Predictive Models and Forecasting Methods

Predicting the price of Bitcoin in 2025, or any future date, is inherently challenging. Numerous models and methodologies exist, each with its strengths and limitations, attempting to forecast this volatile asset’s trajectory. The accuracy of these predictions depends heavily on the model’s assumptions and the accuracy of the input data.

Several forecasting methodologies are employed in Bitcoin price prediction. These range from relatively simple technical analysis to complex econometric models incorporating macroeconomic indicators. Understanding the nuances of each approach is crucial for interpreting any price prediction.

Comparison of Forecasting Methodologies

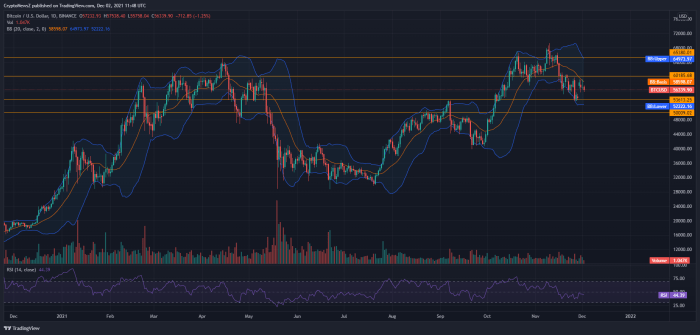

Technical analysis, a widely used approach, relies on historical price and volume data to identify patterns and trends. Indicators like moving averages, relative strength index (RSI), and Bollinger Bands are frequently used to predict future price movements. However, this method is inherently backward-looking and assumes past patterns will repeat, which is not always the case in the highly volatile cryptocurrency market. In contrast, fundamental analysis considers factors such as Bitcoin’s adoption rate, network security, and regulatory landscape to estimate its intrinsic value. This approach attempts to determine a fair price based on underlying fundamentals, rather than relying solely on historical price action. Econometric models, often used in finance, incorporate various factors (e.g., macroeconomic indicators, trading volume, social media sentiment) into sophisticated statistical models to generate price forecasts. These models can be quite complex and require significant computational power and expertise. However, their accuracy depends on the quality and relevance of the input data and the model’s ability to capture the complex dynamics of the Bitcoin market.

Limitations of Using Historical Data

While historical data is essential for any forecasting exercise, relying solely on it to predict future Bitcoin prices has significant limitations. The cryptocurrency market is relatively young and highly susceptible to unpredictable events – regulatory changes, technological advancements, or significant market events – that can drastically alter price trends. Past performance, therefore, is not necessarily indicative of future results. Furthermore, the Bitcoin market exhibits characteristics of a speculative asset, meaning that price movements are often driven by sentiment and speculation rather than purely fundamental factors. This makes it difficult for purely data-driven models to accurately capture the full spectrum of price-influencing factors. For example, the rapid price increases in 2017 and 2021 were driven by speculative bubbles, which are difficult to predict using historical data alone.

Role of Macroeconomic Factors

Macroeconomic factors play a significant role in Bitcoin’s price movements. Inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing its demand and price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to price declines. Government policies and regulations, such as tax laws related to cryptocurrency trading or restrictions on cryptocurrency use, can also significantly impact Bitcoin’s price. The correlation between Bitcoin’s price and macroeconomic indicators is not always consistent and can change over time, making accurate prediction challenging. For instance, the 2022 bear market was partially attributed to rising interest rates and increased inflation globally, demonstrating the influence of macroeconomic trends.

Impact of Regulatory Changes

Regulatory changes significantly influence Bitcoin’s price. Favorable regulations can increase investor confidence and drive adoption, leading to price increases. Conversely, stringent regulations or outright bans can negatively impact Bitcoin’s price by reducing its liquidity and accessibility. The regulatory landscape is constantly evolving, and predicting future regulatory actions is difficult, adding another layer of uncertainty to Bitcoin price forecasting. The varying regulatory approaches adopted by different countries highlight this uncertainty; a positive regulatory development in one jurisdiction might not necessarily translate into a similar impact globally. For example, the differing regulatory stances of the US and China have had contrasting impacts on Bitcoin’s price at different times.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025, or any future date, is inherently complex. Numerous intertwined factors contribute to its volatility and long-term trajectory, making accurate forecasting challenging. However, by analyzing key influences, we can gain a better understanding of potential price movements. This section will explore some of the most significant factors likely to shape Bitcoin’s value in the coming years.

