Bitcoin Price Prediction 2025: Bitcoin Price Prediction For 2025

Bitcoin, the world’s first and most well-known cryptocurrency, has captivated investors and technologists alike with its volatile nature and immense potential. While its price has experienced dramatic swings, ranging from near-zero to record highs, the allure of long-term investment persists, driving a constant demand for price predictions. Accurately forecasting Bitcoin’s value in 2025, however, remains a challenging endeavor, dependent on a complex interplay of factors.

The price of Bitcoin is influenced by a multitude of interconnected elements. Market sentiment, driven by news cycles, social media trends, and overall investor confidence, significantly impacts its volatility. Regulatory changes, both supportive and restrictive, enacted by governments worldwide, can dramatically alter the landscape for Bitcoin adoption and trading. Technological advancements, such as improvements in scalability and transaction speed, can boost its utility and appeal. Finally, macroeconomic conditions, including inflation rates, interest rates, and global economic stability, also play a crucial role in determining Bitcoin’s price trajectory.

Bitcoin’s Price History and Influential Events

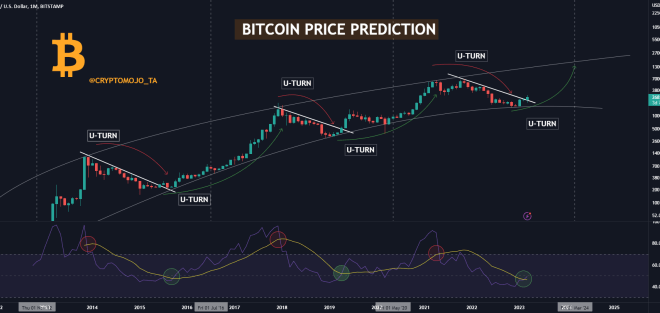

Bitcoin’s history is marked by periods of explosive growth and sharp corrections. Its early years saw a gradual increase in value, followed by periods of rapid appreciation and subsequent crashes. For example, the 2017 bull run saw Bitcoin’s price surge to nearly $20,000, only to plummet significantly in the following year. This volatility was partly fueled by speculative trading and the influx of new investors. Other significant events, such as the halving events (periodic reductions in the rate of Bitcoin mining rewards), have demonstrably impacted its price, often leading to periods of price consolidation before renewed upward momentum. The 2020-2021 bull run, for instance, was partly attributed to increased institutional adoption and the weakening of traditional financial markets amid the COVID-19 pandemic. These events highlight the dynamic and unpredictable nature of Bitcoin’s price movements, making long-term predictions inherently difficult.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, influenced by a confluence of factors ranging from technological advancements to global macroeconomic shifts. While no one can definitively state the exact price, understanding these key drivers provides a framework for informed speculation.

Widespread Cryptocurrency Adoption’s Impact on Bitcoin’s Price

Increased cryptocurrency adoption could significantly boost Bitcoin’s price. As more individuals and businesses utilize cryptocurrencies for transactions and investments, the demand for Bitcoin, as the leading cryptocurrency, is likely to increase. This increased demand, coupled with a relatively fixed supply of 21 million Bitcoin, could drive the price upwards. However, the rate of adoption and its impact on price will depend on various factors, including the ease of use of cryptocurrencies, regulatory clarity, and the overall economic climate. For example, if mainstream payment processors widely integrate Bitcoin, the demand surge could be substantial, leading to a considerable price increase.

Institutional Investment and Price Stability

The entry of institutional investors, such as large corporations and hedge funds, has already shown to influence Bitcoin’s price. Their participation brings increased capital, potentially leading to greater price stability and reduced volatility. However, large-scale institutional selling could also trigger significant price drops. The level of institutional involvement and their trading strategies will be crucial in determining price stability in 2025. Consider, for instance, the impact of a major financial institution announcing a significant Bitcoin holding – this could create a positive market sentiment and drive prices up.

Technological Advancements and Bitcoin’s Scalability

Technological advancements, particularly improvements to the Lightning Network, are vital for enhancing Bitcoin’s scalability and transaction speed. The Lightning Network, a layer-2 scaling solution, allows for faster and cheaper transactions off the main Bitcoin blockchain. Widespread adoption of such technologies could significantly improve Bitcoin’s usability and attract a broader user base, thereby influencing its price positively. If the Lightning Network achieves widespread adoption and significantly reduces transaction fees and confirmation times, this could attract more users and businesses, potentially driving up demand and price.

