Bitcoin Price Predictions UK 2025

Bitcoin, first introduced in 2009, has experienced a turbulent yet captivating journey. Its decentralized nature and potential as a store of value have garnered significant attention globally, including within the UK market. While initially a niche interest, Bitcoin’s adoption in the UK has grown, driven by technological advancements, increasing institutional investment, and a growing awareness of its potential benefits and risks. However, its price remains notoriously volatile, making predictions for 2025 a challenging, yet fascinating, exercise.

Bitcoin’s price volatility stems from a confluence of factors. Supply and demand dynamics play a crucial role; limited supply and increased demand tend to drive prices upwards, while the opposite can lead to significant drops. Regulatory changes, both globally and within the UK, significantly impact investor sentiment and market activity. News events, technological advancements, and macroeconomic factors such as inflation and global economic uncertainty also contribute to price fluctuations. The speculative nature of the cryptocurrency market further exacerbates volatility, leading to periods of rapid price increases and decreases.

Factors Influencing Bitcoin’s Price in the UK

Several key factors will likely shape Bitcoin’s price trajectory in the UK market during 2025. These include the evolving regulatory landscape, the level of institutional adoption, the growth of Bitcoin-related services and infrastructure within the UK, and the overall global economic climate. For example, increased regulatory clarity could boost investor confidence, potentially leading to higher prices. Conversely, stricter regulations could dampen enthusiasm and negatively affect the price. The growing acceptance of Bitcoin by major financial institutions could similarly drive up demand and price, while a global economic downturn could trigger a sell-off, resulting in lower prices. The development of user-friendly Bitcoin payment systems and the expansion of Bitcoin ATMs in the UK would also contribute to greater accessibility and potentially higher demand.

Potential Price Scenarios for Bitcoin in the UK in 2025

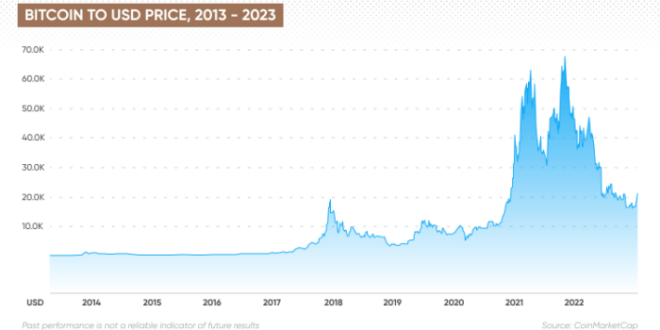

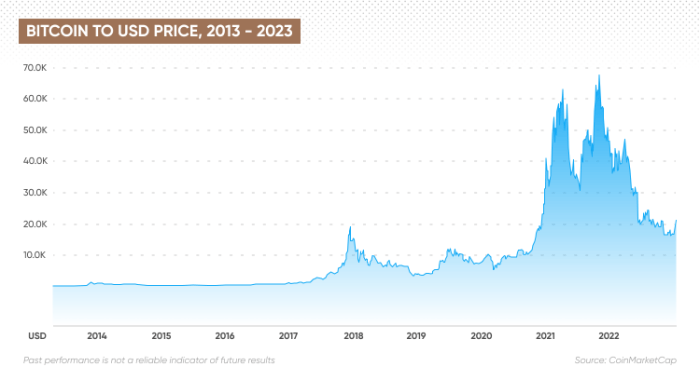

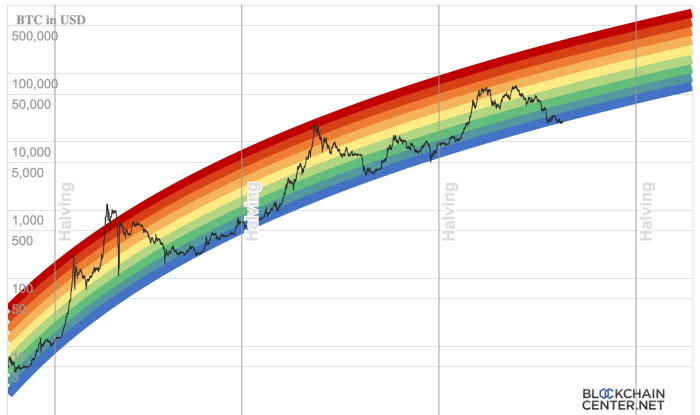

Predicting the exact price of Bitcoin in 2025 is inherently speculative. However, considering historical trends and the factors discussed above, we can Artikel potential scenarios. A bullish scenario might see Bitcoin’s price significantly exceeding its previous highs, driven by widespread institutional adoption, positive regulatory developments, and increasing global demand. This could result in prices well above current levels, perhaps reaching figures previously considered unimaginable. Conversely, a bearish scenario could see the price stagnate or even decline, influenced by negative regulatory actions, a global economic crisis, or a loss of investor confidence. A more moderate scenario could involve a gradual increase in price, reflecting a balanced interplay of positive and negative factors. It’s crucial to remember that these are just potential scenarios, and the actual price could fall anywhere within a wide range. Past performance is not indicative of future results. For example, Bitcoin’s price in 2017 experienced a meteoric rise, followed by a significant correction, illustrating the inherent volatility of the market.

