Bitcoin Price Prediction

Predicting the price of Bitcoin on any given date, let alone January 29th, 2025, is a notoriously difficult task. Bitcoin’s price is incredibly volatile, subject to rapid and significant swings driven by a complex interplay of factors. While many attempt to forecast its future, it’s crucial to remember that these are ultimately speculative exercises, not guarantees. The inherent unpredictability of the cryptocurrency market necessitates a cautious approach to any price prediction.

Bitcoin, first introduced in 2009 by the pseudonymous Satoshi Nakamoto, is a decentralized digital currency operating on a blockchain technology. This means transactions are verified and recorded across a distributed network of computers, eliminating the need for a central authority like a bank. Key characteristics include its limited supply (capped at 21 million coins), its decentralized nature, and its reliance on cryptographic security. Understanding these fundamental aspects, along with broader economic and technological trends, is vital for any attempt at price analysis.

Factors Influencing Bitcoin’s Price

Several interconnected factors contribute to Bitcoin’s price fluctuations. These include macroeconomic conditions (global economic growth, inflation rates, interest rate changes), regulatory developments (government policies and legal frameworks concerning cryptocurrencies), technological advancements (scaling solutions, network upgrades), market sentiment (investor confidence and media coverage), and adoption rates (increasing use of Bitcoin for transactions and investments). For example, periods of high inflation often see increased interest in Bitcoin as a hedge against currency devaluation, leading to price increases. Conversely, negative regulatory announcements can trigger sharp price drops. The interplay of these elements makes predicting future price movements a complex challenge, requiring a sophisticated understanding of the cryptocurrency market and the broader global economy. Predicting the price of Bitcoin on January 29th, 2025, requires careful consideration of all these variables and their potential interactions. Historical price data, while informative, cannot reliably predict future performance due to the constantly evolving nature of the market and its influencing factors.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, constantly shifting and influencing its value. Understanding these factors is crucial for navigating the volatile cryptocurrency market. This section delves into the key macroeconomic, regulatory, technological, and market-driven influences on Bitcoin’s price.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions significantly impact Bitcoin’s price, often acting as a safe haven asset during times of economic uncertainty. Inflation, interest rates, and overall global economic health all play a role.

| Factor | Positive Effect on Bitcoin Price | Negative Effect on Bitcoin Price |

|---|---|---|

| Inflation | High inflation can drive investors towards Bitcoin as a hedge against inflation, increasing demand. For example, during periods of high inflation in Argentina, Bitcoin adoption surged as a store of value. | Unexpectedly low inflation could reduce the appeal of Bitcoin as an inflation hedge, leading to decreased demand and price drops. |

| Interest Rates | Lower interest rates can make Bitcoin more attractive compared to traditional investments with lower yields, potentially increasing demand. | Higher interest rates can make holding Bitcoin less appealing as investors seek higher returns in traditional markets, potentially decreasing demand. The 2022 interest rate hikes by the Federal Reserve are a prime example of this negative correlation. |

| Global Economic Conditions | Geopolitical instability or economic crises can push investors towards Bitcoin as a safe haven asset, boosting its price. The war in Ukraine saw a surge in Bitcoin’s price as investors sought refuge from market uncertainty. | Strong global economic growth can shift investor focus away from riskier assets like Bitcoin towards more traditional investments, potentially reducing demand and price. |

Regulatory Changes and Government Policies

Government regulations and policies significantly influence Bitcoin’s price and adoption. Varying levels of acceptance and legal frameworks across different jurisdictions create diverse market conditions.

Bitcoin Price Prediction For 29 January 2025 – The following are potential regulatory scenarios and their likely impacts:

- Favorable Regulation (e.g., clear regulatory frameworks, tax benefits): Increased institutional investment, broader adoption, and potentially higher prices.

- Unfavorable Regulation (e.g., outright bans, strict KYC/AML regulations): Reduced adoption, decreased liquidity, and potentially lower prices. China’s crackdown on cryptocurrency mining in 2021 is a relevant example.

- Ambiguous Regulation (e.g., lack of clear guidelines): Uncertainty, volatility, and potentially price fluctuations as investors navigate unclear legal landscapes.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem and broader cryptocurrency space influence its price trajectory. Scaling solutions and the emergence of competing cryptocurrencies play significant roles.