Global Economic Events and Regulatory Frameworks

Global economic events and regulatory frameworks significantly impact Bitcoin’s price. Economic uncertainty, such as inflation or recession, often drives investors towards Bitcoin as a safe haven asset, increasing its demand. Conversely, stringent regulations or government crackdowns could negatively affect its price. For example, a global recession could lead to a surge in Bitcoin’s price as investors seek alternative assets. Conversely, a major regulatory crackdown in a significant market could lead to a sharp price decline.

Bitcoin’s Price Prediction Compared to Other Major Cryptocurrencies

Predicting Bitcoin’s price relative to other major cryptocurrencies in 2025 requires careful consideration of their respective market caps, technological advancements, and adoption rates. While Bitcoin is likely to remain the dominant cryptocurrency, other cryptocurrencies could experience significant growth, potentially impacting Bitcoin’s relative market share and price. For example, if a competitor develops a significantly more scalable and efficient blockchain technology, it could attract substantial investment and potentially reduce Bitcoin’s dominance, influencing its price.

Hypothetical Scenario: Bitcoin’s Price Behavior Under Different Macroeconomic Conditions

Let’s consider two hypothetical scenarios:

Scenario 1: A period of global economic stability and increased regulatory clarity. In this scenario, institutional investment continues to grow, driving steady, albeit moderate, price increases for Bitcoin. Technological advancements improve usability, leading to broader adoption. The price could potentially reach a range between $100,000 and $150,000.

Scenario 2: A period of global economic uncertainty and increased regulatory pressure. In this scenario, Bitcoin’s price could experience significant volatility. While it might initially act as a safe-haven asset, driving price increases, increased regulatory scrutiny could lead to periods of decline. The price could fluctuate wildly, potentially ranging from $50,000 to $200,000, depending on the severity and nature of the economic and regulatory events.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the volatile nature of the cryptocurrency market. However, by analyzing current trends, technological advancements, and macroeconomic factors, we can Artikel three plausible scenarios: bullish, bearish, and neutral. These scenarios offer a range of possibilities, highlighting the significant uncertainty involved.

Bitcoin Price Scenarios in 2025

The following table summarizes three potential price scenarios for Bitcoin in 2025, each with its own set of supporting factors and assigned probability. These probabilities are subjective and reflect a balanced assessment of the various factors influencing Bitcoin’s price. It’s crucial to remember that these are just potential scenarios, and the actual price could fall outside these ranges.

| Scenario | Price Range (USD) | Supporting Factors | Probability |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread institutional adoption, positive regulatory developments, continued technological advancements (Layer-2 scaling solutions, improved privacy features), growing global demand driven by inflation hedging and emerging market adoption. Increased Bitcoin scarcity due to halving events. | 30% |

| Neutral | $50,000 – $100,000 | Continued market volatility, regulatory uncertainty in key jurisdictions, competition from alternative cryptocurrencies and blockchain technologies, macroeconomic headwinds (e.g., recession, inflation). A period of consolidation following previous price surges. | 50% |

| Bearish | $20,000 – $40,000 | Significant regulatory crackdowns, major security breaches impacting investor confidence, a prolonged crypto winter due to macroeconomic factors, lack of widespread adoption, and the emergence of superior competing technologies. A significant negative event impacting the overall cryptocurrency market. | 20% |

Bullish Scenario: A Bitcoin Supercycle, Bitcoin Price Prediction For 2025

This scenario envisions a continuation of Bitcoin’s upward trajectory, potentially reaching prices far exceeding its previous all-time highs. This would be fueled by increased institutional investment, widespread global adoption driven by inflation hedging and developing economies’ embrace of digital assets, and significant technological improvements enhancing Bitcoin’s scalability and usability. Similar to the 2020-2021 bull run, a confluence of positive factors would need to align, including favorable regulatory developments and a sustained period of macroeconomic stability. The halving event, reducing the rate of new Bitcoin creation, would also contribute to increased scarcity and potential price appreciation. This scenario is analogous to the dot-com boom, where early adoption and technological advancements propelled significant growth, although the sustainability of such growth is always uncertain.

Neutral Scenario: Consolidation and Stagnation

The neutral scenario suggests a period of price consolidation, with Bitcoin trading within a relatively stable range. This could result from a balance between positive and negative factors. Regulatory uncertainty, competition from alternative cryptocurrencies, and macroeconomic headwinds could limit significant price increases. However, widespread adoption might not decline substantially, preventing a sharp price drop. This scenario mirrors periods of market uncertainty seen in other asset classes, where neither strong bullish nor bearish pressures dominate. The price remains relatively stable, potentially fluctuating around established support and resistance levels.

