Risks and Uncertainties Associated with Predictions

Predicting Bitcoin’s value in 2025, or any future date, is inherently fraught with risk and uncertainty. Numerous factors, both predictable and unpredictable, can significantly influence its price, making any forecast inherently speculative. While historical data and current trends can inform analysis, they cannot definitively predict future outcomes. The cryptocurrency market is exceptionally volatile and susceptible to unforeseen shocks.

The inherent volatility of Bitcoin’s price makes long-term predictions exceptionally challenging. Unlike traditional assets with established valuation models, Bitcoin’s value is largely driven by market sentiment, speculation, and technological developments. This makes it highly susceptible to rapid and dramatic price swings, often unrelated to fundamental economic indicators. For example, a single negative news story about a major exchange or a significant regulatory change could trigger a sharp sell-off, regardless of underlying technological advancements or adoption rates.

Impact of Unforeseen Events

Unforeseen events pose a considerable threat to the accuracy of any Bitcoin price prediction. Technological breakthroughs, such as the development of a superior cryptocurrency or a significant improvement in transaction speed and scalability, could dramatically alter Bitcoin’s market position. Conversely, negative technological developments, such as a major security flaw or a successful 51% attack, could severely damage investor confidence and lead to a substantial price decline. Similarly, major regulatory changes, ranging from outright bans to stringent regulations, can significantly impact Bitcoin’s price and adoption. Geopolitical instability, such as international conflicts or economic crises, can also create uncertainty and trigger significant market fluctuations. The 2022 crypto winter, partly fueled by macroeconomic uncertainty and regulatory crackdowns, serves as a stark reminder of the impact of external factors.

Limitations of Historical Data

Relying solely on historical data to predict future Bitcoin prices is inherently flawed. The cryptocurrency market is relatively young, and its history is characterized by periods of extreme volatility and rapid price changes. Patterns observed in the past may not hold true in the future, especially given the evolving regulatory landscape and technological advancements. Furthermore, extrapolating past trends to predict future prices ignores the potential for disruptive events and paradigm shifts that could fundamentally alter market dynamics. For instance, while Bitcoin’s price has historically increased over time, this trend is not guaranteed to continue, particularly considering the cyclical nature of bull and bear markets. Applying historical price models without considering the unique characteristics of the cryptocurrency market and the potential for unforeseen events can lead to inaccurate and misleading predictions.

Investment Strategies and Considerations: Bitcoin Value Prediction 2025

Investing in Bitcoin requires careful consideration of various factors, including risk tolerance, investment timeframe, and overall financial goals. A well-defined strategy is crucial for navigating the inherent volatility of the cryptocurrency market and maximizing potential returns while minimizing potential losses. This section explores diverse investment strategies and highlights the importance of diversification within a Bitcoin-focused portfolio.

Different investment strategies cater to varying risk appetites and financial objectives. Understanding your personal risk tolerance is paramount before committing capital to Bitcoin. A conservative investor might opt for a smaller allocation, while a more aggressive investor might dedicate a larger portion of their portfolio. Similarly, the investment timeframe significantly influences the chosen strategy. Long-term investors often adopt a “buy and hold” approach, while short-term traders might engage in frequent buying and selling based on market fluctuations.

Risk Tolerance and Investment Goals

The level of risk an investor is willing to accept directly impacts their investment strategy. A risk-averse investor might prefer dollar-cost averaging (DCA), a strategy involving regular, smaller investments over time, mitigating the impact of price volatility. This approach reduces the risk of investing a lump sum at a market peak. Conversely, a more risk-tolerant investor might consider leverage trading, which magnifies both profits and losses. However, leverage trading is significantly riskier and requires a thorough understanding of market dynamics and risk management techniques. For example, an investor with a high-risk tolerance and a short-term goal might use leverage to amplify potential gains from short-term price movements, while an investor with low-risk tolerance and a long-term goal might choose to invest a small, fixed amount each month through DCA.