Factors Influencing Bitcoin Price in the UK

Predicting the price of Bitcoin is inherently complex, influenced by a multitude of interconnected factors. While pinpointing an exact price for Bitcoin in the UK in 2025 remains impossible, understanding the key drivers offers valuable insight into potential price movements. This analysis will examine several crucial factors shaping the UK Bitcoin market.

Global Economic Conditions and Bitcoin Price

Global economic conditions significantly impact Bitcoin’s price in the UK. Periods of economic uncertainty, such as inflation, recession, or geopolitical instability, often drive investors towards Bitcoin as a hedge against traditional assets. Conversely, strong economic growth and stability can lead to decreased demand for Bitcoin as investors shift their focus to more traditional investments. For example, the 2022 inflationary pressures globally saw increased Bitcoin adoption as investors sought inflation hedges. Conversely, periods of strong economic growth, such as the post-2008 recovery in some sectors, have seen Bitcoin prices fluctuate as investors moved into more established markets. The UK’s economic performance relative to the global economy will also influence the local demand for Bitcoin.

Regulatory Changes and Government Policies

The regulatory landscape surrounding cryptocurrencies in the UK significantly influences Bitcoin adoption and price. Clear, consistent, and investor-friendly regulations can boost confidence and increase investment, potentially driving up prices. Conversely, restrictive or unclear regulations can stifle adoption and negatively impact prices. The UK government’s approach to regulating cryptocurrencies, including taxation and licensing, will play a pivotal role in shaping the UK Bitcoin market in 2025. A positive regulatory environment, mirroring that seen in some other countries promoting fintech, could lead to greater institutional investment and wider public acceptance. Conversely, heavy-handed regulation could create uncertainty and suppress prices.

Technological Advancements and Market Sentiment

Technological advancements in Bitcoin’s underlying infrastructure and related technologies (e.g., the Lightning Network) can significantly influence its price. Improvements in scalability, transaction speed, and security can boost adoption and increase demand, potentially driving up prices. Conversely, technological setbacks or security breaches can erode confidence and lead to price drops. Market sentiment, driven by news, social media trends, and overall investor confidence, also plays a crucial role. Positive news and bullish sentiment can create buying pressure, while negative news or bearish sentiment can trigger selling pressure. For instance, successful scaling solutions could increase Bitcoin’s utility and adoption, leading to a positive price impact. Conversely, a major security breach could severely impact market confidence and negatively influence the price.

Major Events and the UK Bitcoin Market

Major global events, such as geopolitical instability, financial crises, or significant changes in monetary policy, can have a profound impact on the UK Bitcoin market. These events often increase market volatility and can lead to significant price swings. For example, the ongoing war in Ukraine has increased uncertainty in global markets, influencing investors to seek safe haven assets, including Bitcoin. Similarly, a major financial crisis could lead to a flight to safety, potentially boosting Bitcoin’s price as investors seek alternative stores of value. The UK’s response to such events will also play a crucial role in shaping the local market.

Factors Influencing Bitcoin Price in 2025: A Predictive Analysis

| Factor | Predicted Impact | Reasoning | Potential Magnitude |

|---|---|---|---|

| Global Economic Stability | Neutral to Positive | Stable global economy reduces risk aversion, but Bitcoin’s status as a hedge may still drive demand. | Moderate |

| UK Regulatory Clarity | Positive | Clear regulations increase institutional investment and public confidence. | High |

| Technological Advancements (Layer-2 solutions) | Positive | Improved scalability and transaction speeds increase Bitcoin’s usability. | High |

| Geopolitical Uncertainty | Neutral to Positive | Increased uncertainty may drive demand for Bitcoin as a safe haven asset. | Moderate to High |

Potential Bitcoin Price Scenarios in the UK for 2025

Predicting the price of Bitcoin is inherently speculative, as numerous factors influence its volatile nature. However, by considering current market trends and potential future events, we can construct plausible price scenarios for the UK market in 2025. These scenarios are not exhaustive, and the actual price could deviate significantly.

