Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging, given the cryptocurrency’s volatility and susceptibility to a wide array of influences. However, by analyzing key macroeconomic, technological, and adoption-related factors, we can develop a more informed perspective on potential price movements. This analysis considers both positive and negative impacts, acknowledging the complex interplay of these forces.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, strong global economic growth might lead investors to favor more traditional assets, potentially reducing Bitcoin’s appeal. Regulatory changes, particularly those impacting cryptocurrency trading or taxation, can also have a substantial influence. A favorable regulatory environment could boost investor confidence and increase liquidity, while restrictive measures could stifle growth and depress prices. For instance, the increasing acceptance of Bitcoin as a legitimate asset class by governments could lead to greater institutional investment and price appreciation. Conversely, a sudden ban or significant tax increase could lead to a market downturn.

Technological Advancements

Technological developments within the cryptocurrency space will also play a crucial role. Scaling solutions, such as the Lightning Network, aim to improve Bitcoin’s transaction speed and reduce fees. Successful implementation could increase Bitcoin’s usability for everyday transactions, potentially boosting adoption and price. Conversely, the emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin, potentially impacting its market dominance and price. The development of more energy-efficient mining techniques could also be a significant positive factor, reducing the environmental concerns associated with Bitcoin mining.

Institutional and Mainstream Adoption

The level of adoption by institutional investors and mainstream users is a key driver of Bitcoin’s price. Increased institutional investment, such as that seen from large corporations or investment firms, brings greater legitimacy and liquidity to the market, typically leading to price appreciation. Simultaneously, wider mainstream adoption, driven by increased user-friendliness and merchant acceptance, expands the market base and potential for growth. However, a lack of significant institutional or mainstream adoption could limit price growth and leave Bitcoin vulnerable to market fluctuations driven by speculative trading. Consider the impact of PayPal’s integration of Bitcoin; it significantly increased the accessibility of Bitcoin for a large user base.

Geopolitical Events and Global Crises

Geopolitical events and global crises can significantly influence Bitcoin’s price. Periods of political instability or economic uncertainty often lead investors to seek safe-haven assets, including Bitcoin, potentially driving up demand and price. Conversely, major global crises could trigger a sell-off across all asset classes, including Bitcoin, leading to a price decline. For instance, the war in Ukraine in 2022 created significant uncertainty and volatility in the global markets, resulting in Bitcoin price fluctuations.

Summary Table of Influencing Factors

| Factor | Potential Positive Impact | Potential Negative Impact | Overall Assessment |

|---|---|---|---|

| Macroeconomic Conditions (Inflation, Growth) | High inflation drives demand as a hedge; strong growth could increase overall investment. | Strong growth may favor traditional assets; deflationary pressures could reduce demand. | Moderately Positive (dependent on specific economic conditions) |

| Technological Advancements (Scaling, Competition) | Improved scalability and efficiency increase usability; innovation enhances competitiveness. | Competition from superior cryptocurrencies; technological failures or vulnerabilities. | Moderately Positive (dependent on successful innovation and market acceptance) |

| Institutional & Mainstream Adoption | Increased legitimacy and liquidity; expands market base and trading volume. | Lack of adoption limits price growth; negative publicity could deter investment. | Highly Positive (critical driver of long-term growth) |

| Geopolitical Events & Global Crises | Acts as a safe-haven asset during uncertainty; diversification benefits. | Market sell-offs during crises; regulatory crackdowns in response to instability. | Neutral to Negative (highly unpredictable and dependent on the nature of the event) |

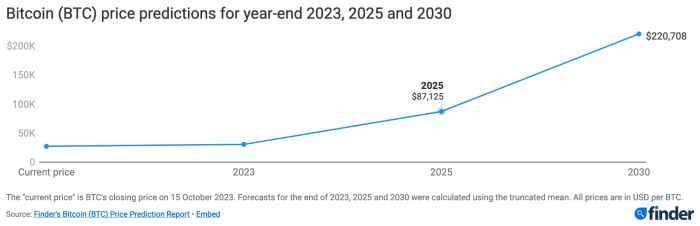

Potential Bitcoin Price Scenarios on January 17, 2025

Predicting Bitcoin’s price with certainty is impossible, but by analyzing current market trends, technological advancements, and macroeconomic factors, we can construct plausible scenarios for its value on January 17, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. It’s crucial to remember that these are educated guesses, and the actual price could deviate significantly.

