Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging, given the cryptocurrency’s volatility and susceptibility to a wide array of interconnected factors. However, by analyzing key economic, technological, regulatory, and market-driven influences, we can formulate a more informed perspective on potential price trajectories.

Global Economic Trends and Bitcoin’s Price

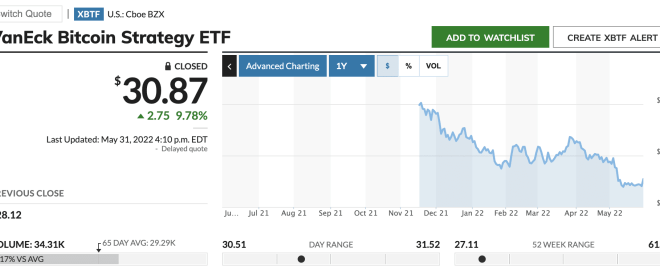

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, might drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a global recession could lead to risk-aversion among investors, causing them to sell off assets like Bitcoin, resulting in price drops. The strength of the US dollar, a significant factor in global markets, also plays a crucial role; a stronger dollar often correlates with lower Bitcoin prices, while a weaker dollar can boost Bitcoin’s appeal. For example, the 2022 inflationary environment saw increased Bitcoin adoption in some countries experiencing high inflation, while the broader economic downturn contributed to a significant price correction.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem are crucial for long-term price appreciation. Layer-2 scaling solutions, like the Lightning Network, aim to increase transaction speed and reduce fees, making Bitcoin more practical for everyday use. Widespread adoption of these solutions could boost Bitcoin’s utility and attract more users, potentially driving price increases. Furthermore, institutional adoption, with larger companies and financial institutions holding Bitcoin as an asset, adds legitimacy and potentially stabilizes price volatility. The increasing sophistication of Bitcoin mining hardware and energy efficiency improvements also contribute to a more robust and sustainable network, impacting its long-term value.

Regulatory Frameworks and Government Policies

Government regulations and policies profoundly influence Bitcoin’s price. Favorable regulations, such as clear guidelines for Bitcoin taxation and usage, could foster wider adoption and investor confidence, potentially pushing prices upward. Conversely, restrictive regulations, such as outright bans or excessive taxation, could stifle growth and negatively impact the price. The varied regulatory approaches across different countries present a complex landscape. For instance, El Salvador’s adoption of Bitcoin as legal tender significantly boosted Bitcoin’s visibility, while China’s crackdown on cryptocurrency mining had a considerably negative impact on its price.

Market Sentiment, Investor Behavior, and Media Coverage

Market sentiment, investor behavior, and media narratives are significant drivers of Bitcoin’s price volatility. Positive media coverage and widespread adoption by institutional investors can fuel bullish sentiment, leading to price increases. Conversely, negative news, regulatory uncertainty, or high-profile security breaches can trigger sell-offs and price declines. The “fear and greed” index, which gauges investor sentiment, often reflects these market shifts. Significant price swings, such as those experienced in 2021 and 2022, highlight the impact of market psychology on Bitcoin’s price. The influence of social media and prominent figures in the crypto space also significantly shapes public perception and trading activity.

Risks and Opportunities in Bitcoin Investment for 2025: Bitcoin Price Usd Prediction 2025 Forbes

Investing in Bitcoin presents a unique blend of substantial risk and considerable potential reward. The cryptocurrency market’s inherent volatility, coupled with evolving regulatory landscapes and technological vulnerabilities, necessitates a thorough understanding of both the upside and downside before committing capital. The following sections detail the key risks and opportunities associated with Bitcoin investment in 2025, alongside strategies for mitigating potential losses.

