Bitcoin Price Prediction

Predicting the price of Bitcoin on any given date, especially several years into the future, is inherently speculative. Numerous factors, both predictable and unpredictable, influence its value. This analysis explores potential scenarios for Bitcoin’s price on January 31st, 2025, considering a range of market conditions and predictive models. While no prediction is guaranteed, understanding the interplay of these factors can provide a more informed perspective.

Potential Factors Influencing Bitcoin’s Price on January 31, 2025

Several key factors could significantly impact Bitcoin’s price by January 31st, 2025. Bullish scenarios often involve widespread adoption, regulatory clarity, and technological advancements. Conversely, bearish scenarios might involve regulatory crackdowns, security breaches, or macroeconomic instability.

A bullish scenario might see increased institutional investment driven by a clearer regulatory landscape in major economies. Widespread adoption by businesses and consumers, fueled by improved user experience and infrastructure, could also push prices higher. Technological advancements, such as the scaling solutions improving transaction speeds and reducing fees, would further enhance Bitcoin’s utility and attractiveness. Conversely, a bearish scenario could involve a major security breach eroding trust in the network, or a significant regulatory crackdown leading to decreased trading volume and investment. A global economic recession could also negatively impact Bitcoin’s price as investors seek safer havens. The emergence of competing cryptocurrencies with superior technology or adoption rates could also exert downward pressure. Finally, unforeseen geopolitical events or natural disasters could trigger widespread market volatility, affecting Bitcoin’s price.

Comparative Analysis of Prediction Models

Various models attempt to forecast Bitcoin’s price. Technical analysis relies on historical price and volume data to identify trends and patterns, projecting future price movements based on chart patterns, indicators, and other technical signals. For example, a simple moving average crossover could suggest a price increase. Fundamental analysis focuses on broader economic factors, such as adoption rates, regulatory developments, and market sentiment, to assess Bitcoin’s intrinsic value. For instance, a positive regulatory shift might lead to a price increase based on increased investor confidence. However, neither approach guarantees accuracy. Technical analysis can be susceptible to manipulation, while fundamental analysis struggles to account for unpredictable events.

Different models might project vastly different price ranges for January 31st, 2025. Some technical models, based on historical volatility and price trends, might predict a price range between $100,000 and $200,000. Fundamental models, considering adoption rates and market capitalization, might suggest a more conservative range, perhaps between $50,000 and $150,000. These are merely examples, and the actual price could fall significantly outside these ranges. The inherent uncertainty in predicting future price movements emphasizes the need for caution and diversified investment strategies.

Potential Price Trajectories

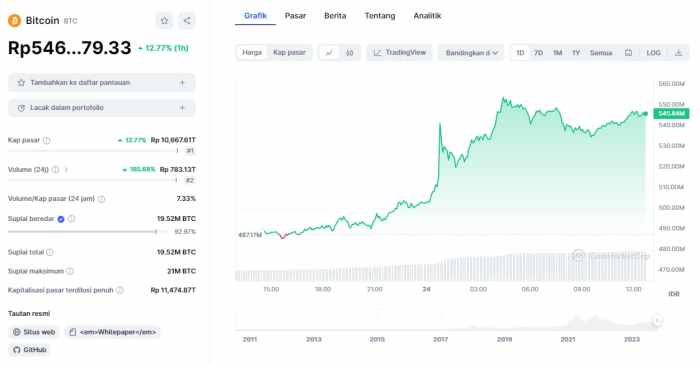

The following description illustrates potential Bitcoin price trajectories leading up to January 31st, 2025.

Imagine a chart with “Price (USD)” on the vertical axis and “Date” on the horizontal axis, spanning from the present day to January 31st, 2025. One potential trajectory shows a gradual, steady increase, with minor corrections along the way, eventually reaching a price of approximately $150,000 by January 31st, 2025. This represents a relatively optimistic but plausible scenario. A second trajectory shows a more volatile path, with significant price swings reflecting market uncertainty. This path might show periods of sharp increases followed by steep corrections, ultimately reaching a price around $75,000 by January 31st, 2025. This illustrates a more conservative or even bearish scenario. A third trajectory, representing a highly bullish scenario, shows exponential growth, reaching prices significantly above $200,000 by the target date. It is important to note that these are illustrative examples, and the actual price movement is likely to be complex and unpredictable. The chart would include clear labels for each trajectory (e.g., “Optimistic Scenario,” “Conservative Scenario,” “Bullish Scenario”) to enhance clarity.

Influential Factors Affecting Bitcoin’s Value: Bitcoin Today Prediction 31 January 2025

Predicting Bitcoin’s value by January 31, 2025, requires considering a complex interplay of factors. While the price is inherently volatile, understanding these influences can provide a more informed perspective on potential price movements. The following sections delve into key macroeconomic trends, regulatory landscapes, technological advancements, and the impact of significant events on Bitcoin’s trajectory.