Specific technological improvements and their potential price impacts:

- Improved Scalability (e.g., Lightning Network): Increased transaction speed and lower fees can lead to greater adoption and potentially higher prices.

- New Cryptocurrencies with Superior Technology: Competition from cryptocurrencies with faster transaction speeds or lower energy consumption could potentially divert investment away from Bitcoin, impacting its price negatively.

- Layer-2 Solutions: These solutions can increase transaction throughput without compromising the security of the main blockchain, potentially driving up Bitcoin’s price by improving usability.

Market Sentiment, Media Coverage, and Social Media Trends

Market sentiment, driven by media coverage and social media trends, plays a significant role in Bitcoin’s price volatility. Positive news and widespread adoption generate excitement, while negative news or controversies can trigger sell-offs.

Examples of past events where these factors significantly influenced price movements:

- Elon Musk’s tweets: Musk’s positive or negative comments about Bitcoin have historically caused significant price swings, illustrating the power of influential figures in shaping market sentiment.

- Major media outlets’ coverage: Positive coverage in prominent financial publications can boost investor confidence and drive price increases, while negative reports can lead to sell-offs.

- Social media trends (e.g., viral memes, influencer endorsements): Social media trends can create hype or fear, resulting in substantial price fluctuations.

Institutional Investment vs. Retail Investor Behavior

The interplay between institutional and retail investors significantly shapes Bitcoin’s price dynamics. Institutional investors tend to be more strategic and less prone to emotional decision-making, while retail investors can be more susceptible to market hype and fear.

| Factor | Institutional Investors | Retail Investors |

|---|---|---|

| Investment Strategy | Long-term, strategic investments; often based on fundamental analysis. | Short-term, often driven by speculation and market sentiment; susceptible to FOMO (fear of missing out) and panic selling. |

| Market Impact | Significant influence on price stability due to larger investment volumes. | Can contribute to significant price volatility due to emotional trading. |

| Price Sensitivity | Less sensitive to short-term price fluctuations. | Highly sensitive to short-term price movements. |

Predictive Modeling Techniques

Predicting Bitcoin’s price is a complex undertaking, relying on a variety of methods that attempt to capture the multifaceted nature of this volatile asset. These methods range from established financial analysis techniques to cutting-edge machine learning algorithms, each with its own strengths and weaknesses. Understanding these methods and their limitations is crucial for interpreting any price prediction.

Several approaches are employed to forecast Bitcoin’s price, each offering a unique perspective. These approaches are often combined to create more robust models, although this doesn’t guarantee accuracy. The inherent volatility of Bitcoin and the influence of external factors make precise long-term predictions exceptionally challenging.

Technical Analysis Models, Bitcoin Price Prediction For 29 January 2025

Technical analysis focuses on historical price and volume data to identify patterns and trends that might predict future price movements. This approach assumes that past market behavior can provide insights into future behavior. However, the effectiveness of technical analysis in predicting Bitcoin’s price is debated, particularly given the relatively short history of the cryptocurrency compared to traditional assets.

- Moving Averages: These calculate the average price over a specific period (e.g., 50-day, 200-day). Crossovers between different moving averages are often interpreted as buy or sell signals. Strength: Relatively simple to understand and implement. Weakness: Can generate false signals, lagging indicator, and not always accurate in highly volatile markets like Bitcoin’s.

- Relative Strength Index (RSI): This momentum indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Strength: Can identify potential reversals. Weakness: Prone to whipsaws (false signals) and can be unreliable during periods of extreme volatility.

- Fibonacci Retracements: These use Fibonacci numbers to identify potential support and resistance levels. Strength: Can provide potential price targets. Weakness: Subjective interpretation, not always accurate.

Fundamental Analysis Models

Fundamental analysis considers factors that influence the intrinsic value of Bitcoin, such as adoption rates, regulatory changes, technological advancements, and macroeconomic conditions. This approach attempts to assess the underlying value of Bitcoin, independent of market sentiment. However, accurately quantifying these factors and their impact on Bitcoin’s price is extremely difficult.

