Bitcoin Price Prediction March 2025

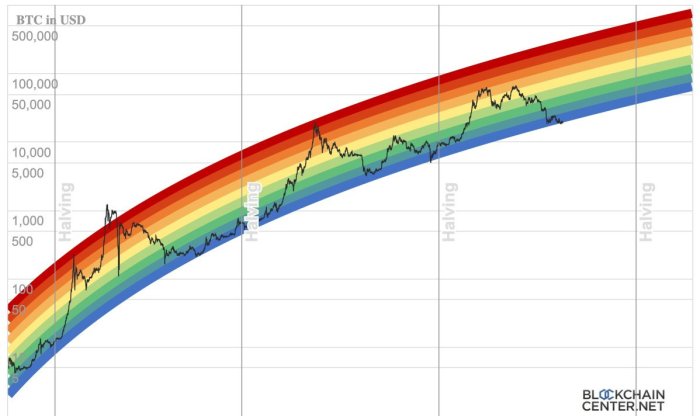

Bitcoin, since its inception, has experienced dramatic price swings, from near-zero to record highs exceeding $68,000. Its journey has been punctuated by significant events such as the 2017 bull run fueled by increasing mainstream adoption and the subsequent market correction, along with regulatory crackdowns in various countries and technological upgrades like the Bitcoin halving events that impact its supply. Predicting its future price, however, remains a highly speculative endeavor.

The inherent volatility of Bitcoin presents a significant challenge to accurate price prediction. Unlike traditional assets with established valuation models, Bitcoin’s price is influenced by a complex interplay of factors, making it susceptible to rapid and unpredictable fluctuations. These fluctuations are often driven by market sentiment, which can shift dramatically based on news events, social media trends, and even celebrity endorsements. Attempts at precise forecasting are therefore fraught with uncertainty.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a dynamic reflection of several interacting factors. Regulatory changes, for instance, can significantly impact investor confidence and market liquidity. A positive regulatory environment, such as the clear establishment of Bitcoin as a legitimate asset class in a major economy, could potentially drive price increases. Conversely, stricter regulations or outright bans can lead to price drops. Technological advancements, such as improvements in scalability and transaction speed, also play a crucial role. Increased efficiency and lower transaction fees can make Bitcoin more attractive to a wider range of users and businesses, potentially boosting demand and price. Finally, market sentiment, encompassing overall investor confidence and speculation, remains a dominant force. Positive news, technological breakthroughs, or institutional adoption can trigger bullish sentiment and price increases, while negative news or security concerns can lead to bearish sentiment and price declines. The 2022 cryptocurrency winter, for example, showcased the impact of negative market sentiment and regulatory uncertainty on Bitcoin’s price. Predicting the interplay of these factors accurately is a significant challenge.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of economic, technological, and regulatory factors. While no one can definitively state the price, understanding these influences provides a framework for informed speculation. The following sections delve into key elements shaping Bitcoin’s potential trajectory.

Global Economic Conditions and Bitcoin’s Price

Global economic conditions significantly impact Bitcoin’s price. Periods of economic uncertainty, such as inflation or recession, often lead investors to seek alternative assets, potentially driving demand for Bitcoin as a hedge against inflation or a store of value. Conversely, strong economic growth might divert investment away from riskier assets like Bitcoin towards more traditional investments. For example, the 2020-2021 Bitcoin bull run coincided with unprecedented monetary easing by central banks globally, leading to increased inflation concerns and a flight to alternative assets. Conversely, a potential global recession could negatively impact Bitcoin’s price as investors seek safer havens.

Institutional Adoption and Investment

The growing adoption of Bitcoin by institutional investors, such as large corporations and investment firms, plays a crucial role in its price appreciation. Increased institutional investment brings greater liquidity and stability to the market, reducing volatility and potentially driving up prices. Examples include MicroStrategy’s significant Bitcoin holdings and Tesla’s previous investment, which signaled a shift in the perception of Bitcoin as a legitimate asset class. Continued institutional adoption, including the potential involvement of pension funds and sovereign wealth funds, could significantly influence Bitcoin’s price in 2025.

