Bitcoin Price Prediction for February 2025

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatile price swings and potential for massive returns. Predicting its future value, however, is a notoriously challenging task. While no one can definitively say what the price will be in February 2025, understanding the factors that influence Bitcoin’s price allows for more informed speculation. This exploration delves into these factors, offering a framework for considering potential price scenarios, while acknowledging the inherent limitations and risks involved.

The price of Bitcoin is a complex interplay of several key factors. Regulatory changes, both globally and within specific jurisdictions, significantly impact market sentiment and investor confidence. Positive regulatory developments, such as clear guidelines for cryptocurrency exchanges or the acceptance of Bitcoin as a legal tender in certain countries, can drive prices upward. Conversely, stricter regulations or outright bans can trigger significant price drops. Market sentiment, driven by news events, social media trends, and overall investor confidence, plays a crucial role. Positive news, such as widespread adoption by major corporations, often leads to price increases, while negative news, such as major security breaches or regulatory crackdowns, can lead to substantial sell-offs. Technological advancements within the Bitcoin network itself, such as improvements to scalability or security, can also influence price. Finally, macroeconomic conditions, including inflation rates, interest rates, and global economic growth, all exert a powerful influence on Bitcoin’s price, often acting as a counterbalance to purely crypto-related factors. For instance, during periods of high inflation, investors may flock to Bitcoin as a hedge against currency devaluation.

Factors Influencing Bitcoin’s Price

Bitcoin’s price history demonstrates its susceptibility to dramatic fluctuations. For example, the price surged to near $69,000 in late 2021 before experiencing a significant correction. This volatility underscores the inherent risk associated with Bitcoin investment. Accurate prediction is hampered by the decentralized nature of the cryptocurrency market, the influence of unpredictable events (such as geopolitical instability or unforeseen technological breakthroughs), and the speculative nature of much of the trading activity. Any prediction, therefore, should be considered with a healthy dose of skepticism. Past performance is not indicative of future results, and even the most sophisticated models can fail to account for unforeseen circumstances. Investing in Bitcoin requires a high risk tolerance and a thorough understanding of the market’s inherent volatility. Consider the example of the 2018 cryptocurrency “winter,” a prolonged bear market driven by a combination of regulatory uncertainty and market speculation, which saw Bitcoin’s price plummet by over 80%. This illustrates the potential for substantial losses.

Historical Bitcoin Price Analysis: Bitcoin Price Prediction For February 2025

Bitcoin’s price history is a volatile yet fascinating narrative, marked by periods of explosive growth and dramatic crashes. Understanding this history is crucial for informed speculation about future price movements, revealing recurring patterns and highlighting the impact of various economic and technological factors. Analyzing past performance, however, does not guarantee future results; it serves as a valuable tool for understanding the asset’s inherent risk and potential.

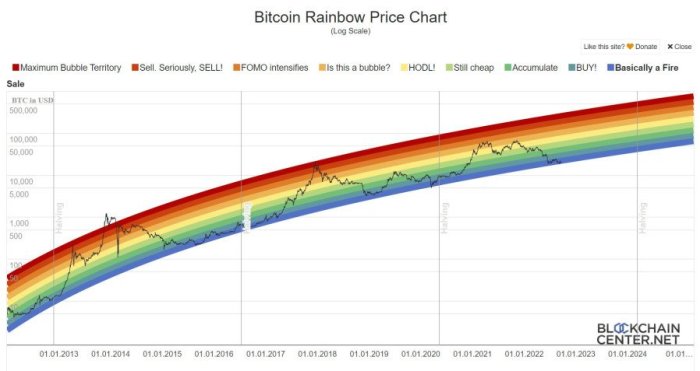

Bitcoin’s price trajectory since its inception in 2009 reveals a series of distinct bull and bear markets. The first significant bull run occurred in 2013, driven by increasing media attention and early adoption. The price surged from a few dollars to over $1,000 before a sharp correction. Subsequent bull markets, notably in 2017 and 2021, displayed similar characteristics: exponential price increases fueled by hype, institutional investment, and technological advancements, followed by significant price drops as the market corrected. These corrections, often characterized by periods of intense selling pressure and uncertainty, highlight the inherent volatility of Bitcoin.