Technological Advancements

Technological innovation plays a crucial role in Bitcoin’s evolution and price. Improvements in scalability, transaction speed, and security directly impact user experience and adoption rates. For example, the development and implementation of layer-2 scaling solutions, such as the Lightning Network, aim to address Bitcoin’s current limitations in transaction throughput. Successful widespread adoption of these solutions could significantly reduce transaction fees and increase the network’s capacity, potentially driving up demand and price. Conversely, a failure to address scalability issues could hinder growth and limit price appreciation. Furthermore, advancements in privacy-enhancing technologies could also positively influence Bitcoin’s appeal to a broader user base.

Institutional Investor Adoption

The growing involvement of institutional investors, such as large corporations and investment firms, represents a significant shift in Bitcoin’s market dynamics. Their entry signals a growing level of legitimacy and acceptance within the traditional financial world. As these institutions allocate larger portions of their portfolios to Bitcoin, it can lead to increased demand and price stability. However, the extent of institutional adoption remains uncertain and depends on various factors, including regulatory clarity, market sentiment, and the overall macroeconomic environment. For instance, the increasing number of publicly traded companies holding Bitcoin on their balance sheets indicates a growing confidence in its long-term value.

Competition from Other Cryptocurrencies

Bitcoin faces competition from a diverse range of alternative cryptocurrencies (altcoins), each with its unique features and functionalities. The emergence of altcoins with faster transaction speeds, lower fees, or enhanced smart contract capabilities could potentially divert some investment away from Bitcoin, impacting its market dominance. However, Bitcoin’s first-mover advantage, established brand recognition, and robust security infrastructure continue to provide it with a significant competitive edge. The continued dominance of Bitcoin will likely depend on its ability to adapt and innovate to maintain its position as the leading cryptocurrency. For example, Ethereum’s rise as a platform for decentralized applications (dApps) highlights the competitive landscape.

Public Perception and Media Coverage

Public perception and media coverage significantly influence Bitcoin’s price. Positive news, such as regulatory approvals or large-scale adoption by major companies, tends to drive up prices. Conversely, negative news, including regulatory crackdowns or security breaches, can lead to significant price drops. The narrative surrounding Bitcoin, whether it is portrayed as a revolutionary technology or a speculative bubble, shapes investor sentiment and market behavior. This influence highlights the importance of responsible and accurate reporting on Bitcoin’s developments and potential. Examples of this include periods of intense media focus on Bitcoin, leading to price surges or crashes, depending on the overall tone of the coverage.

Potential Price Scenarios for 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on numerous interconnected factors. While no one can definitively state the price, exploring potential scenarios based on different assumptions allows for a more informed understanding of the possibilities. The following Artikels three distinct scenarios – bullish, neutral, and bearish – each with its own set of underlying assumptions and justifications.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes continued widespread adoption of Bitcoin as a store of value and a medium of exchange. Strong institutional investment, driven by factors such as increasing regulatory clarity and the maturation of the cryptocurrency market, will be a key driver. Technological advancements, such as the Lightning Network improving scalability and transaction speeds, will also contribute to increased usability. Furthermore, macroeconomic factors like persistent inflation and geopolitical instability could bolster Bitcoin’s appeal as a hedge against traditional assets.

| Scenario | Price Range | Justification |

|---|---|---|

| Bullish | $150,000 – $250,000 | Sustained institutional investment, widespread adoption, technological improvements, and macroeconomic factors driving demand. This scenario mirrors the historical growth trajectory, albeit at a potentially accelerated pace, similar to the price appreciation seen between 2017 and 2021, albeit potentially more sustained. |

Neutral Scenario: Consolidation and Gradual Growth

The neutral scenario assumes a period of consolidation for Bitcoin, characterized by moderate price fluctuations around current levels. While adoption continues, it proceeds at a slower pace than in the bullish scenario. Institutional investment remains steady, but there’s no significant surge. Regulatory uncertainty persists, hindering wider mainstream adoption. Technological advancements continue, but their impact on price is less dramatic than in the bullish scenario. This scenario reflects a more measured growth trajectory, similar to the post-2017 period where Bitcoin experienced several years of relatively stable growth before its next major bull run.

| Scenario | Price Range | Justification |

|---|---|---|

| Neutral | $50,000 – $100,000 | Moderate adoption, steady institutional investment, persistent regulatory uncertainty, and gradual technological improvements leading to consistent, yet less dramatic, price appreciation. This reflects a more stable growth trajectory compared to previous cycles. |

