Bitcoin Price Prediction: Bitcoin Price Prediction For 26 January 2025

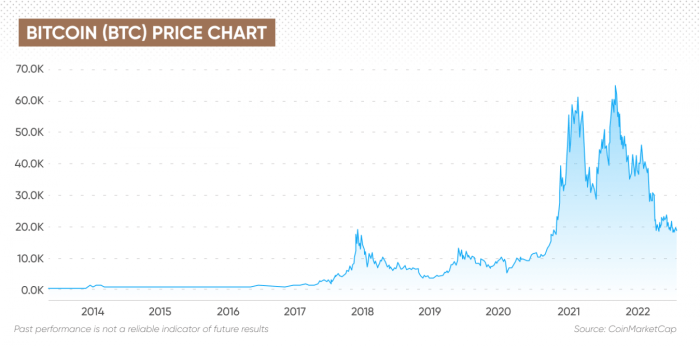

Bitcoin’s price history is a rollercoaster ride, marked by periods of explosive growth and dramatic crashes. From its humble beginnings near zero to its all-time high exceeding $68,000 in late 2021, the cryptocurrency has experienced immense volatility. Significant events such as the 2017 bull run, the 2020 halving, and the various regulatory pronouncements from governments worldwide have all significantly influenced its price. The inherent decentralized nature of Bitcoin, coupled with its limited supply, contributes to its price fluctuations, making accurate long-term predictions exceptionally challenging. Speculative trading, macroeconomic factors, and technological advancements all play a significant role in shaping its market value.

The inherent volatility of Bitcoin presents a considerable challenge for accurate long-term price prediction. Numerous factors, including regulatory changes, technological developments, and overall market sentiment, can cause significant price swings in relatively short periods. Predictive models, while useful for analyzing trends, often fail to account for the unpredictable nature of these external influences. Therefore, any prediction, especially one extending as far as January 26, 2025, should be treated with a healthy dose of skepticism. This article aims to provide a reasoned exploration of potential price scenarios for Bitcoin on January 26, 2025, based on current market trends and historical data, acknowledging the inherent limitations of such an exercise.

Bitcoin Price Prediction Methodology for January 26, 2025

This section will detail the approach used to arrive at a potential price range for Bitcoin on January 26, 2025. The methodology involves analyzing historical price data, considering macroeconomic factors like inflation and interest rates, assessing the impact of technological advancements within the Bitcoin ecosystem, and evaluating the influence of regulatory developments. For example, the impact of widespread adoption by institutional investors or the emergence of competing cryptocurrencies will be factored into the analysis. We will also consider scenarios based on past market cycles, comparing the current market conditions to previous bull and bear markets to gain insights into potential future price movements. While no model can perfectly predict the future, a multi-faceted approach allows for a more nuanced and informed assessment. The resulting prediction will be presented as a range, reflecting the inherent uncertainty associated with such long-term forecasting.

Factors Influencing Bitcoin’s Price

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic, regulatory, technological, and market-driven factors. Understanding these influences is crucial for any attempt at forecasting its value, especially looking ahead to January 26, 2025. This section will delve into the key elements shaping Bitcoin’s price trajectory.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price. Periods of high inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates, which increase the attractiveness of traditional investments, can lead to a decrease in Bitcoin’s demand. Global economic uncertainty, such as recessions or geopolitical instability, often causes investors to seek safe haven assets, potentially boosting Bitcoin’s value as a digital gold. The correlation, however, isn’t always direct, and other factors frequently outweigh macroeconomic trends. For instance, the 2022 bear market saw both high inflation and rising interest rates, yet Bitcoin’s price declined substantially.

