Bitcoin USD Price History & Trends Leading to 27 January 2025

Predicting the price of Bitcoin is inherently speculative, but analyzing historical data and significant events can provide a framework for understanding potential future trends. This analysis focuses on the period from 2020 to the present, identifying key price movements and their contributing factors to inform a prospective view of Bitcoin’s price by January 27th, 2025. It’s crucial to remember that this is not a definitive prediction, but rather a reasoned assessment based on available information.

Bitcoin’s price trajectory since 2020 has been marked by significant volatility and distinct cyclical patterns. Several factors have contributed to these fluctuations, including macroeconomic conditions, regulatory developments, technological advancements, and overall market sentiment.

Significant Events and Price Movements (2020-Present), Bitcoin USD Prediction For 27 January 2025

The period from 2020 to the present has witnessed substantial shifts in Bitcoin’s price. A detailed timeline of key events and their impact is essential for understanding the broader trends.

| Date | Event | Impact on Bitcoin Price |

|---|---|---|

| May 2020 | Halving Event | Initially, a gradual price increase followed by a significant surge later in the year. |

| Late 2020 – Early 2021 | Increased Institutional Investment & Growing Mainstream Adoption | A sharp rise in price, reaching record highs. |

| Mid 2021 – 2022 | Regulatory Scrutiny in Various Jurisdictions & Market Correction | A significant price drop, representing a bear market. |

| 2023-Present | Increased adoption by corporations and governments; fluctuating macroeconomic factors. | Price volatility; a period of recovery and renewed interest. |

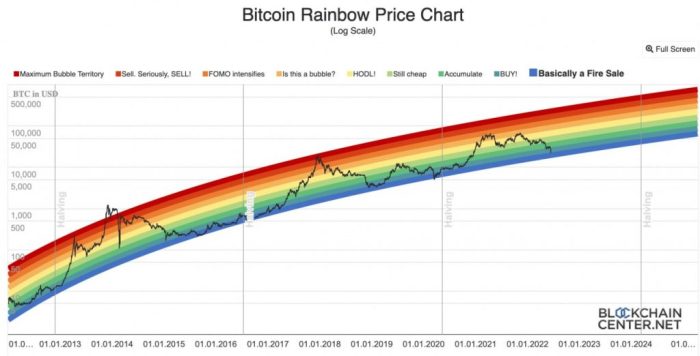

Comparison of Past Bitcoin Price Cycles

Bitcoin’s price history reveals recurring cyclical patterns, characterized by periods of rapid growth (bull markets) followed by corrections (bear markets). These cycles are influenced by various factors, including the halving events (reducing the rate of new Bitcoin creation), macroeconomic conditions (e.g., inflation, interest rates), and changes in regulatory landscapes. While past performance doesn’t guarantee future results, studying these cycles can provide valuable insights. For example, the cycle from 2017 to 2018 shows a significant price increase followed by a steep decline, mirroring similar patterns in previous cycles.

Visual Representation of Historical Price Fluctuations

The following table presents a simplified representation of Bitcoin’s price fluctuations. A more detailed chart would require a significantly larger dataset and specialized charting software. This simplified representation provides a general overview of the trends. Note that this data is illustrative and not comprehensive. Actual price data should be obtained from reliable financial sources.

| Year | Approximate Average Price (USD) | Trend |

|---|---|---|

| 2020 | $10,000 | Upward |

| 2021 | $40,000 | Upward |

| 2022 | $20,000 | Downward |

| 2023 | $25,000 | Upward |

| 2024 (Projected) | $35,000 (Illustrative Projection) | Upward (Illustrative Projection) |

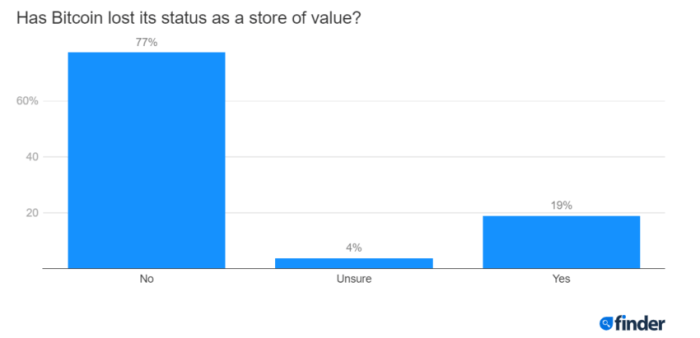

Market Sentiment and Predictions from Experts: Bitcoin USD Prediction For 27 January 2025