Bearish Scenario: A Prolonged Crypto Winter

This scenario anticipates a significant price decline, potentially driven by several negative factors. A major regulatory crackdown, a large-scale security breach, or a prolonged period of macroeconomic instability could severely impact investor confidence, leading to a prolonged “crypto winter.” This would be characterized by low trading volume, reduced investor participation, and a significant drop in Bitcoin’s price. This scenario would be similar to the 2018-2019 bear market, where a combination of regulatory uncertainty and market manipulation contributed to a significant price decline. The recovery from such a scenario could take a considerable amount of time.

Risks and Opportunities Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 presents a complex landscape of potential rewards and significant risks. While the long-term growth potential is alluring, understanding the inherent volatility and regulatory uncertainties is crucial for informed decision-making. A balanced perspective, considering both sides of the coin, is essential before committing capital.

Price Volatility

Bitcoin’s price is notoriously volatile, subject to dramatic swings driven by market sentiment, regulatory changes, technological advancements, and macroeconomic factors. For example, the price experienced significant drops in 2022 due to a combination of increased interest rates and the collapse of several major cryptocurrency exchanges. Investors should be prepared for substantial price fluctuations, potentially losing a significant portion of their investment in short periods. Historically, Bitcoin has demonstrated periods of explosive growth followed by sharp corrections. This volatility necessitates a risk tolerance aligned with the potential for substantial losses.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains fluid and differs significantly across jurisdictions. Governments worldwide are still grappling with how to effectively regulate Bitcoin and other digital assets. Changes in regulations can dramatically impact Bitcoin’s price and accessibility. For instance, a sudden ban on Bitcoin trading in a major market could lead to a significant price drop. The lack of clear, consistent global regulation presents a considerable risk for investors.

Security Breaches

Bitcoin, while decentralized, is not immune to security risks. Exchanges holding Bitcoin can be targets for hacking, resulting in the loss of user funds. Individual wallets can also be compromised through phishing scams or malware. The security of one’s Bitcoin holdings depends on the security measures employed, including strong passwords, two-factor authentication, and the choice of a reputable and secure wallet provider. Losses due to security breaches can be substantial and irreversible.

Long-Term Growth Potential

Despite the risks, Bitcoin’s long-term growth potential remains a significant draw for investors. Its decentralized nature, limited supply, and growing adoption as a store of value and medium of exchange contribute to its potential for appreciation. Some analysts predict Bitcoin could reach significantly higher prices in the coming years, driven by increased institutional adoption and growing global demand. This potential for substantial returns attracts investors seeking long-term growth in a potentially disruptive technology.

Role in a Decentralized Financial System

Bitcoin’s role in the burgeoning decentralized finance (DeFi) ecosystem presents another significant opportunity. DeFi aims to create a more accessible and transparent financial system, independent of traditional intermediaries. Bitcoin’s use in DeFi applications, such as lending and borrowing platforms, could drive further adoption and price appreciation. The growing ecosystem of DeFi applications offers exciting possibilities for Bitcoin’s future utility and value.

Diversification in Cryptocurrency Portfolio

Diversification is crucial for mitigating risk in any investment portfolio, and this is especially true for cryptocurrencies. Investing in a variety of cryptocurrencies, rather than concentrating solely on Bitcoin, can help reduce the impact of price fluctuations in any single asset. A diversified portfolio can provide a more stable and resilient investment strategy, limiting the potential for significant losses. A balanced portfolio might include a mix of Bitcoin, altcoins, and stablecoins, depending on the investor’s risk tolerance and investment goals.

Potential Return on Investment (ROI)

The potential ROI of a Bitcoin investment in 2025 depends heavily on the price of Bitcoin at that time. Let’s consider a few scenarios:

| Scenario | Bitcoin Price in 2025 | ROI (assuming purchase price of $20,000 in 2024) |

|---|---|---|

| Conservative | $30,000 | 50% |

| Moderate | $50,000 | 150% |

| Optimistic | $100,000 | 400% |

These are hypothetical scenarios, and the actual ROI could be significantly higher or lower depending on market conditions. It’s important to remember that past performance is not indicative of future results. These scenarios highlight the potential for significant returns, but also emphasize the inherent risk involved.