Bullish Scenario: Bitcoin Surges Past $100,000

This scenario assumes widespread institutional adoption, positive regulatory developments, and continued technological innovation within the Bitcoin ecosystem. Imagine a world where major corporations and governments increasingly embrace Bitcoin as a store of value and a means of payment. Further, imagine significant improvements in Bitcoin’s scalability and transaction speed. This would likely lead to increased demand, driving the price upwards.

The graph depicting this scenario would show a steady, upward trend from the present day, accelerating in the latter half of 2024 and into 2025. The line would steadily climb, possibly experiencing some minor corrections along the way, but ultimately reaching and surpassing the $100,000 mark by January 17, 2025. The final price point would be visually represented as a sharp upward spike near the end of the graph. This bullish trajectory could be fueled by factors such as a global economic shift towards decentralized finance (DeFi) and a significant increase in Bitcoin’s use in cross-border payments, mimicking the growth experienced by the internet in its early stages.

Bearish Scenario: Bitcoin Price Falls Below $20,000

This scenario paints a less optimistic picture. It hinges on several factors, including increased regulatory scrutiny leading to tighter restrictions on cryptocurrency trading, a significant global economic downturn impacting investor confidence, or a major security breach compromising the Bitcoin network. Furthermore, the emergence of a superior competing cryptocurrency could also contribute to a decline in Bitcoin’s dominance and, consequently, its price.

The graphical representation of this scenario would show a downward trend, starting with a gradual decline before accelerating towards the end of 2024. The line would show periods of consolidation, but the overall direction would be clearly bearish. By January 17, 2025, the price would be significantly below its current value, potentially falling below $20,000. This decline could mirror the sharp drop in the stock market during periods of significant economic uncertainty, such as the 2008 financial crisis.

Neutral Scenario: Bitcoin Consolidates Around $50,000

This scenario assumes a more balanced outlook. It suggests that Bitcoin will neither experience a dramatic surge nor a significant crash. Instead, it anticipates a period of consolidation and sideways trading, with the price fluctuating within a relatively narrow range. This would occur if the positive and negative factors largely cancel each other out. Technological advancements might continue, but they would be offset by regulatory uncertainty or slower-than-expected institutional adoption.

The graph in this scenario would display a relatively flat line with minor oscillations around the $50,000 mark throughout 2024 and into early 2025. The line would exhibit some volatility, representing the natural fluctuations within the cryptocurrency market, but the overall trend would be largely horizontal. This could be compared to the price stability seen in established commodities like gold during periods of economic stability. The overall trajectory would represent a period of market maturity and stabilization, similar to the growth trajectory seen in other mature technological markets after initial hype.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin presents a unique blend of substantial risk and potentially high reward. Its decentralized nature and volatile price action make it unlike traditional assets, requiring a thorough understanding of both its upside and downside before committing capital. This section will explore the inherent risks and potential opportunities associated with Bitcoin investment, offering a balanced perspective for prospective investors.

Inherent Risks of Bitcoin Investment

Bitcoin’s price is notoriously volatile, experiencing significant fluctuations in short periods. This volatility stems from factors such as market sentiment, regulatory changes, and technological developments. For example, the price of Bitcoin has seen dramatic swings, rising to record highs and plummeting to significant lows within the same year. This inherent volatility makes it a high-risk investment, potentially leading to substantial losses if not carefully managed. Furthermore, security breaches targeting exchanges or individual wallets remain a considerable concern, with the potential for theft or loss of funds. Regulatory uncertainty across different jurisdictions also poses a significant risk, as evolving laws and regulations could impact Bitcoin’s accessibility and usability. The lack of a central authority to oversee transactions also introduces complexities and challenges related to consumer protection and dispute resolution.

Potential Opportunities and Rewards for Long-Term Bitcoin Investors

Despite the inherent risks, Bitcoin offers several compelling opportunities for long-term investors. Its limited supply of 21 million coins creates potential for scarcity-driven price appreciation over time, mirroring the behavior of precious metals like gold. Furthermore, Bitcoin’s decentralized nature offers a hedge against traditional financial systems, providing portfolio diversification and reducing reliance on centralized institutions. Historical price movements demonstrate the potential for substantial returns over extended periods, although these returns are not guaranteed and are accompanied by considerable risk. For example, early investors who held Bitcoin for several years have seen their investments appreciate significantly, although many others have experienced losses due to the volatile nature of the market.