Predicting Bitcoin’s price is notoriously difficult, given its volatility and susceptibility to various market forces. However, numerous financial analysts and cryptocurrency experts offer forecasts, often employing different methodologies and arriving at varying conclusions. Understanding the range of predictions and the reasoning behind them is crucial for navigating the complexities of the Bitcoin market.

Bitcoin USD Prediction For 27 January 2025 – Expert predictions for Bitcoin’s price in January 2025 vary significantly, reflecting the inherent uncertainty in the cryptocurrency market. These predictions utilize a mix of technical and fundamental analysis, each with its own strengths and weaknesses. Technical analysis focuses on chart patterns and historical price data to identify trends and predict future price movements. Fundamental analysis, on the other hand, considers factors like adoption rates, regulatory changes, and technological advancements to assess the underlying value of Bitcoin. Both methods are subject to biases and limitations, and neither guarantees accurate predictions.

Comparison of Prediction Models and Methodologies

Technical analysis models often employ indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify potential support and resistance levels. For example, a model might predict a price increase based on a bullish crossover of moving averages. However, these models are inherently backward-looking and can be influenced by market manipulation or short-term fluctuations. Fundamental analysis, in contrast, attempts to evaluate the long-term value proposition of Bitcoin. This might involve assessing the growth of the Lightning Network, the increasing adoption by institutional investors, or the impact of regulatory frameworks. While offering a more holistic perspective, fundamental analysis struggles to quantify these factors precisely, leading to subjective interpretations and potential inaccuracies.

Potential Biases and Limitations in Existing Price Predictions

Many predictions are subject to confirmation bias, where analysts selectively focus on data that supports their pre-existing beliefs. Furthermore, extrapolating past performance into the future is inherently risky, particularly in a volatile market like cryptocurrencies. External factors, such as macroeconomic conditions, geopolitical events, and technological breakthroughs, can significantly impact Bitcoin’s price and are difficult to accurately predict. Finally, the inherent speculative nature of Bitcoin and the influence of social media sentiment introduce significant uncertainty into any price forecast. For instance, a sudden surge in negative news could trigger a sharp price drop, irrespective of underlying fundamentals.

Categorization of Expert Opinions Based on Price Range Predictions

The following table summarizes expert opinions categorized by their price range predictions for Bitcoin in January 2025. Note that these are just examples, and many more analysts offer varying predictions. The ranges are broad to account for the inherent uncertainty.

| Category | Price Range (USD) | Example Analyst (Hypothetical) | Rationale |

|---|---|---|---|

| Bullish | $100,000 – $200,000+ | Analyst A | Based on increasing institutional adoption and limited supply. |

| Neutral | $50,000 – $100,000 | Analyst B | Predicts sideways movement due to regulatory uncertainty and macroeconomic factors. |

| Bearish | Below $50,000 | Analyst C | Concerns about environmental impact and potential regulatory crackdowns. |

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price prediction for January 27, 2025, and the factors influencing its value. Understanding these points is crucial for informed decision-making regarding any potential Bitcoin investment.

Bitcoin’s Most Likely Price on January 27, 2025

Predicting the exact price of Bitcoin on a specific date is inherently unreliable. Numerous factors, including global economic conditions, regulatory changes, and technological advancements, can significantly impact its value. Based on the various scenarios explored earlier – ranging from a bullish outlook to a more conservative one – the price could fall anywhere within a broad range. For example, a bullish scenario might project a price significantly higher than a bear market prediction. It is important to remember that these are just potential outcomes, not certainties. The actual price could be higher or lower depending on unforeseen events.