- Adoption Rate Models: These models attempt to correlate the increasing number of Bitcoin users and transactions with its price. Strength: Intuitive and reflects the network effect. Weakness: Difficult to accurately predict future adoption rates and the correlation may not always be linear.

- Regulatory Impact Models: These models consider the potential effects of government regulations on Bitcoin’s price. Strength: Accounts for significant external influences. Weakness: Difficult to predict future regulatory changes and their impact. The impact can be highly unpredictable and vary widely across jurisdictions.

Machine Learning Models

Machine learning algorithms use complex statistical techniques to identify patterns and relationships in large datasets. These models can analyze vast amounts of data, including price, volume, social media sentiment, and news articles, to predict future price movements. However, these models are only as good as the data they are trained on and can be prone to overfitting (performing well on training data but poorly on new data).

- Recurrent Neural Networks (RNNs): These are particularly well-suited for time series data like Bitcoin prices, as they can capture temporal dependencies. Strength: Can model complex relationships in time series data. Weakness: Can be computationally expensive to train and prone to overfitting. The accuracy depends heavily on the quality and quantity of training data.

- Support Vector Machines (SVMs): These can be used to classify Bitcoin price movements (e.g., up or down) based on various features. Strength: Effective in high-dimensional spaces. Weakness: Sensitive to the choice of kernel function and may not capture non-linear relationships well.

Challenges and Uncertainties in Bitcoin Price Prediction

Accurate long-term Bitcoin price prediction is exceptionally challenging due to several factors. Bitcoin’s price is influenced by a complex interplay of factors, including market sentiment, regulatory changes, technological developments, macroeconomic conditions, and even unforeseen events like major hacks or influential statements from key figures. The high volatility inherent in Bitcoin’s price makes it difficult to establish reliable patterns or trends. Furthermore, the relatively short history of Bitcoin compared to established financial assets limits the amount of reliable historical data available for analysis. Finally, the emergence of new cryptocurrencies and technological advancements continuously introduce uncertainties and disrupt established patterns. Any prediction, regardless of the method used, should be treated with caution and considered alongside a range of possible outcomes. For example, a model might predict a price of $50,000 based on current adoption rates, but a sudden regulatory crackdown could significantly alter this prediction.

Potential Scenarios for Bitcoin’s Price on January 29, 2025

Predicting the price of Bitcoin so far into the future is inherently speculative, relying heavily on assumptions about macroeconomic conditions, regulatory developments, and technological advancements. However, by considering various potential scenarios, we can gain a better understanding of the possible price ranges for Bitcoin on January 29, 2025. The following scenarios represent three distinct possibilities: a bullish outlook, a bearish outlook, and a neutral outlook.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes widespread adoption of Bitcoin as a store of value and a medium of exchange, coupled with significant institutional investment. Increased regulatory clarity and positive macroeconomic conditions, such as persistent inflation or geopolitical instability, could further drive demand. We might see increased integration into traditional financial systems, leading to greater liquidity and accessibility.

| Scenario | Price Range (USD) | Justification |

|---|---|---|

| Bullish | $150,000 – $250,000 | Sustained institutional adoption, increased regulatory clarity, and continued macroeconomic uncertainty could propel Bitcoin’s price to these levels. This is comparable to the growth seen in other asset classes during periods of significant inflation, although the volatility inherent in cryptocurrencies must be considered. For example, the growth of gold during times of economic uncertainty can serve as a parallel. |

This narrative envisions a world where Bitcoin is increasingly accepted by mainstream businesses and governments. Regulatory frameworks become more favorable, facilitating institutional investment and reducing uncertainty. Strong macroeconomic headwinds, perhaps persistent inflation or a global economic slowdown, drive investors towards Bitcoin as a hedge against traditional assets. This increased demand, combined with limited supply, propels Bitcoin’s price significantly higher.