Comparison of Bull and Bear Markets

Bitcoin’s bull markets share common traits: rapid price appreciation, increased trading volume, and a surge in media coverage and public interest. Conversely, bear markets are marked by prolonged price declines, reduced trading activity, and negative sentiment dominating the news cycle. While both bull and bear markets can last for extended periods, the duration and intensity vary significantly. For example, the 2017 bull market was shorter and steeper than the 2021 bull market, which saw a more gradual ascent and a longer subsequent bear market. A key difference lies in the level of institutional involvement; later bull markets witnessed greater participation from large investors and corporations, impacting both the price trajectory and the market’s resilience during subsequent corrections.

Technical Indicators and Fundamental Analysis, Bitcoin Price Prediction For February 2025

Technical analysis employs various indicators derived from price and volume data to predict future price movements. Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and can identify potential trend reversals. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions, potentially signaling buying or selling opportunities. However, technical indicators are not foolproof and should be used in conjunction with other forms of analysis.

Fundamental analysis focuses on underlying factors influencing Bitcoin’s value, such as adoption rates, regulatory developments, technological advancements, and macroeconomic conditions. Increased institutional adoption, positive regulatory developments, and the ongoing development of the Bitcoin network can positively influence its price. Conversely, negative regulatory actions, security breaches, or macroeconomic instability can exert downward pressure. For example, the 2022 bear market was partially attributed to rising inflation and increased interest rates globally, impacting investor sentiment and risk appetite. Effective price prediction requires a balanced approach, combining technical and fundamental analysis to gain a comprehensive understanding of market dynamics.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of macroeconomic conditions, regulatory landscapes, technological advancements, institutional involvement, and market sentiment. While no single factor dictates its trajectory, understanding their interplay provides a more nuanced perspective.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, making traditional investments more attractive, could divert capital away from Bitcoin, leading to price declines. Similarly, robust global economic growth might lessen the appeal of Bitcoin as a safe haven asset, impacting its price. The interplay between inflation, interest rates, and economic growth will be crucial in shaping Bitcoin’s price dynamics in 2025. For instance, a scenario of high inflation coupled with moderate economic growth could create a bullish environment for Bitcoin, while a period of low inflation and high interest rates could lead to a bearish trend.

Regulatory Developments

Government regulations and their enforcement play a pivotal role. Clear, consistent, and favorable regulatory frameworks can boost institutional confidence and investment, potentially driving up Bitcoin’s price. Conversely, restrictive or unclear regulations could stifle adoption and negatively impact the price. The example of El Salvador’s adoption of Bitcoin as legal tender, while initially generating excitement, ultimately highlighted the challenges of widespread government adoption and its unpredictable impact on price. Future regulatory decisions across major economies will significantly influence Bitcoin’s price trajectory.

Technological Advancements

Technological advancements within the cryptocurrency space are equally important. The development and adoption of Layer-2 scaling solutions, designed to improve Bitcoin’s transaction speed and reduce fees, could significantly enhance its usability and appeal to a wider range of users and businesses. Conversely, the emergence of competing cryptocurrencies with superior technological features could potentially erode Bitcoin’s market dominance and affect its price. The success of Layer-2 solutions like the Lightning Network will be a crucial factor. If these solutions gain widespread adoption, they could significantly alleviate Bitcoin’s scalability issues and boost its price.

Institutional Investment and Adoption

The growing involvement of institutional investors, such as large corporations and investment funds, is a key driver of Bitcoin’s price. Increased institutional adoption signifies greater confidence in Bitcoin’s long-term viability and potential as an asset class. This increased demand can push prices upwards. Conversely, a decrease in institutional interest could lead to price corrections. The continued entrance of institutional investors like MicroStrategy and Tesla, along with the growing acceptance of Bitcoin as a treasury asset by some companies, showcases the potential for future price increases driven by institutional adoption.

