Bitcoin Price Prediction

Predicting the price of Bitcoin on any given date, especially as far out as January 24th, 2025, is akin to navigating a turbulent sea in a paper boat. Bitcoin’s history is a rollercoaster of dramatic price swings, from its humble beginnings to its meteoric rise and subsequent corrections. The inherent volatility makes long-term forecasting extremely challenging, and any prediction should be viewed with a healthy dose of skepticism. While various analytical methods exist, they are ultimately limited by the unpredictable nature of this nascent asset class.

Bitcoin’s price journey has been shaped by a complex interplay of factors. Its relatively short history has already witnessed periods of explosive growth fueled by increasing adoption, followed by sharp declines triggered by regulatory uncertainty, market sentiment shifts, or technological setbacks. Understanding these influences is crucial when attempting even a tentative price projection.

Factors Influencing Bitcoin’s Price

Several key elements contribute to Bitcoin’s price volatility and future trajectory. Regulatory landscapes across different jurisdictions significantly impact investor confidence and trading activity. Positive regulatory developments, such as the establishment of clear guidelines for cryptocurrencies, can lead to price increases, while stricter regulations or outright bans can cause sharp declines. Consider, for instance, the impact of China’s crackdown on cryptocurrency mining in 2021, which led to a considerable price drop. Conversely, the increasing acceptance of Bitcoin by institutional investors and larger corporations can boost its price.

Technological advancements within the Bitcoin ecosystem also play a vital role. Upgrades to the Bitcoin network, such as the implementation of the Lightning Network to improve transaction speed and scalability, can positively influence investor sentiment and, consequently, the price. Conversely, any significant technological flaws or security breaches could have a negative impact.

Market sentiment, driven by media coverage, social media trends, and overall economic conditions, is another powerful force. Periods of heightened investor enthusiasm, often fueled by hype or speculation, can lead to rapid price appreciation. Conversely, periods of fear or uncertainty, such as those witnessed during broader market downturns, can cause significant price drops. The correlation between Bitcoin’s price and broader market trends is not always consistent, but it’s a factor that needs consideration. For example, the 2022 bear market saw Bitcoin’s price decline alongside traditional assets like stocks and bonds.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, depending on a confluence of economic, technological, and regulatory factors. While no single factor dictates its trajectory, understanding their interplay is crucial for informed speculation. This section explores the key influences expected to shape Bitcoin’s value by 2025.

Global Economic Conditions and Bitcoin’s Price

Global macroeconomic conditions will significantly impact Bitcoin’s price. Periods of high inflation, like those experienced in 2022, often drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially boosting its price. Conversely, a global recession could lead to risk-aversion among investors, potentially causing a sell-off and depressing Bitcoin’s value. The severity and duration of any economic downturn will be key determinants. For example, the 2008 financial crisis saw a significant drop in many asset classes, including early Bitcoin investments, before its subsequent recovery and growth.

Institutional Adoption and Mainstream Acceptance

The growing adoption of Bitcoin by institutional investors and its increasing mainstream acceptance are pivotal to its future price. Increased institutional investment brings greater liquidity and stability to the market. Simultaneously, wider public acceptance, driven by factors like improved user experience and easier access through regulated exchanges, could significantly expand the market capitalization and price. The example of PayPal integrating Bitcoin payments showcased a significant step towards mainstream adoption, demonstrating the potential impact of such partnerships on price fluctuations.

Technological Developments and Bitcoin’s Market Position

Technological advancements will continuously influence Bitcoin’s market position. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, potentially making Bitcoin more attractive for everyday use. However, the emergence of new cryptocurrencies with superior technology or functionalities could pose a competitive threat, potentially diverting investment away from Bitcoin. The development and adoption of Ethereum’s Layer-2 solutions, for instance, have impacted the overall crypto market and indirectly affected Bitcoin’s price through investor sentiment.

Regulatory Frameworks and Government Policies

Government regulations and policies will play a crucial role in shaping Bitcoin’s price trajectory. Clear and consistent regulatory frameworks could foster investor confidence and encourage institutional adoption. Conversely, restrictive or unpredictable regulations could stifle growth and lead to price volatility. The contrasting regulatory approaches taken by different countries, such as El Salvador’s adoption of Bitcoin as legal tender versus China’s ban, highlight the potential for significant price swings based on governmental actions.

Bitcoin Price Forecasting Models

Various forecasting models are used to predict Bitcoin’s price, each with its limitations and strengths. These include technical analysis, which relies on historical price and volume data to identify patterns and predict future price movements; fundamental analysis, which considers factors like market capitalization, adoption rate, and technological advancements; and quantitative models, which employ statistical methods to forecast prices based on various input variables. The accuracy of these models varies considerably, and none can guarantee precise predictions. For example, while technical analysis successfully predicted some short-term price swings in the past, it often fails to accurately account for unexpected external events like regulatory changes or macroeconomic shifts.