Bearish Scenario: Regulatory Crackdown and Market Correction

This scenario assumes a more negative outlook, characterized by increased regulatory scrutiny and a potential market correction. Stringent regulations could stifle innovation and adoption, reducing demand. A significant macroeconomic downturn, coupled with negative sentiment surrounding cryptocurrencies, could trigger a price decline. The narrative would also include factors like increased security breaches or major hacks impacting investor confidence.

| Scenario | Price Range (USD) | Justification |

|---|---|---|

| Bearish | $20,000 – $40,000 | A severe regulatory crackdown, coupled with a global economic recession and loss of investor confidence, could lead to a significant price drop. This range reflects a substantial correction from current levels, similar to the bear market experienced in 2018-2020. The lack of widespread adoption and a significant negative news event could also contribute to this decline. |

This narrative depicts a scenario where governments worldwide implement strict regulations that severely limit Bitcoin’s use and accessibility. A global recession significantly reduces investor appetite for risky assets, leading to widespread selling pressure. Negative news events, such as a major security breach or a prominent cryptocurrency exchange failure, further erode investor confidence. This combination of factors could trigger a sharp and prolonged decline in Bitcoin’s price.

Neutral Scenario: Gradual Growth and Consolidation

This scenario assumes a more moderate outlook, with gradual price growth interspersed with periods of consolidation. Regulatory uncertainty persists, but there is no major crackdown. Macroeconomic conditions remain relatively stable, with neither significant boom nor bust. Technological advancements continue, but adoption rates remain moderate.

| Scenario | Price Range (USD) | Justification |

|---|---|---|

| Neutral | $60,000 – $100,000 | This range reflects a scenario where Bitcoin experiences steady, albeit not spectacular, growth. This would be similar to the growth observed in previous years, where periods of significant increase are followed by periods of consolidation. This assumes moderate adoption, stable macroeconomic conditions, and continued technological improvements. |

This narrative depicts a more balanced outcome, where Bitcoin’s price steadily increases over time, but at a more moderate pace compared to the bullish scenario. Regulatory developments are neither excessively favorable nor unfavorable. The global economy experiences modest growth, and investor sentiment remains relatively stable. Technological advancements continue, but widespread adoption remains gradual, resulting in a more moderate price increase.

Risk Factors and Considerations: Bitcoin Price Prediction For 29 January 2025

Predicting Bitcoin’s price is inherently uncertain, and several significant risk factors could dramatically impact its value by January 29, 2025, or even sooner. Understanding these risks is crucial for any investor considering exposure to this volatile asset. Effective risk management strategies are paramount to mitigating potential losses.

Key Risk Factors Affecting Bitcoin’s Price

Several factors could negatively influence Bitcoin’s price. These risks vary in their potential severity and interconnectedness, creating a complex investment landscape. It’s important to consider these factors holistically rather than in isolation.

- Regulatory Uncertainty: Government regulations regarding cryptocurrency remain inconsistent globally. Changes in regulatory frameworks, such as stricter KYC/AML requirements or outright bans, could significantly depress Bitcoin’s price. The recent crackdown on cryptocurrency exchanges in certain countries serves as a stark example of this risk.

- Market Volatility: Bitcoin’s price is notoriously volatile, subject to sharp price swings driven by news events, market sentiment, and speculative trading. Sudden drops, like the one experienced during the 2022 crypto winter, can lead to substantial losses for investors.

- Technological Risks: Security breaches, scaling issues, or the emergence of competing cryptocurrencies with superior technology could negatively affect Bitcoin’s adoption and, consequently, its price. The potential for 51% attacks, though unlikely with Bitcoin’s current hash rate, remains a theoretical risk.

- Economic Factors: Macroeconomic conditions, such as inflation, interest rate hikes, and recessions, can influence investor appetite for risk assets like Bitcoin. During periods of economic uncertainty, investors may shift towards safer investments, leading to a decrease in Bitcoin’s price.

- Security Risks: The risk of theft or loss of Bitcoin through hacking, scams, or loss of private keys is a significant concern. Investors need to be vigilant and employ robust security measures to protect their holdings.

Diversification and Risk Management Strategies

Diversification is a cornerstone of sound investment strategy, and this principle applies equally to Bitcoin investments. Over-reliance on a single asset, especially a volatile one like Bitcoin, amplifies the risk of significant losses. A diversified portfolio, incorporating a mix of asset classes (stocks, bonds, real estate, etc.), can help mitigate risk.

To further mitigate risk, investors should consider strategies such as:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Setting stop-loss orders: Automatically selling Bitcoin when it reaches a predetermined price, limiting potential losses.