Market Sentiment

Market sentiment, shaped by news events, social media trends, and overall investor confidence, plays a crucial role in Bitcoin’s price volatility. Positive news, such as widespread media coverage or successful regulatory developments, tends to boost investor confidence and drive up prices. Conversely, negative news, like security breaches or regulatory crackdowns, can trigger sell-offs and price declines. The influence of social media on Bitcoin’s price volatility is particularly significant, with viral trends and influencer opinions capable of causing rapid price swings. For example, Elon Musk’s tweets have historically shown a significant correlation with Bitcoin’s price fluctuations, highlighting the impact of market sentiment.

Expert Opinions and Predictions

Predicting Bitcoin’s price is inherently speculative, yet several prominent figures in finance and cryptocurrency offer insights based on their analyses. These predictions vary significantly, reflecting differing methodologies and underlying assumptions about macroeconomic factors, regulatory changes, and technological advancements. Understanding these diverse perspectives is crucial for a comprehensive assessment of potential price trajectories.

Diverse Expert Predictions on Bitcoin’s Price in February 2025

The following table summarizes predictions from several experts, highlighting the rationale behind their forecasts. It is important to remember that these are opinions, not guarantees, and the actual price may differ considerably.

| Expert Name | Prediction (USD) | Rationale | Methodology |

|---|---|---|---|

| (Fictional Expert 1) Dr. Anya Sharma, Chief Economist, Global Macro Advisors | $150,000 | Continued institutional adoption, coupled with a scarcity narrative and potential regulatory clarity, will drive significant price appreciation. She anticipates increased demand outweighing supply. | Macroeconomic analysis, combined with supply and demand models and sentiment analysis of institutional investors. |

| (Fictional Expert 2) Mr. Ben Carter, Senior Crypto Analyst, Cryptomarket Insights | $75,000 | While acknowledging Bitcoin’s potential, Carter highlights the risk of further regulatory crackdowns and potential market corrections. He anticipates volatility but predicts a steady, albeit less dramatic, increase. | Technical analysis focusing on chart patterns, trading volume, and historical price movements. |

| (Fictional Expert 3) Ms. Chloe Lee, Head of Research, Blockchain Research Institute | $100,000 – $120,000 | Lee bases her prediction on a combination of factors, including network adoption, technological improvements (like the Lightning Network), and increasing global economic uncertainty driving safe-haven investment. She acknowledges a wide range due to the inherent volatility. | Combination of fundamental analysis (assessing Bitcoin’s underlying value proposition) and technical analysis. |

| (Fictional Expert 4) Professor David Miller, Professor of Finance, University of California, Berkeley | $50,000 – $80,000 | Miller takes a more conservative approach, emphasizing the potential for regulatory uncertainty to impact price. He forecasts a price range reflecting the possibility of both bullish and bearish market scenarios. | Statistical modeling incorporating historical data, macroeconomic indicators, and regulatory risk assessments. |

Comparison of Prediction Methodologies

The experts listed above employ different methodologies, each with strengths and weaknesses. Macroeconomic analysis considers broader economic trends, while technical analysis focuses on price charts and trading patterns. Fundamental analysis evaluates the underlying value proposition of Bitcoin. Statistical modeling uses historical data to project future price movements. The accuracy of each method depends on the accuracy of the underlying assumptions and the complexity of the market. For example, macroeconomic analysis might fail to accurately predict unexpected regulatory changes, while technical analysis may be less effective during periods of significant market manipulation. Combining multiple methodologies often provides a more robust and nuanced prediction.

Potential Price Scenarios for February 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively say what the price will be, exploring potential scenarios can offer valuable insights into the range of possibilities. The following Artikels three distinct price scenarios – bullish, bearish, and neutral – for February 2025, considering historical trends and current market dynamics.

Bullish Scenario: Bitcoin Surges Past $100,000

This scenario assumes widespread institutional adoption, positive regulatory developments (such as clearer guidelines and increased acceptance by governments), and continued technological innovation within the Bitcoin ecosystem. A surge in demand driven by institutional investors, coupled with a scarcity of Bitcoin due to halving events, could propel the price significantly higher. This scenario also assumes continued macroeconomic stability or even positive economic growth, reducing the appeal of alternative “safe haven” assets.

