Bitcoin Price Prediction in December 2025

Bitcoin’s price history is marked by extreme volatility, punctuated by periods of rapid growth and dramatic crashes. From its humble beginnings near zero dollars, Bitcoin experienced a meteoric rise, reaching its all-time high in late 2021 before undergoing a significant correction. Key events influencing its price include regulatory announcements, major institutional adoption (like Tesla’s initial investment), technological upgrades (like the halving events that reduce Bitcoin’s inflation rate), and overall market sentiment driven by factors like macroeconomic conditions and media coverage.

Several factors contribute to Bitcoin’s price volatility. These include its relatively limited supply, making it susceptible to price swings based on demand. Furthermore, Bitcoin’s decentralized nature and lack of central oversight mean its price is influenced by speculative trading, market manipulation, and news events impacting investor confidence. External factors such as governmental regulations, economic downturns, and competing cryptocurrencies also play significant roles.

Challenges in Accurately Predicting Bitcoin’s Price

Accurately predicting cryptocurrency prices, including Bitcoin’s, presents considerable challenges. The cryptocurrency market is relatively young and highly speculative, making it difficult to establish reliable historical patterns or predictive models. The influence of unpredictable events, such as regulatory changes, hacking incidents, or sudden shifts in market sentiment, makes forecasting exceptionally complex. Even sophisticated quantitative models often fail to account for the inherent unpredictability of human behavior and the rapid evolution of the cryptocurrency landscape. For example, the 2022 cryptocurrency winter, which saw significant price drops across the board, highlighted the limitations of many predictive models which failed to anticipate the impact of macroeconomic factors like rising interest rates. Furthermore, the inherent interconnectedness of various cryptocurrencies and the broader financial markets adds another layer of complexity to accurate price prediction. Attempts at prediction often rely on subjective analyses, technical indicators, and fundamental factors, which can vary widely among analysts and yield conflicting conclusions.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, influenced by a multitude of interconnected factors. These factors range from macroeconomic trends and regulatory landscapes to technological advancements and the level of mainstream adoption. Understanding these influences is crucial for any informed assessment of potential price movements.

Global Economic Conditions and Bitcoin’s Value

Global economic conditions significantly impact Bitcoin’s price. Periods of economic uncertainty or inflation often see investors flock to Bitcoin as a hedge against traditional assets. Conversely, strong economic growth and stability might lead to reduced demand for Bitcoin as investors shift their focus to more traditional investment avenues. For example, the 2020 COVID-19 pandemic and subsequent economic downturn saw a surge in Bitcoin’s price, partly driven by investors seeking safe haven assets. Conversely, a period of robust global growth could potentially lead to decreased demand for Bitcoin. The strength of the US dollar also plays a crucial role, as Bitcoin is often priced in USD. A strengthening dollar could put downward pressure on Bitcoin’s price, while a weakening dollar could have the opposite effect.

Regulatory Changes and Governmental Policies

Governmental regulations and policies play a critical role in shaping Bitcoin’s adoption and, consequently, its price. Favorable regulations, such as clear guidelines on taxation and licensing, could encourage institutional investment and wider adoption, driving up the price. Conversely, restrictive regulations, such as outright bans or excessive taxation, could stifle growth and negatively impact its value. The varying regulatory approaches across different countries will create a complex and dynamic environment, potentially impacting Bitcoin’s price differently in various regions. For instance, a country’s decision to fully embrace Bitcoin as legal tender could significantly increase demand and value.

Technological Advancements and Bitcoin’s Scalability

Technological advancements in blockchain technology are directly related to Bitcoin’s scalability and efficiency. Improvements in transaction speeds, reduced fees, and enhanced security will likely increase Bitcoin’s appeal and usability. Conversely, a failure to address scalability issues could limit its widespread adoption and negatively affect its price. The development of layer-2 solutions, such as the Lightning Network, aims to improve scalability, potentially boosting Bitcoin’s price by addressing transaction bottlenecks. However, widespread adoption of these solutions is crucial for this positive impact to materialize.

Institutional Investment and Mainstream Adoption

The level of institutional investment and mainstream adoption significantly impacts Bitcoin’s price. Increased participation from large financial institutions and corporations lends credibility and stability to the market, driving up demand and price. Wider mainstream adoption, driven by increased user-friendliness and accessibility, further fuels growth. The entry of companies like MicroStrategy and Tesla into the Bitcoin market demonstrated the growing acceptance of Bitcoin as a legitimate asset class. Conversely, a lack of institutional interest or a decline in public interest could lead to price volatility and potentially downward pressure.