This section details three distinct Bitcoin price scenarios for the UK in 2025: a bullish, a bearish, and a neutral scenario. Each scenario Artikels the market conditions and events that could lead to the predicted price outcome. It is crucial to remember that these are speculative projections, and the actual price could differ considerably.

Bullish Scenario: Bitcoin Price Exceeds £100,000

This scenario envisions a significantly positive outlook for Bitcoin in the UK by 2025. Several factors would contribute to this optimistic projection.

- Widespread Institutional Adoption: Increased institutional investment, driven by regulatory clarity and growing acceptance of Bitcoin as a valuable asset, would fuel significant price appreciation. Examples include larger investment firms allocating a greater percentage of their portfolios to cryptocurrencies, leading to substantial buying pressure.

- Global Economic Uncertainty: Continued global economic instability, such as inflation or geopolitical events, could drive investors towards Bitcoin as a hedge against traditional assets, increasing demand and pushing prices higher. Similar to the 2020-2021 bull run, where uncertainty surrounding the COVID-19 pandemic contributed to Bitcoin’s price surge.

- Technological Advancements: Significant advancements in Bitcoin’s underlying technology, such as the Lightning Network’s widespread adoption, could increase its scalability and transaction speed, making it more attractive to a broader range of users and further driving demand.

Bearish Scenario: Bitcoin Price Falls Below £20,000

A bearish scenario paints a less optimistic picture for Bitcoin’s future in the UK. This price decline would be a result of several intertwined factors.

- Increased Regulatory Scrutiny: Stringent regulations implemented by the UK government, potentially including heavy taxation or outright bans on certain cryptocurrency activities, could significantly dampen investor enthusiasm and drive down prices. This could mirror the impact of stricter regulations in other countries on their local cryptocurrency markets.

- Major Security Breach: A large-scale security breach affecting a major Bitcoin exchange or a significant vulnerability discovered in the Bitcoin protocol itself could erode investor confidence, leading to a significant price drop. The Mt. Gox hack serves as a stark reminder of the potential impact of security breaches on cryptocurrency prices.

- Macroeconomic Downturn: A severe global recession could significantly impact investor risk appetite, leading to a sell-off in riskier assets like Bitcoin, even if the underlying technology remains sound. This could be analogous to the 2018 crypto winter, where a general market downturn played a significant role in Bitcoin’s price decline.

Neutral Scenario: Bitcoin Price Remains Around £40,000

This scenario assumes a relatively stable market environment for Bitcoin in the UK. The price would neither experience a significant surge nor a drastic drop.

- Gradual Institutional Adoption: A moderate level of institutional investment and regulatory clarity would lead to steady, rather than explosive, growth. This would involve a more measured uptake of Bitcoin by institutional investors compared to the bullish scenario.

- Balanced Market Sentiment: Investor sentiment would remain relatively neutral, with neither excessive optimism nor widespread fear dominating the market. This scenario reflects a more balanced approach compared to the extremes of the bullish and bearish scenarios.

- Technological Maturation: Technological advancements would continue, but their impact on the price would be less dramatic than in the bullish scenario, leading to a more gradual increase in adoption and price appreciation.

Investing in Bitcoin in the UK

Investing in Bitcoin presents a unique set of opportunities and risks for UK residents. The cryptocurrency market’s inherent volatility and the evolving regulatory landscape necessitate a thorough understanding before committing capital. This section will explore the potential benefits and drawbacks, examining various investment strategies and their associated risk profiles.

Bitcoin Investment Risks in the UK

Bitcoin’s price is notoriously volatile, subject to significant fluctuations driven by market sentiment, regulatory announcements, technological developments, and macroeconomic factors. A sharp downturn can lead to substantial losses, potentially exceeding the initial investment. Regulatory uncertainty in the UK, and globally, also poses a significant risk. The legal framework surrounding cryptocurrencies is still developing, and changes in regulations could impact the accessibility, taxation, and overall legality of Bitcoin holdings. Furthermore, the decentralized nature of Bitcoin, while a strength in terms of censorship resistance, also means that there’s no central authority to protect investors from scams or hacks. Security breaches affecting exchanges or personal wallets could result in the loss of funds.

Bitcoin Investment Opportunities in the UK

Despite the inherent risks, Bitcoin offers several potential opportunities. Its potential for high returns, particularly during periods of growth, is a significant draw for investors seeking diversification beyond traditional assets like stocks and bonds. Bitcoin’s limited supply (21 million coins) and growing adoption as a store of value and a medium of exchange contribute to its perceived long-term value potential. For UK investors, the relative ease of access to cryptocurrency exchanges and the growing number of Bitcoin-related services offer increased convenience and opportunities for participation in the market. Diversification into Bitcoin can help mitigate risks associated with other investments and potentially enhance overall portfolio performance, although it’s crucial to remember that correlation between Bitcoin and traditional markets isn’t always consistent.