Comparison of Bitcoin with Other Investment Options

Compared to traditional assets like stocks and bonds, Bitcoin offers higher potential returns but also significantly higher risk. Stocks provide exposure to company performance and dividends, while bonds offer relatively stable income streams. However, these options typically offer lower growth potential than Bitcoin. Compared to alternative investments like gold or real estate, Bitcoin’s liquidity is arguably higher, allowing for quicker entry and exit from the market. However, gold and real estate are generally considered less volatile than Bitcoin. Ultimately, the choice between Bitcoin and other investment options depends on individual risk tolerance, investment goals, and time horizon.

Strategies for Mitigating the Risks Associated with Bitcoin Investment

Several strategies can help mitigate the risks associated with Bitcoin investment. Diversification is crucial; avoid investing a large portion of your portfolio in Bitcoin alone. Thorough research and understanding of the technology and market dynamics are essential before investing. Using secure hardware wallets enhances security, minimizing the risk of theft or loss of funds. Adopting a long-term investment strategy can help weather short-term price fluctuations. Finally, staying informed about regulatory developments and market trends allows for proactive risk management. It is important to remember that no investment strategy can eliminate risk entirely, and Bitcoin remains a highly volatile asset.

Expert Opinions and Predictions: Bitcoin Today Prediction 17 January 2025

Predicting Bitcoin’s price is inherently speculative, even for seasoned experts. Numerous factors, ranging from macroeconomic conditions to regulatory changes and technological advancements, influence its trajectory. While no one can definitively state Bitcoin’s price on January 17th, 2025, several analysts offer predictions based on their models and interpretations of market trends. Examining these predictions, their methodologies, and the experts themselves provides valuable context for understanding the range of possible outcomes.

Methodology Used by Crypto Analysts

The methodologies employed by crypto analysts vary significantly. Some rely heavily on technical analysis, studying chart patterns and historical price data to identify trends and predict future movements. Others incorporate fundamental analysis, considering factors such as Bitcoin’s adoption rate, network security, and the overall state of the cryptocurrency market. Quantitative models, utilizing algorithms and statistical data, are also commonly used, attempting to forecast price based on various input parameters. A few analysts even integrate qualitative factors, such as regulatory developments and market sentiment, into their predictions. The accuracy of these predictions is often dependent on the quality of the data used, the sophistication of the models employed, and the analyst’s ability to anticipate unforeseen events. For example, an analyst might use a combination of moving averages and support/resistance levels (technical analysis) along with adoption rates and transaction volume (fundamental analysis) to create a predictive model. The accuracy of this model depends on the accuracy of the input data and the validity of the assumptions built into the model.

Credibility and Track Record of Experts

Assessing the credibility of any expert requires careful consideration. A strong track record of accurate predictions is essential, but even the most experienced analysts can be wrong. Factors to consider include the analyst’s experience in the cryptocurrency market, their understanding of the underlying technology, their transparency in explaining their methodology, and the consistency of their predictions. Looking at the historical accuracy of their previous forecasts provides crucial context. For instance, an analyst consistently predicting bull markets might have a bias that needs to be accounted for. Similarly, an analyst who accurately predicted the 2017 Bitcoin bull run but missed the subsequent crash would have a mixed track record. The best approach is to consult multiple sources and compare their predictions, methodologies, and track records before forming your own opinion.

Summary of Expert Predictions

It’s crucial to understand that the following are examples and do not represent an exhaustive list of all expert opinions. The specific predictions below are hypothetical and for illustrative purposes only. Real-world predictions are constantly evolving and vary widely.

- Analyst A (Technical Analyst): Predicts a price range of $150,000 – $200,000 based on identified patterns in historical price charts and volume indicators. Their methodology relies heavily on technical indicators and historical correlations. They have a relatively good track record, accurately predicting several short-term price movements but missing the timing of major market corrections.

- Analyst B (Fundamental Analyst): Forecasts a price of approximately $100,000, based on projections of increasing adoption, network effects, and the scarcity of Bitcoin. Their methodology emphasizes fundamental factors such as market capitalization and network growth. They have a longer track record with a higher degree of accuracy in long-term predictions, but their short-term predictions are less precise.