Global Macroeconomic Trends and Bitcoin’s Price

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a recessionary environment might lead to risk aversion, causing investors to liquidate assets, including Bitcoin, to secure capital, resulting in price drops. Interest rate hikes by central banks, aimed at curbing inflation, can also impact Bitcoin’s price by making alternative, interest-bearing investments more attractive. For example, the sharp increase in interest rates in 2022 correlated with a significant Bitcoin price decline. The economic climate in 2024-2025 will be a critical determinant of Bitcoin’s performance. A strong global economy might fuel increased investment, while a global downturn could lead to significant sell-offs.

Regulatory Changes and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s adoption and valuation. Favorable regulatory frameworks, such as those promoting clarity and legal certainty around cryptocurrency trading and taxation, can foster institutional investment and wider public acceptance, potentially driving up prices. Conversely, restrictive regulations, including outright bans or excessive taxation, can stifle growth and depress prices. The varying approaches of different countries – some embracing Bitcoin as a potential asset class, others viewing it with suspicion – create a complex and dynamic regulatory landscape that will continue to influence Bitcoin’s value in 2025. For example, the clear regulatory frameworks in some jurisdictions have encouraged the growth of Bitcoin-related businesses, leading to increased investment and positive price action.

Technological Advancements and Bitcoin’s Market Dominance

Technological advancements within the cryptocurrency space have a direct bearing on Bitcoin’s market dominance. The emergence of layer-2 scaling solutions, for instance, aims to address Bitcoin’s scalability limitations, potentially increasing transaction speed and reducing fees. This could make Bitcoin more attractive for everyday use, bolstering its adoption and price. However, the development of new cryptocurrencies with superior features or more efficient technologies could pose a threat to Bitcoin’s dominance, potentially diverting investment and reducing its market share. The competition from altcoins with faster transaction speeds or enhanced functionalities represents a continuous challenge to Bitcoin’s market position.

Impact of Halving Events and Market Corrections, Bitcoin Today Prediction 31 January 2025

Bitcoin’s halving events, which reduce the rate of new Bitcoin creation, historically have been followed by periods of price appreciation. This is due to the reduced supply coupled with continued or increased demand. However, the effect isn’t always immediate or guaranteed. Significant market corrections, often triggered by various factors including macroeconomic instability or regulatory uncertainty, can lead to temporary price declines. These corrections, while disruptive, can also be viewed as opportunities for long-term investors to accumulate Bitcoin at lower prices. The halving event scheduled for 2024 could significantly impact Bitcoin’s price trajectory in the lead-up to January 31, 2025, although its exact impact remains subject to market conditions. The 2012 and 2016 halvings, for instance, were followed by substantial price increases, though the timing and magnitude varied.

Bitcoin Adoption and Market Sentiment

By January 31st, 2025, Bitcoin’s adoption is projected to be significantly higher than current levels, driven by both institutional and retail interest. While predicting precise figures is inherently difficult, we can analyze existing trends to offer a plausible scenario.

The anticipated growth in adoption will be fueled by several converging factors, including increased regulatory clarity in key markets, the maturation of Bitcoin’s underlying technology, and the continued expansion of its use cases beyond simple speculation. This will lead to a shift in market sentiment, influencing Bitcoin’s price trajectory.

Projected Institutional and Retail Adoption

Institutional investors, particularly hedge funds and asset management firms, are likely to increase their Bitcoin holdings substantially by January 31, 2025. This is predicated on the ongoing evolution of institutional-grade custody solutions, improved regulatory frameworks, and a growing recognition of Bitcoin as a potential inflation hedge and portfolio diversifier. We might see a scenario where a larger percentage of institutional portfolios allocate a significant portion, perhaps 5-10%, to Bitcoin, mirroring the increasing allocation to other alternative assets. Conversely, retail adoption will also see growth, potentially driven by easier-to-use interfaces, improved financial literacy regarding cryptocurrencies, and increased acceptance of Bitcoin as a payment method in everyday transactions. This could lead to millions of new retail investors globally holding Bitcoin. Examples like MicroStrategy’s significant Bitcoin holdings demonstrate the growing institutional interest, while the increasing popularity of Bitcoin ATMs and payment processors like Strike showcases retail adoption’s potential expansion.

Anticipated Market Sentiment

The prevailing market sentiment surrounding Bitcoin by January 31, 2025, is likely to be predominantly bullish, albeit with periods of volatility. This prediction is based on the expected increase in adoption discussed above, coupled with the potential for further technological advancements and regulatory developments that could bolster Bitcoin’s legitimacy and utility. However, it’s crucial to acknowledge the inherent volatility of the cryptocurrency market. Negative news events, regulatory crackdowns, or unforeseen technological challenges could trigger temporary bearish periods. Nevertheless, the overall trend, fueled by sustained adoption and a growing understanding of Bitcoin’s value proposition, points towards a bullish outlook. The year 2021 saw significant bullish sentiment leading to a record high price, although this was followed by a correction. A similar pattern, albeit with potentially higher price ceilings, might be observed leading up to January 2025.