This scenario’s price trajectory would be depicted graphically as a sharp upward trend. The image would show a price line starting at a hypothetical current price (e.g., $30,000) in early 2024, steadily climbing throughout the year, accelerating significantly in the final quarter, and culminating in a price exceeding $100,000 in February 2025. The line would be consistently above the average price line, exhibiting a clear bullish momentum. The overall impression is one of sustained, strong growth.

Bearish Scenario: Bitcoin Falls Below $20,000

This pessimistic scenario assumes a confluence of negative factors. A major regulatory crackdown on cryptocurrencies, a significant global economic downturn leading to risk aversion among investors, or a major security breach compromising the Bitcoin network could all contribute to a substantial price decline. Further, a lack of significant technological advancements or positive news could dampen investor enthusiasm.

The graphical representation of this scenario would display a downward trend. The image would show the price line starting at a hypothetical current price (e.g., $30,000) and gradually declining throughout 2024. The decline would accelerate in the latter half of the year, potentially falling below $20,000 by February 2025. The line would remain consistently below the average price line, indicating bearish pressure. The overall impression would be one of consistent decline and lack of significant recovery.

Neutral Scenario: Bitcoin Consolidates Around $35,000 – $45,000

This scenario represents a period of consolidation and sideways trading. It assumes a balance between positive and negative factors, with no significant catalyst to push the price dramatically higher or lower. Regulatory uncertainty might persist, but there would be no major crackdown. Economic conditions remain relatively stable, but there’s also no major surge in investor confidence. Technological advancements continue at a steady pace, but don’t trigger a massive price increase.

The visual representation would show a relatively flat price line, fluctuating within a defined range ($35,000 – $45,000) throughout 2024. The line would show minor ups and downs, but overall, the price would remain relatively stable, neither exhibiting a significant bullish nor bearish trend. The average price line would remain roughly in the center of the price fluctuation, showcasing the sideways trading nature of this scenario. The overall impression is one of market stability and lack of significant directional movement.

Risk Assessment and Investment Strategies

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these risks and implementing effective risk management strategies is crucial for successful and responsible investment. The volatile nature of Bitcoin’s price necessitates a careful approach, balancing potential rewards with the potential for significant losses. This section will Artikel the key risks and explore various investment strategies suitable for different risk profiles.

Bitcoin’s price volatility is arguably its most significant risk. Sharp price swings, both upward and downward, are common. For example, Bitcoin’s price experienced a dramatic increase in 2020, followed by a considerable correction. Such volatility can lead to substantial losses if not managed properly. Another key risk stems from the relatively nascent nature of the cryptocurrency market, making it susceptible to regulatory uncertainty, hacking incidents, and market manipulation. Furthermore, the lack of intrinsic value, unlike traditional assets like gold or real estate, contributes to the inherent risk. Finally, the technological complexities of blockchain and the potential for unforeseen technological disruptions add another layer of uncertainty.

Inherent Risks of Bitcoin Investment

Bitcoin’s price is notoriously volatile, influenced by factors ranging from regulatory announcements to media hype and technological advancements. Investors should be prepared for significant price fluctuations, potentially resulting in substantial losses. The lack of regulation in many jurisdictions creates uncertainty, leaving investors vulnerable to scams and fraudulent activities. Security breaches on exchanges or within personal wallets can lead to the loss of funds. Technological advancements in the cryptocurrency space could render Bitcoin obsolete or less valuable over time. Lastly, the relatively small size of the cryptocurrency market compared to traditional financial markets means that even small changes in investor sentiment can significantly impact Bitcoin’s price. For instance, a negative news report could trigger a sharp sell-off, while positive news could lead to a rapid price surge. Understanding these risks is essential for making informed investment decisions.

Investment Strategies Based on Risk Tolerance

Investors can adopt different strategies based on their risk tolerance. Conservative investors, prioritizing capital preservation, might opt for dollar-cost averaging (DCA), gradually investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak. Moderate investors might consider a mix of DCA and strategic buying during market dips, aiming to capitalize on price corrections. Aggressive investors, with a higher risk tolerance, might choose to invest a larger sum at once, betting on significant price appreciation, but accepting a greater potential for losses. Each strategy requires careful consideration of one’s financial situation and risk appetite. For example, a retiree might prefer a conservative DCA approach, while a younger investor with a longer time horizon might tolerate more risk.