Regulatory Changes and Governmental Policies

Governmental regulations and policies play a pivotal role in Bitcoin’s adoption and valuation. Favorable regulatory frameworks, such as clear guidelines for cryptocurrency exchanges and taxation, can boost investor confidence and increase market participation. Conversely, restrictive regulations, bans, or unclear legal landscapes can stifle adoption and negatively impact price. The regulatory approach varies widely across jurisdictions, with some countries embracing Bitcoin as a potential asset class, while others remain hesitant or outright hostile. The regulatory landscape in the United States, for instance, remains fluid and is a major determinant of global Bitcoin sentiment.

Technological Advancements

Technological advancements within the cryptocurrency space both directly and indirectly influence Bitcoin’s price. Scaling solutions, such as the Lightning Network, aim to improve Bitcoin’s transaction speed and reduce fees, potentially increasing its usability and attractiveness. The emergence of new cryptocurrencies with potentially superior features can, however, pose a competitive threat to Bitcoin’s dominance, potentially diverting investment away from Bitcoin. The development and adoption of layer-2 solutions are crucial for Bitcoin’s long-term scalability and competitiveness, directly impacting its price.

Institutional Adoption

The increasing adoption of Bitcoin by institutional investors and large corporations is a significant factor. Large-scale investments by institutional players provide liquidity to the market and signal a degree of legitimacy and acceptance, potentially boosting price. Conversely, a decrease in institutional interest could lead to a decline in price. Examples such as MicroStrategy’s significant Bitcoin holdings showcase the impact of institutional investors on market sentiment and price.

Key Events and Announcements

Several key events or announcements could significantly impact Bitcoin’s price before January 26, 2025. These include major regulatory decisions from key jurisdictions, significant technological upgrades to the Bitcoin network, large-scale institutional investments or divestments, and any unforeseen geopolitical events. For example, a clear regulatory framework for Bitcoin in the US could trigger a significant price surge, while a major security breach on a large exchange could cause a sharp drop. Predicting the impact of these events requires careful analysis of market sentiment and historical precedent.

Summary of Influencing Factors

| Factor | Potential Impact | Likelihood | Source of Information |

|---|---|---|---|

| Macroeconomic Conditions (Inflation, Interest Rates) | Positive (during high inflation, low interest rates); Negative (during low inflation, high interest rates) | High | Economic data, market analysis |

| Regulatory Changes | Positive (favorable regulations); Negative (restrictive regulations) | Medium | Governmental announcements, legal publications |

| Technological Advancements | Positive (improved scalability, security); Negative (competition from new cryptocurrencies) | Medium | Technological publications, industry reports |

| Institutional Adoption | Positive (increased investment); Negative (decreased investment) | Medium | Financial news, company announcements |

| Key Events/Announcements | Highly Variable (depending on the nature of the event) | Medium to High (depending on the event) | News media, market analysis |

Analyzing Historical Price Trends and Patterns

Bitcoin’s price history is characterized by periods of explosive growth followed by significant corrections, creating a volatile yet fascinating market. Understanding these historical trends and applying various analytical methods can offer insights into potential future price movements, though it’s crucial to remember that no prediction is foolproof. This analysis will explore Bitcoin’s past performance, examining technical indicators and forecasting models to illuminate potential future trajectories.

Bitcoin’s price has demonstrated a clear upward trend since its inception, punctuated by several distinct bull and bear markets. The initial years saw gradual growth, followed by periods of rapid appreciation, like the 2017 bull run reaching near $20,000, and subsequent significant price drops. These cycles are often attributed to factors such as regulatory changes, technological advancements, and overall market sentiment. Analyzing these cyclical patterns can provide clues for potential future price behavior, but it is essential to consider the unique characteristics of each cycle.

Technical Analysis Methods for Bitcoin Price Prediction, Bitcoin Price Prediction For 26 January 2025

Technical analysis employs various tools to interpret price charts and identify patterns, providing potential insights into future price movements. Moving averages, such as the 50-day and 200-day moving averages, are commonly used to smooth out price fluctuations and identify trends. A bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, suggesting a potential upward trend. Conversely, a bearish crossover signals a potential downward trend. The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. RSI values above 70 often suggest an overbought market, potentially indicating a price correction, while values below 30 suggest an oversold market, potentially indicating a price rebound. Other indicators like MACD (Moving Average Convergence Divergence) and Bollinger Bands are also used to identify potential entry and exit points. However, it’s important to note that these indicators are not predictive tools but rather provide insights into market sentiment and momentum.