Technological Developments and Bitcoin’s Value

Technological advancements, particularly scaling solutions like the Lightning Network and layer-2 protocols, directly impact Bitcoin’s usability and transaction speed. Improvements in scalability address the limitations of Bitcoin’s current transaction throughput, making it more practical for everyday use and potentially increasing demand. The successful implementation and adoption of these technologies could lead to increased transaction volume and a rise in Bitcoin’s price. Conversely, a failure to effectively scale the network could hinder its growth and limit price appreciation.

Regulatory Frameworks and Government Policies

Government regulations and policies play a critical role in shaping Bitcoin’s price trajectory. Favorable regulations, such as clear guidelines on taxation and licensing, can boost investor confidence and encourage wider adoption. Conversely, restrictive regulations, including outright bans or excessive taxation, can stifle growth and negatively impact the price. The regulatory landscape varies significantly across countries, and the evolution of these policies will undoubtedly have a profound effect on Bitcoin’s global price. For instance, a clear regulatory framework in a major economy could trigger a significant price increase, while a crackdown in a key market could cause a sharp decline.

Influence of Major Cryptocurrencies on Bitcoin’s Market Dominance and Price

The performance of other major cryptocurrencies, such as Ethereum, influences Bitcoin’s market dominance and, consequently, its price. A surge in the popularity of alternative cryptocurrencies might divert investment away from Bitcoin, potentially reducing its market share and impacting its price. Conversely, if Bitcoin maintains its position as the leading cryptocurrency, its price is likely to be less affected by the performance of other coins. The overall cryptocurrency market sentiment also plays a role; a general market downturn can affect all cryptocurrencies, including Bitcoin, irrespective of their individual performance.

Potential Price Scenarios for Bitcoin in March 2025

Predicting the price of Bitcoin with certainty is impossible. However, by analyzing current market trends, technological advancements, and macroeconomic factors, we can construct plausible price scenarios for March 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. It’s crucial to remember that these are speculative projections and not financial advice.

Bitcoin Price Scenarios: March 2025

The following table Artikels three distinct price scenarios for Bitcoin in March 2025, considering various influencing factors and potential risks. Each scenario is based on a combination of technical analysis, fundamental analysis, and consideration of global economic conditions.

| Scenario | Price Range (USD) | Supporting Factors | Risks |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread adoption by institutional investors; significant regulatory clarity; continued technological advancements (e.g., Lightning Network scalability improvements); strong macroeconomic tailwinds (e.g., inflationary pressures driving demand for alternative assets); increasing scarcity due to halving events. A global shift towards decentralized finance (DeFi) could also significantly boost demand. Similar to the 2021 bull run, a confluence of positive factors could propel Bitcoin to unprecedented highs. | Regulatory crackdowns in key markets; a major security breach compromising Bitcoin’s integrity; unforeseen technological hurdles; a significant global economic downturn; a sudden shift in investor sentiment. A speculative bubble bursting is also a considerable risk. |

| Neutral | $50,000 – $100,000 | Continued institutional interest, but at a slower pace than in the bullish scenario; moderate regulatory oversight; gradual technological improvements; relatively stable macroeconomic conditions; a balance between supply and demand. This scenario assumes a continuation of current trends without major disruptions or significant positive or negative catalysts. It reflects a more conservative outlook, aligning with historical patterns of consolidation after periods of significant price volatility. | Increased competition from altcoins; slow adoption rates in emerging markets; persistent regulatory uncertainty in some jurisdictions; unpredictable macroeconomic events; lack of significant bullish catalysts. This scenario incorporates the risk of a prolonged period of sideways trading, potentially leading to investor frustration and decreased market participation. |

| Bearish | $20,000 – $40,000 | Significant regulatory headwinds leading to decreased investor confidence; a major global economic recession; increased competition from other cryptocurrencies or alternative investments; technological setbacks hindering Bitcoin’s scalability or security; a significant negative news event impacting the overall cryptocurrency market. This scenario mirrors the bear market of 2018-2020, where a combination of negative factors led to a substantial price decline. | The risk is primarily a prolonged period of low price, potentially leading to a significant loss of investor confidence and a substantial reduction in market capitalization. A protracted bear market could also impact the development and innovation within the Bitcoin ecosystem. The potential for a further price decline beyond the specified range cannot be ruled out. |

