Different Prediction Models and Approaches

Predicting Bitcoin’s price, especially years into the future, is inherently challenging. No single model guarantees accuracy, and each approach carries its own set of limitations. Understanding the strengths and weaknesses of various predictive methods is crucial for a nuanced perspective on potential price movements. The following sections explore several prominent models and their applications in a hypothetical scenario for December 2025.

Fundamental Analysis

Fundamental analysis focuses on the underlying value of Bitcoin, considering factors like adoption rates, regulatory changes, technological advancements, and macroeconomic conditions. It aims to determine whether the current price reflects the asset’s intrinsic worth. Strengths include a focus on long-term trends and a consideration of broader market forces. However, weaknesses include the difficulty in quantifying intangible factors like adoption and the influence of unpredictable events like regulatory crackdowns. A hypothetical scenario could involve projecting Bitcoin’s market capitalization based on anticipated adoption growth in emerging markets and comparing this to the current market cap to infer a potential price. For instance, if adoption increases by a factor of X, and the market cap adjusts accordingly, we can estimate a potential price. This approach, however, struggles to account for short-term volatility.

Technical Analysis

Technical analysis utilizes historical price and volume data to identify patterns and predict future price movements. It relies on charts, indicators, and various technical tools to spot trends, support levels, and resistance levels. Strengths lie in its ability to identify short-term price swings and potential trading opportunities. Weaknesses include its reliance on past performance, which doesn’t always guarantee future results, and its susceptibility to manipulation and self-fulfilling prophecies. A hypothetical scenario might involve identifying key support and resistance levels on a Bitcoin price chart and extrapolating potential price ranges based on historical price action. For example, if the price consistently finds support at a certain level, a technical analyst might predict a bounce off that level in December 2025. However, unexpected news or market events could easily invalidate such a prediction.

Quantitative Models

Quantitative models use statistical methods and algorithms to analyze vast datasets and forecast price movements. These models often incorporate factors from both fundamental and technical analysis, along with other relevant data like social media sentiment or Google search trends. Strengths include the ability to process large amounts of data and identify complex relationships. Weaknesses include the risk of overfitting the model to past data, leading to inaccurate predictions, and the difficulty in accounting for unpredictable black swan events. A hypothetical scenario might involve using a machine learning algorithm trained on historical Bitcoin price data, macroeconomic indicators, and social media sentiment to predict the price in December 2025. The model’s accuracy would depend heavily on the quality and completeness of the data used for training, and the model’s ability to adapt to unforeseen circumstances. A potential issue is that the model might be overly sensitive to noise in the data, leading to inaccurate predictions.

Potential Price Scenarios for December 2025

Predicting the price of Bitcoin, a notoriously volatile asset, is inherently challenging. However, by analyzing historical trends, technological advancements, regulatory developments, and macroeconomic factors, we can formulate plausible price scenarios for December 2025. These scenarios are not guarantees but rather informed estimations based on various potential outcomes.

Bitcoin Price Scenarios: December 2025, Bitcoin Price Prediction For December 2025

Below are three distinct scenarios outlining potential Bitcoin price ranges for December 2025, each built on different underlying assumptions. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. Remember, these are speculative estimations and should not be considered financial advice.

| Scenario | Price Range (USD) | Supporting Factors |

|---|---|---|

| Bullish Scenario | $200,000 – $300,000 | Widespread institutional adoption, positive regulatory developments globally, sustained technological advancements (like Layer-2 scaling solutions), continued growth of the DeFi ecosystem, and a strong macroeconomic environment characterized by low inflation and stable growth. This scenario assumes Bitcoin establishes itself as a significant store of value, comparable to gold, and benefits from increasing demand as a hedge against inflation. For example, if a major central bank were to announce a significant Bitcoin holding, a similar surge to the 2021 bull run could occur, but with a larger market capitalization, resulting in a much higher price. |