Forecasting Models and Their Limitations

Several forecasting models attempt to predict Bitcoin’s future price. Time series analysis utilizes historical price data to identify patterns and extrapolate them into the future. This method often employs techniques like ARIMA (Autoregressive Integrated Moving Average) models. However, the inherent volatility of Bitcoin makes accurate long-term predictions challenging. Machine learning models, such as neural networks, can be trained on vast datasets to identify complex relationships and predict future prices. However, these models are susceptible to overfitting, meaning they may perform well on historical data but poorly on new, unseen data. Furthermore, these models rely heavily on the quality and representativeness of the training data, and unexpected events or shifts in market sentiment can render predictions inaccurate. Both time series analysis and machine learning models struggle to accurately predict long-term Bitcoin prices due to the influence of unpredictable external factors.

Historical Price Trends and Projected Trajectories

A line chart illustrating Bitcoin’s historical price from its inception to the present would show a clear upward trend, but with significant fluctuations. The x-axis would represent time, and the y-axis would represent the Bitcoin price in USD. The chart would show several distinct peaks and troughs representing bull and bear markets. Projected trajectories based on historical data would involve overlaying potential future price paths onto this chart. These projections would be based on various models (e.g., time series analysis, moving averages), and multiple scenarios could be shown, reflecting the inherent uncertainty. For example, a conservative projection might show a gradual upward trend, while a more optimistic projection could show a steeper incline. It’s crucial to remember that these projections are merely possibilities, and the actual price trajectory could deviate significantly. The chart would visually demonstrate the volatile nature of Bitcoin’s price, highlighting the limitations of any long-term price prediction. One could overlay various technical indicators like moving averages to illustrate how they might be used to interpret past price movements and potentially inform future price projections. The chart would not provide a definitive answer but rather a visual representation of the complexity and uncertainty inherent in Bitcoin price forecasting.

Disclaimer

Investing in cryptocurrencies, including Bitcoin, carries significant risk. The cryptocurrency market is highly volatile and subject to rapid and unpredictable price swings. The price of Bitcoin can be influenced by a multitude of factors, many of which are beyond anyone’s control, including regulatory changes, technological advancements, market sentiment, and macroeconomic conditions. Past performance is not indicative of future results. Any prediction about Bitcoin’s future price is inherently speculative and should not be considered financial advice.

This Bitcoin price prediction for January 26th, 2025, is based on an analysis of historical data and current market trends. However, it’s crucial to understand that this analysis is not a guarantee of future performance. Unexpected events could drastically alter the predicted trajectory. Therefore, it is essential to approach any price prediction with extreme caution and a full understanding of the potential risks involved. Losses can be substantial, and investors could lose their entire investment.

Risk Considerations for Bitcoin Investment

Investing in Bitcoin involves several key risks. These include the risk of price volatility, the risk of hacking or theft from exchanges or personal wallets, the risk of regulatory uncertainty and potential government crackdowns, and the risk of technological obsolescence. For example, the Mt. Gox exchange collapse in 2014, which resulted in the loss of millions of dollars worth of Bitcoin for users, highlights the security risks inherent in the cryptocurrency market. Similarly, the price of Bitcoin plummeted in 2022 due to a combination of macroeconomic factors and regulatory concerns. These examples illustrate the unpredictable nature of the market and the potential for significant losses.