Scenario: A Major Technological Breakthrough

A significant technological breakthrough in blockchain technology, such as a quantum-resistant cryptographic algorithm or a substantial improvement in transaction throughput, could have a dramatic impact on Bitcoin’s price. Such a breakthrough could significantly enhance Bitcoin’s security and scalability, attracting even more institutional investors and driving up demand. This could lead to a substantial increase in Bitcoin’s price, potentially exceeding current price predictions. Conversely, a negative breakthrough, like the discovery of a significant vulnerability in the Bitcoin protocol, could cause a dramatic price crash.

Bullish vs. Bearish Market Predictions for Bitcoin in 2025

| Factor | Bullish Prediction | Bearish Prediction | Supporting Evidence/Example |

|---|---|---|---|

| Global Economy | Continued economic uncertainty drives safe-haven investment in Bitcoin. | Strong economic growth reduces demand for alternative assets. | 2020 COVID-19 pandemic and subsequent Bitcoin price surge vs. periods of strong economic growth in the past. |

| Regulation | Favorable regulatory frameworks increase institutional investment and adoption. | Restrictive regulations limit growth and adoption. | El Salvador adopting Bitcoin as legal tender (bullish) vs. China’s Bitcoin ban (bearish). |

| Technology | Scalability improvements enhance usability and attract wider adoption. | Scalability issues persist, limiting widespread use. | Successful implementation of layer-2 solutions vs. continued congestion on the Bitcoin network. |

| Adoption | Increased mainstream adoption and institutional investment drive demand. | Limited mainstream adoption and lack of institutional interest. | Growing number of companies accepting Bitcoin as payment vs. continued skepticism among traditional investors. |

Analyzing Historical Price Trends and Patterns

Bitcoin’s price history is characterized by periods of explosive growth followed by significant corrections, creating a volatile yet fascinating landscape for analysis. Understanding these historical patterns, while not guaranteeing future performance, can offer valuable insights into potential price movements and the factors driving them. It’s crucial, however, to approach this analysis with a healthy dose of skepticism, recognizing the limitations of relying solely on past performance to predict the future.

Analyzing Bitcoin’s price history reveals several recurring patterns. These include distinct bull and bear market cycles, often linked to technological advancements, regulatory changes, and macroeconomic factors. Identifying these cycles and their durations can help to contextualize current market conditions and potential future scenarios, although precise timing remains elusive.

Significant Historical Price Patterns and Cycles

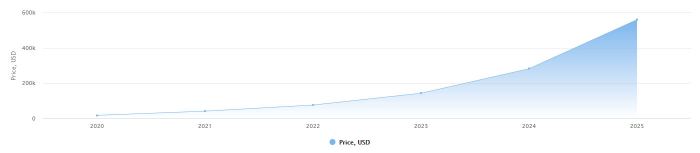

Bitcoin’s price history can be broadly categorized into distinct bull and bear market cycles. The first major bull run occurred in 2013, reaching a peak of around $1,100 before a significant correction. A second, even more substantial bull run commenced in late 2016, culminating in a peak of nearly $20,000 in late 2017, followed by a prolonged bear market. Another significant bull run began in late 2020, peaking at over $68,000 in late 2021, again followed by a substantial correction. Each cycle demonstrates a similar pattern of rapid price appreciation, followed by a period of consolidation or decline. These cycles, however, vary in duration and intensity, highlighting the complexity of Bitcoin’s price dynamics.

Timeline of Key Events Impacting Bitcoin’s Price

A timeline illustrating key events and their correlation with price movements reveals the interplay between external factors and Bitcoin’s price. For example, the 2017 bull run coincided with increased media attention and institutional interest. Conversely, regulatory crackdowns in various countries have historically led to price drops. The 2020-2021 bull run was partly driven by macroeconomic factors, including quantitative easing and the increasing adoption of Bitcoin as a hedge against inflation. Specific events like the collapse of FTX in late 2022 also triggered significant price declines. While correlation doesn’t equal causation, these events highlight the importance of considering broader macroeconomic and geopolitical influences on Bitcoin’s price.

Using Past Price Movements to Inform Future Predictions

While past price movements cannot precisely predict future prices, they can provide a framework for understanding potential scenarios. For instance, analyzing the duration and magnitude of previous bull and bear markets can offer insights into the potential length and intensity of future cycles. Studying the price action during specific events, such as regulatory announcements or technological upgrades, can also help anticipate potential market reactions. However, it’s crucial to remember that the cryptocurrency market is highly susceptible to unexpected events and rapid shifts in sentiment. Therefore, any prediction based solely on historical data should be treated with considerable caution.