Bearish Scenario: Regulatory Crackdown and Market Correction

This scenario anticipates a significant market correction, potentially triggered by stricter government regulations globally. A regulatory crackdown could severely limit Bitcoin’s usability and investment appeal. Negative macroeconomic conditions, such as a global recession, could also contribute to a prolonged bear market. A loss of investor confidence, perhaps due to a major security breach or a significant market manipulation event, could further exacerbate the decline. This scenario would be similar to the 2018-2019 bear market, where Bitcoin’s price dropped significantly before recovering.

| Scenario | Price Range | Justification |

|---|---|---|

| Bearish | $20,000 – $40,000 | Stringent government regulations, negative macroeconomic conditions, and a loss of investor confidence leading to a significant price correction. This scenario considers the potential impact of unforeseen events and a prolonged period of market uncertainty. |

Risks and Uncertainties: Bitcoin Price Usd 2025 Prediction

Investing in Bitcoin, like any other asset class, carries inherent risks. While the potential for high returns is alluring, it’s crucial to understand the volatility and uncertainties involved before committing capital. The decentralized nature of Bitcoin, while a strength, also contributes to its susceptibility to various unpredictable factors.

Predicting the future price of Bitcoin with certainty is impossible. Numerous unforeseen events could significantly impact its value, leading to both substantial gains and devastating losses. A comprehensive understanding of these risks is paramount for informed decision-making.

Regulatory Crackdowns

Government regulations play a significant role in shaping the cryptocurrency landscape. Increased regulatory scrutiny, ranging from outright bans to stringent trading restrictions, could dramatically reduce Bitcoin’s accessibility and liquidity, negatively impacting its price. For example, China’s crackdown on cryptocurrency mining and trading in 2021 led to a significant price correction. Similar actions by other major economies could trigger similar, or even more severe, consequences. The regulatory environment remains fluid and unpredictable, presenting a considerable risk to Bitcoin investors.

Technological Disruptions, Bitcoin Price Usd 2025 Prediction

Bitcoin’s technology is not immune to vulnerabilities. While the blockchain technology is generally considered secure, the possibility of unforeseen technological disruptions, such as successful hacking attempts or the emergence of superior alternative cryptocurrencies, cannot be ruled out. A major security breach, for instance, could erode investor confidence and cause a sharp decline in price. Furthermore, the development of more efficient and scalable blockchain technologies could potentially render Bitcoin less competitive in the long run.

Market Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile. Significant price swings, both upward and downward, are common occurrences. These fluctuations can be triggered by a variety of factors, including news events, market sentiment, and regulatory developments. For example, the price of Bitcoin has experienced dramatic increases and decreases of hundreds of percent in relatively short periods. This inherent volatility presents a significant risk for investors with lower risk tolerance.

Diversification within a Cryptocurrency Portfolio

Given the inherent risks associated with Bitcoin, diversification is crucial for mitigating potential losses. A well-diversified cryptocurrency portfolio should include a range of different cryptocurrencies with varying characteristics and market capitalizations. This strategy helps to reduce the impact of any single asset’s underperformance on the overall portfolio value. For example, an investor might allocate a portion of their portfolio to Bitcoin, while also investing in other established cryptocurrencies like Ethereum or stablecoins, thus reducing their overall exposure to the risks associated with Bitcoin alone. Diversification does not eliminate risk entirely, but it significantly reduces the impact of any single negative event.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is notoriously difficult, even for seasoned experts. A range of opinions exists, influenced by differing analytical methodologies and interpretations of market dynamics. Understanding these perspectives and the overall market sentiment is crucial for navigating the complexities of Bitcoin’s future price trajectory. This section will explore the diverse viewpoints of leading analysts and the prevailing market sentiment, offering a nuanced understanding of potential price movements in 2025.

Expert opinions on Bitcoin’s 2025 price vary widely, reflecting the inherent volatility and uncertainty surrounding the cryptocurrency market. Some analysts, bullish on Bitcoin’s long-term prospects, predict prices well above $100,000, citing factors such as increasing institutional adoption, growing global demand, and limited supply. Others hold more conservative views, forecasting prices in a range from $50,000 to $80,000, highlighting the potential impact of regulatory uncertainty, macroeconomic factors, and the emergence of competing cryptocurrencies. A few analysts even express bearish sentiment, anticipating lower prices due to concerns about market saturation or technological disruption. These differing perspectives highlight the complexity of accurately predicting Bitcoin’s future price.

Leading Analyst Opinions

The opinions of leading cryptocurrency analysts are diverse and often reflect their individual investment strategies and risk tolerances. For instance, some analysts who are fundamentally bullish on Bitcoin’s long-term value might predict a price of $150,000 or more by 2025, based on their assessment of its potential as a store of value and its increasing adoption by institutional investors. Conversely, analysts who prioritize short-term market trends and technical analysis might predict a more moderate price range, perhaps between $50,000 and $80,000, factoring in potential market corrections and the impact of macroeconomic factors. These predictions should be viewed as informed speculation, not guaranteed outcomes.