Recommendation for Responsible Investing

Before making any investment decisions related to Bitcoin or any other cryptocurrency, it is strongly recommended that you conduct your own thorough research and consult with a qualified financial advisor. A financial advisor can help you assess your risk tolerance, understand your investment goals, and make informed decisions that align with your overall financial strategy. Remember, never invest more money than you can afford to lose. The information presented in this prediction is for educational purposes only and should not be interpreted as an endorsement or recommendation to buy or sell Bitcoin.

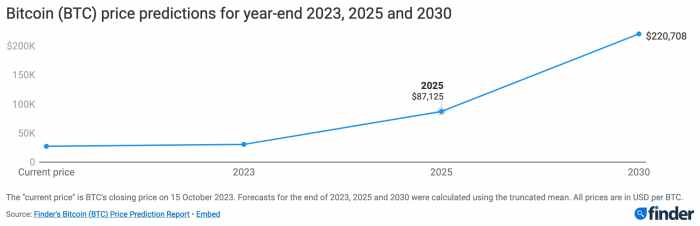

Bitcoin Price Prediction For 26 January 2025 – Predicting the Bitcoin price for January 26th, 2025, is challenging, involving numerous factors. A key element influencing long-term price projections is the halving events, which significantly impact Bitcoin’s inflation rate. To understand the potential impact on the 2025 prediction, it’s helpful to consider the next halving after that date, as found by checking this resource: Next Bitcoin Halving Date After 2025.

Understanding the timing of future halvings provides context for evaluating the long-term price trajectory of Bitcoin and its potential value on January 26th, 2025.

Predicting the Bitcoin price for any specific date, like 26 January 2025, is inherently challenging due to market volatility. However, understanding broader trends is crucial; a helpful resource for this is the comprehensive overview of Bitcoin Prediction Price 2025 , which can inform our perspective on potential long-term price movements. Ultimately, the Bitcoin price on 26 January 2025 will depend on various factors impacting the cryptocurrency market by then.

Predicting the Bitcoin price for January 26th, 2025, is inherently speculative, influenced by various factors including broader market trends and technological advancements. Understanding the potential trajectory requires considering related cryptocurrencies; for instance, to gain a comparative perspective, it’s helpful to explore the predictions for other digital assets like Bitcoin Cash by checking out this resource: What Is The Prediction For Bitcoin Cash In 2025?

. Ultimately, the Bitcoin price prediction for that date will depend on the interplay of numerous economic and technological variables.

Accurately predicting the Bitcoin price for January 26th, 2025, is challenging, given the cryptocurrency’s volatility. However, understanding past predictions can offer some insight. For a perspective on potential future values, you might consider reviewing the analysis presented in Plan B Bitcoin Prediction 2025 , which provides a framework for long-term price estimations. Ultimately, though, the Bitcoin price on that date will depend on various market factors.

Predicting the Bitcoin price for January 26th, 2025, is inherently speculative, but a significant factor to consider is the upcoming Bitcoin halving. To understand its impact, it’s crucial to grasp the mechanics of this event; for a detailed explanation, see this article: What Does It Mean Bitcoin Halving 2025. This halving is expected to significantly influence Bitcoin’s scarcity and, consequently, its potential price appreciation leading up to and beyond January 26th, 2025.

Predicting the Bitcoin price for January 26th, 2025, is challenging, influenced by numerous factors. A key event impacting long-term price is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand the potential impact on the 2025 price, it’s crucial to know when this next halving occurs; you can find out more by checking this resource: When Is The Next Bitcoin Halving In 2025.

This information will help refine any Bitcoin price prediction for January 26th, 2025, by considering the halving’s anticipated effects on supply and demand.

Predicting the Bitcoin price for January 26th, 2025, is inherently speculative, but market analysis plays a key role. To effectively reach potential investors interested in such predictions, a strong online marketing strategy is crucial; consider setting up a Google Ads Account to target relevant audiences. This will allow you to fine-tune your advertising campaign and improve the visibility of your Bitcoin price prediction analysis.

Ultimately, the accuracy of any Bitcoin price prediction remains uncertain.