Media Coverage and Public Perception

Media coverage and public perception will play a significant role in shaping Bitcoin’s price leading up to January 31, 2025. Positive news, such as increased institutional adoption, successful integration into payment systems, and positive regulatory developments, will likely fuel a bullish narrative and drive price appreciation. Conversely, negative news, including regulatory setbacks, security breaches, or prominent scams involving Bitcoin, could create negative sentiment and trigger price declines. The narrative surrounding Bitcoin will be dynamic, fluctuating between periods of hype and skepticism. However, assuming continued positive developments in adoption and technology, the overall trajectory of media coverage and public perception is expected to be largely positive, contributing to a sustained bullish trend in the long term. For example, mainstream media coverage of successful Bitcoin integrations into established financial systems would likely generate positive sentiment and boost prices. Conversely, a major security flaw or regulatory crackdown could significantly impact public perception and lead to a price drop.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin by January 31, 2025, presents a complex landscape of potential rewards and significant risks. While the cryptocurrency has demonstrated remarkable growth potential, its inherent volatility and regulatory uncertainty necessitate a thorough understanding of the associated dangers before committing capital. This section will Artikel key risks and explore potential opportunities for investors.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is notoriously volatile, subject to dramatic swings driven by market sentiment, regulatory news, technological developments, and macroeconomic factors. For example, the 2022 crypto winter saw Bitcoin’s price plummet by over 60%, highlighting the significant potential for capital loss. Regulatory uncertainty adds another layer of risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to potential legal restrictions on trading, taxation, and even outright bans. Furthermore, the decentralized nature of Bitcoin, while a strength, also makes it vulnerable to security breaches, hacks, and scams. The high-profile Mt. Gox exchange hack, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of these risks. Finally, the lack of inherent value, unlike traditional assets backed by physical commodities or government guarantees, contributes to the inherent risk profile.

Potential Investment Opportunities Linked to Bitcoin

Despite the risks, Bitcoin presents several investment opportunities. Direct ownership, the most straightforward approach, allows investors to hold Bitcoin directly through exchanges or digital wallets. However, this exposes investors directly to price volatility and security risks. Derivatives, such as Bitcoin futures and options, offer investors alternative strategies to manage risk and speculate on price movements without directly holding the underlying asset. These instruments can provide leveraged exposure or hedging capabilities, depending on the investor’s strategy. Finally, the growth of the Bitcoin ecosystem has spawned related assets, including Bitcoin mining stocks, blockchain technology companies, and exchange-traded funds (ETFs) tracking Bitcoin’s price. Investing in these related assets can provide indirect exposure to Bitcoin’s growth potential with potentially lower volatility than direct Bitcoin ownership.

Risk Assessment Matrix: Bitcoin vs. Other Asset Classes

A risk assessment matrix comparing Bitcoin to other asset classes by January 31, 2025, would need to consider several factors, including potential return, volatility, liquidity, and regulatory risk. For instance, comparing Bitcoin to established asset classes like gold or government bonds would reveal significant differences. Gold generally offers lower returns but greater stability, while government bonds offer relatively low returns with low risk. Equities, on the other hand, offer higher potential returns but with higher volatility. A simplified representation could be:

| Asset Class | Potential Return | Volatility | Liquidity | Regulatory Risk |

|---|---|---|---|---|

| Bitcoin | High (but highly variable) | Very High | Medium to High (depending on exchange) | High (varies by jurisdiction) |

| Gold | Moderate | Low to Moderate | High | Low |

| Government Bonds | Low | Low | High | Low |

| Equities (Stocks) | High (but highly variable) | High | High | Low to Moderate |

This matrix illustrates that Bitcoin offers significantly higher potential returns but comes with considerably higher risk compared to more traditional assets. The actual values would depend on market conditions closer to January 31, 2025. This simplified matrix does not include all relevant factors and should not be considered exhaustive financial advice. Individual circumstances and risk tolerance should always guide investment decisions.

Frequently Asked Questions (FAQs)

This section addresses some common questions regarding Bitcoin’s potential future price and the associated risks and opportunities. It’s crucial to remember that any prediction is inherently uncertain, and the cryptocurrency market is notoriously volatile. The information provided below is based on current market trends and expert analysis, but should not be considered financial advice.