- Analyst C (Quantitative Analyst): Uses a proprietary quantitative model that incorporates macroeconomic data, regulatory developments, and social media sentiment. Their model predicts a price range of $75,000 – $125,000. This analyst’s track record is relatively new but demonstrates strong correlation with past market movements. However, the complexity of their model makes it difficult to fully assess its validity.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price prediction for January 17, 2025, investment strategies, long-term implications, and regulatory landscape. Understanding these aspects is crucial for making informed decisions about Bitcoin investment.

Bitcoin Price Target Likelihood by January 17, 2025, Bitcoin Today Prediction 17 January 2025

Predicting Bitcoin’s price with certainty is impossible due to its inherent volatility and sensitivity to various factors. While some analysts may offer price targets, these are based on models and assumptions that may not fully account for unforeseen events like regulatory changes, technological breakthroughs, or macroeconomic shifts. For example, a prediction of $100,000 might be based on historical price growth and adoption rates, but a sudden global recession could significantly alter this trajectory. Therefore, any specific price prediction should be viewed with considerable caution. It’s more prudent to consider a range of potential outcomes rather than a single point estimate.

Safe Bitcoin Investment Strategies

Securely investing in Bitcoin involves prioritizing the safety of your private keys. Never store your Bitcoin on exchanges unless you are actively trading. Hardware wallets, such as Ledger or Trezor, offer the highest level of security by storing your private keys offline. Software wallets, while convenient, are more vulnerable to hacking if not properly secured. Diversification is also key; avoid investing your entire portfolio in Bitcoin. Consider spreading your investments across different asset classes to mitigate risk. Furthermore, only invest what you can afford to lose, as the cryptocurrency market is highly volatile. Thoroughly research any platform you use to buy or store Bitcoin, ensuring it has a strong security record and positive user reviews.

Long-Term Implications of Bitcoin Adoption

Widespread Bitcoin adoption could significantly reshape the global financial landscape. It has the potential to democratize finance, offering unbanked populations access to financial services. However, it could also pose challenges to existing financial institutions and regulatory frameworks. Increased Bitcoin usage might lead to greater financial inclusion but also potentially increase the risk of illicit activities if not properly regulated. The environmental impact of Bitcoin mining is another significant long-term concern that needs addressing through technological advancements and sustainable energy sources. The long-term effects are complex and depend heavily on how adoption progresses and how regulatory bodies respond.

Legal and Regulatory Concerns Surrounding Bitcoin

The regulatory landscape for Bitcoin varies significantly across jurisdictions. Some countries have embraced Bitcoin as a legitimate asset class, while others have implemented strict regulations or outright bans. The future regulatory environment remains uncertain, with ongoing debates about taxation, anti-money laundering (AML) compliance, and consumer protection. Regulatory clarity is essential for the long-term growth and stability of the Bitcoin market. Potential future regulations could range from stricter KYC/AML requirements to the introduction of specific licensing frameworks for Bitcoin businesses. Staying informed about relevant legal and regulatory developments in your region is crucial for responsible Bitcoin investment.

Bitcoin Today Prediction 17 January 2025 – Accurately predicting Bitcoin’s price on January 17th, 2025, is challenging, requiring analysis of numerous factors. However, understanding broader long-term trends is crucial; for a comprehensive overview of potential future scenarios, refer to this insightful resource on Prediction On Bitcoin 2025. This broader perspective can inform more nuanced predictions about Bitcoin’s price on January 17th, 2025, considering the overall trajectory outlined in the linked prediction.

Predicting Bitcoin’s price on January 17th, 2025, is inherently speculative, but a key factor to consider is the upcoming Bitcoin halving. To understand its potential impact, it’s crucial to examine the timing and anticipated effects of this event, which you can research further at Bitcoin Halving 2025 Wann. Ultimately, the halving’s influence will significantly shape Bitcoin’s trajectory and thus, any prediction for January 17th, 2025.

Predicting Bitcoin’s price on January 17th, 2025, is inherently speculative, relying on various factors. However, effective marketing strategies can help businesses navigate this uncertainty. For instance, a well-structured Google Ads Account can be crucial for reaching potential investors interested in Bitcoin’s future, allowing businesses to adapt to market shifts and capitalize on opportunities presented by Bitcoin’s price fluctuations.

Therefore, understanding both Bitcoin’s potential and effective digital marketing are key for success in this volatile market.