- Holding long-term: Historically, long-term Bitcoin investments have shown greater returns than short-term trading, although this is not guaranteed.

Importance of Thorough Research and Avoiding Emotional Decision-Making

Before investing in Bitcoin or any other asset, conducting thorough research is crucial. Understanding the technology behind Bitcoin, its potential risks and rewards, and the broader cryptocurrency market is essential for informed decision-making. Relying solely on hype or following the crowd can lead to poor investment choices. Emotional decision-making, driven by fear or greed, should be avoided. A disciplined and rational approach, based on objective analysis, is key to successful investing.

Predicting the Bitcoin price for a specific date like January 29th, 2025, is inherently challenging due to market volatility. However, to gain a broader perspective on potential price movements, it’s helpful to consider wider predictions. For a comprehensive overview of various forecasts, you might find this resource helpful: What Is The Prediction Of Bitcoin In 2025.

Understanding these broader predictions can then inform a more nuanced approach to speculating on the Bitcoin price on January 29th, 2025.

Predicting the Bitcoin price for January 29th, 2025, requires considering various factors, including market sentiment and technological advancements. To gain a broader perspective on potential price movements in the first quarter of 2025, it’s helpful to examine predictions for later in the spring; for example, you might find insights by checking out this resource on Bitcoin Price Prediction April 2025 Usd.

Ultimately, however, any prediction for January 29th, 2025, remains speculative and subject to considerable market volatility.

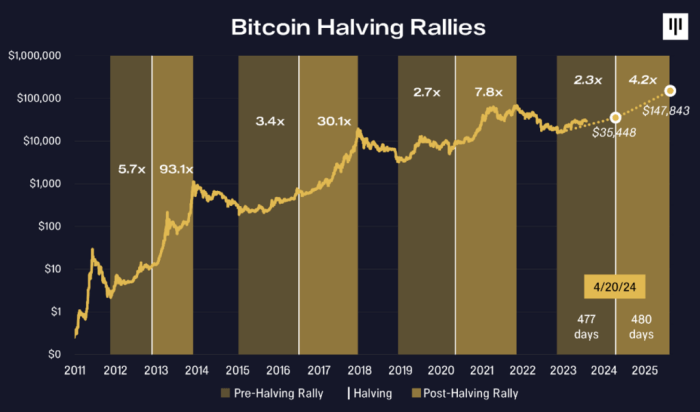

Predicting the Bitcoin price for January 29th, 2025, is challenging, but a key factor to consider is the impact of the next halving. Understanding the dynamics of the upcoming halving event is crucial for any accurate prediction; for more information on this, check out this resource on the Prossimo Halving Bitcoin 2025. Therefore, considering the halving’s effect on scarcity and potential increased demand is essential when formulating a Bitcoin price prediction for that date.

Predicting the Bitcoin price for January 29th, 2025, is challenging, influenced by numerous factors. A key event impacting future price is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand its potential effect, it’s crucial to know the exact date; you can find that information by checking What Day Is The Bitcoin Halving 2025.

This date will be a significant factor in any accurate Bitcoin price prediction for January 2025.

Predicting the Bitcoin price for January 29th, 2025, is inherently speculative, but a major factor influencing any forecast is the anticipated impact of the 2025 Bitcoin halving. Understanding the historical correlation between halvings and subsequent price increases is crucial; for a deeper dive into this, check out this insightful analysis on the Bitcoin Halving 2025 Effect. Ultimately, the Bitcoin price prediction for that date will depend on a complex interplay of factors, with the halving playing a significant, yet uncertain, role.

Predicting the Bitcoin price for January 29th, 2025, is inherently speculative, but several factors influence such forecasts. One prominent perspective to consider is Cathie Wood Bitcoin Prediction 2025 , which offers a valuable insight into potential future price movements. Ultimately, the Bitcoin price on that date will depend on a confluence of market forces and technological advancements.

Predicting the Bitcoin price for January 29th, 2025, is inherently speculative, relying on numerous factors. However, effective marketing strategies can significantly influence any asset’s perceived value; for example, a well-managed Google Ads Account could boost awareness and potentially impact investor sentiment surrounding Bitcoin. Therefore, understanding the interplay between market forces and targeted advertising is crucial when considering future Bitcoin price predictions.