Limitations of Using Historical Data for Price Forecasting

Relying solely on historical data for precise Bitcoin price forecasting is inherently limited. The cryptocurrency market is still relatively young and characterized by high volatility and susceptibility to unforeseen events. Past performance is not indicative of future results, especially in such a dynamic and rapidly evolving environment. Moreover, the influence of external factors, such as regulatory changes, technological advancements, and macroeconomic conditions, makes accurate long-term predictions exceptionally challenging. Over-reliance on historical patterns can lead to inaccurate forecasts and potentially significant financial losses. Therefore, a multifaceted approach that considers a wider range of factors is necessary for a more comprehensive analysis.

Exploring Different Prediction Models

Predicting Bitcoin’s price is a complex endeavor, relying on various models with varying degrees of accuracy and reliability. Understanding the strengths and weaknesses of these models is crucial for interpreting any price prediction, regardless of the source. Different approaches offer unique perspectives, and a combination of methods often yields a more nuanced understanding than relying on a single approach.

Predicting future Bitcoin prices involves employing a variety of analytical techniques, each with its own set of advantages and disadvantages. These models range from the technically driven to the fundamentally grounded, and often a blend of both is used for a more comprehensive forecast.

Technical Analysis in Bitcoin Price Prediction

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements. This method utilizes charts, indicators (like moving averages, RSI, MACD), and candlestick patterns to interpret market sentiment and potential price direction. Strengths include its relative simplicity and the ability to identify short-term price fluctuations. However, its weakness lies in its inherent subjectivity; different analysts can interpret the same chart data differently, leading to conflicting predictions. Moreover, technical analysis struggles to account for external factors that might significantly impact price, such as regulatory changes or major technological advancements. For example, a head-and-shoulders pattern might suggest a price drop, but a positive regulatory announcement could invalidate that prediction.

Fundamental Analysis in Bitcoin Price Prediction

Fundamental analysis evaluates Bitcoin’s underlying value based on factors such as adoption rate, network security, technological advancements, regulatory landscape, and macroeconomic conditions. Unlike technical analysis, which focuses on price action, fundamental analysis attempts to assess Bitcoin’s intrinsic worth. Its strength lies in its focus on long-term value drivers. However, it’s challenging to accurately quantify these factors and their impact on price, making long-term predictions inherently uncertain. For example, increased institutional adoption might suggest a price increase, but a sudden negative regulatory shift could offset this positive influence. Furthermore, predicting the impact of future technological advancements (like layer-2 scaling solutions) on Bitcoin’s value is speculative.

Examples of Successful and Unsuccessful Bitcoin Price Predictions

Numerous predictions about Bitcoin’s price have been made throughout its history, with varying degrees of success. For instance, in early 2017, some analysts predicted Bitcoin would reach $10,000 by the end of the year. This prediction proved remarkably accurate, as Bitcoin indeed surged past that mark later that year. Conversely, many predictions of a specific price target within a set timeframe have been significantly off the mark. Several analysts predicted a substantial price drop in 2018 or 2019 based on technical analysis, but Bitcoin’s price eventually recovered. The accuracy of predictions often hinges on unforeseen events, such as the 2020 COVID-19 pandemic, which drastically altered the macroeconomic environment and, consequently, Bitcoin’s price trajectory. These examples highlight the inherent difficulty in accurately forecasting Bitcoin’s price, regardless of the prediction method employed. The unpredictable nature of the cryptocurrency market makes even the most sophisticated models prone to error.

Addressing the Uncertainty of Price Prediction

Predicting the price of Bitcoin in December 2025, or any other future date, is inherently fraught with uncertainty. Numerous factors, both predictable and unpredictable, can significantly impact its value, making any forecast inherently speculative. While analysis and modeling can provide potential scenarios, it’s crucial to understand the limitations and risks involved.

The inherent volatility of the cryptocurrency market makes long-term price predictions exceptionally challenging. Unlike traditional assets with established valuation methods, Bitcoin’s value is heavily influenced by market sentiment, regulatory changes, technological advancements, and macroeconomic conditions, all of which are difficult to predict with accuracy. Even sophisticated models, which we explored earlier, can only offer probabilities, not certainties.

The Influence of Fear of Missing Out (FOMO)

Fear of Missing Out, or FOMO, is a powerful psychological force that significantly influences market behavior. When Bitcoin’s price experiences a rapid increase, FOMO can drive a surge in demand as investors fear being left behind. This can create a self-fulfilling prophecy, pushing the price even higher in the short term. Conversely, sharp price drops can trigger a wave of panic selling, exacerbating the decline as investors rush to minimize their losses. The 2017 Bitcoin bull run, where prices skyrocketed before a significant correction, is a prime example of FOMO’s impact. The rapid price increase created a sense of urgency among investors, leading to a speculative bubble that ultimately burst.