Technical Analysis and Market Indicators

Predicting Bitcoin’s price in March 2025 requires a multifaceted approach, incorporating technical analysis, on-chain metrics, and sentiment analysis. While no method guarantees accuracy, combining these techniques can offer a more informed perspective on potential price movements. This section delves into the key indicators and their implications for Bitcoin’s price trajectory.

Technical indicators provide insights into price trends and momentum. Understanding these signals, alongside other data points, allows for a more comprehensive prediction model. However, it’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Moving Averages, RSI, and MACD

Moving averages (MAs), such as the 50-day and 200-day MAs, smooth out price fluctuations and identify trends. A bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, suggesting a potential price increase. Conversely, a bearish crossover indicates a potential price decline. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 typically suggest an overbought market, while readings below 30 indicate an oversold market. The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish signal occurs when the MACD line crosses above the signal line, and a bearish signal occurs when it crosses below. For example, a strong bullish crossover of the 50-day MA over the 200-day MA in late 2020 preceded a significant Bitcoin price rally. Conversely, a bearish crossover in early 2022 preceded a market correction. The RSI and MACD can offer complementary insights into market momentum and potential turning points.

On-Chain Metrics

On-chain data provides insights into the activity and behavior within the Bitcoin network. Analyzing metrics such as transaction volume, mining difficulty, and the number of active addresses can offer valuable clues about future price movements. High transaction volume often correlates with increased market activity and potential price appreciation, while a decline in transaction volume can suggest waning interest. Mining difficulty reflects the computational power dedicated to mining Bitcoin. A consistently increasing mining difficulty suggests a healthy network and potentially supports price stability. The number of active addresses indicates the number of unique addresses interacting with the Bitcoin network. A significant increase in active addresses might signal growing adoption and potential price growth. For instance, a sustained increase in transaction volume and mining difficulty in the lead-up to a Bitcoin halving event has historically been associated with price increases.

Market Sentiment and Social Media Analysis

Market sentiment, encompassing investor confidence and overall market psychology, significantly impacts Bitcoin’s price. Social media analysis can provide insights into prevailing sentiment. A surge in positive sentiment on platforms like Twitter or Reddit might indicate increased demand and potential price appreciation, while negative sentiment could suggest a decline. However, it’s essential to consider the potential for manipulation and misinformation on social media. Analyzing multiple sources and combining social media data with other indicators provides a more nuanced understanding of market sentiment. For example, periods of intense fear and uncertainty (FUD) on social media have often preceded market corrections, while periods of widespread enthusiasm and excitement can drive price increases. It is important to approach social media analysis with a critical eye and consider the source’s reliability.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with uncertainty. Numerous factors influence its value, many of which are unpredictable and beyond the control of any individual or institution. While technical analysis and market indicators can provide insights, they cannot definitively predict future price movements. It’s crucial to remember that past performance is not indicative of future results.

The inherent volatility of the cryptocurrency market is a significant risk for investors. Bitcoin’s price has experienced dramatic swings in the past, and these fluctuations can lead to substantial gains or losses in a short period. For example, Bitcoin’s price plummeted in 2022, significantly impacting investors who had not adequately assessed their risk tolerance. This volatility stems from various factors, including market sentiment, regulatory changes, technological developments, and macroeconomic conditions. The lack of inherent value, unlike traditional assets such as gold or real estate, contributes to this volatility.

Market Volatility and Price Fluctuations

Bitcoin’s price is highly susceptible to market sentiment. News events, social media trends, and even celebrity endorsements can trigger significant price swings. A sudden surge in positive news might lead to a price rally, while negative news or regulatory crackdowns can cause a sharp decline. The decentralized nature of Bitcoin, while a strength in many respects, also contributes to this volatility, as there is no central authority to regulate or stabilize the market. The relatively small market capitalization of cryptocurrencies compared to traditional markets amplifies price fluctuations. A relatively small amount of trading volume can cause disproportionately large price changes.