Potential Price Scenarios for Bitcoin on January 24, 2025

Predicting the price of Bitcoin with certainty is impossible. However, by considering various macroeconomic factors, technological advancements, and regulatory developments, we can construct plausible price scenarios for January 24, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, with a neutral scenario positioned in between.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario assumes a continued positive trajectory for Bitcoin, driven by widespread adoption, institutional investment, and positive regulatory developments. Global macroeconomic instability could further fuel Bitcoin’s appeal as a safe haven asset. Technological advancements, such as the successful implementation of Layer-2 scaling solutions, would improve transaction speeds and reduce fees, attracting more users. Positive regulatory frameworks in key jurisdictions would boost investor confidence.

Imagine a hypothetical price chart showing a steady upward trend throughout 2024 and into 2025. The chart would display a gradual increase in price, punctuated by occasional periods of consolidation. Key support levels would be progressively higher, indicating strong underlying demand. Resistance levels would also increase, reflecting the increasing value of Bitcoin. By January 24, 2025, the chart would show Bitcoin reaching a price of, for example, $150,000, representing a significant increase from its price at the time of writing. The overall visual impression is one of sustained growth and bullish momentum. This scenario mirrors the price trajectory of other assets during periods of rapid adoption and technological innovation, such as the internet boom of the late 1990s.

Bearish Scenario: Bitcoin Experiences a Significant Correction

This scenario assumes a downturn in the cryptocurrency market due to factors such as increased regulatory scrutiny, a global economic recession, or a major security breach affecting the Bitcoin network. Negative media coverage and a lack of institutional confidence could also contribute to a price decline. A pessimistic scenario might see investors moving their capital to more stable assets, leading to a significant sell-off in Bitcoin.

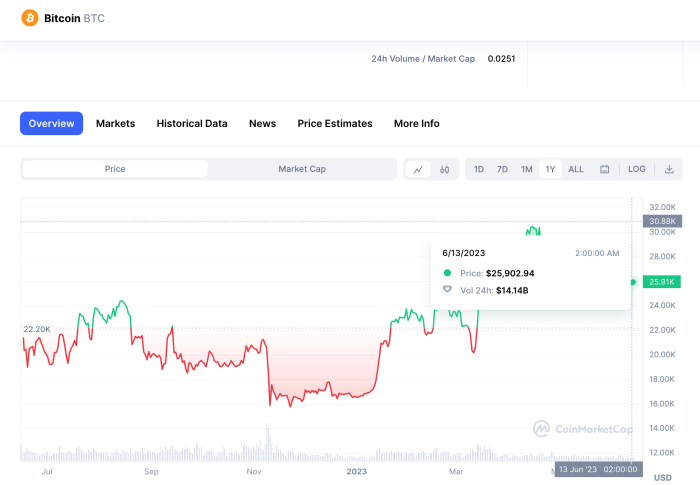

The hypothetical price chart would show a downward trend, potentially with several sharp drops. Support levels would be progressively lower, indicating weakening demand. Resistance levels would act as temporary barriers to the decline, but ultimately would be breached. By January 24, 2025, the chart might show a price of, say, $25,000, representing a substantial drop from current levels. The visual impression is one of instability and bearish sentiment. This scenario could be similar to the 2018 cryptocurrency bear market, where Bitcoin’s price experienced a sharp decline due to a combination of regulatory uncertainty and market speculation.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario assumes a period of consolidation and moderate growth for Bitcoin. The market would experience both periods of upward and downward momentum, reflecting a balance between bullish and bearish forces. This scenario assumes that macroeconomic factors remain relatively stable, and regulatory developments are neither overwhelmingly positive nor negative. Technological advancements continue, but their impact on price is less pronounced than in the bullish scenario.

The hypothetical price chart would depict a sideways trend with minor fluctuations. Support and resistance levels would be relatively close together, indicating a lack of strong directional momentum. By January 24, 2025, the price might be around $50,000, representing moderate growth but without the significant gains or losses seen in the other scenarios. The visual impression is one of stability and sideways consolidation. This scenario could be comparable to the period following a major bull run, where the market consolidates before embarking on a new trend.