Diversification in a Bitcoin-Focused Portfolio, Bitcoin Value Prediction 2025

Diversification is a cornerstone of sound investment practice. While Bitcoin can be a significant part of an investment portfolio, relying solely on it exposes investors to considerable risk. The cryptocurrency market is highly volatile, and Bitcoin’s price can experience sharp fluctuations. Therefore, diversifying across different asset classes, such as stocks, bonds, and other cryptocurrencies, is crucial for mitigating risk. A diversified portfolio reduces the overall volatility and improves the resilience of the portfolio against market downturns. For example, an investor might allocate 10% of their portfolio to Bitcoin, 30% to stocks, 30% to bonds, and 30% to other asset classes like real estate or precious metals. This approach reduces the impact of a potential Bitcoin price crash on their overall investment.

Long-Term versus Short-Term Bitcoin Investments

Long-term Bitcoin investments generally align with a “buy and hold” strategy, aiming to capitalize on the potential for long-term growth. This approach requires patience and the ability to withstand short-term price fluctuations. Historically, Bitcoin has demonstrated periods of significant growth over the long term. However, it’s important to remember that past performance is not indicative of future results. Conversely, short-term Bitcoin investments often involve active trading, attempting to profit from short-term price movements. This strategy demands a high level of market knowledge, technical analysis skills, and risk tolerance. Short-term trading carries a higher risk of losses compared to long-term investing. For example, a long-term investor might purchase Bitcoin and hold it for several years, expecting its value to appreciate significantly, while a short-term trader might buy and sell Bitcoin multiple times a day, trying to profit from minor price changes.

Frequently Asked Questions

Bitcoin’s price volatility and potential for significant returns attract considerable interest, leading to many questions about its future and investment implications. Understanding the factors influencing its price, the reliability of predictions, and associated risks is crucial for informed decision-making. This section addresses common queries to clarify these aspects.

Significant Factors Affecting Bitcoin’s Price

Several interconnected factors influence Bitcoin’s price. These include macroeconomic conditions (like inflation and interest rates), regulatory developments (governmental policies and legal frameworks), technological advancements (scaling solutions and network upgrades), market sentiment (news events, social media trends, and overall investor confidence), and supply and demand dynamics (mining activity and adoption rates). For example, increased regulatory scrutiny in a particular jurisdiction can negatively impact price, while a major technological upgrade could trigger a positive surge. Similarly, widespread adoption by institutional investors often correlates with price increases. The interplay of these factors creates a complex and often unpredictable price environment.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is notoriously volatile and susceptible to unpredictable events. While various analytical models and forecasting techniques exist, they are based on historical data and assumptions that may not hold true in the future. Predictions should be viewed with extreme caution, and it’s vital to remember that past performance is not indicative of future results. Consider, for instance, the significant price swings Bitcoin experienced in 2021 and 2022; no model accurately predicted the magnitude or timing of these fluctuations. Therefore, relying solely on predictions for investment decisions is risky.

Risks Involved in Investing in Bitcoin

Investing in Bitcoin carries significant risks. Price volatility is a major concern, with the potential for substantial losses. Regulatory uncertainty, technological vulnerabilities (like hacking or network failures), and market manipulation are also key risks. Furthermore, Bitcoin’s decentralized nature means there’s limited consumer protection compared to traditional financial assets. For example, the loss of private keys can result in the permanent loss of funds, highlighting the importance of secure storage practices. The lack of inherent value also contributes to its inherent risk profile, as its value is entirely derived from market demand.

Strategies for Mitigating Bitcoin Investment Risks

Several strategies can help mitigate the risks associated with Bitcoin investment. Diversification across different asset classes is crucial to reduce overall portfolio volatility. Dollar-cost averaging (investing a fixed amount at regular intervals) can help reduce the impact of price fluctuations. Thorough research and understanding of the technology and market dynamics are essential before investing. Furthermore, only investing what one can afford to lose is paramount. Secure storage solutions, like hardware wallets, are recommended to protect against theft or loss of funds. Finally, staying informed about market trends and regulatory changes can help make more informed decisions.

Potential Future of Bitcoin Beyond 2025

Predicting Bitcoin’s future beyond 2025 is speculative. However, several potential scenarios exist. Widespread adoption by businesses and governments could lead to increased price stability and mainstream acceptance. Conversely, increased regulation or technological disruptions could negatively impact its value. The development of competing cryptocurrencies and technological advancements could also reshape the landscape. The evolution of Bitcoin’s role in the global financial system will depend on numerous factors, including technological progress, regulatory frameworks, and overall market acceptance. Bitcoin’s long-term success will likely depend on its ability to adapt and evolve within a constantly changing technological and regulatory environment.