Regulatory Uncertainty and Legal Risks

The regulatory landscape for cryptocurrencies is still evolving globally. Different countries have adopted varying approaches, ranging from outright bans to more permissive regulatory frameworks. This uncertainty creates risks for investors. Changes in regulations can impact the accessibility, trading, and overall value of Bitcoin. For example, a sudden ban on cryptocurrency trading in a major market could significantly depress the price. Furthermore, legal challenges surrounding Bitcoin’s status as a currency, security, or commodity remain unresolved in many jurisdictions, creating further uncertainty.

Technological Risks and Security Concerns

Bitcoin’s underlying technology is constantly evolving. While upgrades and improvements aim to enhance security and efficiency, they also introduce potential risks. Bugs or vulnerabilities in the Bitcoin network could be exploited by malicious actors, leading to security breaches or even a complete system failure. Furthermore, the security of individual wallets and exchanges is crucial. Hacking incidents and theft of Bitcoin from exchanges or personal wallets have occurred in the past and remain a significant concern. The complexity of Bitcoin’s technology also presents a risk to less tech-savvy investors who may not fully understand the associated risks.

Importance of Thorough Research and Risk Assessment

Before investing in Bitcoin or any cryptocurrency, conducting thorough research and a comprehensive risk assessment is paramount. This involves understanding the technology behind Bitcoin, analyzing market trends, assessing your personal risk tolerance, and considering the potential for both significant gains and substantial losses. Diversification of your investment portfolio is also essential to mitigate risk. Avoid investing more than you can afford to lose. Seeking advice from a qualified financial advisor can help you make informed investment decisions based on your individual circumstances and financial goals. It is crucial to remember that investing in Bitcoin involves a high degree of risk, and there is no guarantee of profit.

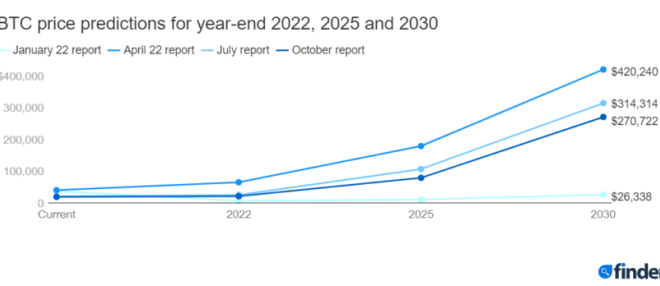

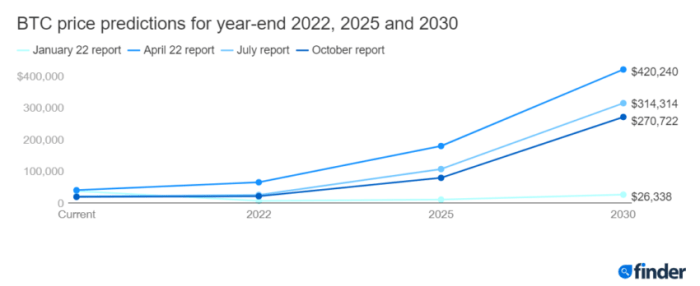

Illustrative Examples of Past Bitcoin Price Predictions

Analyzing past Bitcoin price predictions reveals a fascinating, and often inaccurate, history of forecasting this volatile asset. The accuracy of these predictions has varied wildly, highlighting the inherent challenges in predicting the future of a decentralized digital currency influenced by numerous factors. Examining these examples helps illustrate the importance of considering a range of predictions and understanding their limitations.

Past predictions often relied on extrapolating past trends, applying technical indicators, or making assumptions about adoption rates and regulatory developments. However, unforeseen events, such as regulatory crackdowns, market manipulations, or technological advancements, significantly impacted Bitcoin’s price trajectory, rendering many predictions obsolete. Furthermore, the psychological aspects of market sentiment, often driven by fear and greed, played a crucial role in shaping the actual price movements, making accurate forecasting exceptionally difficult.