Current Market Sentiment and its Influence

Current market sentiment towards Bitcoin is a dynamic factor influencing price movements. Periods of strong investor confidence, often fueled by positive news such as regulatory clarity or significant technological advancements, can drive prices upward. Conversely, periods of uncertainty, triggered by regulatory crackdowns, market crashes, or negative news coverage, can lead to price declines. The overall sentiment can be gauged through various indicators, including social media trends, news articles, and investor surveys. A predominantly bullish sentiment usually correlates with price increases, while a bearish sentiment often precedes price corrections. For example, the market’s reaction to the collapse of FTX in late 2022 demonstrated how negative news can significantly impact sentiment and, consequently, Bitcoin’s price.

Visual Representation of Expert Predictions and Market Sentiment

Imagine a graph with the horizontal axis representing the predicted Bitcoin price in USD (ranging from $0 to $200,000) and the vertical axis representing the number of analysts predicting that price. A bell curve would be plotted, showing a cluster of predictions around a central point (perhaps $75,000), with a long tail extending to higher prices representing the bullish predictions and a shorter tail to lower prices representing the bearish predictions. This central point would represent the average prediction. Overlayed on this graph would be a separate line representing market sentiment over time. This line would fluctuate above and below a neutral baseline, with peaks indicating periods of strong bullish sentiment and troughs indicating periods of bearish sentiment. The graph would visually demonstrate the distribution of expert opinions and how market sentiment influences the potential price range. The visual clearly shows the range of predictions, highlighting the uncertainty inherent in forecasting Bitcoin’s future price and how shifts in market sentiment can impact those predictions.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset, requires a well-defined strategy that aligns with your financial goals and risk tolerance. It’s crucial to approach Bitcoin investment with a balanced perspective, understanding both its potential for high returns and the inherent volatility. A sound strategy involves careful planning, thorough research, and a realistic assessment of your risk appetite.

Developing a sound investment strategy necessitates a comprehensive understanding of your personal financial situation and investment objectives. This includes evaluating your risk tolerance, defining your investment timeframe, and setting realistic expectations for potential returns. It’s also crucial to diversify your portfolio to mitigate risk, rather than concentrating all your investments in Bitcoin. Remember, past performance is not indicative of future results.

Risk Tolerance and Due Diligence

Understanding your risk tolerance is paramount before investing in Bitcoin. Bitcoin’s price is notoriously volatile, experiencing significant swings in short periods. Investors with a low risk tolerance might only allocate a small percentage of their portfolio to Bitcoin, while those with higher risk tolerance might allocate a larger percentage. Due diligence involves thorough research into Bitcoin’s technology, market trends, regulatory landscape, and potential risks. This might involve studying white papers, analyzing market data, and staying informed about relevant news and developments. Failing to conduct adequate due diligence can lead to significant financial losses. For example, an investor who ignores warnings about a potential regulatory crackdown might experience substantial losses if such a crackdown occurs.

Strategies for Mitigating Potential Losses

Several strategies can help mitigate potential losses when investing in Bitcoin. Dollar-cost averaging (DCA) is a popular approach where investors invest a fixed amount of money at regular intervals, regardless of the price. This strategy reduces the risk of investing a large sum at a market peak. Another strategy is to diversify your cryptocurrency holdings, investing in multiple cryptocurrencies rather than solely in Bitcoin. This diversification reduces the impact of a single cryptocurrency’s price decline on your overall portfolio. For instance, if Bitcoin experiences a downturn, other cryptocurrencies in your portfolio might perform better, cushioning the overall loss. Furthermore, setting stop-loss orders can help limit potential losses by automatically selling your Bitcoin if the price falls below a predetermined level. Finally, keeping a long-term perspective is crucial. While short-term price fluctuations are common, Bitcoin’s long-term value proposition is often cited as a reason for long-term investment. However, this long-term perspective should be balanced with a realistic understanding of market risks.

Frequently Asked Questions

Predicting the future price of Bitcoin is inherently complex, involving numerous intertwined factors. The following addresses common questions regarding Bitcoin’s price in 2025 and the associated risks and rewards of investment. Remember that any investment carries risk, and past performance is not indicative of future results.