| Bearish Scenario | $20,000 – $40,000 | Increased regulatory scrutiny and restrictions in major markets, a significant macroeconomic downturn leading to decreased risk appetite among investors, a major security breach impacting confidence, and the emergence of a superior competing cryptocurrency. This scenario assumes a lack of institutional adoption, negative press impacting public perception, and a general aversion to risk in the financial markets. A scenario similar to the 2018 bear market, where Bitcoin fell dramatically, could be envisioned, albeit potentially starting from a higher baseline. |

| Neutral Scenario | $75,000 – $150,000 | A mix of positive and negative factors leading to moderate growth. This scenario assumes continued institutional adoption, but at a slower pace than the bullish scenario. Regulatory uncertainty persists, and macroeconomic conditions remain relatively stable, neither strongly bullish nor bearish. Technological advancements continue, but not at a revolutionary pace. This would represent a steady, albeit less dramatic, appreciation of Bitcoin’s value, similar to the growth seen in established tech companies. |

Risks and Uncertainties Associated with Predictions: Bitcoin Price Prediction For December 2025

Predicting the price of Bitcoin, especially over a long timeframe like December 2025, is inherently fraught with risk and uncertainty. Numerous factors influence Bitcoin’s price, and many of these are unpredictable or subject to rapid change. Any prediction model, no matter how sophisticated, is ultimately a simplification of a complex system, and its accuracy is limited by its inherent assumptions.

The limitations of predictive models stem from the fact that they rely on historical data and identified trends to extrapolate future price movements. However, the cryptocurrency market is relatively young and volatile, making historical data less reliable as a predictor of future performance. Furthermore, unforeseen events – regulatory changes, technological breakthroughs, or macroeconomic shifts – can dramatically alter the price trajectory, rendering even the most carefully constructed models inaccurate. Consider, for instance, the impact of the 2022 crypto winter, a period of significant price declines that was largely unforeseen by many analysts.

Limitations of Predictive Models

Bitcoin price prediction models, whether based on technical analysis, fundamental analysis, or machine learning, all share common limitations. Technical analysis, which focuses on chart patterns and trading volume, struggles to account for unforeseen news or regulatory changes. Fundamental analysis, which considers factors like adoption rate and network security, often underestimates the impact of market sentiment and speculative trading. Machine learning models, while potentially powerful, are only as good as the data they are trained on and can be susceptible to overfitting, meaning they may perform well on historical data but poorly on new, unseen data. The inherent volatility of the cryptocurrency market makes accurate prediction incredibly challenging for any model.

Impact of Unforeseen Events

The unpredictable nature of global events significantly impacts Bitcoin’s price. Unexpected regulatory changes, for example, can cause sharp price swings. A sudden crackdown on cryptocurrency exchanges in a major market could trigger a sell-off. Conversely, positive regulatory developments, such as the approval of a Bitcoin ETF, could lead to a price surge. Similarly, macroeconomic events, such as a global recession or unexpected inflation, can significantly influence investor sentiment and Bitcoin’s price. The collapse of FTX in late 2022 serves as a stark reminder of how a single event can dramatically impact the entire cryptocurrency market.

Importance of Risk Management in Bitcoin Investment

Given the inherent risks and uncertainties associated with Bitcoin price predictions, managing risk is paramount for any investor. This involves diversifying investments, avoiding over-leveraging, and only investing what one can afford to lose. It is crucial to understand that Bitcoin’s price can fluctuate dramatically in short periods, and significant losses are possible. Furthermore, thorough research and a clear understanding of the risks involved are essential before making any investment decisions. Following established risk management strategies and regularly reviewing one’s investment portfolio are vital steps to mitigating potential losses.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin price predictions for December 2025, clarifying the complexities and uncertainties involved in such forecasts. It’s crucial to remember that these are estimations based on various models and assumptions, and the actual price may differ significantly.