Examples of Inaccurate Predictions

Several prominent analysts and commentators made bold price predictions for Bitcoin in the past that proved to be significantly off the mark. For example, some analysts predicted a price of $100,000 per Bitcoin by the end of 2021, a target that was not reached. Imagine a chart showing a predicted sharp upward trajectory reaching $100,000, then a flat line representing the actual price, remaining significantly below the prediction. This discrepancy can be attributed to several factors including the overall market downturn and regulatory uncertainty. Another instance involved a prediction of a Bitcoin price crash to near zero, a scenario that did not materialize, showcasing the limitations of extreme predictions. A visual representation would show a steeply downward sloping line representing the predicted crash, contrasting sharply with the actual price line that, while experiencing volatility, did not approach zero. These inaccurate predictions highlight the significant influence of unforeseen events and the unpredictable nature of market sentiment.

Examples of Relatively Accurate Predictions

While many predictions missed the mark, some analysts successfully predicted broad price movements, even if the precise timing or magnitude was off. For instance, some accurately predicted a significant price increase in 2020-2021, although the specific price target may have been inaccurate. This could be visualized as a predicted upward trend line showing a general increase aligning with the actual price movement, but with differences in the steepness of the incline and the final price reached. The accuracy of these predictions, albeit partial, stemmed from a combination of factors including the growing adoption of Bitcoin by institutional investors and the increasing awareness of its potential as a store of value. These examples, however, still emphasize the need for caution, as even partially accurate predictions do not guarantee future success.

The Importance of Considering a Range of Predictions and Their Limitations

The wide range of past Bitcoin price predictions underscores the significant uncertainty associated with forecasting its future price. Relying on a single prediction is inherently risky. A more prudent approach involves considering multiple predictions from diverse sources, each with its underlying assumptions and methodologies. This allows for a more balanced perspective, acknowledging the inherent limitations of each prediction. Imagine a chart displaying multiple predicted price lines, some optimistic, some pessimistic, and some moderate, all diverging from each other. This visual would highlight the range of potential outcomes and the need to account for uncertainty when making investment decisions. Furthermore, understanding the factors influencing each prediction, including the assumptions made and the potential biases involved, is crucial in assessing their credibility and reliability. Ultimately, any Bitcoin price prediction should be treated with caution, and investment decisions should be made after careful consideration of various factors and risk tolerance.

Frequently Asked Questions (FAQs): Bitcoin Price Prediction March 2025

This section addresses some common questions regarding Bitcoin’s price and investment. Understanding these factors is crucial for making informed decisions in the volatile cryptocurrency market. We’ll explore the key drivers of Bitcoin’s price, the accuracy (or lack thereof) of predictions, the inherent risks of Bitcoin investment, and finally, some alternative investment options.

Major Factors Driving Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics play a fundamental role; limited supply coupled with increasing demand pushes prices upward. Regulatory announcements from governments worldwide significantly impact investor sentiment and, consequently, price. Technological advancements within the Bitcoin network, such as upgrades to its scalability or security, can also affect its value. Macroeconomic conditions, including inflation rates and overall market sentiment, have a considerable influence. Furthermore, media coverage, prominent investor actions, and even social media trends can create price volatility. Finally, the adoption of Bitcoin by businesses and institutions plays a key role in driving its long-term price trajectory. For instance, the 2021 bull run was partially fueled by Tesla’s investment and the acceptance of Bitcoin as a payment method by some companies.

Accuracy of Bitcoin Price Predictions

Predicting Bitcoin’s price with any degree of certainty is extremely challenging. The cryptocurrency market is highly volatile and susceptible to unpredictable events, ranging from regulatory changes to technological disruptions and shifts in investor sentiment. Past performance is not indicative of future results, and historical price movements offer limited insight into future trends. While technical analysis and market indicators can provide some guidance, they are not foolproof. Many predictions rely on assumptions and models that may not accurately reflect the complex reality of the market. For example, numerous analysts predicted a Bitcoin price of $100,000 in 2021, a prediction that didn’t materialize. The inherent uncertainty highlights the speculative nature of Bitcoin price predictions.