Comparison of Price Scenarios

| Scenario | Predicted Price (January 24, 2025) | Influencing Factors |

|---|---|---|

| Bullish | $150,000 | Widespread adoption, institutional investment, positive regulation, technological advancements |

| Bearish | $25,000 | Increased regulation, economic recession, security breaches, negative media coverage |

| Neutral | $50,000 | Stable macroeconomic conditions, moderate technological advancements, balanced regulatory environment |

Risks and Uncertainties Associated with Bitcoin Price Prediction

Predicting the price of Bitcoin, especially over a long timeframe like January 24th, 2025, is inherently fraught with uncertainty. Numerous factors, both predictable and unpredictable, can significantly influence Bitcoin’s value, making any prediction inherently speculative. It’s crucial to understand these limitations before considering any long-term price forecasts.

The inherent volatility of Bitcoin makes long-term price predictions extremely difficult. Unlike traditional assets with established valuation models, Bitcoin’s price is driven by a complex interplay of factors including market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. These elements are often interconnected and difficult to predict accurately, leading to significant price swings. Past performance, while informative, is not necessarily indicative of future results.

Limitations of Long-Term Bitcoin Price Prediction Models

Many attempts to predict Bitcoin’s price rely on technical analysis, fundamental analysis, or algorithmic models. However, these methods have significant limitations when applied to such a volatile and relatively young asset. Technical analysis, which focuses on chart patterns and historical price movements, can be unreliable in a market as unpredictable as Bitcoin’s. Fundamental analysis, which considers factors like adoption rates and network effects, is also challenged by the evolving regulatory landscape and the difficulty in accurately quantifying intangible factors like investor sentiment. Algorithmic models, while sophisticated, are only as good as the data they are trained on and can be easily thrown off by unexpected events. For example, a model trained on data prior to the 2022 cryptocurrency crash would likely have significantly underestimated the depth and duration of the downturn.

Impact of Unexpected Events on Bitcoin’s Price

Unexpected events can dramatically alter Bitcoin’s price trajectory. A major security breach, for example, could erode investor confidence and trigger a significant price drop. Similarly, sudden and sweeping regulatory changes, such as a complete ban on Bitcoin trading in a major market, could severely impact its price. The 2021-2022 cryptocurrency market crash, partly fueled by concerns over regulatory uncertainty and macroeconomic factors, serves as a stark reminder of the potential for unforeseen events to cause significant volatility. Moreover, the collapse of FTX in late 2022 highlighted the risks associated with centralized exchanges and their potential impact on the wider cryptocurrency market.

Risk Management and Diversification in Cryptocurrency Investments

Given the inherent risks associated with Bitcoin and the cryptocurrency market in general, effective risk management is paramount. Diversification is a key strategy. Instead of concentrating investments solely in Bitcoin, investors should consider diversifying across different cryptocurrencies, as well as other asset classes such as stocks, bonds, and real estate. This approach can help mitigate losses if one particular asset experiences a downturn. Furthermore, investors should only invest what they can afford to lose and thoroughly research any investment before committing capital.

Black Swan Events and Their Potential Impact on Bitcoin

The concept of “black swan” events—highly improbable but potentially devastating occurrences—is particularly relevant to Bitcoin. These are events that are outside the realm of normal expectations and are difficult or impossible to predict. A sudden global economic crisis, a major technological disruption affecting blockchain technology, or a significant geopolitical event could all be considered black swan events with the potential to dramatically impact Bitcoin’s price. While these events are inherently unpredictable, understanding their potential impact is crucial for responsible investment decision-making. The 2008 global financial crisis, while not directly impacting Bitcoin (which was still in its early stages), demonstrates the cascading effects that unforeseen macroeconomic events can have on global markets, highlighting the vulnerability of even seemingly robust assets.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is inherently speculative, yet analyzing expert opinions and prevailing market sentiment offers valuable insight into potential price trajectories. While no one can definitively state Bitcoin’s price on January 24th, 2025, understanding the range of perspectives helps contextualize potential outcomes. This section will summarize prominent analysts’ views and the overall market mood surrounding Bitcoin.

Bitcoin Price Prediction For 24 January 2025 – Several factors influence expert opinions and market sentiment. These include macroeconomic conditions (inflation, interest rates), regulatory developments (governmental stances on crypto), technological advancements (scaling solutions, layer-2 protocols), and adoption rates (institutional and retail investor participation). Analyzing these elements helps to understand the diverse predictions and overall market feeling.

Predicting the Bitcoin price for a specific date like 24 January 2025 is inherently challenging, relying heavily on speculation and various market factors. To get a broader understanding of potential future price movements, it’s helpful to consult resources offering a longer-term perspective, such as this comprehensive analysis on Price Prediction Bitcoin 2025. This wider view can inform more realistic expectations regarding the Bitcoin price on 24 January 2025, though ultimately, the market remains unpredictable.