Bitcoin’s Most Likely Price in December 2025

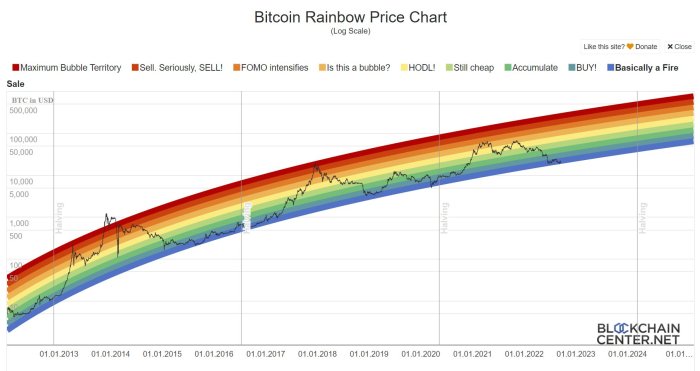

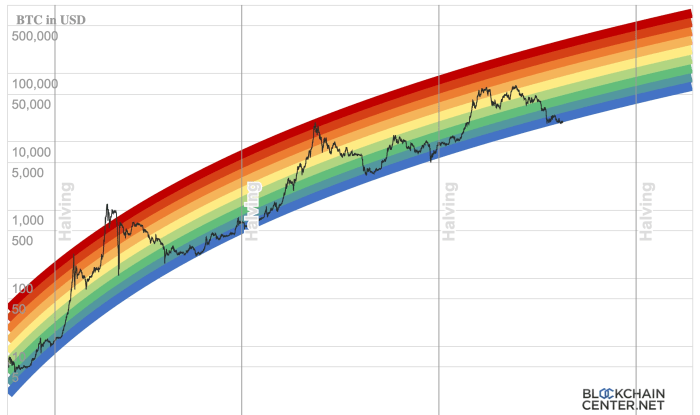

Predicting a single “most likely” price for Bitcoin in December 2025 is inherently difficult. Various models, ranging from simple price trend analyses to sophisticated econometric approaches, yield different results. Some models, based on historical price volatility and adoption rates, might suggest a price range between $100,000 and $200,000. Others, incorporating factors like regulatory changes and technological advancements, could project significantly higher or lower figures. Ultimately, the actual price will depend on a complex interplay of market forces, technological developments, and global economic conditions. It’s more realistic to consider a range of potential outcomes rather than a single point prediction. For example, a scenario with widespread institutional adoption and positive regulatory developments could lead to a price exceeding $200,000, while a scenario with increased regulatory scrutiny or a major market correction could see the price significantly lower.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is notoriously volatile, influenced by factors ranging from speculative trading to global macroeconomic events. Predictions often rely on assumptions that may not hold true, and unforeseen circumstances can drastically alter market dynamics. Past performance is not indicative of future results, a crucial caveat when assessing any cryptocurrency prediction. Therefore, it is essential to conduct independent research, consider multiple perspectives, and understand the inherent limitations of any predictive model before making investment decisions. Relying solely on a single prediction is highly risky. Consider the dot-com bubble of the late 1990s and early 2000s, where predictions of continued exponential growth proved wildly inaccurate. Similarly, the cryptocurrency market has seen periods of rapid growth followed by sharp corrections.

Factors Influencing Significant Price Changes

Several factors can cause substantial price increases or decreases in Bitcoin’s value. Positive catalysts include widespread institutional adoption, positive regulatory developments (like clear regulatory frameworks), technological advancements (like improved scalability or the development of layer-2 solutions), and increased mainstream awareness and use. Conversely, negative factors include increased regulatory scrutiny or bans, significant security breaches, macroeconomic instability (like a global recession), or the emergence of a competing cryptocurrency with superior technology or adoption. The 2017 Bitcoin bull run, for instance, was fueled by increasing institutional interest and media hype, while the subsequent crash was partially attributed to regulatory uncertainty and market manipulation.