The Impact of Market Manipulation and Speculation

The decentralized nature of Bitcoin doesn’t eliminate the risk of market manipulation. Large holders, or “whales,” can influence the price through coordinated buying or selling activities. Speculative trading, driven by short-term price movements rather than fundamental value, also contributes to volatility. For example, coordinated efforts by large investors to artificially inflate or deflate the price can create short-lived price spikes or crashes, misleading less informed participants. This type of activity makes accurate long-term prediction extremely difficult.

Limitations of Prediction Models

Any prediction model, regardless of its complexity, is limited by the data it uses and the assumptions it makes. Historical price trends, while informative, are not necessarily indicative of future performance. Furthermore, models often struggle to account for unforeseen events, such as major regulatory changes, technological breakthroughs, or global economic crises. For instance, a model based on past adoption rates might fail to predict a sudden surge in institutional investment or a significant regulatory crackdown that could drastically alter Bitcoin’s trajectory. The inherent limitations of any model must be acknowledged, emphasizing the probabilistic, rather than deterministic, nature of any prediction.

Potential Price Scenarios for December 2025

Predicting the price of Bitcoin in December 2025 is inherently speculative, given the volatile nature of the cryptocurrency market. However, by considering various economic and technological factors, we can Artikel three plausible scenarios: a bullish, a bearish, and a neutral prediction. These scenarios are not exhaustive, and the actual price could fall outside of these ranges.

Bullish Scenario: Bitcoin Surges to $200,000

This scenario envisions a significant surge in Bitcoin’s price, potentially reaching $200,000 or more by December 2025. This optimistic outlook hinges on several key factors. Firstly, widespread institutional adoption could drive substantial demand. Major financial institutions increasingly view Bitcoin as a viable asset class, potentially leading to large-scale investments. Secondly, continued technological advancements, such as the development of the Lightning Network, could enhance Bitcoin’s scalability and usability, making it more attractive to both businesses and individuals. Finally, global macroeconomic instability, such as persistent inflation or geopolitical uncertainty, could further fuel Bitcoin’s appeal as a hedge against traditional assets. This scenario would likely result in significant gains for early Bitcoin investors and a boom in the broader cryptocurrency market, attracting new investors and fostering innovation.

Bearish Scenario: Bitcoin Falls to $30,000, Bitcoin Price Prediction In December 2025

Conversely, a bearish scenario sees Bitcoin’s price dropping to around $30,000 by December 2025. Several factors could contribute to this outcome. Increased regulatory scrutiny from governments worldwide could dampen investor enthusiasm and restrict market growth. A major security breach or a significant negative event impacting the Bitcoin network could erode investor confidence. Furthermore, a period of sustained economic growth and stability could diminish the appeal of Bitcoin as a safe-haven asset, leading to decreased demand. This scenario would negatively impact Bitcoin investors, potentially leading to significant losses. The broader cryptocurrency market would also likely experience a downturn, with many altcoins suffering even steeper declines. This could mirror the market conditions seen during previous bear markets, such as the 2018-2019 crypto winter.

Neutral Scenario: Bitcoin Stabilizes Around $60,000

A neutral scenario suggests that Bitcoin’s price will stabilize around $60,000 by December 2025. This scenario reflects a more balanced outlook, incorporating both positive and negative factors. While some institutional adoption and technological advancements may occur, they might be offset by regulatory hurdles and macroeconomic uncertainty. The market might experience periods of both growth and decline, leading to an overall relatively flat price trajectory. This scenario would likely see moderate gains or losses for Bitcoin investors, depending on their entry point and risk tolerance. The broader cryptocurrency market would also likely exhibit moderate volatility, with some altcoins performing well while others struggle. This could be similar to the periods of consolidation observed in Bitcoin’s history between major bull and bear cycles.

Risks and Opportunities: Bitcoin Price Prediction In December 2025

Investing in Bitcoin, based on any price prediction, inherently involves significant risk. While the potential for substantial returns is alluring, understanding and mitigating these risks is crucial for responsible investment. The highly volatile nature of Bitcoin’s price means that substantial losses are just as possible as significant gains. This volatility stems from a confluence of factors, including regulatory uncertainty, market sentiment, and technological developments.