Bitcoin Investment Strategies and Risk Tolerance

Different investment strategies cater to varying risk tolerances. Long-term holding (HODLing) involves purchasing Bitcoin and holding it for an extended period, aiming to benefit from potential long-term price appreciation. This strategy mitigates the impact of short-term volatility but requires patience and a high risk tolerance, as it could tie up capital for a significant amount of time with no guaranteed return. Day trading, on the other hand, involves frequent buying and selling of Bitcoin to capitalize on short-term price movements. This requires significant market knowledge, technical analysis skills, and a high tolerance for risk, as it’s susceptible to quick losses. A balanced approach, combining elements of both long-term holding and strategic short-term trades, could potentially optimize risk and reward, depending on individual circumstances and market conditions. It’s crucial to only invest what one can afford to lose and to conduct thorough research before adopting any investment strategy. Seeking advice from a qualified financial advisor is recommended.

Bitcoin’s Role in the UK Fintech Landscape

Bitcoin’s presence within the UK’s burgeoning fintech sector is currently a complex mix of burgeoning adoption and cautious regulatory oversight. While not yet mainstream, its influence is steadily growing, impacting various aspects of the financial landscape and prompting significant debate about its long-term implications.

The current state of Bitcoin adoption within the UK’s financial technology sector is characterized by a cautious yet optimistic approach. Several fintech companies are integrating Bitcoin and other cryptocurrencies into their services, offering trading platforms, custodial solutions, and even Bitcoin-based payment options. However, widespread adoption remains limited by regulatory uncertainty and the inherent volatility of the cryptocurrency market. Many traditional financial institutions are observing from the sidelines, carefully assessing the risks and potential benefits before committing significant resources.

Bitcoin’s Potential Future Impact on Traditional Financial Institutions and Payment Systems

Bitcoin’s potential future impact on established financial institutions and payment systems in the UK is multifaceted. Its decentralized nature challenges the centralized control exerted by traditional banks and payment processors. The potential for faster, cheaper, and more transparent cross-border payments using Bitcoin could disrupt existing systems, forcing traditional players to adapt or risk losing market share. However, concerns about security, scalability, and regulatory compliance continue to hinder widespread adoption within the mainstream financial system. The future likely involves a hybrid model, where Bitcoin and traditional systems coexist and potentially integrate, rather than a complete replacement. For example, a bank might offer Bitcoin custodial services alongside traditional banking products.

The Role of Regulatory Bodies in Shaping the Future of Bitcoin in the UK

Regulatory bodies like the Financial Conduct Authority (FCA) play a crucial role in shaping the future of Bitcoin and other cryptocurrencies in the UK. The FCA’s approach is one of careful regulation, aiming to balance innovation with consumer protection. This involves setting clear guidelines for cryptocurrency businesses operating in the UK, addressing issues such as anti-money laundering (AML) and combating the financing of terrorism (CFT). The FCA’s actions will significantly influence the pace and direction of Bitcoin adoption within the UK, determining the level of access for consumers and the degree of integration with the existing financial infrastructure. Their stance on stablecoins and other crypto-assets will also be key in shaping the overall crypto landscape.

Bitcoin’s Disruptive and Enhancing Potential within the UK Financial System

Imagine a future where international remittances to family members in developing countries are processed instantly and cheaply using Bitcoin, bypassing traditional banking fees and delays. This illustrates Bitcoin’s potential to enhance financial inclusion and efficiency. Conversely, the decentralized and pseudonymous nature of Bitcoin could also be exploited for illicit activities, presenting challenges for law enforcement and regulators. The UK’s financial system could see a significant shift in how cross-border payments are handled, potentially leading to increased competition and innovation in the payments sector. Simultaneously, the need for robust AML/CFT measures will become even more critical to prevent the misuse of Bitcoin for illegal activities. The challenge for the UK will be to harness the positive potential of Bitcoin while mitigating its risks effectively.

Frequently Asked Questions (FAQs) about Bitcoin Price in the UK in 2025: Bitcoin Price Uk 2025

Predicting the price of Bitcoin is inherently speculative, but by analyzing various factors, we can form reasonable expectations for its potential value in the UK market by 2025. This section addresses common questions surrounding Bitcoin’s price trajectory in the UK during that period.