Investment Decisions Based on Predictions

These predictions should not be the sole basis for your investment decisions. Investing in Bitcoin, or any cryptocurrency, carries significant risk. The market is highly volatile, and prices can fluctuate dramatically in short periods. Before investing, carefully assess your personal risk tolerance, diversify your portfolio, and only invest what you can afford to lose. Consult with a qualified financial advisor before making any investment decisions. Remember that cryptocurrency investments are speculative in nature and should not be considered a guaranteed path to financial gain. The potential for significant losses is very real.

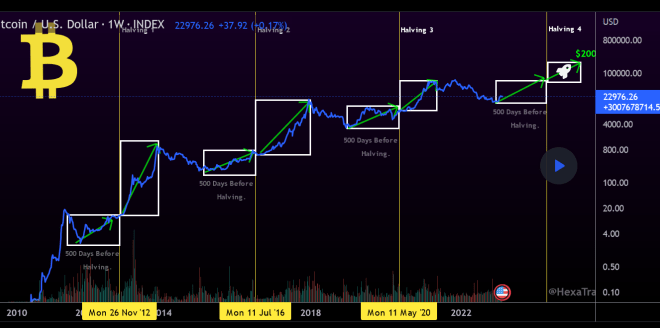

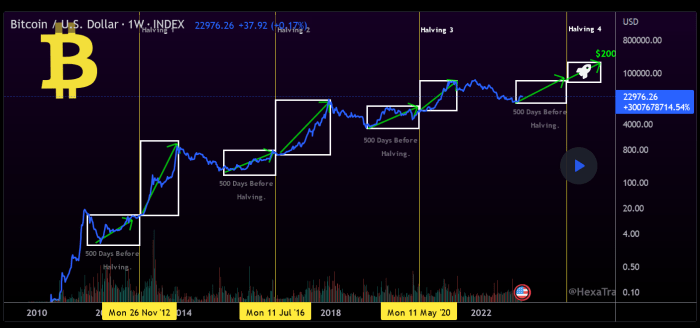

Predicting the Bitcoin price for December 2025 is challenging, involving numerous factors. A key event influencing this prediction is the Bitcoin halving, significantly impacting the supply and potentially the price. For more details on the timing and implications of this event, check out this helpful resource on the Dia Do Halving Bitcoin 2025. Understanding the halving’s effects is crucial for any accurate Bitcoin price prediction for December 2025, allowing for more informed speculation.

Predicting the Bitcoin price for December 2025 is inherently speculative, but a key factor influencing any forecast is the upcoming halving event. Understanding the implications of this halving is crucial for informed speculation; for a detailed explanation, check out this insightful article on Bitcoin Halving 2025: What Does It Mean? Ultimately, the halving’s impact on Bitcoin’s scarcity and, consequently, its price in December 2025, remains a subject of ongoing debate among experts.

Predicting the Bitcoin price for December 2025 is inherently speculative, but a significant factor influencing forecasts is the upcoming halving event. To understand the potential impact on price, it’s crucial to track the Bitcoin Halving Countdown 2025 Date , as this event historically correlates with subsequent price increases. Therefore, monitoring the halving’s proximity is key when formulating any Bitcoin price prediction for December 2025.

Predicting the Bitcoin price for December 2025 is inherently challenging, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving in 2024, which significantly alters the rate of new Bitcoin creation; to understand this crucial event, check out this helpful resource: Apa Itu Bitcoin Halving 2025. Therefore, understanding the halving’s effects is paramount when forecasting Bitcoin’s price trajectory towards the end of 2025.

Predicting the Bitcoin price for December 2025 is challenging, influenced by numerous factors. A key event to consider is the impact of the Bitcoin halving, significantly affecting the cryptocurrency’s inflation rate. For insightful information on this pivotal event, check out the details on Halving Bitcoin 2025 Day , which will likely play a substantial role in shaping the Bitcoin price prediction for December 2025 and beyond.

Predicting the Bitcoin price for December 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timing of this crucial event, you should check this resource: When Is The Bitcoin Halving 2025 Date.

Knowing the halving date allows for a more informed assessment of the potential Bitcoin price trajectory in December 2025.