Bitcoin’s Most Likely Price Range on January 31, 2025

Predicting the exact price of Bitcoin on a specific date is impossible. However, based on various factors including adoption rates, regulatory developments, and macroeconomic conditions, a plausible price range could be between $100,000 and $250,000. This wide range reflects the inherent uncertainty. The lower end of the range assumes slower-than-expected adoption or negative regulatory developments. The higher end assumes significant institutional adoption and continued positive market sentiment. For example, if Bitcoin continues its historical trend of halving cycles driving price increases, and institutional investment continues to flow in, the higher end of the range becomes more likely. Conversely, a major global economic downturn could significantly depress the price. This prediction considers historical price movements, technological advancements within the Bitcoin ecosystem, and evolving global macroeconomic trends. It is important to note that this is a speculative estimate, and the actual price could fall significantly outside this range.

Biggest Risks Associated with Long-Term Bitcoin Investment

Investing in Bitcoin carries significant risks. Volatility is a primary concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial losses. Regulatory uncertainty poses another significant risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. This uncertainty could lead to price drops or even outright bans in certain jurisdictions. Furthermore, security risks, such as hacking and theft from exchanges or individual wallets, are a constant threat. Finally, the inherent speculative nature of Bitcoin means its value is largely driven by market sentiment, making it vulnerable to market manipulation and speculative bubbles. Mitigation strategies include diversifying investments, using secure storage methods (hardware wallets), staying informed about regulatory developments, and only investing what one can afford to lose.

Impact of Regulatory Changes on Bitcoin’s Price and Adoption

Regulatory changes will undoubtedly influence Bitcoin’s price and adoption. Favorable regulations, such as clear guidelines for exchanges and tax treatment, could increase institutional investment and mainstream adoption, driving price appreciation. Conversely, overly restrictive regulations or outright bans could severely limit Bitcoin’s growth and cause significant price declines. For instance, a clear regulatory framework in a major economy like the United States could lead to a surge in institutional investment, while a complete ban in a significant market could lead to a substantial price correction. The impact of regulation is highly dependent on the specific nature and implementation of the regulatory framework. A balanced and predictable regulatory environment is likely to be the most beneficial for Bitcoin’s long-term growth.

Alternative Investment Options Alongside Bitcoin

While Bitcoin offers potential for high returns, it’s essential to consider alternative investments to diversify a portfolio and mitigate risk. Traditional assets like stocks and bonds offer lower volatility and potentially more stable returns, albeit with lower growth potential. Other cryptocurrencies present a higher-risk, higher-reward scenario, with the potential for significant gains or losses. Gold and other precious metals provide a hedge against inflation and economic uncertainty. Real estate offers tangible assets with potential for rental income and appreciation. The best alternative investments depend on individual risk tolerance, financial goals, and investment timeline. Comparing these options requires considering factors such as risk level, potential returns, liquidity, and regulatory oversight. Each investment vehicle has its own set of advantages and disadvantages.

Illustrative Example: Bitcoin Price Trajectory

This hypothetical scenario explores a possible Bitcoin price trajectory between now and January 31st, 2025, considering various potential market influences. It’s crucial to remember that this is a speculative exercise and not a financial prediction. Actual market movements will depend on numerous unpredictable factors.

The scenario begins with Bitcoin trading around $30,000 in early 2024. Positive news regarding widespread adoption by institutional investors and growing regulatory clarity in key markets leads to a steady, albeit gradual, increase throughout the year. By the end of 2024, Bitcoin reaches approximately $45,000. This relatively stable growth reflects a consolidating market, where investors are cautiously optimistic but wary of potential volatility.

Market Events and Price Fluctuations

Several significant events influence Bitcoin’s price in early 2025. First, a major global financial institution announces a substantial Bitcoin investment, triggering a short-term price surge to nearly $60,000. This rapid increase is followed by a period of consolidation as investors take profits, causing a slight dip to around $55,000. Secondly, unforeseen geopolitical instability in a major global economy creates uncertainty in traditional markets, leading to a flight to safety. This influx of capital into Bitcoin pushes its price to a new high of $70,000. However, this rally is short-lived. Concerns arise regarding potential regulatory crackdowns in certain jurisdictions, triggering a significant sell-off, dropping the price back down to approximately $50,000. The price then stabilizes around this level for the remainder of January 2025, as the market absorbs the conflicting signals. This volatility illustrates the inherent risk associated with Bitcoin investment. Similar scenarios have been observed historically; for instance, the rapid price increases and subsequent corrections in 2017 and 2021 demonstrate the potential for dramatic swings in the Bitcoin market. The example demonstrates the potential for both significant gains and losses depending on the confluence of factors influencing the market.

Bitcoin Today Prediction 31 January 2025 – Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.

Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.

Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.

Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.

Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.

Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.

Accurately predicting Bitcoin’s price on January 31st, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective, understanding longer-term trends is crucial; for instance, you might find helpful insights by reviewing a comprehensive analysis like this one on Bitcoin Prediction By End Of 2025. Ultimately, however, Bitcoin’s value on January 31st, 2025, will depend on the confluence of numerous short-term and long-term influences.