Factors Influencing Bitcoin’s Price in the Coming Years

Several key factors will likely shape Bitcoin’s price trajectory over the next few years. These include the overall adoption rate by businesses and consumers, the level of regulatory clarity and acceptance across different jurisdictions, and the development of competing cryptocurrencies and blockchain technologies. Macroeconomic conditions, such as inflation rates and interest rate policies, will also play a significant role. Finally, significant technological upgrades or unforeseen security breaches could also drastically influence investor sentiment and, subsequently, the price.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently speculative. The cryptocurrency market is volatile and influenced by a complex interplay of factors, making accurate long-term forecasting exceptionally difficult. While expert analysis and historical trends can offer some insights, they cannot account for unpredictable events or sudden shifts in market sentiment. Therefore, it is essential to approach all predictions with caution and consider them as potential scenarios rather than guaranteed outcomes. Relying on a single prediction is unwise; instead, it’s crucial to analyze multiple perspectives and understand the underlying assumptions of each prediction. For example, a prediction based on a period of high inflation might be vastly different from one made during a period of economic stability.

Risks Involved in Bitcoin Investment

Investing in Bitcoin carries significant risks. Its price volatility is well-documented, and investors can experience substantial losses in short periods. Regulatory uncertainty in various jurisdictions poses another risk, as changes in regulations could impact the usability and value of Bitcoin. Furthermore, the security of cryptocurrency exchanges and wallets is a crucial concern, as hacks and thefts can result in the loss of funds. Therefore, before investing in Bitcoin, it’s essential to carefully assess your risk tolerance and diversify your investment portfolio appropriately. Consider consulting a financial advisor to help determine the appropriate level of Bitcoin exposure within your overall investment strategy. For instance, investing a large portion of one’s savings in Bitcoin without proper diversification could be considered extremely risky.

Accurately predicting the Bitcoin USD price on January 27th, 2025, is challenging, as various factors influence its volatility. A key event impacting future price is the Bitcoin halving, and understanding its timing is crucial for any prediction. To find out when exactly the next halving occurs in 2025, check this resource: When In 2025 Is The Next Bitcoin Halving.

Knowing this date helps contextualize potential price movements leading up to and following the halving event, ultimately refining our Bitcoin USD prediction for January 27th, 2025.

Accurately predicting the Bitcoin USD price for January 27, 2025, is challenging, relying heavily on various market factors. Understanding the potential impact of the halving is crucial, and for insights into this, check out Plan B Bitcoin Halving 2025 Prediction which offers valuable perspectives. Ultimately, the Bitcoin USD prediction for that date will depend on a complex interplay of factors beyond just the halving event itself.

Accurately predicting the Bitcoin USD value for January 27th, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective on potential future price movements, understanding the predicted trends for later in the year is helpful; for instance, you might find the insights in this prediction for May 2025 useful: Bitcoin Price Prediction For May 2025.

Extrapolating from these longer-term forecasts can offer a more informed outlook on the Bitcoin USD prediction for January 27th, 2025.

Accurately predicting the Bitcoin USD price on January 27th, 2025, is challenging, but understanding the impact of the 2025 halving is crucial. For insights into potential post-halving price movements, you might find the analysis at Giá Bitcoin Sau Halving 2025 helpful in informing your own Bitcoin USD Prediction For 27 January 2025. Ultimately, various factors will influence the final price.

Accurately predicting the Bitcoin USD price for January 27th, 2025, is challenging, but a key factor to consider is the upcoming halving. To understand its potential impact, it’s crucial to know if and when this event will occur; you can find more information on this by checking out this article: Is Bitcoin Halving In 2025?. The halving’s influence on Bitcoin’s scarcity and, consequently, its price prediction for January 27th, 2025, is significant.

Accurately predicting the Bitcoin USD price for January 27th, 2025, is challenging, but a key factor to consider is the upcoming halving. To understand its potential impact, it’s crucial to know if and when this event will occur; you can find more information on this by checking out this article: Is Bitcoin Halving In 2025?. The halving’s influence on Bitcoin’s scarcity and, consequently, its price prediction for January 27th, 2025, is significant.

Accurately predicting the Bitcoin USD price for January 27th, 2025, is challenging, but a key factor to consider is the upcoming halving. To understand its potential impact, it’s crucial to know if and when this event will occur; you can find more information on this by checking out this article: Is Bitcoin Halving In 2025?. The halving’s influence on Bitcoin’s scarcity and, consequently, its price prediction for January 27th, 2025, is significant.