entering the market can create upward pressure on the price, particularly if demand remains strong or increases. However, other market forces can influence the price regardless of the halving. For instance, the 2012 and 2016 halvings were followed by significant price increases, but the timing and extent of the price surges were not directly predictable. The 2020 halving led to a price increase, but it was followed by a significant correction. Therefore, while the halving event is a significant factor, it’s not a guaranteed predictor of price movements.

Disclaimer and Conclusion: Bitcoin Price Prediction End Of 2025

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is volatile and influenced by a multitude of factors, many of which are unpredictable. Any price prediction, including those discussed in this analysis, should be considered a potential outcome among many, and not a guaranteed future. Investing in Bitcoin carries significant risk, and you could lose a substantial portion, or even all, of your investment. It’s crucial to conduct thorough research and understand the risks before investing any funds.

The information provided here is for educational purposes only and should not be considered financial advice. We strongly advise consulting with a qualified financial advisor before making any investment decisions related to Bitcoin. Remember, past performance is not indicative of future results.

Key Takeaways and Limitations of Predictions

This analysis explored various factors influencing Bitcoin’s price, including regulatory developments, adoption rates, technological advancements, macroeconomic conditions, and market sentiment. However, it is vital to acknowledge the inherent limitations of any price prediction model. The cryptocurrency market is notoriously complex and subject to sudden shifts driven by unforeseen events.

- Bitcoin’s price is influenced by a complex interplay of factors, making accurate long-term predictions extremely challenging.

- Predictions are based on models and assumptions that may not fully capture the unpredictable nature of the cryptocurrency market.

- Significant price fluctuations are common in the Bitcoin market, and substantial losses are a possibility.

- Regulatory changes and unforeseen technological developments can dramatically impact Bitcoin’s price.

- Market sentiment plays a crucial role, and sudden shifts in investor confidence can lead to sharp price movements.

For example, the rapid rise of Bitcoin in 2017 was followed by a significant correction, illustrating the volatility inherent in the market. Similarly, the impact of regulatory announcements on Bitcoin’s price has historically been significant, demonstrating the influence of external factors. Therefore, while various models suggest potential price scenarios, the actual price of Bitcoin in 2025 could differ considerably. Always remember that responsible investing involves understanding and accepting the inherent risks involved.

Bitcoin Price Prediction End Of 2025 – Predicting the Bitcoin price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event impacting this prediction is the Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand its potential influence, it’s crucial to know precisely when this halving will occur; you can find out by checking this resource: When Will Bitcoin Halving Take Place In 2025.

This information is essential for more accurate Bitcoin price prediction models for 2025.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, scheduled for 2025, as detailed in this informative article: Nächstes Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate is historically correlated with subsequent price increases, making it a crucial element when considering Bitcoin’s potential value by the end of 2025.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, scheduled for 2025, as detailed in this informative article: Nächstes Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate is historically correlated with subsequent price increases, making it a crucial element when considering Bitcoin’s potential value by the end of 2025.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, scheduled for 2025, as detailed in this informative article: Nächstes Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate is historically correlated with subsequent price increases, making it a crucial element when considering Bitcoin’s potential value by the end of 2025.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, scheduled for 2025, as detailed in this informative article: Nächstes Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate is historically correlated with subsequent price increases, making it a crucial element when considering Bitcoin’s potential value by the end of 2025.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, scheduled for 2025, as detailed in this informative article: Nächstes Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate is historically correlated with subsequent price increases, making it a crucial element when considering Bitcoin’s potential value by the end of 2025.