Price Volatility

Bitcoin’s price is notoriously volatile, subject to significant fluctuations driven by market sentiment, regulatory changes, technological advancements, and macroeconomic factors. For example, the 2021 bull run saw Bitcoin’s price surge to nearly $69,000, only to subsequently undergo a substantial correction. This volatility creates both opportunities for significant profits and the substantial risk of substantial losses. Investors must be prepared for periods of sharp price declines and understand their risk tolerance before entering the market. Past performance, as demonstrated by these price swings, is not indicative of future results.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin remains fluid and varies significantly across jurisdictions. Governments worldwide are still grappling with how to classify and regulate cryptocurrencies, leading to uncertainty regarding taxation, legal protections, and operational restrictions. Changes in regulatory frameworks can dramatically impact Bitcoin’s price and accessibility, presenting a significant risk to investors. For instance, a sudden ban on Bitcoin trading in a major market could trigger a significant price drop. Staying informed about regulatory developments is crucial for navigating this risk.

Security Breaches

Bitcoin exchanges and wallets are not immune to security breaches. Hacking incidents, theft, and scams pose a significant risk to investors. The loss of private keys or compromised exchanges can result in the irreversible loss of funds. While security measures are constantly improving, the inherent risks associated with digital assets remain. The Mt. Gox exchange hack in 2014, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of these potential vulnerabilities.

Long-Term Growth Potential and Adoption Rate

Despite the risks, Bitcoin’s potential for long-term growth remains a significant draw for investors. Its decentralized nature, limited supply, and increasing adoption as a store of value and medium of exchange suggest a potential for continued price appreciation over the long term. Growing institutional adoption, coupled with increasing mainstream awareness, could further fuel Bitcoin’s growth. The integration of Bitcoin into payment systems and financial services could also drive demand and price appreciation. The example of PayPal’s integration of Bitcoin illustrates the potential impact of mainstream adoption.

Strategies for Mitigating Risk

Effective risk mitigation strategies are crucial for navigating the Bitcoin market. Diversification across different asset classes, including traditional investments, is essential to reduce overall portfolio risk. Investors should also carefully assess their risk tolerance and only invest an amount they are comfortable potentially losing. Employing responsible investment practices, such as conducting thorough research and avoiding impulsive decisions, can significantly reduce the risk of financial losses. Regularly reviewing and adjusting one’s investment strategy based on market conditions is also advisable.

Advantages and Disadvantages of Investing in Bitcoin in 2025, Bitcoin Price Usd Prediction 2025 Forbes

Before investing, consider the following:

- Advantages: Potential for high returns, decentralized and censorship-resistant nature, increasing adoption, potential as a hedge against inflation.

- Disadvantages: High price volatility, regulatory uncertainty, security risks, potential for scams and fraud, lack of consumer protection.

Frequently Asked Questions about Bitcoin Price Predictions

Predicting the future price of Bitcoin is inherently speculative, but understanding the range of possibilities and the factors influencing those predictions is crucial for any potential investor. While no one can definitively say what Bitcoin’s price will be in 2025, analyzing various predictions and considering the underlying market dynamics provides a more informed perspective.

Bitcoin Price Predictions for 2025: Optimistic and Pessimistic Views

The range of Bitcoin price predictions for 2025 is vast, reflecting the inherent volatility of the cryptocurrency market. Optimistic predictions, often found on more bullish platforms or from analysts with a positive outlook, might suggest prices reaching tens of thousands, or even hundreds of thousands, of dollars per Bitcoin. These predictions often hinge on factors like widespread adoption, increased institutional investment, and positive regulatory developments. Conversely, pessimistic predictions might point to significantly lower prices, perhaps even below current levels, citing concerns such as regulatory crackdowns, market corrections, or the emergence of competing technologies. For example, some analysts have projected prices as low as $10,000, while others have offered much more optimistic forecasts in the $100,000+ range, depending on their assessment of various market factors. The actual price will likely fall somewhere within this wide spectrum, influenced by the interplay of numerous variables.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is notoriously volatile, influenced by factors ranging from global economic events and regulatory changes to social media sentiment and technological advancements. Predictions often rely on complex algorithms, historical data, and subjective interpretations of market trends, all of which are subject to significant uncertainty. Past performance is not indicative of future results, and unexpected events can drastically alter the market landscape. Therefore, it’s crucial to approach any price prediction with a healthy dose of skepticism and understand that they are educated guesses, not guaranteed outcomes. Treating them as potential scenarios rather than certainties is a more responsible approach. Consider them one piece of information among many, not the definitive answer.