Key Factors Driving Bitcoin Price Predictions for the UK in 2025

Several interconnected factors influence Bitcoin price predictions for the UK in 2025. These include global macroeconomic conditions (inflation, recessionary pressures, etc.), regulatory developments within the UK and globally, technological advancements in the cryptocurrency space (like layer-2 scaling solutions), adoption rates among both individuals and businesses, and overall market sentiment. For example, a global economic downturn might drive investors towards Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, stringent regulations could dampen investor enthusiasm and suppress price growth. The level of mainstream adoption by businesses and consumers in the UK will also significantly impact demand and therefore price.

The UK Government’s Regulatory Stance and its Effect on Bitcoin’s Price

The UK government’s approach to regulating cryptocurrencies directly impacts Bitcoin’s price. A clear, well-defined regulatory framework could foster investor confidence and attract institutional investment, potentially driving up the price. Conversely, overly restrictive or uncertain regulations could create market volatility and potentially suppress price growth. The UK’s stance relative to other major global economies also plays a role; if the UK becomes less crypto-friendly compared to other jurisdictions, this could negatively impact the UK Bitcoin market specifically. For instance, a ban on certain crypto activities could cause a significant price drop.

Potential Risks and Rewards of Investing in Bitcoin in the UK

Investing in Bitcoin carries both significant risks and potential rewards. Rewards include the possibility of substantial returns, given Bitcoin’s historical volatility. However, risks are equally substantial, including extreme price volatility, regulatory uncertainty, security risks associated with holding Bitcoin (e.g., exchange hacks, loss of private keys), and the potential for complete loss of investment. It’s crucial for UK investors to understand these risks before investing and to only invest what they can afford to lose. The high volatility, for example, means a significant investment could lose a substantial portion of its value quickly.

Realistic Price Targets for Bitcoin in the UK in 2025

Predicting specific price targets is extremely challenging. However, based on various analyses and considering the factors mentioned previously, some analysts might suggest a range, perhaps between £30,000 and £100,000 per Bitcoin by 2025. This is purely speculative, and the actual price could be significantly higher or lower. It’s vital to remember that these are just potential scenarios and not guaranteed outcomes. Historical price movements provide some context, but past performance is not indicative of future results.

Safely Investing in Bitcoin in the UK, Bitcoin Price Uk 2025

Investing in Bitcoin safely requires careful consideration. Choose reputable and regulated cryptocurrency exchanges operating within the UK’s legal framework. Securely store your Bitcoin using hardware wallets or reputable software wallets, prioritizing strong password management and two-factor authentication. Diversify your investment portfolio, rather than putting all your eggs in one basket. Thoroughly research and understand the risks before investing, and only invest an amount you can comfortably afford to lose. Consider consulting a financial advisor before making any investment decisions. For example, using a reputable exchange like Coinbase or Kraken offers a degree of protection compared to less-regulated platforms.

Bitcoin Price Uk 2025 – Predicting the Bitcoin price in the UK for 2025 is challenging, given the cryptocurrency’s volatility. However, broader predictions can offer some insight; for example, you might find analyses like those presented in a recent article on Ai Bitcoin Price Prediction 2025 Forbes , which could inform your understanding of potential global trends. Ultimately, though, the UK Bitcoin price will be influenced by a range of global and local factors.

Predicting the Bitcoin price in the UK for 2025 is challenging, as it’s intrinsically linked to global market trends. Understanding the broader picture of the Bitcoin Price In 2025 is crucial for any UK-based forecast. Therefore, while regional factors might influence the final figure, the overall global price will significantly impact the Bitcoin Price Uk 2025.

Predicting the Bitcoin price in the UK for 2025 is challenging, as numerous factors influence its value. To understand potential price movements, it’s helpful to consider broader global predictions; for instance, check out this insightful resource on What Will Bitcoin Be Worth 2025 which offers valuable perspectives. Ultimately, the UK Bitcoin price will likely reflect global trends, though local regulations and market sentiment could introduce variations.

Predicting the Bitcoin price in the UK for 2025 is challenging, as various global factors influence its value. To gain a broader perspective on potential future price movements, it’s helpful to consult resources like this comprehensive analysis: Bitcoin Price Prediction 2025 Re. Understanding these broader predictions can then inform a more nuanced assessment of the Bitcoin price in the UK specifically for 2025.

Predicting the Bitcoin price in the UK for 2025 is challenging, influenced by global market trends and regulatory changes. A key factor to consider is the potential price movement throughout the year; for instance, to understand potential trajectories, checking the predicted Btc Price June 2025 could offer valuable insight. Ultimately, the Bitcoin Price UK 2025 will depend on a complex interplay of factors, making precise forecasting difficult.