Expert Opinions and Market Analysis on Bitcoin’s Future

Predicting the price of Bitcoin, a volatile asset, is inherently challenging. However, numerous financial analysts, economists, and crypto experts offer forecasts based on various models and market observations. These predictions often diverge significantly, reflecting the uncertainty inherent in the cryptocurrency market and the diverse methodologies employed. Understanding these differing viewpoints is crucial for investors navigating the complexities of Bitcoin investment.

Bitcoin Price Prediction For 2025 – A range of factors influence these predictions, including adoption rates, regulatory developments, macroeconomic conditions, and technological advancements within the Bitcoin ecosystem. While some experts maintain a bullish outlook, anticipating substantial price growth, others express more cautious predictions, highlighting potential risks and challenges. Comparing and contrasting these perspectives provides a more comprehensive understanding of the potential future trajectory of Bitcoin’s price.

Predicting the Bitcoin price for 2025 is a complex endeavor, influenced by numerous factors. A key event to consider is the next Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand its potential effect, check out this informative resource on Bitcoin Halving When 2025 , as the reduced supply often leads to price increases.

Ultimately, this halving event will likely play a considerable role in shaping the Bitcoin price prediction for 2025.

Diverse Predictions for Bitcoin’s Price in 2025

The following list summarizes the price predictions of several prominent sources, illustrating the wide spectrum of opinions currently circulating. It’s important to remember that these are predictions, not guarantees, and the actual price could significantly deviate from these estimates.

Predicting the Bitcoin price for 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, scheduled for 2025, as detailed in this insightful article: Nächstes Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate often historically leads to increased price appreciation, thus significantly affecting any 2025 price forecast.

Therefore, understanding the halving’s implications is crucial for accurate Bitcoin price predictions.

- Source: Bloomberg Intelligence (Analyst: Mike McGlone). Prediction: McGlone has suggested that Bitcoin could reach $100,000 by 2025, citing its increasing institutional adoption and its potential as a store of value similar to gold. This prediction is based on a combination of historical price trends and an assessment of Bitcoin’s growing market share amongst institutional investors.

- Source: Fundstrat Global Advisors (Analyst: Tom Lee). Prediction: Lee has historically held bullish views on Bitcoin, although specific price targets for 2025 haven’t been consistently stated in recent reports. His predictions are often grounded in an analysis of Bitcoin’s network effects and its increasing scarcity as a limited asset. He tends to focus on long-term potential rather than precise short-term forecasts.

- Source: Coinbase (Various analysts). Prediction: Coinbase, as a major cryptocurrency exchange, publishes regular market analysis reports, but avoids making specific price predictions for Bitcoin. Their reports typically focus on broader market trends, regulatory changes, and technological advancements that could impact Bitcoin’s price. They emphasize the importance of considering risk and diversification in any investment strategy.

- Source: JP Morgan (Analysts: Nikolaos Panigirtzoglou et al.). Prediction: JP Morgan’s analysis tends to be more conservative. While they acknowledge Bitcoin’s potential, their price predictions often remain below the most optimistic forecasts. Their analysis frequently incorporates macroeconomic factors and potential regulatory risks, leading to more cautious outlooks.

Frequently Asked Questions (FAQ)

This section addresses some common questions regarding Bitcoin’s price and investment in 2025. Understanding these factors is crucial for making informed investment decisions. While precise predictions are impossible, analyzing historical trends and current market dynamics can provide a clearer picture of potential scenarios.

Key Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of several factors. Market sentiment, driven by news, social media trends, and overall investor confidence, plays a significant role. Government regulations and their impact on cryptocurrency adoption globally are also influential. Technological advancements, such as scaling solutions and improved infrastructure, can significantly affect Bitcoin’s usability and value. Finally, macroeconomic conditions, including inflation, interest rates, and global economic growth, often correlate with Bitcoin’s price movements. For instance, periods of high inflation can drive increased demand for Bitcoin as a hedge against inflation.

Safety of Investing in Bitcoin in 2025

Investing in Bitcoin in 2025, or any time, carries inherent risks. Price volatility is a primary concern; Bitcoin’s price has historically experienced significant fluctuations. Regulatory uncertainty remains a factor, with governments worldwide still developing their approaches to cryptocurrency regulation. Security risks, such as hacking and theft from exchanges or personal wallets, are also present. Thorough due diligence, including understanding your risk tolerance, diversifying your portfolio, and employing sound risk management strategies are essential before investing. It is crucial to only invest what you can afford to lose.