Risks Involved in Bitcoin Investment

Investing in Bitcoin carries substantial risks. Price volatility is a major concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to significant gains or losses. Regulatory uncertainty poses another risk; governments worldwide are still developing regulatory frameworks for cryptocurrencies, which can impact their legality and accessibility. Security risks are also prevalent; exchanges and wallets are vulnerable to hacking, and investors can lose their funds. Furthermore, the decentralized nature of Bitcoin means there’s no central authority to protect investors from fraud or market manipulation. Finally, the lack of intrinsic value is a concern for some investors; unlike traditional assets, Bitcoin doesn’t generate income or have an underlying physical asset backing its value. Diversification and only investing what one can afford to lose are crucial risk mitigation strategies.

Alternative Investment Options, Bitcoin Price Prediction March 2025

Investors seeking alternatives to Bitcoin have various options. Traditional asset classes such as stocks, bonds, and real estate offer different risk-reward profiles. Other cryptocurrencies, each with its own characteristics and risks, provide diversification within the digital asset space. Precious metals like gold and silver are often considered safe haven assets. Finally, investments in established companies or index funds can offer more stability and potentially lower risk compared to the volatility of Bitcoin. The choice of alternative investment depends on individual risk tolerance, investment goals, and financial circumstances. Careful research and consideration of the risks involved are crucial before committing to any investment strategy.

Bitcoin Price Prediction March 2025 – Predicting the Bitcoin price in March 2025 is challenging, with various factors influencing its trajectory. A key consideration is the impact of the 2024 halving, and to understand potential post-halving price movements, it’s helpful to review analyses like this one on Giá Bitcoin Sau Halving 2025. Ultimately, the Bitcoin price prediction for March 2025 remains speculative, dependent on both macroeconomic conditions and market sentiment.

Predicting the Bitcoin price in March 2025 is inherently speculative, but a significant factor to consider is the impact of the upcoming halving. Understanding the potential effects of this event is crucial for any reasonable prediction; for a detailed analysis, check out this insightful resource on the Bitcoin Halving 2025 Effect. Ultimately, the halving’s influence on scarcity and miner profitability will likely play a major role in shaping the Bitcoin price in March 2025.

Predicting the Bitcoin price in March 2025 is a complex undertaking, influenced by numerous factors. A key event impacting this prediction is the upcoming Bitcoin Halving, significantly altering the rate of new Bitcoin creation. To stay informed about this crucial event, check out the Bitcoin Halving 2025 Countdown and its potential effect on the Bitcoin price prediction for March 2025.

Understanding the halving’s implications is vital for any serious price forecast.

Predicting the Bitcoin price in March 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the upcoming Bitcoin Halving, significantly altering the rate of new Bitcoin entering circulation. For precise details on the timing of this event, check the confirmed date on this resource: Bitcoin Halving Date April 2025. This halving will likely play a substantial role in shaping the Bitcoin price prediction for March 2025, potentially leading to increased scarcity and price appreciation.

Predicting the Bitcoin price in March 2025 is inherently speculative, but a key factor influencing the forecast is the upcoming Bitcoin halving. To understand the timing of this crucial event, which significantly impacts Bitcoin’s supply and potentially its price, it’s helpful to consult resources like this one detailing the exact date: Bitcoin Halving 2025 Ngày Nào. Therefore, accurate predictions for Bitcoin’s March 2025 price hinge on a thorough analysis of the halving’s impact and other market dynamics.

Predicting the Bitcoin price in March 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, significantly impacting the cryptocurrency’s supply and potentially its value. To understand the timing and potential effects of this event, it’s useful to consult resources such as this article on When Halving Bitcoin 2025 , which can help refine any price prediction for March 2025.

Ultimately, the halving’s impact on the Bitcoin price remains a subject of ongoing discussion and analysis.