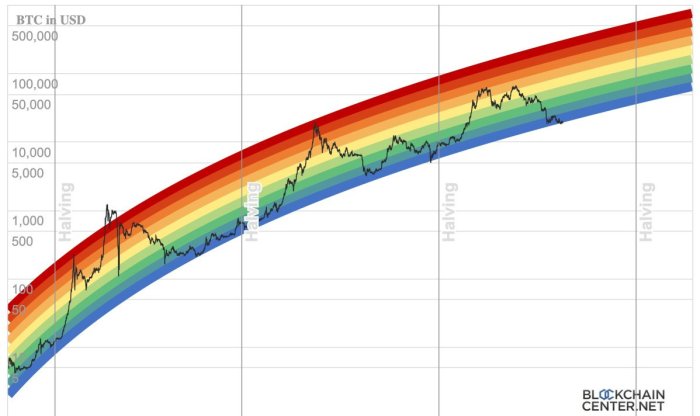

Bitcoin Value Prediction 2025 – Predicting Bitcoin’s value in 2025 is a complex undertaking, influenced by numerous factors. A key event to consider when formulating such predictions is the impact of the next Bitcoin halving. For detailed information on this crucial event, check out this resource on Halving Day Bitcoin 2025 , as it significantly affects the future supply and, consequently, the potential price of Bitcoin in 2025.

Understanding the halving’s implications is therefore vital for any accurate Bitcoin value prediction.

Predicting Bitcoin’s value in 2025 is challenging, influenced by numerous factors including technological advancements and market sentiment. A key event impacting this prediction is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand its influence, it’s crucial to know precisely when this occurred; you can find the answer by checking this resource: When Did The Bitcoin Halving Happen In 2025.

Therefore, accurately pinpointing the halving date is vital for any robust Bitcoin value prediction model for 2025.

Predicting Bitcoin’s value in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will significantly reduce the rate of new Bitcoin creation. For insightful analysis on this crucial event and its potential consequences, refer to this comprehensive resource on Bitcoin Prediction After Halving 2025.

Understanding the post-halving dynamics is essential for any accurate Bitcoin Value Prediction 2025.

Predicting Bitcoin’s value in 2025 is challenging, with various factors influencing its price. A significant event to consider is the Bitcoin Halving in 2024, which will likely impact the market considerably. Understanding the potential consequences requires examining related dynamics, such as the influence on altcoins; for example, you can find insightful analysis on the interplay between the halving and Shiba Inu’s price trajectory at this link: Bitcoin Halving 2025 Shiba Inu.

Ultimately, this event will be a key component in shaping Bitcoin’s value prediction for 2025.

Predicting Bitcoin’s value in 2025 is a complex endeavor, influenced by numerous factors. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the rate of new Bitcoin entering circulation. For detailed information on this crucial event, refer to this resource on Halving Bitcoin 2025. Understanding the halving’s potential effects is vital for any serious attempt at Bitcoin Value Prediction 2025, as it’s likely to influence both supply and demand dynamics.

Predicting Bitcoin’s value in 2025 is a complex undertaking, influenced by numerous factors. A key event impacting these predictions is the upcoming Bitcoin halving, scheduled for April 2025, as detailed in this insightful article: Halving Bitcoin Abril 2025. This halving will significantly reduce the rate of new Bitcoin creation, potentially influencing scarcity and, consequently, its market price.

Therefore, understanding the implications of this halving is crucial for any serious Bitcoin value prediction for 2025.

Predicting Bitcoin’s value in 2025 is a complex task, influenced by various macroeconomic factors and technological advancements. To effectively reach potential investors interested in this prediction, a robust online marketing strategy is crucial, and setting up a Google Ads Account can be a powerful tool to target specific demographics interested in Bitcoin Value Prediction 2025. This allows for precise targeting and measurable results, ultimately improving the outreach for those interested in the future of Bitcoin.