Realistic Price Prediction for Bitcoin in 2025

Predicting Bitcoin’s price with certainty is impossible. Various analysts offer differing predictions, ranging from significantly lower to substantially higher prices than the current market value. Some models suggest a price influenced by factors such as adoption rate, technological improvements, and macroeconomic conditions. For example, if widespread institutional adoption occurs and regulatory clarity emerges, the price could significantly increase. Conversely, a major regulatory crackdown or a significant security breach could lead to a substantial price drop. Therefore, any prediction should be considered with caution, and it’s vital to understand the considerable uncertainty involved.

Protecting Against Bitcoin Price Volatility

Managing the inherent volatility of Bitcoin requires a strategic approach. Diversification is key; don’t put all your eggs in one basket. Invest only a portion of your portfolio in Bitcoin, allocating the rest to other assets like stocks, bonds, or real estate. Dollar-cost averaging, which involves investing a fixed amount at regular intervals regardless of price fluctuations, can mitigate the impact of volatility. Finally, understanding your risk tolerance is paramount. Only invest an amount you are comfortable potentially losing, recognizing that significant price drops are possible.

Disclaimer and Conclusion

Predicting the future price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. Market volatility, regulatory changes, technological advancements, and unforeseen events can significantly impact Bitcoin’s price trajectory. The information presented in this article is for informational purposes only and should not be considered financial advice. Any investment decisions related to Bitcoin should be made after conducting thorough research and consulting with a qualified financial advisor. Remember, investing in cryptocurrencies carries substantial risk, including the potential for complete loss of capital. Do not invest more than you can afford to lose.

Disclaimer Details

It is crucial to understand that the price predictions discussed earlier in this article are based on various factors, including past performance, current market trends, and expert opinions. However, these are merely educated guesses and should not be interpreted as guarantees of future performance. The cryptocurrency market is notoriously volatile, and unforeseen circumstances can dramatically alter price predictions. For example, the unexpected collapse of a major cryptocurrency exchange or a sudden change in government regulation could trigger significant price swings. Therefore, relying solely on predictions for investment decisions is ill-advised. Always conduct your own due diligence and assess your risk tolerance before investing in Bitcoin or any other cryptocurrency.

Key Findings Summary

This article explored the potential price movements of Bitcoin in 2025. To summarize our findings:

- Several factors, including adoption rates, regulatory developments, and technological innovations, will influence Bitcoin’s price in 2025.

- Various price scenarios were presented, ranging from optimistic projections to more conservative estimates, reflecting the inherent uncertainty of the market.

- Investing in Bitcoin presents both significant opportunities and substantial risks. The potential for high returns is counterbalanced by the volatility and potential for substantial losses.

- Expert opinions and market analyses provided a range of perspectives on Bitcoin’s future, highlighting the diversity of viewpoints within the cryptocurrency community.

- Understanding the risks associated with Bitcoin investment is paramount before making any investment decisions.

Predicting the Bitcoin price for 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the upcoming Bitcoin halving in 2024, which will significantly reduce the rate of new Bitcoin creation. For insightful analysis on this crucial event, check out the latest news on the Bitcoin Halving 2025 News website.

Understanding the halving’s potential impact is vital for any serious Bitcoin price prediction for 2025.

Predicting the Bitcoin price for 2025 is a complex undertaking, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving scheduled for that year, significantly altering the rate of new Bitcoin creation. For detailed information on this crucial event, please refer to this insightful resource on the 2025 Bitcoin halving. Understanding the halving’s potential effects is vital for any serious Bitcoin price prediction for 2025.

Predicting the Bitcoin price for 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, which significantly impacts the cryptocurrency’s supply and, consequently, its price. For a detailed analysis of this event’s potential market effects, check out this insightful report: Bitcoin Halving:Impact On The Market 2025 Ocean News. Understanding the halving’s implications is crucial for any serious Bitcoin price prediction for 2025.

Predicting the Bitcoin price for 2025 is a complex endeavor, influenced by numerous factors. A key event impacting these predictions is the upcoming Bitcoin halving, significantly altering the rate of new Bitcoin creation. To keep track of the countdown, you can check this helpful resource: Bitcoin Halving 2025 Time Clock. This halving event will likely play a major role in shaping the Bitcoin price trajectory throughout 2025 and beyond.

Predicting the Bitcoin price for 2025 is a complex undertaking, influenced by numerous factors. To effectively reach potential investors interested in this prediction, a strong online marketing strategy is crucial. This involves setting up a robust Google Ads Account to target relevant keywords and demographics. A well-executed campaign can significantly impact the visibility of your Bitcoin price prediction analysis, ultimately leading to greater reach and engagement.