The importance of diversification and risk management cannot be overstated. Diversification, the practice of spreading investments across various asset classes (stocks, bonds, real estate, etc.), significantly reduces the overall portfolio risk. Holding a significant portion of one’s investment in a single, highly volatile asset like Bitcoin exposes the investor to substantial losses should the price decline sharply. Risk management strategies, such as setting stop-loss orders (automatic sell orders triggered when the price falls below a predetermined level) and only investing capital one can afford to lose, are essential components of responsible Bitcoin investment.

Risk Assessment in Bitcoin Investment

Bitcoin’s price is susceptible to sharp fluctuations driven by several factors. News regarding regulatory changes, significant market events, or technological advancements can trigger dramatic price swings. For example, the collapse of FTX in 2022 caused a significant drop in Bitcoin’s price, highlighting the systemic risk associated with the cryptocurrency market. Similarly, positive news, such as widespread adoption by major corporations or institutional investors, can lead to rapid price increases. However, such events are unpredictable, making accurate price prediction extremely challenging. Investors must be prepared for both substantial gains and potential losses. A thorough understanding of market dynamics and the ability to assess risk objectively are vital for navigating this volatile landscape.

Diversification and Risk Mitigation Strategies

A well-diversified investment portfolio is designed to minimize risk. This involves allocating investments across different asset classes, reducing the impact of poor performance in any single asset. For example, an investor could allocate a small percentage of their overall portfolio to Bitcoin, while the majority remains in more stable assets like bonds or index funds. This strategy limits potential losses should the Bitcoin market experience a downturn. Furthermore, employing risk management tools like stop-loss orders provides a safety net by automatically selling Bitcoin if the price falls below a predefined threshold, helping to limit potential losses. Thorough research and a well-defined investment strategy are crucial for mitigating risk effectively.

Long-Term Growth Potential of Bitcoin

Despite the inherent risks, Bitcoin’s long-term growth prospects attract many investors. The potential for widespread adoption as a store of value and a medium of exchange, coupled with its limited supply (only 21 million Bitcoin will ever exist), suggests a strong underlying value proposition. While the current price is subject to considerable volatility, the long-term vision of Bitcoin as a decentralized, globally accessible digital currency fuels optimism among some investors. The growing acceptance of Bitcoin by institutional investors and its increasing integration into mainstream financial systems further support this long-term bullish outlook. However, realizing this potential requires patience and a tolerance for significant short-term price fluctuations. The path to widespread adoption is likely to be characterized by periods of both rapid growth and substantial corrections.

Bitcoin Price Prediction In December 2025 – Accurately predicting the Bitcoin price in December 2025 is challenging, requiring analysis of various market factors. Understanding potential price movements earlier in the year is crucial, and for this, a look at the Bitcoin March Prediction 2025 can provide valuable insight. This earlier prediction can help inform a more comprehensive outlook on the December 2025 Bitcoin price, allowing for a more nuanced forecast.

Accurately predicting the Bitcoin price in December 2025 is challenging, requiring analysis of various market factors. Understanding the trajectory leading up to that point is crucial, and a key data point is the predicted price in the preceding months. For instance, a look at the Bitcoin Prediction For July 2025 can offer valuable insight into the potential momentum carrying over into December.

Ultimately, the December 2025 price will depend on a multitude of variables beyond any single month’s prediction.

Accurately predicting the Bitcoin price in December 2025 is challenging, relying heavily on various market factors. To gain a clearer perspective on potential price movements leading up to December, it’s helpful to consider the predicted price in the preceding month; you can find insights on this by checking the Bitcoin November 2025 Price Prediction. Understanding November’s projected value can provide a useful benchmark for extrapolating a reasonable range for December 2025’s Bitcoin price.

Predicting the Bitcoin price in December 2025 is challenging, relying heavily on various market factors. A key element in such predictions is understanding the trajectory leading up to that point, and for that, examining the projected price in July 2025 is quite helpful. For insights into the Bitcoin price prediction in July 2025, you might find the analysis at Bitcoin Price Prediction July 2025 useful.

Ultimately, the July predictions will significantly influence any reasonable December 2025 Bitcoin price forecast.

Predicting the Bitcoin price in December 2025 is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding the overall Bitcoin End Of Year Prediction 2025 is crucial; for a comprehensive overview, check out this insightful resource: Bitcoin End Of Year Prediction 2025. Returning to December 2025 specifically, the price will likely depend heavily on the overall market trend established throughout the year.

Predicting the Bitcoin price in December 2025 is challenging, but a key factor influencing its trajectory is the halving event. Understanding the precise timing of the 2025 Bitcoin halving, as detailed on this helpful resource, Date Of 2025 Bitcoin Halving , is crucial. This event, which reduces the rate of new Bitcoin creation, historically precedes significant price increases, thus impacting any December 2025 price prediction.