Prominent Analyst Opinions on Bitcoin’s 2025 Price

A range of predictions exists among prominent cryptocurrency analysts and experts regarding Bitcoin’s price in 2025. These predictions are often based on complex models, technical analysis, and assessments of the broader economic landscape. It’s crucial to remember that these are opinions, not guarantees.

Predicting the Bitcoin price for January 24th, 2025, is inherently speculative, but a key factor to consider is the anticipated impact of the Bitcoin Halving in 2024. Many analysts believe this event will trigger a significant bull run, as discussed in this insightful article on the Bitcoin Halving 2025 Bull Run. Therefore, the price prediction for January 2025 will likely be heavily influenced by the strength and duration of this post-halving rally.

- Some analysts, basing their projections on continued adoption and technological improvements, predict Bitcoin’s price could reach $100,000 or more by 2025. Their reasoning often centers on increasing institutional investment and the growing scarcity of Bitcoin due to its limited supply.

- Others hold more conservative views, predicting a price range between $50,000 and $80,000, citing potential regulatory hurdles, market volatility, and the possibility of competing cryptocurrencies gaining traction.

- A smaller group of analysts express more bearish sentiment, forecasting lower price ranges, potentially even below current market values. These predictions often highlight the risks associated with cryptocurrency investment, including the potential for significant price corrections and regulatory crackdowns.

Market Sentiment Analysis

Market sentiment towards Bitcoin is a dynamic and complex phenomenon. It is influenced by a variety of sources, including social media trends, news coverage, and the overall behavior of investors. A positive market sentiment is generally associated with higher prices, while negative sentiment can lead to price declines.

Predicting the Bitcoin price for January 24th, 2025, is challenging, involving numerous factors. A key element influencing long-term price projections is the Bitcoin halving schedule; understanding future halvings is crucial. To gain insight into the timing of halvings beyond 2025, you can consult this resource: Bitcoin Halving Date After 2025. This information, combined with other market analyses, can help refine any Bitcoin price prediction for January 2025.

For instance, positive news coverage of Bitcoin adoption by large corporations or favorable regulatory developments often fuels optimism and drives up demand. Conversely, negative news such as major security breaches or regulatory crackdowns can trigger fear and uncertainty, leading to sell-offs. Social media platforms also play a significant role in shaping market sentiment, with trends and discussions influencing investor behavior. The overall market sentiment can swing dramatically in short periods, reflecting the inherent volatility of the cryptocurrency market.

Comparison of Perspectives

While there’s a wide range of predictions, several common themes emerge. Most analysts agree that Bitcoin’s price will be significantly influenced by macroeconomic factors, regulatory clarity, and the pace of technological advancements. Areas of disagreement mainly revolve around the magnitude of these influences and the timing of key events. For example, while many agree that increased institutional adoption is bullish for Bitcoin, there’s disagreement on how quickly this adoption will occur and its ultimate impact on price.

Some analysts emphasize the potential for Bitcoin to become a significant store of value, comparable to gold, while others focus on its role as a medium of exchange or a component of a diversified investment portfolio. These differing perspectives shape their price predictions and overall outlook on Bitcoin’s future.

Disclaimer and Investment Advice: Bitcoin Price Prediction For 24 January 2025

The information presented in this analysis regarding the potential Bitcoin price on January 24, 2025, is purely for educational purposes and should not be interpreted as financial advice. This prediction is based on an assessment of current market trends, historical data, and expert opinions; however, the cryptocurrency market is inherently volatile and unpredictable. Any investment decisions made based on this information are solely at your own risk.

It is crucial to understand that predicting the price of Bitcoin, or any cryptocurrency, with certainty is impossible. Numerous factors, both internal and external to the cryptocurrency market, can significantly impact its price. Relying solely on a single prediction, regardless of its source, can lead to substantial financial losses. Therefore, thorough due diligence is paramount before investing in any cryptocurrency.

Importance of Independent Research and Professional Advice

Before making any investment decisions related to Bitcoin or any other cryptocurrency, it is strongly recommended to conduct extensive independent research. This includes analyzing market trends, understanding the underlying technology, assessing the risks involved, and evaluating the potential for both significant gains and losses. Consider consulting with a qualified financial advisor who can provide personalized guidance based on your individual financial situation, risk tolerance, and investment goals. They can help you understand the complexities of cryptocurrency investments and make informed decisions aligned with your overall financial strategy. For example, a financial advisor can help you determine the appropriate allocation of your investment portfolio to high-risk assets like cryptocurrencies, ensuring it aligns with your risk tolerance and long-term financial goals.