Factors to Consider Before Investing in Bitcoin Based on 2025 Predictions

Before investing in Bitcoin based on any prediction, several crucial factors must be carefully considered. First, assess your personal risk tolerance. Bitcoin is a highly volatile asset; its price can fluctuate dramatically in short periods. Only invest what you can afford to lose. Secondly, determine your investment horizon. Are you looking for short-term gains or long-term growth? Your time horizon will influence your investment strategy and risk tolerance. Thirdly, conduct thorough market research, going beyond just price predictions. Understand the technology behind Bitcoin, its potential applications, and the regulatory environment surrounding it. Finally, diversify your portfolio. Don’t put all your eggs in one basket. Investing in Bitcoin should be part of a broader investment strategy, not your sole investment. Consider other asset classes to mitigate risk.

Reliable Sources of Information Beyond Forbes

While Forbes offers valuable insights, relying on a single source for financial information is unwise. Supplement your research with information from other reputable sources. These include established financial news outlets like the Wall Street Journal, Bloomberg, and Reuters. Additionally, research reports from reputable financial analysis firms can provide in-depth market analysis. Academic papers and white papers on blockchain technology and cryptocurrency can also offer valuable context. Remember to critically evaluate the information you find, considering the source’s potential biases and the methodology used in their analysis. Diversifying your information sources is as crucial as diversifying your investments.

Forbes’ Bitcoin price predictions for 2025 vary widely, depending on the analyst and their underlying assumptions. To get a better grasp of potential price ranges, it’s helpful to explore other forecasts; a useful resource is this article on How Much Is Bitcoin In 2025 , which offers multiple perspectives. Ultimately, understanding these different predictions is key to forming your own informed opinion on the Bitcoin Price Usd Prediction 2025 Forbes offers.

Predicting the Bitcoin price in USD for 2025 is a complex endeavor, with Forbes and other outlets offering varied forecasts. To gain a broader perspective on potential future values, it’s helpful to consult resources like this comprehensive analysis: What Will Bitcoin Cost In 2025. Ultimately, Bitcoin Price Usd Prediction 2025 Forbes projections are just one piece of the puzzle when considering this volatile market.

Several forecasts exist regarding the Bitcoin Price USD prediction for 2025, with Forbes contributing to the ongoing discussion. Understanding these predictions often involves considering various factors, and a helpful resource for comparative analysis is the detailed projection offered by this website: Bitcoin Coin Price 2025. Returning to the Forbes predictions, it’s important to note that these are speculative and influenced by market volatility, making a definitive answer elusive.

Speculation around Bitcoin Price USD Prediction 2025 Forbes is rampant, with various analysts offering widely differing figures. Understanding these predictions requires a broader look at the cryptocurrency market’s overall trajectory. For a comprehensive overview of potential price movements, check out this detailed analysis on Bitcoin Price 2025 Prediction , which can help inform your understanding of the Forbes predictions and their underlying assumptions.

Ultimately, Bitcoin Price USD Prediction 2025 Forbes remains a subject of ongoing debate and analysis.

Numerous forecasts exist regarding the Bitcoin Price USD Prediction 2025, with Forbes contributing to the ongoing discussion. To gain a more granular perspective on potential price movements, it’s helpful to examine specific months. For instance, a detailed analysis of the predicted Bitcoin Price 2025 January can offer valuable insights into the broader trajectory. Ultimately, these individual monthly predictions contribute to a more comprehensive understanding of the overall Bitcoin Price USD Prediction 2025 Forbes analysis.