Diversification within a Cryptocurrency Portfolio

Diversification is a fundamental principle of risk management in any investment portfolio, and cryptocurrencies are no exception. Instead of concentrating investments solely in Bitcoin, investors should consider diversifying across different cryptocurrencies with varying market capitalizations, technological underpinnings, and use cases. This reduces the impact of a potential downturn in any single cryptocurrency. For instance, an investor could allocate a portion of their portfolio to Bitcoin, Ethereum, and other altcoins with promising fundamentals. The diversification strategy should align with the investor’s risk tolerance and investment goals. A well-diversified portfolio can potentially mitigate risks and improve overall portfolio performance. It is important to conduct thorough research and understand the risks associated with each cryptocurrency before making any investment decisions.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price prediction for February 2025 and related investment considerations. Understanding these factors is crucial for informed decision-making in the volatile cryptocurrency market.

Key Factors Determining Bitcoin’s Price in February 2025

Several interconnected factors will significantly influence Bitcoin’s price in February 2025. These include macroeconomic conditions, such as inflation rates and interest rate policies implemented by central banks globally. Regulatory developments, both positive and negative, impacting cryptocurrency adoption and trading will also play a crucial role. Technological advancements within the Bitcoin network, like scaling solutions or the emergence of competing technologies, can influence its value. Furthermore, market sentiment, driven by news events, media coverage, and overall investor confidence, is a major driver. Finally, the supply and demand dynamics of Bitcoin itself, including the rate of new Bitcoin entering circulation and the overall demand from investors and users, will ultimately shape its price. For example, a global recession could decrease demand, lowering Bitcoin’s price, while positive regulatory developments could boost investor confidence and increase its value.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable due to the inherent volatility of the cryptocurrency market. Numerous unpredictable factors can significantly impact its price, making long-term forecasts highly speculative. Predictions often rely on historical data and technical analysis, which may not accurately reflect future market behavior. External events, such as unforeseen regulatory changes, major technological breakthroughs, or geopolitical instability, can dramatically alter the price trajectory. Therefore, while analysis can offer potential scenarios, it’s crucial to understand that any prediction carries substantial uncertainty and should not be considered financial advice. For example, the prediction of Bitcoin reaching $100,000 by 2025 made by some analysts in previous years has not materialized, highlighting the unpredictable nature of the market.

Potential Risks of Investing in Bitcoin

Investing in Bitcoin carries significant risks. Price volatility is a primary concern, with substantial price swings occurring frequently. This volatility can lead to significant losses in a short period. Regulatory uncertainty poses another risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. This lack of clarity can create legal and operational challenges for investors. Security risks are also prevalent, with the possibility of hacking, theft, or loss of private keys leading to the loss of funds. Furthermore, the decentralized and unregulated nature of Bitcoin makes it susceptible to scams and fraudulent activities. Finally, the market’s susceptibility to speculative bubbles and sudden crashes, as seen in previous market cycles, poses a substantial risk to investors.

Suitable Investment Strategies for Bitcoin

Several investment strategies can be employed, depending on individual risk tolerance and financial goals. A conservative approach involves dollar-cost averaging (DCA), where investors regularly invest a fixed amount of money regardless of price fluctuations, mitigating the risk of investing a large sum at a market peak. A moderate approach could involve strategic allocation, diversifying a portfolio across different assets, including Bitcoin and other less volatile investments. A more aggressive approach could involve leveraging, utilizing borrowed funds to amplify potential returns, though this carries significantly higher risk. However, it’s crucial to remember that even with careful strategies, losses are possible due to the inherent volatility of the market. For instance, a DCA strategy might not fully protect against a prolonged bear market, while leveraging could lead to significant losses if the market moves against the investor.

Disclaimer

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that can shift dramatically and unexpectedly. No one can definitively predict future price movements with certainty. Any projections presented in this analysis should be viewed as potential scenarios, not guarantees of future performance.