Risks Involved in Cryptocurrency Investment

Investing in cryptocurrencies, including Bitcoin, carries substantial risks. The market is known for its extreme volatility, with prices fluctuating dramatically in short periods. Factors such as regulatory changes, technological advancements, market sentiment, and security breaches can all cause significant price swings. For instance, the collapse of the FTX exchange in 2022 demonstrated the potential for rapid and devastating losses in the cryptocurrency market. Investors could experience a complete loss of their investment, and there is no guarantee of recovering any invested capital. Furthermore, the decentralized nature of cryptocurrencies means that there is less regulatory oversight and protection compared to traditional financial markets. This lack of regulation increases the risk of fraud and scams. Understanding these risks and having a clear understanding of your own risk tolerance is vital before entering the cryptocurrency market.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price and investment. Understanding these factors is crucial for informed decision-making in the cryptocurrency market.

Main Factors Influencing Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics play a significant role, with increased demand driving prices upward and vice versa. Regulatory developments, both globally and within specific jurisdictions, can significantly impact investor sentiment and market activity. Technological advancements within the Bitcoin network, such as upgrades or scaling solutions, can also affect its price. Furthermore, macroeconomic conditions, such as inflation rates and overall market sentiment, influence investor appetite for riskier assets like Bitcoin. Finally, the actions of major players, including institutional investors and whales, can cause significant price fluctuations.

Accuracy of Bitcoin Price Predictions in 2025, Bitcoin Price Prediction For 24 January 2025

Accurately predicting Bitcoin’s price in 2025 is exceptionally challenging. The cryptocurrency market is highly volatile and influenced by unpredictable events, making long-term forecasts unreliable. Numerous unforeseen factors, such as technological breakthroughs, regulatory changes, or geopolitical events, can dramatically alter the market landscape. While price predictions can offer potential scenarios, they should be treated with considerable skepticism and not considered financial advice. For example, predictions made in 2017 for Bitcoin’s price in 2020 were wildly inaccurate due to the unexpected market downturn that occurred.

Risks of Investing in Bitcoin

Investing in Bitcoin carries substantial risks. The cryptocurrency market is notoriously volatile, experiencing significant price swings in short periods. This volatility can lead to substantial losses for investors. Regulatory uncertainty represents another major risk; governments worldwide are still developing frameworks for regulating cryptocurrencies, and changes in regulations could negatively impact Bitcoin’s value or even lead to trading restrictions. Security risks, such as hacking and theft from exchanges or personal wallets, are also a concern. Finally, the lack of intrinsic value in Bitcoin, unlike traditional assets, makes its price highly dependent on market sentiment and speculation.

Reliable Information Sources about Bitcoin

Reliable information about Bitcoin can be found from various reputable sources. These include established financial news outlets with dedicated cryptocurrency sections, research reports from respected financial institutions, and white papers and publications from blockchain technology experts and academics. It’s crucial to be discerning and critically evaluate information from various sources, verifying claims and avoiding biased or unsubstantiated opinions. Government regulatory bodies and financial literacy organizations may also provide educational resources on cryptocurrency investing.

Predicting the Bitcoin price for January 24th, 2025, is challenging, involving numerous factors. A key element influencing long-term price projections is the Bitcoin halving schedule; understanding future halvings is crucial. To gain insight into the timing of halvings beyond 2025, you can consult this resource: Bitcoin Halving Date After 2025. This information, combined with other market analyses, can help refine any Bitcoin price prediction for January 2025.

Predicting the Bitcoin price for January 24th, 2025, is challenging, involving numerous factors. A key element influencing long-term price projections is the Bitcoin halving schedule; understanding future halvings is crucial. To gain insight into the timing of halvings beyond 2025, you can consult this resource: Bitcoin Halving Date After 2025. This information, combined with other market analyses, can help refine any Bitcoin price prediction for January 2025.

Predicting the Bitcoin price for January 24th, 2025, is challenging, involving numerous factors. A key element influencing long-term price projections is the Bitcoin halving schedule; understanding future halvings is crucial. To gain insight into the timing of halvings beyond 2025, you can consult this resource: Bitcoin Halving Date After 2025. This information, combined with other market analyses, can help refine any Bitcoin price prediction for January 2025.

Predicting the Bitcoin price for January 24th, 2025, is challenging, involving numerous factors. A key element influencing long-term price projections is the Bitcoin halving schedule; understanding future halvings is crucial. To gain insight into the timing of halvings beyond 2025, you can consult this resource: Bitcoin Halving Date After 2025. This information, combined with other market analyses, can help refine any Bitcoin price prediction for January 2025.