Bitcoin’s Most Likely Price in 2025

Predicting a precise Bitcoin price for 2025 is impossible. Numerous variables, including regulatory changes, technological advancements, macroeconomic conditions, and overall market sentiment, significantly influence its value. While various predictive models exist, offering price ranges from several thousand dollars to tens of thousands, these are merely estimations based on assumptions that may or may not hold true. For example, a model might predict a price based on historical growth rates, but unforeseen events, such as a major regulatory crackdown, could drastically alter the trajectory. Therefore, it’s more prudent to consider a range of possibilities rather than a single, definitive prediction. Focusing on the underlying technology and its potential long-term adoption is a more reliable approach than chasing specific price targets.

Investing in Bitcoin: Is it Too Late?

Whether it’s “too late” to invest in Bitcoin is subjective and depends on individual risk tolerance and investment goals. While Bitcoin has experienced significant price fluctuations, its underlying technology continues to evolve and gain wider adoption. The potential for future growth remains, but so do significant risks. Investing now might mean higher potential rewards, but also higher potential losses compared to earlier investment periods. Conversely, waiting might mitigate some risk but could also mean missing out on potential gains. A thorough risk assessment and understanding of your own financial situation are crucial before making any investment decisions.

Risks Involved in Bitcoin Investment

Investing in Bitcoin carries considerable risk. Price volatility is a major concern; Bitcoin’s price has historically experienced dramatic swings, resulting in substantial gains or losses in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. This could lead to restrictions on trading, taxation, or even outright bans. Security risks are also significant; exchanges and individual wallets are vulnerable to hacking, and users could lose their investments. Furthermore, the lack of intrinsic value in Bitcoin means its price is entirely driven by market sentiment and speculation, making it highly susceptible to market manipulation and speculative bubbles. Finally, the decentralized and unregulated nature of Bitcoin can lead to difficulties in resolving disputes or recovering losses.

Potential Rewards of Bitcoin Investment

Despite the risks, the potential rewards of Bitcoin investment are considerable. Historical price appreciation has been substantial, although past performance is not a guarantee of future returns. Bitcoin’s limited supply (21 million coins) could lead to scarcity-driven price increases in the future. Furthermore, increasing adoption by businesses and institutions could bolster its value and legitimacy. Successful long-term investment in Bitcoin could lead to significant financial gains, potentially exceeding the returns of traditional investment assets. However, it’s crucial to remember that these potential rewards come with substantial risk, and investors could lose a significant portion or all of their investment.

Bitcoin Price Usd 2025 Prediction – Predicting the Bitcoin price in USD for 2025 is challenging, requiring analysis of various market factors. A key aspect of this involves understanding the trajectory throughout the year, and a granular look at a specific month can offer valuable insight. For example, examining the potential price in October provides a data point; you can find a dedicated analysis on this at Bitcoin Price Prediction October 2025.

This contributes to a broader understanding needed for a more comprehensive Bitcoin Price Usd 2025 Prediction.

Predicting the Bitcoin price in USD for 2025 is inherently speculative, but several factors influence potential outcomes. A key event to consider is the Bitcoin Mining Halving in 2025, as detailed in this informative article: Bitcoin Mining Halving 2025. This halving, reducing the rate of new Bitcoin creation, could significantly impact scarcity and potentially drive up the price, though other market forces will certainly play a role in the ultimate 2025 value.

Predicting the Bitcoin price in USD for 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the next Bitcoin halving, which significantly alters the rate of new Bitcoin creation. For insightful analysis on this crucial event, check out this resource on Bitcoin Halving Price Prediction 2025. Understanding the halving’s potential effects is essential for any comprehensive Bitcoin price prediction in 2025.

Predicting the Bitcoin price in USD for 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming Bitcoin halving, which significantly affects the rate of new Bitcoin creation. To track the countdown to this pivotal event, check out the Bitcoin Halving Clock 2025 for a clearer understanding of its timing.

Ultimately, the halving’s influence on scarcity and potential price increases remains a major factor in any Bitcoin price prediction for 2025.

Predicting the Bitcoin price in USD for 2025 is a complex undertaking, influenced by numerous factors. For a comprehensive overview of potential scenarios, including technological advancements and regulatory changes, it’s helpful to consult broader analyses like those found on sites such as Bitcoin Prediction For 2025. Understanding these broader predictions is crucial for forming a well-rounded perspective on the Bitcoin price in USD by 2025.

Predicting the Bitcoin price in USD for 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting price predictions is the Bitcoin halving, and to understand its influence, it’s important to know if it occurred as scheduled; check this resource to confirm: Did Bitcoin Halving Happen 2025. Ultimately, the halving’s impact on scarcity and subsequent price movements significantly affects Bitcoin’s projected USD value in 2025.