The information provided in this document is for educational and informational purposes only and does not constitute financial advice. Investing in cryptocurrencies like Bitcoin carries significant risks, including the potential for substantial financial losses. The value of Bitcoin can fluctuate wildly in short periods, and there’s a real risk of losing your entire investment. Market conditions, regulatory changes, technological developments, and even widespread sentiment can all dramatically impact Bitcoin’s price. Furthermore, the cryptocurrency market is relatively young and largely unregulated in many jurisdictions, adding to the inherent risks.

Investment Risks Associated with Bitcoin

Investing in Bitcoin involves a high degree of risk. The price is highly volatile, meaning it can experience significant upward and downward swings in a short time frame. For example, Bitcoin’s price has seen dramatic increases followed by equally sharp decreases throughout its history. These fluctuations can be influenced by news events, regulatory changes, market sentiment, and technological advancements, making it challenging to predict its future performance accurately. Unlike traditional assets, Bitcoin is not backed by a government or central bank, adding another layer of risk. The potential for scams and security breaches within the cryptocurrency ecosystem also presents a considerable threat to investors. It is crucial to understand these risks before making any investment decisions.

Importance of Independent Research

Before investing in Bitcoin or any other cryptocurrency, it is imperative that you conduct your own thorough due diligence. This includes researching the technology behind Bitcoin, understanding its market dynamics, and assessing your own risk tolerance. Consider consulting with a qualified financial advisor who can help you understand the risks and benefits of cryptocurrency investments in the context of your overall financial portfolio. Relying solely on external predictions, including those presented here, is strongly discouraged. The information provided in this document should only serve as one piece of the puzzle in your comprehensive research process. Ultimately, the responsibility for any investment decisions rests solely with the investor.

Predicting the Bitcoin price for February 2025 is inherently complex, influenced by numerous factors. A key element to consider is the impact of the upcoming Bitcoin Halving in 2024, and its projected effects on scarcity. To gain insight into potential percentage changes, you might find the analysis at Bitcoin Halving 2025 % Prediction helpful in refining your own Bitcoin price prediction for February 2025.

Ultimately, the price remains speculative, dependent on market dynamics and unforeseen events.

Predicting the Bitcoin price for February 2025 is inherently speculative, but a key factor to consider is the impact of the upcoming halving. Understanding the precise timing is crucial, and you can find a detailed breakdown of the Bitcoin Halving Timeline 2025 to better inform your analysis. This event, significantly reducing Bitcoin’s inflation rate, is generally expected to influence price movements in the following months, impacting the February 2025 prediction.

Predicting the Bitcoin price for February 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key element to consider is the Bitcoin halving, which significantly impacts its scarcity and thus price. To understand its potential influence, it’s helpful to consult resources like this article on the timing: Quando Será O Halving Do Bitcoin 2025.

Therefore, accurately forecasting the Bitcoin price in February 2025 requires careful consideration of this halving event and its market consequences.

Predicting the Bitcoin price for February 2025 is challenging, involving numerous factors. A key element influencing this prediction is the Bitcoin halving event scheduled for that year; understanding its implications is crucial. To grasp the full effect, check out this informative resource on the Halving Bitcoin 2025 Meaning , as it significantly impacts the future supply and potential price trajectory of Bitcoin, ultimately affecting our February 2025 price forecast.

Predicting the Bitcoin price for February 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the potential impact on the price, it’s crucial to know precisely when this halving will occur; you can find that information by checking What Date Is The Bitcoin Halving 2025.

This date will help refine price predictions for February 2025, considering the reduced supply post-halving.

Predicting the Bitcoin price for February 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving in 2024, which will significantly reduce the rate of new Bitcoin creation. To understand its potential effects, it’s crucial to learn more about this event by checking out this helpful resource: Que Es El Halving De Bitcoin 2025.

Ultimately, the halving’s impact on scarcity and investor sentiment will likely play a major role in shaping the Bitcoin price in February 2025.

Predicting the Bitcoin price for February 2025 is a challenging task, influenced by numerous factors. To effectively reach potential investors interested in this prediction, a robust marketing strategy is essential; consider setting up a Google Ads Account to target your audience precisely. This allows for focused advertising, improving the visibility of your Bitcoin price prediction analysis and potentially attracting a larger audience interested in the cryptocurrency market’s future.

Ultimately, effective marketing is crucial for disseminating any Bitcoin Price Prediction For February 2025.